|

|

市場調査レポート

商品コード

1757413

軍事用ジャマーの世界市場の評価、プラットフォーム別、周波数帯域別、役割別、地域別、機会、予測、2018年~2032年Global Military Jammer Market Assessment, By Platform, By Frequency Band, By Role, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 軍事用ジャマーの世界市場の評価、プラットフォーム別、周波数帯域別、役割別、地域別、機会、予測、2018年~2032年 |

|

出版日: 2025年06月27日

発行: Markets & Data

ページ情報: 英文 234 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の軍事用ジャマー市場は、2025年から2032年の予測期間中にCAGR7.33%を記録し、2024年の61億2,000万米ドルから2032年には107億8,000万米ドルに成長すると予測されています。軍事用ジャマー市場の成長は、電子戦の資金が増加し、現代の戦場では高度な脅威に対する高度な保護が要求されているため、引き続き堅調です。人工知能をソフトウェア定義無線システムに統合し、高度な信号処理と組み合わせることで、これらのシステムの運用性能が向上します。コンパクトでポータブルなジャマーの採用は、これらのデバイスが部隊や特殊作戦部隊の迅速な展開を可能にするため、拡大しています。

ドローンや自律型システムが広く普及しているため、高度な反撃ソリューションが必要となり、市場が開拓されています。国防機関は民間会社と協力して技術開発を加速させ、国家安全保障政策は電子戦を不可欠な安全保障要素として重視しています。スペクトラム制御システムや適応能力の開発、複数の作戦シナリオに対応する多目的ソリューションの開発を通じて、市場は進化を続けています。

例えば、2024年4月には、Ultra Intelligence & CommunicationsのArcher対流圏通信システムが米国陸軍に提供され、戦場通信の弾力性を向上させながら、軍事妨害の脅威から保護するために、競合状況下で効果的に動作する安全な展望外リンクを提供します。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 米国の関税の影響

第4章 エグゼクティブサマリー

第5章 顧客の声

- 回答者の人口統計

- ブランド認知度

- 購入決定時に考慮される要素

- ライフサイクルコスト効率

- 周波数互換性

- 電力効率

第6章 世界の軍事用ジャマー市場の展望、2018年~2032年

- 市場規模分析と予測

- 金額別

- 市場シェア分析と予測

- プラットフォーム別

- 空挺

- 地上

- 海上

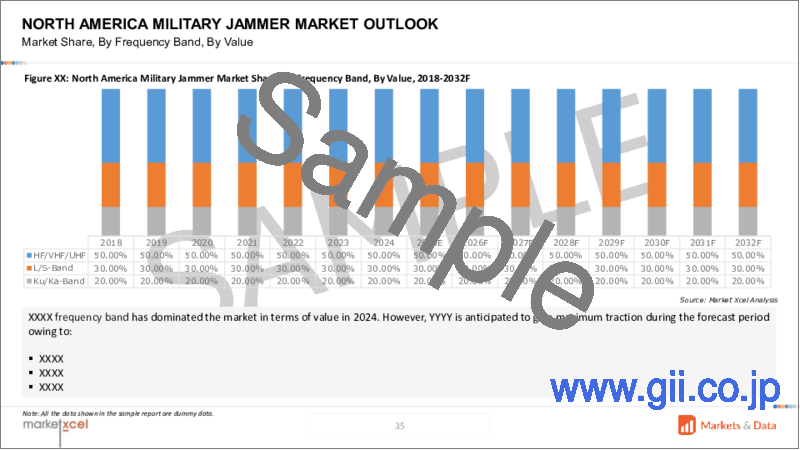

- 周波数帯域別

- HF/VHF/UHF

- L/Sバンド

- Ku/Kaバンド

- 役割別

- 電子攻撃(EA)

- 電子保護(EP)

- 電子支援手段(ESM)

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 企業別市場シェア分析(上位5社およびその他-金額別、2024年)

- プラットフォーム別

- 市場マップ分析、2024年

- プラットフォーム別

- 周波数帯域別

- 役割別

- 地域別

第7章 北米の軍事用ジャマー市場の展望、2018年~2032年

- 市場規模分析と予測

- 金額別

- 市場シェア分析と予測

- プラットフォーム別

- 空挺

- 地上

- 海上

- 周波数帯域別

- HF/VHF/UHF

- L/Sバンド

- Ku/Kaバンド

- 役割別

- 電子攻撃(EA)

