|

|

市場調査レポート

商品コード

1457880

世界と中国の自動車用照明システム(2023年~2024年)Global and China Automotive Lighting System Research Report, 2023-2024 |

||||||

|

|||||||

| 世界と中国の自動車用照明システム(2023年~2024年) |

|

出版日: 2024年03月10日

発行: ResearchInChina

ページ情報: 英文 350 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

インテリジェントヘッドライトと内部照明システムの搭載数は着実に増加しました。

2019年~2023年にインテリジェントヘッドライトと内部照明システムの搭載数は着実に増加しました。内部照明には主に、アンビエントライト、読書灯、トランクライト、ドアライト、クラスターライトが含まれます。このうち、アンビエントライトは2023年に44.1%の普及率を誇り、直近の5年間に16.3%のAAGRを維持しました。ResearchInChinaは、2025年にアンビエントライトが1,300万台に標準装備され、普及率は60%近くに達すると予測しています。

タッチ式読書灯の搭載は2019年~2023年に急増し、2023年の普及率は16.8%に達し、この機能を搭載したモデルはBYD、Audi、Li Autoのモデルがもっとも多かったです。

インテリジェントヘッドライトは、DLPヘッドライト、デジタルヘッドライト、プログラマブルヘッドライト、アダプティブドライビングビーム(ADB)ヘッドライトに代表されます。これらのヘッドライトは、自律走行支援、車外とのインタラクション、エンターテインメントプロジェクションなどの機能を可能にします。

2023年、インテリジェントヘッドライトの光源の主流はLEDの組み合わせで、搭載数の約84%を占め、ハロゲンヘッドライトは15%を占め、レーザーヘッドライトのシェアはまだ0.5%未満です。2023年、インテリジェントヘッドライトの中でマトリクスヘッドライトがもっとも多く搭載され、222万9,000台に取り付けられ、幾何学的マルチビームヘッドライトが続き、23万1,000台に搭載されました。

直近の5年間、ADBヘッドライトの搭載数は増加傾向にあり、2021年に標準ADBヘッドライトの搭載数が初めてオプションの搭載数を上回り、2023年にはADBヘッドライトが158万4,000台に搭載されました。

インテリジェントヘッドライトは、インタラクション、エンターテインメント、インテリジェント運転支援機能を備えています。

19世紀後半には主に夜間照明用として、最初の電動ヘッドランプが市販されました。

2023年、ヘッドライトはより多様化しました。技術の進化に伴い、ヘッドライトは照明以外の機能(インテリジェント運転支援、インタラクション、エンターテインメントなど)を担うようになっています。

自動車用照明機能の多様化は、DLP、MicroLED、ピクセルヘッドライトなどの照明技術の応用を促進しただけでなく、自動車用照明と他の自動車部品との統合にも拍車をかけています。例えば、「照明-スクリーン統合」(車外照明とディスプレイにディスプレイを使用)、「照明-表面統合」(スマート表面技術を照明システムに統合、主に車外グリル照明と車内アンビエント/ドア照明)、「認識照明」(センサーを照明に統合してインテリジェンスを強化)などです。

インテリジェント照明のインタラクション機能の場合、ヘッドライトが投影する映像とLEDディスプレイが示すピクセルグラフィックが、歩行者や車両とのインタラクションに対するユーザーの意思を伝えます。この技術は主に、ピクセルヘッドライトの投影とプログラマブルヘッドライトの光情報インタラクションモードによって実現されます。

Xpengは光情報インタラクション機能を最初に導入し、2020年、約5,000台を売り上げたモデルであるP7に採用しました。この機能は2022年にP5とG9に搭載され、smart#1、Avatr 11、SAIC Rising/IMシリーズ、Hongqi H9もこの年に追随し始めました。2023年、照明情報インタラクション機能を搭載したモデルがブームになり始め、33万台に搭載され、普及率は1.6%に達しました。

