|

|

市場調査レポート

商品コード

1730688

軍用ドローン市場の評価:用途・技術・製品タイプ・地域別の機会および予測 (2018-2032年)Military Drone Market Assessment, By Application, By Technology, By Product Type, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 軍用ドローン市場の評価:用途・技術・製品タイプ・地域別の機会および予測 (2018-2032年) |

|

出版日: 2025年05月22日

発行: Markets & Data

ページ情報: 英文 225 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の軍用ドローンの市場規模は、2025年から2032年の予測期間中にCAGR 14.41%で成長し、2024年の251億9,000万米ドルから、2032年には739億5,000万米ドルに達すると予測されています。

無人戦闘機 (UCAV) としても知られる軍用ドローンは、情報監視、目標捕捉、偵察のために使用されます。これらのドローンはしばしば、ミサイルや対戦車誘導ミサイルなどの航空兵器を搭載するために使用されます。これらのドローンは遠隔操作が可能であり、物理的または搭乗型のパイロットを必要としないため、ドローン全体の重量を軽減するのに役立ちます。

軍用ドローン市場は、戦闘時における人的リスクを最小限に抑えたいという需要の高まりにより、成長を遂げています。AIや機械学習の進展により、高度な検知技術やサーマルイメージングが可能となり、ドローンは国家の監視および安全保障にとって理想的な選択肢となっていることから、これらの技術がドローン市場の成長を後押ししています。

現在では、ドローンは全地球航法衛星システム (GNSS) および非衛星モードの両方で操作することが可能です。これらのナビゲーションシステムは、3Dマップの作成や飛行中の捜索救助任務の遂行に役立ちます。多くの国々がさまざまな目的で軍用ドローンを採用しており、防衛面での国の成長において不可欠な存在となっています。これらのドローンは戦争のためだけでなく、医薬品、血液、食品、検査用の血液サンプルなど、必要な物資を運ぶためにも使用されています。多くのドローン企業は、より多くのペイロードを運搬し、より正確な精度と監視能力を持つ、さらに高度なドローンの開発に力を注いでいます。

当レポートでは、世界の軍用ドローンの市場を調査し、市場の定義と概要、市場規模の推移・予測、各種区分別の詳細分析、産業構造、市場成長への影響因子の分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 米国の関税の影響

第4章 エグゼクティブサマリー

第5章 顧客の声

- 回答者の人口統計

- ブランド認知度

- 購入決定時に考慮される要素

- 信頼性

- ミッション適応性

- コスト効率

- 防衛基準への準拠

- 既存システムとのシームレスな統合

第6章 世界の軍用ドローン市場の展望

- 市場規模の分析・予測

- 市場シェアの分析・予測

- 用途別

- 情報収集、監視、偵察

- 戦闘作戦

- 物流・輸送

- 戦闘被害管理

- 技術別

- 遠隔操作

- 半自動

- 完全自動

- 製品タイプ別

- 固定翼

- 回転翼

- ハイブリッド

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 企業シェア分析 (上位5社およびその他)

- 用途別

- 市場マップ分析

第7章 北米の軍用ドローン市場の展望

- 市場規模の分析・予測

- 市場シェアの分析・予測

- 国別市場評価

- 米国

- カナダ

- メキシコ

第8章 欧州の軍用ドローン市場の展望

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第9章 アジア太平洋の軍用ドローン市場の展望

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第10章 南米の軍用ドローン市場の展望

- ブラジル

- アルゼンチン

第11章 中東・アフリカの軍用ドローン市場の展望

- サウジアラビア

- UAE

- 南アフリカ

第12章 ポーターのファイブフォース分析

第13章 PESTLE分析

第14章 市場力学

- 市場促進要因

- 市場の課題

第15章 市場動向と発展

第16章 ケーススタディ

第17章 競合情勢

- 上位5社の競合マトリックス

- 上位5社のSWOT分析

- 上位10社の情勢

- General Atomics Inc.

