|

市場調査レポート

商品コード

1643042

MulteFire:市場シェア分析、産業動向・統計、成長予測(2025~2030年)MulteFire - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| MulteFire:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

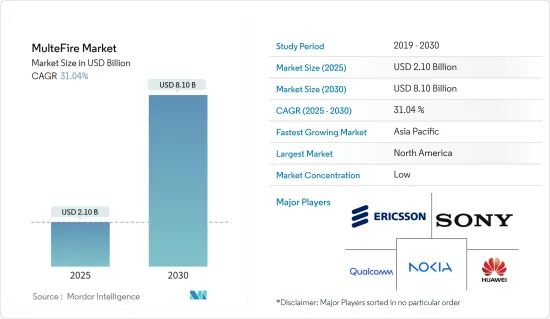

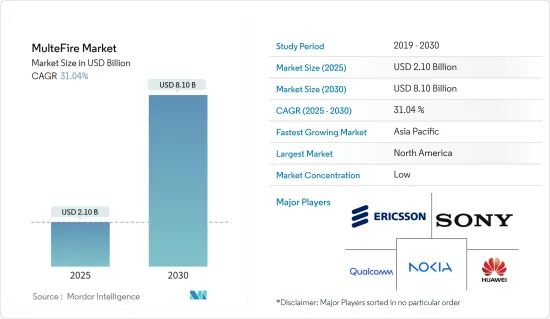

MulteFire市場規模は2025年に21億米ドルと推定され、予測期間(2025-2030年)のCAGRは31.04%で、2030年には81億米ドルに達すると予測されます。

増え続けるデバイスに豊富な情報を提供するため、無線接続への依存度が高まった結果、ネットワークの容量が制限されるようになった。このため、増大するモバイル・データ・トラフィックの問題を解決するための重要なコンポーネントとして、MulteFireの誕生が促されました。

主なハイライト

- MulteFireは、2.4GHzおよび5GHzの世界周波数帯、800/900MHzおよび1.9MHzの地域周波数帯を含む、世界中の免許不要の地域および世界周波数帯で、企業がモバイルネットワーク事業者の関与なしにLTEプライベートネットワークを展開することを可能にする重要なイネーブラとなります。

- MulteFireは、そのスタンドアロン機能により、無線ISP、世界企業、専門業種、さらにはネットワーク事業者など、多くの新しいプレーヤーに免許不要の周波数帯を開放し、すべてのプレーヤーがMulteFireベースのLTEプライベート・ネットワークを展開できるようになります。

- MulteFireは、LTEの優れた性能と免許不要の周波数帯による展開の簡便さを組み合わせることで、より多くの場所でより高度なブロードバンド・サービスを展開することを可能にします。MulteFireはLTEをベースにしているため、最大20MHzの広帯域で動作し、大容量と低遅延をサポートし、最大400Mbpsのピークデータレートを可能にします。

- MulteFireによって、企業やケーブル・プロバイダーが免許不要の周波数帯を使用して独自のLTEネットワークを構築することが可能になるかもしれないです。セキュリティ強化などのLTE機能と組み合わせれば、認可された周波数帯を持たず、Wi-Fiが一般的に提供する以上のモビリティを望む大手企業は、海運港、鉱山、空港などの産業分野でMulteFireを採用すると予想されます。さらに、MulteFireはIoT展開のための接続選択肢になると予測されています。

- 産業用IoT(IIoT)アプリケーション向けに、よりスケーラブルで高度なネットワーク接続のニーズが高まっていることは、予測期間中にmultefire市場の拡大を促進すると予測される主要因の1つです。さらに、高性能で導入が簡単な無線接続ネットワークへのニーズの高まりが、multefire市場の拡大を後押しすると予想されます。

- しかし、大容量でコスト効率に優れたネットワークへのニーズの高まりが、multefire市場の拡大を制限すると予測されています。他方、共有周波数帯の利用に関する決定が遅れているため、期間中のマルチファイア市場の成長はさらに阻害されると予測されています。

