|

市場調査レポート

商品コード

1689867

列車用HVAC:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Train HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 列車用HVAC:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 116 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

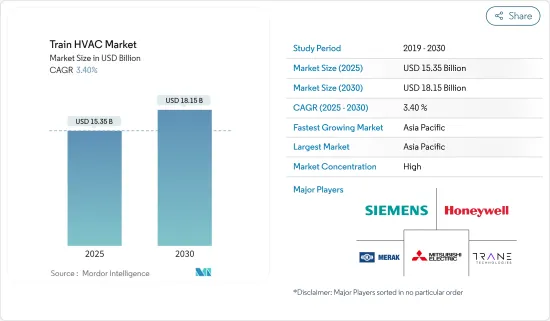

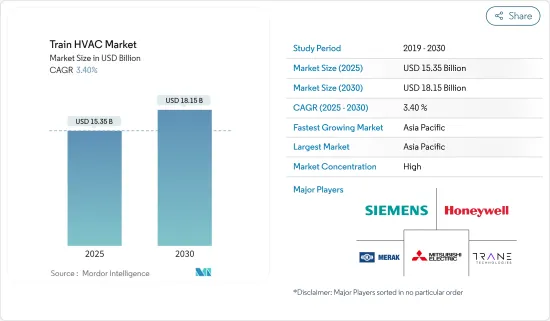

列車用HVAC市場規模は2025年に153億5,000万米ドルと推計され、2030年には181億5,000万米ドルに達すると予測され、予測期間(2025年~2030年)のCAGRは3.4%です。

COVID-19パンデミックの発生時には、ウイルスの蔓延を抑えるために封鎖と社会的距離を置く規範が課されたため、鉄道網の拡張工事は中止されました。しかし、新興経済諸国が徐々に開放されるにつれて、鉄道拡張工事が再開され、政府はこれらの活動の開発のためにさらに資金を投入し、経済を軌道に乗せることが期待されています。この動向は予測期間中も続くと予想されます。

世界人口の増加に伴い、より速く、より安全で、より快適な交通機関へのニーズも高まっています。その結果、世界中の政府が鉄道インフラ開発に多額の予算を投じており、これが業界を前進させています。

列車用HVAC市場は、予測期間中に鉄道からのHVACシステムに対する需要が増加することが主な要因となっています。さらに、政府による公共交通機関への需要の増加も、鉄道HVAC市場の成長を後押しすると予想されます。さらに、旅行中の快適性に対する需要の高まりは、予測期間を通じて鉄道HVAC市場の成長を促進する上で重要な役割を果たしています。

列車用HVAC市場の動向

高速輸送に対する需要の増加

世界中で増大する輸送ニーズに対応するため、いくつかの政府は公共交通機関をより利用しやすくするため、国内の高速輸送網を拡大しています。主要国の政府は、都市鉄道輸送の開発に多額の投資を行っています。旅客輸送用の高速列車の開発に重点が置かれています。

高速輸送システムの近代的なサービスは、駅間の指定路線で提供され、通常、線路上の電気多重装置を使用します。駅には通常、高いホームがあり、列車とホームの間の隙間を最小限にするため、特注の列車が必要となります。他の公共交通機関と統合されているのが一般的で、同じ公共交通当局によって運営されていることが多いです。

高速輸送システムを導入している主な国には、中国、韓国、日本、メキシコ、米国があります。

中国は世界で最も多くの高速輸送システムを有しており、31のシステムが4,500km以上の軌道をカバーしています。過去10年間、世界の高速鉄道拡大構想の大半を担当しました。上海地下鉄は、単独運営では世界最長の高速輸送システムである(路線長で)。

2022年2月、インド政府は、2022年から2025年にかけて、エネルギー効率と乗客の乗り心地を改善した新世代のバンデバラート列車400両を開発・製造すると発表しました。

同様に、韓国は2022年2月、2029年までにすべてのディーゼル旅客機関車を新型新幹線に置き換えることで、鉄道移動による二酸化炭素排出量を30%削減する目標を発表しました。また、韓国は2050年までにカーボン・ニュートラルを実現する計画です。

また、アムトラックは2021年7月、インフラ・プロバイダーであるシーメンス・モビリティと新たな契約を結び、米国北東部を走る83編成の新型車両を建設・運行することを発表しました。

アジア太平洋が最も高い成長率を示す

アジア太平洋は、中国やインドといった巨大な人口を抱える国々によって、列車用空調機器市場を独占しています。鉄道インフラを拡張している中国と、都市交通と鉄道回廊が多いインドが、市場成長の需要を押し上げています。

