|

市場調査レポート

商品コード

1689830

IoT保険- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年)IoT Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| IoT保険- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

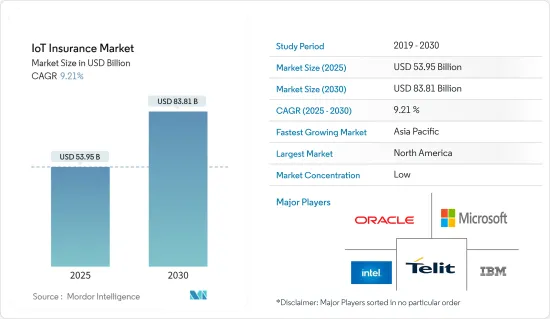

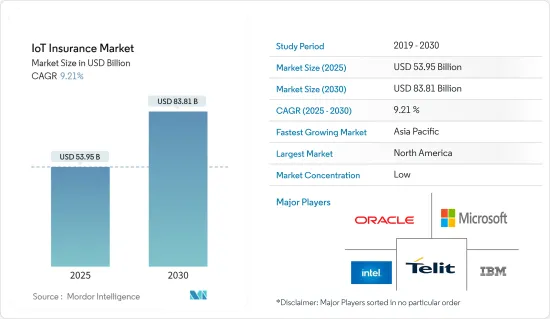

IoT保険市場規模は2025年に539億5,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは9.21%で、2030年には838億1,000万米ドルに達すると予測されます。

保険料とリスク関連コストを削減するためにIoTの利用が拡大しており、革新的な保険モデルと並行して保険セクタが成長しているため、調査された市場成長はさらに拡大します。

主要ハイライト

- データ分析、ビッグデータ、センサ、機械学習技術の成長が市場成長をさらに拡大。スマートグリッドがエネルギー産業全体を支配すると想定される中、IoT公益事業は予測期間中に牽引力を増すと予想されます。

- さらに、スマートウォッチ、スマートフォン、フィットネストラッカーのようなインターネットに接続された医療機器の急速な普及により、生命保険と医療保険の世界市場は予測期間中に大きく成長すると予測されます。

- 機械学習や人工知能のような最先端技術の保険セグメントへの採用の増加は、世界のIoT保険市場の成長に有利な可能性をもたらすと考えられます。

- しかし、顧客の個人情報のセキュリティやプライバシーに関する懸念や、IoT機器を使いこなす作業員の必要性が、IoT保険事業の成長を制限しています。

- COVID-19はIoT保険セグメントの拡大に好影響を与えると予想されます。この背景には、保険金請求管理のために顧客データを収集するデジタル技術を取り入れる保険事業者の増加があります。顧客にCOVID-19保険サービスを提供するために、IoT技術は、携帯電話、ウェアラブルデバイス、センサを介して患者の健康情報を安全に収集することにより、現在のCOVID-19発生時に保険セクタを支援します。

モノのインターネット(IoT)保険市場の動向

小売・商業が大きなシェアを占める見込み

- デジタルディスラプションは商業保険会社に影響を与えると予想され、産業は大きな変革を確認する準備を進めています。IoT技術は様々な新しい取り組みの中核になると予想されます。保険会社はIoTデータを活用して、顧客の評価、保険料の削減、リアルタイムの警告を提供しようとしています。

- 業務用不動産保険会社は、顧客との関係を再構築する機会を何度も確認することになると考えられます。IoTやクラウドなどの技術の進歩により、業務用顧客に価値を提供するために使用できる膨大な量のデータが大幅に作成されており、主に緊密なパートナーシップと新たな収益源を可能にしています。

- ここ数年の世界のeコマース市場の急成長により、小売業も大きな成長を遂げています。その結果、小売業者はIoTソリューションを利用して顧客体験と業務効率を高め、競合を獲得しています。その結果、ショッピング体験の向上を求める顧客のニーズ、スマート決済ソリューションの受け入れ拡大、IoTベースのセンサと接続性のコスト低下が、調査セグメントにおけるIoT技術の採用に影響を与える主要な促進要因となっています。

- IoTは、プロセスの自動化と小売施設の運営効率の向上に大きく貢献しています。エネルギー効率、セキュリティとモニタリング、在庫とサプライチェーンの最適化、労務管理などを記載しています。さらに、IoTは生鮮食品や医薬品のコールドチェーンモニタリングのセグメントでもその能力を開発しています。

