|

|

市場調査レポート

商品コード

1635145

再生可能エネルギー証書(REC)の世界市場の評価:エネルギータイプ別、容量別、最終用途別、地域別、機会、予測(2018年~2032年)Renewable Energy Certificate Market Assessment, By Energy Type, By Capacity, By End-use, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 再生可能エネルギー証書(REC)の世界市場の評価:エネルギータイプ別、容量別、最終用途別、地域別、機会、予測(2018年~2032年) |

|

出版日: 2025年01月17日

発行: Markets & Data

ページ情報: 英文 221 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の再生可能エネルギー証書(REC)の市場規模は、2024年の208億2,000万米ドルから2032年に1,420億2,000万米ドルに達すると予測され、2025年~2032年の予測期間にCAGRで27.13%の成長が見込まれます。

RECは市場に基づいた証書であり、電力網に供給される再生可能エネルギー源から1MWhの電力が発電されたことを証明するものです。RECの仕組みは、再生可能エネルギーの発電を促進し、RPO(再生可能エネルギー購入義務)の遵守を支援するよう設計されています。

再生可能エネルギー証書(REC)市場は、多数の地域で再生可能エネルギー導入基準(RPS)のような政府の規制要件が電力企業に再生可能資源からのエネルギー調達を義務付けていることから大幅な成長を示しており、再生可能エネルギー証書(REC)の需要につながっています。企業もまた、この需要に大きく寄与しています。なぜなら、企業は持続可能性目標や、政府や高等な当局が定めるネットゼロエミッションの要件を達成するために数多くの活動を行っているからです。こうした圧力が、排出を相殺する方法としてRECを購入させます。

さらに、環境にやさしいブランドに対する消費者の支持は高まっており、二酸化炭素排出を削減するために、より環境にやさしい製品を求めるようになっています。また、風力発電や太陽光発電などの再生可能エネルギー設備の急増は、RECの供給を拡大し、価格をさらに安定させ、より入手しやすくしています。

さらに、ブロックチェーンとデジタルプラットフォームの利用における技術的進歩は、REC取引の効率性と容易さを向上させ、複数の部門の参加を可能にしています。

例えば2024年12月、Powerledgerの再生可能エネルギー証書(REC)向けマーケットプレイス、TraceXはCounter-Offer機能を導入し、RECの価格の交渉を可能にしました。このイノベーションにより、買い手と売り手が売り注文の価格について話し合い、合意することが可能になり、固定価格モデルから脱却することができます。

2024年7月、PowerledgerはTraceXマーケットプレイスに新機能を導入し、組織が再生可能エネルギー発電事業者から再生可能エネルギー証書(REC)を直接購入できるようにしました。これにより、企業はレジストリ口座を開設したり、仲介業者を介したりする必要がなくなります。この新機能により、RECの発行元とコストがより明確に理解できるようになり、仲介業者を通した購入の透明性を低下させています。

当レポートでは、世界の再生可能エネルギー証書(REC)市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢などを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

- 購入決定において考慮する要素

- コンプライアンス要件

- 認証基準

- RECのヴィンテージ

- 技術タイプ

- 価格

第5章 世界の再生可能エネルギー証書(REC)市場の見通し(2018年~2032年)

- 市場規模の分析と予測

- 金額

- 市場シェアの分析と予測

- エネルギータイプ別

- 容量別

- 最終用途別

- 地域別

- 市場シェア分析:企業別(金額)(上位5社とその他 - 2024年)

- 市場マップ分析(2024年)

- エネルギータイプ別

- 容量別

- 最終用途別

- 地域別

第6章 北米の再生可能エネルギー証書(REC)市場の見通し(2018年~2032年)

- 市場規模の分析と予測

- 金額

- 市場シェアの分析と予測

- エネルギータイプ別

- 容量別

- 最終用途別

- シェア:国別

- 各国の市場の評価

- 米国の再生可能エネルギー証書(REC)市場の見通し(2018年~2032年)

- カナダ

- メキシコ

第7章 欧州の再生可能エネルギー証書(REC)市場の見通し(2018年~2032年)

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第8章 アジア太平洋の再生可能エネルギー証書(REC)市場の見通し(2018年~2032年)

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第9章 南米の再生可能エネルギー証書(REC)市場の見通し(2018年~2032年)

- ブラジル

- アルゼンチン

第10章 中東・アフリカの再生可能エネルギー証書(REC)市場の見通し(2018年~2032年)

- サウジアラビア

- アラブ首長国連邦

第11章 ポーターのファイブフォース分析

第12章 PESTLE分析

第13章 市場力学

- 市場促進要因

- 市場の課題

第14章 市場の動向と発展

第15章 ケーススタディ

第16章 競合情勢

- マーケットリーダー上位5社の競合マトリクス

- 上位5社のSWOT分析

- 主要企業上位10社の情勢

- NextEra Energy, Inc.

