|

|

市場調査レポート

商品コード

1415559

フッ素樹脂フィルムの世界市場の評価:製品タイプ別、用途別、エンドユーザー別、地域別、機会、予測(2017年~2031年)Fluoropolymer Films Market Assessment, By Product Type, By Application, By End-user, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| フッ素樹脂フィルムの世界市場の評価:製品タイプ別、用途別、エンドユーザー別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年01月24日

発行: Markets & Data

ページ情報: 英文 224 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のフッ素樹脂フィルムの市場規模は、2023年の18億9,000万米ドルから2031年に26億9,000万米ドルに達し、予測期間の2024年~2031年にCAGRで4.5%の成長が見込まれています。

世界レベルでのさまざまな建設部門のインフラプロジェクトの増加が、フッ素樹脂フィルム市場の成長を大きく後押ししています。例えば、人口約6,700万人の先進国フランスでは、新産業の設立が進んでいます。2023年6月、フランスはフランス南東部のクロールに半導体工場を建設するため、STMicroelectronicsに31億米ドルの巨額投資を行っています。

フッ素樹脂フィルム市場は、半導体用途の需要拡大、太陽エネルギーなどの再生可能エネルギー源によるエネルギー需要の増加、高い耐性を持つ屋根構造、工業用加工装置などの主な促進要因によって大きな成長を示しています。フッ素樹脂フィルムは、耐薬品性、光学的透明性、熱安定性、耐候性、耐紫外線(UV)性を備えており、自動車、半導体、航空宇宙、建築など、著名な部門における利用が拡大しています。フッ素樹脂フィルムは、このような驚くべき特性に加えて、落書き防止カバー、自動車用エアバッグシステム、マイク用エレクトレット膜としても使用されています。その結果、半導体産業と建設産業がフッ素樹脂フィルム市場の成長を後押ししています。さらに、フッ素樹脂フィルムに関連する近年の技術革新は、世界の産業における材料供給を増加させ、市場成長を後押しします。

半導体需要の増加がフッ素樹脂フィルム市場の成長に寄与

技術の進歩は、半導体の寄与が重大な要素として認識されうる世界を大いにつないでいます。フッ素樹脂フィルムは半導体のコンポーネントであり、チップの歩留まりを大幅に向上させ、一貫した微細設計を維持し、ダウンタイムを最小限に抑え、加工を改善します。フッ素樹脂は、高温下でも安定性を発揮するユニークな特性を持っており、これによって半導体はより高いエネルギー効率とより低い欠陥率で機能することができます。半導体産業においてフッ素樹脂フィルムを採用することで、伝送速度の向上、高い耐薬品性と純度の付与、関連部品の最大3~4倍の寿命など、数多くの優れた利点があります。半導体製造工程では、フッ素樹脂がコアインフラ機械やケミカルディストリビューションシステムの製造を可能にします。したがって、半導体産業のプラス要因全体がフッ素樹脂フィルム市場の成長に寄与しています。

フッ素樹脂フィルムがインフラ開発に向けたさまざまな建設を推進

土木プロジェクトは国の発展に不可欠な要素であり、国のGDPを向上させるうえで大きな寄与が認められます。フッ素樹脂フィルムは、落書き防止カバー、撥水建築加工、極端な腐食条件からの材料の保全などの特性を付与することにより、建設・インフラセグメントに持続可能なソリューションを次々ともたらしています。これらのフッ素樹脂フィルムは、屋根やファサードのような被覆用途で徐々に使用されるようになっています。フッ素樹脂フィルムは優れた化学的、熱的、酸化的安定性を持つため、建築材料として好ましく使用されます。上記の要因から、フッ素樹脂フィルム市場は、建設産業の推進により大規模な成長が見込まれています。

アジア太平洋市場がフッ素樹脂フィルム市場の成長に大きく寄与

インドや中国などアジア太平洋諸国の人口爆発は、半導体、電子機器、LCDなどの生産を加速させる革新的な技術の開発への需要を高めています。中国、韓国、インド、インドネシアといった国々の経済成長は、数多くの建設プロジェクトや自動車部門の進歩の積み重ねの結果です。これらの国々はまた、さまざまな再生可能プロジェクトや発電所の導入により、持続可能性目標を取り入れ、二酸化炭素排出を削減する方策を採用しています。