- Northrop Grumman Corporation

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- AeroVironment, Inc.

- Lockheed Martin Corporation

- Thales Group

- BAE Systems plc

- Saab

- The Boeing Company

第18章 戦略的提言

第19章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 2. Global Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 3. Global Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 4. Global Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 5. Global Military Drone Market Share (%), By Application, 2018-2032F

- Figure 6. Global Military Drone Market Share (%), By Region, 2018-2032F

- Figure 7. North America Military Drone Market, By Value, in USD Billion, 2018-2032F

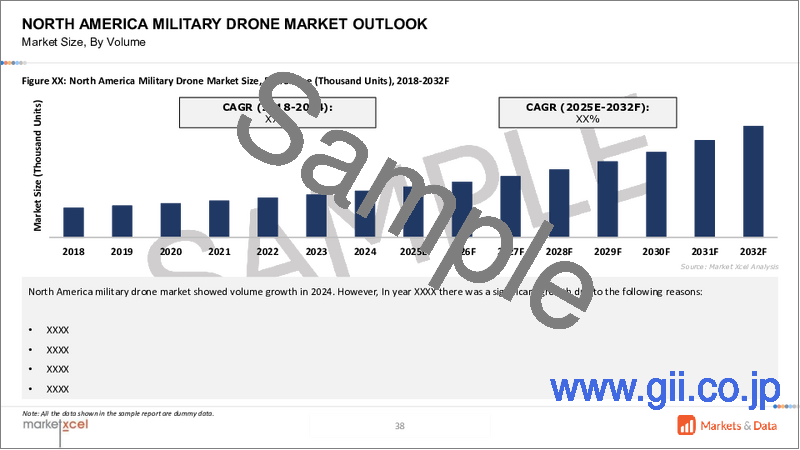

- Figure 8. North America Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 9. North America Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 10. North America Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 11. North America Military Drone Market Share (%), By Application, 2018-2032F

- Figure 12. North America Military Drone Market Share (%), By Country, 2018-2032F

- Figure 13. United States Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 14. United States Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 15. United States Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 16. United States Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 17. United States Military Drone Market Share (%), By Application, 2018-2032F

- Figure 18. Canada Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 19. Canada Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 20. Canada Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 21. Canada Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 22. Canada Military Drone Market Share (%), By Application, 2018-2032F

- Figure 23. Mexico Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 24. Mexico Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 25. Mexico Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 26. Mexico Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 27. Mexico Military Drone Market Share (%), By Application, 2018-2032F

- Figure 28. Europe Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 29. Europe Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 30. Europe Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 31. Europe Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 32. Europe Military Drone Market Share (%), By Application, 2018-2032F

- Figure 33. Europe Military Drone Market Share (%), By Country, 2018-2032F

- Figure 34. Germany Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 35. Germany Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 36. Germany Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 37. Germany Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 38. Germany Military Drone Market Share (%), By Application, 2018-2032F

- Figure 39. France Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 40. France Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 41. France Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 42. France Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 43. France Military Drone Market Share (%), By Application, 2018-2032F

- Figure 44. Italy Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 45. Italy Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 46. Italy Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 47. Italy Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 48. Italy Military Drone Market Share (%), By Application, 2018-2032F

- Figure 49. United Kingdom Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 50. United Kingdom Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 51. United Kingdom Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 52. United Kingdom Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 53. United Kingdom Military Drone Market Share (%), By Application, 2018-2032F

- Figure 54. Russia Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 55. Russia Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 56. Russia Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 57. Russia Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 58. Russia Military Drone Market Share (%), By Application, 2018-2032F

- Figure 59. Netherlands Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 60. Netherlands Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 61. Netherlands Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 62. Netherlands Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 63. Netherlands Military Drone Market Share (%), By Application, 2018-2032F

- Figure 64. Spain Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 65. Spain Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 66. Spain Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 67. Spain Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 68. Spain Military Drone Market Share (%), By Application, 2018-2032F