ZEEKR 007は、フロントフェイスにインテリジェントライトカーテン「Valeo ZEEKR STARGATE」が内蔵されています。フロントライトカーテンは、光情報インタラクションデザインをサポートし、「照明-スクリーン統合」アプローチを採用し、インテリジェントな表現と礼儀正しい表示のカスタマイズを可能にします。ZEEKR STARGATEは、TIが提供する75個の自動車グレードドライバーICによって独立制御されています。

当レポートでは、世界と中国の自動車産業について調査分析し、自動車用照明の搭載数と搭載率のデータや、国内外のサプライヤーのプロファイルなどを提供しています。

目次

第1章 自動車用照明の概要

- 自動車用照明の分類と技術ルート

- 外部照明システム

- 内部照明システム

- 自動車用照明産業の規制と政策

第2章 世界と中国の自動車用照明市場

- 中国の自動車用照明市場データ

- 世界のデータ

第3章 世界の主要自動車用照明サプライヤー

- 自動車用照明の産業チェーン

- 主要自動車用照明メーカーのインテリジェント技術ソリューションと供給関係

- Koito

- Stanley

- Marelli

- Hella

- Digital Lighting Solution

- Valeo

- OSRAM

- SL

- LG Group

- Magna

- Lumileds

- Varroc

第4章 中国の主要自動車用照明サプライヤー

- HASCO Vision

- Changzhou Xingyu Automotive Lighting Systems

- Foshan Lighting

- APT Electronics

- Mande Electronics and Electrical

- Refond Optoelectronics

- Xunchi Vehicle Jiangsu

- Tongbao Optoelectronics

- Zhejiang Ginye Auto Parts

- Anrui Optoelectronics

- Hongli Zhihui Group

- DEPO Auto Parts

- Zhejiang Tianchong Vehicle Lamp Group

- Zhejiang Jiali(Lishui)Industry

第5章 OEMのインテリジェント照明ソリューション

- Audi

- OLED Taillight Technology (DLP)

- BYD

- Cadillac LYRIQ

- IM Motors

- Xpeng X9/G6

- Tesla Model Y

- Li Auto

- NIO ET9

- AITO

- Jiyue 01

- Great Wall MotorのDLP技術に基づくピクセルインテリジェントヘッドライト

- Buick

- Mercedes-BenzのDMDヘッドライト

- Fordのヘッドライト研究開発の歴史と力学

- LexusのBladeScanヘッドライト

第6章 自動車用照明の動向

Installations of intelligent headlights and interior lighting systems made steady growth.

From 2019 to 2023, the installations of intelligent headlights and interior lighting systems grew steadily. Interior lighting mainly includes ambient, reading, trunk, door, and cluster lights. Among them, the ambient light boasted a penetration of 44.1% in 2023, and sustained an AAGR of 16.3% in recent five years. ResearchInChina predicts that the ambient light as a standard configuration will be installed in 13 million vehicles in 2025, with a penetration rate of nearly 60%.

The installations of touch reading light soared from 2019 to 2023, with penetration up to 16.8% in 2023, and the most models equipped with this function were from BYD, Audi, and Li Auto.

Intelligent headlights are led by DLP headlights, digital headlights, programmable headlights, and adaptive driving beam (ADB) headlights. They can enable such functions as autonomous driving assistance, exterior interaction, and entertainment projection.

In 2023, the mainstream light source of intelligent headlights was LED combination, sweeping about 84% of the installations; halogen headlights made up 15%; laser headlights still took a less than 0.5% share. In 2023, among intelligent headlights, matrix headlights were installed most, and mounted on 2,229,000 vehicles; geometric multi-beam headlights followed, with installation in 231,000 vehicles.

In recent five years, the installations of ADB headlights were on the rise: in 2021, the installations of the standard ADB headlights exceeded the optional for the first time; in 2023, ADB headlights were installed in 1,584,000 vehicles.

Intelligent headlights bear interaction, entertainment and intelligent driving assistance functions.

