|

|

市場調査レポート

商品コード

1718946

抗体薬物複合体市場:製品タイプ別、適応症別、標的別、リンカータイプ別、ペイロードタイプ別、地域別、機会、予測、2018年~2032年Antibody Drug Conjugates Market Assessment, By Product, By Indication, By Target, By Linker Type, By Payload Type, Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 抗体薬物複合体市場:製品タイプ別、適応症別、標的別、リンカータイプ別、ペイロードタイプ別、地域別、機会、予測、2018年~2032年 |

|

出版日: 2025年05月05日

発行: Markets & Data

ページ情報: 英文 236 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の抗体薬物複合体(ADC)の市場規模は、予測期間の2025年~2032年に12.41%のCAGRで拡大し、2024年の94億4,000万米ドルから2032年には240億8,000万米ドルに成長すると予測されています。抗体薬物複合体市場は、世界のがん罹患率の上昇、標的療法と低毒性療法の必要性、リンカーとペイロードデザインの技術革新がADC市場を推進する主な要因となっています。旺盛な投資流入と戦略的提携も開発を後押ししています。さらに、規制当局の承認と適応拡大が引き続き市場の可能性を高めています。

例えば、MediLink TherapeuticsとF. Hoffmann-La Roche Ltd.は、YL211と名付けられた次世代ADCの開発を進めるため、2024年5月にライセンス契約と提携を締結しました。

当レポートでは、世界の抗体薬物複合体市場について調査し、市場の概要とともに、製品タイプ別、適応症別、標的別、リンカータイプ別、ペイロードタイプ別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 米国の関税の影響

第4章 エグゼクティブサマリー

第5章 世界の抗体薬物複合体市場の見通し、2018年~2032年

- 市場規模分析と予測

- 市場シェア分析と予測

- 製品別

- カドシラ

- エンヘルトゥ

- アドセトリス

- パドチェフ

- トロデルヴィ

- ポリヴィ

- その他

- 適応症別

- 血液がん

- 乳がん

- 尿路上皮がんと膀胱がん

- その他

- 標的別

- HER2

- CD22

- CD30

- その他

- リンカータイプ別

- 非切断型

- 切断型

- ペイロードタイプ別

- MMAE/オーリスタチン

- カリケアマイシン

- メイタンシノイド

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 企業別市場シェア分析(上位5社およびその他- 金額別、2024年)

- 製品別

- 2024年の市場マップ分析

第6章 北米の抗体薬物複合体市場の見通し、2018年~2032年

- 市場規模分析と予測

- 市場シェア分析と予測

- 国別市場評価

- 米国

- カナダ

- メキシコ

第7章 欧州の抗体薬物複合体市場の見通し、2018年~2032年

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第8章 アジア太平洋の抗体薬物複合体市場の見通し、2018年~2032年

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第9章 南米の抗体薬物複合体市場の見通し、2018年~2032年

- ブラジル

- アルゼンチン

第10章 中東・アフリカの抗体薬物複合体市場の見通し、2018年~2032年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第11章 需要供給分析

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

第14章 PESTLE分析

第15章 価格分析

第16章 市場力学

- 市場の促進要因

- 市場の課題

第17章 市場動向と発展

第18章 規制枠組みとイノベーション

- 規制当局の承認

- 臨床試験

第19章 特許の情勢

第20章 ケーススタディ

第21章 競合情勢

- 市場リーダートップ5の競合マトリックス

- 参入企業トップ5のSWOT分析

- 市場の主要企業トップ10の情勢

- Seagen, Inc.

- Takeda Pharmaceutical Company Ltd.

- AstraZeneca PLC

- F. Hoffmann-La Roche Ltd.

- ImmunoGen, Inc.

- Gilead Sciences, Inc.

- Daiichi Sankyo Company Ltd.

- Pfizer, Inc.

