|

|

市場調査レポート

商品コード

1498375

ペット用サプリメントの世界市場の評価:製品別、タイプ別、製品形状別、成分別、ペットタイプ別、用途別、価格帯別、エンドユーザー別、流通チャネル別、地域別、機会、予測(2017年~2031年)Pet Supplements Market Assessment, By Product, By Type, By Product Form, By Ingredients, By Pet Type, By Application, By Price Range, By End-user, By Distribution Channel, By Region, Opportunities, and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| ペット用サプリメントの世界市場の評価:製品別、タイプ別、製品形状別、成分別、ペットタイプ別、用途別、価格帯別、エンドユーザー別、流通チャネル別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年06月20日

発行: Markets & Data

ページ情報: 英文 244 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のペット用サプリメントの市場規模は、2023年に36億2,000万米ドルであり、2031年に56億6,000万米ドルに達すると予測され、2024年~2031年の予測期間にCAGRで5.7%の成長が見込まれます。市場は、世界中でペットの人間化が進んでいる動向によって大きく牽引されています。これは、ペットの飼い主と動物との絆がどのように変化したかに直結します。コンパニオンアニマルの飼い主は現在、ペットフードに「付加価値」を求めており、それは天然成分や栄養補助成分の添加に見出すことができます。基本的な押し出しや缶詰のペットフードでは、もはや十分ではないためです。2023年3月、栄養補助食品やハーブ製品を扱うZeon Lifesciencesは、ペットの関節と骨の健康、皮膚と被毛の健康、一般的な健康ニーズに対応する製品を揃えたペットケア製品群を発売しました。製品はスプレー、粉末、液体などのさまざまな形状で提供されています。

ペット用サプリメントは、ビタミン、ミネラル、抗酸化物質に加えて、ペットの健康の維持と成長をサポートする恩恵を提供することができます。ペットの特殊な健康上の必要性から、特定の栄養素を多く摂取する必要がある場合や、食事のバランスがよくない場合には、サプリメントが推奨されます。動物の全体的な消費を増やすために、ペット用サプリメントとして化合物が頻繁に使用されます。

愛犬の食事や健康を心配する人は、ここ数年で劇的に増えました。飼い主は、ペットフードやサプリメントの栄養や成分の表示をよく調べ、ペットに最良かつ適切なサプリメントを与えるようにしています。現在、メーカーはペットの健康状態を最大化するために、ソフトチューやジェルのようなより嗜好性の高い形状で、天然成分やオーガニック成分、ビタミン、必須脂肪、ハーブなどのペット用サプリメントを組み合わせたソリューションに注力しています。

2024年4月、Swedencareはペットのヘルス・ウェルネスのブランド、NaturVetを欧州の基準に従って立ち上げました。このブランドは約30年の歴史があり、新製品をポートフォリオに加え、市場にイノベーションを導入することに注力しています。

ペットの人間化が世界のペット用サプリメント市場の動向として勢いを増す

ペットの人間化の動向は、ペットの扱い方、世話の仕方、人間のライフスタイルへの取り込み方を大きく後押ししています。ペットが動物から愛する個体へと変化するにつれて、ペットの家庭での役割は進化し、ペットの飼い方、顧客の選好、市場力学の変化につながっています。人間化の1つは、家族単位でのペットの人気の拡大に反映されています。ペットはしばしば兄弟や親友とみなされ、飼い主は深い感情的な絆と愛着を形成します。感情的なつながりは、ペットの飼い主が、最高級の食品、ファッショナブルなアクセサリ、個別化医療とともに、彼らの仲間に優れた、実現可能なケアを提供したいという願望に沿ったサービスや製品を求める動機となります。

さらに、ペットの人間化は、人間と動物の欲望の境界を曖昧にし、ホスピタリティ、小売、医療などのさまざまな部門におけるペット中心のサービスや商品の開発に役立っています。ペットフレンドリーな宿泊施設や飲食店から、専門的な医療センターや治療パッケージまで、市場はペットやペット特有の要求に応えるペット用サプリメントの需要の高まりに応えています。2023年7月、Procemsa Groupは、ペットの人間化の動向の高まりを考慮し、犬用ビタミン剤、猫の消化器系の健康に向けたプロバイオティクス、ペットの関節のサポートに向けたフードサプリメント、気分調整スティックなどのペット用サプリメント製品群を発売しました。