当レポートでは、世界のフッ素樹脂フィルム市場について調査分析し、市場規模と予測、市場力学、主要企業情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 世界のフッ素樹脂フィルム市場に対するCOVID-19の影響

第4章 エグゼクティブサマリー

第5章 顧客の声

- 市場の認知度と製品情報

- ブランドの認知度とロイヤルティ

- 購入決定において考慮される要素

- 購入頻度

- 購入媒体

第6章 世界のフッ素樹脂フィルム市場の見通し(2017年~2031年)

- 市場規模と予測

- 金額

- 数量

- 製品タイプ別

- テトラフルオロポリマー

- フッ化ビニリデン

- フッ化エチレンプロピレン

- その他

- 用途別

- 装置の製造

- 耐熱性

- 太陽光発電

- 酸化安定性

- その他

- エンドユーザー別

- 自動車

- 半導体

- 航空宇宙

- 建設

- その他

- 地域別

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

- 市場シェア:企業別(2023年)

第7章 世界のフッ素樹脂フィルム市場の見通し:地域別(2017年~2031年)

- 北米

- 市場規模と予測

- 製品タイプ別

- 用途別

- エンドユーザー別

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

- 南米

- ブラジル

- アルゼンチン

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第8章 サプライサイド分析

- 生産能力:企業別

- 生産:企業別

- 運転効率:企業別

- 主な工場の所在地(最大25)

第9章 市場マッピング(2023年)

- 製品タイプ別

- 用途別

- エンドユーザー別

- 地域別

第10章 マクロ環境と産業構造

- 需給分析

- 輸出入の分析 - 数量と金額

- サプライ/バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第11章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第12章 主要企業情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社の市場収益分析(2023年)

- 合併と買収/合弁事業(該当する場合)

- SWOT分析(市場参入企業5社)

- 特許分析(該当する場合)

第13章 価格分析

第14章 ケーススタディ

第15章 主要企業の見通し

- The Chemours Company

- Compagnie de Saint-Gobain S.A.

- Daikin America, Inc.

- Solvay

- Textiles Coated International (TCI)

- Nowofol

- ACG Chemicals

- Honeywell International

- Guraniflon S.p.A

- Dunmore

第16章 戦略的推奨事項

第17章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 2. Global Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 3. Global Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 4. Global Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 5. Global Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 6. Global Fluoropolymer Films Market Share (%), By Region, 2017-2031F

- Figure 7. North America Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 8. North America Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 9. North America Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 10. North America Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 11. North America Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 12. North America Fluoropolymer Films Market Share (%), By Country, 2017-2031F

- Figure 13. United States Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 14. United States Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 15. United States Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 16. United States Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 17. United States Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 18. Canada Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 19. Canada Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 20. Canada Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 21. Canada Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 22. Canada Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 23. Mexico Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 24. Mexico Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 25. Mexico Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 26. Mexico Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 27. Mexico Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 28. Europe Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 29. Europe Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 30. Europe Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 31. Europe Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 32. Europe Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 33. Europe Fluoropolymer Films Market Share (%), By Country, 2017-2031F

- Figure 34. Germany Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 35. Germany Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 36. Germany Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 37. Germany Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 38. Germany Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 39. France Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 40. France Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 41. France Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 42. France Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 43. France Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 44. Italy Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 45. Italy Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 46. Italy Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 47. Italy Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 48. Italy Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 49. United Kingdom Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 50. United Kingdom Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 51. United Kingdom Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 52. United Kingdom Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 53. United Kingdom Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 54. Russia Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 55. Russia Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 56. Russia Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 57. Russia Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 58. Russia Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 59. Netherlands Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 60. Netherlands Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 61. Netherlands Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 62. Netherlands Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 63. Netherlands Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 64. Spain Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 65. Spain Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 66. Spain Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 67. Spain Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 68. Spain Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 69. Turkey Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 70. Turkey Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 71. Turkey Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 72. Turkey Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 73. Turkey Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 74. Poland Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 75. Poland Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 76. Poland Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 77. Poland Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 78. Poland Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 79. South America Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 80. South America Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 81. South America Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 82. South America Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 83. South America Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 84. South America Fluoropolymer Films Market Share (%), By Country, 2017-2031F

