|

|

市場調査レポート

商品コード

1447723

吸引針市場の評価:用途・処置・エンドユーザー・地域別の機会および予測 (2017~2031年)Aspiration Needles Market Assessment, By Application, By Procedure, By End-user, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 吸引針市場の評価:用途・処置・エンドユーザー・地域別の機会および予測 (2017~2031年) |

|

出版日: 2024年03月11日

発行: Markets & Data

ページ情報: 英文 225 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の吸引針の市場規模は、2023年の9億2,750万米ドルから、2024年から2031年の予測期間中は6.57%のCAGRで推移し、2031年には15億4,272万米ドルの規模に成長すると予測されています。

吸引針の市場は、世界の癌の有病率の増加により成長すると予測されています。癌患者の増加に伴い、生検やその他の診断のための吸引針の需要は大幅に増加すると予想されます。政府や医療機関が癌検診や診断を推進し、生検針の需要増加に寄与しています。また、低侵襲な診断方法への嗜好が高まっており、吸引針の需要を牽引しています。さらに、急速な技術進歩も大きな成長促進要因となっています。革新的技術により生検処置の精度と効率が向上し、患者の転帰の改善と採用率の上昇につながり、市場の成長をさらに後押ししています。しかし一方で、吸引針の使用に伴うリスクや合併症の設計が、この市場の大きな課題となっています。参入企業は、これらの課題を克服し、利益を促進するために、製品の技術革新とパートナーシップに焦点を当てています。

癌患者の増加

癌は世界の主要死因です。ライフスタイルの変化、タバコやアルコールの摂取、放射線被曝が癌の主要な原因であり、癌患者の大幅な増加をもたらしています。癌の早期発見のための診断法の進歩が、癌診断市場の需要を急増させています。癌症例の大半は生検法によって診断され、そのために吸引針が広く使用されています。癌生検は死亡率を下げるために不可欠であり、それが世界の吸引針市場の拡大を促進しています。

世界保健機関 (WHO) は、2020年に約1,930万人の新規癌患者が発生したと報告しており、この数は2025年までに2,160万人に増加すると予測されています。乳癌が世界的にもっとも多い癌で、過去5年間に乳癌を克服した女性は推定780万人です。Globocanによる最近の調査データによると、乳癌は癌患者全体のおよそ12%を占めています。この一般的な疾患は、今後数年間、市場の大幅な成長を促進する可能性が高いとされています。

低侵襲診断への嗜好の高まり

低侵襲診断処置への嗜好の高まりは、罹患率、死亡率、入院時間、費用の減少という点で、吸引針の需要を促進しています。画像技術によって誘導されるような低侵襲処置は、医師が針穿刺やカテーテルを通して症状を治療することを可能にし、開腹手術の必要性を減少させます。このような処置は、患者の転帰を改善し、従来の開腹手術の適応とならない患者にも治療の選択肢を広げることにつながり、治療法としてますます用いられるようになっています。2023年10月、Praxis MedicalはEndoCore経気管支針吸引 (EBUS-TBNA) 極小針生検技術のFDA 510 (k) クリアランスを取得しました。EndoCore EBUS-TBNA生検装置は、肺癌の診断と病期分類を支援するために米国の医療機器企業が開発しました。

