|

|

市場調査レポート

商品コード

1709442

自動車用バンパーの世界市場の評価:材料別、位置別、販売チャネル別、地域別、機会、予測(2018年~2032年)Automotive Bumper Market Assessment, By Material [Composite Plastic, Metal, Carbon Fiber], By Position [Front, Rear], By Sales Channel [Original Equipment Manufacturer, Aftermarket], By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 自動車用バンパーの世界市場の評価:材料別、位置別、販売チャネル別、地域別、機会、予測(2018年~2032年) |

|

出版日: 2025年04月21日

発行: Markets & Data

ページ情報: 英文 225 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の自動車用バンパーの市場規模は、2024年の369億5,000万米ドルから2032年に536億1,000万米ドルに達すると予測され、2025年~2032年の予測期間にCAGRで4.76%の成長が見込まれます。市場は、自動車生産台数の増加、新たな安全性ニーズ、よりよい外見と寿命に対する顧客需要の増加により、継続的に拡大しています。自動車の設計がより洗練され、空気力学的になるにつれて、バンパーは衝撃吸収と美しい外見のためにますます重要になっています。メーカーは、衝撃保護に妥協することなく燃費を向上させるため、先進プラスチックや複合材料などの軽量かつ高強度な材料を優先しています。

市場の主な促進要因は、歩行者保護や衝突性能に関する厳しい規制があり、自動車企業がバンパーにハイテクエネルギー吸収装置を採用するようになっていることです。また、SUVや電気自動車の需要も増加しており、これら2つのカテゴリには通常、高性能でモダンな外観のバンパーパッケージが搭載されています。さらに、ADAS(先進運転支援システム)用のセンサーなど、革新的なバンパーシステム技術が産業の様相を変えつつあります。さらに、持続可能性は、リサイクル可能な材料の使用を促進し、自動車産業の一般的な環境上の課題を表しています。

サプライヤーとメーカーはハイテク材料、安全機能、設計の柔軟性に注力しており、自動車用バンパー市場はOEMとアフターマーケットのニーズを満たす長期成長の準備が整っています。さらに、アフターマーケットを規制しようとする政府の取り組みは、自動車アフターマーケットにプラスにもマイナスにも影響する法案の提案につながっています。

例えば、2024年2月にアイダホ州で提案された法案(SB 1233)は、アフターマーケット自動車部品市場に大きな影響を与えるものでした。しかし、Auto Care Associationとその会員の抵抗により、州上院委員会で足踏み状態となっています。この法案は、規制対象のアフターマーケット衝突部品の定義を拡大し、ヘッドランプ、フェンダー、ボンネット、テールランプ、バンパー部品などの重要な部品を対象とするものでした。さらに、非OEM部品の可能性がある場合の安全性や性能に対する影響、取り付け前の認定専門家への相談など、より厳格な消費者情報開示要件が課されることになっています。

当レポートでは、世界の自動車用バンパー市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢などを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

- 回答者の人口統計

- ブランド認知度

- 購入決定において考慮される要素

- 優先される流通チャネル

- アンメットニーズ

第5章 世界の自動車用バンパー市場の見通し(2018年~2032年)

- 市場規模分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- 材料別

- 複合プラスチック

- 金属

- カーボンファイバー

- 位置別

- フロント

- リア

- 販売チャネル別

- OEM

- アフターマーケット

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 市場シェア分析:企業別(金額)(上位5社とその他 - 2024年)

- 材料別

- 市場マップ分析(2024年)

- 材料別

- 位置別

- 販売チャネル別

- 地域別

第6章 北米の自動車用バンパー市場の見通し(2018年~2032年)

- 市場規模分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- 材料別

- 複合プラスチック

- 金属

- カーボンファイバー

- 位置別

- フロント

- リア

- 販売チャネル別

- OEM

- アフターマーケット

- シェア:国別

- 米国

- カナダ

- メキシコ

- 材料別

- 各国の市場の評価

- 米国の自動車用バンパー市場の見通し(2018年~2032年)

