|

|

市場調査レポート

商品コード

1727099

自動車用着色フィルムの世界市場の評価:車両タイプ別、フィルムタイプ別、用途別、地域別、機会、予測(2018年~2032年)Automotive Tinting Film Market Assessment, By Vehicle Type [Passenger Cars, Commercial Vehicles], By Film Type [Window Films, Paint Protection Films, Others], By Application [Windshields, Windows], By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 自動車用着色フィルムの世界市場の評価:車両タイプ別、フィルムタイプ別、用途別、地域別、機会、予測(2018年~2032年) |

|

出版日: 2025年05月19日

発行: Markets & Data

ページ情報: 英文 222 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の自動車用着色フィルムの市場規模は、自動車のカスタマイズ、プライバシーの強化、有害な紫外線からの保護に対する消費者需要の増加により、2024年の54億6,000万米ドルから2032年に82億9,000万米ドルに達すると予測され、2025年~2032年の予測期間にCAGRで5.37%の成長が見込まれます。これらのフィルムは、まぶしさや室内の熱を低減することで運転の快適性を向上させ、エネルギー効率に寄与します。ナノセラミックコーティングなどのフィルム技術の進歩は、耐久性と性能を向上させ、採用をさらに後押ししています。さらに、着色フィルムの健康面や安全面での利点に対する意識の高まりが、さまざまな車両セグメントで市場の拡大を後押ししています。

例えば2024年12月、Cosmo First Limitedは、自動車の外装を強化し保護するために設計された革新的な塗装保護フィルム(Paint Protection Film、PPF)を発売しました。先進の耐傷性、最先端の自己修復技術、疎水性、包括的なUV保護と化学的保護は、Cosmo PPFの主な利点の一部です。さまざまな保護要件に対応するために2つのユニークな製品ラインが用意されています。この製品は、8ミルの厚みと他に類を見ない無期限の保証を含むプレミアムな提供を特徴としています。

当レポートでは、世界の自動車用着色フィルム市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢などを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 米国関税の影響

第4章 エグゼクティブサマリー

第5章 顧客の声

- 回答者の人口統計

- ブランド認知度

- 購入決定において考慮される要素

- 優先される流通チャネル

- 購入後に直面する課題

第6章 世界の自動車用着色フィルム市場の見通し(2018年~2032年)

- 市場規模の分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- 車両タイプ別

- 乗用車

- 商用車

- フィルムタイプ別

- 窓用フィルム

- 塗装保護フィルム

- その他

- 用途別

- フロントガラス

- 窓

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 市場シェア分析:企業別(上位5社とその他)(金額)(2024年)

- 車両タイプ別

- 市場マップ分析(2024年)

- 車両タイプ別

- フィルムタイプ別

- 用途別

- 地域別

第7章 北米の自動車用着色フィルム市場の見通し(2018年~2032年)

- 市場規模の分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- 車両タイプ別

- 乗用車

- 商用車

- フィルムタイプ別

- 窓用フィルム

- 塗装保護フィルム

- その他

- 用途別

- フロントガラス

- 窓

- シェア:国別

- 米国

- カナダ

- メキシコ

- 車両タイプ別

- 各国の市場の評価

- 米国の自動車用着色フィルム市場の見通し(2018年~2032年)

- 市場規模の分析と予測

- 市場シェアの分析と予測

- カナダ

- メキシコ

- 米国の自動車用着色フィルム市場の見通し(2018年~2032年)

第8章 欧州の自動車用着色フィルム市場の見通し(2018年~2032年)

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第9章 アジア太平洋の自動車用着色フィルム市場の見通し(2018年~2032年)

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第10章 南米の自動車用着色フィルム市場の見通し(2018年~2032年)

- ブラジル

- アルゼンチン

第11章 中東・アフリカの自動車用着色フィルム市場の見通し(2018年~2032年)

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第12章 ポーターのファイブフォース分析

第13章 PESTLE分析

第14章 市場力学

- 市場促進要因

- 市場の課題

第15章 市場動向と発展

第16章 ケーススタディ

第17章 競合情勢

- マーケットリーダー上位5社の競合マトリクス

- 上位5社のSWOT分析

- 主要企業上位10社の情勢

- 3M Company

- Eastman Chemical Company

- Johnson Window Films, Inc.

