|

|

市場調査レポート

商品コード

1311886

トラック・BRタイヤの世界市場2023-2030Global Truck and BRadial (TBR) Tire Market 2023-2030 |

||||||

カスタマイズ可能

|

|||||||

| トラック・BRタイヤの世界市場2023-2030 |

|

出版日: 2023年06月30日

発行: Orion Market Research

ページ情報: 英文 95 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のトラック・バス用ラジアルタイヤ(TBR)市場は、予測期間中にCAGR 6.0%で成長すると予測されます。同市場の成長は、商用車需要の増加、輸送・物流産業の拡大、タイヤ製造の技術進歩などの要因によるものです。さらに、燃費効率の必要性、車両性能の向上、安全基準の強化といった要因が、TBRタイヤの需要を促進すると予想されます。例えば、2022年8月、Apollo Tires社は、様々な職種や用途に対応する5種類の新しいトラック・バス用ラジアルタイヤをインドで発売しました。そのうちの1つ、Apollo EnduTrax MAはティッパートラック用に設計されたタイヤで、厳しい地形に対応する優れた耐カット性と耐久性を提供します。Apollo EnduRace RAは、走行距離、耐久性、濡れた路面や乾いた路面でのトラクションで知られる地域用タイヤです。さらに、Apollo EnduMile LHD、LDR、LDTの3種類のタイヤは長距離運行用に設計されており、燃費、耐久性、高速道路でのトラクションを向上させています。今回の発売は、インドのトラック・バス用ラジアルタイヤセグメントにおけるApollo Tiresの市場プレゼンスを高めることを目的としています。

セグメント別の展望

市場は販売チャネルに基づき、OEM市場とアフターマーケット市場に分類されます。先発品市場とは、製造過程で車両に装着されるタイヤを指します。アフターマーケット市場には、タイヤ交換やメンテナンス目的で車両所有者に販売される交換用タイヤが含まれます。どちらのセグメントもTBRタイヤ市場において重要な役割を担っており、タイヤの摩耗や交換により、アフターマーケットセグメントが大きな成長を遂げています。

タイプ別に見ると、市場はステアタイヤ、ドライブタイヤ、トレーラータイヤ、その他に区分されます。ステアタイヤは車両の前車軸用に設計されており、コントロール性と操縦性を提供します。ドライブタイヤは車両の動力軸に装着され、トラクションと動力伝達を提供します。トレーラータイヤは、トレーラーの車軸に装着され、積荷を支え、スムーズな輸送を可能にします。その他」のカテゴリーには、オフロード車や建設車両など、特定の用途に特化したタイヤが含まれます。

トラックセグメントがTBRタイヤの世界市場で最大シェアを占める

トラックセグメントは世界のTBRタイヤ市場で最大のシェアを占めています。これは、輸送や物流の需要が高く、ヘビーデューティー用途をサポートする信頼性と耐久性の高いタイヤへのニーズが高まっているためです。例えば、2023年4月、ミシュランはBFGoodrichブランドの大型小型トラック用タイヤの新ラインを発売します。新ラインは当初、リム径16~22インチをカバーする24サイズで、後に7サイズが追加されます。新しいタイヤラインはHD-Terrain T/A KTと呼ばれ、激しいヘビーデューティ用途向けに設計されています。このタイヤは、耐久性、トラクション、タフネスといった様々な特徴を備えています。BFGoodrich HD-Terrain T/A KTは仕事にも遊びにも使えるように設計されており、オフロードでの使用に適しています。この新しいタイヤ・ラインは、ミシュランのBFGoodrichブランドの一部であり、小規模フリート向けに設計された小型トラック用タイヤのラインナップを揃えています。

地域別展望

北米がトラック・バス用ラジアルタイヤ(TBR)市場で大きなシェアを占めると予想される

これらの地域の中で、北米は予測期間中にTBRタイヤ市場で大きなシェアを占めると予測されています。同地域の市場成長は主に、堅調な輸送・物流産業、貿易活動の増加、大手商用車メーカーの存在といった要因によってもたらされます。例えば、2021年4月にApollo Tiresが米国とカナダ市場のトラック・バス用タイヤ分野に参入しました。同社は、地域用、超広域用、コーチ/都市用、および混合用途のフルレンジを、すべてのポジションに適合する形で提供する計画です。Apollo Tiresは2024年までに市場の90%をカバーすることを目指しています。