ペットの心身の健康への関心の高まりが市場成長を促進

ペットの飼い主はペットを仲間と考え、家族の一員として扱います。そのため、ペットの心身の健康への注目が高まっています。さらに、獣医学の進歩、ペットの健康問題に対する人々の意識の高まり、ペットの人間化の動向が、ペットの心身の健康の重視につながっています。ペットの飼い主の間では予防医療が重要視されるようになり、彼らはペットのウェルビーイングを増進する製品を求めるようになっています。消費者行動の変化は、高級ペット用サプリメント製品に対する需要の高まりにつながっています。さらに、飼い主とペットの絆がますます強まる中、飼い主はペットの福祉と長寿を確保するためにペットに投資しています。2023年10月、Native Petは犬用の新しい多目的サプリメント、The Dailyを発売しました。この製品は、エネルギーの利用、被毛と皮膚の健康、腸の健康、その他の多くの効果を高めることを目的としています。

当レポートでは、世界のペット用サプリメント市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 顧客の声

- 人口統計(年齢/コホート分析 - ベビーブーマー世代、X世代、ミレニアル世代、Z世代、性別、所得 - 低所得、中所得、高所得、地域、国籍など)

- 市場の認知度と製品情報

- ブランド認知度とロイヤルティ

- 購入決定において考慮される要素

- ブランドの評判

- ペットの年齢

- 品質

- 効果

- ペットの安全と健康

- 成分と配合

- 包装と利便性

- ペットの選好とニーズ

- 環境と倫理に関する配慮

- コストパフォーマンス

- 可用性と入手性

- 購入目的

- 購入媒体

- 購入頻度

- 友人や家族からの推奨

- 製品/ブランドの浸透におけるブランドアンバサダーまたはインフルエンサーマーケティングの役割

第5章 世界のペット用サプリメント市場の見通し(2017年~2031年)

- 市場規模と予測

- 金額

- 数量

- 製品別

- 栄養補助食品

- 機能性食品

- 薬用食品

- その他

- タイプ別

- 処方

- OTC

- 製品形状別

- 錠剤

- チュアブル

- 粉末

- その他

- 材料別

- オーガニック

- 従来式

- ペットタイプ別

- 犬

- 猫

- 鳥類

- その他(ウサギ、モルモット、爬虫類)

- 用途別

- マルチビタミン

- 消化

- 皮膚、毛皮

- 股関節、関節

- プレバイオティクス、プロバイオティクス

- 沈静

- その他

- 価格帯別

- エコノミー

- プレミアム

- エンドユーザー別

- 家庭

- 商業

- 流通チャネル別

- オンライン

- オフライン

- 地域別

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

- 市場シェア:企業別(2023年)

第6章 世界のペット用サプリメント市場の見通し:地域別(2017年~2031年)

- 北米

- 市場規模と予測

- 製品別

- タイプ別

- 製品形状別

- 材料別

- ペットタイプ別

- 用途別

- 価格帯別

- エンドユーザー別

- 流通チャネル別

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

- 南米

- ブラジル

- アルゼンチン

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

第7章 市場マッピング(2023年)

- 製品別

- タイプ別

- 製品形状別

- 材料別

- ペットタイプ別

- 用途別

- 価格帯別

- エンドユーザー別

- 流通チャネル別

- 地域別

第8章 マクロ環境と産業構造

- 需給分析

- 輸入輸出分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第9章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第10章 主要企業の情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社の市場収益の分析(2023年)

- 合併と買収/合弁事業(該当する場合)

- SWOT分析(市場企業5社)

- 特許分析(該当する場合)

第11章 価格分析

第12章 ケーススタディ

第13章 主要企業の見通し

- Nestle S.A.

- FoodScience, LLC

- Tangerine Holdings Limited

- NOW Health Group, Inc.

- Virbac Group

- Zoetis Inc.

- Mars, Incorporated

- PetHonesty LLC

- Nutramax Laboratories, Inc.

- Zesty Paws, LLC

第14章 戦略的推奨

第15章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 3. Global Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 4. Global Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 5. Global Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 6. Global Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 7. Global Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 8. Global Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 9. Global Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 10. Global Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 11. Global Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 12. Global Pet Supplements Market Share (%), By Region, 2017-2031F

- Figure 13. North America Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 14. North America Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 15. North America Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 16. North America Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 17. North America Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 18. North America Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 19. North America Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 20. North America Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 21. North America Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 22. North America Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 23. North America Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 24. North America Pet Supplements Market Share (%), By Country, 2017-2031F

- Figure 25. United States Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 26. United States Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 27. United States Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 28. United States Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 29. United States Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 30. United States Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 31. United States Pet Supplements Market Share (%), By Pet Type, 2017-2031F