- 電子保護(EP)

- 電子支援手段(ESM)

- 国別シェア

- 米国

- カナダ

- メキシコ

- プラットフォーム別

- 国別市場評価

- 米国の軍事用ジャマー市場の展望、2018年~2032年*

- 市場規模分析と予測

- 市場シェア分析と予測

- カナダ

- メキシコ

- 米国の軍事用ジャマー市場の展望、2018年~2032年*

すべてのセグメントは、対象となるすべての地域と国に提供されます。

第8章 欧州の軍事用ジャマー市場の展望、2018年~2032年

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第9章 アジア太平洋の軍事用ジャマー市場の展望、2018年~2032年

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第10章 南米の軍事用ジャマー市場の展望、2018年~2032年

- ブラジル

- アルゼンチン

第11章 中東・アフリカの軍事用ジャマー市場の展望、2018年~2032年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第12章 ポーターのファイブフォース分析

第13章 PESTLE分析

第14章 市場力学

- 市場促進要因

- 市場の課題

第15章 市場動向と発展

第16章 ケーススタディ

第17章 競合情勢

- 市場リーダー上位5社の競合マトリックス

- 上位5社のSWOT分析

- 市場上位10の主要企業の情勢

- RTX Corporation

- 会社概要

- 主要経営陣

- 提供される主な製品

- 主要財務状況(報告時点)

- 主要市場への注力と地理的プレゼンス

- 最近の動向/コラボレーション/パートナーシップ/合併と買収

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- BAE Systems Plc

- Thales Group

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Aselsan AS

- Leonardo SpA

- Saab AB

上記の企業は市場シェアに応じて注文を保留するものではなく、調査作業中に入手可能な情報に応じて変更される可能性があります。

第18章 戦略的提言

第19章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 3. Global Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 4. Global Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 5. Global Military Jammer Market Share (%), By Region, 2018-2032F

- Figure 6. North America Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 7. North America Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 8. North America Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 9. North America Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 10. North America Military Jammer Market Share (%), By Country, 2018-2032F

- Figure 11. United States Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 12. United States Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 13. United States Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 14. United States Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 15. Canada Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 16. Canada Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 17. Canada Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 18. Canada Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 19. Mexico Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 20. Mexico Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 21. Mexico Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 22. Mexico Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 23. Europe Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 24. Europe Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 25. Europe Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 26. Europe Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 27. Europe Military Jammer Market Share (%), By Country, 2018-2032F

- Figure 28. Germany Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 29. Germany Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 30. Germany Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 31. Germany Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 32. France Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 33. France Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 34. France Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 35. France Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 36. Italy Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 37. Italy Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 38. Italy Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 39. Italy Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 40. United Kingdom Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 41. United Kingdom Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 42. United Kingdom Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 43. United Kingdom Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 44. Russia Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 45. Russia Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 46. Russia Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 47. Russia Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 48. Netherlands Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 49. Netherlands Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 50. Netherlands Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 51. Netherlands Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 52. Spain Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 53. Spain Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 54. Spain Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 55. Spain Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 56. Turkey Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 57. Turkey Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 58. Turkey Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 59. Turkey Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 60. Poland Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 61. Poland Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 62. Poland Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 63. Poland Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 64. South America Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 65. South America Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 66. South America Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 67. South America Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 68. South America Military Jammer Market Share (%), By Country, 2018-2032F

- Figure 69. Brazil Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 70. Brazil Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 71. Brazil Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 72. Brazil Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 73. Argentina Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 74. Argentina Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 75. Argentina Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 76. Argentina Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 77. Asia-Pacific Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 78. Asia-Pacific Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 79. Asia-Pacific Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 80. Asia-Pacific Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 81. Asia-Pacific Military Jammer Market Share (%), By Country, 2018-2032F

- Figure 82. India Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 83. India Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 84. India Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 85. India Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 86. China Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 87. China Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 88. China Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 89. China Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 90. Japan Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 91. Japan Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 92. Japan Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 93. Japan Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 94. Australia Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 95. Australia Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 96. Australia Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 97. Australia Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 98. Vietnam Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 99. Vietnam Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 100. Vietnam Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 101. Vietnam Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 102. South Korea Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 103. South Korea Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 104. South Korea Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 105. South Korea Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 106. Indonesia Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 107. Indonesia Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 108. Indonesia Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 109. Indonesia Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 110. Philippines Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 111. Philippines Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 112. Philippines Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 113. Philippines Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 114. Middle East & Africa Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 115. Middle East & Africa Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 116. Middle East & Africa Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 117. Middle East & Africa Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 118. Middle East & Africa Military Jammer Market Share (%), By Country, 2018-2032F

