|

|

市場調査レポート

商品コード

1468045

アルゴリズム取引の世界市場(2024年)Global Algorithm Trading Market Research Report 2024 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アルゴリズム取引の世界市場(2024年) |

|

出版日: 2024年04月23日

発行: QYResearch

ページ情報: 英文 143 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界のアルゴリズム取引の市場規模は、2023年に135億2,337万米ドルであり、2030年までに267億3,034万米ドルに達すると予測され、2024年~2030年の予測期間にCAGRで10.58%の成長が見込まれます。

北米市場は、2023年の63億1,947万米ドルから2030年までに123億5,744万米ドルに達すると推定され、予測期間のCAGRは10.46%です。

アジア太平洋市場は、2023年の31億7,934万米ドルから2030年までに63億5,380万米ドルに達すると推定され、予測期間のCAGRは10.73%です。

世界の投資銀行におけるアルゴリズム取引の市場規模は、2023年の68億5,229万米ドルから2030年までに133億8,121万米ドルに達すると推定され、予測期間のCAGRは10.39%です。

世界のアルゴリズム取引の主要企業は、QuantConnect、63 moons、InfoReach、Argo SE、MetaQuotes Software、Automated Trading SoftTech、Tethys Technology、Trading Technologies、Tata Consultancy Servicesなどです。2023年、世界の上位3ベンダーが収益の約22.52%を占めました。

当レポートでは、世界のアルゴリズム取引市場について調査分析し、各地域の市場規模と予測、企業プロファイル、市場力学などを提供しています。

目次

第1章 レポートの概要

- 調査範囲

- 市場の分析:タイプ別

- 世界のアルゴリズム取引の市場規模成長率:タイプ別(2019年・2023年・2030年)

- 外国為替アルゴリズム取引

- 株式アルゴリズム取引

- ファンドアルゴリズム取引

- 債券アルゴリズム取引

- 暗号アルゴリズム取引

- その他のアルゴリズム取引

- 市場:用途別

- 世界のアルゴリズム取引市場の成長:用途別(2019年・2023年・2030年)

- 投資銀行

- ファンド企業

- 個人投資家

- その他

- 前提条件と制限

- 調査目的

- 考慮される年数

第2章 世界の成長動向

- 世界のアルゴリズム取引市場の見通し(2019年~2030年)

- 世界のアルゴリズム取引の成長動向:地域別

- 世界のアルゴリズム取引の市場規模:地域別(2019年・2023年・2030年)

- アルゴリズム取引の市場規模の実績:地域別(2019年~2024年)

- アルゴリズム取引の市場規模の予測:地域別(2025年~2030年)

- アルゴリズム取引の市場力学

- アルゴリズム取引産業の動向

- アルゴリズム取引市場の促進要因

- アルゴリズム取引市場の課題

- アルゴリズム取引市場の抑制要因

第3章 競合情勢:主要企業別

- 世界の主要アルゴリズム取引業者:収益別

- 世界の主要アルゴリズム取引企業:収益別(2019年~2024年)

- 世界のアルゴリズム取引の収益の市場シェア:企業別(2019年~2024年)

- 世界のアルゴリズム取引の市場シェア:企業タイプ別(Tier 1・Tier 2・Tier 3)

- 世界の主要企業のアルゴリズム取引収益ランキング

- 世界のアルゴリズム取引の市場集中度

- 世界のアルゴリズム取引の市場集中度(CR5、HHI)

- 世界のアルゴリズム取引収益の上位5社(2023年)

- 世界のアルゴリズム取引の主要企業の本社とサービス地域

- 世界のアルゴリズム取引の主要企業、製品

- 世界のアルゴリズム取引の主要企業、業界参入日

- 合併と買収、拡張計画

第4章 アルゴリズム取引の内訳データ:タイプ別

- 世界のアルゴリズム取引の市場規模の実績:タイプ別(2019年~2024年)

- 世界のアルゴリズム取引の市場規模の予測:タイプ別(2025年~2030年)

第5章 アルゴリズム取引の内訳データ:用途別

- 世界のアルゴリズム取引の市場規模の実績:用途別(2019年~2024年)