- Figure 69. Turkey Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 70. Turkey Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 71. Turkey Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 72. Turkey Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 73. Turkey Military Drone Market Share (%), By Application, 2018-2032F

- Figure 74. Poland Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 75. Poland Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 76. Poland Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 77. Poland Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 78. Poland Military Drone Market Share (%), By Application, 2018-2032F

- Figure 79. South America Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 80. South America Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 81. South America Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 82. South America Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 83. South America Military Drone Market Share (%), By Application, 2018-2032F

- Figure 84. South America Military Drone Market Share (%), By Country, 2018-2032F

- Figure 85. Brazil Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 86. Brazil Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 87. Brazil Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 88. Brazil Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 89. Brazil Military Drone Market Share (%), By Application, 2018-2032F

- Figure 90. Argentina Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 91. Argentina Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 92. Argentina Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 93. Argentina Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 94. Argentina Military Drone Market Share (%), By Application, 2018-2032F

- Figure 95. Asia-Pacific Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 96. Asia-Pacific Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 97. Asia-Pacific Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 98. Asia-Pacific Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 99. Asia-Pacific Military Drone Market Share (%), By Application, 2018-2032F

- Figure 100. Asia-Pacific Military Drone Market Share (%), By Country, 2018-2032F

- Figure 101. India Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 102. India Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 103. India Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 104. India Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 105. India Military Drone Market Share (%), By Application, 2018-2032F

- Figure 106. China Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 107. China Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 108. China Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 109. China Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 110. China Military Drone Market Share (%), By Application, 2018-2032F

- Figure 111. Japan Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 112. Japan Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 113. Japan Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 114. Japan Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 115. Japan Military Drone Market Share (%), By Application, 2018-2032F

- Figure 116. Australia Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 117. Australia Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 118. Australia Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 119. Australia Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 120. Australia Military Drone Market Share (%), By Application, 2018-2032F

- Figure 121. Vietnam Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 122. Vietnam Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 123. Vietnam Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 124. Vietnam Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 125. Vietnam Military Drone Market Share (%), By Application, 2018-2032F

- Figure 126. South Korea Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 127. South Korea Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 128. South Korea Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 129. South Korea Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 130. South Korea Military Drone Market Share (%), By Application, 2018-2032F

- Figure 131. Indonesia Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 132. Indonesia Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 133. Indonesia Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 134. Indonesia Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 135. Indonesia Military Drone Market Share (%), By Application, 2018-2032F

- Figure 136. Philippines Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 137. Philippines Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 138. Philippines Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 139. Philippines Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 140. Philippines Military Drone Market Share (%), By Application, 2018-2032F

- Figure 141. Middle East & Africa Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 142. Middle East & Africa Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 143. Middle East & Africa Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 144. Middle East & Africa Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 145. Middle East & Africa Military Drone Market Share (%), By Application, 2018-2032F

- Figure 146. Middle East & Africa Military Drone Market Share (%), By Country, 2018-2032F

- Figure 147. Saudi Arabia Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 148. Saudi Arabia Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 149. Saudi Arabia Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 150. Saudi Arabia Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 151. Saudi Arabia Military Drone Market Share (%), By Application, 2018-2032F

- Figure 152. UAE Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 153. UAE Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 154. UAE Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 155. UAE Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 156. UAE Military Drone Market Share (%), By Application, 2018-2032F

- Figure 157. South Africa Military Drone Market, By Value, in USD Billion, 2018-2032F

- Figure 158. South Africa Military Drone Market, By Volume, in Thousand Units, 2018-2032F

- Figure 159. South Africa Military Drone Market Share (%), By Product Type,2018-2032F

- Figure 160. South Africa Military Drone Market Share (%), By Technology, 2018-2032F

- Figure 161. South Africa Military Drone Market Share (%), By Application, 2018-2032F

- Figure 162. By Product Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 163. By Technology Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 164. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 165. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global military drone market is projected to witness a CAGR of 14.41% during the forecast period 2025-2032, growing from USD 25.19 billion in 2024 to USD 73.95 billion in 2032. A military drone, also known as an unmanned combat aerial vehicle (UCAV), is used for intelligence surveillance, target acquisition, and reconnaissance. These drones are often used to carry aircraft ordnances such as missiles, anti-tank guided missiles, etc. These drones are remotely controllable, which signifies that there is no need for any physical/onboard pilot, which helps decrease the drone's overall weight.