目次

第1章 レポート概要

- 業界の現状分析と成長ポテンシャルの展望

- 調査方法とツール

- 市場内訳

- セグメント別

- 地域別

第2章 市場概要と洞察

- 調査範囲

- アナリストの洞察と現在の市場動向

- 主な調査結果

- 推奨事項

- 結論

第3章 競合情勢

- 主要企業分析

- Bridgestone India

- 概要

- 財務分析

- SWOT分析

- 最近の動向

- CONTINENTAL AG

- 会社概要

- 財務分析

- SWOT分析

- 最近の動向

- Michelin

- 概要

- 財務分析

- SWOT分析

- 最近の動向

- Pirelli Tyre S.p.A.

- 概要

- 財務分析

- SWOT分析

- 最近の動向

- The Goodyear Tire & Rubber Co.

- 概要

- 財務分析

- SWOT分析

- 最近の動向

- 主要戦略分析

第4章 市場セグメンテーション

- トラック・BRタイヤ (TBR) の世界市場:用途別

- トラック

- バス

- トラック・BRタイヤ(TBR)の世界市場:タイプ別

- ステアタイヤ

- ドライブタイヤ

- トレーラータイヤ

- その他(オールポジションタイヤ)

- トラック・BRタイヤ (TBR) の世界市場:販売チャネル別

- OEM市場

- アフターマーケット

第5章 地域別分析

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- イタリア

- スペイン

- フランス

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 世界のその他の地域

第6章 企業プロファイル

- Apollo Tyres Ltd.

- Cheng Shin Rubber Ind. Co., Ltd.

- Cooper(R)Tire & Rubber Co.

- Double Coin

- Giti Tire Pte Ltd.

- Hankook Tire Co., Ltd.

- Kumho Tyre(Australia)Pty Ltd.

- MRF Ltd.

- Nokian Tyres

- Sailun Group Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- The Yokohama Rubber Co., Ltd.

- TOYO TIRE U.S.A. CORP.

- Triangle Services, Inc.

- Zhongce Rubber Group Co., Ltd.

LIST OF TABLES

- 1. GLOBAL TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

- 2. GLOBAL TRUCK AND BRADIAL (TBR) TIRE FOR TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 3. GLOBAL TRUCK AND BRADIAL (TBR) TIRE FOR BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 4. GLOBAL TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

- 5. GLOBAL STEER TIRES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 6. GLOBAL DRIVE TIRES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 7. GLOBAL TRAILER TIRES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 8. GLOBAL OTHERS TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 9. GLOBAL TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2022-2030 ($ MILLION)

- 10. GLOBAL TRUCK AND BRADIAL (TBR) TIRE FOR ORIGINAL EQUIPMENT MARKETS (OEM) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 11. GLOBAL TRUCK AND BRADIAL (TBR) TIRE FOR AFTERMARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 12. GLOBAL TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 13. NORTH AMERICAN TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

- 14. NORTH AMERICAN TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

- 15. NORTH AMERICAN TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

- 16. NORTH AMERICAN TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2022-2030 ($ MILLION)

- 17. EUROPEAN TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

- 18. EUROPEAN TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

- 19. EUROPEAN TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

- 20. EUROPEAN TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2022-2030 ($ MILLION)

- 21. ASIA-PACIFIC TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

- 22. ASIA-PACIFIC TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

- 23. ASIA-PACIFIC TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

- 24. ASIA-PACIFIC TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2022-2030 ($ MILLION)

- 25. REST OF THE WORLD TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

- 26. REST OF THE WORLD TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

- 27. REST OF THE WORLD TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

- 28. REST OF THE WORLD TRUCK AND BRADIAL (TBR) TIRE MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2022-2030 ($ MILLION)

LIST OF FIGURES

- 1. GLOBAL TRUCK AND BRADIAL (TBR) TIRE MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

