|

|

市場調査レポート

商品コード

1402428

アダプティブフロントライティングの世界市場の評価:コンポーネント別、ライトタイプ別、技術別、車両タイプ別、販売チャネル別、地域別、機会、予測(2017年~2031年)Adaptive Front Lighting Market Assessment, By Component, By Light Type, By Technology, Vehicle Type, Sales Channel, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| アダプティブフロントライティングの世界市場の評価:コンポーネント別、ライトタイプ別、技術別、車両タイプ別、販売チャネル別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年01月08日

発行: Markets & Data

ページ情報: 英文 229 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のアダプティブフロントライティングの市場規模は、2023年に18億1,000万米ドル、2031年に33億1,000万米ドルに達し、2024年~2031年の予測期間にCAGRで7.85%の成長が見込まれています。悪条件下での視認性向上に向けた自動車照明の力学の変化が市場動向を変えています。効率的な照明技術が市場成長を促進しています。特に、マトリクスLED技術、ADASとの統合、スマート照明制御などの進化するLED技術が市場見通しを形成しています。アダプティブフロントライティングシステムにおける発光ダイオード(LED)技術の使用は、そのエネルギー効率、小さいサイズ、ハイエンドとエントリーレベルの車両のいずれにも適応可能な設計により、ますます普及しています。さらに、耐久性が高く、即座に照明が点灯するため、自動車用LEDライトの使用は有利です。

アダプティブフロントライティングシステムの使用はますます体系化されつつあり、道路、天候、交通のさまざまな状況に適応できるようになっています。さらに、アダプティブフロントライティングシステムは、ステアリング入力に反応し、ダイナミックな照明パターンを提供することができます。アダプティブフロントライティングは、コネクテッドビークルが普及し、車車間(V2V)通信が浸透するにつれて、リアルタイムの情報交換を活用して交通安全を高めることができます。例えば、車両は他の車両や道路インフラから受信した情報に基づいて照明を変更することができます。最後に、政府の取り組みと安全規制がアダプティブフロントライティングシステムの採用を増加させています。ABS、ADAS、クルーズコントロールシステムなどのその他の安全策は、新しい照明システムと統合される可能性が高いです。

安全規制と自動車生産の増加が市場成長を促進

交通安全を高める先進の照明システムを要求する厳しい安全規制や基準の導入は、アダプティブフロントライティングシステムの開発に大きな影響を与えています。これらのシステムは、さまざまな走行条件に適応することができるため、対向車のまぶしさを低減し、ドライバーの視界を改善することができます。自動車産業は世界中で急速に拡大しています。ACEAによると、2022年に世界で8,540万台の自動車が生産され、2021年比で5.7%増加しました。その結果、消費者の精巧な機能に対する要求が高まり、アダプティブフロントライティングを装備した自動車が増加しています。

さらに、世界中で都市化が進んだ結果、夜間に走行する自動車が増加しました。そのため、アダプティブフロントライティングの導入が必要となり、道路状況が複雑な都市部では特に有益です。さらに、ADASや車車間(V2V)通信システムとの技術統合が市場拡大を促進しています。

各国政府がアダプティブフロントライトの採用を支援

政府機関は自動車照明に関する規制や安全基準を設けています。こうした基準は、照明技術の使用を規定したり、安全要件を満たすアダプティブフロントライトシステムの性能要件を策定しています。一部の政府は、このような先進の安全機能の使用を促進するインセンティブを提供しており、このようなシステムを搭載した車両に対する税制優遇、リベート、補助金などが期待されます。

高いエネルギー効率と設計の柔軟性で市場をリードするLEDセグメント

ライトタイプ別では、LEDセグメントが市場をリードすると予測されます。このセグメントの成長は、エネルギー効率、耐久性、デザイン、柔軟性、先進の制御、色のカスタマイズといった特徴によってもたらされます。LEDは従来の照明技術に比べてエネルギー効率が高いです。鮮明で集中的な照明を提供する一方で、エネルギー消費は少ないです。このエネルギー効率のレベルは、二酸化炭素排出を削減し、自動車の燃費を向上させるという世界の取り組みと一致しています。LEDは、その耐久性と回復力に定評があります。