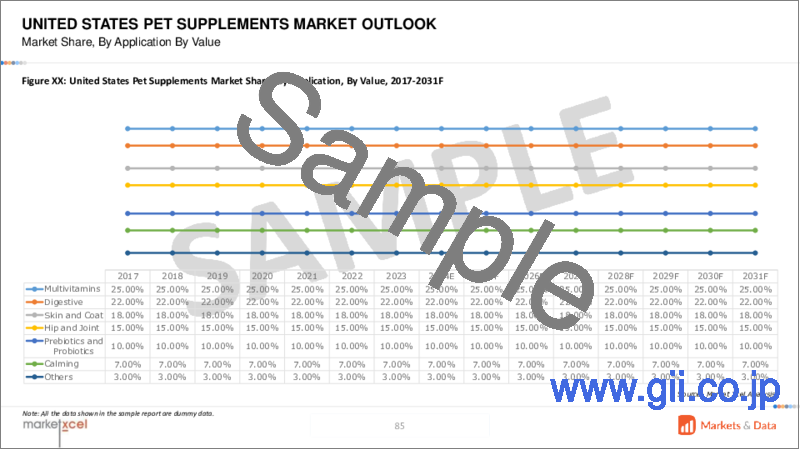

- Figure 32. United States Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 33. United States Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 34. United States Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 35. United States Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 36. Canada Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 37. Canada Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 38. Canada Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 39. Canada Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 40. Canada Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 41. Canada Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 42. Canada Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 43. Canada Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 44. Canada Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 45. Canada Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 46. Canada Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 47. Mexico Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 48. Mexico Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 49. Mexico Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 50. Mexico Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 51. Mexico Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 52. Mexico Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 53. Mexico Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 54. Mexico Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 55. Mexico Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 56. Mexico Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 57. Mexico Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 58. Europe Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 59. Europe Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 60. Europe Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 61. Europe Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 62. Europe Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 63. Europe Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 64. Europe Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 65. Europe Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 66. Europe Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 67. Europe Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 68. Europe Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 69. Europe Pet Supplements Market Share (%), By Country, 2017-2031F

- Figure 70. Germany Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 71. Germany Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 72. Germany Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 73. Germany Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 74. Germany Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 75. Germany Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 76. Germany Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 77. Germany Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 78. Germany Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 79. Germany Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 80. Germany Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 81. France Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 82. France Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 83. France Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 84. France Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 85. France Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 86. France Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 87. France Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 88. France Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 89. France Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 90. France Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 91. France Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 92. Italy Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 93. Italy Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 94. Italy Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 95. Italy Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 96. Italy Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 97. Italy Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 98. Italy Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 99. Italy Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 100. Italy Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 101. Italy Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 102. Italy Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 103. United Kingdom Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 104. United Kingdom Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 105. United Kingdom Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 106. United Kingdom Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 107. United Kingdom Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 108. United Kingdom Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 109. United Kingdom Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 110. United Kingdom Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 111. United Kingdom Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 112. United Kingdom Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 113. United Kingdom Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 114. Russia Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 115. Russia Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 116. Russia Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 117. Russia Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 118. Russia Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 119. Russia Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 120. Russia Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 121. Russia Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 122. Russia Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 123. Russia Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 124. Russia Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 125. Netherlands Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 126. Netherlands Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 127. Netherlands Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 128. Netherlands Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 129. Netherlands Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 130. Netherlands Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 131. Netherlands Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 132. Netherlands Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 133. Netherlands Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 134. Netherlands Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 135. Netherlands Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 136. Spain Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 137. Spain Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 138. Spain Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 139. Spain Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 140. Spain Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 141. Spain Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 142. Spain Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 143. Spain Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 144. Spain Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 145. Spain Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 146. Spain Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 147. Turkey Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 148. Turkey Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 149. Turkey Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 150. Turkey Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 151. Turkey Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 152. Turkey Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 153. Turkey Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 154. Turkey Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 155. Turkey Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 156. Turkey Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 157. Turkey Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 158. Poland Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 159. Poland Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 160. Poland Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 161. Poland Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 162. Poland Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 163. Poland Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 164. Poland Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 165. Poland Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 166. Poland Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 167. Poland Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 168. Poland Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 169. South America Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 170. South America Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 171. South America Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 172. South America Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 173. South America Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 174. South America Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 175. South America Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 176. South America Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 177. South America Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 178. South America Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 179. South America Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 180. South America Pet Supplements Market Share (%), By Country, 2017-2031F

- Figure 181. Brazil Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 182. Brazil Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 183. Brazil Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 184. Brazil Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 185. Brazil Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 186. Brazil Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 187. Brazil Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 188. Brazil Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 189. Brazil Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 190. Brazil Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 191. Brazil Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 192. Argentina Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 193. Argentina Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 194. Argentina Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 195. Argentina Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 196. Argentina Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 197. Argentina Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 198. Argentina Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 199. Argentina Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 200. Argentina Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 201. Argentina Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 202. Argentina Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 203. Asia-Pacific Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 204. Asia-Pacific Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 205. Asia-Pacific Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 206. Asia-Pacific Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 207. Asia-Pacific Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 208. Asia-Pacific Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 209. Asia-Pacific Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 210. Asia-Pacific Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 211. Asia-Pacific Pet Supplements Market Share (%), By Price Range, 2016-2030

