|

|

市場調査レポート

商品コード

1567942

冷間圧造用鋼線の世界市場の評価:グレード別、製造技術別、用途別、エンドユーザー別、地域別、機会、予測(2017年~2031年)Cold Heading Quality Wire Market Assessment, By Grade, By Manufacturing Technology, By Application, By End-user, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 冷間圧造用鋼線の世界市場の評価:グレード別、製造技術別、用途別、エンドユーザー別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年10月11日

発行: Markets & Data

ページ情報: 英文 222 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の冷間圧造用鋼線の市場規模は、2023年の174億5,000万米ドルから2031年に219億9,000万米ドルに達すると予測され、予測期間の2024年~2031年にCAGRで2.93%の成長が見込まれます。

CHQ鋼線は、ファスナー、自動車部品、建設コンポーネントの生産に大量に使用されています。加えて、CHQはナット、ボルト、リベット、ネジ、釘などの生産における冷間圧造用途に非常に適しています。ハードウェアの品質と安全基準が改善されるにつれて、CHQ鋼線から作られる高性能ファスナーの需要が急激に増加しています。アジア太平洋はもっとも有望な市場の1つと考えられており、その主な理由はインドと中国です。両国の政府は、冷間圧造に使用されるワイヤーの品質に関する規制と政策を改善する必要性を強調しています。

例えば2024年2月、Bureau of Indian Standards(BIS)は冷間圧造用途に使用される軟鋼線のQuality Control Order(QCO)を公布しました。この命令の目的は、公共の利益を考慮し、鉄鋼製品の品質と安全性をさらに向上させるため、所定のインド標準の施行を強化することです。この展開により、製品の生産に用いる品質の高い原材料への需要が増加します。

当レポートでは、世界の冷間圧造用鋼線市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢などを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

- 回答者の人口統計

- 購入決定において考慮される要素

- 製品の仕様

- 品質

- 価格

- ブランドバリュー

- リードタイム

第5章 世界の冷間圧造用鋼線市場の見通し(2017年~2031年)

- 市場規模の分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- グレード別

- 製造技術別

- 用途別

- エンドユーザー別

- 地域別

- 市場シェア分析:企業別(金額)(上位5社とその他 - 2023年)

- 市場マップ分析(2023年)

- グレード別

- 製造技術別

- 用途別

- エンドユーザー別

- 地域別

第6章 北米の冷間圧造用鋼線市場の見通し(2017年~2031年)

- 市場規模の分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- グレード別

- 製造技術別

- 用途別

- エンドユーザー別

- シェア:国別

- 各国の市場の評価

- 米国の冷間圧造用鋼線市場の見通し(2017年~2031年)

- カナダ

- メキシコ

第7章 欧州の冷間圧造用鋼線市場の見通し(2017年~2031年)

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第8章 アジア太平洋の冷間圧造用鋼線市場の見通し(2017年~2031年)

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第9章 南米の冷間圧造用鋼線市場の見通し(2017年~2031年)

- ブラジル

- アルゼンチン

第10章 中東・アフリカの冷間圧造用鋼線市場の見通し(2017年~2031年)

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第11章 ポーターのファイブフォース分析

第12章 PESTLE分析

第13章 価格分析

第14章 市場力学

- 市場促進要因

- 市場の課題

第15章 市場の動向と発展

第16章 ケーススタディ

第17章 競合情勢

- マーケットリーダー上位5社の競合マトリクス

- 上位5社のSWOT分析

- 上位10社の市場企業の主要企業の情勢

- Taubensee Steel & Wire Company

- ArcelorMittal SA

- Nippon Steel Corporation

- Syscon Wires Pvt. Ltd.

- Shanghai Metal Corporation

- Voestalpine Wire Germany GmbH

- Tata Steel Limited

- Precision Drawell Pvt Ltd.

- CMC Poland Sp. z o.o.

- Woosin Steel Corp.

- Sivaco Inc.

- Osaka Seiko, Ltd.

