|

|

市場調査レポート

商品コード

1797390

通信業界の主要ベンダー (2025年第2四半期):市場は回復も、関税が長い影を落とすTelecom's Biggest Vendors, 2Q25: Vendor Market Bounces Back, but Tariffs Cast a Long Shadow |

||||||

|

|||||||

| 通信業界の主要ベンダー (2025年第2四半期):市場は回復も、関税が長い影を落とす |

|

出版日: 2025年08月25日

発行: MTN Consulting, LLC

ページ情報: 英文

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

本レポートシリーズの目的は、通信業界の意思決定者に対し、業界における支出動向とベンダーの市場力に関する包括的な視点を提供することです。そのために、幅広い企業タイプおよび技術セグメントにわたって、通信業界における技術ベンダーの収益を評価しています。

本レポートでは、137の通信ネットワークインフラベンダーを追跡調査し、2013年第1四半期から2025年第2四半期までの期間における収益および市場シェアの推定値を提供しています。これら137社のうち111社は現在も通信事業者向けに販売を行っており、その他の多くはデータベース内で他社に買収されています。例えば、ADVAは現在Adtranの一部となっていますが、過去の販売実績があるため両社ともデータベースに残されています。

ビジュアル

レポートハイライト:

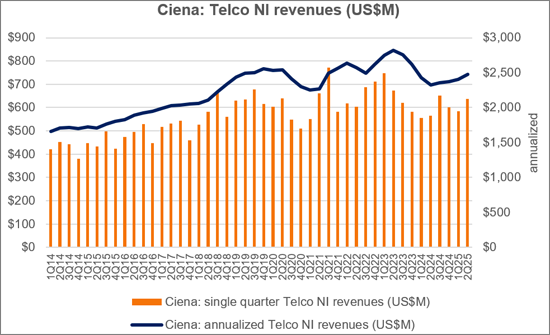

- 売上高:通信ネットワークインフラベンダーの収益は2025年第2四半期に約543億ドルに達し、前年同期比で2.0%増加しました。年率換算の収益は約2,077億ドルと0.7%増加し、9四半期連続の縮小傾向を脱し、ネットワークインフラ投資の緩やかな回復を示しています。2024年前半に市場の減少を和らげる役割を果たしたHuaweiは、2025年第2四半期には再び下落傾向に転じました。Huaweiのデータを除けば、市場収益の成長はさらに強いものとなっています。

- 主要ベンダー:従来のリーダーであるHuawei、Ericsson、Nokiaは、年率換算ベースで市場の約35%を占め、2025年第2四半期単独では36.8%を占めました。Huaweiの市場シェアは2021年以降顕著に弱まり、2025年も中国国外で継続的な圧力に直面しています。一方、China ComserviceやZTEなどのベンダーは、第4位および第5位の座を巡る競争を続けています。

- 前年同期比収益成長率による主要ベンダー:2025年第2四半期では、Dixon TechnologiesとWiwynnが前年同期比収益成長をリードしました。Dixonは前年の低い比較基準が成長を後押しし、WiwynnはAI主導のデジタルトランスフォーメーションに関連するデータセンターインフラ拡張によって成長しました。BroadcomもVMware買収により成長を続けています。一方、Alphabet、Microsoft、Amazon、Dell Technologies、Harmonicもデジタルトランスフォーメーション関連の提供を通じて成長しました。

- 支出見通し:2025年後半以降の見通しは依然として慎重で、緩やかな成長が予測されるものの、マクロ経済の不確実性、関税、地政学的緊張によって抑制される見込みです。資本支出は地域や通信事業者の準備状況によって異なり、市場全体は進化する技術サイクルと地政学的複雑性を乗り越えながら進んでいくことになります。

調査対象

記載企業

|

|

目次

第1章 レポートハイライト

第2章 サマリー:調査結果の解説

第3章 通信ネットワークインフラ市場:最新の結果

第4章 トップ25ベンダー:印刷可能なティアシート

第5章 チャート:各ベンダーのスナップショット

第6章 チャート:ベンダー5社の比較

第7章 ベンダー別の研究開発費

第8章 生データ:企業別の収益予測

第9章 調査手法・前提

第10章 MTN Consultingについて

List of Figures (Partial):

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 2Q25 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 2Q25 ($B)

- Top 25 vendors based on Telco NI revenues in 2Q25 ($B)

- Key vendors' annualized share of Telco NI market

- Telco NI market share changes, 2Q25 TTM vs. 2Q24 TTM

- Telco NI annualized revenue changes, 2Q25 vs. 2Q24

- YoY growth in Telco NI revenues (2Q25)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 2Q25 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 2Q25 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (2Q23-2Q25)

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors' revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market "telco network infrastructure", or "Telco NI." This study tracks 137 Telco NI vendors, providing revenue and market share estimates for the 1Q13-2Q25 period (i.e. 50 quarters). Of these 137 vendors, 111 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

VISUALS

Below are the key highlights of the report:

- Revenues: Telco Network Infrastructure (NI) vendor revenues reached approximately $54.3 billion in 2Q25, representing a 2.0% YoY increase. Annualized revenue edged up 0.7% to about $207.7 billion, snapping a nine-quarter contraction and signaling a modest recovery in network infrastructure investments. Huawei, which assisted in softening the market decline earlier in 2024, reverted to a downtrend in 2Q25. Without Huawei's data included, market revenue growth is much stronger.

- Top vendors: The traditional leaders Huawei, Ericsson, and Nokia accounted for roughly 35% of the Telco NI market on an annualized basis and 36.8% in 2Q25 alone. Huawei's market share has weakened notably since 2021 and faced persistent pressure outside China in 2025. Meanwhile, vendors like China Comservice and ZTE maintained their fight for the 4th and 5th positions.

- Key vendors by YoY revenue growth: Dixon Technologies and Wiwynn led YoY revenue growth in 2Q25, fueled by Dixon's a low year-ago base, and Wiwynn's expansion in data center infrastructure linked to AI-driven digital transformation. Broadcom's surge continues, boosted by its VMware acquisition. Meanwhile, Alphabet, Microsoft, Amazon, Dell Technologies, and Harmonic grew through their digital transformation offerings.

- Spending outlook: The outlook for 2H25 and beyond remains cautious, with gradual growth expected but tempered by macroeconomic uncertainty, tariffs, and geopolitical tensions. Capital spending will vary by region and operator readiness, as the broader market navigates evolving technology cycles and geopolitical complexities.

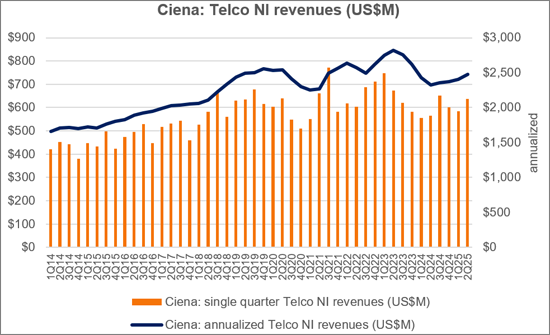

Note: Several companies, including Ciena, were estimated for 2Q results due to the unavailability of official financial reports for the April-June period on a calendar-year basis. These estimates will be revised and updated as more accurate data becomes available.

Research Coverage

Companies Listed:

|

|