北米が主要シェアを占める見込み

- 北米はIoT保険市場にとって重要な地域のひとつとみなされているが、これは同地域全体でIoTに対する認識が高まり、導入が加速しているためです。Liberty Mutual、Progressive、State Farmなど多くの企業が、この地域のIoT技術を活用してリスク評価の効率化を図っています。

- 米国の大手保険会社であるJohn Hancockは、バイタリティと提携し、顧客にフィットビットを無料で配布し、顧客の健康状態を追跡することで、保険金請求のリスクを低減させ、ウェアラブルデバイスの力を活用した最初の企業の1つです。さらに米国は、さまざまな保険会社にIoTソリューションを提供する大手企業の本社とみなされています。

- 加えて、モノのウェブ(IoT)の早期導入や地域の強固な労働力といった要因が、同地域市場の成長を加速させると予測されています。

- 地域全体でIoT保険ソリューションの採用を促進する主要因には、保険産業の拡大、創造的な保険モデルの構築、保険料とリスク関連費用を削減するためのIoT技術の利用拡大などがあります。

モノのインターネット(IoT)保険産業概要

IoT保険市場は、大企業から中小企業までが存在し、国内だけでなく世界の市場で競争できるため、競争が激しくなっています。非常に多くの技術巨大企業が存在するため、市場はセグメント化されているように見えます。IBM Corporation、Microsoft Corporation、Intel Corporation、SAP SEなどが市場参入企業の主要例です。

- 2022年7月-SAPとNTTデータは、壊れやすく繊細な貨物輸送を追跡し、保険手続きを円滑化する共同イノベーションソリューション「Connected Product」を発表しました。輸送状況のエンドツーエンドのリアルタイムモニタリングを可能にすることで、このソリューションは貨物に影響を与える可能性のあるすべての変数をモニタリングし、貨物が事前に定義された特定の条件下で輸送されなかった場合に自動的に保険契約をトリガーし、実行することができます。SAP Business Network for Logisticsを活用することで、各利害関係者のアカウンタビリティが向上し、輸送保険の管理が容易になります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

- COVID-19の産業への影響評価

第5章 市場力学

- 市場の促進要因

- 革新的な保険モデルと並行する保険セクタの成長

- 保険料とリスク関連コストを削減するためのIoT利用の拡大

- 市場抑制要因

- 収集データによるプライバシーへの高いリスク

第6章 市場セグメンテーション

- エンドユーザー産業別

- 小売・商業

- 住宅(スマートホーム)

- 自動車

- 産業

- 医療

- その他のエンドユーザー産業(公共インフラ、物流、ナビゲーション)

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- Oracle Corporation

- Telit Communications PLC

- Synechron Inc.

- Verisk Analytics Inc.

- Accenture PLC

- Aeris Group

- Concirrus Ltd

- Allerin Pvt. Ltd

- ForMotiv LLC

- Wipro Corporation

- Webfleet Solutions BV(Bridgestone Corp.)

第8章 投資分析

第9章 市場の将来

The IoT Insurance Market size is estimated at USD 53.95 billion in 2025, and is expected to reach USD 83.81 billion by 2030, at a CAGR of 9.21% during the forecast period (2025-2030).

The growth of the insurance sector in parallel with innovative insurance models, with the growing usage of IoT to reduce premium and risk-related costs, further expand the studied market growth.

Key Highlights

- Growth in data analytics, Big Data, sensors, and machine learning technologies further expands the studied market's growth. With smart grids envisioned to take over the entire energy industry, IoT utilities are expected to gain traction over the forecast period.

- Additionally, the global market for life and health insurance is predicted to grow significantly during the forecast period due to the rapid uptake of internet-connected medical devices like smartwatches, smartphones, and fitness trackers that are constantly used to gather user data and monitor their behavior or lifestyle.

- Increasing adoption of cutting-edge technologies in the insurance sector, such as machine learning and artificial intelligence, would present lucrative potential for the growth of the worldwide IoT insurance market.

- However, concerns about the security and privacy of customers' personal information and a need for worker proficiency with IoT devices limit the growth of the IoT insurance business.

- COVID-19 is anticipated to have a favorable effect on the expansion of the IoT insurance sector. This is due to an increase in insurance provider businesses' embrace of digital technologies to collect client data for claim management. To provide COVID-19 insurance services to clients, IoT technology assists the insurance sector during the current COVID-19 outbreak by securely collecting patient health information via mobile phones, wearable devices, and sensors.