- 市場規模分析と予測

- 市場シェアの分析と予測

- カナダ

- メキシコ

- 米国の自動車用バンパー市場の見通し(2018年~2032年)

第7章 欧州の自動車用バンパー市場の見通し(2018年~2032年)

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第8章 アジア太平洋の自動車用バンパー市場の見通し(2018年~2032年)

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第9章 南米の自動車用バンパー市場の見通し(2018年~2032年)

- ブラジル

- アルゼンチン

第10章 中東・アフリカの自動車用バンパー市場の見通し(2018年~2032年)

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第11章 ポーターのファイブフォース分析

第12章 PESTLE分析

第13章 価格分析

第14章 市場力学

- 市場促進要因

- 市場の課題

第15章 市場動向と発展

第16章 政策と規制情勢

第17章 ケーススタディ

第18章 競合情勢

- マーケットリーダー上位5社の競合マトリクス

- 上位5社のSWOT分析

- 主要企業上位10社の情勢

- OPMOBILITY SE

- Magna International Inc.

- Hyundai Mobis Co., Ltd.

- Toyoda Gosei Co., Ltd.

- BENTELER International AG

- Flex-N-Gate Group

- KIRCHHOFF Automotive SE

- The NTF Group

- Kasai Kogyo Co., Ltd.

- Seoyon E-Hwa Co., Ltd.

第19章 戦略的提言

第20章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 2. Global Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 3. Global Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 4. Global Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 5. Global Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 6. Global Automotive Bumper Market Share (%), By Region, 2018-2032F

- Figure 7. North America Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 8. North America Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 9. North America Automotive Bumper Market Share (%), By Material, 2018-2032F

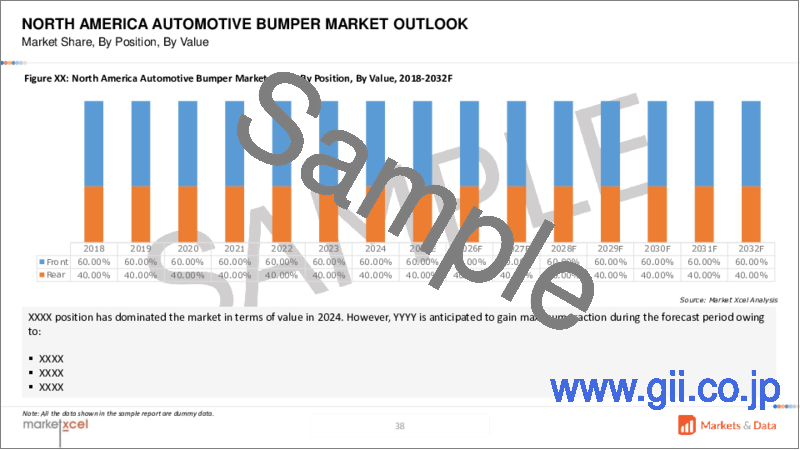

- Figure 10. North America Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 11. North America Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 12. North America Automotive Bumper Market Share (%), By Country, 2018-2032F

- Figure 13. United States Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 14. United States Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 15. United States Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 16. United States Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 17. United States Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 18. Canada Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 19. Canada Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 20. Canada Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 21. Canada Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 22. Canada Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 23. Mexico Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 24. Mexico Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 25. Mexico Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 26. Mexico Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 27. Mexico Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 28. Europe Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 29. Europe Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 30. Europe Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 31. Europe Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 32. Europe Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 33. Europe Automotive Bumper Market Share (%), By Country, 2018-2032F

