|

|

市場調査レポート

商品コード

1613807

中国のカーオーディオシステム産業(2024年)Automotive Audio System Industry Report, 2024 |

||||||

|

|||||||

| 中国のカーオーディオシステム産業(2024年) |

|

出版日: 2024年11月08日

発行: ResearchInChina

ページ情報: 英文 340 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

2024年のカーオーディオシステム:スタッキングが進み、ハードウェアとソフトウェアのチューニング数が変化

8つ以上のスピーカーを搭載した車種の売上が安定して推移。

2024年、カーオーディオ市場は安定して拡大します。8スピーカー以上のモデルの場合、2023年の年間売上は828万7,000台、普及率は39.4%、2024年1月~7月の売上は541万9,000台、普及率は47.5%となっています。今後2年間は約24%の成長率を維持し、2026年に最大で約1,625万台に達すると予測されます。

Luxeed R7

Luxeed R7は、Huaweiのオーディオシステム「HUAWEI SOUND」を搭載しています。車内に配置された17個のスピーカーのうち、15個が7.1chのサラウンド音場を構成し、スターリングディフューザー(Schroederディフューザー技術を搭載し、180°全方位への音の拡散とバランスの取れた音場性能を実現)や独自のターボサブウーファーと組み合わせることで、より小さなボリュームで強力な低域の飛び込みを実現しています。

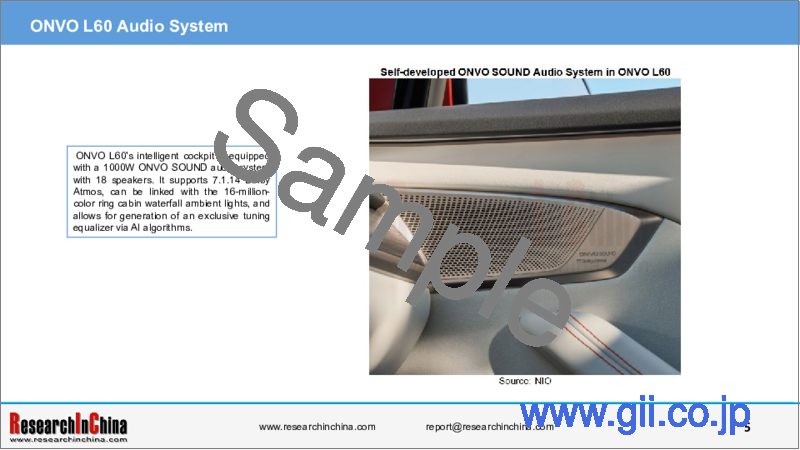

ONVO L60

ONVO L60のインテリジェントコックピットには、18個のスピーカーを備えた1000W ONVO SOUNDオーディオシステムが搭載されています。7.1.14 Dolby Atmosをサポートし、1,600万色のリングキャビンウォーターフォールアンビエントライトと連動させることができ、AIアルゴリズムによって独自のチューニングイコライザーを生成することができます。

OEMはオーディオシステムを深く自社開発し、オーディオブランドのシェアは変わっていません。

スピーカーやマイクが増えるということは、ハードウェアデバイスが増えるだけでなく、音場の再構築、オーディオアーキテクチャの再設計、ソフトウェアチューニング機能の再調整などのさまざまな作業が発生します。これらの作業をすべてサプライヤーに委託すれば、トータルの開発コストは増大します。

コストを抑制するため、OEMはオーディオシステムの自主研究開発をさらに深化させています。中には、主要コンポーネントを直接購入し、サプライチェーンの利点を活用し、独自にスピーカーを設計および製造し、オーディオアーキテクチャ設計、ソリューション統合、デバイス製造、音響効果調整を含むオーディオシステムの自主開発を実現している企業もあります。

Xpeng

Xpengの場合、X9とP7+のオーディオシステムは自社開発です。ここで、Xpeng X9は23個の自社開発Xoperaスピーカーを搭載し、音場モードの選択に対し4つの音場(フロント、センターフロント、センター、リア)で主な音源の位置を提供し、異なるライディングモードでダイナミックな調整をサポートします。