第18章 戦略的推奨

第19章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 3. Global Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 4. Global Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 5. Global Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 6. Global Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 7. Global Cold Heading Quality Wire Market Share (%), By Region, 2017-2031F

- Figure 8. North America Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 9. North America Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

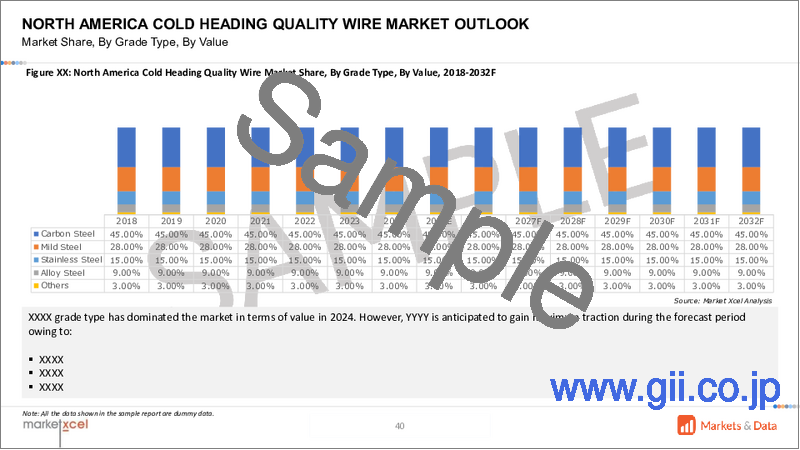

- Figure 10. North America Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 11. North America Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 12. North America Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 13. North America Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 14. North America Cold Heading Quality Wire Market Share (%), By Country, 2017-2031F

- Figure 15. United States Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 16. United States Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 17. United States Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 18. United States Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 19. United States Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 20. United States Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 21. Canada Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 22. Canada Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 23. Canada Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 24. Canada Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 25. Canada Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 26. Canada Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 27. Mexico Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 28. Mexico Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 29. Mexico Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 30. Mexico Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 31. Mexico Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 32. Mexico Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 33. Europe Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 34. Europe Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 35. Europe Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 36. Europe Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 37. Europe Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 38. Europe Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 39. Europe Cold Heading Quality Wire Market Share (%), By Country, 2017-2031F

- Figure 40. Germany Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 41. Germany Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 42. Germany Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 43. Germany Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 44. Germany Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 45. Germany Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 46. France Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 47. France Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 48. France Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 49. France Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 50. France Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 51. France Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 52. Italy Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 53. Italy Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 54. Italy Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 55. Italy Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 56. Italy Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 57. Italy Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 58. United Kingdom Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 59. United Kingdom Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 60. United Kingdom Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 61. United Kingdom Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 62. United Kingdom Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 63. United Kingdom Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 64. Russia Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 65. Russia Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 66. Russia Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 67. Russia Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 68. Russia Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 69. Russia Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 70. Netherlands Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 71. Netherlands Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 72. Netherlands Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 73. Netherlands Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 74. Netherlands Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 75. Netherlands Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 76. Spain Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 77. Spain Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 78. Spain Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 79. Spain Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 80. Spain Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 81. Spain Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 82. Turkey Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 83. Turkey Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 84. Turkey Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 85. Turkey Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 86. Turkey Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 87. Turkey Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 88. Poland Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 89. Poland Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 90. Poland Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 91. Poland Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 92. Poland Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 93. Poland Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 94. South America Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 95. South America Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 96. South America Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 97. South America Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 98. South America Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 99. South America Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 100. South America Cold Heading Quality Wire Market Share (%), By Country, 2017-2031F

- Figure 101. Brazil Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 102. Brazil Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 103. Brazil Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 104. Brazil Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 105. Brazil Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 106. Brazil Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 107. Argentina Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 108. Argentina Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 109. Argentina Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 110. Argentina Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 111. Argentina Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 112. Argentina Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 113. Asia-Pacific Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 114. Asia-Pacific Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 115. Asia-Pacific Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 116. Asia-Pacific Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 117. Asia-Pacific Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 118. Asia-Pacific Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 119. Asia-Pacific Cold Heading Quality Wire Market Share (%), By Country, 2017-2031F

