|

市場調査レポート

商品コード

1403035

永久磁石モーター:市場シェア分析、産業動向・統計、成長予測、2024~2029年Permanent Magnet Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 永久磁石モーター:市場シェア分析、産業動向・統計、成長予測、2024~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

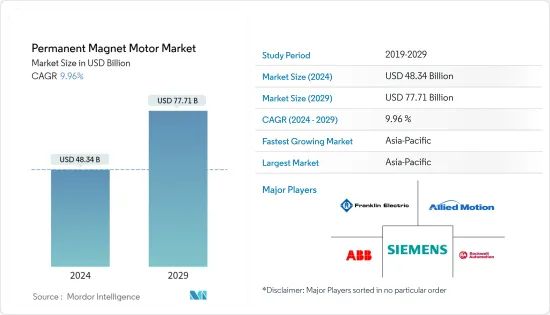

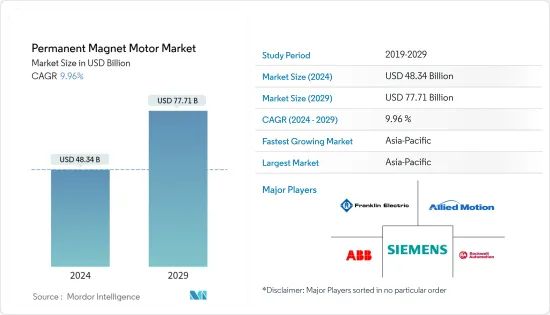

永久磁石モーター市場規模は2024年に483億4,000万米ドルと推定・予測され、2029年には777億1,000万米ドルに達し、予測期間中(2024-2029年)のCAGRは9.96%で成長すると予測されます。

市場成長の原動力は、電気自動車の需要拡大と産業分野での採用拡大です。モーター効率の向上が、エンドユーザー分野での永久磁石モーターの採用をさらに促進しています。

主なハイライト

- 永久磁石モーター(PMM)は、その高効率とスループットにより需要が大幅に増加しています。これらのモーターは、腕時計用のステッピングモーターや工作機械用の産業用ドライブから船舶推進用の大型PM同期モーターまで、幅広い用途をカバーしています。

- 電気自動車は、予測期間中に調査された市場の成長を押し上げると予想されます。2021年には世界的に電気自動車の新車登録台数が空前の市場シェアを記録し、新興国市場がこの動向を支えています。大手自動車メーカーが永久磁石モーターをEVに搭載する動きを強めていることから、世界の需要の高まりが予想され、予測期間中の市場の成長を後押しします。

- ネオジムの高い残留磁束密度とともに高エネルギー製品であることから、ネオジムは産業用途の材料として有力な選択肢となっています。ネオジムには高級品と低級品があり、従来のモーターに比べて優れた性能とトルクを実現できるため、採用が増加しています。しかし、高価格と希少性がこの材料の成長に課題をもたらしそうです。

- また、HVAC機器の需要増も市場調査に影響を与えると予想されます。これは主に、新規世帯数の増加、平均建設支出の増加、急速な都市化、いくつかの主要経済圏における可処分所得の増加によってもたらされています。家電製品や機器のエネルギー効率に関する最低基準の高まりも、HVAC機器におけるPMMの成長を後押ししています。

- 地政学的な懸念や鉱物資源の不足による原材料価格の上昇がモーター価格の上昇を招き、これが市場の成長を制限すると予想されます。また、希土類金属の入手可能性が限られていることも、モーターメーカーにさらなる難題をもたらし、生産コストを上昇させます。

- COVID-19の発生により、いくつかの産業は世界的にほとんどすべての産業活動の停止を余儀なくされました。原材料は昔も今も中国から仕入れているため、調達は米国の関税の影響を受けました。さらに、COVID-19の大流行が広がる中、(製造業など)産業界で重要な用途があり、産業界で大きな採用が見られるPMM市場も大きな影響を受けました。

