|

|

市場調査レポート

商品コード

1773194

自動車用電子制御ユニットの世界市場:車両タイプ別、コンポーネントタイプ別、容量タイプ別、地域別、機会、予測、2018年~2032年Global Automotive Electronic Control Unit Market Assessment, By Vehicle Type, By Component Type, By Capacity Type, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 自動車用電子制御ユニットの世界市場:車両タイプ別、コンポーネントタイプ別、容量タイプ別、地域別、機会、予測、2018年~2032年 |

|

出版日: 2025年07月21日

発行: Markets & Data

ページ情報: 英文 225 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の電子制御ユニットの市場規模は、2025年~2032年の予測期間中に6.53%のCAGRで拡大し、2024年の1,059億3,000万米ドルから2032年には1,757億1,000万米ドルに成長すると予測されています。ECUは、エンジン制御、インフォテインメント、運転支援、安全システムなど、数多くの自動車機能の頭脳として機能します。自律走行機能の統合が進み、排ガス規制が厳しくなり、よりスマートでコネクテッドな自動車を求める消費者の需要が市場の成長を後押ししています。自動車メーカーとサプライヤーは、進化するニーズに対応するため、ECU技術に多額の投資を行っています。

世界中の主要ECUベンダーは、自動車メーカーが開発期間中に問題を特定できるよう、短時間で実用的なソリューションを構築することに注力しています。これにより、特にソフトウェア定義型車両向けの仮想プラットフォームのスペースが生まれました。

例えば、Continental AGとAmazon Web Services(Amazon)は2023年8月、AWS上のContinental Automotive Edge(CAEdge)フレームワークの一部として仮想ECU Creator(vECU Creator)を発表し、自動車ソフトウェア開発を加速させる戦略的協業を開始しました。このソリューションにより、OEMと開発者は、クラウド上でソフトウェア定義の自動車向けソフトウェアのシミュレーション、テスト、検証を行うことができ、開発を最大12カ月短縮し、継続的なアップデートと機能統合をサポートします。

当レポートでは、世界の自動車用電子制御ユニット市場について調査し、市場の概要とともに、車両タイプ別、コンポーネントタイプ別、容量タイプ別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 米国の関税の影響

第4章 エグゼクティブサマリー

第5章 お客様の声

第6章 世界の自動車用電子制御ユニット市場の見通し、2018年~2032年

- 市場規模分析と予測

- 市場シェア分析と予測

- 車両タイプ別

- 乗用車

- 商用車

- コンポーネントタイプ別

- ブレーキ制御モジュール

- サスペンション制御モジュール

- パワートレイン制御モジュール

- トランスミッション制御モジュール

- テレマティクスコントロールユニット

- その他

- 容量タイプ別

- 16ビットECU

- 32ビットECU

- 64ビットECU

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 企業別市場シェア分析(上位5社およびその他- 金額別、2024年)

- 車両タイプ別

- 2024年の市場マップ分析

第7章 北米の自動車用電子制御ユニット市場の見通し、2018年~2032年

- 市場規模分析と予測

- 市場シェア分析と予測

- 国別市場評価

- 米国

- カナダ

- メキシコ

第8章 欧州の自動車用電子制御ユニット市場の見通し、2018年~2032年

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第9章 アジア太平洋の自動車用電子制御ユニット市場の見通し、2018年~2032年

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第10章 南米の自動車用電子制御ユニット市場の見通し、2018年~2032年

- ブラジル

- アルゼンチン

第11章 中東・アフリカの自動車用電子制御ユニット市場の見通し、2018年~2032年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第12章 ポーターのファイブフォース分析

第13章 PESTLE分析

第14章 市場力学

- 市場の促進要因

- 市場の課題

第15章 市場動向と発展

第16章 ケーススタディ

第17章 競合情勢

- 市場リーダートップ5の競合マトリックス

- 参入企業トップ5のSWOT分析

- 市場の主要企業トップ10の情勢

- Lear Corporation

- Robert Bosch GmbH

- NIDEC CORPORATION

- Continental AG

- Aptiv Global Operations Limited

- ZF Friedrichshafen AG

- Autoliv Inc

- Marelli Holdings Co., Ltd.