- Enel Green Power S.p.A.

- NRG Energy, Inc.

- Defense Logistics Energy

- ENGIE SA

- Duke Energy Corporation

- Green-e Energy (Center for Resource Solutions)

- United States Environmental Protection Agency

- Dominion Energy, Inc.

第17章 戦略的推奨

第18章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 3. Global Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 4. Global Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 5. Global Renewable Energy Certificate Market Share (%), By Region, 2018-2032F

- Figure 6. North America Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 7. North America Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 8. North America Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

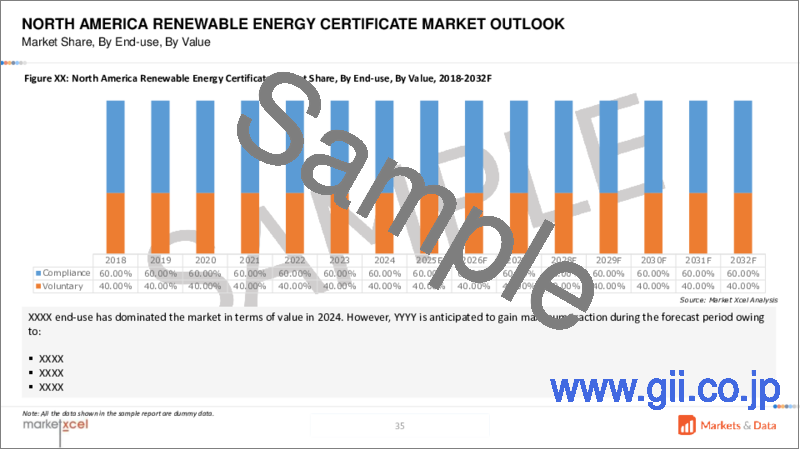

- Figure 9. North America Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 10. North America Renewable Energy Certificate Market Share (%), By Country, 2018-2032F

- Figure 11. United States Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 12. United States Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 13. United States Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 14. United States Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 15. Canada Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 16. Canada Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 17. Canada Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 18. Canada Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 19. Mexico Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 20. Mexico Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 21. Mexico Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 22. Mexico Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 23. Europe Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 24. Europe Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 25. Europe Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 26. Europe Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 27. Europe Renewable Energy Certificate Market Share (%), By Country, 2018-2032F

- Figure 28. Germany Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 29. Germany Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 30. Germany Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 31. Germany Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 32. France Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 33. France Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 34. France Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 35. France Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 36. Italy Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 37. Italy Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 38. Italy Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 39. Italy Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 40. United Kingdom Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 41. United Kingdom Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 42. United Kingdom Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 43. United Kingdom Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 44. Russia Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 45. Russia Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 46. Russia Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 47. Russia Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 48. Netherlands Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 49. Netherlands Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 50. Netherlands Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 51. Netherlands Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 52. Spain Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 53. Spain Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 54. Spain Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 55. Spain Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 56. Turkey Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 57. Turkey Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 58. Turkey Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 59. Turkey Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 60. Poland Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 61. Poland Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 62. Poland Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 63. Poland Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 64. South America Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 65. South America Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 66. South America Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 67. South America Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 68. South America Renewable Energy Certificate Market Share (%), By Country, 2018-2032F

- Figure 69. Brazil Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 70. Brazil Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 71. Brazil Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 72. Brazil Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 73. Argentina Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 74. Argentina Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 75. Argentina Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 76. Argentina Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 77. Asia-Pacific Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 78. Asia-Pacific Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 79. Asia-Pacific Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 80. Asia-Pacific Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 81. Asia-Pacific Renewable Energy Certificate Market Share (%), By Country, 2018-2032F

- Figure 82. India Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 83. India Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 84. India Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 85. India Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 86. China Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 87. China Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 88. China Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 89. China Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 90. Japan Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 91. Japan Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 92. Japan Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 93. Japan Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 94. Australia Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 95. Australia Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 96. Australia Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 97. Australia Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 98. Vietnam Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 99. Vietnam Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 100. Vietnam Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 101. Vietnam Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 102. South Korea Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 103. South Korea Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 104. South Korea Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 105. South Korea Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 106. Indonesia Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 107. Indonesia Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 108. Indonesia Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 109. Indonesia Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 110. Philippines Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 111. Philippines Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 112. Philippines Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 113. Philippines Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 114. Middle East & Africa Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 115. Middle East & Africa Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 116. Middle East & Africa Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 117. Middle East & Africa Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 118. Middle East & Africa Renewable Energy Certificate Market Share (%), By Country, 2018-2032F

