|

市場調査レポート

商品コード

1186903

宇宙経済の世界市場:第3版Global Space Economy, 3rd Edition |

|||||||

| 宇宙経済の世界市場:第3版 |

|

出版日: 2023年01月18日

発行: Northern Sky Research, LLC

ページ情報: 英文

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

当レポートは、インフラ、アプリケーション、通信の3つのセグメントに分け、10年間の収益展望を示し、宇宙経済全体に関する見解を読者に提供しています。

NSRの宇宙経済の世界市場第3版では、以下の主要な質問に答えています。

- 宇宙経済における大きなビジネスチャンスはどこにあるのか?

- インフラへの投資はいつサービスベースの収益に移行するのか?

- 現在のマクロ経済の逆風は、長期的な成長イメージに影響を及ぼしているのか?

- 非地球観測衛星は、価値創造のための重要な軌道として、地球観測衛星に取って代わるのか?

- 機器直販サービスの機会は?

本レポートを購入すべき方

- ベンチャーキャピタルアナリスト/マネージャー

- 事業戦略担当者

- SATCOMサービスプロバイダー

- 国家宇宙機関(ビジネスインキュベーション)

- 打ち上げプロバイダー

- 政府・軍事機関

NSRの特徴

NSRは、投資家の資金や「NewSpace」企業、裕福な「プレーヤー」の流入により、しばしば過大評価される市場である「純粋宇宙」の機会について、公平で集中した見解を提供します。NSRのクライアントは、他に類を見ないリサーチ・ライブラリーと、業界のキーパーソンと数十年にわたり直接仕事をしてきた経験を生かし、その知識を活用しています。この知識と洞察力が、NSRとクライアントに、誇大広告を見抜く力を与えています。

主な特徴

本レポートでカバーしています:

- 課題、主要ドライバー、NSR予測を強調する新しいレポート形式のアプローチ

- 3つの垂直分野 - インフラ、アプリケーション、通信

- 世界、北米、欧州、中東・アフリカ、アジア、海洋の10地域の予測

- NSRの包括的なリサーチライブラリを活用し、統一されたデータセット

レポートのセグメント分け

- 衛星・宇宙インフラ - 宇宙分野における製造と打ち上げの機会にフォーカス

- 衛星&宇宙アプリケーション - 地球観測、M2M/IoT、ビッグデータなどアプリケーション中心のユースケースと収益源

- 衛星・宇宙通信 - 成長中のデバイス間直接接続セグメントを含む衛星接続のビジネスチャンス

目次

第1章 宇宙経済の世界市場のエグゼクティブサマリー

- 概要

- 地域の展望

- 1.4兆ドルの機会

第2章 主な調査結果

- 新たなアプリケーションとコネクティビティ

- 成長実績の比較

第3章 課題と推奨事項

- 短期的な逆風

- 成長エンジンであるコネクティビティ

- 2022年からの予測

- SATCOM市場で引き続き行われるM&A

- 衛星からデバイスへの直接取引の第2の波

- スターシップ戦略

- 世界の宇宙経済における3つの大きな成長機会

- 2031年までの提言

第4章 付録

- 一目で予測

- 衛星・宇宙のインフラ

- 衛星・宇宙のアプリケーション

- 衛星・宇宙の通信

- 定義

- 変更ログ

Report Summary:

NSR's “Global Space Economy, 3rd Edition (GSE3) ” report provides readers an exclusive market view of the entire space economy. After years of unbridled growth, the Satellite and Space markets are seeing and feeling the market slowdown felt across the globe - or are they?

NSR's provides unparalleled insights on first-order revenues from the launching, manufacturing, and sale of space-based services. “GSE3 ” focuses on the revenue outlook over the period of 10 years, split into three segmentations: Infrastructure, Applications, and Communications.

NSR's GSE3 answers these key questions:

- Where are the major opportunities in the space economy?

- When will infrastructure investments transition to service-based revenues?

- Are current macroeconomic headwinds challenging the long-term growth picture?

- Will Non-GEO displace GEO as a key orbit for value creation?

- What is the opportunity for direct-to-device services?

Who Should Purchase this Report:

- Venture Capital Analysts/Managers

- Business Strategy Mangers

- SATCOM Service Providers

- National Space Agencies (Business Incubation)

- Launch Providers

- Government and Military Organizations

NSR Difference

An often over-hyped market, especially with the recent pasts' influx of investor money, 'NewSpace' companies and wealthy 'players'; NSR offers an unbiased, focused view on the pure-space opportunity. NSR clients benefit from our unparallelled research library and decades of working directly with the industry's key players. This knowledge and insight gives NSR, and our clients the edge to see past the hype.

Key Features:

Covered in this Report:

- NEW in this Edition - A new report format approach highlighting challenges, key drivers, and NSR predictions.

- 3 verticals - Infrastructure, Application, and Communications.

- Forecasts for 10 Regions - Global, North America, Europe, Middle East & Africa, Asia, and Ocean regions.

- A unified and harmonized dataset leveraging NSR's comprehensive research library.

Report Segmentation:

- Satellite & Space Infrastructure - Focused on the manufacturing and launching opportunities in the space sector.