- 2. GLOBAL TRUCK AND BRADIAL (TBR) TIRE FOR TRUCK MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 3. GLOBAL TRUCK AND BRADIAL (TBR) TIRE FOR BUS MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 4. GLOBAL TRUCK AND BRADIAL (TBR) TIRE MARKET SHARE BY TYPE, 2022 VS 2030 (%)

- 5. GLOBAL STEER TIRES MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 6. GLOBAL DRIVE TIRES MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 7. GLOBAL TRAILER TIRES MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 8. GLOBAL OTHERS TRUCK AND BRADIAL (TBR) TIRE MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 9. GLOBAL TRUCK AND BRADIAL (TBR) TIRE MARKET SHARE BY SALES CHANNEL, 2022 VS 2030 (%)

- 10. GLOBAL TRUCK AND BRADIAL (TBR) TIRE FOR ORIGINAL EQUIPMENT MARKET (OEM) MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 11. GLOBAL TRUCK AND BRADIAL (TBR) TIRE FOR AFTERMARKET MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 12. GLOBAL TRUCK AND BRADIAL (TBR) TIRE MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 13. US TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 14. CANADA TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 15. UK TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 16. FRANCE TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 17. GERMANY TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 18. ITALY TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 19. SPAIN TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 20. REST OF EUROPE TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 21. INDIA TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 22. CHINA TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 23. JAPAN TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 24. SOUTH KOREA TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 25. REST OF ASIA-PACIFIC TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

- 26. REST OF THE WORLD TRUCK AND BRADIAL (TBR) TIRE MARKET SIZE, 2022-2030 ($ MILLION)

Title: Global Truck and Bus Radial (TBR) Tire Market Size, Share & Trends Analysis Report by Application (Truck, and Bus), by Sales Channel (Original Equipment Markets, and Aftermarket), and by Type (Steer Tires, Drive Tires, Trailer Tires, and Others) Forecast Period (2023-2030).

The global truck and bus radial (TBR) tire market is anticipated to grow at a CAGR of 6.0% during the forecast period. The growth of the market is attributed to factors such as the increasing demand for commercial vehicles, expanding transportation and logistics industry, and technological advancements in tire manufacturing. Furthermore, factors such as the need for fuel efficiency, improved vehicle performance, and increased safety standards are expected to drive the demand for TBR tires. For instance, in August 2022, Apollo Tires launched five new truck-bus radial tires in India, catering to various positions and applications. One of the tires, Apollo EnduTrax MA, is designed for tipper trucks, offering superior cut resistance and durability for challenging terrains. The Apollo EnduRace RA is a regional tire known for its mileage, durability, and traction on wet and dry roads. Additionally, three tires, Apollo EnduMile LHD, LDR, and LDT, are designed for long-haul operations, providing improved fuel efficiency, longevity, and highway traction. This launch aims to enhance Apollo Tires' market presence in India's truck and bus radial tire segment.

Segmental Outlook

The global TBR tire market is segmented based on its application, sales channel, and type. Based on the application, the market is segmented into trucks and buses. TBR tires are specifically designed to meet the requirements of heavy-duty commercial vehicles, offering durability, load-carrying capacity, and superior traction. The truck segment dominates the market due to the high demand for TBR tires in the transportation and logistics industry.

Based on the sales channel, the market is categorized into original equipment markets and the aftermarket. Original equipment markets refer to the tires installed on vehicles during the manufacturing process. The aftermarket includes replacement tires sold to vehicle owners for tire replacement and maintenance purposes. Both segments play a crucial role in the TBR tire market, with the aftermarket segment witnessing significant growth due to tire wear and replacements.

