|

|

市場調査レポート

商品コード

1421710

金融リース市場、シェア、規模、動向、産業分析レポート:タイプ別、ビジネスタイプ別、用途別、地域別、セグメント別予測、2024年~2032年Financial Leasing Market Share, Size, Trends, Industry Analysis Report, By Type (Banking, Non-Banking); By Business Type; By Application; By Region; Segment Forecast, 2024- 2032 |

||||||

カスタマイズ可能

|

|||||||

| 金融リース市場、シェア、規模、動向、産業分析レポート:タイプ別、ビジネスタイプ別、用途別、地域別、セグメント別予測、2024年~2032年 |

|

出版日: 2023年11月23日

発行: Polaris Market Research

ページ情報: 英文 116 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

Polaris Market Researchの最新調査によると、世界の金融リース市場規模は2032年までに3,693億米ドルに達する見込みです。当レポートでは、現在の市場力学を詳細に洞察し、今後の市場成長に関する分析を提供しています。

金融リースは、財務状況に直面している企業が高額な資産を取得することを可能にします。金融リース市場は、為替レートの変動から生じるリスクや、他国の不安定な規制シナリオのために直面する問題が、国際的な金融リースサービスの提供に熱心な金融リースサービス提供企業を潜在的に妨げており、市場成長の妨げとなっています。新興諸国の未開拓の可能性、リース・サービスに対する政府の支援やイニシアチブの波は、金融リース市場成長の機会です。

特にヘルスケア、建設、IT・通信などの分野での重機、設備、基幹資産に対する需要の急増が成長を促す主な要因です。農業経済から製造業経済へと移行しつつある新興経済諸国は、金融リースの需要を促進するとみられます。さらに、自動車や耐久消費財に対する世界の需要の増加が、市場拡大の見通しにプラスに働くとみられます。

世界の金融リース市場は、消費者が住宅や自動車のような重要な買い物をクレジットで行えるようになり、クレジットの利用しやすさが向上したことが原動力となって拡大しています。さらに、金融リースには、月々の分割払いの安さ、期間の延長、税制上の大きな優遇措置、手間のかからないメンテナンスなど、特有の利点があります。これらの分割払いには保険料も含まれるため、リース・オプションは費用対効果に優れています。こうしたことから、この業界は好調な見通しを立てています。

さらに、企業や組織は、リスクや潜在的な損失を軽減するために設備リースを選ぶようになってきています。この動向は市場に成長機会をもたらすと予想されます。しかし、金融リース・プロバイダーの金利変動に関する懸念は根強く、これは成長を抑制する可能性があります。さらに、インフレ率の上昇は銀行の収益性と金融資産の実質リターンに悪影響を及ぼし、金融リースの収益性を低下させる可能性があります。