- Figure 120. India Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 121. India Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 122. India Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 123. India Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 124. India Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 125. India Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 126. China Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 127. China Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 128. China Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 129. China Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 130. China Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 131. China Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 132. Japan Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 133. Japan Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 134. Japan Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 135. Japan Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 136. Japan Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 137. Japan Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 138. Australia Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 139. Australia Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 140. Australia Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 141. Australia Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 142. Australia Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 143. Australia Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 144. Vietnam Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 145. Vietnam Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 146. Vietnam Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 147. Vietnam Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 148. Vietnam Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 149. Vietnam Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 150. South Korea Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 151. South Korea Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 152. South Korea Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 153. South Korea Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 154. South Korea Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 155. South Korea Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 156. Indonesia Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 157. Indonesia Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 158. Indonesia Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 159. Indonesia Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 160. Indonesia Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 161. Indonesia Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 162. Philippines Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 163. Philippines Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 164. Philippines Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 165. Philippines Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 166. Philippines Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 167. Philippines Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 168. Middle East & Africa Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 169. Middle East & Africa Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 170. Middle East & Africa Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 171. Middle East & Africa Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 172. Middle East & Africa Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 173. Middle East & Africa Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 174. Middle East & Africa Cold Heading Quality Wire Market Share (%), By Country, 2017-2031F

- Figure 175. Saudi Arabia Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 176. Saudi Arabia Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 177. Saudi Arabia Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 178. Saudi Arabia Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 179. Saudi Arabia Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 180. Saudi Arabia Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 181. UAE Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 182. UAE Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 183. UAE Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 184. UAE Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 185. UAE Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 186. UAE Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 187. South Africa Cold Heading Quality Wire Market, By Value, In USD Billion, 2017-2031F

- Figure 188. South Africa Cold Heading Quality Wire Market, By Volume, In Million Tons, 2017-2031F

- Figure 189. South Africa Cold Heading Quality Wire Market Share (%), By Grade, 2017-2031F

- Figure 190. South Africa Cold Heading Quality Wire Market Share (%), By Manufacturing Technology, 2017-2031F

- Figure 191. South Africa Cold Heading Quality Wire Market Share (%), By Application, 2017-2031F

- Figure 192. South Africa Cold Heading Quality Wire Market Share (%), By End-user, 2017-2031F

- Figure 193. By Grade Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 194. By Manufacturing Technology Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 195. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 196. By End-user Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 197. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global cold heading quality wire market is projected to witness a CAGR of 2.93% during the forecast period 2024-2031, growing from USD 17.45 billion in 2023 to USD 21.99 billion in 2031.

CHQ wire is being used massively for the production of fasteners, automobile parts, and construction components. In addition, CHQ is highly appropriate for cold heading applications in the production of nuts, bolts, rivets, screws, nails, etc. As the quality and safety norms improve for hardware, the demand for high-performance fasteners made from CHQ wire is rising at an exponential rate. Asia-Pacific is considered one of the most promising markets, primarily due to India and China. The governments of the two countries stress the necessity to upgrade regulations and policies concerning the quality of wires utilized in cold heading.

For instance, in February 2024, the Bureau of Indian Standards (BIS) promulgated a Quality Control Order (QCO) for mild steel wires used in cold heading applications. The aim of this order is to fortify the enforcement of the prescribed Indian Standards to further improve the quality and safety of the steel product in view of the public's best interest. This development will increase the demand for quality raw materials for the production of products.

The rise in Demand for Fasteners is Propelling Market Growth Extensively

Automobile manufacture as well as infrastructural structures continue to enhance the requirement of fasteners worldwide. The rapid industrialization in manufacturing, construction, or automobiles - escalates the demand for strong fasteners. Improvements in technology have enhanced the strength and performance of such products due to which the demand for CHQ is high in the market. The demand for CHQ wire is due to the requirement of fasteners with high-performance capabilities regarding strapping tighter safety rules, quality standards, and an urge of manufacturers towards this kind of wire due to its reliability and durability, enhanced by the increasing emphasis on sustainability and customizing designs in a fastener. Moreover, due to the growing demand of industries for abrasion-resistant and lightweight construction material, the need for producing fasteners also arises.

For instance, in August 2024, Hangzhou Suntech Machinery Co., Ltd. of China announced to focus on spheroidizing the annealing processes for CHQ wires, which are crucial for the production of fasteners. This development will increase the demand for CHQ in the production of fasteners.

Increase in the Adoption of Cold Forged Parts Augments Market Growth

Cold-forged parts are prime products in the fastening and fixing industry which are produced from CHQ wires. CHQ has excellent properties like high durability, design flexibility, etc. CHQ wire is available with special designs for cold forged products so that manufacturers could produce highly efficient bolts, nuts, etc., The product manufactured from CHQ have excellent dimension accuracy and surface quality. The products of cold forging improve the mechanical properties of the wire, and the improvement itself permits the wire to work in extreme weather conditions.