- Figure 85. Brazil Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 86. Brazil Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 87. Brazil Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 88. Brazil Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 89. Brazil Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 90. Argentina Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 91. Argentina Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 92. Argentina Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 93. Argentina Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 94. Argentina Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 95. Asia-Pacific Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 96. Asia-Pacific Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 97. Asia-Pacific Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 98. Asia-Pacific Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 99. Asia-Pacific Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 100. Asia-Pacific Fluoropolymer Films Market Share (%), By Country, 2017-2031F

- Figure 101. India Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 102. India Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 103. India Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 104. India Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 105. India Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 106. China Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 107. China Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 108. China Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 109. China Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 110. China Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 111. Japan Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 112. Japan Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 113. Japan Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 114. Japan Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 115. Japan Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 116. Australia Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 117. Australia Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 118. Australia Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 119. Australia Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 120. Australia Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 121. Vietnam Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 122. Vietnam Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 123. Vietnam Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 124. Vietnam Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 125. Vietnam Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 126. South Korea Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 127. South Korea Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 128. South Korea Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 129. South Korea Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 130. South Korea Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 131. Indonesia Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 132. Indonesia Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 133. Indonesia Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 134. Indonesia Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 135. Indonesia Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 136. Philippines Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 137. Philippines Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 138. Philippines Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 139. Philippines Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 140. Philippines Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 141. Middle East & Africa Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 142. Middle East & Africa Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 143. Middle East & Africa Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 144. Middle East & Africa Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 145. Middle East & Africa Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 146. Middle East & Africa Fluoropolymer Films Market Share (%), By Country, 2017-2031F

- Figure 147. Saudi Arabia Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 148. Saudi Arabia Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 149. Saudi Arabia Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 150. Saudi Arabia Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 151. Saudi Arabia Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 152. UAE Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 153. UAE Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 154. UAE Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 155. UAE Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 156. UAE Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 157. South Africa Fluoropolymer Films Market, By Value, in USD Billion, 2017-2031F

- Figure 158. South Africa Fluoropolymer Films Market, By Volume, in Kilotons, 2017-2031F

- Figure 159. South Africa Fluoropolymer Films Market Share (%), By Product Type, 2017-2031F

- Figure 160. South Africa Fluoropolymer Films Market Share (%), By Application, 2017-2031F

- Figure 161. South Africa Fluoropolymer Films Market Share (%), By End-user, 2017-2031F

- Figure 162. By Product Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 163. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 164. By End-user Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 165. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global fluoropolymer films market is projected to witness a CAGR of 4.5% during the forecast period 2024-2031, growing from USD 1.89 billion in 2023 to USD 2.69 billion in 2031. Fluoropolymer films are progressively designed for driving connectivity and developing network infrastructure that is powered by semiconductors and circuit boards. For instance, in October 2023, China's huge semiconductor state fund invested around USD 2 billion in Changxin Xinqiao a memory chip company to fulfil the requirement of electronics demand.

The rising infrastructure projects in various construction sectors at the global level are significantly propelling the growth of the fluoropolymer films market. For illustration, France, a developed country with around 67 million population, has progressively accomplished new industry establishment. In June 2023, France successively invested in STMicroelectronics with a huge sum of USD 3.10 billion to build a semiconductor factory in Crolles, southeastern France.

The fluoropolymer films market is experiencing massive growth due to several key drivers, such as growing demand for semiconductor applications, rising energy demand from renewable sources like solar energy, highly resistant roof structures, and industrial processing equipment, among others. Fluoropolymer films offer chemical resistance, optical transparency, thermal stability, and weather and ultraviolet (UV) resistance, which extends its application in prominent sectors, including automotive, semiconductors, aerospace, construction, and others. In addition to such incredible properties. fluoropolymer films are also used as anti-graffiti coverings, automotive airbag systems, and microphone electret membranes. Consequently, the semiconductor and construction industries are propelling the growth of the fluoropolymer films market. Additionally, recent technological innovations related to fluoropolymer films will increase the supply of material in the global industry, thereby favoring market growth.

Rising Semiconductor Demand is Contributing To the Growth of Fluoropolymer Films Market

The advancement in technology has substantially connected the world where the contribution of semiconductors can be recognized as a prominent component. Fluoropolymer films are building blocks of semiconductors that significantly maximize chip yields, keep consistent micro-design, minimize downtime, and improve processing. Fluoropolymers possess unique properties that deliver stability at high temperatures, which enables semiconductors to work with higher energy efficiency and lower defectivity. There are numerous excellent benefits of incorporating fluoropolymer films in the semiconductor industry enhancement in transmission speeds, imparting high chemical resistance and purity, and increased lifespan of associated components by up to 3-4 times. During semiconductor fabrication, fluoropolymer successively enables the production of core infrastructure machines and chemical distribution systems. Hence, the overall positive market factors for the semiconductor industry contribute to the growth of the fluoropolymer films market.