P7+では、Xpengはドイツから輸入したスピーカー振動板を使用し、20個のスピーカーソリューションを独自に設計しています。開発プロセスでは、1,500回以上のユーザーリスニング選好調査、100回以上のスピーカー振動板調整、40回以上のオーディオチューニング最適化、クロスレベルの高級モデルによる20回以上のブラインドリスニングテストなどのさまざまな作業を完了しました。このオーディオソリューションは、7.1.4 Dolby Atmosをサポートし、3つのチューニングスタイルと9バンドイコライザーを提供します。

Jiyue

Jiyue 01と07には、自社開発のRobo Soundオーディオシステムが搭載されています。Jiyue 01は16個のスピーカーを搭載し、7.1.2 Dolby Atmosのデコードに対応、アンプのピーク出力は1,000Wです。Jiyue 07は18個のスピーカーと16チャネル独立アンプを搭載し、スカイチャネルを持つ7.1.2スピーカーレイアウトを採用し、360度のサラウンド効果をもたらすことができます。

当レポートでは、中国のカーオーディオシステム産業について調査分析し、カーオーディオシステムの技術、売上と普及率、国内外のサプライヤーなどの情報を提供しています。

目次

第1章 カーオーディオシステムのイントロダクション

- カーオーディオの構造と機能

- オーディオシステムサラウンド技術

- オーディオシステム材料技術

- 車両チューニングソフトウェアアルゴリズム

- カーオーディオインテリジェント技術

第2章 カーオーディオ市場の現状

- 市場データ

- 売上と普及率

- マルチスピーカーモデルの搭載数と普及率:エネルギータイプ別(2022年~2024年)

- マルチスピーカーモデルの搭載数と普及率:価格帯別(2022年~2024年)

- マルチスピーカーモデルの搭載数と普及率:クラス別(2022年~2024年)(1)

- マルチスピーカーモデルの搭載数と普及率:サプライヤータイプ別(2022年~2024年)(2)

- マルチスピーカーモデルの搭載数と普及率:OEM別(2022年~2024年)(1)

- マルチスピーカーモデルの搭載数と普及率:ブランド別(2022年~2024年)(2)

- マルチスピーカーモデルの搭載数と普及率:ブランドサプライヤー別、標準構成(2022年~2024年)(1)

- マルチスピーカーモデルの搭載数と普及率:ブランドサプライヤー別、オプション構成(2022年~2024年)(2)

- 上位40のマルチスピーカー車(2024年1月~7月)

- 上位40のマルチスピーカーモデル(2024年1月~7月)

- 産業チェーン

第3章 カーオーディオシステムサプライヤー

- Goertek Dynaudio

- Harman

- BOSE

- Martin Logan

- YAMAHA

- Dirac

- Bowers & Wilkins

- Meridian

- HUAWEI SOUND

- ARKAMYS

- Sonavox

- NXP

- AAC Technologies

- iFLYTEK

第4章 カーオーディオシステムの事例と動向

- Tesla

- BYD

- Xpeng

- Li Auto

- NIO

- Neta

- Great Wall Motor

- Changan

- Geely

- SAIC

- FAW

- BMW

- Mercedes-Benz

- Xiaomi

- Leapmotor

- その他のモデル

- 動向

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made steady growth.

In 2024, the automotive audio market makes steady growth. In the case of models equipped with at least 8 speakers, the annual sales of such models in 2023 were 8.287 million units, with a penetration rate of 39.4%; the sales from January to July 2024 reached 5.419 million units, with a penetration rate of 47.5%. It is expected to sustain growth rate of about 24% in the next two years, and will be up to about 16.25 million units in 2026.

From 2022 to July 2024 the sales of models by number of speakers are shown below. Overall, the sales of models with more speakers were on the rise year on year.

Luxeed R7

Luxeed R7 packs Huawei's HUAWEI SOUND audio system. Of the 17 speakers arranged inside the car, 15 constitute a 7.1 surround sound field, and combined with the star ring diffusor (equipped with Schroeder diffusor technology, achieving 180° full-angle sound diffusion and balanced sound field performance) and the unique turbo subwoofer, enable stronger low-frequency dive in a smaller volume; 1 speaker is deployed outside the car, and used to play specific sound effects.