- Infineon Technologies AG

- 3M Company

第18章 戦略的提言

第19章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 3. Global Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 4. Global Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 5. Global Electronic Control Unit Market Share (%), By Region, 2018-2032F

- Figure 6. North America Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 7. North America Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 8. North America Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

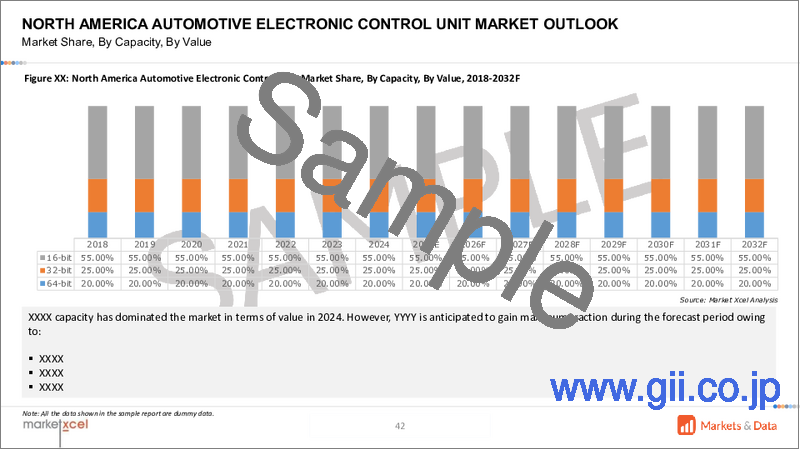

- Figure 9. North America Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 10. North America Electronic Control Unit Market Share (%), By Country, 2018-2032F

- Figure 11. United States Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 12. United States Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 13. United States Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 14. United States Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 15. Canada Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 16. Canada Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 17. Canada Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 18. Canada Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 19. Mexico Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 20. Mexico Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 21. Mexico Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 22. Mexico Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 23. Europe Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 24. Europe Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 25. Europe Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 26. Europe Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 27. Europe Electronic Control Unit Market Share (%), By Country, 2018-2032F

- Figure 28. Germany Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 29. Germany Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 30. Germany Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 31. Germany Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 32. France Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 33. France Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 34. France Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 35. France Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 36. Italy Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 37. Italy Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 38. Italy Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 39. Italy Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 40. United Kingdom Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 41. United Kingdom Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 42. United Kingdom Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 43. United Kingdom Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 44. Russia Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 45. Russia Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 46. Russia Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 47. Russia Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 48. Netherlands Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 49. Netherlands Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 50. Netherlands Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 51. Netherlands Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 52. Spain Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 53. Spain Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 54. Spain Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 55. Spain Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 56. Turkey Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 57. Turkey Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 58. Turkey Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 59. Turkey Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 60. Poland Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 61. Poland Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 62. Poland Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 63. Poland Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 64. South America Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 65. South America Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 66. South America Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 67. South America Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 68. South America Electronic Control Unit Market Share (%), By Country, 2018-2032F

- Figure 69. Brazil Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 70. Brazil Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 71. Brazil Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 72. Brazil Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 73. Argentina Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 74. Argentina Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 75. Argentina Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 76. Argentina Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 77. Asia-Pacific Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 78. Asia-Pacific Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 79. Asia-Pacific Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 80. Asia-Pacific Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 81. Asia-Pacific Electronic Control Unit Market Share (%), By Country, 2018-2032F

- Figure 82. India Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 83. India Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 84. India Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 85. India Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 86. China Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 87. China Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 88. China Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 89. China Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 90. Japan Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 91. Japan Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 92. Japan Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 93. Japan Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 94. Australia Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 95. Australia Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 96. Australia Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 97. Australia Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 98. Vietnam Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 99. Vietnam Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 100. Vietnam Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 101. Vietnam Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 102. South Korea Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 103. South Korea Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 104. South Korea Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 105. South Korea Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 106. Indonesia Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 107. Indonesia Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 108. Indonesia Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 109. Indonesia Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 110. Philippines Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 111. Philippines Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 112. Philippines Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 113. Philippines Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 114. Middle East & Africa Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 115. Middle East & Africa Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 116. Middle East & Africa Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 117. Middle East & Africa Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 118. Middle East & Africa Electronic Control Unit Market Share (%), By Country, 2018-2032F

- Figure 119. Saudi Arabia Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 120. Saudi Arabia Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 121. Saudi Arabia Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 122. Saudi Arabia Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 123. UAE Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 124. UAE Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 125. UAE Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 126. UAE Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 127. South Africa Electronic Control Unit Market, By Value, In USD Billion, 2018-2032F

- Figure 128. South Africa Electronic Control Unit Market Share (%), By Vehicle Type, 2018-2032F

- Figure 129. South Africa Electronic Control Unit Market Share (%), By Component Type, 2018-2032F

- Figure 130. South Africa Electronic Control Unit Market Share (%), By Capacity Type, 2018-2032F

- Figure 131. By Vehicle Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 132. By Component Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 133. By Capacity Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 134. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global electronic control unit market is projected to witness a CAGR of 6.53% during the forecast period 2025-2032, growing from USD 105.93 billion in 2024 to USD 175.71 billion in 2032F, as modern vehicles become increasingly reliant on advanced electronics for enhanced performance, safety, and comfort. ECUs act as the brains behind numerous automotive functions such as engine control, infotainment, driver assistance, and safety systems. The growing integration of autonomous driving features, stringent emission regulations, and consumer demand for smarter, connected cars are fueling market growth. Automakers and suppliers are investing heavily in ECU technology to meet evolving needs.

