|

市場調査レポート

商品コード

1690745

5Gデバイス-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)5G Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 5Gデバイス-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

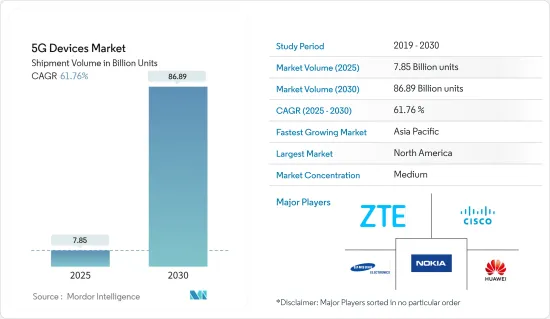

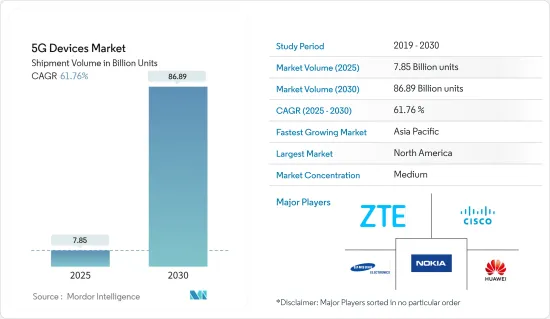

5Gデバイス市場規模は出荷台数ベースで、2025年の78億5,000万台から2030年には868億9,000万台に拡大し、予測期間(2025~2030年)のCAGRは61.76%になると予測されます。

5G技術は超高速ネットワークカバレッジを提供し、IoTの助けを借りて数多くの新しい用途を可能にします。また、COVID-19の流行が5Gの普及を遅らせています。

主要ハイライト

- 昨年のEricssonConsumerLabレポートによると、昨年4月から7月にかけて、37市場の49,100人の顧客を対象にオンラインインタビューが実施されました。インタビューに選ばれた回答者は、調査対象市場のオンライン人口17億人、4億3,000万人の5Gユーザーを代表しており、年齢層は15歳から69歳までと幅広いです。調査によると、5Gの次の波はすでに動き出しており、アーリーアダプター市場では主流の顧客がこの技術を受け入れ始めています。

- 接続性、デジタル用途、ウェアラブル技術の採用拡大が、5G機器市場の参入企業の成長を促進すると予想されます。さらに、モデム、タワー、その他のサポートインフラを含む既存のサポートインフラのアップグレードは、新規参入企業にとって大きなビジネス機会となります。5G技術の採用は、世界のいくつかの地域市場で肯定的なシグナルを受けているため、5Gデバイス市場の成長は大きな機会を促進すると予想されます。

- 大手チップメーカーも、市場でのデバイス普及を促進するため、5Gデバイスコンポーネントの開発に注力しています。これには、大量導入のためにより多くのモデルを導入し、量販市場で競争しているチップセット・ベンダーも含まれます。昨年5月、MediaTekはDimensity 1050 mmWave SoCとその関連モデルを発表し、デバイスにおける5G接続性を強調しました。

- また、新たな用途、ビジネスモデル、デバイスコストの低下がIoTの採用を促進し、接続デバイスとエンドポイントの数が世界的に増加しています。5Gは大規模マシン型通信(mMTC)を提供し、数百億台のネットワーク対応デバイスのワイヤレス接続をサポートする態勢を整えています。最新の通信システムは、すでにいくつかのMTC用途に対応しています。しかし、mMTCの特徴である、膨大な数のデバイスと微小なペイロードサイズには、新しいコンセプトとアプローチが必要です。5Gでは、1平方キロメートルあたり約100万台のデバイス密度を実現できます。

- しかし、それを支えるインフラの世界の運用と設置は、多くの地域で引き続き大きなハードルとなっています。例えば、国際標準化団体3GPPは昨年9月、5G仕様の次期リリース「リリース17」を前年後半に更新しました。昨年3月にはパンデミックの影響などでリリースが凍結されていました。このような遅延は、企業のサプライチェーンやその他の活動にその後の遅れを生みます。