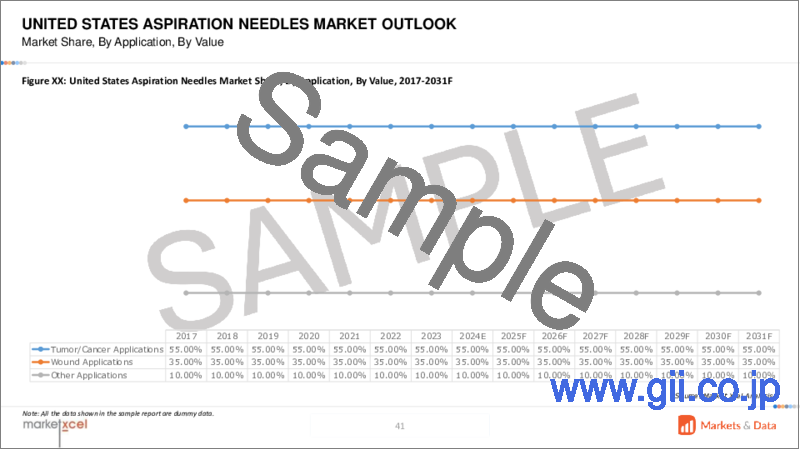

癌用途の優位性

微細針吸引法 (FNA) は、乳癌、肺癌、大腸癌、前立腺癌、腎臓癌、骨・骨髄癌などの診断に広く用いられています。FNAは、特に乳房のしこりの評価において、優れた安全で費用対効果の高い診断法であると考えられています。さらに、FNAは精度が高く、特定の種類の癌については感度が90%以上、特異度が95%以上です。企業はソリューションの開発や規制当局の認可取得に積極的に取り組んでいます。

当レポートでは、世界の吸引針の市場を調査し、市場の定義と概要、市場規模の推移・予測、各種区分・地域別の詳細分析、産業構造、市場成長への影響因子の分析、ケーススタディ、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 世界の吸引針市場の展望

- 市場規模・予測

- 用途別

- 腫瘍/癌

- 創傷

- その他

- 処置別

- 画像ベースの処置

- 画像ベース以外の処置

- エンドユーザー別

- 病院・外科センター

- 診断クリニック・病理ラボ

- 外来診療センター

- 研究および学術機関

- 地域別

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

- 企業別の市場シェア

第5章 世界の吸引針市場の展望:地域別

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

第6章 市場マッピング

- 用途別

- 処置別

- エンドユーザー別

- 地域別

第7章 マクロ環境と産業構造

- 需給分析

- 輸出入分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第8章 市場力学

- 成長促進要因

- 成長阻害要因 (課題・抑制要因)

第9章 規制の枠組みとイノベーション

- 臨床試験

- 特許の情勢

- 規制当局の承認

- イノベーション/新興技術

第10章 主要企業の情勢

- 市場リーダー上位5社の競合マトリックス

- 市場リーダー上位5社の市場収益分析

- M&A・ジョイントベンチャー (該当する場合)

- SWOT分析 (主要企業)

- 特許分析 (該当する場合)

第11章 価格分析

第12章 ケーススタディ

第13章 主要企業の見通し

- Merit Medical Systems

- Cook Group Incorporated

- Olympus Corporation

- Medtronic PLC

- Argon Medical Devices Inc.

- Boston Scientific Corporation

- Cardinal Health Inc.

- Conmed Corporation

- Inrad Inc.

- Bronchus Medical Devices Inc

第14章 戦略的提言

第15章 当社について・免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1.Global Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 2.Global Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 3.Global Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 4.Global Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 5.Global Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 6.Global Aspiration Needles Market Share (%), By Region, 2017-2031F

- Figure 7.North America Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 8.North America Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 9.North America Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 10.North America Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 11.North America Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 12.North America Aspiration Needles Market Share (%), By Country, 2017-2031F

- Figure 13.United States Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 14.United States Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 15.United States Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 16.United States Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 17.United States Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 18.Canada Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 19.Canada Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 20.Canada Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 21.Canada Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 22.Canada Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 23.Mexico Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 24.Mexico Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 25.Mexico Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 26.Mexico Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 27.Mexico Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 28.Europe Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 29.Europe Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 30.Europe Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 31.Europe Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 32.Europe Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 33.Europe Aspiration Needles Market Share (%), By Country, 2017-2031F

- Figure 34.Germany Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 35.Germany Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 36.Germany Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 37.Germany Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 38.Germany Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 39.France Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 40.France Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 41.France Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 42.France Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 43.France Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 44.Italy Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 45.Italy Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 46.Italy Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 47.Italy Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 48.Italy Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 49.United Kingdom Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 50.United Kingdom Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 51.United Kingdom Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 52.United Kingdom Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 53.United Kingdom Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 54.Russia Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 55.Russia Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 56.Russia Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 57.Russia Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 58.Russia Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 59.Netherlands Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 60.Netherlands Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 61.Netherlands Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 62.Netherlands Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 63.Netherlands Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 64.Spain Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 65.Spain Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 66.Spain Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 67.Spain Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 68.Spain Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 69.Turkey Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 70.Turkey Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 71.Turkey Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 72.Turkey Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 73.Turkey Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 74.Poland Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 75.Poland Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 76.Poland Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 77.Poland Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 78.Poland Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 79.South America Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 80.South America Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 81.South America Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 82.South America Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 83.South America Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 84.South America Aspiration Needles Market Share (%), By Country, 2017-2031F