- Toray Plastics (America), Inc.

- Saint-Gobain Group

- Madico, Inc.

- Avery Dennison Corporation

- Garware Hi-Tech Films Ltd.

- Erickson International, LLC (American Standard Window Films)

- Huper Optik USA

第18章 戦略的提言

第19章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 2. Global Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 3. Global Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 4. Global Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 5. Global Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 6. Global Automotive Tinting Films Market Share (%), By Region, 2018-2032F

- Figure 7. North America Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 8. North America Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

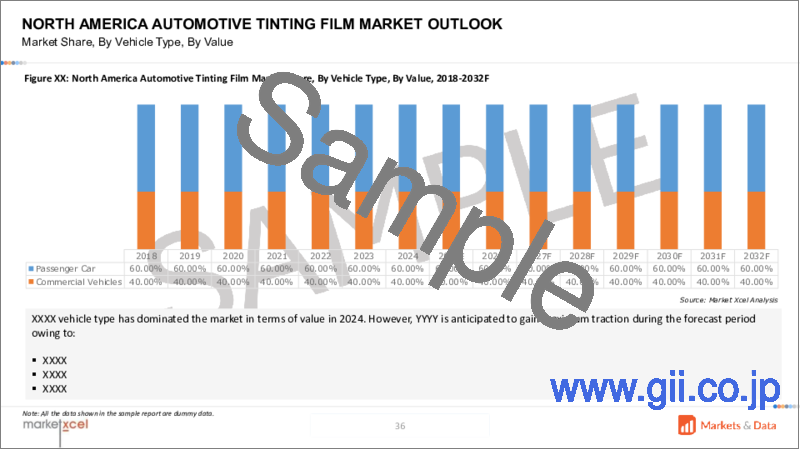

- Figure 9. North America Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 10. North America Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 11. North America Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 12. North America Automotive Tinting Films Market Share (%), By Country, 2018-2032F

- Figure 13. United States Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 14. United States Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 15. United States Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 16. United States Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 17. United States Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 18. Canada Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 19. Canada Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 20. Canada Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 21. Canada Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 22. Canada Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 23. Mexico Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 24. Mexico Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 25. Mexico Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 26. Mexico Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 27. Mexico Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 28. Europe Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 29. Europe Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 30. Europe Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 31. Europe Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 32. Europe Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 33. Europe Automotive Tinting Films Market Share (%), By Country, 2018-2032F

- Figure 34. Germany Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 35. Germany Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 36. Germany Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 37. Germany Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 38. Germany Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 39. France Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 40. France Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 41. France Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 42. France Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 43. France Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 44. Italy Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 45. Italy Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 46. Italy Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 47. Italy Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 48. Italy Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 49. United Kingdom Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 50. United Kingdom Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 51. United Kingdom Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 52. United Kingdom Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 53. United Kingdom Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 54. Russia Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 55. Russia Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 56. Russia Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 57. Russia Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 58. Russia Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 59. Netherlands Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 60. Netherlands Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 61. Netherlands Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 62. Netherlands Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 63. Netherlands Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 64. Spain Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 65. Spain Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 66. Spain Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 67. Spain Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 68. Spain Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 69. Turkey Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 70. Turkey Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 71. Turkey Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 72. Turkey Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 73. Turkey Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 74. Poland Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 75. Poland Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 76. Poland Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 77. Poland Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 78. Poland Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 79. South America Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 80. South America Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 81. South America Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 82. South America Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 83. South America Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 84. South America Automotive Tinting Films Market Share (%), By Country, 2018-2032F

- Figure 85. Brazil Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 86. Brazil Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 87. Brazil Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 88. Brazil Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 89. Brazil Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 90. Argentina Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 91. Argentina Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 92. Argentina Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 93. Argentina Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 94. Argentina Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 95. Asia-Pacific Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 96. Asia-Pacific Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 97. Asia-Pacific Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 98. Asia-Pacific Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 99. Asia-Pacific Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 100. Asia-Pacific Automotive Tinting Films Market Share (%), By Country, 2018-2032F