For instance, in June 2024, India's Super Screws Pvt. Ltd., and Mitsuchi Corporation of Japan agreed to form a JV for manufacturing cold forged parts in India. Similarly, the manufacturing facility to be established in the country through this joint venture will cater not only to the needs of the country but also export into other markets around the world. The collaboration between Super Screws Pvt Ltd. and Mitsuchi Corporation is an amalgamation of Super Screws' outstanding capabilities in the engineering domain with highly sophisticated production techniques provided by Mitsuchi Corporation. The new program will give an upward curve to the growth rate in the use of cold-forged parts within the country and elsewhere in the world.

Additionally, in February 2024, CRU International Ltd launched a new European CHQ wire rod pricing assessment to meet the increasing demand for the fastener and fixing industry. The new CHQ wire rod assessment covers the 20MnB4 grade, defined by its chemical composition, including manganese with 0.90-1.00% and boron with 0.002-0.0004%. The core size of the products ranges between 5 mm to 15 mm.

Rapid Technological Developments of CHQ Wires to Fuel Market Growth

Companies around the world are also engineering technological advancements related to CHQ wires, which are manufactured using steel wires. The automotive and construction industries demand higher-grade material, and thus the technological advancements of CHQ wires have been recognized as inescapable in order to meet particular demands. Furthermore, these developments increase product reliability and allow manufacturers to reduce expenses connected with manufacturing processes.

For instance, in April 2024, at the Wire and Tube trade fair in Dusseldorf, Germany, ArcelorMittal showcased its latest developments in bars, rods, and wire solutions, thereby highlighting its determination to progress in the steel wire market. ArcelorMittal's drawing wire division, WireSolutions, presented an extensive product line that featured cold-heading quality materials. Moreover, ArcelorMittal announced that these products have been developed to keep up with the growing need for high-performance materials across a variety of industries such as construction, automotive sectors, etc.

Government Initiatives to Act as a Catalyst

Government policies and programs have been one of the key driving factors for the steel wire industry where CHQ wires are witnessing accelerated production. The framework of governmental regulation enhances competitiveness and is in synergy with greater objectives for economic development and infrastructure building. Therefore, the demand for these sectors at large would also lead to higher demand in the automotive, real estate, and construction sectors. These regulations encourage innovation and investment in new technology, which will enable manufacturers to improve their productions even more in the future. Moreover, with the concern of the future of this world due to the increase of environmental issues, government initiatives, which will fuel sustainable manufacturing, are becoming critical, thus increasing the demand for eco-friendly CHQ wire solutions. It meets all the regulatory requirements as well as the changing preferences of eco-aware consumers and companies.

In April 2023, the World Steel Association report indicated that steel consumption for 2023, including steel wire, rose by 2.3% to reach 1,822.3 million metric tons and is expected to grow at a rate of 1.7% to reach 1,854.0 million metric tons in 2024. The growth in steel wire consumption is fueled by the rising need for high-strength, lightweight materials and the continuous expansion of infrastructure projects, thereby enhancing CHQ wire's market potential.

Asia-Pacific to Emerge as a Market Leader

Cold heading quality wire has been consumed and produced mostly in Asia-Pacific due to the availability of ample steel resources in the region. It is also driven by the growing disposable income and infrastructural facilities, wherein the China is the largest consumer and producer of the products of steel. Additionally, steel wire production is crucial in China as it provides the necessary raw materials to produce CHQ wires with high adaptability and durability. Furthermore, the increased production rate of steel wire benefits the automotive and construction industries, which are the primary users of CHQ wire.

Furthermore, India has today emerged as one of the major steel wire manufacturing countries in this region and, nowadays, the country has become more concentrating on the consumption of steel wire rods for different applications in various industries such as automotive, construction, etc. According to Society of Indian Automobile Manufacturers (SIAM) states that in FY2024, the passenger vehicle (PV) segment in India witnessed impeccable growth, registering a massive 8.4% surge in sales, accounting for total sales of around 5 million units. The massive growth in PV sales has led to an increase in demand for forged automotive parts, which are produced from CHQ wires.