- COVID-19パンデミックの直接的な影響はあらゆる産業に及んでおり、広範なレイオフ、記録的な失業、個人消費の深刻な抑制を引き起こしています。COVID-19の蔓延により、サプライチェーンが大きく混乱し、短期・中期的に5Gの構築プロセスが阻害されました。このように、5Gハードウェアの重大な遅延と景気減速の一般的な影響が当てはまる。

5Gデバイス市場動向

スマートフォンセグメントが最も高い成長を遂げる見込み

- Ericsson Mobility Report 2021によると、世界で約650の新しい5Gスマートフォンが発売され、全フォームファクタの5Gの50%を占めています。スマートフォンが提供するハンドヘルドのワイヤレスフォームファクタと5Gアクセスの利便性は、ほとんど比類がないです。世界のいくつかの地域ではすでに5Gの展開が始まっているが、手つかずの地域もあり、来るべき5Gの開始を活用するために、5G対応スマートフォンの発売を受ける準備を進めています。

- 技術の進歩が進み、超高帯域幅、超低遅延、大規模接続に対する需要が高まっていることから、市場に成長機会がもたらされると予想されます。さらに、エネルギー管理やスマートホーム製品などの統合IoT(モノのインターネット)向けの高速データ接続に対する需要の高まりは、予測期間中に5Gスマートフォンの採用を促進すると予想されます。

- 複数のスマートフォンメーカーは、競争の激しい市場情勢に対応するため、地域市場の反応に応じて戦略的な発売を計画しています。昨年8月、Samsungは新世代の5G対応折りたたみ式端末で12時間足らずで60億インドルピーの売上を記録した後、インド市場でさらなるスマートフォンを発売する計画を共有しました。同社は、前年にインドで5Gが展開されるのに先駆けて、この端末を発売する予定です。

- さらに、市場参入企業はハイエンドの5Gスマートフォン体験を顧客に提供することに注力しています。例えば、Qualcommは昨年5月、主要なスマートフォンの実装向けに、クロック速度が最大3.2GHzのSnapdragon 8 Gen 1 SoCを発表しました。このプロセッサは、第4世代のSnapdragon X65 5G Modem-RFシステムを搭載し、最大10 Gbpsの5G速度を実現します。

- このような市場の開拓は、スマートフォンで最新かつ最速のオールラウンドな体験を得るために、5G非搭載スマートフォンをアップグレードする購入者を惹きつけ、5Gスマートフォン市場を牽引しています。

北米が大きなシェアを占める見込み

- 同地域のサービスプロバイダはすでに、モバイルブロードバンドを中心とした商用5Gサービスを開始しています。3つの周波数帯すべてに対応する5Gデバイスの導入により、同地域での同技術の早期普及が可能になります。現在のところ、5Gサービスは4Gサービスと統合されているか、顧客が5Gサービスを利用できる地域から利用できない地域に移動する際に5Gから4Gへのハンドオフが行われています。

- Ericson Mobility Report 2021によると、2021年には4Gから5Gへの移行が大幅に進み、約6,400万件の5G契約が追加されました。5Gの契約数は今年末には2億5,000万、2027年には4億に達し、モバイル契約の90%を占めると予想されています。

- 同様に、北米では固定無線アクセス(FWA)の契約数が最も増加しており、調査対象となったサービスプロバイダの約60%がFWAを提供しています。このような地域的な立ち上げは、5G展開のインフラ的なサポートを後押しし、北米の新規ユーザーの最大エリアに到達します。

- 最近、複数の製品が発表され、この地域全体で5G接続が可能になりました。Nokiaは昨年9月、北米でのプライベートワイヤレスネットワーク接続を促進するため、ユーザー機器の産業用ポートフォリオを拡大すると発表しました。その新しいNokia 5G産業用フィールドルーターとドングル、無線アクセススペクトラム機能、Nokia Connectivity Operations Dashboardは、安全で信頼性の高いプライベート4G/LTEと5G無線を展開・管理するための選択肢を増やすことになります。Nokiaの5Gフィールドルーターと5Gドングルは、米国とカナダの市民ブロードバンド無線サービス(CBRS)3.5GHz帯で展開できます。

5Gデバイス産業概要

5Gデバイス市場の競争は中程度で、多くの世界的・地域的参入企業で構成されています。これらの参入企業はかなりの市場シェアを占めており、顧客基盤の拡大に注力しています。ベンダーは、新しいソリューションの導入に向けた研究開発投資、戦略的パートナーシップ、その他の有機的・無機的成長戦略に注力し、競合他社に対する競合を獲得しています。