- 世界のアルゴリズム取引の市場規模の予測:用途別(2025年~2030年)

第6章 北米

- 北米のアルゴリズム取引の市場規模(2019年~2030年)

- 北米のアルゴリズム取引市場の成長率:国別(2019年・2023年・2030年)

- 北米のアルゴリズム取引の市場規模:国別(2019年~2024年)

- 北米のアルゴリズム取引の市場規模:国別(2025年~2030年)

- 米国

- カナダ

第7章 欧州

- 欧州のアルゴリズム取引の市場規模(2019年~2030年)

- 欧州のアルゴリズム取引市場の成長率:国別(2019年・2023年・2030年)

- 欧州のアルゴリズム取引の市場規模:国別(2019年~2024年)

- 欧州のアルゴリズム取引の市場規模:国別(2025年~2030年)

- ドイツ

- 英国

- フランス

第8章 アジア太平洋

- アジア太平洋のアルゴリズム取引の市場規模(2019年~2030年)

- アジア太平洋のアルゴリズム取引市場の成長率:国別(2019年・2023年・2030年)

- アジア太平洋のアルゴリズム取引の市場規模:地域別(2019年~2024年)

- アジア太平洋のアルゴリズム取引の市場規模:地域別(2025年~2030年)

- 中国

- 日本

- 韓国

- インド

- 東南アジア

第9章 ラテンアメリカ

- ラテンアメリカのアルゴリズム取引の市場規模(2019年~2030年)

- ラテンアメリカのアルゴリズム取引市場の成長率:国別(2019年・2023年・2030年)

- ラテンアメリカのアルゴリズム取引の市場規模:国別(2019年~2024年)

- ラテンアメリカのアルゴリズム取引の市場規模:国別(2025年~2030年)

- メキシコ

- ブラジル

- アルゼンチン

第10章 中東・アフリカ

- 中東・アフリカのアルゴリズム取引の市場規模(2019年~2030年)

- 中東・アフリカのアルゴリズム取引市場の成長率:国別(2019年・2023年・2030年)

- 中東・アフリカのアルゴリズム取引の市場規模:国別(2019年~2024年)

- 中東・アフリカのアルゴリズム取引の市場規模:国別(2025年~2030年)

- 中東

- アフリカ

第11章 主要企業のプロファイル

- QuantConnect

- 63 moons

- InfoReach

- Argo SE

- MetaQuotes Software

- Automated Trading SoftTech

- Tethys Technology

- Trading Technologies

- Tata Consultancy Services

- Exegy

- Virtu Financial

- Symphony Fintech

- Kuberre Systems

- Itexus

- QuantCore Capital Management

第12章 アナリストの視点/結論

第13章 付録

List of Tables

- Table 1. Global Algorithm Trading Market Size Growth Rate by Type (US$ Million): 2019 VS 2023 VS 2030

- Table 2. Global Algorithm Trading Market Size Growth by Application (US$ Million): 2019 VS 2023 VS 2030

- Table 3. Global Algorithm Trading Market Size by Region (US$ Million): 2019 VS 2023 VS 2030

- Table 4. Global Algorithm Trading Market Size by Region (2019-2024) & (US$ Million)

- Table 5. Global Algorithm Trading Market Share by Region (2019-2024)

- Table 6. Global Algorithm Trading Forecasted Market Size by Region (2025-2030) & (US$ Million)

- Table 7. Global Algorithm Trading Market Share by Region (2025-2030)

- Table 8. Algorithm Trading Market Trends

- Table 9. Algorithm Trading Market Drivers

- Table 10. Algorithm Trading Market Challenges

- Table 11. Algorithm Trading Market Restraints

- Table 12. Global Algorithm Trading Revenue by Players (2019-2024) & (US$ Million)

- Table 13. Global Algorithm Trading Market Share by Players (2019-2024)

- Table 14. Global Top Algorithm Trading Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Algorithm Trading as of 2023)

- Table 15. Ranking of Global Top Algorithm Trading Companies by Revenue (US$ Million) in 2023