- Figure 85.Brazil Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 86.Brazil Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 87.Brazil Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 88.Brazil Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 89.Brazil Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 90.Argentina Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 91.Argentina Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 92.Argentina Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 93.Argentina Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 94.Argentina Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 95.Asia-Pacific Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 96.Asia-Pacific Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 97.Asia-Pacific Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 98.Asia-Pacific Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 99.Asia-Pacific Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 100.Asia-Pacific Aspiration Needles Market Share (%), By Country, 2017-2031F

- Figure 101.India Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 102.India Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 103.India Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 104.India Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 105.India Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 106.China Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 107.China Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 108.China Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 109.China Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 110.China Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 111.Japan Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 112.Japan Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 113.Japan Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 114.Japan Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 115.Japan Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 116.Australia Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 117.Australia Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 118.Australia Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 119.Australia Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 120.Australia Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 121.Vietnam Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 122.Vietnam Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 123.Vietnam Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 124.Vietnam Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 125.Vietnam Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 126.South Korea Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 127.South Korea Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 128.South Korea Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 129.South Korea Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 130.South Korea Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 131.Indonesia Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 132.Indonesia Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 133.Indonesia Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 134.Indonesia Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 135.Indonesia Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 136.Philippines Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 137.Philippines Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 138.Philippines Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 139.Philippines Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 140.Philippines Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 141.Middle East & Africa Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 142.Middle East & Africa Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 143.Middle East & Africa Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 144.Middle East & Africa Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 145.Middle East & Africa Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 146.Middle East & Africa Aspiration Needles Market Share (%), By Country, 2017-2031F

- Figure 147.Saudi Arabia Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 148.Saudi Arabia Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 149.Saudi Arabia Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 150.Saudi Arabia Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 151.Saudi Arabia Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 152.UAE Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 153.UAE Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 154.UAE Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 155.UAE Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 156.UAE Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 157.South Africa Aspiration Needles Market, By Value, in USD Million, 2017-2031F

- Figure 158.South Africa Aspiration Needles Market, By Volume, in Million Units, 2017-2031F

- Figure 159.South Africa Aspiration Needles Market Share (%), By Application, 2017-2031F

- Figure 160.South Africa Aspiration Needles Market Share (%), By Procedure, 2017-2031F

- Figure 161.South Africa Aspiration Needles Market Share (%), By End-user, 2017-2031F

- Figure 162.By Application Map-Market Size (USD Million) & Growth Rate (%), 2023

- Figure 163.By Procedure Map-Market Size (USD Million) & Growth Rate (%), 2023

- Figure 164.By End-user Map-Market Size (USD Million) & Growth Rate (%), 2023

- Figure 165.By Region Map-Market Size (USD Million) & Growth Rate (%), 2023

Global aspiration needles market is projected to witness a CAGR of 6.57% during the forecast period 2024-2031, growing from USD 927.5 million in 2023 to USD 1542.72 million in 2031. The aspiration needle market is anticipated to thrive due to the growing prevalence of cancer across the globe. With the growing number of cancer cases, the demand for aspiration needles for biopsy and other diagnostics is expected to increase significantly. Governments and health organizations promote cancer screenings and diagnostics, contributing to an increase in demand for biopsy needles. There is a growing preference for minimally invasive diagnostic procedures, which drives demand for aspiration needles. Moreover, rapid technological advancements represent a significant growth-inducing factor. Innovative technologies enable better accuracy and efficiency in biopsy procedures, leading to improved patient outcomes and increased adoption rates, further boosting the market growth. However, risks associated with the use of aspiration needles and design complications are some major challenges for this market. Market players are focusing on product innovations and partnerships to overcome these challenges and drive profits.