- 2022年9月-HMD Globalは、ドイツ・ベルリンで開催されたIFA 2022において、約11の5G帯域を搭載した新型5GスマートフォンNokia X30とその他数点のNokia製品を発表。

- 2022年8月-Bharti Airtel(Airtel)が、2022年8月に5Gの展開を開始するため、Ericsson、Nokia、Samsungと5Gネットワーク契約を締結したと発表。5G機器とソリューションを供給するSamsungとの提携は、従来のパートナーであるNokiaとEricssonとともに2022年に開始されます。この5Gパートナーシップは、インド電気通信省が実施した周波数オークションで、Airtelが900MHz、1,800MHz、2,100MHz、3,300MHz、26GHzの19,867.8MHZの周波数帯を入札し、取得したことに続くものです。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 市場の定義と範囲

- 調査の前提

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の利害関係者分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19が5G情勢に与える影響

第5章 市場力学

- 市場の促進要因

- 世界のデバイス数とエンドポイント数の持続的増加

- 採用を後押しするコンポーネントとデバイスレベルでの技術革新

- スマートフォン利用の増加とスマートフォンにおける技術進歩の高まりが市場を牽引すると予想

- 市場抑制要因

- 規制と標準化の遅れ

- 設計と運用上の課題

- 市場機会

- 産業部門からの需要増加の見込み

- 新興国での5G導入に向けた継続的な取り組み

- 5Gのタイムラインと5G対応デバイスの普及

- 5Gとその先

- 主要な産業規制と施策

第6章 技術スナップショット

第7章 5Gの市場情勢

- 世界の通信事業者数-トライアルと商用開始の内訳(18年第2四半期~20年第1四半期)

- 5G導入に関する国別カバレッジ-投資と商用化の動向

- セルサイトバックホール、マクロ、スモールセルサイトバックホールの総使用率(マイクロ波、衛星、サブ6GHz)

- 市場展望

第8章 市場セグメンテーション

- フォームファクタ

- モジュール

- CPE(屋内/屋外)

- スマートフォン

- ホットスポット

- ノートパソコン

- 産業グレードCPE/ルーター/ゲートウェイ

- その他のフォームファクタ

- スペクトラムサポート

- サブ6 GHz

- ミリ波

- 両方のスペクトラムバンド

- 地域

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- 北米

第9章 競合情勢

- 企業プロファイル

- ZTE Corporation

- Cisco Systems Inc

- Nokia Corporation

- Huawei Technologies Co. Ltd

- Samsung Electronics Co. Ltd

- Xiaomi Corporation

- Motorola Mobility LLC(Lenovo Group Limited)

- BBK Electronics Corporation

- Keysight Technologies Inc.

第10章 投資分析

第11章 市場機会と今後の動向

The 5G Devices Market size in terms of shipment volume is expected to grow from 7.85 billion units in 2025 to 86.89 billion units by 2030, at a CAGR of 61.76% during the forecast period (2025-2030).

5G technology will offer ultra-high-speed network coverage and enable numerous new applications with the help of IoT. Also, the COVID-19 pandemic has delayed the widespread deployment of 5G.

Key Highlights

- According to the last year's Ericsson ConsumerLab report, Online interviews were conducted with 49,100 customers in 37 markets between April and July last year. The respondents chosen for the interview represent the surveyed markets' online population of 1.7 billion customers and 430 million 5G users, who range in age from 15 to 69. According to studies, the next wave of 5G is already in motion, with mainstream customers starting to accept the technology in early adopter markets.

- The growing adoption of connectivity, digital applications, and wearable technology is expected to drive growth for players in the 5G devices market. Moreover, upgrading existing supporting infrastructure, including modems, towers, and other supporting infrastructure, will present significant opportunities for new players. The 5G devices market's growth is expected to drive significant opportunities as the adoption of 5G technology has received positive signals in several local markets worldwide.

- Major chip makers also focus on 5G device component development to boost device penetration in the market. This includes chipset vendors competing in volume-driven markets as they introduce more models for mass deployments. In May last year, MediaTek launched Dimensity 1050 mmWave SoC, and related models, to highlight 5G connectivity in devices.