ONVO L60

ONVO L60's intelligent cockpit is equipped with a 1000W ONVO SOUND audio system with 18 speakers. It supports 7.1.14 Dolby Atmos, can be linked with the 16-million-color ring cabin waterfall ambient lights, and allows for generation of an exclusive tuning equalizer via AI algorithms.

OEMs deeply self-develop audio systems, and the share of audio brands remains unchanged.

The more speakers and microphones not only means more hardware devices, but also involves a range of tasks such as reconstruction of the sound field, redesign of the audio architecture, and readjustment of the software tuning function. If all of the work is outsourced to suppliers, the total development cost will increase.

To control costs, OEMs have further deepened independent R&D of audio systems. Some of them directly purchase key components, leverage the advantages of the supply chain, and independently design and manufacture speakers, achieving self-development of audio systems, involving audio architecture design, solution integration, device manufacturing, and sound effect adjustment.

Xpeng

In Xpeng's case, the audio systems of both X9 and P7+ are self-developed. Wherein, Xpeng X9 carries 23 self-developed Xopera speakers, providing key sound source locations in four sound fields (front, center front, center, and rear) for selection in the sound field mode, and different riding modes support dynamic adjustment.

For P7+, Xpeng uses speaker diaphragms imported from Germany and independently designs the 20-speaker solution. In the development process, it completed a range of tasks, for example, 1,500+ user listening preference surveys, 100+ speaker diaphragm modulations, 40+ rounds of audio tuning optimization, and 20+ rounds of blind listening tests with cross-level luxury models. The audio solution supports 7.1.4 Dolby Atmos and provides 3 tuning styles and 9-band equalizers for car owners to choose from.

Jiyue

Jiyue 01 and 07 are both equipped with the self-developed Robo Sound audio system. Jiyue 01 bears 16 speakers, supports 7.1.2 Dolby Atmos decoding, and the peak power of amplifiers is 1000W. Jiyue 07 is equipped with 18 speakers, and 16-channel independent amplifiers, and adopts 7.1.2 speaker layout with sky channels, which can bring 360-degree surround effects.

BYD

BYD adopts different speaker configuration strategies according to vehicle orientation:

Low-to-mid-end models such as Qin Series pack self-developed speakers;

High-end models (including some mid-end models) use branded speakers, for example, Dynaudio (supply to Han, Song L, Seal, Yangwang U8, etc.), Devialet (supply to Bao 5), and Infinity (supply to Song PLUS NEV).

How much impact do OEMs' self-developed audio solutions have on the market share of audio brands?

According to the data from ResearchInChina, from 2022 to July 2024, except for the model price range of RMB350,000-500,000, the penetration rate of brand suppliers in other price ranges didn't decrease, but rose steadily. It can be seen that brand suppliers still firmly dominate the market of audio systems for mid-to-high-end models, and are not affected by the model of "some OEMs self-developing audio systems".

While OEMs are working on in-depth self-development of audio systems, brand speaker suppliers are also optimizing automotive acoustic technology.

Harman

In 2024, Harman announced Seat Sonic, a technology which aims to enhance in-car entertainment by integrating sound into seats. The technology moves hardware components from the doors to the seats, reducing design complexity, and uses vibration sensors embedded in the seats to convert audio signals into vibrations, thereby improving the sound field effect in the cabin.

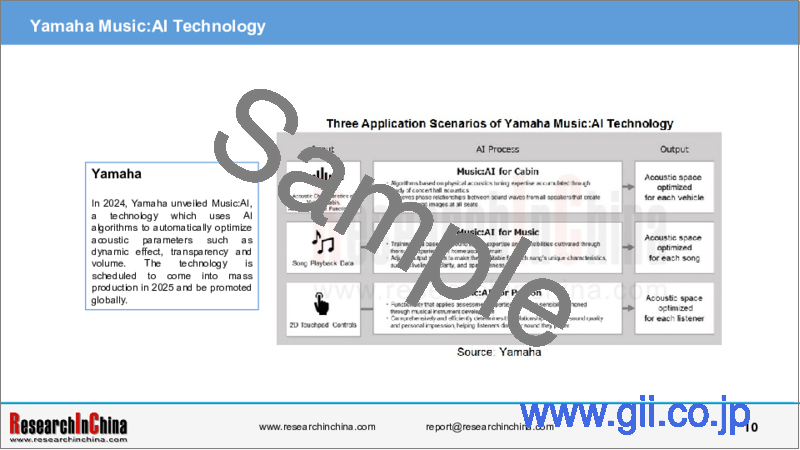

Yamaha

In 2024, Yamaha unveiled Music:AI, a technology which uses AI algorithms to automatically optimize acoustic parameters such as dynamic effect, transparency and volume. The technology is scheduled to come into mass production in 2025 and be promoted globally.