- Figure 212. Asia-Pacific Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 213. Asia-Pacific Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 214. Asia-Pacific Pet Supplements Market Share (%), By Country, 2017-2031F

- Figure 215. India Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 216. India Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 217. India Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 218. India Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 219. India Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 220. India Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 221. India Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 222. India Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 223. India Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 224. India Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 225. India Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 226. China Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 227. China Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 228. China Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 229. China Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 230. China Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 231. China Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 232. China Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 233. China Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 234. China Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 235. China Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 236. China Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 237. Japan Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 238. Japan Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 239. Japan Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 240. Japan Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 241. Japan Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 242. Japan Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 243. Japan Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 244. Japan Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 245. Japan Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 246. Japan Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 247. Japan Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 248. Australia Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 249. Australia Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 250. Australia Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 251. Australia Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 252. Australia Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 253. Australia Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 254. Australia Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 255. Australia Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 256. Australia Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 257. Australia Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 258. Australia Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 259. Vietnam Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 260. Vietnam Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 261. Vietnam Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 262. Vietnam Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 263. Vietnam Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 264. Vietnam Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 265. Vietnam Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 266. Vietnam Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 267. Vietnam Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 268. Vietnam Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 269. Vietnam Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 270. South Korea Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 271. South Korea Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 272. South Korea Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 273. South Korea Pet Supplements Market Share (%), By Type, 2017-2031F\

- Figure 274. South Korea Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 275. South Korea Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 276. South Korea Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 277. South Korea Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 278. South Korea Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 279. South Korea Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 280. South Korea Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 281. Indonesia Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 282. Indonesia Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 283. Indonesia Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 284. Indonesia Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 285. Indonesia Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 286. Indonesia Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 287. Indonesia Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 288. Indonesia Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 289. Indonesia Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 290. Indonesia Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 291. Indonesia Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 292. Philippines Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 293. Philippines Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 294. Philippines Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 295. Philippines Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 296. Philippines Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 297. Philippines Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 298. Philippines Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 299. Philippines Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 300. Philippines Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 301. Philippines Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 302. Philippines Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 303. Middle East & Africa Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 304. Middle East & Africa Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 305. Middle East & Africa Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 306. Middle East & Africa Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 307. Middle East & Africa Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 308. Middle East & Africa Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 309. Middle East & Africa Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 310. Middle East & Africa Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 311. Middle East & Africa Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 312. Middle East & Africa Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 313. Middle East & Africa Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 314. Middle East & Africa Pet Supplements Market Share (%), By Country, 2017-2031F

- Figure 315. Saudi Arabia Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 316. Saudi Arabia Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 317. Saudi Arabia Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 318. Saudi Arabia Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 319. Saudi Arabia Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 320. Saudi Arabia Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 321. Saudi Arabia Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 322. Saudi Arabia Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 323. Saudi Arabia Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 324. Saudi Arabia Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 325. Saudi Arabia Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 326. UAE Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 327. UAE Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 328. UAE Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 329. UAE Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 330. UAE Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 331. UAE Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 332. UAE Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 333. UAE Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 334. UAE Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 335. UAE Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 336. UAE Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 337. South Africa Pet Supplements Market, By Value, In USD Billion, 2017-2031F

- Figure 338. South Africa Pet Supplements Market, By Volume, In Units, 2017-2031F

- Figure 339. South Africa Pet Supplements Market Share (%), By Product, 2017-2031F

- Figure 340. South Africa Pet Supplements Market Share (%), By Type, 2017-2031F

- Figure 341. South Africa Pet Supplements Market Share (%), By Product Form, 2017-2031F

- Figure 342. South Africa Pet Supplements Market Share (%), By Ingredients, 2017-2031F

- Figure 343. South Africa Pet Supplements Market Share (%), By Pet Type, 2017-2031F

- Figure 344. South Africa Pet Supplements Market Share (%), By Application, 2017-2031F

- Figure 345. South Africa Pet Supplements Market Share (%), By Price Range, 2017-2031F

- Figure 346. South Africa Pet Supplements Market Share (%), By End-user, 2017-2031F

- Figure 347. South Africa Pet Supplements Market Share (%), By Distribution Channel, 2017-2031F

- Figure 348. By Product Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 349. By Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 350. By Product Form Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 351. By Ingredients Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 352. By Pet Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 353. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 354. By Price Range Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 355. By End-user Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 356. By Distribution Channel Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 357. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global pet supplements market was valued at USD 3.62 billion in 2023, expected to reach USD 5.66 billion in 2031, with a CAGR of 5.7% for the forecast period between 2024 and 2031. The market is majorly driven by the rising trend of pet humanization across the globe. It directly relates to how the bond between pet owners and their animals has changed. Owners of companion animals now look for "added value" in pet food, which can be found in the addition of natural ingredients and nutraceuticals, as basic extruded or canned meals are no longer sufficient for their needs. In March 2023, nutraceuticals and herbal products company, Zeon Lifesciences, launched its pet care product range with products catering to joint and bone health, skin, and coat health, along with general wellness needs of pets. The products are available in multiple forms such as sprays, powders, and liquids.