- COVID-19はマルチファイア市場に大きな影響を与えています。さまざまな製造企業や事業の急速な閉鎖が市場に大きな影響を与えました。第一期中期には、COVID-19の発生により、インターネットの利用状況に変化が見られ、インターネットの品質に基づいてサーバーで監視されるダウンロード速度が各地で変化し、トラフィック量が増加しました。最も顕著なトラフィック量の増加は、学校の休校や自宅待機の指示といった公式の方針が発表された直後に、実質的にあらゆる場所で観測されました。

MulteFireの市場動向

産業用モノのインターネット(IIoT)アプリケーション向けに、より優れたスケーラブルなネットワーク接続に対する需要の高まり

- 企業やケーブル・プロバイダーが免許不要の周波数帯を利用して独自のLTEネットワークを構築することは、MulteFireによって可能になるかもしれないです。セキュリティ強化などのLTE機能と組み合わせることで、認可された周波数帯を持たず、Wi-Fiが一般的に提供する以上のモビリティを望む大手企業は、海運港、鉱山、空港などの産業分野でMulteFireを採用すると予想されます。さらに、MulteFireはIoT展開のための接続選択肢となることが期待され、それによって市場成長が促進されます。

- さらに、MulteFireアライアンスは、企業や産業用IoT向けのプライベートLTEネットワークを、MulteFire技術の恩恵を受ける重要なユースケースと考えています。同アライアンスは、免許不要の共有周波数帯でLTEと次世代セルラー技術を採用するという目標を推進するため、インダストリアル・インターネット・アライアンス(AII)との提携を歓迎しました。このような取り組みは、市場の成長を大きく後押しします。

- さらに、モビリティとセキュリティは、IoT展開のための接続性の選択肢を評価する重要なビジネスと考えられています。MulteFireのようなプライベートLTEネットワークは、免許不要の周波数帯や共有周波数帯のみを使用しながら、両方の要件を満たしています。これは、センサーベースのIoTデバイスのサイズと拡張性を懸念するセクターにとって理想的なネットワークオプションです。MulteFireは、周波数帯の共有と共存を実現することで、プライベートLTEの設置を容易にするため、IoTネットワークのアーキテクチャに不可欠です。

- さらに、エリクソンのレポートによると、2022年には、IoT接続の総額は約132億になると報告されています。これらの技術により、2021年には接続機器数が大幅に増加し、2022年末には約5億台に達すると予測されています。ネットワーク能力の向上は、FDD帯域におけるマッシブIoTと4Gおよび5G間の周波数共有を可能にすることで、マッシブIoT技術の開発を促進します。このようなIoT接続の増加は、IIoT技術を大きく構成し、それによって市場の成長を促進します。

北米が最大市場シェアを占める

- 北米は、MulteFire技術ベースのネットワークを展開する上で最も重要な地域のひとつです。MulteFireアライアンスは、産業製造、鉱業、ヘルスケア、商業など、さまざまな業種のさまざまなアプリケーションでLTE技術を免許不要帯域で利用できるようにする可能性を調査するイニシアチブをとっており、これがMulteFire市場成長の原動力となりそうです。

- この地域には、クアルコム、インテル、ウェーブワイヤレス、スパイダークラウドワイヤレス、TMobile、ベライゾンなど、MulteFireアライアンスのメンバーである数多くの大手企業が拠点を置いています。同地域におけるこのような有力企業の存在は、市場シェアの拡大に大きく寄与しており、予測期間中に同地域がビジネスチャンスを生み出す可能性を高めています。

- 同地域では、免許不要の周波数帯で5G NRを運用する標準化が進んでおり、プライベートネットワークの急速な拡大を可能にする可能性があります。これはスタンドアロンNR-Uと呼ばれ、LTEのMulteFireにおけるスタンドアロンNR-Uと類似しています。アンライセンス・スペクトラムでスタンドアロンで動作するNRは、5GへのMulteFire進化経路となり、米国では5Gネットワークの大規模な展開が目の当たりにされました。