In September 2023, Broncus Medical launched the BioStar Transbronchial Aspiration Needle (TBNA) to facilitate minimally invasive diagnostic procedures. This advanced needle enables medical professionals to collect precise tissue samples and high-quality specimens, aiding in the diagnosis and staging of lung cancer. The needle seamlessly integrates with endobronchial ultrasound bronchoscopy (EBUS) techniques, enhancing clinical outcomes and patient care. Designed for versatility, the BioStar TBNA is suitable for both conventional TBNA (cTBNA) and EBUS-TBNA diagnostic methods. Broncus offers the needle in 21G, 22G, and 25G sizes to accommodate various clinical needs.

Increasing Number of Cancer Cases

Cancer is a primary cause of death worldwide. Changes in lifestyle, tobacco and alcohol consumption, and radiation exposure are leading causes of cancer and have resulted in a significant increase in cancer cases. Advancements in diagnostics for early cancer detection have surged the demand in the cancer diagnostics market. The majority of cancer cases are diagnosed through the biopsy method and aspiration needles are widely used for that purpose. Cancer biopsy is essential to lower mortality rates, thereby driving the global aspiration needle market's expansion.

The World Health Organization reported approximately 19.3 million new cancer cases in 2020, a number that is projected to rise to 21.6 million by 2025. Breast cancer is the most common cancer globally, with an estimated 7.8 million women surviving breast cancer in the past five years. Data from recent Globocan study indicates that breast cancer accounts for roughly 12% of all cancer cases. This prevalent condition is likely to drive significant market growth over the forthcoming years.

Growing Preference for Minimally Invasive Diagnostic Procedures

The growing preference for minimally invasive diagnostic procedures is driving the demand for aspiration needles due to the benefits they offer in terms of decreased morbidity, mortality, hospitalization time, and expenses. Minimally invasive procedures, such as those guided by imaging technologies, allow physicians to treat conditions through needle punctures or catheters, reducing the need for open surgeries. These procedures are increasingly being used in therapeutic modalities, leading to improved patient outcomes, and expanded treatment options for individuals who are not candidates for traditional open surgeries. Manufacturers are actively involved in product development to cater to the market needs. For example, in October 2023, Praxis Medical received FDA 510(k) clearance for its EndoCore Endobronchial ultrasound with transbronchial needle aspiration (EBUS-TBNA) tiny needle biopsy technology. The EndoCore EBUS-TBNA biopsy instrument was created by an American medical device business to aid in the diagnosis and staging of lung cancer.

Dominance of Cancer Application

Fine-needle aspiration (FNA) is widely used in the diagnosis of breast cancer, lung cancer, and other types of cancer, such as colorectal, prostate, kidney, and bone and bone marrow cancer. FNA is considered an excellent, safe, and cost-effective diagnostic procedure, particularly for evaluating breast lumps. Additionally, FNA is highly accurate, with sensitivities above 90% and specificities above 95% for certain types of cancer. Market players are actively involved in developing solutions and obtaining regulatory clearance. For instance, in September 2023, Limaca Medical obtained approval from the FDA for its innovative Precision GI, a first-of-its-kind endoscopic biopsy tool for gastrointestinal diseases. Unlike other existing biopsy devices, Precision GI uses an automated, motorized cutting needle, ensuring precise tissue collection for accurate diagnosis. Limaca Medical, a leading healthcare company, is committed to revolutionizing endoscopic biopsy procedures for patients battling life-threatening digestive and lung cancers.

Image-guided Systems Dominate the Market

Image-guided systems are preferred for aspiration needle biopsies due to their higher accuracy compared to palpation-guided biopsies. Research shows that image-guided biopsies have a sensitivity of 96.3% for diagnosing malignant lesions, while palpation-guided biopsies have a lower sensitivity of 46.7%. Image guidance, such as ultrasound, allows for real-time visualization of the needle placement, ensuring accurate sampling of the target tissue. Additionally, image-guided biopsies offer advantages like better patient tolerance, improved cosmetic outcomes, and cost-effectiveness compared to open surgical biopsies. The use of image guidance in needle biopsies improves diagnostic accuracy and minimizes the risk of erroneous sampling, making it the preferred choice for various medical procedures.