白熱電球に比べ、LEDの寿命は大幅に長く、メンテナンスや交換にかかる費用も少なく済みます。LEDは高度に制御可能であるため、アダプティブフロントライティングシステムに使用することができます。これらのシステムは、さまざまな走行状況に応じて光線の方向と強さを動的に調整することができます。最後に、環境への利益と技術の進歩が、予測期間を通じてこのセグメントの成長を支えています。LEDには、以前の照明技術に含まれていた水銀などの有害金属が含まれていません。さらに、そのエネルギー効率は、エネルギー使用とカーボンフットプリントを削減する世界の取り組みに沿っています。

当レポートでは、世界のアダプティブフロントライティング市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 世界のアダプティブフロントライティング市場に対するCOVID-19の影響

第4章 ロシア・ウクライナ戦争の影響

第5章 エグゼクティブサマリー

第6章 顧客の声

- 耐久性

- 輝度

- 統合機能

- カスタマイズ

- 道路認識

- サプライチェーン、入手性

第7章 世界のアダプティブフロントライティング市場の見通し(2017年~2031年)

- 市場規模と予測

- 金額

- コンポーネント別

- センサー

- 制御システム

- ヘッドライト調整

- ライトタイプ別

- ハロゲン

- LED

- その他

- 技術別

- アダプティブハイビームシステム

- マトリクスLEDハイライト

- 予測的アダプティブフロントシステム

- その他

- 車両別

- 乗用車

- 商用車

- その他

- 販売チャネル別

- OEM

- アフターマーケット

- 地域別

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

- 市場シェア:企業別(2023年)

第8章 世界のアダプティブフロントライティング市場の見通し:地域別(2017年~2031年)

- 北米

- 市場規模と予測

- コンポーネント別

- ライトタイプ別

- 技術別

- 車両別

- 販売チャネル別

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- 南米

- ブラジル

- アルゼンチン

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- 韓国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第9章 市場マッピング(2023年)

- コンポーネント別

- ライトタイプ別

- 技術別

- 車両別

- 販売チャネル別

- 地域別

第10章 マクロ環境と産業構造

- 需給分析

- 輸出入の分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第11章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第12章 主要企業情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社の市場収益分析(2023年)

- 合併と買収/合弁事業(該当する場合)

- SWOT分析(市場参入企業5社)

- 特許分析(該当する場合)

第13章 価格分析

第14章 ケーススタディ

第15章 主要企業の見通し

- OSRAM Licht AG

- Robert Bosch GmbH

- Valeo SA

- Continental AG

- Denso Corporation

- Hyundai Mobis

- Johnson Electric

- Stanley Electric Co. Ltd

- Hell GmbH Co. Ltd

- Magneti Marelli S.p.A

第16章 戦略的推奨事項

第17章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 3. Global Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 4. Global Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 5. Global Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 6. Global Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 7. Global Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 8. Global Adaptive Front Lighting Market Share (%), By Region, 2017-2031F

- Figure 9. North America Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 10. North America Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 11. North America Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

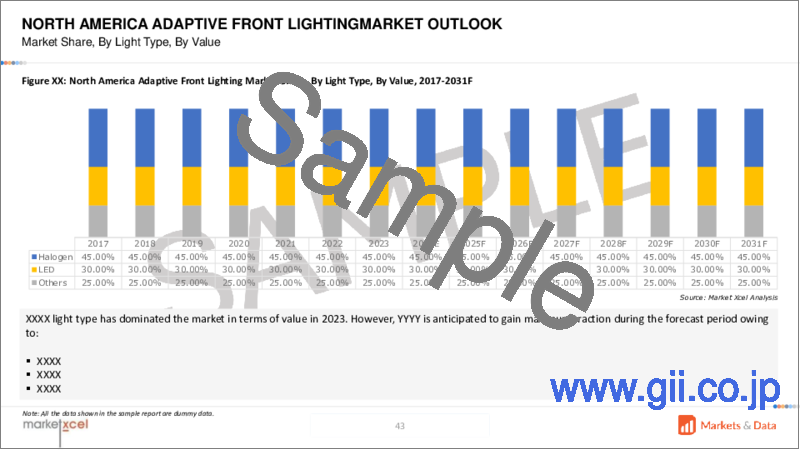

- Figure 12. North America Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 13. North America Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 14. North America Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 15. North America Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 16. North America Adaptive Front Lighting Market Share (%), By Country, 2017-2031F