In late 19th century, the first electric headlamp was available on market, mainly for night lighting.

In 2023, headlights became more diversified. As technology evolves, they begin to carry functions other than lighting, including: intelligent driving assistance, interaction, and entertainment.

The diversification of automotive lighting functions has not only expedited the application of lighting technologies like DLP, MicroLED, and pixel headlights, but also fueled the integration of automotive lighting with other auto parts, for example, "lighting-screen integration" (using displays for exterior lighting and display), "lighting-surface integration" (integrating smart surface technology into the lighting system, mainly exterior grille lights and interior ambient/door lights), and "perception lighting" (integrating sensors into lights to enhance intelligence).

In the case of interaction function of intelligent lighting, the images projected by headlights and the pixel graphics showed by the LED display convey the user's intents for interaction with pedestrians and vehicles. This technology is mainly enabled by the projection of pixel headlights and the light information interaction mode of programmable headlights.

Xpeng was the first to introduce the light information interaction function, and used it in P7 in 2020, a model with sales of about 5,000 units. This function was available to P5 and G9 in 2022, and smart#1, Avatr 11, SAIC Rising/IM series, and Hongqi H9 began to follow suit in the year. In 2023, the models equipped with lighting information interaction function began to boom, with 330,000 vehicles installed with it, the penetration rate up to 1.6%.

ZEEKR 007 packs Valeo ZEEKR STARGATE, an integrated intelligent light curtain in the front face. The front light curtain supports the light information interaction design, adopts the "light-screen integration" approach, and allows customization of intelligent expressions and courtesy signs. ZEEKR STARGATE is independently controlled by 75 automotive-grade driver ICs provided by TI.

In December 2023, AITO M9 was officially released with Huawei's XPixel automotive lighting technology. DLP projection enables intelligent driving assistance functions such as lane change and turning alert, lane guidance, and light blanket projection. In terms of interaction function, AITO M9's ISD lights with more than 1,000 pixels have built in over 10 animation effects such as welcome, charging animation and light information interaction, as well as over 40 customized patterns. The 4M high-speed serial communication realizes smoother animation effects, and the customized animations can be refreshed via OTA updates to meet the customization requirements of different target groups.

Intelligent automotive lighting is integrated with sensors.

As autonomous driving technology advances, automotive lighting systems are no longer limited to lighting functions, but further integrated with radar, camera and other ADAS sensors. They utilize intelligent perception function and common EEA to further enhance lighting intelligence, and keep evolving towards perception lighting.

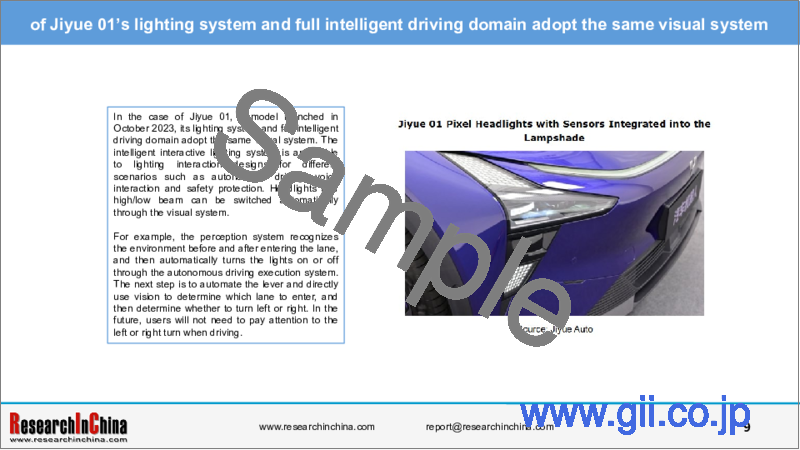

In the case of Jiyue 01, a model launched in October 2023, its lighting system and full intelligent driving domain adopt the same visual system. The intelligent interactive lighting system is applicable to lighting interaction designs for different scenarios such as autonomous driving, voice interaction and safety protection. Headlights and high/low beam can be switched automatically through the visual system.

