|

市場調査レポート

商品コード

1850230

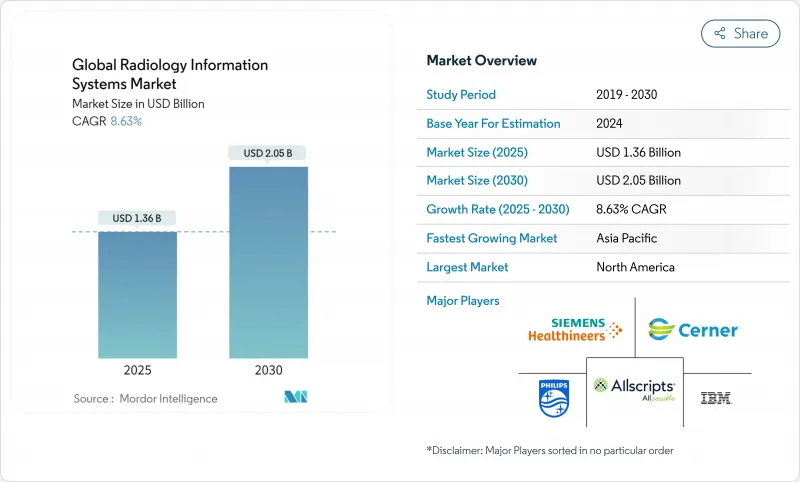

放射線情報システム:世界市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Global Radiology Information Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 放射線情報システム:世界市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月13日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

放射線情報システム市場は、2025年に13億6,000万米ドルに達し、CAGR 9.12%で拡大し、2030年には21億1,000万米ドルに達すると予測されています。

成長の原動力となっているのは、全国的な相互運用性の義務付け、ワークフローへの圧力を増幅させる放射線技師不足の深刻化、クラウドネイティブなアーキテクチャを奨励するサイバーセキュリティ要件の高まりです。統合されたエンタープライズ・プラットフォームは、統一された記録内でスケジューリング、報告、請求を同期させるため、引き続き調達の意思決定を支配しているが、スタンドアローン・ソリューションは、モジュール式で従量課金の導入を好む外来画像診断および遠隔画像診断ネットワークでニッチを開拓しています。クラウドの採用は、プロバイダーが拡張可能な容量と資本リスクの低減を求めているため加速しているが、その一方で、多くのプロバイダーはデータ主権遵守のためにオンプレミスのインストールに依存しています。病院がリアルタイムのデータ共有ルールを満たすために旧式のインフラを再プラットフォーム化する中、導入サービス、AI対応アナリティクス、堅牢なゼロトラスト・セキュリティをバンドルするベンダーは、新規契約の獲得に最適な立場にあります。

世界の放射線情報システム市場動向と洞察

慢性疾患の世界的負担の増大

がん罹患率は2045年までに42%上昇すると予測されており、この動向は画像処理スループットと情報管理に対する持続的なプレッシャーとなっています。病院や外来センターは、増加する検査量をカタログ化し、長期的なフォローアップを自動化するAI対応のRIS環境を導入し、臨床医が微妙な疾患の進行を早期に発見できるようにしています。国立がん研究センターが2024年に開始する、2万4,000人の参加者をカバーする多がん検診ネットワークは、拡張可能なデータインフラが不可欠である理由を強調しています。ベンダーは現在、過去の画像に隠されたリスクの手がかりにフラグを立てる高度な分析を組み込み、価値ベースの償還に沿ったパーソナライズされた監視プログラムを改善しています。

全社的なデジタル化と電子カルテとの緊密な統合

医療システム幹部の72パーセントが、RISとEHRの融合に依存するデジタル変革イニシアチブによって、ワークフローが目に見えて向上したと報告しています。リアルタイムの画像、オーダー、結果の交換により、冗長なデータ入力が削減され、事務的なエラー率が低下します。エピックシステムズは2023年に39.1%のEHR市場シェアに成長し、画像に特化した100以上のAI機能を構築して情報学統合を強化しており、プラットフォームリーダーがシームレスな放射線科モジュールによってロックインをどのように生み出しているかを示しています。RISサプライヤーは、標準化されたFHIR APIによってこれらのエコシステムを補完し、専門分野固有の分析を通じてベンダーの差別化を維持しています。

画像データのサイバーセキュリティ保険料の高騰

医療機関の88%が毎年少なくとも1回のサイバー攻撃に耐えており、画像アーカイブはランサムウェアの標的として珍重されています。2020年にバーモント大学ヘルスネットワークで発生した情報漏えいは、6,300万米ドルの損失と39日間のダウンタイムを引き起こし、不十分なセキュリティ管理による隠れたコストを浮き彫りにしました。保険会社は、総所有コストを膨れ上がらせる高額な保険料で対応しています。クラウド・ハイパースケーラは、ゼロトラスト機能とマネージド検出サービスをバンドルすることで対抗しているが、データ居住規則によって一部の病院はローカルデータセンターに縛られています。