過去10年間、中国では大規模かつ急速な都市鉄道輸送の開発が行われました。中国の都市鉄道輸送は最近の動向として、ネットワーク化された構造、知的化された設備、多様化したシステム、革新的な技術を開発しています。その動向は、スーパーシティやメガシティの中心部では大容量の地下鉄を採用し、中心市街地と遠隔地の町との間では中容量のモノレール、都市内快速鉄道、磁気浮上式鉄道を採用する方向にシフトしています。

- 2021年12月、中国の国家開発改革委員会(NRDC)は、無錫に時速350kmの新高速鉄道、時速160kmの幹線鉄道、地下鉄3路線を建設することを承認し、総投資額は2,485億人民元(約385億5,000万米ドル)に達しました。

- 2021年1月、ボンバルディア四方(青島)運輸(BST)合弁会社は、中国国鉄集団(CHINA RAILWAY)から中国標準の新型高速車両CR400AFを16両納入する契約を獲得しました。契約金額は約4,600万米ドル。

インド政府は、老朽化した鉄道インフラを近代化し、サービスの質を向上させるため、数多くのプロジェクトを立ち上げています。鉄道省は、2023年までに鉄道の改良に5,000,000カロールインドルピー(6,600億米ドル)を投資する意向であると述べた。アップグレードには、鉄道の完全電化、既存路線の設備増強と高速化、新規路線の拡大、鉄道駅の改良、インド全土の主要都市を結ぶ大規模な高速鉄道網の導入と最終的な開発、国内の貨物コストを削減するためのさまざまな貨物専用通路の開発などが含まれます。

アルストム、ボンバルディア、ヒュンダイ・ローテムなどの世界企業は、すでにインドに製造工場を設立しています。また、CRCCはマハラシュトラ州政府とMoUを締結し、ナーグプル(MIHAN)のMultimodal International Cargo Hub and Airportに製造施設を設置しています。

列車用HVAC産業の概要

列車用HVAC市場は、トラン・テクノロジーズ、三菱電機、メラクSA、ハネウェル・インターナショナル、シーメンスAGなどのメーカーが独占しています。同市場では、複数の企業が新製品開発のための提携やパートナーシップを発表しています。例えば

- 2021年7月、ハネウェルはTrane Technologiesと提携し、R-410Aに代わる業界初の不燃性代替冷媒であるハネウェルのSolstice(R)N41(R-466A)を実地試験することで、環境に優しい次世代冷媒への移行を加速すると発表しました。トレーンは、1年間の実地試験の一環として、ソルスティスN41を米国内の異なる地域にある3つの顧客拠点に配備し、試験を行います。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 列車タイプ

- 旅客列車

- 貨物列車

- システム

- 蒸気サイクルシステム

- エアサイクルシステム

- 冷媒

- 一般冷媒

- 天然冷媒(二酸化炭素(CO2))

- コンポーネント

- エアダンパー

- ブロワー

- コンプレッサー

- コンデンサー

- インバーター

- 蒸発器

- その他のコンポーネント

- 地域

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他の欧州

- アジア太平洋

- インド

- 中国

- 日本

- その他のアジア太平洋

- 世界のその他の地域

- ブラジル

- アラブ首長国連邦

- その他の国

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Thermo King Corporation

- Merak SA

- Liebherr Group

- Siemens AG

- Mitsubishi Electric Corporation

- Toshiba Infrastructure Systems and Solutions Corporation

- Leel Electricals Limited

- Honeywell International Inc.

- Trane Inc.

- Faiveley Transport

第7章 市場機会と今後の動向

The Train HVAC Market size is estimated at USD 15.35 billion in 2025, and is expected to reach USD 18.15 billion by 2030, at a CAGR of 3.4% during the forecast period (2025-2030).

During the outbreak of the COVID-19 pandemic, the work for the expansion of rail networks was halted because of the imposed lockdown and social distancing norms to control the spread of the virus. Yet, with the gradual opening of economies, the rail expansion work has resumed, and the governments are expected to invest more money for the development of these activities and bring the economy back on track. This trend is expected to follow during the forecast period as well.

As the world's population grows, so does the need for quicker, safer, and more pleasant transportation. As a result, governments throughout the world are spending extensively on railway infrastructure development, which is propelling the industry forward.

The train HVAC market is majorly driven by the increasing demand for HVAC systems from railways over the forecast period. In addition, the increase in demand for public transport by the government is also expected to boost the growth of the railway HVAC market. Additionally, the rising demand for comfort during traveling plays a significant role in fueling the growth of the railway HVAC market throughout the forecast period.

Train HVAC Market Trends

Increasing Demand for Rapid Transit

In order to meet the growing transportation needs across the world, several governments are expanding their rapid transit networks within the countries to make public transportation more feasible for the population. The governments of major countries are investing heavily in developing urban rail transit. The focus is on developing high-speed trains for passenger travel.

