|

|

市場調査レポート

商品コード

1741559

米国の通信会社の設備投資が減少、AI大手が主役に浮上US Telco Capex Fading as AI Giants Take Center Stage |

||||||

|

|||||||

| 米国の通信会社の設備投資が減少、AI大手が主役に浮上 |

|

出版日: 2025年06月04日

発行: MTN Consulting, LLC

ページ情報: 英文 9 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

米国は依然として世界最大の市場だが、2024年の通信設備投資は8%減の810億ドルに落ち込み、2025年第1四半期の見通しも弱含み。通信各社は政策の不確実性、インフレ懸念、生成AIバブルの中で、投資よりも収益化へと軸足を移しつつある

本レポートでは、AT&T、Verizon、Charter、Comcast、T-Mobile(DT)、Lumen、Frontier など主要通信事業者の2025年第1四半期の決算を基に、米国における通信設備投資の短期的な見通しを検討しています。現状の支出パターンと過去の予測との比較、投資判断に影響を与える主要な要因を明らかにするとともに、ベンダーへの影響、AI、大規模言語モデル(LLM)、データセンターなどの新興分野の動向について分析しています。

米国市場は2024年末時点で、通信設備投資が805億ドル、収益が5,052億ドルとなり、それぞれ世界全体の業界の27%と28%を占めました。米国の設備投資額と収益の比率、つまり資本集約度は2022年から2023年にかけて17~18%の範囲で、これは過去の水準を大きく上回っています。この比率は2024年に入ってから緩やかになり、通年での資本集約度は15.9%でした。2025年第1四半期の決算発表やその他のデータに基づくと、この比率はさらに下がる見通しです。米国の通信会社は、これまでの投資を収益に結びつけることに重点を置き、資本の節約やコスト削減を優先しています。経済や政策の不確実性は依然として高く、大統領によって仕組まれた通商上の緊急事態によってインフレや景気後退への懸念が強まっています。

通信事業者は設備投資を節約する一方で、データセンター市場における大規模な投資バブルは皮肉に映っています。通信会社は同様の投資家の関心を引きつけるのに苦戦しています。それでも、米国でAIから利益を得る別の道を模索しています。生成AIの波にうまく乗れているわけではありませんが、AI技術を活用して業務効率を高める取り組みを進めています。

今後数四半期にわたって、米国の通信事業者の設備投資は引き続き厳しく抑制されると思われます。経済成長の鈍化は、通信収益に打撃を与えます。政府債務の増大や関税の導入は、インフレを加速させる原因となります。米国への国際的な訪問者の減少や海外からの投資の減少は、いずれも需要の低下につながります。さらに、関税はネットワーク構築に使われる特定部品の不足や高騰を引き起こす可能性があります。隣接分野であるデータセンターからの投資が急増しているため、通信会社は自社の人材を確保・維持することが難しくなり、労働コストも上昇します。しかし、通信会社はこうした課題に何年も前から取り組んできており、今回も乗り越えると思われます。

調査対象

掲載組織

|

|

|

目次

サマリー

市場背景:米国

2025年第1四半期の業績

AT&T

Verizon

Comcast

Charter Communications

T-Mobile (DT)

Frontier Communications

Lumen Technologies (ex-CenturyLink)

Dish Network (EchoStar)

付録

List of Figures and Tables:

- Figure 1: Capex forecast for US telco market and recent changes

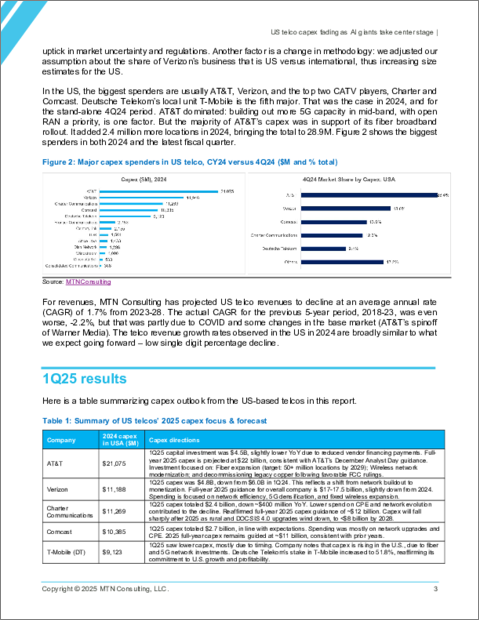

- Figure 2: Major capex spenders in US telco, CY24 versus 4Q24 ($M and % total)

