|

|

市場調査レポート

商品コード

1445547

感染症治療薬市場の評価:治療モード・感染タイプ・投与経路・診断技術・エンドユーザー・地域別の機会および予測 (2017~2031年)Infectious Disease Therapeutics Market Assessment, By Mode of Treatment, By Infection Type, By Route of Administration, By Diagnostic Technique, By End-user, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 感染症治療薬市場の評価:治療モード・感染タイプ・投与経路・診断技術・エンドユーザー・地域別の機会および予測 (2017~2031年) |

|

出版日: 2024年03月07日

発行: Markets & Data

ページ情報: 英文 242 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の感染症治療薬の市場規模は、2024年から2031年の予測期間中にCAGR 5.76%を記録し、2023年の21,080億9,000万米ドルから、2031年には1,691億5,000万米ドルの規模に成長すると予測されています。

2022年の感染症による死亡者数は、COVID-19に次いで結核が2番目に多く、COVID-19は124万人、結核は113万人、HIV/AIDSは63万人、マラリアは62万人の死亡者数となっています。世界の医療産業は、ウイルス、ウイロイド、細菌などさまざまな感染性病原体によって引き起こされる感染症によって大きな圧力を受けています。診断や治療法の進歩、衛生状態の改善、ワクチン接種、抗菌薬治療などにより、感染症による死亡者数は減少しているもの、感染症の増加や再発は引き続き世界の保健環境に影響を及ぼしています。感染症治療薬の市場は、感染症発生件数の増加、感染症の早期診断に関する意識の高まり、さまざまな民間・政府機関による研究・資金提供活動の活発化により、予測期間中に大きく成長すると予想されています。

感染症の有病率と死亡率の増加

感染症の有病率の増加が途上国での感染症治療薬の販売を促進すると予想されています。さらに、新興国における医療研究や生命科学分野への多額の投資が先進技術の採用を促進し、感染症の診断・治療を推進しています。

政府の取り組み

世界各国の政府は、さまざまな取り組みを通じて感染症治療薬市場の発展に積極的に関与しています。こうした取り組みは、新たな健康課題に対処し、感染症発生への備えを確実にすることを目的としています。各国政府はR&Dに多額の資金を充てることが多く、革新的な治療薬の開発を目的とする製薬企業や学術機関を支援しています。さらに、規制機関は、新しい治療法の利用を促進するために、承認プロセスの合理化において重要な役割を果たしています。

分子診断技術、特にPCRの優位性

核酸増幅検査、PCRは、今後さらに普及する分子診断技術の一つです。PCRは病原体の検出にもっとも広く使われている核酸増幅法であり、感染症、細菌感染症、消化器感染症、性感染症の早期診断に重要なツールとなっています。

当レポートでは、世界の感染症治療薬の市場を調査し、市場の定義と概要、市場規模の推移・予測、各種区分・地域別の詳細分析、産業構造、市場成長への影響因子の分析、ケーススタディ、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 世界の感染症治療薬市場の展望

- 市場規模・予測

- 治療モード別

- ワクチン

- 薬剤

- 感染タイプ別

- ウイルス感染

- 細菌感染

- 真菌感染症

- 寄生虫感染症

- その他

- 投与経路別

- 経口

- 非経口

- その他

- 診断技術別

- 免疫診断

- ポリメラーゼ連鎖反応

- 臨床微生物学

- 等温核酸増幅技術

- DNA配列決定

- 次世代シーケンシング

- DNAマイクロアレイ

- その他

- エンドユーザー別

- 病院

- 診断センター

- 小売薬局

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 企業別市場シェア

第5章 世界の感染症治療薬市場の展望:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第6章 市場マッピング

- 治療モード別

- 感染タイプ別

- 投与経路別

- 診断技術別

- エンドユーザー別

- 地域別

第7章 マクロ環境と産業構造

- 需要供給分析

- 輸出入分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第8章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第9章 規制の枠組みとイノベーション

- 臨床試験

- 特許の情勢

- 規制当局の承認

- イノベーション/新興技術

第10章 主要企業の情勢

- 市場リーダー上位5社の競合マトリックス

- 市場リーダー上位5社の市場収益分析

- M&A・ジョイントベンチャー (該当する場合)

- SWOT分析 (参入5社)

- 特許分析 (該当する場合)

第11章 価格分析

第12章 ケーススタディ

第13章 主要企業の見通し

- AbbVie Inc.