- Figure 101. India Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 102. India Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 103. India Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 104. India Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 105. India Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 106. China Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 107. China Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 108. China Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 109. China Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 110. China Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 111. Japan Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 112. Japan Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 113. Japan Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 114. Japan Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 115. Japan Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 116. Australia Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 117. Australia Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 118. Australia Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 119. Australia Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 120. Australia Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 121. Vietnam Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 122. Vietnam Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 123. Vietnam Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 124. Vietnam Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 125. Vietnam Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 126. South Korea Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 127. South Korea Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 128. South Korea Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 129. South Korea Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 130. South Korea Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 131. Indonesia Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 132. Indonesia Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 133. Indonesia Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 134. Indonesia Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 135. Indonesia Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 136. Philippines Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 137. Philippines Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 138. Philippines Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 139. Philippines Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 140. Philippines Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 141. Middle East & Africa Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 142. Middle East & Africa Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 143. Middle East & Africa Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 144. Middle East & Africa Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 145. Middle East & Africa Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 146. Middle East & Africa Automotive Tinting Films Market Share (%), By Country, 2018-2032F

- Figure 147. Saudi Arabia Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 148. Saudi Arabia Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 149. Saudi Arabia Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 150. Saudi Arabia Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 151. Saudi Arabia Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 152. UAE Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 153. UAE Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 154. UAE Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 155. UAE Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 156. UAE Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 157. South Africa Automotive Tinting Films Market, By Value, in USD Billion, 2018-2032F

- Figure 158. South Africa Automotive Tinting Films Market, By Volume, in Thousand Units, 2018-2032F

- Figure 159. South Africa Automotive Tinting Films Market Share (%), By Vehicle Type, 2018-2032F

- Figure 160. South Africa Automotive Tinting Films Market Share (%), By Film Type, 2018-2032F

- Figure 161. South Africa Automotive Tinting Films Market Share (%), By Application, 2018-2032F

- Figure 162. By Vehicle Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 163. By Film Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 164. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 165. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global automotive tinting films market is projected to witness a CAGR of 5.37% during the forecast period 2025-2032, growing from USD 5.46 billion in 2024 to USD 8.29 billion in 2032F, owing to increasing consumer demand for vehicle customization, enhanced privacy, and protection against harmful UV rays. These films improve driving comfort by reducing glare and interior heat, contributing to energy efficiency. Advancements in film technology, such as nano-ceramic coatings, have enhanced durability and performance, further boosting adoption. Additionally, rising awareness of the health and safety benefits of tinting films propels market expansion across various vehicle segments.

For instance, in December 2024, Cosmo First Limited launched its innovative Paint Protection Films (PPF), designed to enhance and preserve automotive exteriors. Advanced scratch resistance, cutting-edge self-healing technology, hydrophobic qualities, and all-encompassing UV and chemical protection are some of Cosmo PPF's key advantages. Two unique product line variations are available to meet varying protective requirements. The product features a premium offering, including a remarkable 8-mil thickness and an unparalleled lifetime warranty.

Enhanced Vehicle Aesthetics and Rising Awareness of UV Protection to Fuel the Market

Consumers increasingly seek to personalize their vehicles, and tinting films offer an affordable means to enhance aesthetics and comfort. These films provide a sleek appearance and reduce interior temperatures by blocking solar heat, leading to a more comfortable driving experience. Tinting films protect passengers and interior materials from sun damage by minimizing glare and UV exposure. This combination of style and functionality drives consumer preference, fueling demand in both new vehicle purchases and aftermarket applications.

For instance, in April 2024, Hyundai Motor Company introduced the inaugural application of Nano Cooling Film, a window tint for vehicles that significantly enhances interior cooling efficiency in comparison to traditional tint films. This advanced film optimizes heat dissipation through its nanostructure, which possesses superior heat transfer properties. It is anticipated that this innovative transparent film will perform more effectively in hot and arid climates, as its cooling capabilities are maximized at elevated outdoor temperatures.

Growing awareness of the harmful effects of UV radiation has led consumers to seek protective solutions in their vehicles. Automotive tinting films effectively block a significant portion of UV rays, safeguarding occupants from potential skin damage and reducing the risk of interior fading.

Energy Efficiency and Environmental Concerns to Shape the Market Dynamics

Automotive tinting films contribute to energy efficiency by reducing air conditioning and lowering fuel consumption and greenhouse gas emissions. This aligns with global efforts to promote environmentally friendly transportation solutions. As governments and consumers prioritize sustainability, vehicles equipped with energy-saving features like tinting films gain favor. The environmental benefits and cost savings on fuel make tinting films an attractive option for eco-conscious consumers and fleet operators aiming to reduce their carbon footprint.