- Figure 119. Saudi Arabia Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 120. Saudi Arabia Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 121. Saudi Arabia Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 122. Saudi Arabia Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 123. UAE Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 124. UAE Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 125. UAE Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 126. UAE Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 127. South Africa Military Jammer Market, By Value, In USD Billion, 2018-2032F

- Figure 128. South Africa Military Jammer Market Share (%), By Platform, 2018-2032F

- Figure 129. South Africa Military Jammer Market Share (%), By Frequency Band, 2018-2032F

- Figure 130. South Africa Military Jammer Market Share (%), By Role, 2018-2032F

- Figure 131. By Platform Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 132. By Frequency Band Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 133. By Role Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 134. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global military jammer market is projected to witness a CAGR of 7.33% during the forecast period 2025-2032, growing from USD 6.12 billion in 2024 to USD 10.78 billion in 2032. Military jammer market growth remains strong due to electronic warfare receiving increased funding, while modern battlefields demand advanced protection against sophisticated threats. The integration of artificial intelligence with software-defined radio systems, combined with advanced signal processing, improves the operational performance of these systems. The adoption of compact and portable jammers is expanding due to these devices enabling the quick deployment of troops and special operations forces.

The market develops due to drones and autonomous systems spreading widely, which require sophisticated counterattack solutions. Defense agencies collaborate with private companies to speed up technological development, while national security policies focus on electronic warfare as an essential security element. The market maintains its evolution through the development of spectrum control systems and adaptive capabilities, and multi-purpose solutions that address multiple operational scenarios.

For instance, in April 2024, the Archer troposcatter communications system from Ultra Intelligence & Communications served the U.S. Army to offer secure beyond-line-of-sight links that operate effectively in contested situations to protect against military jamming threats while improving battlefield communications resilience.

Technological Advancement Pumps the Military Jammer Market Growth

The military jammer market experiences robust growth due to technological progress as its fundamental driver. Software-defined radio, together with artificial intelligence, creates advanced jamming systems that automatically identify and neutralize threats through real-time operations. The increasing deployment of drones and autonomous vehicles in current military operations has created greater demand for sophisticated jamming systems, which can defend against these emerging threats. Compact portable jammers gain market acceptance because they enable mobility operations while connecting with unmanned platforms. The advancement of sophisticated signal processing systems, together with multi-functional jammers, produces fresh operational conditions that make electronic warfare essential for current military strategies.

For instance, in September 2024, the U.S. Navy assigned L3Harris Technologies, Inc. a contract worth USD 587.3 million to produce Next Generation Jammer Low-Band pods for EA-18G Growler aircraft. The implementation of modern software systems and AESA technology drives growth in the military jamming field by substituting outdated equipment and improving electronic attack functions.

Rising Electronic Warfare Equipment Fuels Military Jammer Market Growth

The military jammer market experiences substantial growth due to the expanding usage of advanced electronic warfare equipment. Military operations today utilize electronic countermeasures to break enemy communications, together with radar and navigation systems, which provide tactical superiority and asset protection. Modern military forces face increased demand for versatile jamming systems that can block various frequencies and technologies due to rising threats from drones and autonomous vehicles. The performance and flexibility of these systems improve through innovations that include artificial intelligence alongside software-defined radio. Defense forces worldwide will maintain their modernization efforts, which drive electronic warfare development to protect essential communication networks during modern conflicts.

For instance, in July 2024, the U.S. Army granted Mastodon Design LLC a contract worth almost USD 100 million to deliver manpack electronic warfare systems because advanced jamming equipment needs are expanding the military electronic warfare market.