- Table 16. Global 5 Largest Players Market Share by Algorithm Trading Revenue (CR5 and HHI) & (2019-2024)

- Table 17. Global Key Players of Algorithm Trading, Headquarters and Area Served

- Table 18. Global Key Players of Algorithm Trading, Product

- Table 19. Global Key Players of Algorithm Trading, Date of Enter into This Industry

- Table 20. Mergers & Acquisitions, Expansion Plans

- Table 21. Global Algorithm Trading Market Size by Type (2019-2024) & (US$ Million)

- Table 22. Global Algorithm Trading Revenue Market Share by Type (2019-2024)

- Table 23. Global Algorithm Trading Forecasted Market Size by Type (2025-2030) & (US$ Million)

- Table 24. Global Algorithm Trading Revenue Market Share by Type (2025-2030)

- Table 25. Global Algorithm Trading Market Size by Application (2019-2024) & (US$ Million)

- Table 26. Global Algorithm Trading Revenue Market Share by Application (2019-2024)

- Table 27. Global Algorithm Trading Forecasted Market Size by Application (2025-2030) & (US$ Million)

- Table 28. Global Algorithm Trading Revenue Market Share by Application (2025-2030)

- Table 29. North America Algorithm Trading Market Size Growth Rate by Country (US$ Million): 2019 VS 2023 VS 2030

- Table 30. North America Algorithm Trading Market Size by Country (2019-2024) & (US$ Million)

- Table 31. North America Algorithm Trading Market Size by Country (2025-2030) & (US$ Million)

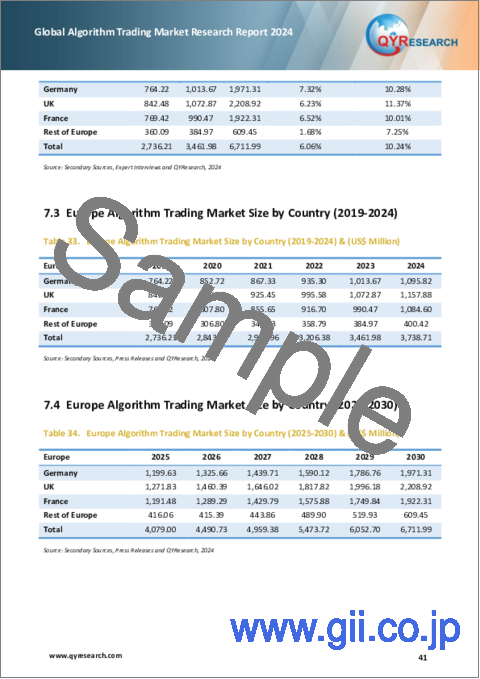

- Table 32. Europe Algorithm Trading Market Size Growth Rate by Country (US$ Million): 2019 VS 2023 VS 2030

- Table 33. Europe Algorithm Trading Market Size by Country (2019-2024) & (US$ Million)

- Table 34. Europe Algorithm Trading Market Size by Country (2025-2030) & (US$ Million)

- Table 35. Asia-Pacific Algorithm Trading Market Size Growth Rate by Country (US$ Million): 2019 VS 2023 VS 2030

- Table 36. Asia-Pacific Algorithm Trading Market Size by Region (2019-2024) & (US$ Million)

- Table 37. Asia-Pacific Algorithm Trading Market Size by Region (2025-2030) & (US$ Million)

- Table 38. Latin America Algorithm Trading Market Size Growth Rate by Country (US$ Million): 2019 VS 2023 VS 2030

- Table 39. Latin America Algorithm Trading Market Size by Country (2019-2024) & (US$ Million)

- Table 40. Latin America Algorithm Trading Market Size by Country (2025-2030) & (US$ Million)

- Table 41. Middle East & Africa Algorithm Trading Market Size Growth Rate by Country (US$ Million): 2019 VS 2023 VS 2030

- Table 42. Middle East & Africa Algorithm Trading Market Size by Country (2019-2024) & (US$ Million)

- Table 43. Middle East & Africa Algorithm Trading Market Size by Country (2025-2030) & (US$ Million)