セグメント分析

統合プラットフォームは2025年の売上高の69.14%を占め、医療システムが登録、スケジューリング、ワークリスト、請求のための単一ベンダーを重視していることを証明しています。スケールメリットにより、インターフェースのメンテナンスが軽減され、ガバナンスが一元化されます。スタンドアロンソリューションはCAGR 9.65%で成長するが、これは専門画像センターと遠隔画像診断ネットワークが、企業ライセンスのオーバーヘッドを伴わない軽量でクラウドファーストのツールを切望しているためです。RISサプライヤーが企業バイヤーを惹きつけるために高度なオーケストレーションを組み込むにつれて、ベンダーの統合が加速しています。

エピックシステムズは2023年に153の急性期病院を追加し、オラクルヘルスはAIを活用した事前承認を導入して否認を削減しました。これらの動きは、アナリティクスが新たな戦場であることを示しています。軽快な企業は、主流のEHRにプラグインするAPI中心のモジュラー設計で対抗し、かつて顧客をモノリシックなスタックに閉じ込めていた切り替えの摩擦を減らしています。

CTOがオフサイトのデータ保存義務化を警戒しているため、オンプレミスのインストールが65.57%と依然として優勢です。しかし、CIOが弾力的なスケーリングとセキュリティのアウトソーシングを優先しているため、クラウドサブスクリプションのCAGRは9.81%となっています。プロバイダーはインフラ契約に年間平均3,800万米ドルを費やしているが、プロビジョニングされた容量の44%しか利用できていないです。

COVID-19の緊急事態は、スタッフがリモート・リーディングに移行した際に、固定データセンターの脆弱性を露呈しました。医療システムは現在、需要ピーク時に余剰負荷をクラウドにバーストするハイブリッドモデルでヘッジしています。GEヘルスケアとアマゾンウェブサービス、マイクロソフトのEpic向け画像クラウドなどの戦略的提携は、コンプライアンス管理と地域データストアをパッケージ化することで、この移行を加速させています。

地域別分析

北米は2025年の世界売上高の49.53%を占め、21世紀治療法と、クラウドのパイロットやAIの試験に資金を提供する旺盛なベンチャー資金に支えられています。Sutter Healthの10億米ドルの画像AIパートナーシップは、投資規模の典型です。2024年7月から施行された24時間のレポート公開ウィンドウの義務化により、病院はレガシーRISキューを見直す必要に迫られ、ライセンスの段階的なアップグレードをサポートしています。

アジア太平洋地域は、CAGR 10.34%で最も急速に成長しています。日本のDXプログラムは、構造化画像データの国家品質基準を設定し、病院コンソーシアムに相互運用可能なプラットフォームへの移行を促しています。中国は多額の公共予算を地方のクラウドデータセンターに投入し、言語をローカライズしながらもHL7との互換性を維持するRISへの需要を押し上げています。インドの遠隔医療イニシアチブは、農村部での診断に奨励金を支給することで、低帯域幅の環境に適応するウェブベースのRISの購入を促しています。

欧州の規制状況は、2025年1月に欧州医療データスペース規制が発効したことで一変しました。この規則では、2029年まで段階的に導入される共通のデータ仕様が規定されており、RISベンダーは認証のための明確なロードマップを得ることができます。GEヘルスケアが2億4,900万米ドルを投じて英国の31の病院をカバーするナフィールド・ヘルスと締結したAI画像処理契約は、EHDSの完全施行に先立ち、プロバイダーがどのようにインフラの将来性を確保しているかを示しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 慢性疾患による世界の負担の増大

- 企業全体のデジタル化と電子健康記録との緊密な統合

- 米国ONC情報ブロック規則や計画中のEU健康データスペースなどの新たな相互運用性義務

- 放射線科のスループットに報いる価値ベースのケアインセンティブ

- 国レベルのがん検診の拡大(低線量CTなど)

- ティア2/3病院における遠隔放射線診断サービスアグリゲーターの台頭

- 市場抑制要因

- 画像データに対するサイバーセキュリティ保険料の高騰

- 高額な初期ライセンス料、ワークフローの再設計コスト、インターフェース作業

- 放射線科医の人員不足によりシステム利用が制限される

- データ主権ルールが複数国でのクラウド展開を複雑化

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- タイプ別

- 統合RIS

- スタンドアロンRIS

- 展開モード別

- オンプレミス

- クラウドベース/Webホステッド

- コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

- エンドユーザー別

- 病院と医療システム

- 診断画像センター

- 外来手術センター

- 遠隔放射線診断プロバイダー

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東

- GCC

- 南アフリカ

- その他中東

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- Epic Systems Corporation

- Oracle Health(Cerner)

- GE HealthCare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Sectra AB

- Agfa HealthCare

- RamSoft Inc.

- Fujifilm Healthcare

- Change Healthcare

- INFINITT Healthcare

- Visage Imaging

- Allscripts Healthcare Solutions

- McKesson Corporation

- MedInformatix Inc.

- NextGen Healthcare

- Varian Medical Systems

- Konica Minolta Healthcare Americas

- Merative(Merge PACS)

- 3M