For instance, according to the recent data released by the Consumer Technology Association, in 2022, the United States consumer technology industry was estimated to have generated over USD 505 billion in retail sales revenue. In 2022, IBM generated a revenue of USD 60.5 billion, consequently leading to a revenue growth of around 12%. They have successfully invested around USD 2 billion and assisted in acquiring 8 companies. In addition, the data published by Europe Journal describes the semiconductor industry's growth where the European Union (EU) has significantly fascinated nearly USD 100 billion investments stated by the European Union (EU) Commission chief.

Fluoropolymer Films is Propelling Various Construction Works for Infrastructure Development

Civil engineering projects are an integral part of the development of a nation where significant contributions can be recognized in enhancing the country's GDP. Fluoropolymer films are successively delivering sustainable solutions in the construction and infrastructure segment by imparting characteristics like anti-graffiti coverings, water-repellent architectural fabrication, and prevention of materials from extreme corrosive conditions, among others. These fluoropolymer films are progressively used in cladding applications like roofing and facade construction. Fluoropolymer films possess excellent chemical, thermal, and oxidative stability and hence, are suitably used as construction materials. Accounting to the above-mentioned factors, fluoropolymer films market is anticipated to experience massive growth due to the propelling construction industry.

For instance, in May 2022, the Biden administration cleared a huge amount of USD 550 billion to ensure substantial upgrades across infrastructure projects, including roads, bridges, and dams. Furthermore, a long bridge in Saudia Arabia is coming into existence, which connects the intersection with the Riyadh-Jeddah highway. Moreover, according to the data released by the European Steel Association (EUROFER), in 2022, the volume of production in the construction sector across the European Union substantially grew by 4.8% as opposed to the year 2021. A recent report by the Canadian Construction Association states that the construction industry accounts for 7.4% of its gross domestic product (GDP) and generates a revenue of around USD 151 billion. As a result, the booming construction activities at the global level are driving the adoption of fluoropolymer films, which is amplifying the market growth.

Asia-Pacific Market is Progressively Contributing to the Growth of Fluoropolymer Films Market

The population explosion in Asia-Pacific countries, such as India and China, has increased the demand for developing innovative technologies to accelerate the production of semiconductors, electronic gadgets, LCDs, etc. The growing economy of countries like China, South Korea, India, and Indonesia is an accumulative outcome of numerous construction projects and advancements in the automotive sector. These countries have also adopted measures to incorporate sustainable goals and reduce carbon emissions by implementing various renewable projects and power plants.

For instance, in November 2022, a joint venture between Sony Group Corp and NEC Corp in Japan successfully urged investing around USD 500 million to commence and establish Japan as a huge production hub for developing advanced chips. India has established a massive infrastructure for taking the country to the progressive map of sustainable goals and incorporated numerous projects in the solar industry and photovoltaic industry. Likewise, under the China Belt and Road Initiative (BRI), the investment in road projects 2022 was USD 67.8 billion. China State Railway Group in August 2022 has progressively commissioned huge investments to enhance the railway network across the country by 2035. Therefore, with such a definite investment, the Asia-Pacific region is considered a prominent contributor to the growth of the fluoropolymer films market.

Impact of COVID-19

The shutdown of construction and transportation industries deteriorated the economic stability across various regions in the year 2020. The revenue for electronic sector also drastically reduced during the pandemic due to lower consumer demands. Along with this, the unavailability of resources and manpower for building effective management system significantly affected the fluoropolymer films market growth. During COVID-19, the semiconductor industry experienced unprecedented fluctuations, which declined by 5% to 15% across various countries in 2020. Semiconductors' demand for wireless and communication devices dropped as there came a shift in consumer preferences for less expensive phones. However, during the second half of 2020, the semiconductor industry projected decent growth as consumer demand rose again, which encouraged industries to bid for fluoropolymer film products in their practices. Consecutively, the ease in restrictions and removal of lockdown shifted the worst phase of the market to probable growth, deriving impeccable market opportunities.