The military drone market is experiencing growth due to the rising demand for minimizing human risk in combat. The rise of artificial intelligence and machine learning in drones is enhancing their market growth as they are making advanced detection technologies and thermal imaging, making these drones a perfect choice for surveillance and security for a country.

Nowadays, drones can operate on global navigation satellite systems and non-satellite modes. These navigational systems help create 3D maps and perform search and rescue tasks while flying. Many countries have adopted military drones for various purposes and have made them essential for their country's growth in defense. These drones are not only used for war but also carry necessary things like medicines, blood, food, and laboratory blood samples for checkups. Many drone companies are pushing their limits to create more advanced drones that can carry more payloads, with more accurate precision and surveillance.

For example, in January 2025, Elbit Systems Ltd. introduced two new military drones, the Hermes 900 and the Hermes 450 UCAVs, known for their multi-role capabilities, offering surveillance, reconnaissance, and intelligence gathering. Many countries use these drones and have earned a reputation for providing durable and high-end performance.

Expanding Role of Military Drones in Professional Workloads

The use of military drones for professional workloads is critical for the expansion of the military drone market. Surveillance, 3D mapping, and thermal imaging necessitate a significant amount of stability and control system and battery backup. As these sectors improve and expand, experts will require more powerful batteries and acceleration to speed up their work processes. Drone makers are responding by developing high-performance battery backups that are lightweight and cheap. This market sector accounts for a sizable and growing portion of military drone sales, propelling innovation and growth in the sector.

For example, in February 2025, ideaForge Technology Pvt. Ltd. developed a drone named Netra5, which is five steps ahead in innovation. This drone has GNSS-denied operations and Hops frequency and can operate under any condition.

AI Revolution Propels the Military Drone Market Growth

Incorporating UCAV drones into AI and machine learning processes has propelled the expansion of these drone markets globally. AI and machine learning necessitate vast parallel computing capacity of drones. As these technologies gain traction in fields of armory, thermal imaging, healthcare, surveillance, and 3D mapping. Drone manufacturers have taken advantage by developing stealth and low detectable technology that uses radar-absorbing material and reduces thermal signatures. Some drones use AI to identify enemies and engage without direct human control.

For example, in October 2023, Baykar Defense Industry and Technology Inc. developed Bayraktar TB2, which has key features such as folded-wing design, increased payload capacity up to 1.5 tons, AI-assisted targeting, and longer endurance flight.

Economic and Industrial Growth

Technological advancements in drone technologies have captured the eyes of buyers. With increased demand for these drones, the market capital also increases, providing opportunities for other manufacturers to come to compete and tackle the market. The market is still struggling with the shortage of these drones as buyers are paying higher prices for increased demand for drones.

For example, in November 2024, Wing Aviation LLC, an autonomous smart plane manufacturer based in St. Louis, Missouri, announced a collaboration with RTX Corporation, an RTX business known for its defense technology. This collaboration aims to advance capabilities in threat detection and operational flexibility for defense and civil applications.

Dominance of Intelligence, Surveillance and Reconnaissance in Military Drone

Military drones are primarily used for surveillance, intelligence, and reconnaissance as they offer no human casualties, intercept enemy radar systems, High-resolution images for target identification, real-time troop movement, and tracking of their armed forces. Market data states a growing need for high-performance drones, as sales continuously increase. Major countries like America, China and many others are mainly focusing on developing the advanced drones for their military and well as for trade. As the military becomes more reliant on these drones to save its armed personnel.

