|

|

市場調査レポート

商品コード

1479073

昆虫由来ペットフード市場:原料別、カテゴリー別、フードタイプ別、包装タイプ別、価格帯別、エンドユーザー別、流通チャネル別、地域別、機会、予測、2017年~2031年Insect Based Pet Food Market Assessment, By Source, By Category, By Food Type, By Packaging Type, By Price Range, By End-user, By Distribution Channel, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 昆虫由来ペットフード市場:原料別、カテゴリー別、フードタイプ別、包装タイプ別、価格帯別、エンドユーザー別、流通チャネル別、地域別、機会、予測、2017年~2031年 |

|

出版日: 2024年05月14日

発行: Markets & Data

ページ情報: 英文 215 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の昆虫由来ペットフードの市場規模は、予測期間の2024年~2031年に8.6%のCAGRで拡大し、2023年の48億3,000万米ドルから2031年には93億4,000万米ドルに成長すると予測されています。人気のある家畜種をベースとしない食事を与えたいと考える飼い主にとって、昆虫由来ペットフードは素晴らしい選択肢です。ペットフード事業では、ミールワーム、コオロギ、ブラックアーミーフライの幼虫など、昆虫をペットのタンパク源として利用するケースが増えています。

昆虫由来製品は、さまざまな食事条件や嗜好に対応できるよう、さまざまな形態で販売されています。また、この業界では、ペットの栄養をカスタマイズし、専門化する傾向が顕著です。企業は昆虫原料の調達と生産方法を強調し、業界が持続可能性と透明性を重視するようになっていることを示しています。

Rabobankの分析によると、動物用食品を原料とする昆虫タンパク質の需要は、2021年から4,900%増加し、10年後には50万トンに達する可能性があります。昆虫にはミネラル、ビタミン、タンパク質が豊富に含まれており、昆虫由来ペットフードは栄養価が高いだけでなく環境にも優しいです。最新の市場動向は、著名なペットフード企業による製品開発、ペットフードメーカーと昆虫養殖を実践する企業との提携、昆虫を使ったペットフード製品の人気上昇です。こうした持続可能で栄養価の高い食品は市場で需要が高まっており、市場の将来展望は革新と拡大の可能性に満ちています。

当レポートでは、世界の昆虫由来ペットフード市場について調査し、市場の概要とともに、原料別、カテゴリー別、フードタイプ別、包装タイプ別、価格帯別、エンドユーザー別、流通チャネル別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の昆虫由来ペットフード市場の見通し、2017年~2031年

- 市場規模と予測

- 原料別

- カテゴリー別

- フードタイプ別

- 包装タイプ別

- 価格帯別

- エンドユーザー別

- 流通チャネル別

- 地域別

- 企業別市場シェア(%)、2023年

第6章 世界の昆虫由来ペットフード市場の見通し、地域別、2017年~2031年

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

第7章 市場マッピング、2023年

第8章 マクロ環境と産業構造

- 供給需要分析

- 輸出入分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第9章 市場力学

第10章 主要参入企業の情勢

第11章 価格分析

第12章 ケーススタディ

第13章 主要参入企業の見通し

- Innovafeed SAS

- Mars, Incorporated

- Nestle S.A.

- Ynsect (SAS)

- Entobel Holdings PTE

- Protix B.V.

- nextProtein SA

- Buhler AG

- Symply Pet Foods Limited

- Jiminy's, LLC

第14章 戦略的提言

第15章 お問い合わせと免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1.Global Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 2.Global Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 3.Global Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 4.Global Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 5.Global Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 6.Global Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 7.Global Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 8.Global Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 9.Global Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 10.Global Insect Based Pet Food Market Share (%), By Region, 2017-2031F

- Figure 11.North America Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 12.North America Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 13.North America Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 14.North America Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 15.North America Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 16.North America Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 17.North America Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 18.North America Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 19.North America Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