Pet supplements, in addition to vitamins, minerals, and antioxidants, can offer advantages that support the maintenance and growth of pets' health. If the pet's special health requirements call for a greater intake of a certain nutrient or if their diet isn't well-balanced, a supplement can be recommended. Compounds are frequently used as pet supplements to increase the animal's overall consumption.

The number of people who are worried about food and the health of their dogs has increased dramatically in the past several years. Owners closely examine the nutritional and component labels on pet food and supplements to ensure that their pets get the best and most appropriate supplements available. Currently, the manufacturers are focusing mostly on natural and organic ingredients in more palatable forms, such as soft chews and gels, as well as combination solutions that combine vitamins, essential fats, herbs, and other pet supplements to maximize the health conditions of their pets.

In April 2024, Swedencare launched its pet health and wellness brand, NaturVet, in Europe, according to the standards in the region. The brand is about 30 years old and focuses on adding new products to its portfolio and introducing innovations to the market.

Pet Humanization to Gain Acceleration as Global Pet Supplements Market Trend

The pet humanization trend has greatly encouraged how pets are dealt with, cared for, and included in human lifestyles. As pets transition from animals to beloved individuals, their household roles have evolved, leading to shifts in pet possession practices, customer preferences, and market dynamics. One thing of humanization is reflected in the extended popularity of pets in the family unit. They are frequently regarded as siblings or confidants, with owners forming deep emotional bonds and attachments. The emotional connection drives pet owners to seek services and products that align with their desire to provide excellent, feasible care for their companions, together with top-class food, fashionable accessories, and personalized healthcare.

Furthermore, the humanization of pets has blurred the boundaries between human and animal desires, helping to develop pet-centric services and offerings in diverse sectors, such as hospitality, retail, and healthcare. From pet-friendly accommodations and eating places to specialized healthcare centers and remedy packages, the market has responded to the rising demand for pet supplements that cater to pets and their specific requirements. In July 2023, considering the growing trend of pet humanization, Procemsa Group launched its range of supplements for pets, including dog vitamins, probiotics for the digestive well-being of cats, food supplements for joint support in pets, and mood-regulation sticks, among others.

Increasing Focus on Pet Health and Wellness Fuels the Market Growth

Pet owners consider their pets as companions and treat them as family members. It leads to an increased focus on the health and wellness of pets. Furthermore, advancements in veterinary science, growing awareness among people regarding the health issues of their pets, and pet humanization trends have led to an increased emphasis on pet health and wellness. Preventive healthcare is becoming relevant among pet owners, and they seek products that enhance the well-being of their pets. The change in consumer behavior has led to a growing demand for premium pet supplement products. Moreover, with the ever-strengthening bond between pet owners and their pets, pet owners invest in their pets to ensure their welfare and longevity. In October 2023, Native Pet launched a new multipurpose supplement for dogs, The Daily, in powder form containing active ingredients with whole food sources and no additives. The product aims to enhance the utilization of energy, coat and skin health, gut health, and many other benefits.

Dog Supplements Hold the Largest Market Share

Dog supplements represent the largest segment within the global pet supplements market, reflecting the increasing emphasis on canine health and well-being of dogs worldwide. Rising pet ownership rates, especially in developed regions, have led to higher spending on pet health products. Additionally, advancements in veterinary medicine and pet nutrition have expanded the range of supplements available, catering to specific health concerns of dogs such as allergies, stress, and joint stiffness. Furthermore, the rising trend of humanization of pets contributes significantly to the market expansion. Many pet owners view their dogs as family members and are willing to invest in premium supplements to ensure their pets lead healthy and active lives. The emotional connection drives the demand for innovative and premium-quality products in the dog supplement segment.

In December 2023, Arterra, a new dog supplement brand, was launched to set a new industry standard and help dogs live happier, healthier, and longer lives. The firm sells a number of advanced vitamins specifically meant to slow down dogs' aging process.