For example, the perception system recognizes the environment before and after entering the lane, and then automatically turns the lights on or off through the autonomous driving execution system. The next step is to automate the lever and directly use vision to determine which lane to enter, and then determine whether to turn left or right. In the future, users will not need to pay attention to the left or right turn when driving.

ZKW has been researching the integration of sensors and lighting systems since 2019, and has launched products that integrate radar sensors and lighting systems, for example, the "Project Dragonfly".

In May 2023, ZKW and REHAU Automotive decided to jointly drive forward the integration of modern lighting systems in vehicle fronts. They will promote the "seamless intelligent vehicle front" project where light, sensor technology and electronics in the vehicle front are connected. The seamless vehicle front is enriched with light, logo, sensor and heating elements and thus becomes an intelligent design object.

Table of Contents

1 Overview of Automotive Lighting

- 1.1 Automotive Lighting Classification and Technology Route

- 1.1.1 Classification and Functions of Automotive Lighting System

- 1.1.2 Development History

- 1.1.3 Light Source Evolution Route

- 1.1.4 Mainstream Automotive Lighting Technology Route

- 1.1.5 Comparison between Intelligent Automotive Lighting Technologies

- 1.2 Exterior Lighting System

- 1.2.1 Composition of Headlight

- 1.2.2 LED Lighting: Application

- 1.2.2 LED Lighting: Classification

- 1.2.2 LED Lighting: Cost Structure

- 1.2.2 LED Lighting: Industry Chain

- 1.2.3 Intelligent Automotive Lighting Technologies

- 1.2.4 AFS Headlights

- 1.2.5 Matrix Headlight: Principle

- 1.2.5 Matrix Headlight: Cases

- 1.2.6 ADB Headlight: Principle and Functions

- 1.2.6 ADB Headlight: Development History

- 1.2.7 Pixel Headlight

- 1.2.8 Digital Headlight

- 1.2.9 DLP Technology: Definition

- 1.2.9 DLP Technology: Development History

- 1.2.9 DLP Technology: Principles

- 1.2.9 DLP Technology: DMD Chip Structure

- 1.2.9 DLP Technology: DMD Chip Characteristics and Limitations

- 1.2.10 DLP Automotive Lighting Solutions

- 1.2.11 DLP Automotive Lighting Suppliers and Solutions

- 1.2.12 OEM Solutions for DLP Automotive Lighting

- 1.2.13 Optimize ADB by DLP

- 1.2.14 New Solution for DMD Chip

- 1.2.15 Micro LED Direct Light Source Projection Technology

- 1.2.16 Micro LED Case

- 1.2.17 List of Micro LED Automotive Light Source Module Suppliers and Solutions