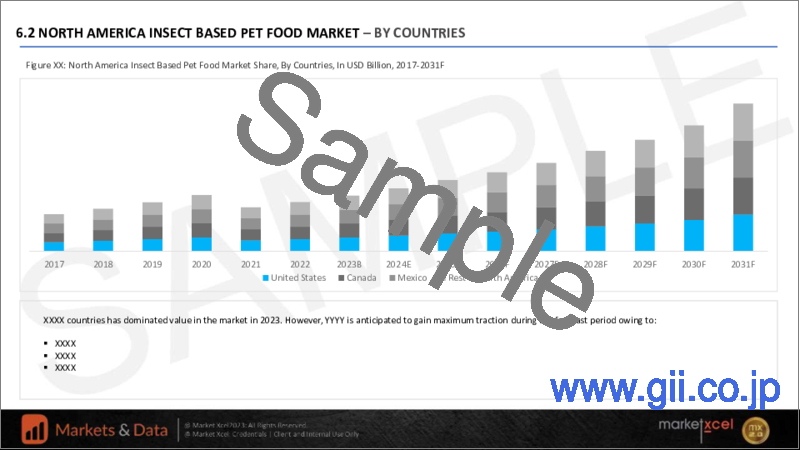

- Figure 20.North America Insect Based Pet Food Market Share (%), By Country, 2017-2031F

- Figure 21.United States Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 22.United States Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 23.United States Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 24.United States Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 25.United States Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 26.United States Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 27.United States Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 28.United States Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 29.United States Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 30.Canada Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 31.Canada Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 32.Canada Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 33.Canada Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 34.Canada Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 35.Canada Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 36.Canada Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 37.Canada Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 38.Canada Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 39.Mexico Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 40.Mexico Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 41.Mexico Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 42.Mexico Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 43.Mexico Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 44.Mexico Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 45.Mexico Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 46.Mexico Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 47.Mexico Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 48.Europe Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 49.Europe Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 50.Europe Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 51.Europe Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 52.Europe Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 53.Europe Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 54.Europe Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 55.Europe Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 56.Europe Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 57.Europe Insect Based Pet Food Market Share (%), By Country, 2017-2031F

- Figure 58.Germany Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 59.Germany Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 60.Germany Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 61.Germany Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 62.Germany Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 63.Germany Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 64.Germany Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 65.Germany Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 66.Germany Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 67.France Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 68.France Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 69.France Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 70.France Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 71.France Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 72.France Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 73.France Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 74.France Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 75.France Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 76.Italy Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 77.Italy Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 78.Italy Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 79.Italy Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 80.Italy Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 81.Italy Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 82.Italy Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 83.Italy Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 84.Italy Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 85.United Kingdom Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 86.United Kingdom Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 87.United Kingdom Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 88.United Kingdom Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 89.United Kingdom Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 90.United Kingdom Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 91.United Kingdom Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 92.United Kingdom Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 93.United Kingdom Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 94.Russia Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 95.Russia Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 96.Russia Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 97.Russia Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 98.Russia Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 99.Russia Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 100.Russia Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 101.Russia Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 102.Russia Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 103.Netherlands Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 104.Netherlands Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 105.Netherlands Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 106.Netherlands Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 107.Netherlands Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 108.Netherlands Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 109.Netherlands Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 110.Netherlands Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 111.Netherlands Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 112.Spain Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 113.Spain Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 114.Spain Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 115.Spain Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 116.Spain Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 117.Spain Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 118.Spain Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 119.Spain Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 120.Spain Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 121.Turkey Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 122.Turkey Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 123.Turkey Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 124.Turkey Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 125.Turkey Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 126.Turkey Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 127.Turkey Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 128.Turkey Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 129.Turkey Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 130.Poland Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 131.Poland Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 132.Poland Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 133.Poland Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 134.Poland Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 135.Poland Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 136.Poland Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 137.Poland Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 138.Poland Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 139.South America Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 140.South America Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 141.South America Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 142.South America Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 143.South America Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 144.South America Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 145.South America Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 146.South America Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 147.South America Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 148.South America Insect Based Pet Food Market Share (%), By Country, 2017-2031F

- Figure 149.Brazil Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 150.Brazil Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 151.Brazil Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 152.Brazil Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 153.Brazil Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 154.Brazil Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 155.Brazil Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 156.Brazil Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 157.Brazil Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 158.Argentina Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 159.Argentina Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 160.Argentina Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 161.Argentina Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 162.Argentina Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 163.Argentina Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 164.Argentina Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 165.Argentina Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 166.Argentina Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 167.Asia-Pacific Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 168.Asia-Pacific Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 169.Asia-Pacific Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 170.Asia-Pacific Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 171.Asia-Pacific Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 172.Asia-Pacific Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 173.Asia-Pacific Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 174.Asia-Pacific Insect Based Pet Food Market Share (%), By End-user, In USD Billion, 2016-2030

- Figure 175.Asia-Pacific Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 176.Asia-Pacific Insect Based Pet Food Market Share (%), By Country, 2017-2031F