Airborne Dominates the Military Jammer Market Share

The military jammer market shows airborne platforms as its leading force because modern warfare demands enhanced electronic warfare systems. The airborne jamming systems function as key components that electronic warfare aircraft and combat jets use to interfere with enemy radar and communication systems for protecting allied forces and mission success. The development and upgrade of these systems receive multiple contracts from national armed forces. Such agreements include the supply of new equipment, integration into existing platforms, and ongoing support, ensuring that forces remain prepared for evolving threats and operational requirements. The growing strategic importance of airborne electronic attack capabilities serves as a fundamental element for building military power and operational durability.

For instance, in October 2024, the United States Navy awarded RTX Corporation (Raytheon) a contract to develop Next Generation Jammer Mid-Band Expansion, which establishes airborne electronic attack as a leading military jamming capability through its carrier-based aircraft threat countermeasure systems.

North America Leads Military Jammer Market Size

The military jammer market receives its primary leadership from North America due to its large defense spending and leading defense companies, and technological advancements. The electronic warfare programs, alongside research and development funding from the government, support North America to sustain its market dominance. Advanced technologies, including artificial intelligence, have produced autonomous jamming systems that deliver improved operational performance. The creation of small portable jammers enables flexible military operations and anti-drone activities. The market position of North America remains dominant due to its technological advancement strategy for military modernization, whereas other regions stay behind in both market share and innovation development.

For instance, in October 2024, Leonardo UK (Leonardo S.p.A) released BriteStorm as a lightweight stand-in jammer for unmanned systems, which targets both the United States and worldwide markets. The payload operates in United States trials to suppress enemy air defenses and is designed for quick integration and export.

Impact of U.S. Tariffs on the Military Jammer Market

The implementation of tariffs on imported electronic components such as RF sensors and microchips has resulted in increased input costs for manufacturers who produce military jammers. Companies face two outcomes from this situation, which include increased product prices or decreased profit margins.

Companies are relocating their supply sources away from China to European suppliers and Southeast Asian suppliers, and domestic suppliers to avoid tariffs. Companies must make initial investments to restructure their supply chains, which leads to stable, long-term supply chains.

The tariffs have motivated manufacturers in the United States and their allied countries to dedicate increased resources to research and development activities in their local facilities. The increased investment in research and development activities leads to enhanced technological capabilities and innovative solutions for military jamming systems.

The implementation of tariffs creates supply chain blockage, which results in procurement and testing delays for advanced jamming technologies. The continuous growth of the defense market remains stable due to unchanging defense budgets, which maintain demand levels.

Key Players Landscape and Outlook

The military jammer market contains intense competition among leading companies that compete to build innovative technologies to face modern security threats. The industry develops intelligent portable jamming solutions that adapt to evolving threats that include drones and electronic attacks. Industry growth derives from worldwide security threats and modern armed forces. The market requires trustworthy multi-band systems that function effectively throughout land, sea, and air domains for achieving success. Companies dedicate their efforts to developing cyber-electronic fusion technologies that allow them to keep their competitive advantage. The market environment evolves through fast technological advancements, together with the requirement to defeat sophisticated electronic warfare operations.

For instance, in June 2023, Lockheed Martin Corporation received a USD 37 million contract from the U.S. Army to create TLS-EAB long-range jammers for General Dynamics. Military jamming systems face strong competitive pressure in the market since modern electronic warfare equipment experiences continuous growth from worldwide security threats and armed forces upgrading their capabilities.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Impact of U.S. Tariffs

4. Executive Summary

5. Voice of Customers

- 5.1. Respondent Demographics

- 5.2. Brand Awareness

- 5.3. Factors Considered in Purchase Decisions

- 5.4. Lifecycle Cost Efficiency

- 5.5. Frequency Compatibility

- 5.6. Power Efficiency

6. Global Military Jammer Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Platform

- 6.2.1.1. Airborne

- 6.2.1.2. Ground-Based

- 6.2.1.3. Naval

- 6.2.2. By Frequency Band

- 6.2.2.1. HF/VHF/UHF

- 6.2.2.2. L/S-Band

- 6.2.2.3. Ku/Ka-Band

- 6.2.3. By Role

- 6.2.3.1. Electronic Attack (EA)

- 6.2.3.2. Electronic Protection (EP)

- 6.2.3.3. Electronic Support Measures (ESM)