Key Players Landscape and Outlook

The rising fluoropolymer films market has encouraged prominent companies to develop innovative solutions for advanced chips required in the electronic sectors, along with effective roofing solutions. The leading global companies in the fluoropolymer films market are progressively developing excellent fluoropolymer films that are benefitting prominent sectors. For instance, The Chemours Company is making fluoropolymer with unique properties that successfully handle high-purity chemicals at even higher temperatures, enabling semiconductors to work effectively. Daikin America, Inc., a global player, provides high-performance fluoropolymer films and sheets based on fluorine technology, offering outstanding chemical resistance, transparency, weather resistance, heat resistance, and electrical characteristics.

In October 2023, The Chemours Company and Honeywell successfully collaborated to commence the extension of the pilot program across the European Union and the UK for fluorinated gas reclaiming and recycling to progressively minimize environmental impacts and promote a circular economy.

Table of Contents

1. Research Methodology

2. Project Scope & Definitions

3. Impact of COVID-19 on Global Fluoropolymer Films Market

4. Executive Summary

5. Voice of Customer

- 5.1. Market Awareness and Product Information

- 5.2. Brand Awareness and Loyalty

- 5.3. Factors Considered in Purchase Decision

- 5.3.1. Brand Name

- 5.3.2. Quality

- 5.3.3. Quantity

- 5.3.4. Price

- 5.3.5. Product Specification

- 5.3.6. Application Specification

- 5.3.7. Shelf Life

- 5.3.8. Availability of Product

- 5.4. Frequency of Purchase

- 5.5. Medium of Purchase

6. Global Fluoropolymer Films Market Outlook, 2017-2031F

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. By Product Type

- 6.2.1. Tetrafluoropolymer

- 6.2.2. Vinylidenefluoride

- 6.2.3. Fluorinated Ethylenepropylene

- 6.2.4. Others

- 6.3. By Application

- 6.3.1. Equipment Fabrication

- 6.3.2. Heat Resistance

- 6.3.3. Photovoltaic

- 6.3.4. Oxidative Stability

- 6.3.5. Others

- 6.4. By End-user

- 6.4.1. Automotive

- 6.4.2. Semiconductors

- 6.4.3. Aerospace

- 6.4.4. Constructions

- 6.4.5. Others

- 6.5. By Region

- 6.5.1. North America

- 6.5.2. Europe

- 6.5.3. South America

- 6.5.4. Asia-Pacific

- 6.5.5. Middle East and Africa

- 6.6. By Company Market Share (%), 2023

7. Global Fluoropolymer Films Market Outlook, By Region, 2017-2031F

- 7.1. North America*

- 7.1.1. Market Size & Forecast

- 7.1.1.1. By Value

- 7.1.1.2. By Volume

- 7.1.2. By Product Type

- 7.1.2.1. Tetrafluoropolymer

- 7.1.2.2. Vinylidenefluoride

- 7.1.2.3. Fluorinated Ethylenepropylene

- 7.1.2.4. Others

- 7.1.3. By Application

- 7.1.3.1. Equipment Fabrication

- 7.1.3.2. Heat Resistance

- 7.1.3.3. Photovoltaic

- 7.1.3.4. Oxidative Stability

- 7.1.3.5. Others

- 7.1.4. By End-user

- 7.1.4.1. Automotive

- 7.1.4.2. Semiconductors

- 7.1.4.3. Aerospace

- 7.1.4.4. Constructions

- 7.1.4.5. Others

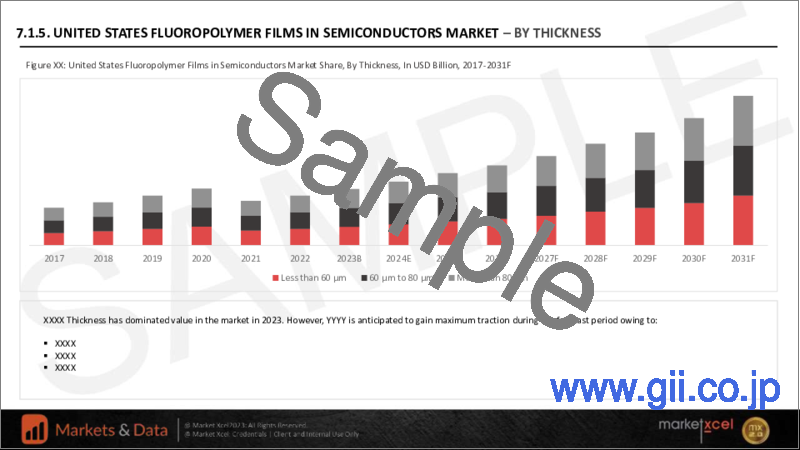