- Boehringer Ingelheim GmbH

- F Hoffmann-La Roche, Ltd

- Bayer AG

- GlaxoSmithKline plc.

- Pfizer Inc.

- Janssen Pharmaceutical (Johnson & Johnson)

- Merck & Co., Inc.

- Novartis AG

- Moderna, Inc.

- Eli Lilly & Co

- Novo Nordisk, Inc.

- Applied Molecular Genetics Inc.

第14章 戦略的提言

第15章 当社について・免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 3. Global Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 4. Global Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 5. Global Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 6. Global Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 7. Global Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 8. Global Infectious Disease Therapeutics Market Share (%), By Region, 2017-2031F

- Figure 9. North America Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 10. North America Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 11. North America Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 12. North America Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 13. North America Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 14. North America Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 15. North America Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 16. North America Infectious Disease Therapeutics Market Share (%), By Country, 2017-2031F

- Figure 17. United States Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 18. United States Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 19. United States Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 20. United States Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 21. United States Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

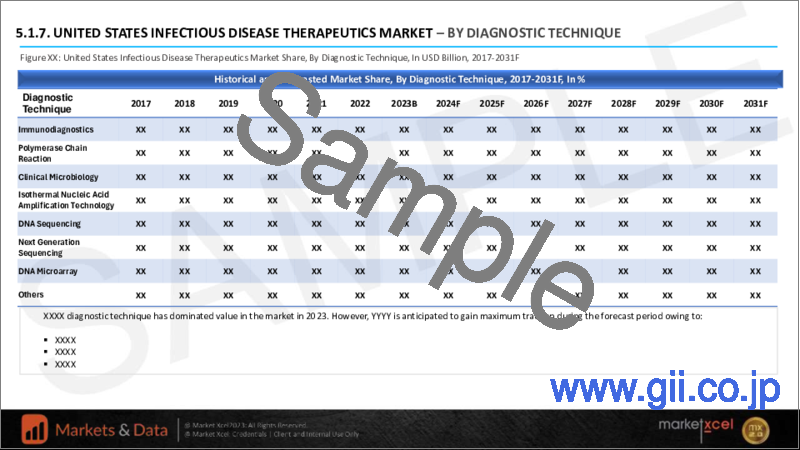

- Figure 22. United States Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 23. United States Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 24. Canada Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 25. Canada Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 26. Canada Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 27. Canada Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 28. Canada Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 29. Canada Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 30. Canada Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 31. Mexico Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 32. Mexico Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 33. Mexico Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 34. Mexico Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 35. Mexico Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 36. Mexico Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 37. Mexico Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 38. Europe Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 39. Europe Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 40. Europe Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 41. Europe Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 42. Europe Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 43. Europe Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 44. Europe Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 45. Europe Infectious Disease Therapeutics Market Share (%), By Country, 2017-2031F

- Figure 46. Germany Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 47. Germany Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 48. Germany Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 49. Germany Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 50. Germany Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 51. Germany Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 52. Germany Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 53. France Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 54. France Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 55. France Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 56. France Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 57. France Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 58. France Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 59. France Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 60. Italy Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 61. Italy Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 62. Italy Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 63. Italy Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 64. Italy Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 65. Italy Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 66. Italy Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 67. United Kingdom Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 68. United Kingdom Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 69. United Kingdom Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 70. United Kingdom Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 71. United Kingdom Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 72. United Kingdom Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 73. United Kingdom Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 74. Russia Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 75. Russia Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 76. Russia Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 77. Russia Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 78. Russia Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 79. Russia Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 80. Russia Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 81. Netherlands Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 82. Netherlands Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 83. Netherlands Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 84. Netherlands Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 85. Netherlands Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 86. Netherlands Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 87. Netherlands Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 88. Spain Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 89. Spain Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 90. Spain Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 91. Spain Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 92. Spain Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 93. Spain Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 94. Spain Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 95. Turkey Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 96. Turkey Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 97. Turkey Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 98. Turkey Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 99. Turkey Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 100. Turkey Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 101. Turkey Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 102. Poland Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 103. Poland Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 104. Poland Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 105. Poland Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 106. Poland Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 107. Poland Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 108. Poland Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 109. South America Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 110. South America Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 111. South America Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 112. South America Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 113. South America Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 114. South America Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 115. South America Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 116. South America Infectious Disease Therapeutics Market Share (%), By Country, 2017-2031F