More speakers are not always better, and tuning technology is a way to improve sound effects.

In 2024, the audio system has begun to be deeply integrated with various functions of intelligent cockpits, such as music recommendation and audio-visual linkage. AI algorithms and models allow the sound effect mode to be automatically adjusted according to the user's preferences and the current environment, providing users with more intimate and personalized services. Multi-channel audio systems find broader application, including more ceiling speakers and subwoofer configurations, to achieve better 3D sound effects. To ensure user experience, more speakers in an automotive audio system are inevitable, so are the more speakers and microphones in a car audio system, the better?

ResearchInChina's research shows that after speakers in a car reach a number, blindly adding speakers will not only increase hardware costs, but will also have a very limited effect in improving in-car sound effect. It will also have some impact on audio architecture design and sound field layout.

In involution on increasing the number of hardware, in 2024 OEMs pay ever more attention to tuning technologies that can optimize acoustic effects, and cooperate with established tuning suppliers or use AI technologies (such as foundation models) for tuning.

Great Wall

In April 2024, Great Wall Motor cooperated with Dirac, a Swedish digital audio tuning supplier, to equip WEY Blue Mountain Intelligent Driving Edition with "Dirac Virtuo Professional". Based on sound separation technology, this technology decodes the spatial information contained in ordinary stereo music, re-positions the spatial dynamics and remixes it, and then allows the more than 20 speakers in the car to play it in the corresponding locations according to the spatial layout. This technology lets the narrow sound movement trajectory originally limited by dual channels extend to the entire cabin space, thereby achieving 100% conversion of audio contents, and enabling all types of sound sources to have a three-dimensional sense of space.

Geely

In May 2024, Geely and Flyme Sound Inside jointly released the AI-powered intelligent audio system - "Flyme Sound". The system supports 9.1.6 channels and panoramic surround sound. The entire architecture design can accommodate up to 27 speakers, and uses AI algorithms to enable the audio system with intelligent optimization capabilities. It can automatically optimize the sound field distribution, intelligently match the sound effects, and automatically switch virtual venues according to the in-car space, the number of passengers, what to play, etc., in a bid to ensure that every location is the best for listening.

This technology is first installed on Galaxy E5. It is equipped with a total of 16 speakers, including 2 headrest speakers with 4 modes, and can simulate 4 mixing effects and support WANOS panoramic sound.

Table of Contents

1 Introduction to Automotive Audio System

- 1.1 Structure and Function of Automotive Audio

- 1.1.1 Development History

- 1.1.2 Composition of Audio System

- 1.1.3 Audio Host: Integration with IVI System

- 1.1.3 Audio Host: Digital Audio Source Calling and Management

- 1.1.3 Audio Host: Event Audible Processing

- 1.1.4 Digital Amplifier: Types

- 1.1.5 Digital Amplifier: Structure (Bose)

- 1.1.5 Digital Amplifier: Structure (BYD)

- 1.1.5 Digital Amplifier: Structure (Harman)

- 1.1.5 Digital Amplifier: Structure (Awinic/Goodix)

- 1.1.6 DSP Amplifier: Introduction

- 1.1.6 DSP Amplifier: Working Mode

- 1.1.6 DSP Amplifier: Principle

- 1.1.6 DSP Amplifier: Common Chips

- 1.1.6 DSP Amplifier: Common Chips (NXP)

- 1.1.6 DSP Amplifier: Common Chips (TI)

- 1.1.6 DSP Amplifier: Common Chips (ADI)