North America to Dominate the Global Pet Supplements Market Share

North America has a substantial share due to one of the highest pet ownership rates in the world. Due to the region's strong consumer buying power, pet owners can invest significant money in pet care, especially in high-quality supplements, which fuels the industry's growth. Furthermore, pet owners in North America have access to a wealth of information regarding pet health, which promotes a greater understanding of the advantages of supplements. The existence of top-notch veterinary organizations encourages supplement use as a crucial component of pet care. Leading producers of pet supplements, which continuously do research and development to meet a wide range of pet demands, are based in North America.

The regulatory structure in the region guarantees compliance with particular safety and efficacy criteria, thereby fostering customer confidence and promoting market expansion. In April 2024, Cymbiotika, a San Diego-based brand specializing in health and wellness, introduced a new product line named Cymbiotika Pets. The line offers supplements specifically formulated to support and improve the health and vitality of dogs. The products include four types of soft chew supplements: Dog's Allergy & Immune Health, Dog's Calm, Dog's Hip & Joint, and Dog's Probiotic+.

Future Market Scenario (2024 - 2031F)

The pet supplements market is experiencing regular growth, pushed by growing pet possession rates, growing consciousness of pet health, and advancements in the science of pet nutrition.

With rising demand for specialized and premium merchandise, pet supplement producers can expand their services to include a wider range of formulations targeting precise fitness concerns and varied age groups.

With growing emphasis on sustainability and ethical sourcing, there may be a shift towards green packaging, cruelty-free ingredients, and transparent supply chains in the pet supplements industry.

Key Players Landscape and Outlook

The pet dietary supplements market landscape consists of several key players, including market giants, acknowledged for their significant product portfolios and international reach. Alongside these established manufacturers, niche and strong point players have emerged, imparting modern formulations and focused on unique pet fitness requirements. The market is expected to witness sustained growth pushed through the growing rate of pet possession and a growing focus on pet health and wellness. Prominent players are probable to invest in studies and product improvement, advertising and marketing techniques, and strategic collaborations to capitalize on emerging possibilities and maintain their aggressive positions in this dynamic and evolving marketplace.

In April 2024, VetPlus, owned by Tangerine Holdings Limited, launched a new product, Sustain for Cats, the first feline veterinary product in the United Kingdom. This product is a combination of postbiotics, probiotics, and prebiotics, helping cats maintain immune and gastrointestinal health. The company also launched another product, Gomega for Cats, helping cats with their cardiovascular and kidney health.

Table of Contents

1. Research Methodology

2. Project Scope and Definitions

3. Executive Summary

4. Voice of Customer

- 4.1. Demographics (Age/Cohort Analysis - Baby Boomers and Gen X, Millennials, Gen Z; Gender; Income - Low, Mid, and High; Geography; Nationality; etc.)

- 4.2. Market Awareness and Product Information

- 4.3. Brand Awareness and Loyalty

- 4.4. Factors Considered in Purchase Decision

- 4.4.1. Brand Reputation

- 4.4.2. Pet's Age

- 4.4.3. Quality

- 4.4.4. Effectiveness

- 4.4.5. Pet Safety and Health

- 4.4.6. Ingredients and Formulation

- 4.4.7. Packaging and Convenience

- 4.4.8. Pet Preferences and Needs

- 4.4.9. Environmental and Ethical Considerations

- 4.4.10. Value for Money

- 4.4.11. Availability and Accessibility

- 4.5. Purpose of Purchase

- 4.6. Medium of Purchase

- 4.7. Frequency of Purchase

- 4.8. Recommendations From Friends/Family

- 4.9. Role of Brand Ambassador or Influencer Marketing on Product/Brand Absorption.

5. Global Pet Supplements Market Outlook, 2017-2031F

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. By Product

- 5.2.1. Dietary Supplements

- 5.2.2. Functional Foods

- 5.2.3. Medicinal Foods

- 5.2.4. Others

- 5.3. By Type

- 5.3.1. Prescription

- 5.3.2. Over the Counter

- 5.4. By Product Form

- 5.4.1. Pills

- 5.4.2. Chewables

- 5.4.3. Powders

- 5.4.4. Others

- 5.5. By Ingredients

- 5.5.1. Organic

- 5.5.2. Conventional

- 5.6. By Pet Type

- 5.6.1. Dogs

- 5.6.2. Cats

- 5.6.3. Birds

- 5.6.4. Others (Rabbits, Guinea Pigs, Reptiles)