- MulteFire市場は、IoTデバイス、インダストリー4.0ソリューション、スマート製造ソリューションの利用が増加し、データ転送のための信頼性が高く安全なネットワークに対する需要が高まっていることから恩恵を受けると予想されます。例えば、2023年2月、国際的なエンジニアリング・サービス会社であるL&T Technology Services Limitedは、人工知能(AI)、ロボット工学、3Dビジョン・システム、コネクテッド・マシンの最新の進歩を利用して、輸送、医療機器、高度な技術進歩などの重要な垂直分野向けのインダストリー4.0技術に焦点を当てた新しい製品群を発表しました。このような技術統合は、強化されたサービスを提供する上でMulteFire技術を大きく後押しし、それによってこの地域の市場シェアを拡大します。

- さらに、この地域では、企業が免許不要の周波数帯で提供されるLTEの機能を利用できるプライベートIoTネットワークの展開も見られます。さらに、同地域では、商品やコンテナの追跡、安全・環境情報の提供、輸送網の監視を目的とした産業用IoTアプリケーションの開発も進んでおり、次世代オペレーションの開発に向けたMulteFireの利用拡大が期待されています。

MulteFire産業の概要

MulteFire市場は、Qualcomm、Nokia、Huaweiなど少数の著名企業が大きな市場シェアを占めており、比較的統合されています。各社は市場シェアを高めるため、技術革新や提携に積極的に取り組んでいます。さらに、この市場のすべての企業がMulteFire Allianceに加盟しています。著名な市場参入企業には、Qualcomm Technologies, Inc.、Nokia Corporation、Huawei Technologies、Telefonaktiebolaget LM Ericsson、ソニー株式会社などがあります。

- 2023年2月-4G/5Gプライベート・ワイヤレス・ネットワークとマルチアクセス・エッジ・コンピューティング(MEC)技術を活用して工場を自動化するノキアとキンドリルの提携が、さらに3年間延長されました。両社は、政府が産業利用向けに免許制周波数帯を配布していることや、免許不要の無線ネットワーキング・ソリューション(米国のCBRSやMulteFireなど)のイントロダクションより、周波数帯の不足が急速に減少していると主張。

- 2023年1月- ドイツテレコムが、5Gネットワークを強化するためにスモールセルを追加導入すると発表。同通信事業者は、スモールセルが市場、小売モール、鉄道やバスの停留所のような人口密集地域におけるネットワーク品質を強化することを明らかにしました。ドイツテレコムは、2025年までに約3,000台の古くなった公衆電話を5Gスモールセルに変換すると述べた。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- 共有周波数帯域と免許不要周波数帯域の利用可能性

- 産業用モノのインターネット(IIoT)アプリケーション向けの、より優れたスケーラブルなネットワーク接続に対する需要の高まり

- スペクトラムライセンスを必要としない低コストでの導入

- 市場抑制要因

- チャネルへのアクセスにおいてWi-Fi技術に比べ不利

- 共有スペクトル利用に関する意思決定の遅れ

- 技術スナップショット

第6章 市場セグメンテーション

- 機器タイプ別

- スモールセル

- スイッチ

- コントローラー

- エンドユーザー業界別

- 商業施設

- サプライチェーンと流通

- 小売

- ホスピタリティ

- 公共施設

- ヘルスケア

- その他

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州

- アジア太平洋

- インド

- 中国

- 日本

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- アルゼンチン

- その他ラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- その他中東とアフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Qualcomm Technologies, Inc.

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Sony Corporation

- Intel Corporation

- Samsung Electronics Co Ltd

- InterDigital Inc.

- Baicells Technologies

- DEKRA India Private Limited

第8章 投資分析

第9章 市場機会と今後の動向

The MulteFire Market size is estimated at USD 2.10 billion in 2025, and is expected to reach USD 8.10 billion by 2030, at a CAGR of 31.04% during the forecast period (2025-2030).

The network's capacity has become limited as a result of the rising reliance on wireless connections to provide rich information to an ever-growing number of devices. Therefore, this encouraged the creation of MulteFire, which was intended to be a vital component of the solution to the growing mobile data traffic issue.