- Astellas Pharma Inc

- ADC Therapeutics SA

第22章 戦略的提言

第23章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 3. Global Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 4. Global Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 5. Global Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 6. Global Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 7. Global Antibody Drug Conjugates Market Share (%), By Region, 2018-2032F

- Figure 8. North America Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 9. North America Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 10. North America Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 11. North America Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 12. North America Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 13. North America Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

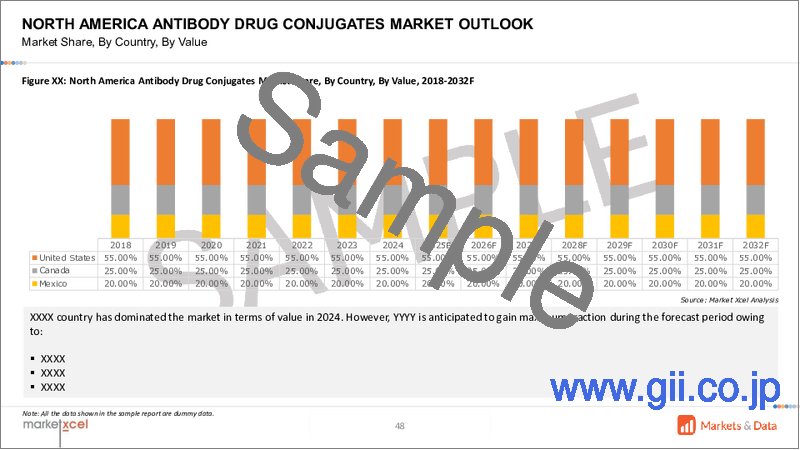

- Figure 14. North America Antibody Drug Conjugates Market Share (%), By Country, 2018-2032F

- Figure 15. United States Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 16. United States Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 17. United States Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 18. United States Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 19. United States Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 20. United States Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 21. Canada Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 22. Canada Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 23. Canada Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 24. Canada Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 25. Canada Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 26. Canada Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 27. Mexico Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 28. Mexico Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 29. Mexico Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 30. Mexico Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 31. Mexico Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 32. Mexico Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 33. Europe Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 34. Europe Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 35. Europe Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 36. Europe Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 37. Europe Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 38. Europe Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 39. Europe Antibody Drug Conjugates Market Share (%), By Country, 2018-2032F

- Figure 40. Germany Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 41. Germany Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 42. Germany Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 43. Germany Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 44. Germany Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 45. Germany Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 46. France Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 47. France Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 48. France Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 49. France Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 50. France Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 51. France Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 52. Italy Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 53. Italy Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 54. Italy Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 55. Italy Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 56. Italy Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 57. Italy Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 58. United Kingdom Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 59. United Kingdom Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 60. United Kingdom Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 61. United Kingdom Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 62. United Kingdom Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 63. United Kingdom Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 64. Russia Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 65. Russia Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 66. Russia Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 67. Russia Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 68. Russia Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 69. Russia Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 70. Netherlands Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 71. Netherlands Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 72. Netherlands Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 73. Netherlands Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 74. Netherlands Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 75. Netherlands Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 76. Spain Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 77. Spain Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 78. Spain Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 79. Spain Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 80. Spain Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 81. Spain Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 82. Turkey Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 83. Turkey Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 84. Turkey Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 85. Turkey Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 86. Turkey Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 87. Turkey Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 88. Poland Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 89. Poland Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 90. Poland Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 91. Poland Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 92. Poland Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 93. Poland Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 94. South America Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 95. South America Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 96. South America Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 97. South America Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 98. South America Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 99. South America Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 100. South America Antibody Drug Conjugates Market Share (%), By Country, 2018-2032F

- Figure 101. Brazil Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 102. Brazil Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 103. Brazil Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 104. Brazil Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 105. Brazil Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 106. Brazil Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 107. Argentina Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 108. Argentina Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 109. Argentina Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 110. Argentina Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 111. Argentina Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 112. Argentina Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 113. Asia-Pacific Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 114. Asia-Pacific Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 115. Asia-Pacific Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 116. Asia-Pacific Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 117. Asia-Pacific Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 118. Asia-Pacific Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 119. Asia-Pacific Antibody Drug Conjugates Market Share (%), By Country, 2018-2032F

- Figure 120. India Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 121. India Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 122. India Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 123. India Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 124. India Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 125. India Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 126. China Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 127. China Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 128. China Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 129. China Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 130. China Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 131. China Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 132. Japan Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 133. Japan Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 134. Japan Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 135. Japan Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 136. Japan Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 137. Japan Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 138. Australia Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 139. Australia Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 140. Australia Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 141. Australia Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 142. Australia Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 143. Australia Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 144. Vietnam Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 145. Vietnam Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 146. Vietnam Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 147. Vietnam Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 148. Vietnam Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 149. Vietnam Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 150. South Korea Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 151. South Korea Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 152. South Korea Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 153. South Korea Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 154. South Korea Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 155. South Korea Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 156. Indonesia Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 157. Indonesia Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 158. Indonesia Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 159. Indonesia Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 160. Indonesia Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 161. Indonesia Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 162. Philippines Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 163. Philippines Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 164. Philippines Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 165. Philippines Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 166. Philippines Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 167. Philippines Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 168. Middle East & Africa Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 169. Middle East & Africa Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 170. Middle East & Africa Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 171. Middle East & Africa Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 172. Middle East & Africa Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 173. Middle East & Africa Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 174. Middle East & Africa Antibody Drug Conjugates Market Share (%), By Country, 2018-2032F

