|

市場調査レポート

商品コード

1643036

コンシューマー向けIoT:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Consumer IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| コンシューマー向けIoT:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

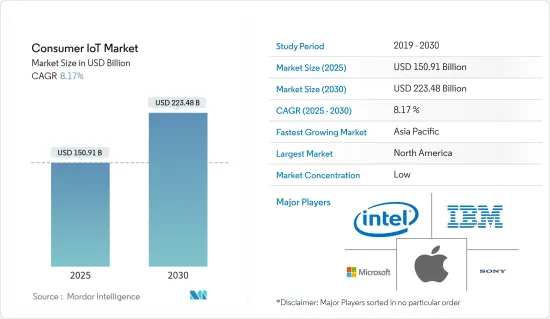

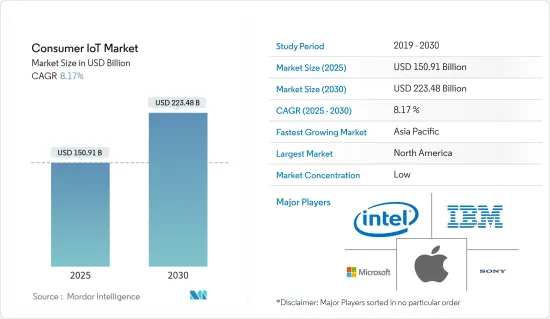

コンシューマー向けIoTの市場規模は2025年に1,509億1,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは8.17%で、2030年には2,234億8,000万米ドルに達すると予測されます。

主なハイライト

- Iotは世界のデジタルトランスフォーメーションの基盤であり、多くの消費者、産業、政府、防衛アプリケーションの変革を支援しています。2022年のIT支出は減少したもの、2023年には成長が見込まれます。IoT Analyticsのレポートによると、IoTは2023年に約19%の成長を遂げ、このIT支出を牽引します。IoTの導入は労働力不足の克服に役立ち、デジタルトランスフォーメーションの取り組みを加速させる可能性があります。

- 5GとIoTを統合することで、様々な業界で多くの持続可能な使用事例を促進することができます。83%の組織がIoT技術を導入することで効率を向上させています。例えば、水産業におけるIoTアプリケーションにより、公益事業会社は水不足の影響を受ける地域で配水を認識、監視、管理し、効率的に収益化することができます。スマート・ウォーター・ソリューション

- IoTは、ロボット外科医やスマート病院のようなイノベーションによってヘルスケア業界を変えつつあり、患者ケアを次のレベルに引き上げています。センサーデータを利用するIoT機器は、健康状態のモニタリング、早期診断、入院治療などに役立っています。例えば、IoTプラットフォーム上で動作するアップル・スマートウォッチは、転倒検知システムや緊急通報サービスと統合されており、時間通りに命を救うのに役立っています。

- COVID-19の発生は、IoTに対する消費者の視点を変えました。IoTロボットのイントロダクションは、家庭、小売、製造、ヘルスケアなどの分野で需要を獲得しています。例えば、クリーン・テクノロジー企業のSkilancer Solar社は、家庭の屋根に設置された小規模太陽光発電所を清掃するための水を使わないロボットを開発しました。これらのロボットは、人間が関与することなく、要件に応じてパネルを清掃するのに役立ちます。

- IoTは利便性をもたらし、日常業務の生産時間を向上させるかもしれないが、その導入にはかなりのコストがかかるため、この技術の採用は遅れています。こうしたIoT機器の開発と維持にかかるコストが高いことが、市場の成長を抑制しています。

コンシューマー向けモノのインターネット(IoT)市場動向

ホームオートメーションが最大市場シェアを占める見込み

- スマートフォンの普及と高速ネットワークのイントロダクションより、人々は日常業務にIoT技術を導入するようになった。5Gの導入が加速する中、世界のIoT市場は2029年までに2兆4,652億6,000万米ドルに達すると予測されます。