Major ECU vendors across the globe are focusing on building shorter but practical solutions for automakers to identify issues in the development period. This has created space for virtual platforms, especially for software-defined vehicles.

For instance, in August 2023, Continental AG and Amazon Web Services (Amazon) introduced a strategic collaboration to accelerate automotive software development with the launch of the virtual ECU Creator (vECU Creator) as part of the Continental Automotive Edge (CAEdge) framework on AWS. The solution enables OEMs and developers to simulate, test, and validate software for software-defined vehicles in the cloud, speeding up development by up to twelve months and supporting continuous updates and feature integration.

Government Regulations and ADAS Fuel the Electronic Control Unit Market Demand

Stringent government regulations on vehicle emissions are driving demand for advanced ECUs that manage engine performance and fuel efficiency. By optimizing fuel injection, combustion, and exhaust after-treatment systems, ECUs help automakers comply with environmental standards while maintaining vehicle power and drivability. This push for greener vehicles has made electronic control units critical to modern powertrains, especially as hybrid and electric vehicles grow in popularity. Such regulatory pressures encourage the continuous development of more sophisticated, efficient, and integrated ECU systems.

The rising popularity of advanced driver-assistance systems and semi-autonomous driving features is a significant catalyst for the ECU market. Modern vehicles rely on multiple ECUs to process sensor data, control braking, lane-keeping, adaptive cruise control, and collision avoidance technologies. As consumers expect higher levels of vehicle safety and convenience, automakers are integrating more electronic controls to enable more innovative driving experiences. This increasing complexity has led automakers to adopt the latest technology, such as machine learning and artificial intelligence, syncing it with the central control unit to make the vehicle smart.

For instance, in November 2024, Marelli Holdings Co., Ltd announced the launch of its advanced AI-based Electronic Control Unit, the VEC_480, designed for all propulsion types in motorsport, from traditional to electric. This breakthrough solution delivers 2.5 times higher real-time computing performance, tenfold inter-processor bandwidth, and improved memory bandwidth, supporting real-time AI inference, predictive analysis, and advanced connectivity for enhanced vehicle management and reliability.

Rising Sales of Connected Cars and Electrification to Shape Electronic Control Unit Market Dynamics

Growing consumer demand for connected cars with enhanced infotainment and telematics functions is propelling the automotive ECU market. Infotainment ECUs manage multimedia, navigation, internet connectivity, and real-time vehicle diagnostics, transforming the driving experience. Automakers are competing to offer seamless integration of smartphones, voice assistants, and cloud services. This trend is expanding the scope of ECUs beyond traditional powertrain and safety controls, pushing suppliers to develop flexible, scalable platforms that support frequent software updates and evolving digital ecosystems.

Electrification of vehicles is another key driver boosting the automotive ECU market. Electric and hybrid cars require sophisticated ECUs to manage battery performance, energy recovery, thermal management, and motor control. As the transition to zero-emission mobility accelerates, OEMs and suppliers are innovating specialized ECUs designed for complex electric powertrains. These units enable precise energy management, extended driving range, and optimal battery health. The shift toward electrification opens new growth avenues for ECU manufacturers across all vehicle segments.

Passenger Cars Lead in the Global Electronic Control Unit Market Share

Based on vehicle type, the passenger cars segment leads the automotive ECU market as these vehicles incorporate the highest number of electronic control units per model. Modern passenger cars increasingly feature multiple ECUs for managing powertrain efficiency, safety systems, infotainment, climate control, and advanced driver-assistance technologies. Rising consumer demand for premium features, connected services, and autonomous driving capabilities is accelerating the integration of sophisticated ECUs in new car models. Automakers are differentiating their offerings by providing enhanced digital interfaces and real-time data processing, which require robust electronic control architectures. As urban mobility trends evolve, compact and mid-size passenger cars demand futuristic ECU systems that also safeguard the vehicle against cyber-crimes while integrating with hybrid and Electric vehicles.