For instance, in December 2024, Rheinmetall AG and Auterion LLC are working together on drone technology and developing standard operating systems for the military industry. Their expertise is to create a military industry standard for controlling and operating unmanned aerial, land, and naval drone systems.

North America Dominates the Military Drone Market

North America, particularly the U.S., dominates the global military drone market due to its defense and armed forces spending. With the largest defense budget globally, the U.S. invests heavily in next-generation drones, including stealthy loyal wingman systems like the XQ-58 Valkyrie and carrier-based MQ-25 Stingray. The US is a global leader in drone technology, particularly in areas like autonomous flight, artificial intelligence, and cybersecurity.

For instance, in November 2024, Parrot Drones SAS made the first ever 4G drone, which is used for Intelligence, Surveillance, Reconnaissance, and is also lightweight and compact. This drone has the ability to see beyond visual line of sight (BVLoS), always connected, and provide real-time streaming with 12 Mbps video bitrate/low latency 1080p streaming.

Impact of U.S. Tariffs on Global Military Drone Market

Boost domestic Drone Manufacturing: Encourages U.S. defense contractors to produce more drones locally, reducing reliance on foreign suppliers.

Strengthens National Security: Reduces dependence on potentially risky foreign suppliers (e.g., China) for critical drone components (chips, sensors, AI tech).

Higher Costs for U.S. Military and Allies: Tariffs increase prices for drone components, raising procurement costs and could slow down drone fleet modernization efforts.

Key Players Landscape and Outlook

Key global players in the global military drone market excel their innovations, provide cheaper rates and excellent quality, combat proven reliability, strategic partnerships and scalable production. Leading companies such as General Atomic Inc., Northrop Grumman Corporation, Elbit Systems ltd., Israel Aerospace Industries Ltd, dominate by developing cutting edge drones with advanced autonomy, AI driven targeting, and multi-role capabilities.

For instance, in May 2025, Patria and ACC Innovation signed an agreement to develop militarized quadcopter drones for NATO member countries. The initial phase of the partnership will focus on creating a military version of ACC Innovation's Thunder Wasp GT quadcopter, which has a maximum take-off weight of approximately 800 kg.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Impact of U.S. Tariffs