Government regulations and safety standards increasingly recognize the benefits of automotive tinting films. Policies permitting certain window tinting levels for UV protection and glare reduction support market growth. Additionally, safety standards that encourage the use of shatter-resistant films enhance occupant protection during accidents. Regulatory frameworks that balance visibility requirements with health and safety considerations create a conducive environment for adopting tinting films, encouraging manufacturers and consumers to integrate these solutions into vehicles.

Passenger Cars Leads the Global Automotive Tinting Films Market

The passenger car segment dominates the automotive tinting films market due to the high volume of vehicles and consumer emphasis on comfort and personalization. Tinting films in passenger cars offer benefits such as reduced interior heat, enhanced privacy, and protection against UV rays, improving the overall driving experience. As consumers become more health-conscious and aware of the damaging effects of sun exposure, the demand for UV-protective films has surged. Hence, companies innovate their new range while embracing the latest technology. For instance, in May 2025, Al-Rabiya Auto Accessories Tr launched a new luminous carbon window film across the Middle East. Incorporating cutting-edge carbon technology, the Luminous carbon window film is engineered to satisfy the increasing need for robust, visually appealing, and energy-efficient window solutions.

Furthermore, advancements in film technology have introduced options like nano-ceramic films, which provide superior heat rejection without compromising visibility. Functional advantages and aesthetic appeal make tinting films a popular choice among passenger car owners. This trend is particularly pronounced in regions with high temperatures and sunlight exposure, where the benefits of tinting are most appreciated.

Asia-Pacific Holds the Dominant Share in the Global Automotive Tinting Films Market

Asia-Pacific leads the automotive tinting films market, driven by rapid urbanization, increasing vehicle ownership, and heightened awareness of vehicle comfort and safety. Countries like China, India, and Japan have witnessed significant growth in automotive sales, creating a substantial market for tinting films. In these regions, consumers prioritize solutions that enhance driving comfort and protect against harsh sunlight. Additionally, supportive government policies promoting energy efficiency and environmental protection encourage the adoption of tinting films. The presence of major automotive manufacturers and a robust aftermarket industry further bolster the market. As the middle-class population expands and disposable incomes rise, the demand for vehicle enhancements like tinting films is expected to continue its upward trajectory in the Asia-Pacific region.

For instance, in February 2025, Avery Dennison Corporation launched a new series of automotive window films, redefining the performance and style. Encore automotive window films portfolio, an innovative range of products, is designed to set a new standard in performance and style for window film professionals and automotive enthusiasts.

Impact of the U.S. Tariffs on the Global Automotive Tinting Films Market

The imposition of U.S. tariffs on imported materials and products has affected the automotive tinting films market by increasing production costs for manufacturers reliant on foreign raw materials. These additional expenses may lead to higher prices for consumers, potentially dampening demand. Manufacturers might also face supply chain disruptions, prompting a reevaluation of sourcing strategies. While some companies may shift towards domestic suppliers to mitigate tariff impacts, the overall effect could include reduced profit margins and a slowdown in market growth within the affected regions.

Key Players Landscape and Outlook

Leading companies in the automotive tinting films market focus on innovation, quality, and strategic partnerships to maintain a competitive edge. Investments in research and development lead to the creation of advanced films with improved heat rejection, UV protection, and durability. These innovations cater to evolving consumer preferences for high-performance and aesthetically pleasing products. Companies also expand their global footprint through collaborations with automotive manufacturers and distributors, ensuring widespread availability of their products. Marketing efforts emphasize the health, comfort, and environmental benefits of tinting films, educating consumers and driving demand. Additionally, firms adapt to regional regulations and standards, customizing their offerings to meet local requirements. This multifaceted approach enables key players to capture market share and foster brand loyalty in a competitive landscape.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Impact of U.S. Tariffs