金融リース市場レポート・ハイライト

- リース業務の全体的な効率性と有効性の向上により、2022年の市場シェアは銀行部門が最大

- 国際部門は、多様な業界にサービスを提供していることから、予測期間中に最も高い成長が見込まれます。

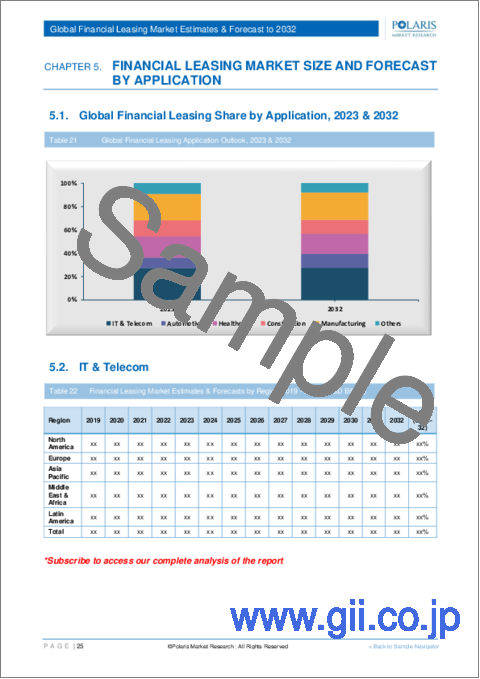

- 主に急速な技術進歩により、IT・通信分野が2022年の市場収益で大きなシェアを占める

- 北米地域は、技術の飛躍的な成長と研究開発投資の増加により、2022年の市場シェアの大半を占める

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 世界の金融リース市場に関する洞察

- 金融リース市場- 用途のスナップショット

- 金融リース市場力学

- 促進要因と機会

- 都市化の進展

- 購入平価性の向上

- 抑制要因と課題

- 市場のボラティリティ

- 促進要因と機会

- PESTEL分析

- 金融リース市場の用途動向

- バリューチェーン分析

- COVID-19感染症の影響分析

第5章 世界の金融リース市場、タイプ別

- 主な調査結果

- イントロダクション

- 銀行業

- ノンバンク

第6章 世界の金融リース市場、ビジネスタイプ別

- 主な調査結果

- イントロダクション

- 国内

- 国際的

第7章 世界の金融リース市場、用途別

- 主な調査結果

- イントロダクション

- IT&テレコム

- 自動車

- ヘルスケア

- 建設

- 製造業

- その他

第8章 世界の金融リース市場、地域別

- 主な調査結果

- イントロダクション

- 金融リース市場評価、地域別、2019-2032年

- 金融リース市場-北米

- 北米:金融リース市場、タイプ別、2019~2032年

- 北米:金融リース市場、用途別、2019~2032年

- 北米:金融リース市場、ビジネスタイプ別、2019~2032年

- 金融リース市場-米国

- 金融リース市場- カナダ

- 金融リース市場- 欧州

- 欧州:金融リース市場、タイプ別、2019~2032年

- 欧州:金融リース市場、用途別、2019~2032年

- 欧州:金融リース市場、ビジネスタイプ別、2019~2032年

- 金融リース市場- 英国

- 金融リース市場- フランス

- 金融リース市場- ドイツ

- 金融リース市場- イタリア

- 金融リース市場- スペイン

- 金融リース市場- オランダ

- 金融リース市場- ロシア

- 金融リース市場- アジア太平洋

- アジア太平洋:金融リース市場、タイプ別、2019~2032年

- アジア太平洋:金融リース市場、用途別、2019~2032年

- アジア太平洋:金融リース市場、ビジネスタイプ別、2019~2032年

- 金融リース市場- 中国

- 金融リース市場- インド

- 金融リース市場- マレーシア

- 金融リース市場- 日本

- 金融リース市場- インドネシア

- 金融リース市場- 韓国

- 金融リース市場-中東およびアフリカ

- 中東およびアフリカ:金融リース市場、タイプ別、2019~2032年

- 中東およびアフリカ:金融リース市場、用途別、2019~2032年

- 中東およびアフリカ:金融リース市場、ビジネスタイプ別、2019~2032年

- 金融リース市場- サウジアラビア

- 金融リース市場- アラブ首長国連邦

- 金融リース市場- イスラエル

- 金融リース市場- 南アフリカ

- 金融リース市場-ラテンアメリカ

- ラテンアメリカ:金融リース市場、タイプ別、2019~2032年

- ラテンアメリカ:金融リース市場、用途別、2019-2032

- ラテンアメリカ:金融リース市場、ビジネスタイプ別、2019-2032年

- 金融リース市場- メキシコ

- 金融リース市場- ブラジル

- 金融リース市場- アルゼンチン

第9章 競合情勢

- 拡張と買収の分析

- 拡大

- 買収

- 提携/協業/合意/公開

第10章 企業プロファイル

- BNP Paribas Leasing Solutions

- CDB Leasing Co., Ltd.(CLC).

- CIT Group Inc.

- De Lage Landen International B.V.

- DLL Group

- Fuyo General Lease Co., Ltd.

- GE Capital Aviation Services(GECAS)

- Hitachi Capital Corporation

- Industrial and Commercial Bank of China Financial Leasing Co., Ltd.(ICBC Leasing)

- Japan Airlines Lease Co., Ltd.(JALC)

- Mizuho Leasing Company, Limited

- PACCAR Financial Corp.

- SMBC Aviation Capital

- Sumitomo Mitsui Finance and Leasing Co., Ltd.