- Figure 177.India Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 178.India Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 179.India Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 180.India Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 181.India Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 182.India Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 183.India Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 184.India Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 185.India Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 186.China Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 187.China Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 188.China Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 189.China Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 190.China Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 191.China Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 192.China Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 193.China Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 194.China Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 195.Japan Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 196.Japan Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 197.Japan Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 198.Japan Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 199.Japan Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 200.Japan Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 201.Japan Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 202.Japan Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 203.Japan Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 204.Australia Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 205.Australia Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 206.Australia Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 207.Australia Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 208.Australia Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 209.Australia Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 210.Australia Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 211.Australia Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 212.Australia Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 213.Vietnam Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 214.Vietnam Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 215.Vietnam Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 216.Vietnam Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 217.Vietnam Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 218.Vietnam Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 219.Vietnam Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 220.Vietnam Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 221.Vietnam Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 222.South Korea Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 223.South Korea Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 224.South Korea Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 225.South Korea Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 226.South Korea Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 227.South Korea Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 228.South Korea Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 229.South Korea Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 230.South Korea Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 231.Indonesia Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 232.Indonesia Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 233.Indonesia Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 234.Indonesia Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 235.Indonesia Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 236.Indonesia Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 237.Indonesia Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 238.Indonesia Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 239.Indonesia Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 240.Philippines Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 241.Philippines Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 242.Philippines Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 243.Philippines Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 244.Philippines Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 245.Philippines Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 246.Philippines Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 247.Philippines Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 248.Philippines Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 249.Middle East & Africa Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 250.Middle East & Africa Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 251.Middle East & Africa Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 252.Middle East & Africa Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 253.Middle East & Africa Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 254.Middle East & Africa Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 255.Middle East & Africa Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 256.Middle East & Africa Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 257.Middle East & Africa Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 258.Middle East & Africa Insect Based Pet Food Market Share (%), By Country, 2017-2031F

- Figure 259.Saudi Arabia Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 260.Saudi Arabia Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 261.Saudi Arabia Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 262.Saudi Arabia Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 263.Saudi Arabia Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 264.Saudi Arabia Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 265.Saudi Arabia Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 266.Saudi Arabia Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 267.Saudi Arabia Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 268.UAE Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 269.UAE Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 270.UAE Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 271.UAE Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 272.UAE Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 273.UAE Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 274.UAE Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 275.UAE Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 276.UAE Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 277.South Africa Insect Based Pet Food Market, By Value, In USD Billion, 2017-2031F

- Figure 278.South Africa Insect Based Pet Food Market, By Volume, In Tonnes, 2017-2031F

- Figure 279.South Africa Insect Based Pet Food Market Share (%), By Source, 2017-2031F

- Figure 280.South Africa Insect Based Pet Food Market Share (%), By Category, 2017-2031F

- Figure 281.South Africa Insect Based Pet Food Market Share (%), By Food Type, 2017-2031F

- Figure 282.South Africa Insect Based Pet Food Market Share (%), By Packaging Type, 2017-2031F

- Figure 283.South Africa Insect Based Pet Food Market Share (%), By Price Range, 2017-2031F

- Figure 284.South Africa Insect Based Pet Food Market Share (%), By End-user, 2017-2031F

- Figure 285.South Africa Insect Based Pet Food Market Share (%), By Distribution Channel, 2017-2031F

- Figure 286.By Source Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 287.By Category Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 288.By Food Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 289.By Packaging Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 290.By Price Range Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 291.By End-user Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 292.By Distribution Channel Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 293.By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global insect-based pet food market is projected to witness a CAGR of 8.6% during the forecast period 2024-2031, growing from USD 4.83 billion in 2023 to USD 9.34 billion in 2031. For pet owners who wish to feed their animals a diet that isn't based on popular livestock species, insect-based pet foods are a great alternative. The pet food business is seeing a rise in the usage of insects as protein sources for pets, including mealworms, crickets, and black army fly larvae.

Insect-based products are available in a range of forms to accommodate varying dietary requirements and tastes. Also, the industry has a noticeable trend towards customized and specialized pet nutrition. Companies are stressing the sourcing and production method of their insect ingredients, demonstrating the industry's increased emphasis on sustainability and transparency.

According to a Rabobank analysis, the demand for insect protein, which is fueled by food for animals, could increase by 4,900% from 2021 to half a million metric tonnes by the end of the decade. Insects are rich in minerals, vitamins, and proteins, which makes the insect-based pet food environmentally friendly as well as nutritious. The latest market trends are product developments by prominent pet food companies, partnerships between pet food manufacturers and companies which practice insect farming, and rising popularity of pet food products made using insects. These sustainable and nutritious food options are witnessing a rising demand in the market, making the market's future outlook promising with numerous prospects for innovation and expansion.