- Figure 34. Germany Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 35. Germany Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 36. Germany Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 37. Germany Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 38. Germany Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 39. France Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 40. France Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 41. France Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 42. France Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 43. France Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 44. Italy Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 45. Italy Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 46. Italy Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 47. Italy Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 48. Italy Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 49. United Kingdom Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 50. United Kingdom Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 51. United Kingdom Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 52. United Kingdom Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 53. United Kingdom Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 54. Russia Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 55. Russia Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 56. Russia Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 57. Russia Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 58. Russia Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 59. Netherlands Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 60. Netherlands Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 61. Netherlands Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 62. Netherlands Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 63. Netherlands Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 64. Spain Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 65. Spain Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 66. Spain Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 67. Spain Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 68. Spain Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 69. Turkey Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 70. Turkey Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 71. Turkey Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 72. Turkey Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 73. Turkey Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 74. Poland Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 75. Poland Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 76. Poland Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 77. Poland Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 78. Poland Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 79. Asia-Pacific Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 80. Asia-Pacific Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 81. Asia-Pacific Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 82. Asia-Pacific Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 83. Asia-Pacific Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 84. Asia-Pacific Automotive Bumper Market Share (%), By Country, 2018-2032F

- Figure 85. India Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 86. India Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 87. India Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 88. India Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 89. India Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 90. China Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 91. China Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 92. China Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 93. China Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 94. China Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 95. Japan Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 96. Japan Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 97. Japan Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 98. Japan Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 99. Japan Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 100. Australia Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 101. Australia Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 102. Australia Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 103. Australia Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 104. Australia Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 105. Vietnam Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 106. Vietnam Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 107. Vietnam Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 108. Vietnam Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 109. Vietnam Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 110. South Korea Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 111. South Korea Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 112. South Korea Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 113. South Korea Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 114. South Korea Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 115. Indonesia Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 116. Indonesia Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 117. Indonesia Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 118. Indonesia Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 119. Indonesia Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 120. Philippines Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 121. Philippines Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 122. Philippines Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 123. Philippines Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 124. Philippines Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 125. South America Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 126. South America Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 127. South America Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 128. South America Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 129. South America Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 130. South America Automotive Bumper Market Share (%), By Country, 2018-2032F

- Figure 131. Brazil Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 132. Brazil Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 133. Brazil Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 134. Brazil Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 135. Brazil Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 136. Argentina Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 137. Argentina Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 138. Argentina Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 139. Argentina Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 140. Argentina Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 141. Middle East & Africa Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 142. Middle East & Africa Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 143. Middle East & Africa Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 144. Middle East & Africa Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 145. Middle East & Africa Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 146. Middle East & Africa Automotive Bumper Market Share (%), By Country, 2018-2032F

- Figure 147. Saudi Arabia Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 148. Saudi Arabia Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 149. Saudi Arabia Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 150. Saudi Arabia Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 151. Saudi Arabia Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 152. UAE Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 153. UAE Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 154. UAE Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 155. UAE Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 156. UAE Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 157. South Africa Automotive Bumper Market, By Value, in USD Billion, 2018-2032F

- Figure 158. South Africa Automotive Bumper Market, By Volume, in Thousand Units, 2018-2032F

- Figure 159. South Africa Automotive Bumper Market Share (%), By Material, 2018-2032F

- Figure 160. South Africa Automotive Bumper Market Share (%), By Position, 2018-2032F

- Figure 161. South Africa Automotive Bumper Market Share (%), By Sales Channel, 2018-2032F

- Figure 162. By Material Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 163. By Position Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 164. By Sales Channel Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 165. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global automotive bumper market is projected to witness a CAGR of 4.76% during the forecast period, 2025-2032, growing from USD 36.95 billion in 2024 to USD 53.61 billion in 2032. The automotive bumper market is continuously increasing due to higher motor vehicle manufacturing, new safety needs, and increasing customer demand for better appearance and longevity. As vehicle designs become sleeker and more aerodynamic, bumpers are increasingly critical for shock absorption and aesthetics. Manufacturers prioritize lightweight yet high-strength materials, such as advanced plastics and composites, to enhance fuel efficiency without compromising impact protection.

Key drivers powering the market include rigorous regulatory necessities in pedestrian protection and crash performance, leading automotive companies to employ high-tech energy-absorbing devices in bumpers. There is also an increase in SUV and electric car demand that generates demand, wherein these two categories typically come in capable and modern-looking bumper packages. In addition, innovative bumper system technology, such as sensors for advanced driver-assistance systems (ADAS), is transforming the industry profile. Furthermore, sustainability drives the use of recyclable materials, representing the general environmental agenda of the automotive industry.