- Table 44. QuantConnect Company Details

- Table 45. QuantConnect Business Overview

- Table 46. QuantConnect Algorithm Trading Product

- Table 47. QuantConnect Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 48. 63 moons Company Details

- Table 49. 63 moons Business Overview

- Table 50. 63 moons Algorithm Trading Product

- Table 51. 63 moons Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 52. 63 moons Recent Development

- Table 53. InfoReach Company Details

- Table 54. InfoReach Business Overview

- Table 55. InfoReach Algorithm Trading Product

- Table 56. InfoReach Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 57. InfoReach Recent Development

- Table 58. Argo SE Company Details

- Table 59. Argo SE Business Overview

- Table 60. Argo SE Algorithm Trading Product

- Table 61. Argo SE Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 62. Argo SE Recent Development

- Table 63. MetaQuotes Software Company Details

- Table 64. MetaQuotes Software Business Overview

- Table 65. MetaQuotes Software Algorithm Trading Product

- Table 66. MetaQuotes Software Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 67. MetaQuotes Software Recent Development

- Table 68. Automated Trading SoftTech Company Details

- Table 69. Automated Trading SoftTech Business Overview

- Table 70. Automated Trading SoftTech Algorithm Trading Product

- Table 71. Automated Trading SoftTech Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 72. Tethys Technology Company Details

- Table 73. Tethys Technology Business Overview

- Table 74. Tethys Technology Algorithm Trading Product

- Table 75. Tethys Technology Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 76. Trading Technologies Company Details

- Table 77. Trading Technologies Business Overview

- Table 78. Trading Technologies Algorithm Trading Product

- Table 79. Trading Technologies Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 80. Trading Technologies Recent Development

- Table 81. Tata Consultancy Services Company Details

- Table 82. Tata Consultancy Services Business Overview

- Table 83. Tata Consultancy Services Algorithm Trading Product

- Table 84. Tata Consultancy Services Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 85. Tata Consultancy Services Recent Development

- Table 86. Exegy Company Details

- Table 87. Exegy Business Overview

- Table 88. Exegy Algorithm Trading Product

- Table 89. Exegy Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 90. Exegy Recent Development

- Table 91. Virtu Financial Company Details

- Table 92. Virtu Financial Business Overview

- Table 93. Virtu Financial Algorithm Trading Product

- Table 94. Virtu Financial Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 95. Virtu Financial Recent Development

- Table 96. Symphony Fintech Company Details

- Table 97. Symphony Fintech Business Overview

- Table 98. Symphony Fintech Algorithm Trading Product

- Table 99. Symphony Fintech Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 100. Kuberre Systems Company Details

- Table 101. Kuberre Systems Business Overview

- Table 102. Kuberre Systems Algorithm Trading Product

- Table 103. Kuberre Systems Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 104. Itexus Company Details

- Table 105. Itexus Business Overview

- Table 106. Itexus Algorithm Trading Product

- Table 107. Itexus Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 108. QuantCore Capital Management Company Details

- Table 109. QuantCore Capital Management Business Overview

- Table 110. QuantCore Capital Management Algorithm Trading Product

- Table 111. QuantCore Capital Management Revenue in Algorithm Trading Business (2019-2024) & (US$ Million)

- Table 112. Research Programs/Design for This Report

- Table 113. Key Data Information from Secondary Sources

- Table 114. Key Data Information from Primary Sources

- Table 115. Authors List of This Report

List of Figures

- Figure 1. Algorithm Trading Picture

- Figure 2. Global Algorithm Trading Market Size Comparison by Type (2024-2030) & (US$ Million)

- Figure 3. Global Algorithm Trading Market Share by Type: 2023 VS 2030

- Figure 4. Forex Algorithm Trading Features

- Figure 5. Stock Algorithm Trading Features

- Figure 6. Fund Algorithm Trading Features

- Figure 7. Bond Algorithm Trading Features

- Figure 8. Cryptographic Algorithm Trading Features

- Figure 9. Commodity algorithmic trading Features

- Figure 10. Global Algorithm Trading Market Size by Application (2024-2030) & (US$ Million)

