|

|

市場調査レポート

商品コード

1761702

UV硬化型接着剤の世界市場の需要、予測分析(2018年~2034年)Global UV Curing Adhesives Market Demand & Forecast Analysis, 2018-2034 |

||||||

|

|||||||

| UV硬化型接着剤の世界市場の需要、予測分析(2018年~2034年) |

|

出版日: 2025年05月02日

発行: Prismane Consulting

ページ情報: 英文 179 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

UV硬化型接着剤の需要の分析

UV硬化型接着剤は、その汎用性と性能上の利点を裏付けるように、さまざまな産業で応用されています。医療部門は重要なユーザーであり、高速な硬化と生体適合性が重要な機器や器具にこれらの接着剤を採用しています。建設産業では、迅速な接着と耐久性を必要とする作業にUV硬化型接着剤を活用しています。木材や家具製造は、クリーンな塗布と迅速な硬化時間の恩恵を受けており、効率的な生産工程を可能にしています。電気・電子部門では、特に機器の小型化・複雑化に伴い、精密かつ信頼性の高いコンポーネントの組立にUV硬化型接着剤が重用されています。また、自動車産業では、内装や外装の組立にUV硬化型接着剤が広く使用されており、強度がありながら軽量な接着ソリューションが求められています。包装や消費財などの他の産業も、UV硬化技術の採用を徐々に増やしています。

競合情勢

複数の老舗企業が世界のUV硬化型接着剤市場を独占しています。H.B. Fuller、Bostik、SIKA、Dymax Corporation、Master Bond、Henkel、Sartomer、3M、Beacon Adhesives、Avery Dennison Corporation、Denka Company Limited、Dow Corningなどが技術革新と市場の拡大を促進している主要企業です。これらの企業は、接着剤の製法の改良、硬化速度の向上、環境にやさしい製品の開発など、研究開発に多額の投資を行っています。また、地理的なリーチを拡大し、エンドユーザーとの関係を強化することで、業界特有の課題により適したソリューションを提供することも、戦略的な焦点となっています。このダイナミックな市場で競争力を維持するためには、絶え間ないイノベーションと製品の多様化が不可欠であることに変わりはありません。

地域の市場力学

UV硬化型接着剤市場は、アジア太平洋、北米、欧州の各地域で力強い成長が見込まれています。アジア太平洋は、中国、インド、日本、韓国などの国々における急速な工業化、電子機器製造の拡大、自動車部門の成長により市場をリードしています。北米と欧州は、先進の製造インフラと厳格な品質基準のおかげで大きな市場シェアを維持しており、これが高性能接着剤の需要を促進しています。また、これらの地域では持続可能な製品への関心が高まっており、メーカー各社は低排出でエネルギー効率の高いUV硬化型接着剤の開発を進めています。南米と中東・アフリカの新興市場では、工業活動と建設活動の拡大に伴い、UV硬化技術が徐々に採用されつつあります。

市場促進要因:迅速かつクリーンな組立に対する需要の増加

UV硬化型接着剤市場の成長促進要因の1つは、製造における高速かつクリーンで効率的な組立プロセスへのニーズの高まりです。従来の接着剤は、長い硬化時間や熱や溶剤の使用を必要とすることが多く、生産に時間がかかったり、環境への懸念が生じたりします。UV硬化型接着剤は、UVライトを照射すると数秒で硬化するため、製造サイクルタイムとエネルギー消費を劇的に削減できるという大きな利点があります。この効率性により、電子機器や医療機器など、精度と速度が重要な産業に理想的なものとなっています。また、UV硬化型接着剤の無溶剤という性質は、環境に配慮した生産方式に対する規制要件の高まりにも合致しており、その採用をさらに後押ししています。

市場抑制要因:一部の伝統的市場での限定的な普及

その利点にもかかわらず、UV硬化型接着剤は、特定の伝統的な市場や用途に浸透する上で課題に直面しています。一部の産業では、UV硬化装置に関連する高い初期投資費用や専門的なトレーニングの必要性から、従来の接着剤からの切り替えをためらっています。さらに、UV硬化には紫外線を直接視線方向に照射する必要があるため、接着剤が完全に露出しない複雑な組立や光が遮断される組立での使用が制限される可能性があります。このような技術的制約により、UV硬化型接着剤は特定の部門での適用可能性が制限され、市場成長が鈍化しています。さらに、コストを重視する市場では、従来の代替品と比較してUV硬化型接着剤の価格帯が高いことが、特に発展途上地域で広く採用される際の障壁となる可能性があります。