In January 2024, Denmark-based Globe Buddy launched a new sustainable pet food for dogs, Globe Buddy Brown, containing protein derived from black soldier fly larvae. The product is suitable for dogs with sensitive digestion or those allergic to traditional meats. The packaging of the product is fully recyclable, achieving the company's goal of sustainability.

Sustainability Trend to Navigate the Market

When it comes to the environment, pet food made from insects is far superior to standard meat-based pet feeds. Due to its high nutritional content, it is regarded as one of the greatest components in dog food. Compared to raising animals, the manufacturing of insects for pet food produces a lot less greenhouse gas. Recent studies have shown that crickets produce eighty percent less methane than cattle. Comparing insect farming to conventional cattle production, less space and water are needed.

For instance, compared to mealworm protein, one gram of edible cow protein requires almost five times as much water to create. The process by which insects turn food into protein is quite effective. Whereas 10 kg of feed is required to create 1 kilogram of beef protein while 2 kg of feed is needed to produce 1 kg of cricket protein. The requirement for additional area and resources to generate insect food can be decreased by rearing insects on organic waste streams, such as food waste or agricultural outputs, such as pig manure slurry and silage grass. Furthermore, as insect farming doesn't involve extensive land use changes or deforestation, it has a lower impact on biodiversity than cattle production.

Black Soldier Flies Dominate Global Insect-based Pet Food Market Share

In 2023, black soldier flies held the dominant share in global insect-based pet food market. Although, meat, chicken, and fish are typically used in pet food, especially for dog food, they can be replaced with black soldier fly larvae, which are incredibly nutritious and sustainable. The insects occupy comparatively less space than cattle. In fact, in a 3,600 square foot area, farmers may generate up to 300 tonnes of insect-based protein. Furthermore, they grow without light or water and survive on food scraps. Black soldier fly larvae has ten essential amino acids which proves to be advantageous with an optimum unsaturated fat profile. The larvae have the ability to completely replace cattle products as they contain up to 54% crude protein. The composition of fats is made up of 21% monounsaturated and 19% polyunsaturated fats. It enhances the flavor and satisfaction factor of the insect-based pet food of every meal. With the trend, in September 2023, a strategic collaboration in the field of black soldier fly (BSF) genetics and processing was launched by the Israeli genomics business NRGene Technologies Ltd. and the Swiss technology group Buhler AG. The two businesses are pooling their resources to offer services and solutions to this quickly changing sector, to guarantee effective insect production on an industrial scale.

Furthermore, in November 2023, Entobel opened new black soldier fly ("BSF") manufacturing plant, the largest of its kind in Asia, marking the company's continued leadership as a global producer of functional insect protein for animal and plant nutrition. The facility has 50 levels of vertical raising and uses data analytics, robots, and state-of-the-art sensors to automate tasks and increase production.

North America Holds the Largest Market Share

Insect-based pet food sales in North America are expected to dominate the market by 2031. Demand for pet food containing insects is rising along with the number of pet owners in the region. Because of their high rates of pet ownership, the United States and Mexico account for the majority of the insect-based pet food market in North America. The number of Americans who keep pets has increased dramatically during the previous thirty years. 66% of American households, or 86.9 million residences, have pets as of 2024. Statistics on pet ownership indicate an increase from 56% in 1988. Pets provide invaluable companionship and emotional support to their owners. In actuality, 97% of pet owners view their animals as members of their family. With rising pet ownership trend in the region, the market for insect-based pet food is growing. People are being more aware of the sustainable impact of insect-based pet food as compared to the traditional one, thereby increasing the demand for it. In January 2024, The Association of American Feed Control Officials (AAFCO) authorized Ynsect (SAS) to use mealworm proteins that have been defatted in dog food. The approval presents Ynsect (SAS) and its pet food brand, Spryng, with enormous opportunities as there is a growing awareness among pet owners of the advantages of animal-based substitutes in terms of nutrition and the environment.

Future Market Scenario (2024 - 2031F)

With rising sustainability trend, major pet food companies are expected to collaborate with insect farming companies to develop insect-based pet food products catering to the demands of environmentally friendly individuals.

As researchers are diving deep into the nutritional benefits of insect protein, with evolving insect farming regulations, the insect-based pet food products will see a surge in demand as well as production.