- Figure 119. Saudi Arabia Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 120. Saudi Arabia Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 121. Saudi Arabia Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 122. Saudi Arabia Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 123. UAE Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 124. UAE Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 125. UAE Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 126. UAE Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 127. South Africa Renewable Energy Certificate Market, By Value, In USD Billion, 2018-2032F

- Figure 128. South Africa Renewable Energy Certificate Market Share (%), By Energy Type, 2018-2032F

- Figure 129. South Africa Renewable Energy Certificate Market Share (%), By Capacity, 2018-2032F

- Figure 130. South Africa Renewable Energy Certificate Market Share (%), By End-use, 2018-2032F

- Figure 131. By Energy Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 132. By Capacity Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 133. By End-use Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 134. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global renewable energy certificate market is projected to witness a CAGR of 27.13% during the forecast period 2025-2032, growing from USD 20.82 billion in 2024 to USD 142.02 billion in 2032.

A REC is a market-based instrument, which represents proof that one megawatt hour of electricity has been generated from renewable energy sources supplied into the power grid. The REC mechanism is designed to foster the generation of renewable energy and help in compliance with RPOs, or Renewable Purchase Obligations which are mandates upon utilities to source a certain percentage of their energy from renewable resources.

The Renewable Energy Certificate (REC) market is witnessing substantial growth due to several factors, such as government regulatory requirements like Renewable Portfolio Standards (RPS) in many areas that require utilities to obtain a metric of energy from renewable sources, leading to a demand for Renewable Energy Certificates. Corporations also make a major contribution to this demand, as they engage in numerous activities to achieve sustainability objectives and net zero emissions requirements set by governments and higher authorities. These kinds of pressure make them purchase the RECs as a way of offsetting their emissions.

Moreover, consumers' support for greener brands is increasing, and they are demanding more eco-friendly products to reduce carbon emissions, which encourages companies to buy RECs to bolster their green credentials. Also, the surge in renewable energy installations such as wind and solar has expanded the supply of RECs, further stabilizing prices and making them more accessible.

Furthermore, technological advancement in blockchain and the use of digital platforms have improved the efficiency and ease of conducting REC transactions, allowing the participation of multiple sectors.

For instance, in December 2024, Powerledger's TraceX marketplace for renewable energy certificates (RECs) introduced a Counter-Offer feature, allowing for negotiations on REC prices. This innovation enables buyers and sellers to discuss and agree on prices for sell orders, moving away from fixed pricing models.

In July 2024, Powerledger introduced a new feature in its TraceX marketplace, allowing organizations to purchase Renewable Energy Certificates (RECs) directly from renewable energy generators. This eliminates the need for businesses to open their registry account or go through intermediaries. The new feature provides a clearer understanding of the origins and costs of RECs, reducing the transparency of buying through intermediaries.

Renewable Portfolio Standards is Acting as a Catalyst for REC Market Growth

As the world shifts towards clean energy sources, regulatory requirements such as Renewable Portfolio Standards (RPS) emerge as key factors in developing the Renewable Energy Certificate (REC) market. The concept of RPS obligates a certain proportion of electricity providers to obtain energy from renewable sources such as wind, biomass, and solar energy. This push will consistently sustain the demand for Renewable Energy Certificates. These certificates are issued when renewable energy is consumed and fed into the network.

As of December 2024, over 50% of all states in the United States have Renewable Portfolio Standards (RPS) programs, which have tremendously increased electricity generation from renewable sources. These requirements also encourage investment in renewable technologies and provide a mechanism for local utilities (loUs) to meet their obligations. This organized framework fosters competition among different forms of renewable technologies, making them cheaper and encouraging their development. Moreover, the stable and predictable nature of RPS provides the safety and security needed to plan and invest in renewable energy projects over the long term.

By establishing deadlines and goals, these regulatory requirements also ensure that utilities and corporations meet their pledges about renewable energy, strengthening the move towards achieving a cleaner energy environment.

For instance, in January 2023, the states that adopted renewable portfolio standards increased the wind generation capacity, with an average increase of 600 to 1,200 megawatts (MW).

Technological Innovations are Transforming the Renewable Energy Certificate Market

Technological advancements are playing a crucial role in the growth of the Renewable Energy Certificate (REC) market, particularly through innovations like blockchain and enhanced data analytics. Blockchain technology offers a secure and transparent way to track RECs throughout the supply chain, ensuring authenticity and preventing issues like double counting or fraud. By using a decentralized ledger, blockchain allows real-time recording of transactions, which builds trust among participants and reduces the need for intermediaries, ultimately lowering costs.