Future Market Scenario (2024 - 2031F)

The governments are focusing on the properties of CHQ wires, thereby making material suitable for usage in the aerospace and defense industry which in turn will lead to ample opportunities for market growth in the upcoming years.

Majorly all industries are prioritizing sustainability which is increasing the demand for lightweight and high-strength materials, The CHQ wire aligning with environmental goals which drive its demand in the market. Consequently, the shifting preferences are expected to create substantial opportunities for market growth in the forecast period.

Research and development (R&D) in CHQ wires is crucial in driving innovation and increasing product quality. Continuous R&D will enable the manufacturers to raise the level of strength, ductility, and performance of CHQ wires which opportunities for market expedition in the forecast period.

Furthermore, the rise in expenditure towards the development of construction projects is increasing the CHQ wire demand to manufacture nuts, bolts, and screws, which, in turn, is anticipated to provide a huge opportunity for market growth over the forecast period.

Key Players Landscape and Outlook

The market leaders of CHQ wires are continuously competing to gain a significant edge. These organizations are investing heavily in research and development activities for CHQ wires, leading to some of the most advanced wire manufacturing technologies. Moreover, the CHQ firms are getting involved in various strategic partnerships for the introduction of various steel wire projects, thereby increasing market competition.

In April 2024, Voestalpine Wire Germany GmbH, achieved a significant milestone by producing the world's first high-quality green wire rods made up of hydrogen-reduced pure iron and scrap at its Donawitz plant, which is crucial for CHQ wire manufacturing. The innovative process aims to reduce carbon emissions in wire production. Moreover, the resulting wire rod is characterized by exceptional hardness and wear resistance, thereby making it suitable for various applications.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customer

- 4.1. Respondent Demographics

- 4.2. Factors Considered in Purchase Decisions

- 4.2.1. Product Specification

- 4.2.2. Quality

- 4.2.3. Pricing

- 4.2.4. Brand Value

- 4.2.5. Lead Time

5. Global Cold Heading Quality Wire Market Outlook, 2017-2031F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Grade

- 5.2.1.1. Carbon Steel

- 5.2.1.2. Mild Steel

- 5.2.1.3. Stainless Steel

- 5.2.1.4. Alloy Steel

- 5.2.1.5. Others

- 5.2.2. By Manufacturing Technology

- 5.2.2.1. HRPPD ((Hot Rolled Pickling, Phosphating and Drawing)

- 5.2.2.2. SAPPD (Spherodized Annealed, Pickling, Phosphating and Drawing)

- 5.2.2.3. DAAPD (Drawing, Spherodized Annealed, Pickling, Phosphating and Final Drawing)

- 5.2.3. By Application

- 5.2.3.1. Cold Forged Parts

- 5.2.3.2. Fasteners

- 5.2.3.3. Bearing

- 5.2.3.4. Others

- 5.2.4. By End-user

- 5.2.4.1. Automotive

- 5.2.4.2. Furniture

- 5.2.4.3. Infrastructure and Construction

- 5.2.4.4. Industrial

- 5.2.4.5. Others

- 5.2.5. By Region

- 5.2.5.1. North America

- 5.2.5.2. Europe

- 5.2.5.3. Asia-Pacific

- 5.2.5.4. South America

- 5.2.5.5. Middle East and Africa

- 5.2.6. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2023)

- 5.2.1. By Grade

- 5.3. Market Map Analysis, 2023

- 5.3.1. By Grade

- 5.3.2. By Manufacturing Technology

- 5.3.3. By Application

- 5.3.4. By End-user

- 5.3.5. By Region

6. North America Cold Heading Quality Wire Market Outlook, 2017-2031F*

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis and Forecast

- 6.2.1. By Grade

- 6.2.1.1. Carbon Steel

- 6.2.1.2. Mild Steel

- 6.2.1.3. Stainless Steel

- 6.2.1.4. Alloy Steel

- 6.2.1.5. Others

- 6.2.2. By Manufacturing Technology

- 6.2.2.1. HRPPD (Hot Rolled Pickling, Phosphating and Drawing)