- 7.1.5. United States*

- 7.1.5.1. Market Size & Forecast

- 7.1.5.1.1. By Value

- 7.1.5.1.2. By Volume

- 7.1.5.2. By Product Type

- 7.1.5.2.1. Tetrafluoropolymer

- 7.1.5.2.2. Vinylidenefluoride

- 7.1.5.2.3. Fluorinated Ethylenepropylene

- 7.1.5.2.4. Others

- 7.1.5.3. By Application

- 7.1.5.3.1. Equipment Fabrication

- 7.1.5.3.2. Heat Resistance

- 7.1.5.3.3. Photovoltaic

- 7.1.5.3.4. Oxidative Stability

- 7.1.5.3.5. Others

- 7.1.5.4. By End-user

- 7.1.5.4.1. Automotive

- 7.1.5.4.2. Semiconductors

- 7.1.5.4.3. Aerospace

- 7.1.5.4.4. Constructions

- 7.1.5.4.5. Others

- 7.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered:

- 7.1.6. Canada

- 7.1.7. Mexico

- 7.2. Europe

- 7.2.1. Germany

- 7.2.2. France

- 7.2.3. Italy

- 7.2.4. United Kingdom

- 7.2.5. Russia

- 7.2.6. Netherlands

- 7.2.7. Spain

- 7.2.8. Turkey

- 7.2.9. Poland

- 7.3. South America

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.4. Asia-Pacific

- 7.4.1. India

- 7.4.2. China

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Vietnam

- 7.4.6. South Korea

- 7.4.7. Indonesia

- 7.4.8. Philippines

- 7.5. Middle East & Africa

- 7.5.1. Saudi Arabia

- 7.5.2. UAE

- 7.5.3. South Africa

8. Supply Side Analysis

- 8.1. Capacity, By Company

- 8.2. Production, By Company

- 8.3. Operating Efficiency, By Company

- 8.4. Key Plant Locations (Up to 25)

9. Market Mapping, 2023

- 9.1. By Product Type

- 9.2. By Application

- 9.3. By End-user

- 9.4. By Region

10. Macro Environment and Industry Structure

- 10.1. Supply Demand Analysis

- 10.2. Import Export Analysis - Volume and Value

- 10.3. Supply/Value Chain Analysis

- 10.4. PESTEL Analysis

- 10.4.1. Political Factors

- 10.4.2. Economic System

- 10.4.3. Social Implications

- 10.4.4. Technological Advancements

- 10.4.5. Environmental Impacts

- 10.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 10.5. Porter's Five Forces Analysis

- 10.5.1. Supplier Power

- 10.5.2. Buyer Power

- 10.5.3. Substitution Threat

- 10.5.4. Threat from New Entrant

- 10.5.5. Competitive Rivalry

11. Market Dynamics

- 11.1. Growth Drivers

- 11.2. Growth Inhibitors (Challenges, Restraints)

12. Key Players Landscape

- 12.1. Competition Matrix of Top Five Market Leaders

- 12.2. Market Revenue Analysis of Top Five Market Leaders (in %, 2023)

- 12.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 12.4. SWOT Analysis (For Five Market Players)

- 12.5. Patent Analysis (If Applicable)

13. Pricing Analysis

14. Case Studies

15. Key Players Outlook

- 15.1. The Chemours Company

- 15.1.1. Company Details

- 15.1.2. Key Management Personnel

- 15.1.3. Products & Services

- 15.1.4. Financials (As reported)

- 15.1.5. Key Market Focus & Geographical Presence

- 15.1.6. Recent Developments

- 15.2. Compagnie de Saint-Gobain S.A.

- 15.3. Daikin America, Inc.

- 15.4. Solvay

- 15.5. Textiles Coated International (TCI)

- 15.6. Nowofol

- 15.7. ACG Chemicals

- 15.8. Honeywell International

- 15.9. Guraniflon S.p.A

- 15.10. Dunmore

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.