Moreover, improvements in data analytics facilitate better price discovery and market forecasting, making it easier for buyers and sellers to navigate the REC landscape. Online trading platforms enhance transaction efficiency, increasing accessibility for all stakeholders. For example, platforms like Power Ledger's TraceX simplify the buying and selling of RECs, connecting renewable energy producers with potential buyers.

These technological innovations not only boost efficiency and transparency but also enhance confidence in the REC market. As more companies recognize these benefits, participation in renewable energy solutions is likely to rise. Consequently, the REC market is expected to experience significant growth driven by these advancements that support sustainability efforts.

Compliance Segment is Dominating the Renewable Energy Certificate Market Share

Due to the diverse compliance regimes established by governments in different countries around the globe, the compliance segment is dominating the Renewable Energy Certificate (REC) market. These frameworks require utilities and large companies to fulfill certain renewable energy obligations, which in turn compel them to purchase a specified number of RECs within a given year. Such laws create a guaranteed market for RECs, as firms seek to comply with Renewable Portfolio Standards (RPS) or similar policies that have been established to increase the levels of renewable energy.

Additionally, the increasing focus on environmental sustainability has led many industries to adopt rigorous compliance measures. Companies have now started facing environmental constraints which say that they need to use clean energy or else they need to buy RECs to substantiate their emissions. Sustainable development is becoming increasingly important for individuals and businesses, further increasing the demand for compliance related RECs.

Moreover, as renewable energy technologies become more economically viable and accessible over time, the potential for these resources to be included in the energy mix also increases. The combination of regulatory forces and market elements makes the compliance segment well-suited for further growth in Renewable Energy Certificates (RECs). Consequently, this segment is expected to continue expanding as governments reinforce their commitments to renewable energy and climate goals.

For instance, in August 2023, Tata Power announced its commitment to fulfill its Renewable Purchase Obligation (RPO) by acquiring RECs to meet regulatory requirements. The company aimed to source 100% of its energy from renewable sources by 2024, which necessitated significant REC purchases to comply with state mandates.

North America Dominates Renewable Energy Certificate Market Share

A renewable energy certificate (REC) is a green certificate issued for the generation of a unit of renewable energy. North America has dominated the REC market due to several key factors. The region has a conducive regulatory environment, and many states have renewable portfolio standards (RPS). Most of these regulations require utilities to buy a certain percentage of their energy from renewable sources, creating a substantial demand for RECs to ensure compliance.

Additionally, big corporations such as Tesla, Microsoft, and Google, which actively purchase RECs to meet their sustainability goals, further strengthen this market. These companies are focused on cutting carbon emissions and boosting their corporate responsibility profiles, which raises the market demand for both compliance and voluntary RECs.

Moreover, North America has developed the capacity for developing renewable energy, such as solar and wind power, which helps in the increasing supply of RECs. The combination of regulatory mandates, corporate sustainability initiatives, and a high capacity of renewable energy supply which positions North America as a dominant force in the REC market, with expectations for continued growth in the coming years as more entities seek to meet their renewable energy targets.

Future Market Scenario (2025 - 2032F)

Regulatory frameworks for Renewable Energy Certificates (RECs) are likely to change and may become more stringent in the future. New policies that require a greater percentage of energy to come from renewable sources will directly impact the demand for RECs. As countries commit to achieving net-zero emissions, government actions may increase, potentially leading to minimum price support for RECs or new incentives designed to promote renewable energy projects. This shift could significantly influence the REC market operation and growth in the coming years.

Technological improvements in renewable energy such as more efficient solar cells, better wind turbine designs, and innovative bioenergy solutions are anticipated to enhance production efficiency and reduce costs. This trend may result in a greater supply of Renewable Energy Certificates (RECs), which will impact on market prices and strategies.

The demand for more specialized and niche Renewable Energy Certificates (RECs) is expected to rise as consumers and companies look for greater clarity in their environmental impact claims.

Key Players Landscape and Outlook

Continuous innovation characterizes the landscape of renewable certificate globally, with key players striving to enhance their offerings and maintain competitive advantages. The market prognosis remains positive, fueled by increasing regulatory mandates like Renewable Portfolio Standards (RPS) and a surge in corporate sustainability commitments. As businesses aim to meet ambitious renewable energy targets, the demand for RECs will likely rise, encouraging innovation and collaboration among market players.