- Figure 117. Brazil Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 118. Brazil Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 119. Brazil Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 120. Brazil Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 121. Brazil Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 122. Brazil Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 123. Brazil Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 124. Argentina Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 125. Argentina Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 126. Argentina Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 127. Argentina Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 128. Argentina Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 129. Argentina Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 130. Argentina Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 131. Asia-Pacific Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 132. Asia-Pacific Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 133. Asia-Pacific Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 134. Asia-Pacific Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 135. Asia-Pacific Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 136. Asia-Pacific Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 137. Asia- Pacific Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 138. Asia-Pacific Infectious Disease Therapeutics Market Share (%), By Country, 2017-2031F

- Figure 139. India Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 140. India Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 141. India Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 142. India Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 143. India Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 144. India Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 145. India Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 146. China Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 147. China Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 148. China Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 149. China Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 150. China Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 151. China Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 152. China Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 153. Japan Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 154. Japan Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 155. Japan Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 156. Japan Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 157. Japan Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 158. Japan Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 159. Japan Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 160. Australia Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 161. Australia Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 162. Australia Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 163. Australia Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 164. Australia Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 165. Australia Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 166. Australia Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 167. Vietnam Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 168. Vietnam Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 169. Vietnam Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 170. Vietnam Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 171. Vietnam Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 172. Vietnam Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 173. Vietnam Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 174. South Korea Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 175. South Korea Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 176. South Korea Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 177. South Korea Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 178. South Korea Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 179. South Korea Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 180. South Korea Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 181. Indonesia Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 182. Indonesia Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 183. Indonesia Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 184. Indonesia Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 185. Indonesia Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 186. Indonesia Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 187. Indonesia Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 188. Philippines Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 189. Philippines Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 190. Philippines Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 191. Philippines Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 192. Philippines Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 193. Philippines Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 194. Philippines Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 195. Middle East & Africa Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 196. Middle East & Africa Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 197. Middle East & Africa Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 198. Middle East & Africa Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 199. Middle East & Africa Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 200. Middle East & Africa Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 201. Middle East & Africa Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 202. Middle East & Africa Infectious Disease Therapeutics Market Share (%), By Country, 2017-2031F

- Figure 203. Saudi Arabia Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 204. Saudi Arabia Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 205. Saudi Arabia Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 206. Saudi Arabia Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 207. Saudi Arabia Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 208. Saudi Arabia Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 209. Saudi Arabia Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 210. UAE Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 211. UAE Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 212. UAE Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 213. UAE Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 214. UAE Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 215. UAE Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 216. UAE Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 217. South Africa Infectious Disease Therapeutics Market, By Value, In USD Billion, 2017-2031F

- Figure 218. South Africa Infectious Disease Therapeutics Market, By Volume, In Million Units, 2017-2031F

- Figure 219. South Africa Infectious Disease Therapeutics Market Share (%), By Mode of Treatment, 2017-2031F

- Figure 220. South Africa Infectious Disease Therapeutics Market Share (%), By Infection Type, 2017-2031F

- Figure 221. South Africa Infectious Disease Therapeutics Market Share (%), By Route of Administration, 2017-2031F

- Figure 222. South Africa Infectious Disease Therapeutics Market Share (%), By Diagnostic Technique, 2017-2031F

- Figure 223. South Africa Infectious Disease Therapeutics Market Share (%), By End-user, 2017-2031F