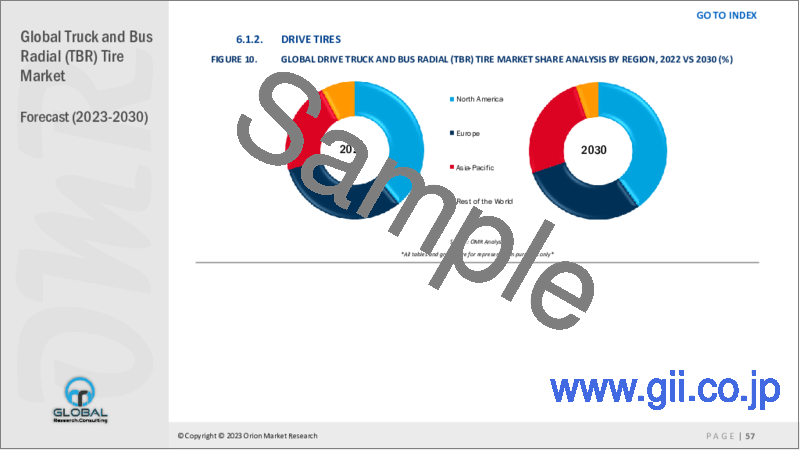

Based on the type, the market is segmented into steer tires, drive tires, trailer tires, and others. Steer tires are designed for the front axle of the vehicle, providing control and maneuverability. Drive tires are installed on the vehicle's powered axle, delivering traction and power transmission. Trailer tires are fitted on the trailer's axle, supporting the load and enabling smooth transportation. The "others" category includes specialized tires for specific applications, such as off-road or construction vehicles.

The Truck Segment Holds largest Share of the Global TBR Tire Market

The truck segment holds the largest share of the global TBR tire market due to the high demand for transportation and logistics, driving the need for reliable and durable tires to support heavy-duty applications. For instance, in April 2023, Michelin is launched a new line of BFGoodrich-branded heavy-duty light-truck tires. The new line will initially have 24 sizes covering 16- to 22-inch rim diameters, with seven additional sizes to debut later. The new tire line is called the HD-Terrain T/A KT and is engineered for intense heavy-duty applications. The tire features a variety of characteristics such as durability, traction, and toughness. The BFGoodrich HD-Terrain T/A KT is designed for both work and play, and is suitable for off-road use. The new tire line is part of Michelin's BFGoodrich brand, which has a range of light truck tires designed for small fleets.

Regional Outlooks

The global TBR tire market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed at a regional or country level as per the requirement. Among regions, the Asia-Pacific region is projected to experience considerable growth in the TBR tire market. Rapid industrialization, infrastructure development, and increasing urbanization in countries like China and India are driving the demand for commercial vehicles and subsequently boosting the demand for TBR tires. Additionally, the expanding e-commerce sector and growing transportation requirements contribute to market growth in the region.

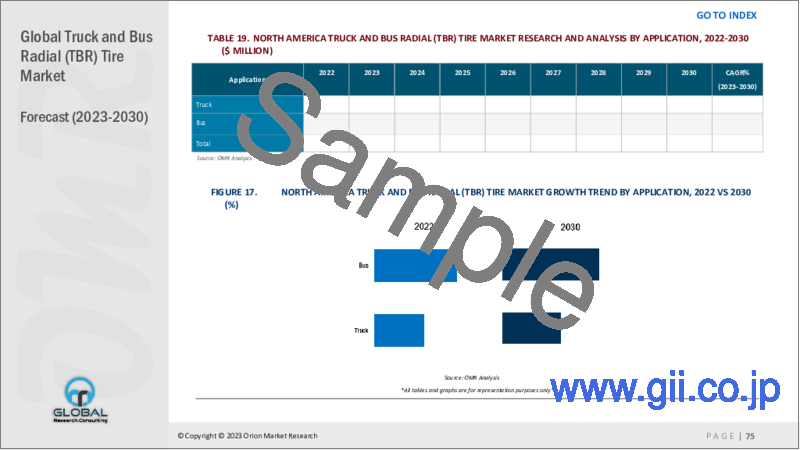

North America is Anticipated to Hold a Significant Share in the Truck and Bus Radial (TBR) Tire Market

Among these regions, North America is anticipated to hold a significant share in the TBR tire market during the forecast period. The growth of the market in the region is primarily driven by factors such as the robust transportation and logistics industry, increasing trade activities, and the presence of major commercial vehicle manufacturers. For instance, in April 2021, Apollo Tires entered the truck-bus tire segment in the US and Canada markets. The company plans to offer a full range of regional, super-regional, coach/urban, and mixed-use applications with fitments for all positions. Apollo Tires aims to cover 90% of the market by 2024.