- 1.2.18 Micro LED Automotive Light Tier1 Suppliers and Solutions

- 1.2.19 Micro-LED Latest Dynamics

- 1.2.20 Driver Chips

- 1.3 Interior Lighting System

- 1.3.1 Classification of In-vehicle Ambient Lighting - By Light Emitting Forms

- 1.3.2 Main Functions and Principles of In-vehicle Ambient Lighting

- 1.3.3 Ambient Lighting Technology Route

- 1.3.4 Application History of In-vehicle Ambient Lighting

- 1.3.5 Development Cycle of In-vehicle Ambient Lighting

- 1.3.6 Industry Chain of In-vehicle Ambient Lighting

- 1.3.7 In-vehicle Ambient Lighting Solutions

- 1.4 Regulations and Policies for Automotive Lighting Industry

- 1.4.1 Global Automotive Lighting Standard System

- 1.4.2 China's Automotive Lighting Standard System

- 1.4.3 Automotive Lighting Regulations in China

- 1.4.4 China's Automotive Lighting Design Requirements

- 1.4.5 Automotive Lighting Regulations in United States

- 1.4.6 Automotive Lighting Standards in United States

- 1.4.7 Automotive Lighting Standards in Japan and Australia

- 1.4.8 Automotive Lighting Regulations in European Union

- 1.4.9 Projection Regulations

- 1.4.10 ADS Automotive Lighting Regulations

2 Global and China Automotive Lighting Markets

- 2.1 China Automotive Lighting Market Data

- 2.1.1 Installation of Different Types of Low/High Beam

- 2.1.2 Installation and Growth Rate of LED/Laser High Beam

- 2.1.3 Installation and Penetration Rate of Automatic Induction Light

- 2.1.4 Installation and Penetration Rate of Adaptive High/ Low Beam

- 2.1.5 Installation and Penetration Rate of AFS Light

- 2.1.6 Installation and Penetration Rate of ADB Headlight

- 2.1.7 Installation and Penetration Rate of AHS

- 2.1.8 Installation and Penetration Rate of Matrix/Geometric Multi-Beam Headlight

- 2.1.9 Installation and Penetration Rate of Pixel/Laser Headlight

- 2.1.10 Installation and Penetration Rate of Light Signal Function

- 2.1.11 Installation and Penetration Rate of Headlight Raising Function

- 2.1.12 Installation and Penetration Rate of Headlight Cleaning Function

- 2.1.13 Installation and Major Models of Headlight Delay Off Function

- 2.1.13 Penetration Rate of Headlight Delay Off Function

- 2.1.14 Installation and Penetration Rate of Turn Assist Light

- 2.1.15 Installation and Penetration Rate of Daytime Driving Light

- 2.1.16 Installation and Penetration Rate of Fog Light

- 2.1.17 Installation and Penetration Rate of Rain & Fog Mode

- 2.1.18 Market Size and Penetration Rate of Ambient Lighting Market

- 2.1.19 Installation and Penetration Rate of Touch Reading Light

- 2.1.20 Characteristics of China's Automotive Lighting Industry

- 2.1.21 China's Automotive Lighting Aftermarket

- 2.2 Global Data

- 2.2.1 Cost Comparison between Automotive Lighting with Different Light Sources

- 2.2.2 Global Automotive Lighting Market Size

- 2.2.3 Global Automotive Exterior Lighting Market Size

3 Major Global Automotive Lighting Suppliers

- Automotive Lighting Industry Chain

- Intelligent Technology Solutions and Supply Relationships of Major Automotive Lighting Suppliers