- Also, emerging applications, business models, and falling device costs have driven IoT adoption, increasing the number of connected devices and endpoints globally. 5G offers massive machine-type communication (mMTC), poised to support tens of billions of network-enabled devices to be wirelessly connected. Modern communication systems already serve several MTC applications. However, the characteristic properties of mMTC, i.e., the massive number of devices and the tiny payload sizes, require novel concepts and approaches. 5G allows a density of approximately one million devices per square kilometer.

- However, the global operation and installation of the supportive infrastructure continue to be a significant hurdle in many areas. For instance, in September last year, the international standardization body, 3GPP, updated the next release of the 5G specification, Release 17, for the second half of the previous year. The release was frozen in March last year due to the pandemic and other reasons. Such delays create subsequent delays in companies' supply chains and other operational activities.

- The COVID-19 pandemic's immediate effects have been felt in every industry, causing widespread layoffs, record unemployment, and severely curtailing consumer spending. The spread of COVID-19 resulted in a significant supply chain disruption impeding the 5G buildout process in the short & medium term. The critical 5G hardware delays and general effects of the economic slowdown thus apply.

5G Devices Market Trends

Smartphone Segment is Expected to Witness the Highest Growth

- According to the Ericsson Mobility Report 2021, around 650 new 5G smartphones have been launched globally, accounting for 50% of all the 5G from all form factors. The handheld wireless form factor and convenience of 5G access offered by smartphones are nearly unmatched. As several parts of the world have already begun rolling out 5G, some untouched regions are preparing to receive 5G-enabled smartphone launches to leverage the upcoming 5G launch.

- The increasing technological advancements and growing demand for ultra-high bandwidth, ultra-low latency, and massive connectivity are expected to offer growth opportunities to the market. Moreover, the rising demand for high-speed data connectivity for integrated IoT (Internet of Things) applications, such as energy management and smart home products, is anticipated to propel the adoption of 5G smartphones over the forecast period.

- Several smartphone manufacturers adapt and plan strategic launches according to the local market responses to compete in the highly competitive landscapes. In August last year, Samsung shared plans to launch more smartphones in the Indian market after recording sales of INR 600 crore in less than 12 hours for its new generation 5G-enabled foldable devices. The company would launch the devices ahead of the 5G roll-out in India in the previous year.

- Further, the market players focus on providing customers with a high-end 5G smartphone experience. For instance, in May last year, Qualcomm launched Snapdragon 8 Gen 1 SoC, with clock speeds up to 3.2 GHz for major smartphone implementation. The processor features the fourth-generation Snapdragon X65 5G Modem-RF System, bringing 5G speeds of up to 10 Gbps.

- Such developments attract buyers to upgrade their non-5G smartphones to get the latest and fastest, all-around experience in their smartphone, driving the 5G smartphone market.

North America Expected to Hold a Significant Share

- Service providers in the region have already launched commercial 5G services focused on mobile broadband. The introduction of 5G devices that support all three spectrum bands will enable early adoption of the technology in the region. As of now, 5G services are integrated with 4G services or with hand-off from 5G to 4G when a customer moves from an area where 5G service is available to one where it is not.

- According to the Ericson Mobility Report 2021, around 64 million 5G subscriptions were added in 2021 as migration from 4G to 5G subscriptions picked up significantly. The number of 5G subscriptions is expected to reach 250 million at the end of the current year and 400 million by 2027, accounting for 90 percent of mobile subscriptions.

- Similarly, the report also mentioned North America registering the strongest increase in the number of fixed wireless access (FWA), with about 60% of all service providers surveyed offering FWA. Such regional launches boost the infrastructural support for the 5G roll-out, reaching maximum areas in North America for new users.

- Multiple product launches have enabled 5G connectivity across the region recently. In September last year, Nokia announced extending its Industrial portfolio of user equipment to facilitate private wireless network connectivity in North America. Its new Nokia 5G Industrial fieldrouter and dongle, radio access spectrum capabilities, and Nokia Connectivity Operations Dashboard would provide more options for deploying and managing secure, reliable private 4G/LTE and 5G wireless. The Nokia 5G fieldrouter and 5G dongle could be deployed in the US and Canada Citizen Broadband Radio Service (CBRS) 3.5 GHz spectrum.