- Satellite & Space Applications - Earth Observation, M2M/IoT, Big Data and other application-centric use-cases and revenue streams.

- Satellite & Space Communications - Satellite connectivity opportunities, including the growing direct-to-device segment.

Companies included in this Report:

SpaceX Starlink, OneWeb, ViaSat, Canadian Space Agency, Indian Ministry of Defense, European Space Agency, SES, National Institute of Standards and Technology, Inmarsat, Eutelsat, T-Mobile, Globalstar, Apple, Samsung, Iridium, KT, NASA, AquarianSpace, AALYRIA, L3Harris.

Table of Contents

1. Global Space Economy Executive Summary

- 1.1. Overview

- 1.2. Regional Outlook

- 1.3. A $1.4 Trillion Opportunity

2. Key Findings

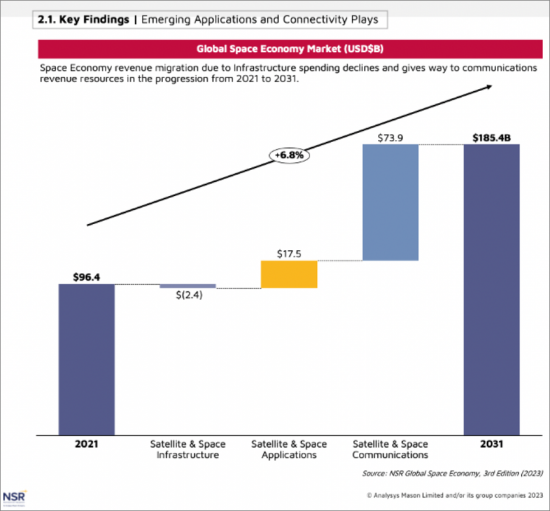

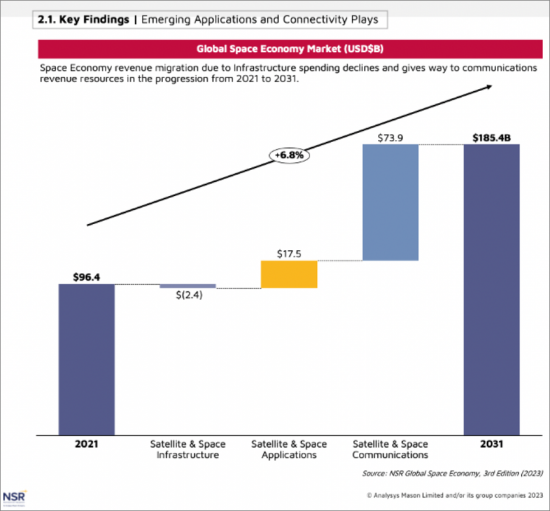

- 2.1. Emerging Applications and Connectivity Plays

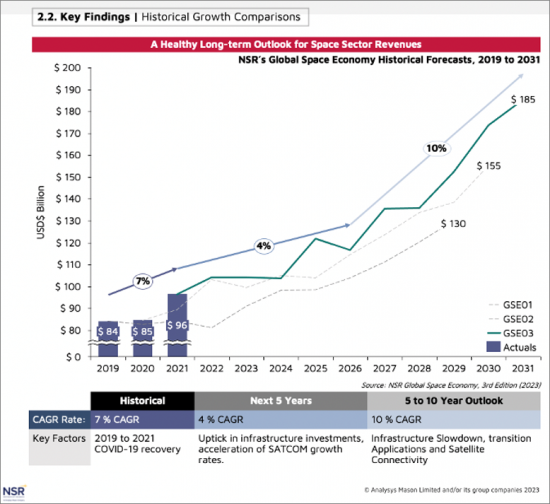

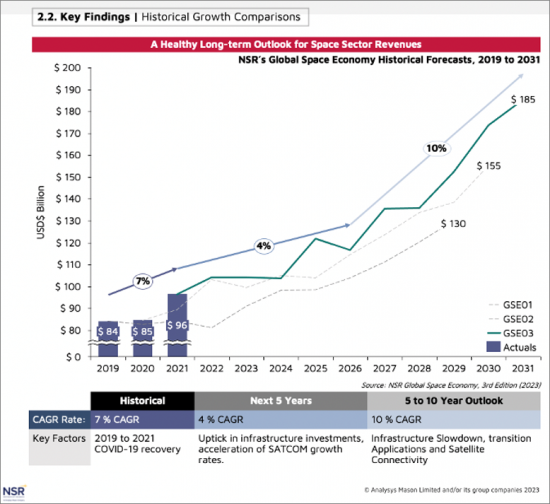

- 2.2. Historical Growth Comparisons

3. Challenges and Recommendations

- 3.1. Near-term Headwinds

- 3.2. Connectivity is the Growth Engine

- 3.3. Predictions from 2022

- 3.3.1. M&A will continue in SATCOM Markets

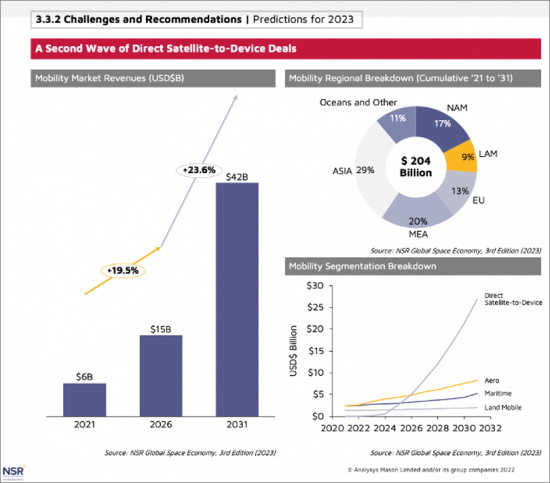

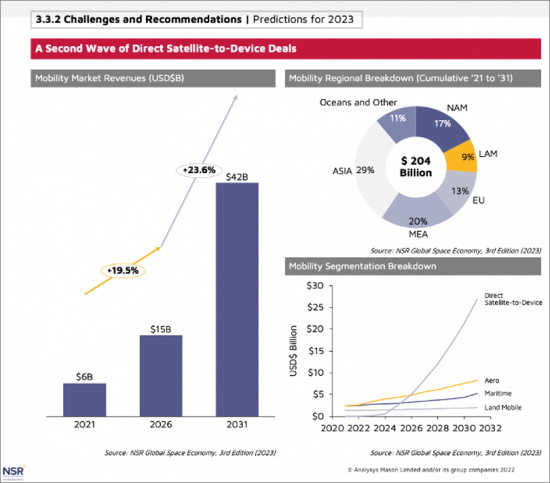

- 3.3.2. A Second Wave of Direct Satellite-to-Device Deals

- 3.3.3. Starship Strategy

- 3.4. 3 Big Growth Opportunities in the Global Space Economy

- 3.5. Recommendations to 2031

4. Appendix

- 4.1. Forecast at-a-glance

- 4.2. Satellite & Space Infrastructure

- 4.3. Satellite & Space Applications

- 4.4. Satellite & Space Communications

- 4.5. Definitions

- 4.6. Changelog

List of Exhibits

1. Global Space Economy Executive Summary

- 1.1. Global Space Economy Summary

- 1.2. Table of Regional Revenues

- 1.3. NSR's Global Space Economy Revenues, 2021 to 2031 (USD$B)

2. Key Findings

- 2.1. Global Space Economy Market (USD$B), 2021 to 2031

- 2.2. NSR's Global Space Economy Historical Forecasts, 2019 to 2031

3. Challenges and Recommendations