Modern services on rapid transit systems are provided on designated lines between stations, typically using electric multiple units on rail tracks. The stations typically have high platforms, requiring custom-made trains to minimize gaps between trains and platforms. They are typically integrated with other public transport modes and often operated by the same public transport authorities.

Some of the major countries with rapid transit systems are China, South Korea, Japan, Mexico, and the United States.

China has the most rapid transit systems in the world, with 31 systems covering over 4,500 kilometers of track. It was in charge of the majority of the world's rapid transit expansion initiatives during the last decade. The Shanghai Metro is the world's longest single-operator rapid transit system (in terms of route length).

In February 2022, the Indian government announced 400 new-generation Vande Bharat trains with better energy efficiency and passenger riding experience will be developed and manufactured during 2022-2025.

Similarly, in February 2022, South Korea announced goals to cut 30% of carbon emissions from railway travel by replacing all diesel passenger locomotives with a new bullet train by 2029. Also, South Korea plans to be carbon neutral by 2050.

Also, in July 2021, Amtrak announced a new agreement with infrastructure provider Siemens Mobility to build and execute a fresh new fleet of 83 trains that will travel across the northeastern United States in a significant modernization.

Asia-Pacific Will Exhibit the Highest Growth Rate

The Asia-Pacific region is dominating the train HVAC market, owing to countries with huge populations, such as China and India. China, with its expansion of railway infrastructure, and India, with its many urban transit and railway corridors, are pushing the demand for market growth.

Over the past decade, China experienced large-scale and rapid urban rail transit developments. Urban rail transit in China has been developing a networked structure, intellectualized equipment, diversified systems, and innovative technology in recent years. The trend is shifting toward the adoption of large-capacity subways in the central areas of super cities and megacities, with the adoption of a medium-capacity monorail, inner-city rapid rail transit, and magnetic suspension trains between central urban areas and remote towns.

- In December 2021, China's National Development and Reform Commission (NRDC) approved the construction of a new 350 km/h high-speed line, a 160 km/h mainline, and three metro lines in Wuxi, with an overall investment totaling CNY 248.5billion (USD 38.55 billion).

- In January 2021, the Bombardier Sifang (Qingdao) Transportation (BST) joint venture secured a contract from China State Railway Group (CHINA RAILWAY) to deliver 16 new Chinese standard high-speed CR400AF cars. The value of the contract is approximately USD 46 million.

The Indian government is launching a number of projects to modernize its old railway infrastructure and improve service quality. The Railway Ministry said that it intends to invest INR 5,000,000 crore (USD 660 billion) in railway upgrades by 2023. Upgrades include complete electrification of railways, upgrading existing lines with more facilities and faster speeds, expanding new lines, upgrading railway stations, introducing and eventually developing a large high-speed train network connecting major cities across India, and developing various dedicated freight corridors to reduce cargo costs within the country.

Global players, such as Alstom, Bombardier, and Hyundai Rotem, have already set up manufacturing plants in India. CRCC also entered an MoU with the Government of Maharashtra for setting up a manufacturing facility in the Multimodal International Cargo Hub and Airport at Nagpur (MIHAN).

Train HVAC Industry Overview

The train HVAC market is dominated by manufacturers such as Trane Technologies, Mitsubishi Electric, Merak SA, Honeywell International, and Siemens AG. Several players in the market announced collaborations and partnerships to develop new products. For instance

- In July 2021, Honeywell announced that it would partner with Trane Technologies to accelerate the transition to a next-generation, environmentally preferable refrigerant by field testing Honeywell's Solstice(R) N41 (R-466A), the industry's first non-flammable alternative to R-410A. Trane will deploy and test Solstice N41 at three customer locations in different parts of the United States as part of a one-year field trial.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Train Type

- 5.1.1 Passenger Train

- 5.1.2 Freight Train

- 5.2 Systems

- 5.2.1 Vapour Cycle Systems

- 5.2.2 Air Cycle Systems

- 5.3 Refreigerants

- 5.3.1 Coventional Refrigerants

- 5.3.2 Natural Refrigerants (Carbon Dioxide (CO2))

- 5.4 Components

- 5.4.1 Air Dampers

- 5.4.2 Blower

- 5.4.3 Compressor

- 5.4.4 Condenser

- 5.4.5 Inverter

- 5.4.6 Evaporator

- 5.4.7 Other Components

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thermo King Corporation

- 6.2.2 Merak SA

- 6.2.3 Liebherr Group

- 6.2.4 Siemens AG

- 6.2.5 Mitsubishi Electric Corporation

- 6.2.6 Toshiba Infrastructure Systems and Solutions Corporation

- 6.2.7 Leel Electricals Limited

- 6.2.8 Honeywell International Inc.

- 6.2.9 Trane Inc.

- 6.2.10 Faiveley Transport