In February 2023, TransMed7, a company specializing in breast biopsy devices, announced the clinical use of production models of its Concorde US ultrasound-guided biopsy devices. The Concorde US platform consists of two models, the Concorde US model and Concorde ST. Among these, Concorde US can be used handheld with ultrasound guidance or with an optional stage mount adapter for stereotactic and 2D/3D tomosynthesis procedures. On the other hand, Concorde ST is suitable for stereotactic and 2D/3D tomosynthesis-guided breast biopsy procedures, offering console-replacing functionality.

North America to be the Dominating Region

North America dominates the aspiration needle market due to several reasons. Firstly, there is a well-developed healthcare infrastructure in the region, which supports the adoption of advanced medical technologies such as aspiration needles. Secondly, there is high healthcare spending in countries like the United States, which drives the demand for innovative medical devices. Thirdly, there is an increasing prevalence of chronic diseases, which require regular monitoring and treatment using aspiration needles. Finally, there is a strong focus on improving the visibility of biopsy needles to aid market growth, which contributes to the dominant position of North America in the aspiration needle market.

Future Market Scenario

Over time, transthoracic needle aspiration (TTNA) has undergone major advancements, and continuing developments promise to improve its efficiency and introduce individualized medicine. Technology advancements, better biopsy samples, and increased capabilities are among these advancements. TTNA has moved from fluoroscopy to computed tomography (CT), resulting in better visualization and cutting-edge biopsy equipment. In TTNA operations, a variety of needles are utilized, including suction needles, cutting needles, and automated core biopsy needles. The future holds promising growth for the aspiration needles market.

Key Players Landscape and Outlook

Merit Medical Systems, Cook Group Incorporated, Olympus Corporation, Medtronic PLC, Argon Medical Devices Inc., and Boston Scientific Corporation are some of the key players in the aspiration needles market. These companies are major players in the industry, focusing on strategies like product launches, technological innovations, and partnerships to strengthen their market position. Market tactics like mergers and acquisitions are some other factors driving the market growth.

In November 2023, Broncus, through its Chinese subsidiary, agreed to purchase 100% of Hangzhou Jingliang, a Chinese device manufacturer. This acquisition aims to expand Broncus's offerings in lung disease diagnosis and treatment, including the BioStar transbronchial aspiration needle (TBNA) for minimally invasive diagnostic applications. China represents a significant market for Broncus, contributing USD 4.25 million in revenue during the first half of the fiscal year 2023.