Key Highlights

- MulteFire will be a critical enabler allowing enterprises to deploy LTE private networks without the involvement of a mobile network operator in unlicensed regional and global spectrum bands around the world, which includes the 2.4 GHz and 5 GHz global bands and the 800/900 MHz and 1.9 MHz regional bands.

- MulteFire, with its standalone feature, will open up an unlicensed spectrum to a host of new players, including wireless ISPs, global enterprises, specialist verticals, and even network operators, where all can deploy MulteFire-based LTE private networks.

- MulteFire enables the deployment of enhanced broadband services in more places with the combination of the enhanced performance of LTE with the deployment simplicity of the unlicensed spectrum. Since MulteFire is based on LTE, it will operate in wider bandwidths that support up to 20 MHz to support high capacity and low latency, capable of peak data rates up to 400 Mbps.

- The use of unlicensed spectrum by businesses or cable providers to create their own LTE networks may be made possible by MulteFire. When paired with LTE features like increased security, major organizations that lack licensed spectrum and desire greater mobility than Wi-Fi generally offers are expected to embrace MulteFire in industrial sectors like shipping ports, mines, and airports, among others. Additionally, MulteFire is predicted to be a connection choice for IoT deployments.

- The rise in the need for more scalable and advanced network connectivity for industrial IoT (IIoT) applications is one of the key factors anticipated to propel multefire market expansion over the projected period. Additionally, the increased need for high-performance and simple-to-deploy wireless connection networks is expected to fuel the multefire market's expansion.

- However, the increased need for high-capacity, cost-effective networks is predicted to limit the multefire market's expansion. On the other side, the growth of the multefire market in the timeframe period is further anticipated to be hampered by the delay in decisions relating to the utilization of shared spectrum.

- The COVID-19 has had a significant impact on the Multefire market. The rapid closure of various manufacturing firms and businesses significantly impacted the market. During the mid-first phase, the COVID-19 outbreak has caused changes in internet usage and download speeds monitored on servers based on internet quality to be seen in various places, increasing traffic volume. The most significant increases in traffic volume were observed practically everywhere immediately following announcements of official policies, such as school closings and instructions to stay at home.

MulteFire Market Trends

Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications

- The use of unlicensed spectrum by businesses or cable providers to create their own LTE networks may be made possible by MulteFire. When paired with LTE features like increased security, major organizations that lack licensed spectrum and desire greater mobility than Wi-Fi generally offers are expected to embrace MulteFire in industrial sectors like shipping ports, mines, and airports, among others. Additionally, MulteFire is expected to be a connection choice for IoT deployments, thereby driving market growth.

- Moreover, the MulteFire Alliance considers private LTE networks for enterprise and industrial IoT to be critical use cases that will benefit from MulteFire technology. The alliance welcomed this collaboration with the Alliance of Industrial Internet (AII) to advance its goal of employing LTE and next-gen cellular technologies in unlicensed and shared spectrum. Such initiatives significantly drive growth in the market.

- Further, mobility and security are considered significant businesses that assess connectivity alternatives for their IoT deployments. Private LTE networks like MulteFire meet both requirements while solely employing unlicensed or shared spectrum. This is an ideal network option for sectors concerned about the size and extensiveness of their sensor-based IoT devices. MulteFire is essential in the IoT network architecture because it makes private LTE installations easier by providing spectrum sharing and coexistence.

- Furthermore, according to Ericsson's report, in 2022, the total IoT connections were reported to be valued at around 13.2 billion. These technologies enabled a significant increase in the number of connected devices in 2021, projected to reach about 500 million by the end of 2022. Increased network capabilities promote the development of Massive IoT technologies by enabling spectrum sharing between Massive IoT and 4G and 5G in FDD bands. Such rise in IoT connections would significantly comprise IIoT technologies, thereby driving the market growth.

North America to Hold a Largest Market Share

- North America would be among the most significant regions for deploying MulteFire technology-based networks. The MulteFire Alliance's initiatives to investigate possibilities for making LTE technologies available in the unlicensed band for a variety of applications in several verticals, such as industrial manufacturing, mining, healthcare, and commercial, are likely to be a driving force behind the growth of the MulteFire market.