Consumers seeking unique and alternative sources of protein for their pets will rely positively on insect-based pet food products.

Key Players Landscape and Outlook

As the demand for alternative protein sources in the pet food industry grow, prominent players demonstrate considerable market growth in recent years by extending their product variety and distribution networks. The market for pet food made from insects is anticipated to grow due to a growing emphasis on sustainability and alternative protein sources. Leading companies are driving innovation and market growth in the pet food sector and are continually working on developing new products through innovation and ethical production practices.

In April 2023, Protix, a major supplier of insect components, introduced fresh PureeX, a tasty fresh insect meat, in response to consumer demand for fresh, healthy, and environmentally friendly pet food. The business claims that this new frozen PureeX variation lowers the "pawprint" of pet food while providing pet food makers and their clients with all the health benefits of proteins and fats from insects.

Table of Contents

1.Research Methodology

2.Project Scope & Definitions

3.Executive Summary

4.Voice of Customer

- 4.1.Demographics (Age/Cohort Analysis - Baby Boomers and Gen X, Millennials, Gen Z; Gender; Income - Low, Mid and High; Geography; Nationality; etc.)

- 4.2.Market Awareness and Product Information

- 4.3.Product Intelligence

- 4.4.Brand Awareness and Loyalty

- 4.5.Factors Considered in Purchase Decision

- 4.5.1.Brand Reputation

- 4.5.2.Pet's Age

- 4.5.3.Breed

- 4.5.4.Dietary Needs

- 4.5.5.Ingredient Quality

- 4.5.6.Health Considerations/Allergies (if any)

- 4.5.7.Certifications

- 4.5.8.Value for Money

- 4.5.9.Sustainability Factor

- 4.5.10.Availability and Accessibility

- 4.6.Frequency of Purchase

- 4.7.Purchase Channel

- 4.8.Existing or Intended User

- 4.9.Recommendations from veterinarians, friends, family/online reviews

- 4.10.Role of Brand Ambassador or Influencer Marketing on Product/Brand Absorption