- 1.1.7 Speaker: Structure

- 1.1.7 Speaker: Installation Location

- 1.1.8 Subwoofer

- 1.1.9 AVAS

- 1.1.10 Automotive Microphone: Karaoke Microphone

- 1.1.10 Automotive Microphone: MEMS Microphone Array

- 1.1.10 Automotive Microphone: ASR Microphone Array

- 1.1.10 Automotive Microphone: Installation Location

- 1.1.11 Automotive Radio

- 1.2 Audio System Surround Technology

- 1.2.1 Dolby Atmos Technology

- 1.2.2 Sound Field Technology

- 1.2.3 Headrest Audio

- 1.3 Audio System Material Technology

- 1.3.1 Built-in Dome Unit

- 1.3.2 Magnesium Silicate Polymer Cone and Aluminum Voice Coil

- 1.3.3 Dissymmetric Spider

- 1.3.4 Magnetic Drive System

- 1.3.5 Magnetic Fluid and Crossover

- 1.3.6 XStat Sensor

- 1.3.7 Folded Motion Technology

- 1.3.8 Bass Technology

- 1.4 Vehicle Tuning Software Algorithm

- 1.4.1 EQ Equalizer

- 1.4.2 Dirac Room Algorithm

- 1.4.3 DSP Active Speaker

- 1.4.4 Enhanced Bass Calibration Algorithm

- 1.4.5 FIFO Buffer Adjustment Technology

- 1.4.6 Exponential Smoothing Filter Algorithm

- 1.4.7 Data Storage and Packing Technology

- 1.4.8 Upsampling Algorithm

- 1.4.9 3D Audio Reproduction Technology

- 1.4.10 Multi-zone Sound Replay Technology

- 1.5 Vehicle Audio Intelligent Technology

- 1.5.1 Noise Reduction Technology

- 1.5.2 In-vehicle Calling Rendering Technology

- 1.5.3 Customizable Zoning Volume Control

- 1.5.4 Front/Rear Volume Zoning (RSA)

- 1.5.5 Sound Effect Upgrade Technology

- 1.5.6 Virtual Scenario Technology

- 1.5.7 Lightweight Technology

- 1.5.8 AI tuning Technology

2 Status Quo of Automotive Audio Market

- 2.1 Market Data

- 2.1.1 Sales and Penetration Rate

- 2.1.2 Installations and Penetration Rate of Multi-speaker Models (by Energy Type), 2022-2024

- 2.1.3 Installations and Penetration Rate of Multi-speaker Models (by Price Range), 2022-2024

- 2.1.4 Installations and Penetration Rate of Multi-speaker Models (by Class), 2022-2024 (1)

- 2.1.5 Installations and Penetration Rate of Multi-speaker Models (by Supplier Type), 2022-2024 (2)

- 2.1.6 Installations and Penetration Rate of Multi-speaker Models (by OEM), 2022-2024 (1)

- 2.1.7 Installations and Penetration Rate of Multi-speaker Models (by Brand), 2022-2024 (2)

- 2.1.8 Installations and Penetration Rate of Multi-speaker Models (by Brand Supplier - Standard Configuration), 2022-2024 (1)

- 2.1.8 Installations and Penetration Rate of Multi-speaker Models (by Brand Supplier - Optional Configuration), 2022-2024 (2)

- 2.1.9 TOP40 Multi-speaker Cars, Jan.-Jul. 2024

- 2.1.10 TOP40 Multi-speaker Models, Jan.-Jul. 2024

- 2.2 Industry Chain

3 Automotive Audio System Suppliers

- 3.1 Goertek Dynaudio

- 3.1.1 Profile of Goertek

- 3.1.2 Speakers of Goertek

- 3.1.3 Dynaudio Premium Audio System

- 3.1.4 Installations (Standard Configuration Only) of Dynaudio Audio (1)

- 3.1.4 Installations (Including Optional Configuration) of Dynaudio Audio (2)

- 3.1.5 Dynaudio Surpax Series

- 3.1.6 Dynaudio Car Audio: Solutions for Volkswagen

- 3.1.7 Goertek's Technology under Development

- 3.2 Harman

- 3.2.1 Profile

- 3.2.2 Partners

- 3.2.3 Music Cockpit

- 3.2.4 Intelligent Connected Audio Technology

- 3.2.5 AudioWorX Suite

- 3.2.6 Clari-Fi Technology

- 3.2.7 HALOsonic Technology Suite

- 3.2.7 HALOsonic Technology Suite - Road Noise Cancellation (RNC)