- Numerous significant businesses that are MulteFire Alliance members are based in the region, including Qualcomm, Intel, Wave Wireless, SpiderCloud Wireless, TMobile, and Verizon. Such prominent player presence in the region significantly contributes to the considerable market share, thereby enhancing the potential of the region in creating opportunities during the forecast period.

- The region is witnessing standardization in the operation of 5G NR in an unlicensed spectrum, and this has the potential to enable private networks to expand rapidly. This is called standalone NR-U and is analogous to standalone NR-U in MulteFire for LTE. The NR operating standalone in the unlicensed spectrum will become the MulteFire evolution path to 5G, and the United States witnessed a massive rollout of the 5G network.

- The market for MulteFire is anticipated to benefit from the rising usage of IoT devices, industry 4.0 solutions, and smart manufacturing solutions, which have increased the demand for a dependable and secure network for data transfers. For instance, in February 2023, L&T Technology Services Limited, an international engineering services firm, introduced a new suite of offerings focused on Industry 4.0 technologies for crucial verticals like transportation, medical devices, and high technological advancements, using the most recent advances in Artificial Intelligence (AI), robotics, 3D-vision systems, and connected machines. Such tehnology integrations would significantly drive the MulteFire technology in offering enhanced services, thereby increasing the region's market share.

- Futhermore, the region is also witnessing the deployment of Private IoT networks where enterprises can take advantage of the capabilities of LTE delivered over the unlicensed spectrum. Moreover, emerging Industrial IoT applications in the region to track goods and containers, provide safety and environmental information, and monitor transportation networks is also expected to boost the usage of MulteFire to develop next-generation operations.

MulteFire Industry Overview

The MulteFire market is relatively consolidated with a few prominent companies, such as Qualcomm, Nokia, and Huawei, which account for a significant market share. The companies significantly engage in innovations and partnerships to enhance their market shares. Moreover, all the companies in this market are a part of The MulteFire Alliance. A few of the prominent market players include Qualcomm Technologies, Inc., Nokia Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Sony Corporation, etc.

- February 2023 - the partnership between Nokia and Kyndryl, which automates factories utilizing 4G/5G private wireless networks and multi-access edge computing (MEC) technology, has been extended for another three years. The companies claimed that the lack of spectrum availability is rapidly declining due to governments distributing licensed spectrum for industrial usage and the introduction of unlicensed wireless networking solutions (such as CBRS in the US and MulteFire).

- January 2023 - Deutsche Telekom stated that the firm would deploy additional small cells to strengthen its 5G network. The carrier clarified that small cells enhance network quality in densely populated regions like markets, retail malls, and railway or bus stops. By 2025, Deutsche Telekom stated it would convert about 3,000 outdated public payphones into 5G small cells.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Availability of Shared and Unlicensed Spectrum Bands

- 5.1.2 Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications

- 5.1.3 Low Cost of Deployment that doesn't Require Spectrum License

- 5.2 Market Restraints

- 5.2.1 Disadvantage Compared to Wi-Fi Technologies in Accessing the Channel

- 5.2.2 Delay in Decision-Making Regarding Use of Shared Spectrum

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 Equipment Type

- 6.1.1 Small Cells

- 6.1.2 Switches

- 6.1.3 Controllers

- 6.2 End User Vertical

- 6.2.1 Commercial & Institutional Buildings

- 6.2.2 Supply Chain and Distribution

- 6.2.3 Retail

- 6.2.4 Hospitality

- 6.2.5 Public Venues

- 6.2.6 Healthcare

- 6.2.7 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Technologies, Inc.

- 7.1.2 Nokia Corporation

- 7.1.3 Huawei Technologies Co., Ltd.

- 7.1.4 Telefonaktiebolaget LM Ericsson

- 7.1.5 Sony Corporation

- 7.1.6 Intel Corporation

- 7.1.7 Samsung Electronics Co Ltd

- 7.1.8 InterDigital Inc.

- 7.1.9 Baicells Technologies

- 7.1.10 DEKRA India Private Limited