当レポートでは、世界のUV硬化型接着剤市場について調査分析し、市場力学と産業動向、各セグメントの需要、メーカーのプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 市場の要約

- 市場の進化

- 需要の概要

- 産業構造

- 戦略上の問題

- 最終用途の動向

- 成長予測

第3章 経済とエネルギーの見通し

- GDPと人口動態

- 金融政策と財政政策

- 原油生産と価格

- 天然ガス

- 電気料金

第4章 最終用途部門の実績

- 自動車

- 電気・電子

- 建設

- 医療

- その他

第5章 UV硬化型接着剤のイントロダクションと市場の概要

- 製品の説明

- グレードと特性

- 原材料

- 製造プロセス

- 環境問題

- バリューチェーン

- 用途

第6章 市場力学と産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第7章 世界のUV硬化型接着剤の需要の分析:タイプ別、用途別(数量と金額)(2018年~2034年)

- 戦略上の問題とCOVID-19の影響

- 需要の分析と予測(2018年~2034年)

- 需要

- 需要成長率

- 促進要因の分析

- 世界のUV硬化型接着剤市場:タイプ別

- アクリル

- エポキシポリブタジエン(EP)

- ポリエステル

- シリコン

- スチレンコポリマー

- ビニール

- その他

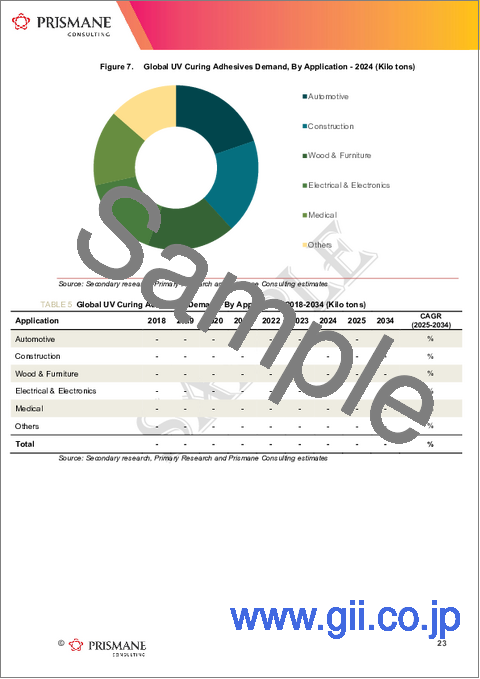

- 世界のUV硬化型接着剤市場:用途別

- 医療

- 建設

- 木材・家具

- 電気・電子

- 自動車

- その他

第8章 需要の分析と市場のレビュー:地域/国別(数量と金額)(2018年~2034年)

- 戦略上の問題とCOVID-19の影響

- 需要の分析と予測(2018年~2034年)