- Wells Fargo Equipment Finance

List of Tables

- Table 1 Global Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 2 Global Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 3 Global Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 4 Financial Leasing Market Assessment, By Geography, 2019-2032 (USD Billion)

- Table 5 North America: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 6 North America: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 7 North America: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 8 U.S.: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 9 U.S.: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 10 U.S.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 11 Canada: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 12 Canada: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 13 Canada: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 14 Europe: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 15 Europe: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 16 Europe: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 17 UK: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 18 UK: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 19 UK: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 20 France: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 21 France: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 22 France: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 23 Germany: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 24 Germany: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 25 Germany: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 26 Italy: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 27 Italy: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 28 Italy: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 29 Spain: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 30 Spain: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 31 Spain: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 32 Netherlands: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 33 Netherlands: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 34 Netherlands: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 35 Russia: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 36 Russia: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 37 Russia: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 38 Asia Pacific: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 39 Asia Pacific: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 40 Asia Pacific: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 41 China: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 42 China: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 43 China: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 44 India: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 45 India: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 46 India: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 47 Malaysia: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 48 Malaysia: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 49 Malaysia: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 50 Japan: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 51 Japan: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 52 Japan: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 53 Indonesia: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 54 Indonesia: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 55 Indonesia: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 56 South Korea: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 57 South Korea: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 58 South Korea: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 59 Middle East & Africa: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 60 Middle East & Africa: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 61 Middle East & Africa: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 62 Saudi Arabia: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 63 Saudi Arabia: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 64 Saudi Arabia: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 65 UAE: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 66 UAE: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 67 UAE: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 68 Israel: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 69 Israel: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 70 Israel: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 71 South Africa: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 72 South Africa: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 73 South Africa: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 74 Latin America: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 75 Latin America: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 76 Latin America: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 77 Mexico: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 78 Mexico: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 79 Mexico: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 80 Brazil: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 81 Brazil: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 82 Brazil: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- Table 83 Argentina: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- Table 84 Argentina: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- Table 85 Argentina: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

List of Figures

- Figure 1. Global Financial Leasing Market, 2019-2032 (USD Billion)

- Figure 2. Integrated Ecosystem

- Figure 3. Research Methodology: Top-Down & Bottom-Up Approach

- Figure 4. Market by Geography

- Figure 5. Porter's Five Forces

- Figure 6. Market by Business Type

- Figure 7. Global Financial Leasing Market, by Business Type, 2022 & 2032 (USD Billion)

- Figure 8. Market by Type

- Figure 9. Global Financial Leasing Market, by Type, 2022 & 2032 (USD Billion)

- Figure 10. Market by Application

- Figure 11. Global Financial Leasing Market, by Application, 2022 & 2032 (USD Billion)

- Figure 12. Financial Leasing Market Assessment, By Geography, 2019-2032 (USD Billion)

- Figure 13. Strategic Analysis - Financial Leasing Market

The global financial leasing market size is expected to reach USD 369.30 billion by 2032, according to a new study by Polaris Market Research. The report "Financial Leasing Market Share, Size, Trends, Industry Analysis Report, By Type (Banking, Non-Banking); By Business Type; By Application; By Region; Segment Forecast, 2024- 2032" gives a detailed insight into current market dynamics and provides analysis on future market growth.

The finance lease allows enterprises facing financial conditions to acquire costly assets; the financial leasing market has to face some of the market restraints are the risks arising from exchange rate changes and the problems faced because of a precarious regulatory scenario in other countries are potentially prevented finance lease service providing companies keen to provide international finance lease services are hampering the market growth. The untapped possibility of developing countries and the wave in government support and initiatives toward leasing services are opportunities for the financial leasing market growth.

The surge in demand for heavy machinery, equipment, and essential assets, particularly in sectors like healthcare, construction, and IT & telecom, is a primary factor driving growth. Developing nations transitioning from agricultural to manufacturing-based economies are set to fuel demand for financial leasing. Furthermore, the global increase in demand for automobiles and durable consumer goods is poised to contribute to a positive outlook for market expansion.

The global financial leasing market is witnessing expansion, driven by increased credit accessibility, enabling consumers to make significant purchases like homes and cars on credit. Additionally, finance leases offer specific advantages, including low monthly installments, extended terms, significant tax benefits, and hassle-free maintenance. These installments encompass insurance charges, rendering leasing options cost-effective. Given these factors, the industry is poised for a favorable outlook.