- 5.7. By Application

- 5.7.1. Multivitamins

- 5.7.2. Digestive

- 5.7.3. Skin and Coat

- 5.7.4. Hip and Joint

- 5.7.5. Prebiotics and Probiotics

- 5.7.6. Calming

- 5.7.7. Others

- 5.8. By Price Range

- 5.8.1. Economy

- 5.8.2. Premium

- 5.9. By End-user

- 5.9.1. Household

- 5.9.2. Commercial

- 5.9.2.1. Veterinary Hospitals and Clinics

- 5.9.2.2. Breeders and Trainers

- 5.9.2.3. Others

- 5.10. By Distribution Channel

- 5.10.1. Online

- 5.10.1.1. Company Owned Website

- 5.10.1.2. E-commerce Website

- 5.10.2. Offline

- 5.10.2.1. Medical Stores and Pharmacies

- 5.10.2.2. Veterinary Hospitals and Clinics

- 5.10.2.3. Hypermarkets/Supermarkets

- 5.10.2.4. Pet Stores

- 5.10.2.5. Others

- 5.10.1. Online

- 5.11. By Region

- 5.11.1. North America

- 5.11.2. Europe

- 5.11.3. South America

- 5.11.4. Asia-Pacific

- 5.11.5. Middle East and Africa

- 5.12. By Company Market Share (%), 2023

6. Global Pet Supplements Market Outlook, By Region, 2017-2031F

- 6.1. North America*

- 6.1.1. Market Size & Forecast

- 6.1.1.1. By Value

- 6.1.1.2. By Volume

- 6.1.2. By Product

- 6.1.2.1. Dietary Supplements

- 6.1.2.2. Functional Foods

- 6.1.2.3. Medicinal Foods

- 6.1.2.4. Others

- 6.1.3. By Type

- 6.1.3.1. Prescription

- 6.1.3.2. Over the Counter

- 6.1.4. By Product Form

- 6.1.4.1. Pills

- 6.1.4.2. Chewables

- 6.1.4.3. Powders

- 6.1.4.4. Others

- 6.1.5. By Ingredients

- 6.1.5.1. Organic

- 6.1.5.2. Conventional

- 6.1.6. By Pet Type

- 6.1.6.1. Dogs

- 6.1.6.2. Cats

- 6.1.6.3. Birds

- 6.1.6.4. Others (Rabbits, Guinea Pigs, Reptiles)

- 6.1.7. By Application

- 6.1.7.1. Multivitamins

- 6.1.7.2. Digestive

- 6.1.7.3. Skin and Coat

- 6.1.7.4. Hip and Joint

- 6.1.7.5. Prebiotics and Probiotics

- 6.1.7.6. Calming

- 6.1.7.7. Others

- 6.1.8. By Price Range

- 6.1.8.1. Economy

- 6.1.8.2. Premium

- 6.1.9. By End-user

- 6.1.9.1. Household

- 6.1.9.2. Commercial

- 6.1.9.2.1. Veterinary Hospitals and Clinics

- 6.1.9.2.2. Breeders and Trainers

- 6.1.9.2.3. Others

- 6.1.10. By Distribution Channel

- 6.1.10.1. Online

- 6.1.10.1.1. Company Owned Website

- 6.1.10.1.2. E-commerce Website

- 6.1.10.2. Offline

- 6.1.10.2.1. Medical Stores and Pharmacies

- 6.1.10.2.2. Veterinary Hospitals and Clinics

- 6.1.10.2.3. Hypermarkets/Supermarkets

- 6.1.10.2.4. Pet Stores

- 6.1.10.2.5. Others

- 6.1.10.1. Online

- 6.1.11. United States*

- 6.1.11.1. Market Size & Forecast

- 6.1.11.1.1. By Value

- 6.1.11.1.2. By Volume

- 6.1.11.2. By Product

- 6.1.11.2.1. Dietary Supplements

- 6.1.11.2.2. Functional Foods

- 6.1.11.2.3. Medicinal Foods

- 6.1.11.2.4. Others

- 6.1.11.3. By Type

- 6.1.11.3.1. Prescription

- 6.1.11.3.2. Over the Counter

- 6.1.11.4. By Product Form

- 6.1.11.4.1. Pills

- 6.1.11.4.2. Chewables

- 6.1.11.4.3. Powders

- 6.1.11.4.4. Others

- 6.1.11.5. By Ingredients

- 6.1.11.5.1. Organic

- 6.1.11.5.2. Conventional

- 6.1.11.6. By Pet Type

- 6.1.11.6.1. Dogs

- 6.1.11.6.2. Cats

- 6.1.11.6.3. Birds

- 6.1.11.6.4. Others (Rabbits, Guinea Pigs, Reptiles)