- 需要

- 需要成長率

- UV硬化型接着剤市場:タイプ別

- UV硬化型接着剤市場:用途別

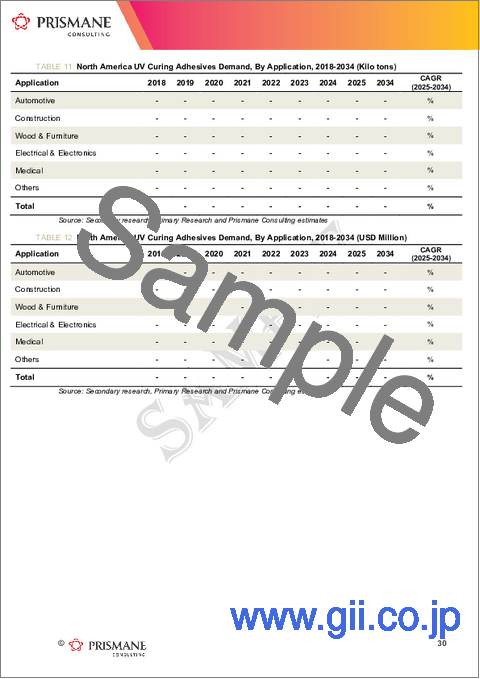

- 北米

- 米国

- カナダ

- メキシコ

- 西欧

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- その他の西欧

- 中欧・東欧

- ロシア

- ポーランド

- その他の中欧・東欧

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 中南米

- 中東・アフリカ

第9章 価格分析

第10章 主な戦略上の問題と事業機会の評価

- 市場の魅力の評価

- 見通しとターゲット市場の調査

第11章 戦略的推奨と提案

第12章 企業分析

- UV硬化型接着剤メーカーのプロファイル/企業分析

- 基本詳細

- 本社、主要市場

- 所有

- 企業の財務

- 製造拠点

- 世界の売上

- 総従業員数

- 製品ポートフォリオ/サービス/ソリューション

- 採用された主な事業戦略とPrismane Consultingの概要

- 近年の発展

- 対象企業

- H.B. Fuller

- Bostik

- SIKA

- Dymax Corporation

- Master Bond

- Henkel

- Sartomer

- 3M

- Beacon Adhesives

- Avery Dennison Corporation

- Denka Company Limited

- Dow Corning

- その他のメーカー

第13章 付録

UV curing adhesives are specialized materials that cure quickly when exposed to ultraviolet light, forming strong and durable bonds. These adhesives are increasingly preferred for their ability to provide precise and reliable adhesion without the need for heat or solvents, making them ideal for sensitive applications. The market is segmented by adhesive type and end-use application, reflecting diverse industry needs and technological advancements.

UV Curing Adhesives demand analysis

The UV curing adhesives market is composed of several types, each offering unique properties suited to specific applications. Acrylic adhesives are widely used due to their strong bonding capabilities and flexibility. Epoxy polybutadiene adhesives offer excellent chemical resistance and toughness, making them suitable for demanding environments. Polyester adhesives provide good adhesion with a range of substrates, while silicone-based adhesives are favored for their heat resistance and flexibility. Styrene copolymers and vinyl adhesives also play important roles, with applications in various specialized fields. These diverse adhesive types allow manufacturers and end users to select the most appropriate product depending on the required performance characteristics.

UV curing adhesives have found applications across multiple industries, underscoring their versatility and performance benefits. The medical sector is a significant user, employing these adhesives in devices and instruments where fast curing and biocompatibility are critical. The construction industry leverages UV curing adhesives for tasks requiring rapid bonding and durability. Wood and furniture manufacturing benefit from the clean application and quick setting times, enabling efficient production processes. The electrical and electronics sector relies heavily on UV curing adhesives for assembling components with precision and reliability, especially as devices become smaller and more complex. The automotive industry also uses these adhesives extensively for interior and exterior assembly, seeking strong yet lightweight bonding solutions. Other industries, such as packaging and consumer goods, are gradually increasing their adoption of UV curing technology as well.

Competitive Landscape

Several well-established companies dominate the UV curing adhesives market globally. H.B. Fuller, Bostik, SIKA, Dymax Corporation, Master Bond, Henkel, Sartomer, 3M, Beacon Adhesives, Avery Dennison Corporation, Denka Company Limited, and Dow Corning are among the key players driving innovation and market expansion. These companies invest significantly in research and development to improve adhesive formulations, enhance curing speed, and develop environmentally friendly products. Their strategic focus also includes expanding geographic reach and building stronger relationships with end-users to better tailor solutions to industry-specific challenges. Continuous innovation and product diversification remain critical for maintaining a competitive edge in this dynamic market.

Regional Market Dynamics

The UV curing adhesives market shows strong growth prospects across Asia-Pacific, North America, and Europe. Asia-Pacific leads the market due to rapid industrialization, expanding electronics manufacturing, and growing automotive sectors in countries like China, India, Japan, and South Korea. North America and Europe maintain significant market shares thanks to their advanced manufacturing infrastructure and stringent quality standards, which drive demand for high-performance adhesives. These regions are also witnessing growing interest in sustainable products, pushing manufacturers to develop low-emission, energy-efficient UV curing adhesives. Emerging markets in South America and the Middle East & Africa are gradually adopting UV curing technology as industrial and construction activities expand.

Market Growth Driver: Increasing Demand for Fast and Clean Assembly

One of the primary drivers of growth in the UV curing adhesives market is the increasing need for fast, clean, and efficient assembly processes in manufacturing. Traditional adhesives often require long curing times or the use of heat and solvents, which can slow production and create environmental concerns. UV curing adhesives offer a significant advantage by curing within seconds upon exposure to UV light, which dramatically reduces manufacturing cycle times and energy consumption. This efficiency makes them ideal for industries like electronics and medical devices, where precision and speed are critical. The solvent-free nature of UV curing adhesives also aligns well with growing regulatory requirements for environmentally responsible manufacturing practices, further boosting their adoption.