- 3.2.7 HALOsonic Technology Suite - Engine Order Cancellation (EOC)

- 3.2.7 HALOsonic Technology Suite - Sound2Target

- 3.2.7 HALOsonic Technology Suite - External Electronic Sound Synthesis (eESS)

- 3.2.8 Independent Sound Zones (ISZ) Technology

- 3.2.9 VirtualWORKS Technology

- 3.2.10 Revel Solution for Lincoln (1)

- 3.2.10 Revel Solution for Lincoln (2)

- 3.2.11 Profile of Harman Kardon

- 3.2.12 Installations (Standard Configuration Only) of Harman Kardon Audio, 2022-2024 (1)

- 3.2.12 Installations (Including Optional Configuration) of Harman Kardon Audio, 2022-2024 (2)

- 3.2.13 QLS-3D Technology

- 3.2.14 VNC Technology

- 3.2.15 Logic7 Surround Technology

- 3.2.16 Auto Leveling and Speed Dependent Volume Compensation Technology

- 3.2.17 Profile of Infinity

- 3.2.18 Installations (Standard Configuration Only) of Infinity Audio, 2022-2024 (1)

- 3.2.18 Installations (Including Optional Configuration) of Infinity Audio, 2022-2024 (2)

- 3.2.19 Installations (Standard Configuration Only) of Revel Audio, 2022-2024 (1)

- 3.2.19 Installations (Including Optional Configuration) of Revel Audio, 2022-2024 (2)

- 3.2.20 Installations (Standard Configuration Only) of JBL Audio, 2022-2024 (1)

- 3.2.20 Installations (Including Optional Configuration) of JBL Audio, 2022-2024 (2)

- 3.3 BOSE

- 3.3.1 Profile

- 3.3.2 Installations (Standard Configuration Only) of BOSE Audio, 2022-2024 (1)

- 3.2.2 Installations (Including Optional Configuration) of BOSE Audio, 2022-2024 (2)

- 3.3.3 Automotive Audio Technology: Types (1)

- 3.3.3 Automotive Audio Technology: Noise Compensation Technology (2)

- 3.3.3 Automotive Audio Technology: Surround Sound Technology (3)

- 3.3.3 Automotive Audio Technology: Virtual Surround Sound Technology (4)

- 3.3.3 Automotive Audio Technology: Sound Source Restoration Technology (5)

- 3.3.3 Automotive Audio Technology: Advanced Sound Field Localization Technology (6)

- 3.3.3 Automotive Audio Technology: SeatCentric Seat Sound Field Experience Solution (7)

- 3.3.4 Active Management Technology: QuietComfort Active Road Noise Cancellation Technology (1)

- 3.3.4 Active Management Technology: Engine Harmonic Cancellation (EHC) (2)

- 3.3.4 Active Management Technology: Engine Harmonic Enhancement Technology (EHE) (3)

- 3.3.4 Active Management Technology: Electric Vehicle Sound Enhancement Technology (EVSE) (4)

- 3.3.5 Seat Sound Field Technology

- 3.3.6 Cooperation Case: Porsche

- 3.4 Martin Logan

- 3.4.1 Profile

- 3.4.2 Automotive Audio Technology

- 3.4.3 Electrostatic Diaphragm Technology

- 3.4.4 Curvilinear Line Source technology

- 3.4.5 Cone Bass Unit

- 3.5 YAMAHA

- 3.5.1 Profile

- 3.5.2 Supported Models

- 3.5.3 Customized Chips

- 3.5.4 Features

- 3.5.5 Installations (Standard Configuration Only) of YAMAHA Audio, 2022-2024 (1)

- 3.5.5 Installations (Including Optional Configuration) of YAMAHA Audio, 2022-2024 (2)

- 3.6 Dirac

- 3.6.1 Profile

- 3.6.2 Dirac Live Room Correction Sound Field Technology

- 3.6.3 Dirac Optep Sound Optimization Technology

- 3.6.4 Dirac Virtuo Spatial Audio Technology

- 3.6.5 Dirac Automotive Intelligent Audio Platform

- 3.6.6 Dirac Upmixing Technology

- 3.6.7 Dirac Intelligent Audio Platform (IAP)