With suppliers and manufacturers concentrating on high-technology materials, safety features, and design flexibility, the automobile bumper market is ready for long-term growth to meet OEM and aftermarket needs. Moreover, government efforts to regulate the aftermarket led to the proposals of bills that impact the automotive aftermarket positively and negatively.

For instance, in February 2024, A bill proposed in Idaho (SB 1233) would have had a significant effect on the aftermarket auto parts market. Still, it has been stuck in a state Senate committee after resistance from the Auto Care Association and its members. The legislation broadened the definition of regulatory aftermarket crash parts to cover crucial components like headlamps, fenders, hoods, taillamps, and bumper parts. Additionally, it would have subjected more strict consumer disclosure requirements, including safety and performance consequences of possible non-OEM parts, and calls for consultation with certified experts before installation.

Growing Electric Vehicles Drive the Automotive Bumper Market

The EV industry's speedy expansion is fueling the auto bumper market demand, as manufacturers are transitioning to meet the special requirements of electric vehicles. EV bumpers increasingly incorporate aerodynamic technologies to maximize driving range efficiency without compromising crash protection ratings. Lightweight composite materials are becoming more popular, assisting in balancing battery weight without sacrificing structural integrity.

Styling developments in EV bumpers boast seamless, futuristic shapes compatible with the clean, modern appearance of electric driving. Integrating sophisticated sensors and cameras in driver-assistance systems also drives bumper functionality up. As automakers place equal emphasis on performance and sustainability, demand is growing for high-performance, recyclable bumper solutions. As EVs revolutionize auto design paradigms, bumper systems are transforming into high-tech elements that optimize safety, efficiency, and aesthetics in the emerging world of electrified transportation.

For instance, in April 2025, Hyundai Motor Company launched the second-generation Nexo during the Seoul Mobility Show 2025, marking a milestone in fuel cell electric vehicle (FCEV) technology. The geometric, avant-garde design of the front is captured through square-themed concepts, starting from the narrow, segment-cut upper lighting clusters to the air dam and block-patterned lights placed on the bumper. This refresh reflects Hyundai's drive to advance FCEV technology while keeping Nexo recognizable.

Luxury Vehicle Sales Fuel Bumper Market Innovation

The expanding luxury vehicle market is driving high-end demand for bumpers that provide sophisticated styling and creative function. Luxury clients want exclusive materials like carbon fiber composites and aluminum alloys that provide lightweight capabilities and exclusive design. Automobile manufacturers are responding with streamlined, sculpted designs that create brand equity and feature next-generation technologies. These range from radar-compatible materials for autonomous driving systems to self-healing coatings that preserve flawless finishes. The increasing demand for personalized bumper treatments in luxury SUVs and performance models further fuels innovation. With high-end auto manufacturers pushing limits in technology and design, bumper systems become more than protective components to signature design elements. Such a trend sustains luxury vehicles as the top growth drivers for the high-value segment of the automotive bumper market.

For instance, in April 2025, Aston Martin Lagonda Limited unveiled the 2025 Vanquish in India, the third iteration of its lead grand tourer. The new vehicle boasts an evolutionary design with high-end improvements, like a hand-finished interior with a luxury finish and a 6.0L V12 petrol engine. Design features include carbon-fiber accents with 'Aston Martin V12' emblazoning, 21-inch golden alloy wheels, and swan-wing doors. The sports car gets a sporty bumper with the quad exhaust system and diffuser, vertically mounted LED taillamps connected by gloss black elements, and carbon fiber on the tailgate.

After Market Segment Dominates the Market

The aftermarket segment leads the automobile bumper market due to growing consumer interest in customization, repairing, and upgrading bumpers. Owners of vehicles are increasingly demanding replacement bumpers that offer higher durability with custom styling, stimulating strong aftermarket sales. Growing repair demands and increased demand for appearance modifications continue to drive segment growth. Customers chose high-end aftermarket bumpers with new materials, creative styles, and better impact resistance. The presence of affordable alternatives to OEM components further solidifies the segment's market position. As online platforms make it easy to access a variety of bumper choices and installation services, the aftermarket ecosystem prospers. The flexibility of this segment in keeping pace with changing consumer demand and vehicle fashions confirms its position as the industry's future direction driver.