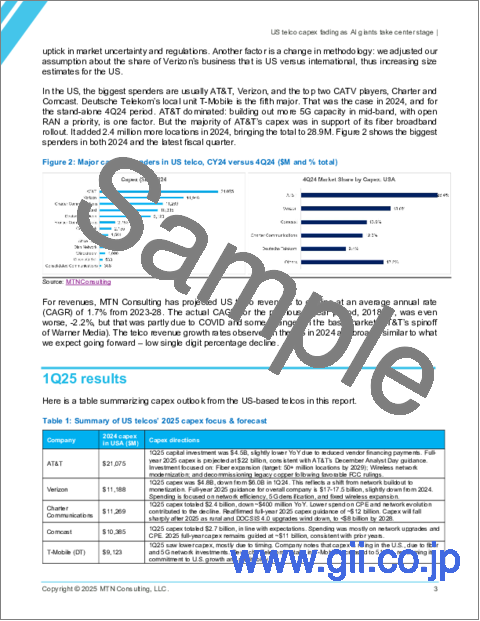

- Table 1: Summary of US telcos' 2025 capex focus & forecast

- Figure 3: AT&T's total corporate capex, capital intensity, and share of global capex

- Figure 4: Verizon's total corporate capex, capital intensity, and share of global capex

- Figure 5: Comcast's total corporate capex, capital intensity, and share of global capex

- Figure 6: Charter Communications' total corporate capex, capital intensity, and share of global capex

- Figure 7: T-Mobile total corporate capex, capital intensity, and share of global capex

- Figure 8: Frontier capex, capital intensity, and share of global capex

- Figure 9: Lumen capex, capital intensity, and share of global capex

- Figure 10: Dish Network capex, capital intensity, and share of global capex

US is still world's biggest market but capex dipped 8% in 2024, to $81B, and 1Q25 guidance was weak; telcos shifting to monetization amidst policy uncertainty, inflation fears, and the generative AI bubble.

This brief examines the near-term outlook for telecom capital expenditures (capex) in the US, based on the 1Q25 earnings of key operators, including AT&T, Verizon, Charter, Comcast, T-Mobile (DT), Lumen, Frontier, and more. It analyzes how current spending patterns compare with previous forecasts, highlights the main forces shaping investment decisions, explores implications for vendors, and discusses trends in emerging areas such as AI, large language models (LLMs), and data centers.

The US market closed 2024 with $80.5 billion in telco capex and $505.2 billion in revenues, representing 27% and 28% of global industry totals, respectively. The USA's capex to revenue ratio, or capital intensity, was in the 17-18% range in 2022-23. That was well above historic levels. The ratio started to moderate in 2024. For full-year 2024, capital intensity was 15.9%. Based upon 1Q25 earnings calls and other datapoints, that will fall further. US telcos are looking to monetize recent investments, and more focused on conserving capital and cutting costs. Economic and policy uncertainty continues to be high, with inflation and recession fears stemming from the presidentially contrived trade emergency.

As telcos conserve capex, they must see irony in the massive investment bubble in the data center market. Telcos are struggling to attract the same investor interest. However, telcos are finding other ways to benefit from AI in the US. They aren't positioned well to ride the GenAI wave, but they are deploying AI-based technologies to deliver operational efficiency.

For instance:

- AT&T: using AI to improve call center automation, software development, and digital acquisition. The company says that investment in automation is helping offset labor costs and drive self-service efficiency across sales and support channels.

- Verizon: integrating AI into customer care and network ops; use cases include predictive maintenance, customer service automation, and internal process efficiencies.

- Comcast: AI is deployed across billing automation, network troubleshooting, and customer service, reducing truck rolls and call center loads. Machine learning models are used to predict customer churn and drive targeted promotions.

- Charter: has invested in AI for years, focused on frontline efficiency and self-service; it is reducing repair calls and truck rolls. Internal tools are used to optimize operations, enhance agent support, and reduce OPEX.

- DT/T-Mobile: AI is integral to DT's digital transformation, aiming at Euro-800 million in group cost savings by 2027. AI is used to optimize fiber rollouts, automate customer service (e.g., chatbots solving 50% of issues without humans), and remotely manage 75% of routers. DT says that AI supports operations across service, coding, sales, and mobile RAN monitoring.

- Lumen: Lumen is positioning itself as a backbone provider for the AI economy. Lumen Digital platform uses AI for automation and real-time network control.

Over the next few quarters, US telcos will remain tightly constrained on capex. Weaker economic growth will hit revenues. Rising government debt and tariffs will cause inflation to spike. Fewer international visitors to the US, less foreign investment, both lead to weaker demand. Tariffs may also cause shortages or high costs in certain component parts used in building networks. Labor costs will rise, as the surge in investment from an adjacent sector (data centers) will make it harder for telcos to keep their staff. But telcos have been wrestling with such issues for years, and they will survive this as well.

Research Coverage

Organizations mentioned:

|

|

|