Market Restraint: Limited Penetration in Some Traditional Markets

Despite their advantages, UV curing adhesives face challenges in penetrating certain traditional markets and applications. Some industries remain hesitant to switch from conventional adhesives due to high initial investment costs associated with UV curing equipment and the need for specialized training. Additionally, UV curing requires direct line-of-sight exposure to ultraviolet light, which can limit its use in complex or shadowed assemblies where the adhesive is not fully exposed. These technical limitations restrict UV curing adhesives' applicability in certain sectors, slowing market growth. Moreover, in cost-sensitive markets, the higher price point of UV curing adhesives compared to some traditional alternatives can be a barrier to wider adoption, especially in developing regions.

Table of Contents

1. Introduction

- Scope

- Market Coverage

- Types

- Applications

- Regions

- Countries

- Years Considered

- Historical - 2018 - 2023

- Base - 2024

- Forecast Period - 2025 - 2034

- Research Methodology

- Approach

- Research Methodology

- Prismane Consulting Market Models

- Assumptions & Limitations

- Abbreviations & Definitions

- Conversion Factors

- Data Sources

2. Market Synopsis

- Market Evolution

- Demand Overview

- Industry Structure

- Strategic Issues

- End-use Trends

- Growth Forecast

3. Economic & Energy Outlook

- GDP and Demographics

- Monetary & Fiscal Policies

- Crude Oil Production and prices

- Natural Gas

- Electricity Prices

4. End-use Sector Performance

- Automotive

- Electrical & Electronics

- Construction

- Medical

- Others

5. Introduction to UV Curing Adhesives and Market Overview

- Product Description

- Grades & Properties

- Raw Material

- Manufacturing Process

- Environmental Issues

- Value Chain

- Applications

6. Market Dynamics and Industry Trends

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

7. Global UV Curing Adhesives Demand Analysis, By Types, By Applications (Volume, Value) (2018-2034)

- Strategic Issues and COVID-19 Impact

- Demand Analysis and Forecast (2018- 2034)

- Demand

- Demand Growth Rate (%)

- Driving Force Analysis

- Global UV Curing Adhesives Market, By Types

- Acrylic

- Epoxy Polybutadiene (EP)

- Polyester

- Silicone

- Styrene Copolymer

- Vinyl

- Others

- Global UV Curing Adhesives Market, By Applications

- Medical

- Construction

- Wood & Furniture

- Electrical & Electronics

- Automotive

- Others

8. Demand Analysis and Market Review, By Region, By Country (Volume, Value), (2018- 2034)

- Strategic Issues and COVID-19 Impact

- Demand Analysis and Forecast (2018 - 2034)

- Demand

- Demand Growth Rate (%)

- UV Curing Adhesives Market, By Types

- UV Curing Adhesives Market, By Applications

Note: Demand Analysis has been provided for all major Regions / Countries as mentioned below. The demand (consumption) split by types and applications have been provided for each of the countries / regions in Volume (Kilo tons) and Value (USD Million).

- North America

- USA

- Canada

- Mexico

- Western Europe

- Germany

- France

- Italy

- United Kingdom

- Spain

- Rest of Western Europe

- Central & Eastern Europe

- Russia

- Poland

- Rest of Central & Eastern Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Central & South America

- Middle East & Africa

Note: CAGR will be calculated for all types and applications to arrive at the regional / global demand growth for the forecast period (2025 - 2034)

9. Pricing Analysis

10. Key Strategic Issues and Business Opportunity Assessment

- Market Attractiveness Assessment

- Prospective & Target Market Study

11. Strategic Recommendation & Suggestions

12. Company Analysis

- UV Curing Adhesives Manufacturers Profiles/ Company Analysis

- Basic Details

- Headquarter, Key Markets

- Ownership

- Company Financial

- Manufacturing Bases

- Global Turnover

- Total Employee

- Product Portfolio / Services / Solutions

- Key Business Strategies adopted and Prismane Consulting Overview

- Recent Developments

- Companies Covered -

- H.B. Fuller

- Bostik

- SIKA

- Dymax Corporation

- Master Bond

- Henkel

- Sartomer

- 3M

- Beacon Adhesives

- Avery Dennison Corporation

- Denka Company Limited

- Dow Corning

- Other Manufacturers

Note: This section includes company information, company financials, manufacturing bases and operating regions. Company financials have been mentioned only for those companies where financials were available in SEC Filings, annual reports, or company websites. All the reported financials in this report are in U.S. Dollars. Financials reported in other currencies have been converted using average currency conversion rates. Company profiles may include manufacturers, suppliers, and distributors.

13. Appendices

- Demand - Regions

- Demand - Countries