For instance, in February 2023, Shizen Energy Inc. is launching a new service to provide renewable energy certificates, including non-fossil certificates with tracking, in line with international sustainability standards like RE100 and CDP. The service will be provided in Japan, internationally, and more than 50 countries.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customer

- 4.1. Factors Consider in Purchase Decision

- 4.1.1. Compliance Requirements

- 4.1.2. Certification Standards

- 4.1.3. Vintage of RECs

- 4.1.4. Technology Type

- 4.1.5. Pricing

5. Global Renewable Energy Certificate Market Outlook, 2018-2032F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Energy Type

- 5.2.1.1. Solar Power

- 5.2.1.2. Wind Power

- 5.2.1.3. Hydro-electric Power

- 5.2.1.4. Gas Power

- 5.2.2. By Capacity

- 5.2.2.1. 0-1000 KWh

- 5.2.2.2. 1100-5000 KWh

- 5.2.2.3. More than 5000 KWh

- 5.2.3. By End-use

- 5.2.3.1. Compliance

- 5.2.3.2. Voluntary

- 5.2.4. By Region

- 5.2.4.1. North America

- 5.2.4.2. Europe

- 5.2.4.3. Asia-Pacific

- 5.2.4.4. South America

- 5.2.4.5. Middle East and Africa

- 5.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 5.2.1. By Energy Type

- 5.3. Market Map Analysis, 2024

- 5.3.1. By Energy Type

- 5.3.2. By Capacity

- 5.3.3. By End-use

- 5.3.4. By Region

6. North America Renewable Energy Certificate Market Outlook, 2018-2032F*

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Energy Type

- 6.2.1.1. Solar Energy

- 6.2.1.2. Wind Power

- 6.2.1.3. Hydro-electric Power

- 6.2.1.4. Gas Power

- 6.2.2. By Capacity

- 6.2.2.1. 0-1000 KWh

- 6.2.2.2. 1100-5000 KWh

- 6.2.2.3. More than 5000 KWh

- 6.2.3. By End-use

- 6.2.3.1. Compliance

- 6.2.3.2. Voluntary

- 6.2.4. By Country Share

- 6.2.4.1. United States

- 6.2.4.2. Canada

- 6.2.4.3. Mexico

- 6.2.1. By Energy Type

- 6.3. Country Market Assessment

- 6.3.1. United States Renewable Energy Certificate Market Outlook, 2018-2032F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Energy Type

- 6.3.1.2.1.1. Solar Power

- 6.3.1.2.1.2. Wind Power

- 6.3.1.2.1.3. Hydro-electric Power

- 6.3.1.2.1.4. Gas Power

- 6.3.1.2.2. By Capacity

- 6.3.1.2.2.1. 0-1000 KWh

- 6.3.1.2.2.2. 1100-5000 KWh

- 6.3.1.2.2.3. More than 5000 KWh

- 6.3.1.2.3. By End-use

- 6.3.1.2.3.1. Compliance

- 6.3.1.2.3.2. Voluntary

- 6.3.1.2.1. By Energy Type

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Renewable Energy Certificate Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

7. Europe Renewable Energy Certificate Market Outlook, 2018-2032F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Renewable Energy Certificate Market Outlook, 2018-2032F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Renewable Energy Certificate Market Outlook, 2018-2032F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Renewable Energy Certificate Market Outlook, 2018-2032F

- 10.1. Saudi Arabia

- 10.2. UAE

11. Porter's Five Forces Analysis

12. PESTLE Analysis

13. Market Dynamics

- 13.1. Market Drivers

- 13.2. Market Challenges

14. Market Trends and Developments

15. Case Studies

16. Competitive Landscape

- 16.1. Competition Matrix of Top 5 Market Leaders

- 16.2. SWOT Analysis for Top 5 Players

- 16.3. Key Players Landscape for Top 10 Market Players

- 16.3.1. NextEra Energy, Inc.

- 16.3.1.1. Company Details

- 16.3.1.2. Key Management Personnel

- 16.3.1.3. Products and Services

- 16.3.1.4. Financials (As Reported)

- 16.3.1.5. Key Market Focus and Geographical Presence

- 16.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 16.3.2. Enel Green Power S.p.A.

- 16.3.3. NRG Energy, Inc.

- 16.3.4. Defense Logistics Energy

- 16.3.5. Central Electricity Regulatory Commission

- 16.3.6. ENGIE SA

- 16.3.7. Duke Energy Corporation

- 16.3.8. Green-e Energy (Center for Resource Solutions)

- 16.3.9. United States Environmental Protection Agency

- 16.3.10. Dominion Energy, Inc.

- 16.3.1. NextEra Energy, Inc.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.