- 都市のデジタル化は、政府が世界的に力を入れている分野の1つです。IoTは、こうしたスマートシティプロジェクトを支える主要なビルディングブロックです。香港を拠点とするGLy Capital Investment社は、ドイツを拠点とするVolocopter社にNeomプロジェクトのための資金を提供しました。このプロジェクトでは、乗客や物資を輸送するベロシティ・エア・タクシーを開発し、物理的インフラとデジタル・インフラを一致させることを可能にします。

- 2023年2月- シンガポールの起業家チームがインドのスマートシティ・コマンド・コントロール・センターを訪問し、特にUP州における統合交通管理システム、固形廃棄物管理システム、健康ATMなどの設備を備えたスマートシティプロジェクトへの投資を計画。

- 2022年10月- テクノロジー企業のABBがスマートホームオートメーション用のSmartTouch 10を発表。これは屋内通信に役立ち、追加の屋内ビデオステーションの必要性を代替します。このデバイスは、IPカメラから照明、遮光、シーン、温度制御まで、建物全体の設置を管理できます。通知センターは、すべてのアクションや不在訪問をユーザーに通知します。

北米が最大の市場シェアを占める

- 北米は、ほとんどの技術革新と進歩を採用するパイオニアであり、IoTの採用は、この地域全体の様々な産業および消費者セクターを再構築しています。同地域の5G採用率は高く、2022年第3四半期までに合計1億800万台の5G接続が敷設されています。現在進行中の自律的な5G配備は、IoT市場全体を牽引すると思われます。

- 2023年2月- カナダを拠点とするIoT企業Eleven-xは、駐車スポットを監視し、空き状況データをリアルタイムで提供するスマートパーキングシステムで北米の自治体駐車場を支援します。これにより、地域の混雑が緩和され、駐車違反の取り締まりが最適化され、都市のモビリティがさらに向上します。

- 2022年8月- 北米最大のIOTペイ・プラットフォームがGrubMarketに買収されます。この買収により、GrubMarketはIOT Payの技術と決済インフラを利用してフードサプライチェーン業界の合理化を図る。IOT Payはまた、中小企業(SMB)向けのデジタル・バンキング・ソリューションの展開も視野に入れています。

コンシューマー向けモノのインターネット(IoT)産業の概要

コンシューマー向けIoT市場は、巨大な可能性を秘めながら高度に細分化されており、AI、機械学習、ビッグデータ、5G技術への大規模な投資により、次の段階に向かおうとしています。IoTは生活を簡素化し、人々は生活様式を規制・監視するためにガジェットを購入します。この分野でサービスを提供している主要企業には、マイクロソフト、アップル、ソニー、IBM、インテルなどがあります。これらのIoTリーダー企業は、新製品開発やコラボレーションに投資し、さまざまな業界や地域にその足跡を広げています。

2023年2月、TaoglasとIoTディストリビューターのWestbase.ioは、欧州地域の顧客に革新的な4G/5GおよびIoTソリューションを提供するために協力しました。この提携により、建設、物流、緊急サービス、スマートシティ、コネクテッドヘルス、その他の要求の厳しいアプリケーションにおいて、信頼性の高い高性能ソリューションを顧客に提供することになります。タオグラスの高度に洗練されたアンテナは、ウェストベースのネットワークにより、産業界の顧客に最先端のRFおよびアンテナ技術を提供します。

2022年11月、スイスを拠点とするIoT企業ロリオットは、アラブ首長国連邦を拠点とするIoTプラットフォームDisrupt-Xと、欧州やその他の地域でのIoT普及を推進する契約を締結しました。両社は、産業、商業、住宅分野向けに設計された革新的なIoT製品やサービスを提供するスマート・ソリューションの開発に投資します。また、欧州地域の顧客向けにローカル・ネットワーク・サーバーの提供も計画しています。さらにDisrupt-X社は、自社のIoTプラットフォームからLORIOTネットワークサーバーに直接アクセスできるダッシュボードを導入します。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

- 消費者IoT市場におけるCOVID-19の評価

第5章 市場力学

- 市場促進要因

- 消費者におけるコネクテッドデバイスの採用と技術の普及の増加

- 5Gと増加する携帯電話ネットワークの影響

- ホームオートメーションの増加による市場の活性化

- 市場の課題

- 政府規制、データのセキュリティとプライバシー、相互運用性への懸念

第6章 市場セグメンテーション

- タイプ別

- ハードウェア(プロセッサー、センサー、ゲートウェイ、コントローラー、スイッチなどのコンポーネント)