For instance, in April 2023, TTTech Auto launched the N4 Network Controller, a high-performance Electronic Control Unit (ECU) with advanced networking capabilities, designed as a central security gateway for modern automotive E/E architectures. This product enables software-defined vehicles, supports functional safety up to ASIL B, and ensures cybersecurity according to ISO 21434. The N4 facilitates over-the-air updates, Time Sensitive Networking, and paves the way for hybrid or full zonal vehicle architectures.

Asia-Pacific Dominates the Global Electronic Control Unit Market Size

Asia-Pacific dominates the automotive ECU market due to the region's strong automotive manufacturing base, rapid vehicle electrification, and adoption of advanced technologies. Countries such as China, Japan, and South Korea are home to leading automakers and Tier 1 suppliers heavily investing in innovative vehicle electronics. Governments in the region are promoting electric mobility through incentives and infrastructure development, boosting demand for specialized ECUs for electric powertrains and rising disposable incomes and consumer preference for connected cars further fuel adoption of advanced ECUs for infotainment and safety applications. Local manufacturers are also expanding ECU production capabilities to cater to both domestic and export markets, strengthening Asia Pacific's position as a global hub for automotive electronics. Apart from the local manufacturers, the global auto giants are also expanding their space in ECU production in Asian countries.

For instance, in December 2022, Continental AG expanded its manufacturing footprint in India as its Bengaluru plant rolled out the five millionth Electronic Control Unit (ECU) in less than six years. The facility, operational since February 2017, supplies advanced ECUs, including variants for safety-critical Electronic Stability Control to leading OEMs. They planned to boost ECU capacity by 20% in 2023 to meet growing market demand.

Impact of the U.S. Tariff on the Global Electronic Control Unit Market

US tariffs on imported automotive components have increased production costs for manufacturers sourcing ECU and related electronics from overseas. This has created supply chain uncertainties, forcing automakers to reassess supplier networks and explore localized manufacturing to reduce tariff exposure. Some companies have faced delays and higher prices, squeezing profit margins and complicating cost forecasts for new vehicle models. While tariffs aim to boost domestic production, they also challenge global supply chains that rely on cost-effective international sourcing for critical ECU components.

Key Players Landscape and Outlook

Key players in the automotive ECU market are focusing on technological innovation and strategic partnerships to maintain a competitive edge. They invest significantly in research and development to create modular and software-centric ECUs that support next-generation vehicle architectures, including autonomous and electric platforms. Many companies are forming alliances with semiconductor manufacturers, software developers, and cloud service providers to deliver integrated solutions that combine hardware and software seamlessly. Additionally, they expand production footprints in emerging markets to cater to regional demand and navigate trade restrictions. Aftermarket services, over-the-air updates, and cybersecurity enhancements are also central to their strategies as vehicles become more connected and reliant on data-driven control systems. Companies also develop ECUs for the two-wheeler operations, building advanced technology around braking, clutch, and transmission.

For instance, in November 2024, NIDEC Corporation built an electric clutch ECU specifically for two-wheeled vehicles, allowing riders to shift gears without the need for a clutch lever when the vehicle's drive force varies during acceleration, deceleration, or stopping. In contrast to four-wheeled vehicles, most mid-size and larger two-wheelers are equipped with manual transmissions, necessitating that the rider engage the clutch and change gears when starting, adjusting speed, or halting.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Impact of U.S. Tariffs