- Figure 17. United States Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 18. United States Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 19. United States Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 20. United States Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 21. United States Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 22. United States Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 23. United States Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 24. Canada Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 25. Canada Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 26. Canada Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 27. Canada Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 28. Canada Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 29. Canada Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 30. Canada Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 31. Mexico Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 32. Mexico Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 33. Mexico Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 34. Mexico Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 35. Mexico Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 36. Mexico Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 37. Mexico Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 38. Europe Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 39. Europe Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 40. Europe Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 41. Europe Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 42. Europe Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 43. Europe Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 44. Europe Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 45. Europe Adaptive Front Lighting Market Share (%), By Country, 2017-2031F

- Figure 46. Germany Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 47. Germany Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 48. Germany Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 49. Germany Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 50. Germany Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 51. Germany Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 52. Germany Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 53. France Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 54. France Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 55. France Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 56. France Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 57. France Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 58. France Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 59. France Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 60. Italy Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 61. Italy Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 62. Italy Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 63. Italy Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 64. Italy Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 65. Italy Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 66. Italy Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 67. United Kingdom Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 68. United Kingdom Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 69. United Kingdom Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 70. United Kingdom Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 71. United Kingdom Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 72. United Kingdom Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 73. United Kingdom Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 74. Russia Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 75. Russia Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 76. Russia Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 77. Russia Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 78. Russia Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 79. Russia Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 80. Russia Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 81. Netherlands Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 82. Netherlands Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 83. Netherlands Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 84. Netherlands Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 85. Netherlands Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 86. Netherlands Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 87. Netherlands Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 88. Spain Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 89. Spain Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 90. Spain Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 91. Spain Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 92. Spain Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 93. Spain Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 94. Spain Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 95. Turkey Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 96. Turkey Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 97. Turkey Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 98. Turkey Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 99. Turkey Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 100. Turkey Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 101. Turkey Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 102. Poland Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 103. Poland Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 104. Poland Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 105. Poland Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 106. Poland Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 107. Poland Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 108. Poland Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 109. South America Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 110. South America Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 111. South America Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 112. South America Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 113. South America Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 114. South America Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 115. South America Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 116. South America Adaptive Front Lighting Market Share (%), By Country, 2017-2031F

- Figure 117. Brazil Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 118. Brazil Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 119. Brazil Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 120. Brazil Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 121. Brazil Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 122. Brazil Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 123. Brazil Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 124. Argentina Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 125. Argentina Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 126. Argentina Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 127. Argentina Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 128. Argentina Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 129. Argentina Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 130. Argentina Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 131. Asia-Pacific Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 132. Asia-Pacific Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 133. Asia-Pacific Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 134. Asia-Pacific Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 135. Asia-Pacific Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 136. Asia-Pacific Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 137. Asia- Pacific Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 138. Asia-Pacific Adaptive Front Lighting Market Share (%), By Country, 2017-2031F

- Figure 139. India Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 140. India Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 141. India Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 142. India Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 143. India Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 144. India Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 145. India Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 146. China Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 147. China Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 148. China Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 149. China Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 150. China Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 151. China Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 152. China Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 153. Japan Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 154. Japan Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 155. Japan Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 156. Japan Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 157. Japan Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 158. Japan Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 159. Japan Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 160. Australia Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 161. Australia Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 162. Australia Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 163. Australia Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 164. Australia Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 165. Australia Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 166. Australia Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 167. Vietnam Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 168. Vietnam Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 169. Vietnam Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 170. Vietnam Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 171. Vietnam Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 172. Vietnam Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 173. Vietnam Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 174. South Korea Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 175. South Korea Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 176. South Korea Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 177. South Korea Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 178. South Korea Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 179. South Korea Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 180. South Korea Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 181. Indonesia Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 182. Indonesia Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 183. Indonesia Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 184. Indonesia Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 185. Indonesia Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 186. Indonesia Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 187. Indonesia Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 188. Philippines Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 189. Philippines Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 190. Philippines Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 191. Philippines Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 192. Philippines Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 193. Philippines Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 194. Philippines Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 195. Middle East & Africa Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 196. Middle East & Africa Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 197. Middle East & Africa Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 198. Middle East & Africa Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 199. Middle East & Africa Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 200. Middle East & Africa Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 201. Middle East & Africa Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 202. Middle East & Africa Adaptive Front Lighting Market Share (%), By Country, 2017-2031F

- Figure 203. Saudi Arabia Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 204. Saudi Arabia Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 205. Saudi Arabia Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 206. Saudi Arabia Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 207. Saudi Arabia Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 208. Saudi Arabia Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 209. Saudi Arabia Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 210. UAE Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 211. UAE Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 212. UAE Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 213. UAE Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 214. UAE Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 215. UAE Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 216. UAE Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 217. South Africa Adaptive Front Lighting Market, By Value, In USD Billion, 2017-2031F