- 3.1 Koito

- 3.1.1 Profile

- 3.1.2 Operation

- 3.1.3 Layout in China

- 3.1.4 Shareholding Companies/Overseas Companies

- 3.1.5 BladeScan@ADB Headlamp System and Supported Models

- 3.1.6 Automotive Lighting Technology Integrated with Sensors

- 3.1.7 Cooperation and Deployments in Intelligent Automotive Lighting

- 3.2 Stanley

- 3.2.1 Profile

- 3.2.2 Product Classification

- 3.2.3 Layout in China

- 3.2.4 LCD-ADB Headlight Systems

- 3.2.5 Laser Scan Headlight Systems

- 3.2.6 Automotive LED Lights

- 3.2.7 Automotive Ambient Lights

- 3.3 Marelli

- 3.3.1 Profile

- 3.3.2 Development History of Automotive Lighting

- 3.3.3 Ambient Lights

- 3.3.4 h-Digi micro-LED Digital Headlights

- 3.3.5 Front-end Lighting Modules & Combined Headlights

- 3.3.6 Folia-LED Taillight Solution

- 3.3.7 ADB Headlights

- 3.3.8 Latest Products for CES2024

- 3.4 Hella

- 3.4.1 Profile

- 3.4.2 Operation

- 3.4.3 Development History of Automotive Lighting

- 3.4.4 Development History in China

- 3.4.5 Layout in China

- 3.4.6Digital Lighting Solution

- 3.5 Valeo

- 3.5.1 Profile

- 3.5.2 Development History of Automotive Lighting

- 3.5.3 Layout in China

- 3.5.4 Intelligent Automotive Lighting Technology

- 3.5.5 Technology Evolution: Front Lighting Technology

- 3.5.5 Technology Evolution: Rear Lighting Technology

- 3.5.5 Technology Evolution: Automotive Interior Lighting Technology

- 3.5.6 Latest Dynamics

- 3.6 OSRAM

- 3.6.1 Profile

- 3.6.2 Development History of Automotive Lighting

- 3.6.3 Automotive Lighting Development Plan

- 3.6.4 Dynamics

- 3.7 SL

- 3.7.1 Profile

- 3.7.2 Layout in China

- 3.7.3 Innovative Automotive Lighting Technology

- 3.8 LG Group

- 3.8.1 Profile

- 3.8.2 Dynamics: LG Innotek Nexlide-E Lighting Module

- 3.8.3 Introduction of LG Subsidiary: ZKW

- 3.8.4 ZKW Global Distribution

- 3.8.5 ZKW Development History

- 3.8.6 Technology Route

- 3.8.7 stripeZ Technology: Principle and Structure

- 3.8.8 Dynamic: New µMirror Module for Dynamic Lighting Functions Developed with Various Companies