- Figure 224. By Mode of Treatment Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 225. By Infection Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 226. By Route of Administration Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 227. By Diagnostic Technique Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 228. By End-user Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 229. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global infectious disease therapeutics market is projected to witness a CAGR of 5.76% during the forecast period 2024-2031, growing from USD 108.09 billion in 2023 to USD 169.15 billion in 2031. Infectious diseases have a significant impact on the global healthcare market, leading to economic, social, and health-related consequences. Tuberculosis accounted for the second highest deaths from infectious disease in 2022 after COVID-19. COVID-19, tuberculosis, HIV/AIDS, and malaria accounted for 1.24 million, 1.13 million, 0.63 million, and 0.62 million deaths respectively. The global healthcare industry is under significant pressure due to infectious diseases, which are caused by various infectious agents such as viruses, viroids, and bacteria. Although advanced diagnosis and treatment options, as well as improvements in hygiene, vaccination, and antimicrobial therapy, have reduced the number of deaths caused by infectious diseases, the rise and re-occurrence of infectious diseases continue to affect global health outcome. The infectious disease therapeutics market is expected to grow significantly over the forecast period due to rising infectious disease occurrences, increased awareness about early infectious disease diagnosis, and increased research and funding activities by various private and government organizations.

For instance, WHO launched a global network to detect and prevent infectious disease threats in 2023. Not only does this initiative provide a platform to connect countries and regions, but it also improves the system for analyzing and collecting samples from around the globe, which will help and improve the public healthcare sector in decision-making and welfare.

Increasing Prevalence and Mortality Rate of Infectious Diseases

The increasing prevalence of infectious diseases is expected to drive the sales of infectious disease therapeutics in developing nations. Furthermore, significant investments in health research and life sciences in emerging countries are facilitating the adoption of advanced technologies, thereby promoting the diagnosis and treatment of infectious diseases. Morbidity and mortality are mainly caused due to infectious diseases. Such diseases are the cause of more than 33% or 52 million annual deaths, globally. Nearly half of the global population is at risk of recurring infectious diseases.

Countries, such as India, South Korea, Brazil, and Mexico, have a high burden of infectious diseases like Hepatitis, HAI, HIV, and influenza. As a result, medical device companies are increasing investments and manufacturing capacities in these countries to meet the demand for diagnostic devices and instruments over the forecast period.

Viral Therapeutics are Dominating the Market

In 2022, viral therapeutics held the second-largest market share in the infectious disease therapeutics sector. The significant share held by this segment is attributed to the growing prevalence of viral diseases like hepatitis and HIV, the increasing number of clinical trials for new drug launches, and initiatives aimed at enhancing drug adoption. Hepatitis and human papillomavirus patients are increasing at a rapid rate globally. Due to the rapid increase in the prevalence and incidence of infectious diseases, medical device manufacturers are prioritizing innovation and manufacturing capacities.

The World Health Organization's (WHO) Global Health Sector Strategy on viral hepatitis aims to test and treat a large proportion of individuals with HBV and HCV by 2030. In January 2023, the Serum Institute of India launched 'CERVAVAC,' the first Quadrivalent Human Papillomavirus vaccine made in India, in collaboration with DBT, BIRAC, and the Bill and Melinda Gates Foundation. This vaccine is India's first indigenously developed vaccine for the prevention of cervical cancer. This vaccine is affordable and cost effective and the government of India has taken initiatives to make it accessible for everyone in the country.

Government Initiatives

Governments around the globe have been actively engaged in fostering advancements within the infectious disease therapeutics market through various initiatives. These efforts aim to address emerging health challenges and ensure preparedness for infectious outbreaks. Governments often allocate substantial funding for research and development, supporting pharmaceutical companies and academic institutions with their objective of developing innovative therapeutics. Additionally, regulatory bodies play a crucial role in streamlining the approval process to expedite the availability of new treatments. For instance, in India, the Infectious Disease Biology Program aims to provide solutions to infectious diseases of global concern such as HIV/AIDS, tuberculosis, and vector borne diseases, along with emerging or re-emerging threats like influenza, Japanese Encephalitis, and antibiotic-resistant microbes in terms of therapeutics, diagnostics, and preventive measures. The Program supports R&D projects to achieve the Sustainable Development Goals Target to combat various water-borne diseases, communicable diseases, and hepatitis and end the epidemics of viral diseases like AIDS, TB, and malaria by the year 2030.