- Figure 218. South Africa Adaptive Front Lighting Market, By Volume, In Million Units, 2017-2031F

- Figure 219. South Africa Adaptive Front Lighting Market Share (%), By Component, 2017-2031F

- Figure 220. South Africa Adaptive Front Lighting Market Share (%), By Light Type, 2017-2031F

- Figure 221. South Africa Adaptive Front Lighting Market Share (%), By Technology, 2017-2031F

- Figure 222. South Africa Adaptive Front Lighting Market Share (%), By Vehicle, 2017-2031F

- Figure 223. South Africa Adaptive Front Lighting Market Share (%), By Sales Channel, 2017-2031F

- Figure 224. By Component Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 225. By Light Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 226. By Technology Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 227. By Vehicle Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 228. By Sales Channel Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 229. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global adaptive front lighting market size was valued at USD 1.81 billion in 2023, which is expected to reach USD 3.31 billion in 2031, with a CAGR of 7.85% for the forecast period between 2024 and 2031. The changing dynamics of automotive lighting for better visibility in odd conditions are changing the market trend. Efficient lighting technology is flourishing the market growth. Notably, evolving LED technologies like matrix LED technology, integration with advanced driver assistance systems (ADAS), and smart lighting controls are shaping the market prospects. The use of light emitting diode (LED) technology in adaptive front lighting systems has become increasingly popular due to its energy efficiency, small size, and adaptable design in both high-end and entry-level vehicles. Furthermore, the high durability and instant illumination favor the usage of LED lights for automotives.

The use of adaptive front lighting systems is becoming increasingly systematic and capable of adapting to a wide range of conditions on the road, in the weather, and in traffic. Additionally, adaptive front lighting systems can respond to steering inputs and offer dynamic lighting patterns. Adaptive front lighting can take advantage of real-time information exchange to enhance road safety as connected vehicles become more prevalent and vehicle-to-vehicle (V2V) communication becomes more prevalent. For instance, a vehicle could modify its lighting based on information received from other vehicles and road infrastructure. Lastly, the government initiatives and safety regulations increase the adoption of adaptive front lighting systems. Other safety measurements such as ABS, ADAS, and cruise control systems are likely to integrate with new lighting systems.

Advanced LED Technology and Smart Lighting Control to Garner the Market Growth

The advanced LED technology with higher, quick, and efficient illumination is likely to speed up the adoption rate of adaptive front lighting. The adaptive lights play a crucial role in delivering enough vison to the driver, and thereby preventing accidents. Enhancing security is further added through the customizable lighting experience and advanced sensors. Manufacturers are providing a range of customizable lighting solutions to meet the needs of individual customers. It include features such as adjustable color temperature and mood lighting. Additionally, the utilization of sophisticated sensors, such as Light Detection and Ranging (LiDAR) and infrared sensors (IR), is becoming increasingly prevalent in adaptive front lighting system to improve their performance in varied weather and road conditions.

In July 2023, prior to the official introduction of the mid-sized electric SUV, Audi released several promotional images of the new Q6 e-Tron, as well as the introduction of its second-generation adaptive OLED headlight and taillamp system. Certain adaptive front lighting systems now have the capability to detect and adjust according to road conditions. For instance, they can modify the light beam to prevent reflections from wet road surfaces, thereby improving visibility in inclement weather.

Safety Regulations and Increasing Vehicle Production to Fuel the Market Growth

The implementation of stringent safety regulations and standards requiring advanced lighting systems to enhance road safety has been a major influence on the development of adaptive front lighting systems. These systems can adapt to varying driving conditions, thereby reducing the glare of incoming vehicles, and improving the driver's visibility. The automotive industry is expanding rapidly around the world. According to ACEA, in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. It has resulted in an increased demand for sophisticated features from consumers and more vehicles equipped with adaptive front lighting.

Additionally, urbanization around the world has resulted in an increase in the number of vehicles operating at night. It has necessitated the implementation of adaptive front lighting, which is particularly beneficial in urban settings with intricate road conditions. Furthermore, the technological integration with advanced driver assistance systems (ADAS) and vehicle-to-vehicle (V2V) communication systems have flourished the market expansion.

Governments are Supporting the Adoption of Adaptive Front Lights

Governmental bodies have established regulations and safety standards related to automotive lighting. Such standards prescribe the use of lighting technologies or specify the performance requirements of adaptive front lighting systems to meet safety requirements. Some governments provide incentives to promote the use of such sophisticated safety features, expected to include tax incentives, rebates, or subsidies on vehicles with such systems installed.