Furthermore, businesses and organizations are increasingly opting for equipment leasing to mitigate risks and potential losses. This trend is expected to create growth opportunities in the market. However, concerns persist regarding fluctuating interest rates from finance lease providers, which could temper growth. Moreover, a rising inflation rate can negatively impact bank profitability and real returns on financial assets, potentially making financial leasing less profitable.

Financial Leasing Market Report Highlights

- Banking segment accounted for largest market share in 2022, due to enhancing the overall efficiency and effectiveness of leasing operations

- International segment is expected to witness highest growth during forecast period, due to diverse range of industries it serves

- IT & Telecom segment held the significant market revenue share in 2022, mainly due to rapid technological advancements

- North America region dominated the market with majority share in 2022, owing to exponential growth in the technology and rising R&D investments

- The global key market players include: CIT Group Inc., De Lage Landen International B.V., DLL Group, Fuyo General Lease Co., Ltd., GE Capital Aviation Services (GECAS), Hitachi Capital Corporation

Polaris Market Research has segmented the financial leasing market report based on type, business type, application, and region:

Financial Leasing, Type Outlook (Revenue - USD Billion, 2019 - 2032)

- Banking

- Non-Banking

Financial Leasing, Business Type Outlook (Revenue - USD Billion, 2019 - 2032)

- Domestic

- International

Financial Leasing, Application Outlook (Revenue - USD Billion, 2019 - 2032)

- IT & Telecom

- Automotive

- Healthcare

- Construction

- Manufacturing

- Others

Financial Leasing, Regional Outlook (Revenue - USD Billion, 2019 - 2032)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Latin America

- Argentina

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

Table of Contents

1. Introduction

- 1.1. Report Description

- 1.1.1. Objectives of the Study

- 1.1.2. Market Scope

- 1.1.3. Assumptions

- 1.2. Stakeholders

2. Executive Summary

- 2.1. Market Highlights

3. Research Methodology

- 3.1. Overview

- 3.1.1. Data Mining

- 3.2. Data Sources

- 3.2.1. Primary Sources

- 3.2.2. Secondary Sources

4. Global Financial Leasing Market Insights

- 4.1. Financial Leasing Market - Application Snapshot

- 4.2. Financial Leasing Market Dynamics

- 4.2.1. Drivers and Opportunities

- 4.2.1.1. Rise in urbanization

- 4.2.1.2. Increasing purchase parity

- 4.2.2. Restraints and Challenges

- 4.2.2.1. Market Volatility

- 4.2.1. Drivers and Opportunities

- 4.3. Porter's Five Forces Analysis

- 4.3.1. Bargaining Power of Suppliers (Moderate)

- 4.3.2. Threats of New Entrants: (Low)

- 4.3.3. Bargaining Power of Buyers (Moderate)

- 4.3.4. Threat of Substitute (Moderate)

- 4.3.5. Rivalry among existing firms (High)

- 4.4. PESTEL Analysis

- 4.5. Financial Leasing Market Application Trends

- 4.6. Value Chain Analysis

- 4.7. COVID-19 Impact Analysis

5. Global Financial Leasing Market, by Type

- 5.1. Key Findings

- 5.2. Introduction

- 5.2.1. Global Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 5.3. Banking

- 5.3.1. Global Financial Leasing Market, by Banking, by Region, 2019-2032 (USD Billion)

- 5.4. Non-Banking

- 5.4.1. Global Financial Leasing Market, by Non-Banking, by Region, 2019-2032 (USD Billion)

6. Global Financial Leasing Market, by Business Type

- 6.1. Key Findings

- 6.2. Introduction

- 6.2.1. Global Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 6.3. Domestic

- 6.3.1. Global Financial Leasing Market, by Domestic, by Region, 2019-2032 (USD Billion)

- 6.4. International

- 6.4.1. Global Financial Leasing Market, by International, by Region, 2019-2032 (USD Billion)

7. Global Financial Leasing Market, by Application

- 7.1. Key Findings

- 7.2. Introduction

- 7.2.1. Global Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 7.3. IT & Telecom

- 7.3.1. Global Financial Leasing Market, by IT & Telecom, By Region, 2019-2032 (USD Billion)

- 7.4. Automotive

- 7.4.1. Global Financial Leasing Market, by Automotive, By Region, 2019-2032 (USD Billion)