Dominance of Molecular Diagnostic Techniques, Especially PCR

Nucleic Acid amplification tests, PCR, are a few molecular diagnostic techniques that are going to be more popular in the coming frame of time. PCR is the most widely used nucleic acid amplification method for pathogen detection and has become an important tool in the early diagnosis of infectious diseases, bacterial infections, GI infections, and sexually transmitted diseases.

Thermo Fisher launched real-time PCR kits for the detection of infectious diseases in India in February 2023. The TaqPath PCR kits provide assurance and consistency for the creation and examination of diagnostic tests for infectious diseases. Genetic risk factor identification, therapy response monitoring, and disease screening are a few patient care practices that can be now carried out using the TaqPath PCR kits developed by Thermo Fisher.

North America Dominates Infectious Disease Therapeutics Market

North America is dominating the infectious diseases therapeutics market due to the increasing prevalence of infectious diseases, improving healthcare infrastructure, the presence of key market players, and rising awareness programs. Government initiatives and their effort towards providing the country with adequate infrastructure and facilities, such as trained professionals, high-end medical devices, and drugs, are creating lucrative market opportunities in the region. Other factors accelerating the market demand in North America includes the growing prevalence of such diseases, favorable reimbursement scenarios, the presence of numerous manufacturers in the U.S., and an increasing number of clinical trials for developing new treatment drugs and devices. According to the Centers for Disease Control and Prevention, in the United States., influenza and pneumonia caused 41,917 deaths in 2022.

Future Market Scenario (2024 - 2031F)

The future market scenario for treatments for infectious diseases is expected to be dynamic, driven by continued technological development and a greater emphasis on preventive measures. More individualized and efficient treatments are expected by the ongoing development of precision medicine, which is made possible by advancements in genomics and personalized therapies. Novel treatments for infectious diseases are being made possible by developments in immunotherapy and antiviral drugs, which are changing the market landscape. The COVID-19 pandemic has expedited the development, production, and distribution of vaccines, enabling a more responsive approach to newly emerging infectious diseases.

Key Players Landscape and Outlook

The global market for infectious disease therapeutics is fiercely competitive and somewhat fragmented. To stay ahead, major industry players continuously implement various growth strategies such as innovations, mergers, acquisitions, collaborations, and partnerships. Additionally, they focus on research and development to provide the most effective and economical solutions. Most prominent players of this market, such as Pfizer Inc, Gilead Sciences Inc, F. Hoffmann-La Roche Ltd, Boehringer Ingelheim GmbH, Bayer AG, Janssen Pharmaceutical, GSK Plc, AbbVie Inc, Merck & Co Inc, and Astellas Pharma Inc., are the ones mostly bringing new innovations and robust technology in the market.

In January 2023, Thermo Fisher Scientific Inc. (US) introduced the CE-IVD marked Applied Biosystems TaqPath Seq HIV-1 Genotyping Kit. This kit is designed to detect genomic mutations in HIV-1 viral ribonucleic acid extracted from plasma or dried blood spots, specifically analyzing mutations in the protease, reverse transcriptase, and integrase regions of the pol gene.

Roche introduced the Elecsys HCV Duo in July 2022. This immunoassay enables the simultaneous and independent determination of the hepatitis C virus (HCV) antigen and antibody status from a single human plasma or serum sample.

May & Baker Nigeria Plc launched Artelum Combo, a new drug to combat malaria parasites across Nigeria in March 2022. The medicine is a unique combination of Arthemeter Lumefantrine and Paracetamol, providing complete malaria therapy in a single package.