For example, the SIAM and major automotive trade exhibitions such as the auto expo have a significant impact on the development of the industry, while initiatives such as the 'Make in India' program are projected to bring significant growth in the coming years. Governments provide funding for research and development of adaptive front lighting technologies. This funding can facilitate the development of cutting-edge lighting solutions. In some countries, governments subsidize the development of innovative automotive lighting technologies, including adaptive lighting solutions. It involves funding research, development, and testing.

While in some geographies, the governments impose lenient regulations regarding road and vehicle safety. For instance, the car manufacturers and American Automobile Association are not satisfied with the United States' regulatory body National Highway Traffic Safety Administration (NHTSA). The body hasn't yet updated the rules about the utilization of adaptive front lights and hence companies are pushing American regulators to certify OEM adaptive front lighting systems.

LED Segment Leads the Market with Higher Energy Efficiency and Design Flexibility

Based on light type, the LED segment is expected to lead the market. The segmental growth garners with features like energy efficiency, durability, design, flexibility, advanced control, and color customization. LEDs are energy-efficient in comparison to conventional lighting technologies. They use less energy while providing a clear and concentrated illumination. This level of energy efficiency is in line with global efforts to reduce carbon emissions and enhance fuel efficiency in vehicles. Light-emitting diodes (LEDs) are renowned for their durability and resilience.

Compared to incandescent bulbs, the lifespan of LEDs is significantly longer, requiring lower maintenance and replacement expenses. LEDs are highly controllable, allowing them to be used in adaptive front lighting systems. These systems can dynamically adjust the direction and intensity of light beam in response to various driving conditions. Lastly, the environmental benefits and technological advancements are helping the segment to grow through the forecast period. LEDs do not contain any toxic metals, such as mercury, which are present in some earlier lighting technologies. Furthermore, their energy efficiency is in line with global initiatives to reduce energy use and carbon footprint.

In July 2023, OSRAM unveiled a revolutionary new technology in automotive forward lighting, EVIYOS 2.0. The advanced intelligent multipixel LED is capable of fully adaptive and dynamic headlight operation, as well as image projection. EVs 2.0 are capable of selectively illuminating the road ahead to enhance the driver's visibility in high beams without producing the glare typically associated with other road users.

Rising Sales of Automotive and Stringent Safety Regulations Fuels the Passenger Vehicle Segment

Based on vehicle type, the passenger vehicle segment is expected to hold the major portion of the market. The growth is attributed to the safety regulation and standards along with the urbanization and increased sales of personal vehicles. The latest technology, such as adaptive front lighting, is typically found in premium and luxury passenger cars. These vehicles are the first to adopt advanced lighting solutions, thus setting trends that mainstream models later adopt. To enhance road safety, a variety of safety regulations have been implemented in various countries and regions that promote or mandate the implementation of advanced lighting systems. These standards are applicable to passenger vehicles, and automotive manufacturers are often required to install adaptive front lighting to meet them. Hence, the adoption of automotive adaptive front lighting is increasing due to the rising sales of passenger vehicles.

Rapid Urbanization to Make Asia-Pacific the Leading Region

Asia-Pacific is expected to lead the global adaptive front lighting market. The rising disposable income of many countries in Asia-Pacific has increased the demand for luxury and premium vehicles. These vehicles are often equipped with adaptive front lighting, which has contributed to the expansion of the market. The rapid urbanization of many Asian countries has increased the number of vehicles being driven both during the daytime and at night.

For instance, Audi and Mercedes-Benz reports rise in sales of their luxury cars by 96.83% and 12.61% respectively in first half of 2023, as compared to first half of 2022. As a result, adaptive front lighting systems have become increasingly popular in these settings. Countries like India and China are investing in partnerships among companies and authorities as well. Higher number of accidents due to lack of proper lighting during the night drives are making the governments to focus on advanced lighting solutions. It doesn't just interest government authorities but let local automotive brands to align with the latest technology. Hence, the tie-ups between local automotive component brands and international companies are garnering growth of the region.

In July 2023, Marelli has partnered with Ams OSRAM to introduce h-Digi micro-LED module in series production.