- Figure 11. Global Algorithm Trading Market Share by Application: 2023 VS 2030

- Figure 12. Investment Bank Case Studies

- Figure 13. Fund Company Case Studies

- Figure 14. Individual Investor Case Studies

- Figure 15. Insurance Industry Case Studies

- Figure 16. Algorithm Trading Report Years Considered

- Figure 17. Global Algorithm Trading Market Size (US$ Million), Year-over-Year: 2019-2030

- Figure 18. Global Algorithm Trading Market Size, (US$ Million), 2019 VS 2023 VS 2030

- Figure 19. Global Algorithm Trading Market Share by Region: 2023 VS 2030

- Figure 20. Global Algorithm Trading Market Share by Players in 2023

- Figure 21. Global Top Algorithm Trading Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Algorithm Trading as of 2023)

- Figure 22. The Top 5 Players Market Share by Algorithm Trading Revenue in 2023

- Figure 23. North America Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 24. North America Algorithm Trading Market Share by Country (2019-2030)

- Figure 25. United States Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 26. Canada Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 27. Europe Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 28. Europe Algorithm Trading Market Share by Country (2019-2030)

- Figure 29. Germany Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 30. U.K. Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 31. France Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 32. Asia-Pacific Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 33. Asia-Pacific Algorithm Trading Market Share by Region (2019-2030)

- Figure 34. China Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 35. Japan Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 36. South Korea Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 37. India Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 38. Southeast Asia Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 39. Latin America Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 40. Latin America Algorithm Trading Market Share by Country (2019-2030)

- Figure 41. Mexico Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 42. Brazil Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 43. Argentina Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 44. Middle East & Africa Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 45. Middle East & Africa Algorithm Trading Market Share by Country (2019-2030)

- Figure 46. Middle East Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 47. Africa Algorithm Trading Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 48. QuantConnect Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 49. 63 moons Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 50. InfoReach Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 51. Argo SE Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 52. MetaQuotes Software Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 53. Automated Trading SoftTech Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 54. Tethys Technology Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 55. Trading Technologies Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 56. Tata Consultancy Services Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 57. Exegy Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 58. Virtu Financial Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 59. Symphony Fintech Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 60. Kuberre Systems Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 61. Itexus Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 62. QuantCore Capital Management Revenue Growth Rate in Algorithm Trading Business (2019-2024)

- Figure 63. Bottom-up and Top-down Approaches for This Report

- Figure 64. Data Triangulation

- Figure 65. Key Executives Interviewed

The global Algorithm Trading market was valued at US$ 13,523.37 million in 2023 and is anticipated to reach US$ 26,730.34 million by 2030, witnessing a CAGR of 10.58% during the forecast period 2024-2030.

North American market for Algorithm Trading is estimated to increase from $ 6,319.47 million in 2023 to reach $ 12,357.44 million by 2030, at a CAGR of 10.46% during the forecast period of 2024 through 2030.

Asia-Pacific market for Algorithm Trading is estimated to increase from $ 3,179.34 million in 2023 to reach $ 6,353.80 million by 2030, at a CAGR of 10.73% during the forecast period of 2024 through 2030.

The global market for Algorithm Trading in Investment Bank is estimated to increase from $ 6,852.29 million in 2023 to $ 13,381.21 million by 2030, at a CAGR of 10.39% during the forecast period of 2024 through 2030.

The major global companies of Algorithm Trading include QuantConnect, 63 moons, InfoReach, Argo SE, MetaQuotes Software, Automated Trading SoftTech, Tethys Technology, Trading Technologies, and Tata Consultancy Services, etc. In 2023, the world's top three vendors accounted for approximately 22.52 % of the revenue.

This report aims to provide a comprehensive presentation of the global market for Algorithm Trading, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Algorithm Trading.

The Algorithm Trading market size, estimations, and forecasts are provided in terms of and revenue ($ millions), considering 2023 as the base year, with history and forecast data for the period from 2019 to 2030. This report segments the global Algorithm Trading market comprehensively. Regional market sizes, concerning products by Type, by Application, and by players, are also provided.

For a more in-depth understanding of the market, the report provides profiles of the competitive landscape, key competitors, and their respective market ranks. The report also discusses technological trends and new product developments.