- ソリューション(独立ソフトウェア、統合プラットフォーム)

- サービス(デバイス・ライフサイクル管理、遠隔監視、導入サービス)

- 用途別

- ホームオートメーション(スマートサーモスタット、メーター、ロックなど)

- コンシューマー向けウェアラブル(スマートウォッチ、メガネ、フィットネストラッカーなど)

- コンシューマーエレクトロニクス(スマートTV、その他のコネクテッド白物家電)

- ヘルスケア(医療用デバイス、ウェアラブル、プラットフォームなど)

- 自動車(インフォテインメント・システム、コネクテッド・カーなど)

- 地域

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- その他のアジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- その他ラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- AT&T Inc.

- Microsoft Corporation

- Sony Corporation

- Apple Inc.

- LG Electronics

- Alphabet Inc.

- Hewlett Packard Enterprise(HPE)

- Honeywell International Inc.

- Cisco Systems Inc.

- Intel Corporation

- IBM Corporation

- Schneider Electric SE

- Symantec Corporation

- Qorvo Inc.

第8章 投資分析

第9章 コンシューマー向けiotの世界市場の将来性

The Consumer IoT Market size is estimated at USD 150.91 billion in 2025, and is expected to reach USD 223.48 billion by 2030, at a CAGR of 8.17% during the forecast period (2025-2030).

Key Highlights

- Iot is the base of digital transformation worldwide, helping to transform many consumer, industrial, government, and defense applications. Even though IT spending fell in 2022, it is expected to grow in 2023. IoT will drive this IT expenditure with approximately 19% growth in 2023, as mentioned in a report by IoT Analytics. IoT deployment helps overcome labor shortages and could speed up digital transformation initiatives.

- Integrating 5G and IoT can promote many sustainability use cases in various industries. 83% of organizations have improved their efficiency by introducing IoT technology. For instance, with IoT applications in Water Industry, the utility company can recognize, monitor, manage, and monetize water distribution effectively in regions impacted by water scarcity. Smart Water solutions

- IoT is changing the healthcare industry with innovations like robot surgeons and smart hospitals, which take patient care to the next level. IoT devices that use sensor data help in health condition monitoring, early diagnosis, in-patient treatment, and more. For instance, Apple Smartwatch, which works on an IoT platform, is integrated with Fall Detection System and Emergency Call services that help save lives on time.

- The COVID-19 outbreak changed the perspective of consumers toward IoT. The introduction of IoT robots is catching demand in sectors like household, retail, manufacturing, healthcare, and others. For instance, Skilancer Solar, a clean-tech firm, developed a waterless robot for cleaning small-scale solar power plants on household rooftops. These robots will help to clean the panels as per requirement, without any human involvement.

- IoT may bring convenience and improve the productive time of daily tasks, but the implementation of it is pretty expensive, so there is slow adoption of this technology. The high cost involved in developing and maintaining these IoT devices restrains the market growth.

Consumer Internet of Things (IoT) Market Trends

Home Automation is Expected to Account for Maximum Market Share

- The increasing use of smartphones and the introduction of high-speed networks have enabled people to adopt IoT technologies in their routine tasks. As 5G adoption accelerates, the global IoT market is expected to reach 2,465.26 billion USD by 2029.

- The digitization of cities is one area that Governments are focussing globally. IoT is the major building block behind these smart city projects. Hong Kong-based GLy Capital Investment provided funds to German-based Volocopter for project Neom. The project will involve the development of Velocity air taxis to transport passengers and goods, enabling the physical and digital infrastructure to match.

- Feb 2023 - A team of Singapore entrepreneurs visited the Smart City Command Control Centre in India as they plan to invest in Smart City projects, particularly in UP state, with facilities like the integrated traffic management system, the solid waste management system, and health ATMs.