- 3.9 Magna

- 3.9.1 Profile

- 3.9.2 Ultra-thin Micro LED Lighting Technology

- 3.9.3 Latest Dynamics

- 3.10 Lumileds

- 3.10.1 Profile

- 3.10.2 Global Layout

- 3.10.3 Subsidiaries in China

- 3.11 Varroc

- 3.11.1 Profile

- 3.11.2 Equity Structure of Subsidiaries

- 3.11.3 Layout in China

- 3.11.4 Automotive Lighting Business Layout and Lighting Technology

4 Major Chinese Automotive Lighting Suppliers

- 4.1 HASCO Vision

- 4.1.1 Profile

- 4.1.2 Development History and Financial Data

- 4.1.3 Main Products and Technologies

- 4.1.4 Intelligent Interactive Lighting System

- 4.1.5 Digital Lighting Solutions

- 4.2 Changzhou Xingyu Automotive Lighting Systems

- 4.2.1 Profile

- 4.2.2 Operation

- 4.2.3 Automobile Lights Production Bases and Capacity

- 4.2.4 Global Layout

- 4.2.5 R&D History of Intelligent Automotive Lighting

- 4.2.6 Major Customers and Dynamics

- 4.3 Foshan Lighting

- 4.3.1 Profile

- 4.3.2 Financial and Equity Situation

- 4.3.3 Automotive Lighting Technology and Layout

- 4.3.4 Subsidiary: Nanning Liaowang Auto Lamp

- 4.3.5 Layout of Nanning Liaowang Auto Lamp

- 4.3.6 Subsidiary: NationStar Optoelectronics

- 4.4 APT Electronics

- 4.4.1 Profile

- 4.4.2 Financial Data

- 4.4.3 Development History

- 4.4.4 Core Technology

- 4.4.5 Technology Route

- 4.4.6 Automotive LED Product Map

- 4.4.7 High-power Automotive LED Light Source Roadmap

- 4.5 Mande Electronics and Electrical

- 4.5.1 Profile

- 4.5.2 Lighting Products

- 4.5.3 Intelligent Automotive Lighting Solutions

- 4.6 Refond Optoelectronics

- 4.6.1 Profile

- 4.6.2 Lighting Module Products

- 4.6.3 Lighting Products: Ambient Lighting/Illuminated Vehicle Marker

- 4.6.3 Lighting Products: Mini LED Taillights

- 4.6.4 Next Planning

- 4.7 Xunchi Vehicle Jiangsu

- 4.7.1 Profile

- 4.7.2 Technology and Dynamics

- 4.8 Tongbao Optoelectronics

- 4.8.1 Profile

- 4.8.2 Operation

- 4.9 Zhejiang Ginye Auto Parts

- 4.9.1 Profile and Dynamics

- 4.9.2 Automotive Lighting Solutions

- 4.10 Anrui Optoelectronics

- 4.10.1 Profile

- 4.10.2 R&D and Production Bases

- 4.10.3 Deployments in Intelligent Automotive Lighting

- 4.11 Hongli Zhihui Group

- 4.11.1 Profile

- 4.11.2 Operation

- 4.11.3 Lighting Products and Supporting

- 4.11.4 Automotive Lighting Dynamics

- 4.12 DEPO Auto Parts

- 4.12.1 Profile

- 4.12.2 Operation

- 4.12.3 Deployments in Intelligent Automotive Lighting and R&D Directions

- 4.13 Zhejiang Tianchong Vehicle Lamp Group

- 4.13.1 Profile

- 4.13.2 Intelligent Automotive Lighting Products

- 4.14 Zhejiang Jiali (Lishui) Industry

- 4.14.1 Profile

- 4.14.2 Main Products

5 Intelligent Lighting Solutions of OEMs

- 5.1 Audi

- 5.1.1 Evolution of Automotive Lighting Technology

- 5.1.2 OLED Taillight Technology

- 5.1.3OLED Taillight Technology (DLP)

- 5.2 BYD

- 5.2.1 Introduction to Automotive Lighting

- 5.2.2 Automotive Lighting Technology-Full Vehicle LED

- 5.2.3 LED Headlight Modularization

- 5.2.4 Features of Yangwang Light Set

- 5.2.5 Development Plan for Automotive LED Lighting

- 5.3 Cadillac LYRIQ

- 5.4 IM Motors

- 5.4.1 IM L7 Intelligent Lighting System

- 5.4.2 DLP Projection Headlight Technology Evolution and Characteristics

- 5.5 Xpeng X9/G6

- 5.6 Tesla Model Y

- 5.7 Li Auto

- 5.7.1 LI L9

- 5.7.2 Li L7/L8

- 5.8 NIO ET9

- 5.9 AITO

- 5.9.1 Huawei XPixel Technology Solution

- 5.9.2 AITO M9 Intelligent Headlights: 13 Functions/Scenario Applications

- 5.10 Jiyue 01

- 5.11 Great Wall Motor's Pixel Intelligent Headlights Based on DLP Technology

- 5.12 Buick

- 5.12.1 Matrix Pixel Intelligent Headlight Technology Evolution

- 5.12.2 Third Generation Matrix Pixel Intelligent Headlight

- 5.13 Mercedes-Benz DMD Headlights

- 5.14 Ford Headlight R&D History and Dynamics

- 5.15 Lexus BladeScan Headlights

6 Automotive Lighting Trends

- 6.1 Trend 1

- 6.1.1 Light-screen Integration/ Light-surface Integration

- 6.1.2 iNest 3.0 Concept Car of Nobo Automotive

- 6.1.3 Light-screen Integration of Changan E07

- 6.1.4 Vision One-Eleven Pixel Screen of Mercedes-Benz

- 6.1.5 ZEEKR 007: Light-screen Integration

- 6.2 Trend 2

- 6.2.1 Intelligent Automotive Lights Carry Exterior Interaction Functions

- 6.2.2 Advantage of Integrated Interaction Function: Enhancing User Experience

- 6.2.2 Advantage of Integrated Interaction Function: Accelerating Intelligent Lighting Technology

- 6.2.3 Lighting Interaction Function Cases

- 6.3 Trend 3

- 6.4 Trend 4

- 6.5 Trend 5

- 6.6 Trend 6

- 6.6.1 Intelligent Automotive Lights Evolving Toward Autonomous Lighting

- 6.6.2 Types and Characteristics of Automotive Light Sensors

- 6.6.3 Application Cases of Automotive Light Sensors

- 6.6.4 Cases

- 6.7 Trend 7