- 3.7 Bowers & Wilkins

- 3.7.1 Profile

- 3.7.2 Installations (Standard Configuration Only) of Bowers & Wilkins Audio, 2022-2024 (1)

- 3.7.2 Installations (Including Optional Configuration) of Bowers & Wilkins Audio, 2022-2024 (2)

- 3.7.3 Diamond Dome Speaker and Nautilus Speaker

- 3.7.4 Top Tweeter and Speaker Cone Technology

- 3.7.5 Noise Reduction Technology

- 3.8 Meridian

- 3.8.1 Profile

- 3.8.2 Installations (Standard Configuration Only) of Meridian Audio, 2022-2024 (1)

- 3.8.2 Installations (Including Optional Configuration) of Meridian Audio, 2022-2024 (2)

- 3.8.3 Audio Technology: Upmixing (1)

- 3.8.3 Audio Technology: Cabin Correction (2)

- 3.8.3 Audio Technology: Sound Restoration (3)

- 3.8.3 Audio Technology: Sound Balance (4)

- 3.8.3 Audio Technology: True Time (5)

- 3.8.3 Audio Technology: Trifield 3D and Intelli-Q (6)

- 3.9 HUAWEI SOUND

- 3.9.1 Dedicated Sound Unit

- 3.9.2 Tuning Modes

- 3.9.3 Installations of HUAWEI SOUND Audio, 2022-2024

- 3.10 ARKAMYS

- 3.10.1 Three Categories of Products

- 3.10.2 Tuning Technology

- 3.10.3 Noise Reduction and Sound Alerts Technology

- 3.10.4 Installations (Standard Configuration Only) of ARKAMYS Audio, 2022-2024 (1)

- 3.10.4 Installations (Including Optional Configuration) of ARKAMYS Audio, 2022-2024 (2)

- 3.11 Sonavox

- 3.11.1 Profile

- 3.11.2 Automotive Audio Products

- 3.11.3 R&D Projects and Strength

- 3.11.4 Core Technologies

- 3.11.5 Installations of Sonavox Audio, 2022-2024

- 3.12 NXP

- 3.12.1 Profile

- 3.12.2 Audio Solutions (1)

- 3.12.2 Audio Solutions (2)

- 3.12.3 Speaker Solutions (1)

- 3.12.3 Speaker Solutions (2)

- 3.12.3 Speaker Solutions (3)