Impact of COVID-19

COVID-19 damaged the market through constant supply chain disruptions, reduced demand, financial strain, and production halts. Alongside, the limited operations of automotive research and development damaged the market. In response to COVID-19, several automotive manufacturers temporarily ceased or reduced production. It resulted in supply chain disruption and a delay in the manufacturing and deployment of adaptive front lighting in vehicles. The economic effects of the pandemic, as well as the restrictions imposed by the government, resulted in a decrease in consumer demand for new cars. Consequently, manufacturers experienced a decrease in sales and had to revise their production plans. The pandemic had a significant impact on research and development in the automotive sector, potentially delaying the deployment of new technologies and advances in adaptive front lighting.

Impact of Russia-Ukraine War

Russia-Ukraine war has an adverse impact the automotives and components market. Ukraine has traditionally been a major manufacturer of electronic devices, including those utilized in automotive lighting applications. However, the ongoing conflict and economic crisis in the region have caused a disruption in the supply chain of these essential components, which potentially led to delayed product deliveries. The effects of the war have an impact on the fluctuation of the prices of essential raw materials for automotive lighting, including metals, plastics, and electronic components. These fluctuations impacted on the total cost of production for adaptive front lighting.

Key Player Landscape and Outlook

The competitive landscape of the global adaptive front lighting market is focused on advanced technologies. Companies focus on higher integration with safety modules, compatibility, light output, and energy efficiency. Some of the major players in global adaptive front lighting market are Robert Bosch GmbH, Valeo SA, Continental AG, Denso Corporation, Hyundai Mobis, Johnson Electric, Stanley Electric Co. Ltd, Hell GmbH Co. Ltd, Magneti Marelli S.p.A, and Koito Manufacturing.

In June 2023, Motherson, in partnership with Marelli declared the opening of its automotive lighting tool room, the first of its kind in India. The new facility is designed to capitalize on the existing strengths of Motherson, and Marelli, to satisfy the long-standing requirements of Indian Original Equipment Manufacturer (OEM) for the localization of sophisticated automotive lighting solutions.

In October 2023, KOITO MATERIALING Co., Ltd. and KONSO CORPORATION entered into an agreement to collaborate on the development of a system to enhance the object recognition performance. The lighting is expected to integrate with vehicle image sensors through the coordination of lamps and image sensors to enhance driving safety at night.