4. Executive Summary

5. Voice of Customers

- 5.1. Respondent Demographics

- 5.2. Brand Awareness

- 5.3. Factors Considered in Purchase Decisions

- 5.4. Unmet Needs

6. Global Automotive Electronic Control Unit Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Vehicle Type

- 6.2.1.1. Passenger Cars

- 6.2.1.2. Commercial Vehicles

- 6.2.2. By Component Type

- 6.2.2.1. Brake Control Module

- 6.2.2.2. Suspension Control Module

- 6.2.2.3. Powertrain Control Module

- 6.2.2.4. Transmission Control Module

- 6.2.2.5. Telematics Control Unit

- 6.2.2.6. Others

- 6.2.3. By Capacity Type

- 6.2.3.1. 16-bit ECU

- 6.2.3.2. 32-bit ECU

- 6.2.3.3. 64-bit ECU

- 6.2.4. By Region

- 6.2.4.1. North America

- 6.2.4.2. Europe

- 6.2.4.3. Asia-Pacific

- 6.2.4.4. South America

- 6.2.4.5. Middle East and Africa

- 6.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 6.2.1. By Vehicle Type

- 6.3. Market Map Analysis, 2024

- 6.3.1. By Vehicle Type

- 6.3.2. By Component Type

- 6.3.3. By Capacity Type

- 6.3.4. By Region

7. North America Automotive Electronic Control Unit Market Outlook, 2018-2032F

- 7.1. Market Size Analysis & Forecast

- 7.1.1. By Value

- 7.2. Market Share Analysis & Forecast

- 7.2.1. By Vehicle Type

- 7.2.1.1. Passenger Cars

- 7.2.1.2. Commercial Vehicles

- 7.2.2. By Component Type

- 7.2.2.1. Brake Control Module

- 7.2.2.2. Suspension Control Module

- 7.2.2.3. Powertrain Control Module

- 7.2.2.4. Transmission Control Module

- 7.2.2.5. Telematics Control Unit

- 7.2.2.6. Others

- 7.2.3. By Capacity Type

- 7.2.3.1. 16-bit ECU

- 7.2.3.2. 32-bit ECU

- 7.2.3.3. 64-bit ECU

- 7.2.4. By Country Share

- 7.2.4.1. United States

- 7.2.4.2. Canada

- 7.2.4.3. Mexico

- 7.2.1. By Vehicle Type

- 7.3. Country Market Assessment

- 7.3.1. United States Automotive Electronic Control Unit Market Outlook, 2018-2032F*

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share Analysis & Forecast

- 7.3.1.2.1. By Vehicle Type

- 7.3.1.2.1.1. Passenger Cars

- 7.3.1.2.1.2. Commercial Vehicles

- 7.3.1.2.2. By Component Type

- 7.3.1.2.2.1. Brake Control Module

- 7.3.1.2.2.2. Suspension Control Module

- 7.3.1.2.2.3. Powertrain Control Module

- 7.3.1.2.2.4. Transmission Control Module

- 7.3.1.2.2.5. Telematics Control Unit

- 7.3.1.2.2.6. Others

- 7.3.1.2.3. By Capacity Type

- 7.3.1.2.3.1. 16-bit ECU

- 7.3.1.2.3.2. 32-bit ECU

- 7.3.1.2.3.3. 64-bit ECU

- 7.3.1.2.1. By Vehicle Type

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.1. United States Automotive Electronic Control Unit Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

8. Europe Automotive Electronic Control Unit Market Outlook, 2018-2032F

- 8.1. Germany

- 8.2. France

- 8.3. Italy

- 8.4. United Kingdom

- 8.5. Russia

- 8.6. Netherlands

- 8.7. Spain

- 8.8. Turkey

- 8.9. Poland

9. Asia-Pacific Automotive Electronic Control Unit Market Outlook, 2018-2032F

- 9.1. India

- 9.2. China

- 9.3. Japan

- 9.4. Australia

- 9.5. Vietnam

- 9.6. South Korea

- 9.7. Indonesia

- 9.8. Philippines

10. South America Automotive Electronic Control Unit Market Outlook, 2018-2032F

- 10.1. Brazil

- 10.2. Argentina

11. Middle East and Africa Automotive Electronic Control Unit Market Outlook, 2018-2032F

- 11.1. Saudi Arabia

- 11.2. UAE

- 11.3. South Africa

12. Porter's Five Forces Analysis

13. PESTLE Analysis

14. Market Dynamics

- 14.1. Market Drivers

- 14.2. Market Challenges

15. Market Trends and Developments

16. Case Studies

17. Competitive Landscape

- 17.1. Competition Matrix of Top 5 Market Leaders

- 17.2. SWOT Analysis for Top 5 Players

- 17.3. Key Players Landscape for Top 10 Market Players

- 17.3.1. Lear Corporation

- 17.3.1.1. Company Details

- 17.3.1.2. Key Management Personnel

- 17.3.1.3. Key Products Offered

- 17.3.1.4. Key Financials (As Reported)

- 17.3.1.5. Key Market Focus and Geographical Presence

- 17.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisitions

- 17.3.2. Robert Bosch GmbH

- 17.3.3. NIDEC CORPORATION

- 17.3.4. Continental AG

- 17.3.5. Aptiv Global Operations Limited

- 17.3.6. ZF Friedrichshafen AG

- 17.3.7. Autoliv Inc

- 17.3.8. Marelli Holdings Co., Ltd.

- 17.3.9. Infineon Technologies AG

- 17.3.10. 3M Company

- 17.3.1. Lear Corporation

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.