5.Global Insect Based Pet Food Market Outlook, 2017-2031F

- 5.1.Market Size & Forecast

- 5.1.1.By Value

- 5.1.2.By Volume

- 5.2.By Source

- 5.2.1.Black Soldier Flies

- 5.2.2.Grasshoppers

- 5.2.3.Crickets

- 5.2.4.Mealworms

- 5.2.5.Bees

- 5.2.6.Cockroaches

- 5.2.7.Others

- 5.3.By Category

- 5.3.1.Organic

- 5.3.2.Natural

- 5.4.By Food Type

- 5.4.1.Dry

- 5.4.2.Wet

- 5.4.3.Treats and Chews

- 5.4.3.1.Biscuits & Cookies

- 5.4.3.2.Dental treats

- 5.4.3.3.Freeze-Dried Treats

- 5.4.3.4.Functional & Training Treats

- 5.4.3.5.Others

- 5.5.By Packaging Type

- 5.5.1.Pouches

- 5.5.2.Cans

- 5.5.3.Cartons

- 5.5.4.Bottles and Jars

- 5.5.5.Others

- 5.6.By Price Range

- 5.6.1.Economy

- 5.6.2.Premium

- 5.7.By End-user

- 5.7.1.Household

- 5.7.2.Commercial

- 5.7.2.1.Veterinary Hospitals and Clinics

- 5.7.2.2.Breeders and Trainers

- 5.7.2.3.Others

- 5.8.By Distribution Channel

- 5.8.1.Online

- 5.8.2.Offline

- 5.8.2.1.Medical Store and Pharmacies

- 5.8.2.2.Veterinary Hospitals and Clinics

- 5.8.2.3.Hypermarkets/Supermarkets

- 5.8.2.4.Wholesalers/Distributors

- 5.8.2.5.Pet Stores

- 5.8.2.6.Others

- 5.9.By Region

- 5.9.1.North America

- 5.9.2.Europe

- 5.9.3.South America

- 5.9.4.Asia-Pacific

- 5.9.5.Middle East and Africa

- 5.10.By Company Market Share (%), 2023

6.Global Insect Based Pet Food Market Outlook, By Region, 2017-2031F

- 6.1.North America*

- 6.1.1.Market Size & Forecast

- 6.1.1.1.By Value

- 6.1.1.2.By Volume

- 6.1.2.By Source

- 6.1.2.1.Black Soldier Flies

- 6.1.2.2.Grasshoppers

- 6.1.2.3.Crickets

- 6.1.2.4.Mealworms

- 6.1.2.5.Bees

- 6.1.2.6.Cockroaches

- 6.1.2.7.Others

- 6.1.3.By Category

- 6.1.3.1.Organic

- 6.1.3.2.Natural

- 6.1.4.By Food Type

- 6.1.4.1.Dry

- 6.1.4.2.Wet

- 6.1.4.3.Treats and Chews

- 6.1.4.3.1.Biscuits & Cookies

- 6.1.4.3.2.Dental treats

- 6.1.4.3.3.Freeze-Dried Treats

- 6.1.4.3.4.Functional & Training Treats

- 6.1.4.3.5.Others

- 6.1.5.By Packaging Type

- 6.1.5.1.Pouches

- 6.1.5.2.Cans

- 6.1.5.3.Cartons

- 6.1.5.4.Bottles and Jars

- 6.1.5.5.Others

- 6.1.6.By Price Range

- 6.1.6.1.Economy

- 6.1.6.2.Premium

- 6.1.7.By End-user

- 6.1.7.1.Household

- 6.1.7.2.Commercial

- 6.1.7.2.1.Veterinary Hospitals and Clinics

- 6.1.7.2.2.Breeders and Trainers

- 6.1.7.2.3.Others

- 6.1.8.By Distribution Channel

- 6.1.8.1.Online

- 6.1.8.2.Offline

- 6.1.8.2.1.Medical Store and Pharmacies

- 6.1.8.2.2.Veterinary Hospitals and Clinics

- 6.1.8.2.3.Hypermarkets/Supermarkets

- 6.1.8.2.4.Wholesalers/Distributors

- 6.1.8.2.5.Pet Stores

- 6.1.8.2.6.Others

- 6.1.9.United States*

- 6.1.9.1.Market Size & Forecast

- 6.1.9.1.1.By Value

- 6.1.9.1.2.By Volume

- 6.1.9.2.By Source

- 6.1.9.2.1.Black Soldier Flies

- 6.1.9.2.2.Grasshoppers

- 6.1.9.2.3.Crickets

- 6.1.9.2.4.Mealworms

- 6.1.9.2.5.Bees

- 6.1.9.2.6.Cockroaches

- 6.1.9.2.7.Others

- 6.1.9.3.By Category

- 6.1.9.3.1.Organic

- 6.1.9.3.2.Natural

- 6.1.9.4.By Food Type

- 6.1.9.4.1.Dry

- 6.1.9.4.2.Wet

- 6.1.9.4.3.Treats and Chews

- 6.1.9.4.3.1.Biscuits & Cookies

- 6.1.9.4.3.2.Dental treats

- 6.1.9.4.3.3.Freeze-Dried Treats