The report will help the Algorithm Trading companies, new entrants, and industry chain related companies in this market with information on the revenues for the overall market and the sub-segments across the different segments, by company, by Type, by Application, and by regions.

Market Segmentation

By Company

- QuantConnect

- 63 moons

- InfoReach

- Argo SE

- MetaQuotes Software

- Automated Trading SoftTech

- Tethys Technology

- Trading Technologies

- Tata Consultancy Services

- Exegy

- Virtu Financial

- Symphony Fintech

- Kuberre Systems

- Itexus

- QuantCore Capital Management

Segment by Type

- Forex Algorithm Trading

- Stock Algorithm Trading

- Fund Algorithm Trading

- Bond Algorithm Trading

- Cryptographic Algorithm Trading

- Other Algorithmic Trading

Segment by Application

- Investment Bank

- Fund Company

By Region

- North America

- United States

- Canada

- Others

- Asia-Pacific

- China

- Japan

- South Korea

- Southeast Asia

- India

- Rest of Asia

- Europe

- Germany

- France

- U.K.

- Rest of Europe

- South America

- Mexico

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Middle East

- Africa

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by Type, by Application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: Introduces executive summary of global market size, regional market size, this section also introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by companies in the industry, and the analysis of relevant policies in the industry.

Chapter 3: Detailed analysis of Algorithm Trading company competitive landscape, revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 5: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 6, 7, 8, 9, 10: North America, Europe, Asia Pacific, Latin America, Middle East and Africa segment by country. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 11: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 12: The main points and conclusions of the report.

Table of Contents

1 Report Overview

- 1.1 Study Scope

- 1.2 Market Analysis by Type

- 1.2.1 Global Algorithm Trading Market Size Growth Rate by Type: 2019 VS 2023 VS 2030

- 1.2.2 Forex Algorithm Trading

- 1.2.3 Stock Algorithm Trading

- 1.2.4 Fund Algorithm Trading

- 1.2.5 Bond Algorithm Trading

- 1.2.6 Cryptographic Algorithm Trading

- 1.2.7 Other Algorithmic Trading

- 1.3 Market by Application

- 1.3.1 Global Algorithm Trading Market Growth by Application: 2019 VS 2023 VS 2030

- 1.3.2 Investment Bank

- 1.3.3 Fund Company

- 1.3.4 Individual Investor

- 1.3.5 Others

- 1.4 Assumptions and Limitations

- 1.5 Study Objectives

- 1.6 Years Considered

2 Global Growth Trends

- 2.1 Global Algorithm Trading Market Perspective (2019-2030)

- 2.2 Global Algorithm Trading Growth Trends by Region

- 2.2.1 Global Algorithm Trading Market Size by Region: 2019 VS 2023 VS 2030

- 2.2.2 Algorithm Trading Historic Market Size by Region (2019-2024)

- 2.2.3 Algorithm Trading Forecasted Market Size by Region (2025-2030)

- 2.3 Algorithm Trading Market Dynamics

- 2.3.1 Algorithm Trading Industry Trends

- 2.3.2 Algorithm Trading Market Drivers

- 2.3.3 Algorithm Trading Market Challenges

- 2.3.4 Algorithm Trading Market Restraints

3 Competition Landscape by Key Players

- 3.1 Global Top Algorithm Trading Players by Revenue

- 3.1.1 Global Top Algorithm Trading Players by Revenue (2019-2024)

- 3.1.2 Global Algorithm Trading Revenue Market Share by Players (2019-2024)

- 3.2 Global Algorithm Trading Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

- 3.3 Global Key Players Ranking by Algorithm Trading Revenue

- 3.4 Global Algorithm Trading Market Concentration Ratio

- 3.4.1 Global Algorithm Trading Market Concentration Ratio (CR5 and HHI)