Table of Contents

1. Research Methodology

2. Project Scope & Definitions

3. Impact of COVID-19 on Global Adaptive Front Lighting Market

4. Impact of Russia-Ukraine War

5. Executive Summary

6. Voice of Customer

- 6.1. Durability

- 6.2. Brightness

- 6.3. Integration Capability

- 6.4. Customization

- 6.5. Road Recognition

- 6.6. Supply Chain and Availability

7. Global Adaptive Front Lighting Market Outlook, 2017-2031F

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. By Component

- 7.2.1. Sensors

- 7.2.2. Control System

- 7.2.3. Headlight Adjustment

- 7.3. By Light Type

- 7.3.1. Halogen

- 7.3.2. LED

- 7.3.3. Others

- 7.4. By Technology

- 7.4.1. Adaptive High Beam Systems

- 7.4.2. Matrix LED Highlights

- 7.4.3. Predictive Adaptive Front System

- 7.4.4. Others

- 7.5. By Vehicle

- 7.5.1. Passenger Vehicle

- 7.5.2. Commercial Vehicle

- 7.5.3. Others

- 7.6. By Sales Channel

- 7.6.1. OEM

- 7.6.2. Aftermarket

- 7.7. By Region

- 7.7.1. North America

- 7.7.2. Europe

- 7.7.3. South America

- 7.7.4. Asia-Pacific

- 7.7.5. Middle East and Africa

- 7.8. By Company Market Share (%), 2023

8. Global Adaptive Front Lighting Market Outlook, By Region, 2017-2031F

- 8.1. North America*

- 8.1.1. Market Size & Forecast

- 8.1.1.1. By Value

- 8.1.2. By Component

- 8.1.2.1. Sensors

- 8.1.2.2. Control System

- 8.1.2.3. Headlight Adjustment

- 8.1.3. By Light Type

- 8.1.3.1. Halogen

- 8.1.3.2. LED

- 8.1.3.3. Others

- 8.1.4. By Technology

- 8.1.4.1. Adaptive High Beam Systems

- 8.1.4.2. Matrix LED Highlights

- 8.1.4.3. Predictive Adaptive Front System

- 8.1.4.4. Others

- 8.1.5. By Vehicle

- 8.1.5.1. Passenger Vehicle

- 8.1.5.2. Commercial Vehicle

- 8.1.5.3. Others

- 8.1.6. By Sales Channel

- 8.1.6.1. OEM

- 8.1.6.2. Aftermarket

- 8.1.7. United States*

- 8.1.7.1. Market Size & Forecast

- 8.1.7.1.1. By Value

- 8.1.7.1.2. By Volume

- 8.1.7.2. By Component

- 8.1.7.2.1. Sensors

- 8.1.7.2.2. Control System

- 8.1.7.2.3. Headlight Adjustment

- 8.1.7.3. By Light Type

- 8.1.7.3.1. Halogen

- 8.1.7.3.2. LED

- 8.1.7.3.3. Others

- 8.1.7.4. By Technology

- 8.1.7.4.1. Adaptive High Beam Systems

- 8.1.7.4.2. Matrix LED Highlights

- 8.1.7.4.3. Predictive Adaptive Front System

- 8.1.7.4.4. Others

- 8.1.7.5. By Vehicle

- 8.1.7.5.1. Passenger Vehicle

- 8.1.7.5.2. Commercial Vehicle

- 8.1.7.5.3. Others

- 8.1.7.6. By Sales Channel

- 8.1.7.6.1. OEM

- 8.1.7.6.2. Aftermarket

- 8.1.1. Market Size & Forecast

- 8.2. Canada

- 8.3. Mexico

All segments will be provided for all regions and countries covered:

- 8.4. Europe

- 8.4.1. Germany

- 8.4.2. France

- 8.4.3. Italy

- 8.4.4. United Kingdom

- 8.4.5. Russia

- 8.4.6. Netherlands

- 8.4.7. Spain

- 8.5. South America

- 8.5.1. Brazil

- 8.5.2. Argentina

- 8.6. Asia-Pacific

- 8.6.1. India

- 8.6.2. China

- 8.6.3. Japan

- 8.6.4. Australia

- 8.6.5. South Korea

- 8.7. Middle East & Africa

- 8.7.1. Saudi Arabia

- 8.7.2. UAE

- 8.7.3. South Africa

9. Market Mapping, 2023

- 9.1. By Component

- 9.2. By Light Type

- 9.3. By Technology

- 9.4. By Vehicle

- 9.5. By Sales Channel

- 9.6. By Region

10. Macro Environment and Industry Structure

- 10.1. Supply Demand Analysis

- 10.2. Import Export Analysis

- 10.3. Value Chain Analysis

- 10.4. PESTEL Analysis

- 10.4.1. Political Factors

- 10.4.2. Economic System

- 10.4.3. Social Implications

- 10.4.4. Technological Advancements

- 10.4.5. Environmental Impacts

- 10.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 10.5. Porter's Five Forces Analysis

- 10.5.1. Supplier Power

- 10.5.2. Buyer Power

- 10.5.3. Substitution Threat

- 10.5.4. Threat from New Entrant

- 10.5.5. Competitive Rivalry

11. Market Dynamics

- 11.1. Growth Drivers

- 11.2. Growth Inhibitors (Challenges and Restraints)

12. Key Players Landscape

- 12.1. Competition Matrix of Top Five Market Leaders

- 12.2. Market Revenue Analysis of Top Five Market Leaders (in %, 2023)

- 12.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 12.4. SWOT Analysis (For Five Market Players)

- 12.5. Patent Analysis (If Applicable)

13. Pricing Analysis

14. Case Studies

15. Key Players Outlook

- 15.1. OSRAM Licht AG

- 15.1.1. Company Details

- 15.1.2. Key Management Personnel

- 15.1.3. Products & Services

- 15.1.4. Financials (As reported)

- 15.1.5. Key Market Focus & Geographical Presence

- 15.1.6. Recent Developments

- 15.2. Robert Bosch GmbH

- 15.3. Valeo SA

- 15.4. Continental AG

- 15.5. Denso Corporation

- 15.6. Hyundai Mobis

- 15.7. Johnson Electric

- 15.8. Stanley Electric Co. Ltd

- 15.9. Hell GmbH Co. Ltd

- 15.10. Magneti Marelli S.p.A

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.