- Figure 175. Saudi Arabia Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 176. Saudi Arabia Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 177. Saudi Arabia Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 178. Saudi Arabia Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 179. Saudi Arabia Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 180. Saudi Arabia Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 181. UAE Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 182. UAE Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 183. UAE Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 184. UAE Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 185. UAE Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 186. UAE Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 187. South Africa Antibody Drug Conjugates Market, By Value, In USD Billion, 2018-2032F

- Figure 188. South Africa Antibody Drug Conjugates Market Share (%), By Product, 2018-2032F

- Figure 189. South Africa Antibody Drug Conjugates Market Share (%), By Indication, 2018-2032F

- Figure 190. South Africa Antibody Drug Conjugates Market Share (%), By Target, 2018-2032F

- Figure 191. South Africa Antibody Drug Conjugates Market Share (%), By Linker Type, 2018-2032F

- Figure 192. South Africa Antibody Drug Conjugates Market Share (%), By Payload Type, 2018-2032F

- Figure 193. By Product Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 194. By Indication Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 195. By Target Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 196. By Linker Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 197. By Payload Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 198. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global antibody drug conjugates (ADC) market is projected to witness a CAGR of 12.41% during the forecast period 2025-2032, growing from USD 9.44 billion in 2024 to USD 24.08 billion in 2032. The antibody-drug conjugates market is being driven by the rising global cancer burden, the need for targeted and less toxic therapies, and technological innovations in the linker and payload design are key drivers propelling the ADC market. Strong investment inflows and strategic collaborations are also boosting development. Additionally, regulatory approvals and expanding indications continue to enhance market potential.

For instance, MediLink Therapeutics and F. Hoffmann-La Roche Ltd. established a licensing agreement and collaboration in May 2024 to advance the development of a next-generation ADC, designated YL211.

Rising Global Cancer Burden Driving Demand for Targeted Therapies

The global prevalence of cancer continues to escalate, propelling the demand for more targeted, effective, and less toxic treatment options such as antibody-drug conjugates (ADCs). ADCs offer a unique approach by combining the targeting capabilities of monoclonal antibodies with the cancer-killing ability of cytotoxic drugs. This enables delivery of high-potency treatment directly to tumor cells, minimizing systemic toxicity. As conventional chemotherapies often affect healthy tissues, ADCs present a transformative shift in oncology. Increasing patient demand for precision medicine and the rapid expansion of clinical trials for novel ADCs are further fueling market growth. The pipeline includes numerous candidates in Phase I-III trials across various solid tumors and hematological malignancies. For instance, in 2023, Pfizer Inc. acquired Seagen Inc. for USD 43 billion to strengthen its oncology pipeline and gain access to four approved ADCs and a rich development portfolio.

Expanding R&D and Technological Advancements in Payload and Linker Innovations

The evolution of ADC technology has accelerated in recent years, driven by research and innovation in payloads, linkers, and antibody engineering. Improvements in linker stability and site-specific conjugation methods are enhancing the efficacy and safety of ADCs by ensuring that cytotoxic payloads are released only in target cancer cells. Additionally, next-generation payloads such as topoisomerase inhibitors are offering broader efficacy across resistant tumors. This technological progression enhances clinical outcomes and expands the potential use of ADCs across diverse cancer types. Companies are leveraging AI and computational biology to optimize payload design and antibody-payload matching, reducing off-target effects. In October 2023, Daiichi Sankyo and Merck entered a USD 22 billion partnership to co-develop three next-generation ADCs using novel linker-payload technology.

Strong Growth in HER2-Targeting ADCs for Breast Cancer

HER2-positive breast cancer represents a major clinical focus in the ADC market. With a significant percentage of breast cancer patients showing HER2 overexpression, pharmaceutical companies are increasingly investing in HER2-targeting ADCs to improve treatment outcomes. Drugs such as Enhertu (trastuzumab deruxtecan) have demonstrated superior efficacy in metastatic settings, even in HER2-low patients, expanding their treatment scope. This has prompted revisions in clinical guidelines and rapidly increased demand from oncologists and healthcare providers. The success of HER2-directed ADCs has also inspired new R&D pipelines targeting HER2 in other cancers such as gastric and colorectal. For instance, in April 2024, AstraZeneca and Daiichi Sankyo's Enhertu received FDA approval for HER2-low breast cancer, expanding its indication and accelerating global market penetration.