- 3.4.2 Global Top 5 Companies by Algorithm Trading Revenue in 2023

- 3.5 Global Key Players of Algorithm Trading Head office and Area Served

- 3.6 Global Key Players of Algorithm Trading, Product

- 3.7 Global Key Players of Algorithm Trading, Date of Enter into This Industry

- 3.8 Mergers & Acquisitions, Expansion Plans

4 Algorithm Trading Breakdown Data by Type

- 4.1 Global Algorithm Trading Historic Market Size by Type (2019-2024)

- 4.2 Global Algorithm Trading Forecasted Market Size by Type (2025-2030)

5 Algorithm Trading Breakdown Data by Application

- 5.1 Global Algorithm Trading Historic Market Size by Application (2019-2024)

- 5.2 Global Algorithm Trading Forecasted Market Size by Application (2025-2030)

6 North America

- 6.1 North America Algorithm Trading Market Size (2019-2030)

- 6.2 North America Algorithm Trading Market Growth Rate by Country: 2019 VS 2023 VS 2030

- 6.3 North America Algorithm Trading Market Size by Country (2019-2024)

- 6.4 North America Algorithm Trading Market Size by Country (2025-2030)

- 6.5 United States

- 6.6 Canada

7 Europe

- 7.1 Europe Algorithm Trading Market Size (2019-2030)

- 7.2 Europe Algorithm Trading Market Growth Rate by Country: 2019 VS 2023 VS 2030

- 7.3 Europe Algorithm Trading Market Size by Country (2019-2024)

- 7.4 Europe Algorithm Trading Market Size by Country (2025-2030)

- 7.5 Germany

- 7.6 U.K.

- 7.7 France

8 Asia-Pacific

- 8.1 Asia-Pacific Algorithm Trading Market Size (2019-2030)

- 8.2 Asia-Pacific Algorithm Trading Market Growth Rate by Country: 2019 VS 2023 VS 2030

- 8.3 Asia-Pacific Algorithm Trading Market Size by Region (2019-2024)

- 8.4 Asia-Pacific Algorithm Trading Market Size by Region (2025-2030)

- 8.5 China

- 8.6 Japan

- 8.7 South Korea

- 8.8 India

- 8.9 Southeast Asia

9 Latin America

- 9.1 Latin America Algorithm Trading Market Size (2019-2030)

- 9.2 Latin America Algorithm Trading Market Growth Rate by Country: 2019 VS 2023 VS 2030

- 9.3 Latin America Algorithm Trading Market Size by Country (2019-2024)

- 9.4 Latin America Algorithm Trading Market Size by Country (2025-2030)

- 9.5 Mexico

- 9.6 Brazil

- 9.7 Argentina

10 Middle East & Africa

- 10.1 Middle East & Africa Algorithm Trading Market Size (2019-2030)

- 10.2 Middle East & Africa Algorithm Trading Market Growth Rate by Country: 2019 VS 2023 VS 2030

- 10.3 Middle East & Africa Algorithm Trading Market Size by Country (2019-2024)

- 10.4 Middle East & Africa Algorithm Trading Market Size by Country (2025-2030)

- 10.5 Middle East

- 10.6 Africa

11 Key Players Profiles

- 11.1 QuantConnect

- 11.1.1 QuantConnect Company Details

- 11.1.2 QuantConnect Business Overview

- 11.1.3 QuantConnect Algorithm Trading Introduction

- 11.1.4 QuantConnect Revenue in Algorithm Trading Business (2019-2024)

- 11.2 63 moons

- 11.2.1 63 moons Company Details

- 11.2.2 63 moons Business Overview

- 11.2.3 63 moons Algorithm Trading Introduction

- 11.2.4 63 moons Revenue in Algorithm Trading Business (2019-2024)

- 11.2.5 63 moons Recent Development

- 11.3 InfoReach

- 11.3.1 InfoReach Company Details

- 11.3.2 InfoReach Business Overview

- 11.3.3 InfoReach Algorithm Trading Introduction

- 11.3.4 InfoReach Revenue in Algorithm Trading Business (2019-2024)

- 11.3.5 InfoReach Recent Development

- 11.4 Argo SE

- 11.4.1 Argo SE Company Details

- 11.4.2 Argo SE Business Overview

- 11.4.3 Argo SE Algorithm Trading Introduction

- 11.4.4 Argo SE Revenue in Algorithm Trading Business (2019-2024)