Internet of Things (IoT) Insurance Market Trends

Retail and Commercial is Expected to Hold Significant Share

- Digital disruptions are expected to impact commercial insurers, as the industry has been preparing to witness some significant transformation. IoT technology is expected to be at the core of various new initiatives. Insurance firms are trying to utilize IoT data to assess customers, reduce premiums, and provide real-time warnings.

- Commercial property insurers are expected to witness multiple opportunities to redraw their relationships with their clients. Technological advancements, such as IoT and cloud, are significantly creating vast amounts of data that can be used to deliver value to commercial customers, primarily enabling closer partnerships and new sources of revenue.

- Due mainly to the rapid rise of the global e-commerce market over the past few years, the retail sector has also seen enormous growth. As a result, retailers use IoT solutions to boost the customer experience and operational efficiency to gain a competitive edge. As a result, the need from customers for an improved shopping experience, the growing acceptance of smart payment solutions, and the declining cost of IoT-based sensors and connectivity are some of the key drivers influencing the adoption of IoT technology in the researched segment.

- IoT has been significantly contributing to process automation and improving the operational effectiveness of retail establishments. It offers energy efficiency, security and surveillance, inventory and supply chain optimization, and labor management. Additionally, IoT is developing its capabilities in the area of cold chain monitoring for perishable food and pharmaceutical products.

North America is Expected to Hold Major Share

- North America is regarded as one of the significant regions for the IoT insurance market due to the growing awareness and the faster adoption of IoT across the region. Many companies, such as Liberty Mutual, Progressive, and State Farm, are leveraging the region's IoT technologies to enhance their risk assessment efficiency.

- John Hancock, a major insurance company in the United States, was one of the first to utilize the power of wearable devices by partnering with Vitality, distributing free Fitbits to customers, and tracking their well-being, making them less at risk of filing a claim. Moreover, the United States is regarded as the headquarters of some major players who offer their IoT solutions for various insurance companies.

- Additionally, it is projected that factors like the early adoption of the web of things (IoT) and a robust regional labor force will accelerate the regional market's growth.

- Some key factors driving the adoption of IoT insurance solutions across the region include the expansion of the insurance industry, the creation of creative insurance models, and the expanding use of IoT technology to lower premium and risk-related expenses.

Internet of Things (IoT) Insurance Industry Overview

The IoT insurance market is highly competitive, due to the market's large and small businesses' existence, which allows them to compete on both domestic and global marketplaces. Due to the presence of so many technology behemoths, the market seems to be fragmented. IBM Corporation, Microsoft Corporation, Intel Corporation, and SAP SE are a few of the market's main participants.

- July 2022 - SAP and NTT DATA announced Co-Innovation Solution Connected Product to Track Fragile and Sensitive Cargo Shipments and Facilitate Insurance Procedures, where By enabling end-to-end, real-time monitoring of the transportation conditions, the solution can monitor all variables that could affect a shipment, and automatically trigger and execute insurance policies if goods are not transported under certain pre-defined conditions. Utilizing SAP Business Network for Logistics helps improve accountability for each stakeholder and makes transport insurance management easier.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Insurance Sector in Parallel with Innovative Insurance Models

- 5.1.2 Growing Usage of IoT to Reduce the Premium and Risk-related Costs

- 5.2 Market Restraint

- 5.2.1 High Risk for Privacy from the Collected Data

6 MARKET SEGMENTATION

- 6.1 By End-User Industry

- 6.1.1 Retail and Commercial

- 6.1.2 Residential (Smart homes)

- 6.1.3 Automotive

- 6.1.4 Industrial

- 6.1.5 Healthcare

- 6.1.6 Other End-user Industries (Public Infrastructure, Logistics and Navigation)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Intel Corporation

- 7.1.4 Oracle Corporation

- 7.1.5 Telit Communications PLC

- 7.1.6 Synechron Inc.

- 7.1.7 Verisk Analytics Inc.

- 7.1.8 Accenture PLC

- 7.1.9 Aeris Group

- 7.1.10 Concirrus Ltd

- 7.1.11 Allerin Pvt. Ltd

- 7.1.12 ForMotiv LLC

- 7.1.13 Wipro Corporation

- 7.1.14 Webfleet Solutions BV (Bridgestone Corp.)