For instance, in November 2024, A consignment of 960 pieces of Stiffener Assy-Fr Bumper Lwr under HSN Code 87081090 was exported from South Korea to India. The shipment, conducted by Hyundai Mobis United Arab Emirates, reached Kattupalli Port for Mobis India Ltd., based in Kanchipuram, Tamil Nadu. Selling at USD 4,799.30, these OEM bumper stiffeners are essential to Hyundai/Kia vehicle assembly lines in India, a testament to the increasing aftermarket automobile trade between South Korea and India.

Asia-Pacific Leads the Market

The Asia-Pacific dominates the automotive bumper market, supported by exploding vehicle output and rising aftermarket demand in emerging economies. The growth is driven by China, India, and Southeast Asian countries through fast-expanding auto industries and rising consumer vehicle ownership. The region's strong demand stems from key strategic advantages: high-density manufacturing clusters supplying global OEMs, cost-competitive material sourcing, and substantial government incentives supporting automotive industry growth. Domestic manufacturers can produce economic and premium bumper solutions for varied market demands. Growing disposable incomes and urbanization drive replacement demand, while strict safety regulations drive technological innovation. As large auto manufacturers increase Asia Pacific production capabilities and indigenous brands continue to make inroads into the market, the region is set to keep its bumper market leadership intact through innovation and scale.

For instance, in April 2025, Skoda Auto a.s is set to launch the all-new second-generation Kodiaq in India, a major facelift of its high-end SUV segment. Since its September 2024 world premiere, the India-badged car will be domestically manufactured through CKD kits in Skoda's Aurangabad factory, holding a competitive pricing structure. The latest Kodiaq has remarkable body design improvements with a revised rear bumper, with a simulated diffuser panel marked by slight chrome trim details.

Future Market Scenario (2025 - 2032F)

ADAS-enabled bumpers with embedded sensors will become standard, enhancing collision avoidance. This evolution will merge safety with autonomous driving requirements.

Bio-based composites and recyclable materials will dominate, driven by stringent eco-regulations. Manufacturers will prioritize circular economy solutions to reduce environmental impact.

Advanced composites and hybrid materials will replace traditional steel/plastic to improve fuel efficiency. EVs will accelerate demand for weight-optimized designs.

3D-printed and modular bumpers will enable personalized styling. E-commerce platforms will expand access to niche aftermarket solutions globally.

Key Players Landscape and Outlook

The automotive bumper market is characterized by a dynamic competitive landscape with global OEM suppliers. Competition is intensifying around material science innovations, with manufacturers racing to develop advanced composites and sustainable materials that meet evolving industry standards. Strategic partnerships between material suppliers and bumper producers are becoming crucial to accelerate innovation cycles, particularly in smart bumper systems compatible with ADAS technologies. The competitive edge increasingly hinges on four key factors: the development of intelligent bumper systems, lightweight material expertise, circular economy capabilities, and regional customization proficiency.

For instance, in July 2023, SSAB AB partnered with KIRCHHOFF Automotive SE to integrate fossil-free steel into safety-critical auto parts, reducing production emissions by 40%. The collaboration focuses on components like crash boxes, lower beams, and closure plates (weighing 300g 1.3kg), manufactured via cold-forming processes. By adopting SSAB's eco-friendly steel, KIRCHHOFF achieves significant CO2 reductions, exemplified by a near-40% drop in front bumper production emissions. This initiative supports the automotive industry's shift toward sustainable material sourcing without compromising safety or performance.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customers