5G Devices Industry Overview

The 5G devices market is moderately competitive and consists of many global and regional players. These players account for a considerable market share and focus on expanding their customer base. The vendors focus on the research and development investment in introducing new solutions, strategic partnerships, and other organic & inorganic growth strategies to earn a competitive edge over their counterparts.

- September 2022 - HMD Global launched the new Nokia X30 5G smartphone and a few more Nokia products at IFA 2022 in Berlin, Germany, featuring around eleven 5G bands.

- August 2022 - Bharti Airtel (Airtel) announced signing 5G network agreements with Ericsson, Nokia, and Samsung to commence 5G deployment in August 2022. The partnership with Samsung to supply 5G equipment and solutions would begin in 2022, along with the older partners, Nokia and Ericsson. The 5G partnerships would follow closely on the edge of spectrum auctions conducted by the Department of Telecom in India, where Airtel bid for and acquired 19867.8 MHZ spectrum in 900 MHz, 1800 MHz, 2100 MHz, 3300 MHz, and 26 GHz frequencies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the 5G Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Sustained Increase in Number of Devices and Endpoints Worldwide

- 5.1.2 Technological Innovations at a Component and Device Level to Aid Adoption

- 5.1.3 Increasing use of Smart Phones and rising Technological advancement in the smart phones is expected to drive market.

- 5.2 Market Restraints

- 5.2.1 Regulatory and Standardization Delays

- 5.2.2 Design and Operational Challenges

- 5.3 Market Opportunities

- 5.3.1 Anticipated Rise in Demand from the Industrial Sector

- 5.3.2 Ongoing Efforts toward Introduction of 5G in Emerging Countries

- 5.4 5G Timeline and proliferation 5G enabled devices

- 5.5 5G and Beyond - The Path Ahead

- 5.6 Key Industry Regulations and Policies

6 TECHNOLOGY SNAPSHOT

7 5G ADOPTION MARKET LANDSCAPE

- 7.1 Number of Operators Worldwide - Breakdown by Trials and Commercial Launches (Q2'18 - Q1'20)

- 7.2 Country-level coverage on 5G Adoption - Investment and Commercialization Trends

- 7.3 Total Cell-site Backhaul, Macro, and Small Cell-site Backhaul Usage - In Percentage (Microwave, Satellite, Sub-6 GHz)

- 7.4 Market Outlook

8 MARKET SEGMENTATION

- 8.1 Form Factor

- 8.1.1 Modules

- 8.1.2 CPE (Indoor/Outdoor)

- 8.1.3 Smartphone

- 8.1.4 Hotspots

- 8.1.5 Laptops

- 8.1.6 Industrial Grade CPE/Router/Gateway

- 8.1.7 Other Form Factors

- 8.2 Spectrum Support

- 8.2.1 Sub-6 GHz

- 8.2.2 mmWave

- 8.2.3 Both Spectrum Bands

- 8.3 Geography

- 8.3.1 North America

- 8.3.1.1 United States

- 8.3.1.2 Canada

- 8.3.2 Europe

- 8.3.2.1 Germany

- 8.3.2.2 UK

- 8.3.2.3 France

- 8.3.2.4 Spain

- 8.3.2.5 Rest of Europe

- 8.3.3 Asia-Pacific

- 8.3.3.1 China

- 8.3.3.2 Japan

- 8.3.3.3 India

- 8.3.3.4 Australia

- 8.3.3.5 Rest of Asia-Pacific

- 8.3.4 Latin America

- 8.3.4.1 Brazil

- 8.3.4.2 Mexico

- 8.3.4.3 Argentina

- 8.3.4.4 Rest of Latin America

- 8.3.5 Middle East and Africa

- 8.3.5.1 UAE

- 8.3.5.2 Saudi Arabia

- 8.3.5.3 South Africa

- 8.3.5.4 Rest of Middle East and Africa

- 8.3.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 ZTE Corporation

- 9.1.2 Cisco Systems Inc

- 9.1.3 Nokia Corporation

- 9.1.4 Huawei Technologies Co. Ltd

- 9.1.5 Samsung Electronics Co. Ltd

- 9.1.6 Xiaomi Corporation

- 9.1.7 Motorola Mobility LLC (Lenovo Group Limited)

- 9.1.8 BBK Electronics Corporation

- 9.1.9 Keysight Technologies Inc.