- 6.1.11.7. By Application

- 6.1.11.7.1. Multivitamins

- 6.1.11.7.2. Digestive

- 6.1.11.7.3. Skin and Coat

- 6.1.11.7.4. Hip and Joint

- 6.1.11.7.5. Prebiotics and Probiotics

- 6.1.11.7.6. Calming

- 6.1.11.7.7. Others

- 6.1.11.8. By Price Range

- 6.1.11.8.1. Economy

- 6.1.11.8.2. Premium

- 6.1.11.9. By End-user

- 6.1.11.9.1. Household

- 6.1.11.9.2. Commercial

- 6.1.11.9.2.1. Veterinary Hospitals and Clinics

- 6.1.11.9.2.2. Breeders and Trainers

- 6.1.11.9.2.3. Others

- 6.1.11.10. By Distribution Channel

- 6.1.11.10.1. Online

- 6.1.11.10.1.1. Company Owned Website

- 6.1.11.10.1.2. E-commerce Website

- 6.1.11.10.2. Offline

- 6.1.11.10.2.1. Medical Stores and Pharmacies

- 6.1.11.10.2.2. Veterinary Hospitals and Clinics

- 6.1.11.10.2.3. Hypermarkets/Supermarkets

- 6.1.11.10.2.4. Pet Stores

- 6.1.11.10.2.5. Others

- 6.1.11.10.1. Online

- 6.1.11.1. Market Size & Forecast

- 6.1.12. Canada

- 6.1.13. Mexico

- 6.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 6.2. Europe

- 6.2.1. Germany

- 6.2.2. France

- 6.2.3. Italy

- 6.2.4. United Kingdom

- 6.2.5. Russia

- 6.2.6. Netherlands

- 6.2.7. Spain

- 6.2.8. Turkey

- 6.2.9. Poland

- 6.3. South America

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.4. Asia-Pacific

- 6.4.1. India

- 6.4.2. China

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Vietnam

- 6.4.6. South Korea

- 6.4.7. Indonesia

- 6.4.8. Philippines

- 6.5. Middle East and Africa

- 6.5.1. UAE

- 6.5.2. Saudi Arabia

- 6.5.3. South Africa

7. Market Mapping, 2023

- 7.1. By Product

- 7.2. By Type

- 7.3. By Product Form

- 7.4. By Ingredients

- 7.5. By Pet Type

- 7.6. By Application

- 7.7. By Price Range

- 7.8. By End-user

- 7.9. By Distribution Channel

- 7.10. By Region

8. Macro Environment and Industry Structure

- 8.1. Supply Demand Analysis

- 8.2. Import Export Analysis

- 8.3. Value Chain Analysis

- 8.4. PESTEL Analysis

- 8.4.1. Political Factors

- 8.4.2. Economic System

- 8.4.3. Social Implications

- 8.4.4. Technological Advancements

- 8.4.5. Environmental Impacts

- 8.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 8.5. Porter's Five Forces Analysis

- 8.5.1. Supplier Power

- 8.5.2. Buyer Power

- 8.5.3. Substitution Threat

- 8.5.4. Threat from New Entrant

- 8.5.5. Competitive Rivalry

9. Market Dynamics

- 9.1. Growth Drivers

- 9.2. Growth Inhibitors (Challenges and Restraints)

10. Key Players Landscape

- 10.1. Competition Matrix of Top Five Market Leaders

- 10.2. Market Revenue Analysis of Top Five Market Leaders (By Value, 2023)

- 10.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4. SWOT Analysis (For Five Market Players)

- 10.5. Patent Analysis (If Applicable)

11. Pricing Analysis

12. Case Studies

13. Key Players Outlook

- 13.1. Nestle S.A.

- 13.1.1. Company Details

- 13.1.2. Key Management Personnel

- 13.1.3. Products and Services

- 13.1.4. Financials (As reported)

- 13.1.5. Key Market Focus and Geographical Presence

- 13.1.6. Recent Developments

- 13.2. FoodScience, LLC

- 13.3. Tangerine Holdings Limited

- 13.4. NOW Health Group, Inc.

- 13.5. Virbac Group

- 13.6. Zoetis Inc.

- 13.7. Mars, Incorporated

- 13.8. PetHonesty LLC

- 13.9. Nutramax Laboratories, Inc.

- 13.10. Zesty Paws, LLC

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work