- 7.5. Healthcare

- 7.5.1. Global Financial Leasing Market, by Healthcare, By Region, 2019-2032 (USD Billion)

- 7.6. Construction

- 7.6.1. Global Financial Leasing Market, by Construction, By Region, 2019-2032 (USD Billion)

- 7.7. Manufacturing

- 7.7.1. Global Financial Leasing Market, by Manufacturing, By Region, 2019-2032 (USD Billion)

- 7.8. Others

- 7.8.1. Global Financial Leasing Market, by Others, By Region, 2019-2032 (USD Billion)

8. Global Financial Leasing Market, by Geography

- 8.1. Key findings

- 8.2. Introduction

- 8.2.1. Financial Leasing Market Assessment, By Geography, 2019-2032 (USD Billion)

- 8.3. Financial Leasing Market - North America

- 8.3.1. North America: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.3.2. North America: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.3.3. North America: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.3.4. Financial Leasing Market - U.S.

- 8.3.4.1. U.S.: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.3.4.2. U.S.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.3.4.3. U.S.: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.3.5. Financial Leasing Market - Canada

- 8.3.5.1. Canada: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.3.5.2. Canada.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.3.5.3. Canada: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.4. Financial Leasing Market - Europe

- 8.4.1. Europe: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.4.2. Europe.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.4.3. Europe: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.4.4. Financial Leasing Market - UK

- 8.4.4.1. UK: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.4.4.2. UK.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.4.4.3. UK: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.4.5. Financial Leasing Market - France

- 8.4.5.1. France: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.4.5.2. France.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.4.5.3. France: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.4.6. Financial Leasing Market - Germany

- 8.4.6.1. Germany: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.4.6.2. Germany.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.4.6.3. Germany: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.4.7. Financial Leasing Market - Italy

- 8.4.7.1. Italy: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.4.7.2. Italy.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.4.7.3. Italy: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.4.8. Financial Leasing Market - Spain

- 8.4.8.1. Spain: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.4.8.2. Spain.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.4.8.3. Spain: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.4.9. Financial Leasing Market - Netherlands

- 8.4.9.1. Netherlands: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.4.9.2. Netherlands.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.4.9.3. Netherlands: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.4.10. Financial Leasing Market - Russia

- 8.4.10.1. Russia: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.4.10.2. Russia.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.4.10.3. Russia: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.5. Financial Leasing Market - Asia Pacific

- 8.5.1. Asia Pacific: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.5.2. Asia Pacific.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.5.3. Asia Pacific: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.5.4. Financial Leasing Market - China

- 8.5.4.1. China: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.5.4.2. China.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.5.4.3. China: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.5.5. Financial Leasing Market - India

- 8.5.5.1. India: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.5.5.2. India.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.5.5.3. India: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.5.6. Financial Leasing Market - Malaysia

- 8.5.6.1. Malaysia: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.5.6.2. Malaysia.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.5.6.3. Malaysia: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.5.7. Financial Leasing Market - Japan

- 8.5.7.1. Japan: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.5.7.2. Japan.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.5.7.3. Japan: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.5.8. Financial Leasing Market - Indonesia

- 8.5.8.1. Indonesia: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.5.8.2. Indonesia.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.5.8.3. Indonesia: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.5.9. Financial Leasing Market - South Korea

- 8.5.9.1. South Korea: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.5.9.2. South Korea.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.5.9.3. South Korea: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.6. Financial Leasing Market - Middle East & Africa

- 8.6.1. Middle East & Africa: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.6.2. Middle East & Africa.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.6.3. Middle East & Africa: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.6.4. Financial Leasing Market - Saudi Arabia

- 8.6.4.1. Saudi Arabia: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.6.4.2. Saudi Arabia.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.6.4.3. Saudi Arabia: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.6.5. Financial Leasing Market - UAE

- 8.6.5.1. UAE: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.6.5.2. UAE.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.6.5.3. UAE: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.6.6. Financial Leasing Market - Israel

- 8.6.6.1. Israel: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.6.6.2. Israel.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.6.6.3. Israel: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.6.7. Financial Leasing Market - South Africa

- 8.6.7.1. South Africa: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.6.7.2. South Africa.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.6.7.3. South Africa: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.7. Financial Leasing Market - Latin America