Market Players Outlook

The major companies serving the global truck and bus radial (TBR) tire market include: Michelin, Bridgestone India, The Goodyear Tire & Rubber Co., CONTINENTAL AG, and Pirelli Tire S.p.A, among others. These market players are considerably contributing to market growth by adopting various strategies such as mergers and acquisitions, partnerships, collaborations, funding, and new product launches to stay competitive. They focus on developing innovative and technologically advanced TBR tire solutions to meet the evolving customer demands and capitalize on the growing market opportunities. For instance, in May 2022, Bridgestone launched the R192E, an all-position radial tire designed specifically for electric urban transit. The tire has a high load capacity and ultra-low rolling resistance, making it ideal for use on electric buses. This is Bridgestone's first commercial tire for electric buses. The R192E tire is designed to empower the next generation of electric buses, which are becoming increasingly popular due to their environmental benefits. The tire is expected to provide better fuel efficiency and longer tire life, which will help to reduce operating costs for electric bus operators.

The Report Covers:

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global truck and bus radial (TBR) tire market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where' in the market.

Table of Contents

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- 1.1. Research Methods and Tools

- 1.2. Market Breakdown

- 1.2.1. By Segments

- 1.2.2. By Region

2. Market Overview and Insights

- 2.1. Scope of the Report

- 2.2. Analyst Insight & Current Market Trends

- 2.2.1. Key Findings

- 2.2.2. Recommendations

- 2.2.3. Conclusion

3. Competitive Landscape

- 3.1. Key Company Analysis

- 3.2. Bridgestone India

- 3.2.1. Overview

- 3.2.2. Financial Analysis

- 3.2.3. SWOT Analysis

- 3.2.4. Recent Developments

- 3.3. CONTINENTAL AG

- 3.3.1. Overview

- 3.3.2. Financial Analysis

- 3.3.3. SWOT Analysis

- 3.3.4. Recent Developments

- 3.4. Michelin

- 3.4.1. Overview

- 3.4.2. Financial Analysis

- 3.4.3. SWOT Analysis

- 3.4.4. Recent Developments

- 3.5. Pirelli Tyre S.p.A.

- 3.5.1. Overview

- 3.5.2. Financial Analysis

- 3.5.3. SWOT Analysis

- 3.5.4. Recent Developments

- 3.6. The Goodyear Tire & Rubber Co.

- 3.6.1. Overview

- 3.6.2. Financial Analysis

- 3.6.3. SWOT Analysis

- 3.6.4. Recent Developments

- 3.7. Key Strategy Analysis

4. Market Segmentation

- 4.1. Global Truck and BRadial (TBR) Tire Market by Application

- 4.1.1. Truck

- 4.1.2. Bus

- 4.2. Global Truck and BRadial (TBR) Tire Market by Type

- 4.2.1. Steer Tires

- 4.2.2. Drive Tires

- 4.2.3. Trailer Tires

- 4.2.4. Others (All-Position Tire)

- 4.3. Global Truck and BRadial (TBR) Tire Market by Sales Channel

- 4.3.1. Original Equipment Market (OEM)

- 4.3.2. Aftermarket

5. Regional Analysis

- 5.1. North America

- 5.1.1. United States

- 5.1.2. Canada

- 5.2. Europe

- 5.2.1. UK

- 5.2.2. Germany

- 5.2.3. Italy

- 5.2.4. Spain

- 5.2.5. France

- 5.2.6. Rest of Europe

- 5.3. Asia-Pacific

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Rest of the World

6. Company Profiles

- 6.1. Apollo Tyres Ltd.

- 6.2. Cheng Shin Rubber Ind. Co., Ltd.

- 6.3. Cooper® Tire & Rubber Co.

- 6.4. Double Coin

- 6.5. Giti Tire Pte Ltd.

- 6.6. Hankook Tire Co., Ltd.

- 6.7. Kumho Tyre (Australia) Pty Ltd.

- 6.8. MRF Ltd.

- 6.9. Nokian Tyres

- 6.10. Sailun Group Co., Ltd.

- 6.11. Sumitomo Rubber Industries, Ltd.

- 6.12. The Yokohama Rubber Co., Ltd.

- 6.13. TOYO TIRE U.S.A. CORP.

- 6.14. Triangle Services, Inc.

- 6.15. Zhongce Rubber Group Co., Ltd.