Table of Contents

1.Research Methodology

2.Project Scope & Definitions

3.Executive Summary

4.Global Aspiration Needles Market Outlook, 2017-2031F

- 4.1.Market Size & Forecast

- 4.1.1. By Value

- 4.1.2. By Volume

- 4.2.By Application

- 4.2.1.Tumor/Cancer Applications

- 4.2.2.Wound Applications

- 4.2.3.Other Applications

- 4.3.By Procedure

- 4.3.1.Image-guided Procedures

- 4.3.2.Non-image-guided Procedures

- 4.4.By End-user

- 4.4.1.Hospitals & Surgical Centers

- 4.4.2.Diagnostic Clinics & Pathology Laboratories

- 4.4.3.Ambulatory Care Centers

- 4.4.4.Research & Academic Institutes

- 4.5.By Region

- 4.5.1.North America

- 4.5.2.Europe

- 4.5.3.Asia-Pacific

- 4.5.4.South America

- 4.5.5.Middle East and Africa

- 4.6.By Company Market Share (%), 2023

5.Global Aspiration Needles Market Outlook, By Region, 2017-2031F

- 5.1.North America*

- 5.1.1.Market Size & Forecast

- 5.1.1.1.By Value

- 5.1.1.2.By Volume

- 5.1.2.By Application

- 5.1.2.1.Tumor/Cancer Applications

- 5.1.2.2.Wound Applications

- 5.1.2.3.Other Applications

- 5.1.3.By Procedure

- 5.1.3.1.Image-guided Procedures

- 5.1.3.2.Non-image-guided Procedures

- 5.1.4.By End-user

- 5.1.4.1.Hospitals & Surgical Centers

- 5.1.4.2.Diagnostic Clinics & Pathology Laboratories

- 5.1.4.3.Ambulatory Care Centers

- 5.1.4.4.Research & Academic Institutes

- 5.1.5.United States*

- 5.1.5.1.Market Size & Forecast

- 5.1.5.1.1.By Value

- 5.1.5.1.2.By Volume

- 5.1.5.2.By Application

- 5.1.5.2.1.Tumor/Cancer Applications

- 5.1.5.2.2.Wound Applications

- 5.1.5.2.3.Other Applications

- 5.1.5.3.By Procedure

- 5.1.5.3.1.Image-guided Procedures

- 5.1.5.3.2.Non-image-guided Procedures

- 5.1.5.4.By End-user

- 5.1.5.4.1.Hospitals & Surgical Centers

- 5.1.5.4.2.Diagnostic Clinics & Pathology Laboratories

- 5.1.5.4.3.Ambulatory Care Centers

- 5.1.5.4.4.Research & Academic Institutes

- 5.1.6.Canada

- 5.1.7.Mexico

- 5.1.1.Market Size & Forecast

All segments will be provided for all regions and countries covered

- 5.2.Europe

- 5.2.1.Germany

- 5.2.2.France

- 5.2.3.Italy

- 5.2.4.United Kingdom

- 5.2.5.Russia

- 5.2.6.Netherlands

- 5.2.7.Spain

- 5.2.8.Turkey

- 5.2.9.Poland

- 5.3.Asia-Pacific

- 5.3.1.India

- 5.3.2.China

- 5.3.3.Japan

- 5.3.4.Australia

- 5.3.5.Vietnam

- 5.3.6.South Korea

- 5.3.7.Indonesia

- 5.3.8.Philippines

- 5.4.South America

- 5.4.1.Brazil

- 5.4.2.Argentina

- 5.5.Middle East & Africa

- 5.5.1.Saudi Arabia

- 5.5.2.UAE

- 5.5.3.South Africa

6.Market Mapping, 2023

- 6.1.By Application

- 6.2.By Procedure

- 6.3.By End-user

- 6.4.By Region

7.Macro Environment and Industry Structure

- 7.1.Demand Supply Analysis

- 7.2.Import Export Analysis

- 7.3.Value Chain Analysis

- 7.4.PESTEL Analysis

- 7.4.1.Political Factors

- 7.4.2.Economic System

- 7.4.3.Social Implications

- 7.4.4.Technological Advancements

- 7.4.5.Environmental Impacts

- 7.4.6.Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 7.5.Porter's Five Forces Analysis

- 7.5.1.Supplier Power

- 7.5.2.Buyer Power

- 7.5.3.Substitution Threat

- 7.5.4.Threat from New Entrant

- 7.5.5.Competitive Rivalry

8.Market Dynamics

- 8.1.Growth Drivers

- 8.2.Growth Inhibitors (Challenges and Restraints)

9.Regulatory Framework and Innovation

- 9.1.Clinical Trials

- 9.2.Patent Landscape

- 9.3.Regulatory Approvals

- 9.4.Innovations/Emerging Technologies

10.Key Players Landscape

- 10.1.Competition Matrix of Top Five Market Leaders

- 10.2.Market Revenue Analysis of Top Five Market Leaders (in %, 2023)

- 10.3.Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4.SWOT Analysis (For Five Market Players)

11.Pricing Analysis

12.Case Studies

13.Key Players Outlook

- 13.1.Merit Medical Systems

- 13.1.1.Company Details

- 13.1.2.Key Management Personnel

- 13.1.3.Products & Services

- 13.1.4.Financials (As reported)

- 13.1.5.Key Market Focus & Geographical Presence

- 13.1.6.Recent Developments

- 13.2.Cook Group Incorporated

- 13.3.Olympus Corporation

- 13.4.Medtronic PLC

- 13.5.Argon Medical Devices Inc.

- 13.6.Boston Scientific Corporation

- 13.7.Cardinal Health Inc.

- 13.8.Conmed Corporation

- 13.9.Inrad Inc.

- 13.10.Bronchus Medical Devices Inc

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.