- 8.7.1. Latin America: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.7.2. Latin America.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.7.3. Latin America: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.7.4. Financial Leasing Market - Mexico

- 8.7.4.1. Mexico: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.7.4.2. Mexico.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.7.4.3. Mexico: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.7.5. Financial Leasing Market - Brazil

- 8.7.5.1. Brazil: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.7.5.2. Brazil.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.7.5.3. Brazil: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

- 8.7.6. Financial Leasing Market - Argentina

- 8.7.6.1. Argentina: Financial Leasing Market, by Type, 2019-2032 (USD Billion)

- 8.7.6.2. Argentina.: Financial Leasing Market, by Application, 2019-2032 (USD Billion)

- 8.7.6.3. Argentina: Financial Leasing Market, by Business Type, 2019-2032 (USD Billion)

9. Competitive Landscape

- 9.1. Expansion and Acquisition Analysis

- 9.1.1. Expansion

- 9.1.2. Acquisitions

- 9.2. Partnerships/Collaborations/Agreements/Exhibitions

10. Company Profiles

- 10.1. BNP Paribas Leasing Solutions

- 10.1.1. Company Overview

- 10.1.2. Financial Performance

- 10.1.3. Product Benchmarking

- 10.1.4. Recent Development

- 10.2. CDB Leasing Co., Ltd. (CLC).

- 10.2.1. Company Overview

- 10.2.2. Financial Performance

- 10.2.3. Product Benchmarking

- 10.2.4. Recent Development

- 10.3. CIT Group Inc.

- 10.3.1. Company Overview

- 10.3.2. Financial Performance

- 10.3.3. Product Benchmarking

- 10.3.4. Recent Development

- 10.4. De Lage Landen International B.V.

- 10.4.1. Company Overview

- 10.4.2. Financial Performance

- 10.4.3. Product Benchmarking

- 10.4.4. Recent Development

- 10.5. DLL Group

- 10.5.1. Company Overview

- 10.5.2. Financial Performance

- 10.5.3. Product Benchmarking

- 10.5.4. Recent Development

- 10.6. Fuyo General Lease Co., Ltd.

- 10.6.1. Company Overview

- 10.6.2. Financial Performance

- 10.6.3. Product Benchmarking

- 10.6.4. Recent Development

- 10.7. GE Capital Aviation Services (GECAS)

- 10.7.1. Company Overview

- 10.7.2. Financial Performance

- 10.7.3. Product Benchmarking

- 10.7.4. Recent Development

- 10.8. Hitachi Capital Corporation

- 10.8.1. Company Overview

- 10.8.2. Financial Performance

- 10.8.3. Product Benchmarking

- 10.8.4. Recent Development

- 10.9. Industrial and Commercial Bank of China Financial Leasing Co., Ltd. (ICBC Leasing)

- 10.9.1. Company Overview

- 10.9.2. Financial Performance

- 10.9.3. Product Benchmarking

- 10.9.4. Recent Development

- 10.10. Japan Airlines Lease Co., Ltd. (JALC)

- 10.10.1. Company Overview

- 10.10.2. Financial Performance

- 10.10.3. Product Benchmarking

- 10.10.4. Recent Development

- 10.11. Mizuho Leasing Company, Limited

- 10.11.1. Company Overview

- 10.11.2. Financial Performance

- 10.11.3. Product Benchmarking

- 10.11.4. Recent Development

- 10.12. PACCAR Financial Corp.

- 10.12.1. Company Overview

- 10.12.2. Financial Performance

- 10.12.3. Product Benchmarking

- 10.12.4. Recent Development

- 10.13. SMBC Aviation Capital

- 10.13.1. Company Overview

- 10.13.2. Financial Performance

- 10.13.3. Product Benchmarking

- 10.13.4. Recent Development

- 10.14. Sumitomo Mitsui Finance and Leasing Co., Ltd.

- 10.14.1. Company Overview

- 10.14.2. Financial Performance

- 10.14.3. Product Benchmarking

- 10.14.4. Recent Development

- 10.15. Wells Fargo Equipment Finance

- 10.15.1. Company Overview

- 10.15.2. Financial Performance

- 10.15.3. Product Benchmarking

- 10.15.4. Recent Development