- 6.1.9.4.3.4.Functional & Training Treats

- 6.1.9.4.3.5.Others

- 6.1.9.5.By Packaging Type

- 6.1.9.5.1.Pouches

- 6.1.9.5.2.Cans

- 6.1.9.5.3.Cartons

- 6.1.9.5.4.Bottles and Jars

- 6.1.9.5.5.Others

- 6.1.9.6.By Price Range

- 6.1.9.6.1.Economy

- 6.1.9.6.2.Premium

- 6.1.9.7.By End-user

- 6.1.9.7.1.Household

- 6.1.9.7.2.Commercial

- 6.1.9.7.2.1.Veterinary Hospitals and Clinics

- 6.1.9.7.2.2.Breeders and Trainers

- 6.1.9.7.2.3.Others

- 6.1.9.8.By Distribution Channel

- 6.1.9.8.1.Online

- 6.1.9.8.2.Offline

- 6.1.9.8.2.1.Medical Store and Pharmacies

- 6.1.9.8.2.2.Veterinary Hospitals and Clinics

- 6.1.9.8.2.3.Hypermarkets/Supermarkets

- 6.1.9.8.2.4.Wholesalers/Distributors

- 6.1.9.8.2.5.Pet Stores

- 6.1.9.8.2.6.Others

- 6.1.9.1.Market Size & Forecast

- 6.1.10.Canada

- 6.1.11.Mexico

- 6.1.1.Market Size & Forecast

All segments will be provided for all regions and countries covered

- 6.2.Europe

- 6.2.1.Germany

- 6.2.2.France

- 6.2.3.Italy

- 6.2.4.United Kingdom

- 6.2.5.Russia

- 6.2.6.Netherlands

- 6.2.7.Spain

- 6.2.8.Turkey

- 6.2.9.Poland

- 6.3.South America

- 6.3.1.Brazil

- 6.3.2.Argentina

- 6.4.Asia-Pacific

- 6.4.1.India

- 6.4.2.China

- 6.4.3.Japan

- 6.4.4.Australia

- 6.4.5.Vietnam

- 6.4.6.South Korea

- 6.4.7.Indonesia

- 6.4.8.Philippines

- 6.5.Middle East & Africa

- 6.5.1.UAE

- 6.5.2.Saudi Arabia

- 6.5.3.South Africa

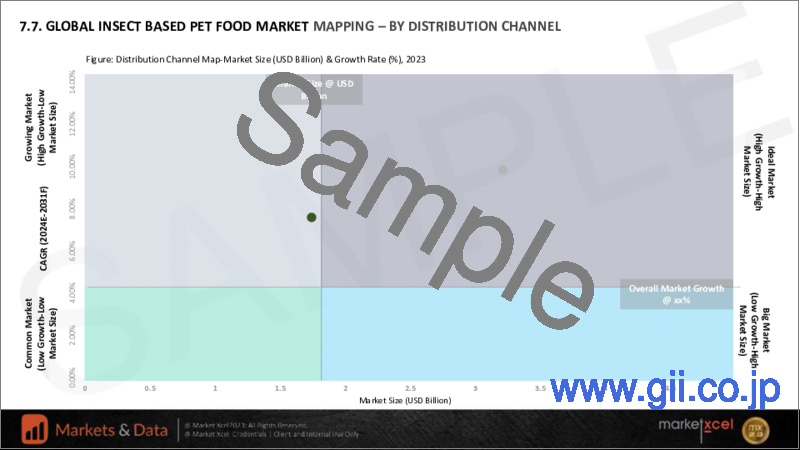

7.Market Mapping, 2023

- 7.1.By Source

- 7.2.By Category

- 7.3.By Food Type

- 7.4.By Packaging Type

- 7.5.By Price Range

- 7.6.By End-user

- 7.7.By Distribution Channel

- 7.8.By Region

8.Macro Environment and Industry Structure

- 8.1.Supply Demand Analysis

- 8.2.Import Export Analysis

- 8.3.Value Chain Analysis

- 8.4.PESTEL Analysis

- 8.4.1.Political Factors

- 8.4.2.Economic System

- 8.4.3.Social Implications

- 8.4.4.Technological Advancements

- 8.4.5.Environmental Impacts

- 8.4.6.Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 8.5.Porter's Five Forces Analysis

- 8.5.1.Supplier Power

- 8.5.2.Buyer Power

- 8.5.3.Substitution Threat

- 8.5.4.Threat from New Entrant

- 8.5.5.Competitive Rivalry

9.Market Dynamics

- 9.1.Growth Drivers

- 9.2.Growth Inhibitors (Challenges and Restraints)

10.Key Players Landscape

- 10.1.Competition Matrix of Top Five Market Leaders

- 10.2.Market Revenue Analysis of Top Five Market Leaders (in %, 2023)

- 10.3.Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4.SWOT Analysis (For Five Market Players)

- 10.5.Patent Analysis (If Applicable)

11.Pricing Analysis

12.Case Studies

13.Key Players Outlook

- 13.1.Innovafeed SAS

- 13.1.1.Company Details

- 13.1.2.Key Management Personnel

- 13.1.3.Products & Services

- 13.1.4.Financials (As reported)

- 13.1.5.Key Market Focus & Geographical Presence

- 13.1.6.Recent Developments

- 13.2.Mars, Incorporated

- 13.3.Nestle S.A.

- 13.4.Ynsect (SAS)

- 13.5.Entobel Holdings PTE

- 13.6.Protix B.V.

- 13.7.nextProtein SA

- 13.8.Buhler AG

- 13.9.Symply Pet Foods Limited

- 13.10.Jiminy's, LLC

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work