North America Leads ADC Adoption with Robust Regulatory and Commercial Landscape

North America holds the dominant share of the global ADC market due to its strong pharmaceutical ecosystem, early adoption of novel therapies, and expedited regulatory pathways. The region benefits from a high number of clinical trials, substantial funding for oncological research, and a high prevalence of cancer. Furthermore, the U.S. FDA has demonstrated supportive regulatory frameworks for ADC approvals, contributing to the rapid commercialization of therapies. Strategic partnerships, academic-industry collaborations, and the presence of top ADC developers in the region are consolidating its leadership position. In January 2024, Johnson & Johnson Services, Inc. completed the acquisition of Ambrx Biopharma, Inc., which possesses exclusive ADC technology for developing innovative next-generation ADCs aimed at cancer treatment. J&J intends to concentrate on its prostate cancer portfolio while leveraging this proprietary technology.

Future Market Scenario (2025-2032F)

The global antibody drug conjugates (ADCs) market is poised for robust expansion, driven by increasing cancer incidence, advancements in linker-payload technologies, and a surge in oncology-focused R&D. The market is expected to benefit from growing clinical adoption of next-generation ADCs that target broader indications, including HER2-low and triple-negative breast cancers. Additionally, emerging economies are gradually adopting ADCs, encouraged by expanding healthcare infrastructure and rising access to advanced treatments. Collaborations between biotech firms and large pharmaceutical companies are accelerating the commercialization of promising candidates. Regulatory support for fast-track approvals and a rich clinical pipeline suggest sustained growth, making ADCs a central pillar in the future of precision oncology therapeutics.

Key Players Landscape and Outlook

The key players in the market are significantly investing in developing antibody-drug conjugates and are utilizing strategies such as mergers, acquisitions, partnerships, and new product launches to improve their services and competitiveness. Such efforts will propel significant growth in the market, allowing large-cap industry players to increase their presence and, therefore, find new opportunities in this market.

For example, in January 2024, Celltrion, Inc. and WuXi XDC formalized their partnership by signing a Memorandum of Understanding (MOU) aimed at providing integrated services for antibody-drug conjugates (ADCs), encompassing both their development and manufacturing.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Impact of U.S. Tariffs

4. Executive Summary

5. Global Antibody Drug Conjugates Market Outlook, 2018-2032F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Product