- October 2022 - The technology company ABB released SmartTouch 10 for smart home automation. This will help indoor communication, replacing the need for an additional indoor video station. The device can manage entire building installation, from IP cameras to lighting, shading, scene, and temperature control. A notification center informs users about all actions and missed visits.

North America Occupies the Largest Market Share

- North America is a pioneer in adopting most technological innovations and advancements, and the adoption of IoT is reshaping various industrial and consumer sectors throughout the region. The 5G adoption in the region is high, and a total of 108 million 5G connections have been laid by Q3 2022. The autonomous 5G deployments that are underway will drive the market for IoT as a whole.

- February 2023 - Canadian-based IoT company, Eleven-x, will help North America municipal parking with the smart parking system that will monitor parking spots and provide real-time data on availability. This will reduce congestion in the area and optimize parking enforcement, further improving urban mobility.

- August 2022 - North America's biggest IOT Pay platform was acquired by GrubMarket. This acquisition will help GrubMarket to use IOT Pay's technology and payments infrastructure to streamline the food supply chain industry. IOT Pay is also looking forward to rolling out a digital banking solution for small and medium-sized businesses (SMBs).

Consumer Internet of Things (IoT) Industry Overview

The Consumer IoT market is highly fragmented with huge potential and is turning to the next level with significant investments in AI, machine learning, big data, and 5G technology. IoT simplifies lives, and people buy gadgets to regulate and monitor their way of living. Some significant players offering their services in this sector include Microsoft Corporation, Apple Inc, Sony Corporation, IBM, Intel, and so on. These IoT leaders invest in new product developments and collaborations to expand their footprints across different industries and geographies.

In February 2023, Taoglas and Westbase.io, the IoT distributor, collaborated to provide innovative 4G/5G and IoT solutions to its customers in European Region. The partnership will offer clients reliable and high-performance solutions across construction, logistics, emergency services, smart cities, connected health, and other demanding applications. The highly-sophisticated antennas from Taoglas will deliver the most advanced RF and antenna technologies to the industrial clients with Westbase's network.

In November 2022, Switzerland-based IoT company, Loriot, signed a contract with Disrupt-X, a UAE-based IoT platform, to promote IoT dissemination in Europe and other geographies. The companies will invest in developing smart solutions that deliver innovative IoT products and services designed for the industrial, commercial, and residential sectors. They also plan to offer local Network Servers for their clients in the European region. Further, Disrupt-X will introduce a dashboard to access LORIOT Network Servers directly from its IoT Platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 on the Consumer IoT Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Connected Devices and Technology Proliferation Among Consumers

- 5.1.2 Impact of 5G and Increased Cellular Networks

- 5.1.3 Increasing home automation is expected to flourish the market

- 5.2 Market Challenges

- 5.2.1 Government Regulations, Security and Privacy of Data and Interoperability Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware (Components, such as Processors, Sensors, Gateways, Controllers, and Switches)

- 6.1.2 Solutions (Independent Software and Integrated Platforms)

- 6.1.3 Services (Device Lifecycle Management, Remote Monitoring, and implementation Services)

- 6.2 By Application

- 6.2.1 Home Automation (Smart Thermostats, Meters, Locks, etc.)

- 6.2.2 Consumer Wearables (Smart Watches, Glasses, Fitness Trackers, etc.)

- 6.2.3 Consumer Electronics (Smart TV and Other Connected White Goods)

- 6.2.4 Healthcare (Medical-grade Devices and Wearables, Platforms, etc.)

- 6.2.5 Automotive (Infotainment System, Connected Cars, etc.)

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 UK

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 UAE

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of MEA

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 Sony Corporation

- 7.1.4 Apple Inc.

- 7.1.5 LG Electronics

- 7.1.6 Alphabet Inc.

- 7.1.7 Hewlett Packard Enterprise (HPE)

- 7.1.8 Honeywell International Inc.

- 7.1.9 Cisco Systems Inc.

- 7.1.10 Intel Corporation

- 7.1.11 IBM Corporation

- 7.1.12 Schneider Electric SE

- 7.1.13 Symantec Corporation

- 7.1.14 Qorvo Inc.