- 3.13 AAC Technologies

- 3.13.1 Profile

- 3.13.2 Acoustic Products

- 3.13.3 Microphones

- 3.13.4 MEMS Speakers

- 3.14 iFLYTEK

- 3.14.1 Profile

- 3.14.2 Intelligent Vehicle Product Layout

- 3.14.3 Intelligent Interaction Development Route

- 3.14.4 Intelligent Cockpit Solutions

- 3.14.5 Feiyu Platform

- 3.14.6 Noise Reduction Technology

- 3.14.7 Upsampling Algorithm

- 3.14.8 Integrating AI into Acoustic Design of Cockpits

- 3.14.9 Spark 4.0 Intelligent Cockpit Voice Service

4 Automotive Audio System Cases and Trends

- 4.1 Tesla

- 4.1.1 Installation Share of Speakers in Tesla Models

- 4.1.2 Model 3's Audio

- 4.1.3 Model Y's Audio

- 4.1.4 Tesla Microphones

- 4.2 BYD

- 4.2.1 Sales of Models with Different Speakers

- 4.2.2 Sales of Models by Number of Speakers, Jan.-Jul. 2024

- 4.2.3 Audio Component Circuit Diagram (1): Seal

- 4.2.3 Audio Component Circuit Diagram (2): Song Series

- 4.2.3 Audio Component Circuit Diagram (3): Han

- 4.2.4 Han EV's Speaker Solution: Hardware Devices

- 4.2.4 Han EV's Speaker Solution: Software Tuning

- 4.2.5 Yangwang U8's Speaker Solution

- 4.2.6 Source of Speakers

- 4.3 Xpeng

- 4.3.1 Sales of Models with Different Speakers

- 4.3.2 MONA M03 Audio

- 4.3.3 Xpeng X9's Audio

- 4.3.4 G9 Model

- 4.3.5 P7 Model

- 4.4 Li Auto

- 4.4.1 Sales of Models with Different Speakers

- 4.4.2 Li L6' Audio

- 4.4.3 Li Mega's Audio

- 4.4.4 L Series

- 4.5 NIO

- 4.5.1 Sales of Models with Different Speakers

- 4.5.2 ET9 Model

- 4.5.3 ET7 Model: Layout

- 4.5.3 ET7 Model: Sound Channel

- 4.5.3 ET7 Model: Tuning Algorithm

- 4.5.4 ES8 Model

- 4.5.5 ET5 Model

- 4.6 Neta

- 4.6.1 Sales of Models with Different Speakers

- 4.6.2 Neta S Model

- 4.6.3 Neta L Model

- 4.7 Great Wall Motor

- 4.7.1 Sales of Models with Different Speakers

- 4.7.2 Haval Cool Dog

- 4.7.3 Tank 300

- 4.7.4 Tank 500

- 4.7.5 Mocha

- 4.7.6 2025 WEY Blue Mountain

- 4.8 Changan

- 4.8.1 Sales of Models with Different Speakers

- 4.8.2 Model: Explorer

- 4.8.2 Model: Corsair

- 4.8.2 Model: UNI-K

- 4.9 Geely

- 4.9.1 Sales of Models with Different Speakers

- 4.9.2 Audio of 2024 Models: Zeekr 001 (2025 Model)

- 4.9.2 Audio of 2024 Models: Geely Galaxy E5

- 4.9.2 Audio of 2024 Models: LEVC L380

- 4.9.2 Audio of 2024 Models: Lotus Eletre S+

- 4.9.3 Boyue

- 4.9.4 Xingyue L

- 4.9.5 XC90

- 4.10 SAIC

- 4.10.1 Sales of Models with Different Speakers

- 4.10.2 IM LS6's Audio

- 4.10.3 IM LS7

- 4.10.4 Cadillac Model

- 4.10.5 Buick Model

- 4.11 FAW

- 4.11.1 Sales of FAW Models with Different Speakers

- 4.11.2 Audi Q7

- 4.12 BMW

- 4.12.1 Sales of Models with Different Speakers

- 4.12.2 BMW I7 Model

- 4.13 Mercedes-Benz

- 4.13.1 Sales of Mercedes-Benz Models with Different Speakers

- 4.13.2 Maybach Model

- 4.14 Xiaomi

- 4.14.1 SU7's Speaker System

- 4.14.2 SU7's Multi-sound Zone Recognition/False Wake-up Suppression

- 4.15 Leapmotor

- 4.15.1 C11's Audio

- 4.15.2 C16's Audio

- 4.16 Other Models

- 4.16.1 AITO M9: Sound Distribution (1)

- 4.16.1 AITO M9: Tuning Capability (2)

- 4.16.2 Stelato S9

- 4.16.3 ARCFOX aT/S

- 4.16.4 Porsche Taycan's Audio

- 4.16.5 Dongfeng e-phi-007

- 4.17 Trends

- 4.17.1 Configuration Schemes for Some Popular Models

- 4.17.2 Content Per-car Value of Audio System Increases

- 4.17.3 Foundation Models Expand the Boundaries of Audio Use

- 4.17.4 Installation of Sound Zone Recognition Increases

- 4.17.5 KTV Entertainment Functions Are Enhanced

- 4.17.6 External Amplifiers Become A New Choice for Users

- 4.17.7 Chip Vendors Take A Deeper Part: Cooperation with Tuning Suppliers

- 4.17.7 Chip Vendors Take A Deeper Part: DSP Chips Are Expected to Be Localized

- 4.17.8 Audio Tuning: Personalized (1)

- 4.17.8 Audio Tuning: Precise (2)

- 4.17.9 Music Cockpit: Audio Links with Lighting and Seats

- 4.17.10 OTA Is A Value-added Path for Tuning Software

- 4.17.11 The "White Label Manufacturer + Tuning Software" Solution Is Expected to Challenge the Market Share of Brand Suppliers

- 4.17.12 OEMs' Self-developed Solutions Become More Cost-effective: Cases