- 6.2.2.2. SAPPD (Spherodized Annealed, Pickling, Phosphating and Drawing)

- 6.2.2.3. DAAPD (Drawing, Spherodized Annealed, Pickling, Phosphating and Final Drawing)

- 6.2.3. By Application

- 6.2.3.1. Cold Forged Parts

- 6.2.3.2. Fasteners

- 6.2.3.3. Bearing

- 6.2.3.4. Others

- 6.2.4. By End-user

- 6.2.4.1. Automotive

- 6.2.4.2. Furniture

- 6.2.4.3. Infrastructure and Construction

- 6.2.4.4. Industrial

- 6.2.4.5. Others

- 6.2.5. By Country Share

- 6.2.5.1. United States

- 6.2.5.2. Canada

- 6.2.5.3. Mexico

- 6.2.1. By Grade

- 6.3. Country Market Assessment

- 6.3.1. United States Cold Heading Quality Wire Market Outlook, 2017-2031F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.1.2. By Volume

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Grade

- 6.3.1.2.1.1. Carbon Steel

- 6.3.1.2.1.2. Mild Steel

- 6.3.1.2.1.3. Stainless Steel

- 6.3.1.2.1.4. Alloy Steel

- 6.3.1.2.1.5. Others

- 6.3.1.2.2. By Manufacturing Technology

- 6.3.1.2.2.1. HRPPD (Hot Rolled Pickling, Phosphating and Drawing)

- 6.3.1.2.2.2. SAPPD (Spherodized Annealed, Pickling, Phosphating and Drawing)

- 6.3.1.2.2.3. DAPPD (Drawing, Spherodized Annealed, Pickling, Phosphating and Final Drawing)

- 6.3.1.2.3. By Application

- 6.3.1.2.3.1. Cold Forged Parts

- 6.3.1.2.3.2. Fasteners

- 6.3.1.2.3.3. Bearing

- 6.3.1.2.3.4. Others

- 6.3.1.2.4. By End-user

- 6.3.1.2.4.1. Automotive

- 6.3.1.2.4.2. Furniture

- 6.3.1.2.4.3. Infrastructure and Construction

- 6.3.1.2.4.4. Industrial

- 6.3.1.2.4.5. Others

- 6.3.1.2.1. By Grade

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Cold Heading Quality Wire Market Outlook, 2017-2031F*

All segments will be provided for all regions and countries covered

7. Europe Cold Heading Quality Wire Market Outlook, 2017-2031F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Cold Heading Quality Wire Market Outlook, 2017-2031F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Cold Heading Quality Wire Market Outlook, 2017-2031F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Cold Heading Quality Wire Market Outlook, 2017-2031F

- 10.1. Saudi Arabia

- 10.2. UAE

- 10.3. South Africa

11. Porter's Five Forces Analysis

12. PESTLE Analysis

13. Pricing Analysis

14. Market Dynamics

- 14.1. Market Drivers

- 14.2. Market Challenges

15. Market Trends and Developments

16. Case Studies

17. Competitive Landscape

- 17.1. Competition Matrix of Top 5 Market Leaders

- 17.2. SWOT Analysis for Top 5 Players

- 17.3. Key Players Landscape for Top 10 Market Players

- 17.3.1. Taubensee Steel & Wire Company

- 17.3.1.1. Company Details

- 17.3.1.2. Key Management Personnel

- 17.3.1.3. Products and Services

- 17.3.1.4. Financials (As Reported)

- 17.3.1.5. Key Market Focus and Geographical Presence

- 17.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 17.3.2. ArcelorMittal SA

- 17.3.3. Nippon Steel Corporation

- 17.3.4. Syscon Wires Pvt. Ltd.

- 17.3.5. Shanghai Metal Corporation

- 17.3.6. Voestalpine Wire Germany GmbH

- 17.3.7. Tata Steel Limited

- 17.3.8. Precision Drawell Pvt Ltd.

- 17.3.9. CMC Poland Sp. z o.o.

- 17.3.10. Woosin Steel Corp.

- 17.3.11. Sivaco Inc.

- 17.3.12. Osaka Seiko, Ltd.

- 17.3.1. Taubensee Steel & Wire Company

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.