- 11.4.5 Argo SE Recent Development

- 11.5 MetaQuotes Software

- 11.5.1 MetaQuotes Software Company Details

- 11.5.2 MetaQuotes Software Business Overview

- 11.5.3 MetaQuotes Software Algorithm Trading Introduction

- 11.5.4 MetaQuotes Software Revenue in Algorithm Trading Business (2019-2024)

- 11.5.5 MetaQuotes Software Recent Development

- 11.6 Automated Trading SoftTech

- 11.6.1 Automated Trading SoftTech Company Details

- 11.6.2 Automated Trading SoftTech Business Overview

- 11.6.3 Automated Trading SoftTech Algorithm Trading Introduction

- 11.6.4 Automated Trading SoftTech Revenue in Algorithm Trading Business (2019-2024)

- 11.7 Tethys Technology

- 11.7.1 Tethys Technology Company Details

- 11.7.2 Tethys Technology Business Overview

- 11.7.3 Tethys Technology Algorithm Trading Introduction

- 11.7.4 Tethys Technology Revenue in Algorithm Trading Business (2019-2024)

- 11.8 Trading Technologies

- 11.8.1 Trading Technologies Company Details

- 11.8.2 Trading Technologies Business Overview

- 11.8.3 Trading Technologies Algorithm Trading Introduction

- 11.8.4 Trading Technologies Revenue in Algorithm Trading Business (2019-2024)

- 11.8.5 Trading Technologies Recent Development

- 11.9 Tata Consultancy Services

- 11.9.1 Tata Consultancy Services Company Details

- 11.9.2 Tata Consultancy Services Business Overview

- 11.9.3 Tata Consultancy Services Algorithm Trading Introduction

- 11.9.4 Tata Consultancy Services Revenue in Algorithm Trading Business (2019-2024)

- 11.9.5 Tata Consultancy Services Recent Development

- 11.10 Exegy

- 11.10.1 Exegy Company Details

- 11.10.2 Exegy Business Overview

- 11.10.3 Exegy Algorithm Trading Introduction

- 11.10.4 Exegy Revenue in Algorithm Trading Business (2019-2024)

- 11.10.5 Exegy Recent Development

- 11.11 Virtu Financial

- 11.11.1 Virtu Financial Company Details

- 11.11.2 Virtu Financial Business Overview

- 11.11.3 Virtu Financial Algorithm Trading Introduction

- 11.11.4 Virtu Financial Revenue in Algorithm Trading Business (2019-2024)

- 11.11.5 Virtu Financial Recent Development

- 11.12 Symphony Fintech

- 11.12.1 Symphony Fintech Company Details

- 11.12.2 Symphony Fintech Business Overview

- 11.12.3 Symphony Fintech Algorithm Trading Introduction

- 11.12.4 Symphony Fintech Revenue in Algorithm Trading Business (2019-2024)

- 11.13 Kuberre Systems

- 11.13.1 Kuberre Systems Company Details

- 11.13.2 Kuberre Systems Business Overview

- 11.13.3 Kuberre Systems Algorithm Trading Introduction

- 11.13.4 Kuberre Systems Revenue in Algorithm Trading Business (2019-2024)

- 11.14 Itexus

- 11.14.1 Itexus Company Details

- 11.14.2 Itexus Business Overview

- 11.14.3 Itexus Algorithm Trading Introduction

- 11.14.4 Itexus Revenue in Algorithm Trading Business (2019-2024)

- 11.15 QuantCore Capital Management

- 11.15.1 QuantCore Capital Management Company Details

- 11.15.2 QuantCore Capital Management Business Overview

- 11.15.3 QuantCore Capital Management Algorithm Trading Introduction

- 11.15.4 QuantCore Capital Management Revenue in Algorithm Trading Business (2019-2024)

12 Analyst's Viewpoints/Conclusions

13 Appendix

- 13.1 Research Methodology

- 13.1.1 Methodology/Research Approach

- 13.1.2 Data Source

- 13.2 Author Details

- 13.3 Disclaimer