Table of Contents

1. Research Methodology

2. Project Scope & Definitions

3. Executive Summary

4. Global Infectious Disease Therapeutics Market Outlook, 2017-2031F

- 4.1. Market Size & Forecast

- 4.1.1. Value

- 4.1.2. Volume

- 4.2. By Mode of Treatment

- 4.2.1. Vaccines

- 4.2.2. Drugs

- 4.3. By Infection Type

- 4.3.1. Viral Infection

- 4.3.2. Bacterial Infection

- 4.3.3. Fungal Infection

- 4.3.4. Parasitic Infection

- 4.3.5. Others

- 4.4. By Route of Administration

- 4.4.1. Oral

- 4.4.2. Parenteral

- 4.4.2.1. Subcutaneous

- 4.4.2.2. Intravenous

- 4.4.2.3. Intradermal

- 4.4.2.4. Intramuscular

- 4.4.3. Others

- 4.5. By Diagnostic Technique

- 4.5.1. Immunodiagnostics

- 4.5.2. Polymerase Chain Reaction

- 4.5.3. Clinical Microbiology

- 4.5.4. Isothermal Nucleic Acid Amplification Technology

- 4.5.5. DNA Sequencing

- 4.5.6. Next Generation Sequencing

- 4.5.7. DNA Microarray

- 4.5.8. Others

- 4.6. By End-user

- 4.6.1. Hospitals

- 4.6.2. Diagnostic Centres

- 4.6.3. Retail Pharmacies

- 4.6.4. Others

- 4.7. By Region

- 4.7.1. North America

- 4.7.2. Europe

- 4.7.3. South America

- 4.7.4. Asia-Pacific

- 4.7.5. Middle East and Africa

- 4.8. By Company Market Share (%), 2023

5. Global Infectious Disease Therapeutics Market Outlook, By Region, 2017-2031F

- 5.1. North America*

- 5.1.1. Market Size & Forecast

- 5.1.1.1. Value

- 5.1.1.2. Volume

- 5.1.2. By Mode of Treatment

- 5.1.2.1. Vaccines

- 5.1.2.2. Drugs

- 5.1.3. By Infection Type

- 5.1.3.1. Viral Infection

- 5.1.3.2. Bacterial Infection

- 5.1.3.3. Fungal Infection

- 5.1.3.4. Parasitic Infection

- 5.1.3.5. Others

- 5.1.4. By Route of Administration

- 5.1.4.1.1. Oral

- 5.1.4.1.2. Parenteral

- 5.1.4.1.2.1. Subcutaneous

- 5.1.4.1.2.2. Intravenous

- 5.1.4.1.2.3. Intradermal

- 5.1.4.1.2.4. Intramuscular

- 5.1.4.1.3. Others

- 5.1.5. By Diagnostic Technique

- 5.1.5.1. Immunodiagnostics

- 5.1.5.2. Polymerase Chain Reaction

- 5.1.5.3. Clinical Microbiology

- 5.1.5.4. Isothermal Nucleic Acid Amplification Technology

- 5.1.5.5. DNA Sequencing

- 5.1.5.6. Next Generation Sequencing

- 5.1.5.7. DNA Microarray

- 5.1.5.8. Others

- 5.1.6. By End-user

- 5.1.6.1. Hospitals

- 5.1.6.2. Diagnostic Centres

- 5.1.6.3. Retail Pharmacies

- 5.1.6.4. Others

- 5.1.7. United States*

- 5.1.7.1. Market Size & Forecast

- 5.1.7.1.1. By Value

- 5.1.7.1.2. By Volume

- 5.1.7.2. By Mode of Treatment

- 5.1.7.2.1. Vaccines

- 5.1.7.2.2. Drugs

- 5.1.7.3. By Infection Type

- 5.1.7.3.1. Viral Infection

- 5.1.7.3.2. Bacterial Infection

- 5.1.7.3.3. Fungal Infection

- 5.1.7.3.4. Parasitic Infection

- 5.1.7.3.5. Others

- 5.1.7.4. By Route of Administration

- 5.1.7.4.1.1. Oral

- 5.1.7.4.1.2. Parenteral

- 5.1.7.4.1.2.1. Subcutaneous

- 5.1.7.4.1.2.2. Intravenous

- 5.1.7.4.1.2.3. Intradermal

- 5.1.7.4.1.2.4. Intramuscular

- 5.1.7.4.1.3. Others

- 5.1.7.5. By Diagnostic Technique