4. Executive Summary

5. Voice of Customers

- 5.1. Respondent Demographics

- 5.2. Brand Awareness

- 5.3. Factors Considered in Purchase Decisions

- 5.4. Reliability

- 5.5. Mission Adaptability

- 5.6. Cost-Efficiency

- 5.7. Compliance With Defense Standards

- 5.8. Seamless Integration with Existing Systems

6. Global Military Drone Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Application

- 6.2.1.1. Intelligence, Surveillance and Reconnaissance

- 6.2.1.2. Combat Operations

- 6.2.1.3. Logistics and Transport

- 6.2.1.4. Battle Damage Management

- 6.2.2. By Technology

- 6.2.2.1. Remotely Operated

- 6.2.2.2. Semi-Autonomous

- 6.2.2.3. Fully Autonomous

- 6.2.3. By Product Type

- 6.2.3.1. Fixed Wing

- 6.2.3.2. Rotary Wing

- 6.2.3.3. Hybrid

- 6.2.4. By Region

- 6.2.4.1. North America

- 6.2.4.2. Europe

- 6.2.4.3. Asia-Pacific

- 6.2.4.4. South America

- 6.2.4.5. Middle East and Africa

- 6.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 6.2.1. By Application

- 6.3. Market Map Analysis, 2024

- 6.3.1. By Application

- 6.3.2. By Technology

- 6.3.3. By Product Type

- 6.3.4. By Region

7. North America Military Drone Market Outlook, 2018-2032F*

- 7.1. Market Size Analysis & Forecast

- 7.1.1. By Value

- 7.1.2. By Volume

- 7.2. Market Share Analysis & Forecast

- 7.2.1. By Application

- 7.2.1.1. Intelligence, Surveillance and Reconnaissance

- 7.2.1.2. Combat Operations

- 7.2.1.3. Logistics and Transport

- 7.2.1.4. Battle Damage Management

- 7.2.2. By Technology

- 7.2.2.1. Remotely Operated

- 7.2.2.2. Semi-Autonomous

- 7.2.2.3. Fully Autonomous

- 7.2.3. By Product Type

- 7.2.3.1. Fixed Wing

- 7.2.3.2. Rotary Wing

- 7.2.3.3. Hybrid

- 7.2.4. By Country Share

- 7.2.4.1. United States

- 7.2.4.2. Canada

- 7.2.4.3. Mexico

- 7.2.1. By Application

- 7.3. Country Market Assessment

- 7.3.1. United States Military Drone Market Outlook, 2018-2032F*

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.1.2. By Volume

- 7.3.1.2. Market Share Analysis & Forecast

- 7.3.1.2.1. By Application

- 7.3.1.2.1.1. Intelligence, Surveillance and Reconnaissance

- 7.3.1.2.1.2. Combat Operations

- 7.3.1.2.1.3. Logistics and Transport

- 7.3.1.2.1.4. Battle Damage Management

- 7.3.1.2.2. By Technology

- 7.3.1.2.2.1. Remotely Operated

- 7.3.1.2.2.2. Semi-Autonomous

- 7.3.1.2.2.3. Fully Autonomous

- 7.3.1.2.3. By Product Type

- 7.3.1.2.3.1. Fixed Wing

- 7.3.1.2.3.2. Rotary Wing

- 7.3.1.2.3.3. Hybrid

- 7.3.1.2.1. By Application

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.1. United States Military Drone Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

8. Europe Military Drone Market Outlook, 2018-2032F

- 8.1. Germany

- 8.2. France

- 8.3. Italy

- 8.4. United Kingdom

- 8.5. Russia

- 8.6. Netherlands

- 8.7. Spain

- 8.8. Turkey

- 8.9. Poland

9. Asia-Pacific Military Drone Market Outlook, 2018-2032F

- 9.1. India

- 9.2. China

- 9.3. Japan

- 9.4. Australia

- 9.5. Vietnam

- 9.6. South Korea

- 9.7. Indonesia

- 9.8. Philippines

10. South America Military Drone Market Outlook, 2018-2032F

- 10.1. Brazil

- 10.2. Argentina

11. Middle East and Africa Military Drone Market Outlook, 2018-2032F

- 11.1. Saudi Arabia

- 11.2. UAE

- 11.3. South Africa

12. Porter's Five Forces Analysis

13. PESTLE Analysis

14. Market Dynamics

- 14.1. Market Drivers

- 14.2. Market Challenges

15. Market Trends and Developments

16. Case Studies

17. Competitive Landscape

- 17.1. Competition Matrix of Top 5 Market Leaders

- 17.2. SWOT Analysis for Top 5 Players

- 17.3. Key Players Landscape for Top 10 Market Players

- 17.3.1. General Atomics Inc.

- 17.3.1.1. Company Details

- 17.3.1.2. Key Management Personnel

- 17.3.1.3. Products

- 17.3.1.4. Financials

- 17.3.1.5. Key Market Focus and Geographical Presence

- 17.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 17.3.2. Northrop Grumman Corporation

- 17.3.3. Elbit Systems Ltd.

- 17.3.4. Israel Aerospace Industries Ltd.

- 17.3.5. AeroVironment, Inc.

- 17.3.6. Lockheed Martin Corporation

- 17.3.7. Thales Group

- 17.3.8. BAE Systems plc

- 17.3.9. Saab

- 17.3.10. The Boeing Company

- 17.3.1. General Atomics Inc.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work. Market Trends and Developments