- 6.2.4. By Region

- 6.2.4.1. North America

- 6.2.4.2. Europe

- 6.2.4.3. Asia-Pacific

- 6.2.4.4. South America

- 6.2.4.5. Middle East and Africa

- 6.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 6.2.1. By Platform

- 6.3. Market Map Analysis, 2024

- 6.3.1. By Platform

- 6.3.2. By Frequency Band

- 6.3.3. By Role

- 6.3.4. By Region

7. North America Military Jammer Market Outlook, 2018-2032F

- 7.1. Market Size Analysis & Forecast

- 7.1.1. By Value

- 7.2. Market Share Analysis & Forecast

- 7.2.1. By Platform

- 7.2.1.1. Airborne

- 7.2.1.2. Ground-Based

- 7.2.1.3. Naval

- 7.2.2. By Frequency Band

- 7.2.2.1. HF/VHF/UHF

- 7.2.2.2. L/S-Band

- 7.2.2.3. Ku/Ka-Band

- 7.2.3. By Role

- 7.2.3.1. Electronic Attack (EA)

- 7.2.3.2. Electronic Protection (EP)

- 7.2.3.3. Electronic Support Measures (ESM)

- 7.2.4. By Country Share

- 7.2.4.1. United States

- 7.2.4.2. Canada

- 7.2.4.3. Mexico

- 7.2.1. By Platform

- 7.3. Country Market Assessment

- 7.3.1. United States Military Jammer Market Outlook, 2018-2032F*

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share Analysis & Forecast

- 7.3.1.2.1. By Platform

- 7.3.1.2.1.1. Airborne

- 7.3.1.2.1.2. Ground-Based

- 7.3.1.2.1.3. Naval

- 7.3.1.2.2. By Frequency Band

- 7.3.1.2.2.1. HF/VHF/UHF

- 7.3.1.2.2.2. L/S-Band

- 7.3.1.2.2.3. Ku/Ka-Band

- 7.3.1.2.3. By Role

- 7.3.1.2.3.1. Electronic Attack (EA)

- 7.3.1.2.3.2. Electronic Protection (EP)

- 7.3.1.2.3.3. Electronic Support Measures (ESM)

- 7.3.1.2.1. By Platform

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.1. United States Military Jammer Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

8. Europe Military Jammer Market Outlook, 2018-2032F

- 8.1. Germany

- 8.2. France

- 8.3. Italy

- 8.4. United Kingdom

- 8.5. Russia

- 8.6. Netherlands

- 8.7. Spain

- 8.8. Turkey

- 8.9. Poland

9. Asia-Pacific Military Jammer Market Outlook, 2018-2032F

- 9.1. India

- 9.2. China

- 9.3. Japan

- 9.4. Australia

- 9.5. Vietnam

- 9.6. South Korea

- 9.7. Indonesia

- 9.8. Philippines

10. South America Military Jammer Market Outlook, 2018-2032F

- 10.1. Brazil

- 10.2. Argentina

11. Middle East and Africa Military Jammer Market Outlook, 2018-2032F

- 11.1. Saudi Arabia

- 11.2. UAE

- 11.3. South Africa

12. Porter's Five Forces Analysis

13. PESTLE Analysis

14. Market Dynamics

- 14.1. Market Drivers

- 14.2. Market Challenges

15. Market Trends and Developments

16. Case Studies

17. Competitive Landscape

- 17.1. Competition Matrix of Top 5 Market Leaders

- 17.2. SWOT Analysis for Top 5 Players

- 17.3. Key Players Landscape for Top 10 Market Players

- 17.3.1. RTX Corporation

- 17.3.1.1. Company Details

- 17.3.1.2. Key Management Personnel

- 17.3.1.3. Key Products Offered

- 17.3.1.4. Key Financials (As Reported)

- 17.3.1.5. Key Market Focus and Geographical Presence

- 17.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisitions

- 17.3.2. Lockheed Martin Corporation

- 17.3.3. Northrop Grumman Corporation

- 17.3.4. BAE Systems Plc

- 17.3.5. Thales Group

- 17.3.6. Elbit Systems Ltd.

- 17.3.7. L3Harris Technologies, Inc.

- 17.3.8. Aselsan A.S.

- 17.3.9. Leonardo S.p.A.

- 17.3.10. Saab AB

- 17.3.1. RTX Corporation

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.