- 5.2.1.1. Kadcyla

- 5.2.1.2. Enhertu

- 5.2.1.3. Adcetris

- 5.2.1.4. Padcev

- 5.2.1.5. Trodelvy

- 5.2.1.6. Polivy

- 5.2.1.7. Others

- 5.2.2. By Indication

- 5.2.2.1. Blood Cancer

- 5.2.2.1.1. Leukemia

- 5.2.2.1.2. Lymphoma

- 5.2.2.1.3. Multiple Myeloma

- 5.2.2.2. Breast Cancer

- 5.2.2.3. Urothelial Cancer and Bladder Cancer

- 5.2.2.4. Other Cancer Oncology

- 5.2.2.1. Blood Cancer

- 5.2.3. By Target

- 5.2.3.1. HER2

- 5.2.3.2. CD22

- 5.2.3.3. CD30

- 5.2.3.4. Others

- 5.2.4. By Linker Type

- 5.2.4.1. Non-Cleavable

- 5.2.4.2. Cleavable

- 5.2.5. By Payload Type

- 5.2.5.1. MMAE/auristatin

- 5.2.5.2. Calicheamicin

- 5.2.5.3. Maytansinoids

- 5.2.5.4. Others

- 5.2.6. By Region

- 5.2.6.1. North America

- 5.2.6.2. Europe

- 5.2.6.3. Asia-Pacific

- 5.2.6.4. South America

- 5.2.6.5. Middle East and Africa

- 5.2.7. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 5.2.1. By Product

- 5.3. Market Map Analysis, 2024

- 5.3.1. By Product

- 5.3.2. By Indication

- 5.3.3. By Target

- 5.3.4. By Linker Type

- 5.3.5. By Payload Type

- 5.3.6. By Region

6. North America Antibody Drug Conjugates Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Product

- 6.2.1.1. Kadcyla

- 6.2.1.2. Enhertu

- 6.2.1.3. Adcetris

- 6.2.1.4. Padcev

- 6.2.1.5. Trodelvy

- 6.2.1.6. Polivy

- 6.2.1.7. Others

- 6.2.2. By Indication

- 6.2.2.1. Blood Cancer

- 6.2.2.1.1. Leukemia

- 6.2.2.1.2. Lymphoma

- 6.2.2.1.3. Multiple Myeloma

- 6.2.2.2. Breast Cancer

- 6.2.2.3. Urothelial Cancer & Bladder Cancer

- 6.2.2.4. Other Cancer Oncology

- 6.2.2.1. Blood Cancer

- 6.2.3. By Target

- 6.2.3.1. HER2

- 6.2.3.2. CD22

- 6.2.3.3. CD30

- 6.2.3.4. Others

- 6.2.4. By Linker Type

- 6.2.4.1. Non-Cleavable

- 6.2.4.2. Cleavable

- 6.2.5. By Payload Type

- 6.2.5.1. MMAE/auristatin

- 6.2.5.2. Calicheamicin

- 6.2.5.3. Maytansinoids

- 6.2.5.4. Others

- 6.2.6. By Country Share

- 6.2.6.1. United States

- 6.2.6.2. Canada

- 6.2.6.3. Mexico

- 6.2.1. By Product

- 6.3. Country Market Assessment

- 6.3.1. United States Antibody Drug Conjugates Market Outlook, 2018-2032F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Product

- 6.3.1.2.1.1. Kadcyla

- 6.3.1.2.1.2. Enhertu

- 6.3.1.2.1.3. Adcetris

- 6.3.1.2.1.4. Padcev

- 6.3.1.2.1.5. Trodelvy

- 6.3.1.2.1.6. Polivy

- 6.3.1.2.1.7. Others

- 6.3.1.2.2. By Indication

- 6.3.1.2.2.1. Blood Cancer

- 6.3.1.2.2.1.1. Leukemia

- 6.3.1.2.2.1.2. Lymphoma

- 6.3.1.2.2.1.3. Multiple Myeloma

- 6.3.1.2.2.2. Breast Cancer

- 6.3.1.2.2.3. Urothelial Cancer & Bladder Cancer

- 6.3.1.2.2.4. Other Cancer Oncology

- 6.3.1.2.3. By Target

- 6.3.1.2.3.1. HER2

- 6.3.1.2.3.2. CD22

- 6.3.1.2.3.3. CD30

- 6.3.1.2.3.4. Others

- 6.3.1.2.4. By Linker Type

- 6.3.1.2.4.1. Non-Cleavable

- 6.3.1.2.4.2. Cleavable

- 6.3.1.2.5. By Payload Type

- 6.3.1.2.5.1. MMAE/auristatin

- 6.3.1.2.5.2. Calicheamicin

- 6.3.1.2.5.3. Maytansinoids

- 6.3.1.2.5.4. Others

- 6.3.1.2.1. By Product

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Antibody Drug Conjugates Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

7. Europe Antibody Drug Conjugates Market Outlook, 2018-2032F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Antibody Drug Conjugates Market Outlook, 2018-2032F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Antibody Drug Conjugates Market Outlook, 2018-2032F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Antibody Drug Conjugates Market Outlook, 2018-2032F

- 10.1. Saudi Arabia

- 10.2. UAE

- 10.3. South Africa

11. Demand Supply Analysis

12. Value Chain Analysis

13. Porter's Five Forces Analysis

14. PESTLE Analysis

15. Pricing Analysis

16. Market Dynamics

- 16.1. Market Drivers

- 16.2. Market Challenges

17. Market Trends and Developments

18. Regulatory Framework and Innovation

- 18.1. Regulatory Approvals

- 18.2. Clinical Trials

19. Patent Landscape

20. Case Studies

21. Competitive Landscape

- 21.1. Competition Matrix of Top 5 Market Leaders

- 21.2. SWOT Analysis for Top 5 Players

- 21.3. Key Players Landscape for Top 10 Market Players

- 21.3.1. Seagen, Inc.

- 21.3.1.1. Company Details

- 21.3.1.2. Key Management Personnel

- 21.3.1.3. Products and Services

- 21.3.1.4. Financials (As Reported)

- 21.3.1.5. Key Market Focus and Geographical Presence

- 21.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisitions

- 21.3.2. Takeda Pharmaceutical Company Ltd.

- 21.3.3. AstraZeneca PLC

- 21.3.4. F. Hoffmann-La Roche Ltd.

- 21.3.5. ImmunoGen, Inc.

- 21.3.6. Gilead Sciences, Inc.

- 21.3.7. Daiichi Sankyo Company Ltd.

- 21.3.8. Pfizer, Inc.

- 21.3.9. Astellas Pharma Inc

- 21.3.10. ADC Therapeutics SA

- 21.3.1. Seagen, Inc.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.