- 4.1. Respondent Demographics

- 4.2. Brand Awareness

- 4.3. Factors Considered in Purchase Decisions

- 4.4. Preferred Distribution Channel

- 4.5. Unmet Needs

5. Global Automotive Bumper Market Outlook, 2018-2032F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Material

- 5.2.1.1. Composite Plastic

- 5.2.1.2. Metal

- 5.2.1.3. Carbon Fiber

- 5.2.2. By Position

- 5.2.2.1. Front

- 5.2.2.2. Rear

- 5.2.3. By Sales Channel

- 5.2.3.1. Original Equipment Manufacturer

- 5.2.3.2. Aftermarket

- 5.2.4. By Region

- 5.2.4.1. North America

- 5.2.4.2. Europe

- 5.2.4.3. Asia-Pacific

- 5.2.4.4. South America

- 5.2.4.5. Middle East and Africa

- 5.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 5.2.1. By Material

- 5.3. Market Map Analysis, 2024

- 5.3.1. By Material

- 5.3.2. By Position

- 5.3.3. By Sales Channel

- 5.3.4. By Region

6. North America Automotive Bumper Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Material

- 6.2.1.1. Composite Plastic

- 6.2.1.2. Metal

- 6.2.1.3. Carbon Fiber

- 6.2.2. By Position

- 6.2.2.1. Front

- 6.2.2.2. Rear

- 6.2.3. By Sales Channel

- 6.2.3.1. Original Equipment Manufacturer

- 6.2.3.2. Aftermarket

- 6.2.4. By Country Share

- 6.2.4.1. United States

- 6.2.4.2. Canada

- 6.2.4.3. Mexico

- 6.2.1. By Material

- 6.3. Country Market Assessment

- 6.3.1. United States Automotive Bumper Market Outlook, 2018-2032F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.1.2. By Volume

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Material

- 6.3.1.2.1.1. Composite Plastic

- 6.3.1.2.1.2. Metal

- 6.3.1.2.1.3. Carbon Fiber

- 6.3.1.2.2. By Position

- 6.3.1.2.2.1. Front

- 6.3.1.2.2.2. Rear

- 6.3.1.2.3. By Sales Channel

- 6.3.1.2.3.1. Original Equipment Manufacturer

- 6.3.1.2.3.2. Aftermarket

- 6.3.1.2.1. By Material

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Automotive Bumper Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

7. Europe Automotive Bumper Market Outlook, 2018-2032F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Automotive Bumper Market Outlook, 2018-2032F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Automotive Bumper Market Outlook, 2018-2032F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Automotive Bumper Market Outlook, 2018-2032F

- 10.1. Saudi Arabia

- 10.2. UAE

- 10.3. South Africa

11. Porter's Five Forces Analysis

12. PESTLE Analysis

13. Pricing Analysis

14. Market Dynamics

- 14.1. Market Drivers

- 14.2. Market Challenges

15. Market Trends and Developments

16. Policy and Regulatory Landscape

17. Case Studies

18. Competitive Landscape

- 18.1. Competition Matrix of Top 5 Market Leaders

- 18.2. SWOT Analysis for Top 5 Players

- 18.3. Key Players Landscape for Top 10 Market Players

- 18.3.1. OPMOBILITY SE

- 18.3.1.1. Company Details

- 18.3.1.2. Key Management Personnel

- 18.3.1.3. Products and Services

- 18.3.1.4. Financials (As Reported)

- 18.3.1.5. Key Market Focus and Geographical Presence

- 18.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 18.3.2. Magna International Inc.

- 18.3.3. Hyundai Mobis Co., Ltd.

- 18.3.4. Toyoda Gosei Co., Ltd.

- 18.3.5. BENTELER International AG

- 18.3.6. Flex-N-Gate Group

- 18.3.7. KIRCHHOFF Automotive SE

- 18.3.8. The NTF Group

- 18.3.9. Kasai Kogyo Co., Ltd.

- 18.3.10. Seoyon E-Hwa Co., Ltd.

- 18.3.1. OPMOBILITY SE

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.