4. Executive Summary

5. Voice of Customers

- 5.1. Respondent Demographics

- 5.2. Brand Awareness

- 5.3. Factors Considered in Purchase Decisions

- 5.4. Preferred Distribution Channel

- 5.5. Challenges Faced Post Purchase

6. Global Automotive Tinting Film Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Vehicle Type

- 6.2.1.1. Passenger Cars

- 6.2.1.2. Commercial Vehicles

- 6.2.2. By Film Type

- 6.2.2.1. Window Films

- 6.2.2.2. Paint Protection Films

- 6.2.2.3. Others

- 6.2.3. By Application

- 6.2.3.1. Windshields

- 6.2.3.2. Windows

- 6.2.4. By Region

- 6.2.4.1. North America

- 6.2.4.2. Europe

- 6.2.4.3. Asia-Pacific

- 6.2.4.4. South America

- 6.2.4.5. Middle East and Africa

- 6.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 6.2.1. By Vehicle Type

- 6.3. Market Map Analysis, 2024

- 6.3.1. By Vehicle Type

- 6.3.2. By Film Type

- 6.3.3. By Application

- 6.3.4. By Region

7. North America Automotive Tinting Film Market Outlook, 2018-2032F

- 7.1. Market Size Analysis & Forecast

- 7.1.1. By Value

- 7.1.2. By Volume

- 7.2. Market Share Analysis & Forecast

- 7.2.1. By Vehicle Type

- 7.2.1.1. Passenger Cars

- 7.2.1.2. Commercial Vehicles

- 7.2.2. By Film Type

- 7.2.2.1. Window Films

- 7.2.2.2. Paint Protection Films

- 7.2.2.3. Others

- 7.2.3. By Application

- 7.2.3.1. Windshields

- 7.2.3.2. Windows

- 7.2.4. By Country Share

- 7.2.4.1. United States

- 7.2.4.2. Canada

- 7.2.4.3. Mexico

- 7.2.1. By Vehicle Type

- 7.3. Country Market Assessment

- 7.3.1. United States Automotive Tinting Film Market Outlook, 2018-2032F*

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.1.2. By Volume

- 7.3.1.2. Market Share Analysis & Forecast

- 7.3.1.2.1. By Vehicle Type

- 7.3.1.2.1.1. Passenger Cars

- 7.3.1.2.1.2. Commercial Vehicles

- 7.3.1.2.2. By Film Type

- 7.3.1.2.2.1. Window Films

- 7.3.1.2.2.2. Paint Protection Films

- 7.3.1.2.2.3. Others

- 7.3.1.2.3. By Application

- 7.3.1.2.3.1. Windshields

- 7.3.1.2.3.2. Windows

- 7.3.1.2.1. By Vehicle Type

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.1. United States Automotive Tinting Film Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

8. Europe Automotive Tinting Film Market Outlook, 2018-2032F

- 8.1. Germany

- 8.2. France

- 8.3. Italy

- 8.4. United Kingdom

- 8.5. Russia

- 8.6. Netherlands

- 8.7. Spain

- 8.8. Turkey

- 8.9. Poland

9. Asia-Pacific Automotive Tinting Film Market Outlook, 2018-2032F

- 9.1. India

- 9.2. China

- 9.3. Japan

- 9.4. Australia

- 9.5. Vietnam

- 9.6. South Korea

- 9.7. Indonesia

- 9.8. Philippines

10. South America Automotive Tinting Film Market Outlook, 2018-2032F

- 10.1. Brazil

- 10.2. Argentina

11. Middle East and Africa Automotive Tinting Film Market Outlook, 2018-2032F

- 11.1. Saudi Arabia

- 11.2. UAE

- 11.3. South Africa

12. Porter's Five Forces Analysis

13. PESTLE Analysis

14. Market Dynamics

- 14.1. Market Drivers

- 14.2. Market Challenges

15. Market Trends and Developments

16. Case Studies

17. Competitive Landscape

- 17.1. Competition Matrix of Top 5 Market Leaders

- 17.2. SWOT Analysis for Top 5 Players

- 17.3. Key Players Landscape for Top 10 Market Players

- 17.3.1. 3M Company

- 17.3.1.1. Company Details

- 17.3.1.2. Key Management Personnel

- 17.3.1.3. Key Products Offered

- 17.3.1.4. Key Financials (As Reported)

- 17.3.1.5. Key Market Focus and Geographical Presence

- 17.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisitions

- 17.3.2. Eastman Chemical Company

- 17.3.3. Johnson Window Films, Inc.

- 17.3.4. Toray Plastics (America), Inc.

- 17.3.5. Saint-Gobain Group

- 17.3.6. Madico, Inc.

- 17.3.7. Avery Dennison Corporation

- 17.3.8. Garware Hi-Tech Films Ltd.

- 17.3.9. Erickson International, LLC (American Standard Window Films)

- 17.3.10. Huper Optik USA

- 17.3.1. 3M Company

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.