- 3.1. Global Space Economy Historical Yearly Revenue (USD$B)

- 3.2. Global Space Economy SATCOM Verticals Breakdown, 2021 to 2031 (USD$B)

- 3.3. SATCOM Supply Breakdown (Gbps)

- 3.4. Economies of Scale on the Launchpad-Cost per Mbps per Month to Orbit per Satellite by Throughput.

- 3.5. Global GEO-HTS & Non-GEO-HTS Bandwidth Supply (in Gbps)

- 3.6. 1,444,039 Gbps Non-GEO "Filed" Supply as of 2022

- 3.7. Mobility Market Breakdown

- 3.8. Mobility Regional Breakdown

- 3.9. Mobility Segmentation Breakdown

- 3.10. Global Satellite Order and Launches

- 3.11. 2021 Launch Market Share (%)

- 3.12. Global Manufacturing and Launch Revenue

- 3.13. Applications Market Opportunity Growth Rate (%)

- 3.14. Infrastructure Market Opportunity Growth Rate (%)

- 3.15. Communications Market Opportunity Growth Rate (%)

4. Appendix

- 4.1. Global Space Economy Forecast, 2021 to 2031 (USD$B)

- 4.2. Global Space Economy Cumulative Outlook (USD$B)

- 4.3. Global Space Economy Regional Breakdown (USD$B)

- 4.4. Satellite & Space Infrastructure Market Segmentation, Current vs. Previous Edition

- 4.5. Spotlight: Crew & Cargo (USD$B), '21 to '31

- 4.6. Infrastructure Regional Breakdown (USD$B)

- 4.7. Satellite & Space Infrastructure Segment Revenues, 2021 to 2031 (USD$B)

- 4.8. Satellite & Space Infrastructure Orbital Breakdown ('21 to '31)

- 4.9. Satellite & Space Applications Market Segmentation, Current vs. Previous Edition

- 4.10. Spotlight: EO Information Products (USD$B), '21 to 31

- 4.11. Applications Regional Breakdown (USD$B)

- 4.12. Satellite & Space Applications Segment Revenues (USD$B)

- 4.13. Satellite & Space Applications Orbital Breakdown ('21 to '31)

- 4.14. Satellite & Space Communications Market Segmentation, Current vs. Previous Edition

- 4.15. Spotlight: Mobility and the Satellite-to-Device Opportunity

- 4.16. Communications Regional Breakdown (USD$B)

- 4.17. Satellite & Space Communications Segment Revenues (USD$B)

- 4.18. Satellite & Space Communications Orbital Breakdown ('21 to '31)