- 5.1.7.5.1. Immunodiagnostics

- 5.1.7.5.2. Polymerase Chain Reaction

- 5.1.7.5.3. Clinical Microbiology

- 5.1.7.5.4. Isothermal Nucleic Acid Amplification Technology

- 5.1.7.5.5. DNA Sequencing

- 5.1.7.5.6. Next Generation Sequencing

- 5.1.7.5.7. DNA Microarray

- 5.1.7.5.8. Others

- 5.1.7.6. By End-user

- 5.1.7.6.1. Hospitals

- 5.1.7.6.2. Diagnostic Centres

- 5.1.7.6.3. Retail Pharmacies

- 5.1.7.6.4. Others

- 5.1.8. Canada

- 5.1.9. Mexico

- 5.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 5.2. Europe

- 5.2.1. Germany

- 5.2.2. France

- 5.2.3. Italy

- 5.2.4. United Kingdom

- 5.2.5. Russia

- 5.2.6. Spain

- 5.2.7. Others

- 5.3. South America

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.4. Asia-Pacific

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Others

- 5.5. Middle East & Africa

- 5.5.1. Saudi Arabia

- 5.5.2. UAE

- 5.5.3. South Africa

6. Market Mapping, 2023

- 6.1. By Mode of Treatment

- 6.2. By Infection Type

- 6.3. By Route of Administration

- 6.4. By Diagnostic Technique

- 6.5. By End-user

- 6.6. By Region

7. Macro Environment and Industry Structure

- 7.1. Supply Demand Analysis

- 7.2. Import Export Analysis

- 7.3. Value Chain Analysis

- 7.4. PESTEL Analysis

- 7.4.1. Political Factors

- 7.4.2. Economic System

- 7.4.3. Social Implications

- 7.4.4. Technological Advancements

- 7.4.5. Environmental Impacts

- 7.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 7.5. Porter's Five Forces Analysis

- 7.5.1. Supplier Power

- 7.5.2. Buyer Power

- 7.5.3. Substitution Threat

- 7.5.4. Threat from New Entrant

- 7.5.5. Competitive Rivalry

8. Market Dynamics

- 8.1. Growth Drivers

- 8.2. Growth Inhibitors (Challenges and Restraints)

9. Regulatory Framework and Innovation

- 9.1. Clinical Trials

- 9.2. Patent Landscape

- 9.3. Regulatory Approvals

- 9.4. Innovations/Emerging Technologies

10. Key Players Landscape

- 10.1. Competition Matrix of Top Five Market Leaders

- 10.2. Market Revenue Analysis of Top Five Market Leaders (in %, 2023)

- 10.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4. SWOT Analysis (For Five Market Players)

- 10.5. Patent Analysis (If Applicable)

11. Pricing Analysis

12. Case Studies

13. Key Players Outlook

- 13.1. AbbVie Inc.

- 13.1.1. Company Details

- 13.1.2. Key Management Personnel

- 13.1.3. Products & Services

- 13.1.4. Financials (As reported)

- 13.1.5. Key Market Focus & Geographical Presence

- 13.1.6. Recent Developments

- 13.2. Boehringer Ingelheim GmbH

- 13.3. F Hoffmann-La Roche, Ltd

- 13.4. Bayer AG

- 13.5. GlaxoSmithKline plc.

- 13.6. Pfizer Inc.

- 13.7. Janssen Pharmaceutical (Johnson & Johnson)

- 13.8. Merck & Co., Inc.

- 13.9. Novartis AG

- 13.10. Moderna, Inc.

- 13.11. Eli Lilly & Co

- 13.12. Novo Nordisk, Inc.

- 13.13. Applied Molecular Genetics Inc.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work