永久磁石モーター市場動向

直流モーターが大きなシェアを占める

- 産業界が誘導モーターから移行し始めて以来、永久磁石直流モーターは産業界で人気があります。直流モーターには、操作のしやすさ、コンパクトなサイズ、さらなる制御を必要としない性能など、いくつかの利点があります。

- PMDCモーターは高効率で、小さなフォームファクターでかなりのパワーとトルクを提供することができます。さらに、様々なアプリケーションで広く使用されているため、バッテリーと簡単に連動させることができます。小型でバッテリーと連動できることから、ドローン、回生ブレーキ、電動工具など、多くの新しい産業や用途で有用です。

- PMDCモーターは、ACやヒーターに使用される窓や送風機を含む自動車部品、パソコンのディスクやドライブ、玩具や小型ロボットのような小型の電力定格機器など、さまざまな用途に使用されています。

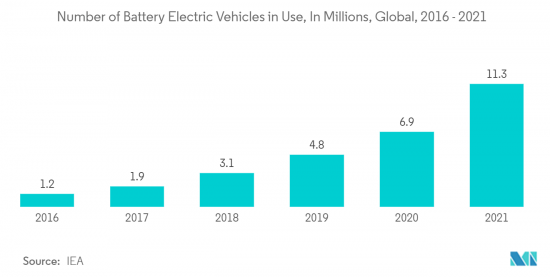

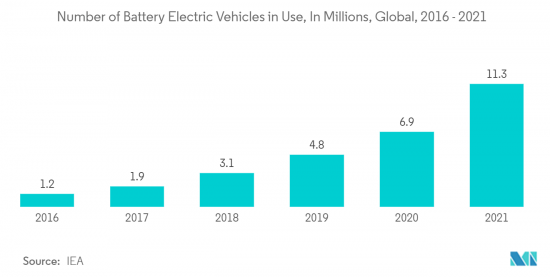

- 近年、世界は電気自動車の出現を目の当たりにしています。電気自動車は、しばしば自動車市場の将来と考えられています。電気自動車へのPMDCモーターの採用が増加し、テスラ・モーターズのような大手企業による投資の増加が市場を押し上げると予想されています。IEAによると、世界で販売されるバッテリー電気自動車の台数は、2021年の約46億台から2022年には約730万台に増加します。

- さらに、持続可能な未来に向けて各国が電気自動車の迅速な導入を模索しているため、市場は多くの開拓を目の当たりにしています。例えば、2022年7月、IITカラグプールは、電子情報技術省(MeitY)の電気自動車サブシステムの国産化プログラムの一環として、電子リキシャ用の国産で効率的かつ安価なスマートコントローラーを開発しました。このスマートコントローラーは、直流電圧供給によるブラシレスDCモーター(BLDC)を使用しています。

北米が大きな市場シェアを占める

- 北米地域は、エネルギー効率の高い持続可能な環境の構築に向けた政府の取り組みと相まって、市場関係者やその他の組織による投資が増加しているため、世界的に大きなシェアを占めると予想されます。強力な風力エネルギー部門は、この地域で成長し、予測期間中に永久磁石市場の成長を後押しするように設定されています。

- エネルギー効率の高いソリューションへの注目が高まる中、この地域の産業界はさまざまな工場運営部門にPMMを導入しており、PMM市場を拡大しています。カナダは、CIPEC(カナダ省エネルギー産業プログラム)のようなプログラムでエネルギー消費に重点を置いています。

- 採掘とリサイクルのためのレアアースクリーンテック開発者であるGeomega Resources Inc.は、Round Top-Heavy Rare Earth and Critical Minerals Project West Texasの資金調達・開発パートナーであるUSAレアアースと協力して、レアアースを含む生産廃棄物のリサイクルにも取り組んでいます。この廃棄物は、USAレアアースが米国で焼結ネオジム鉄ボロン永久磁石(焼結ネオ磁石)を生産する際に出るものです。このような取り組みにより、同地域、特に同地域の主要産業であるこの分野でのPMMの採用が促進されることが期待されます。

- さらに、ピッツバーグ大学の研究者は、オハイオ州の先端材料研究開発企業であるPowdermet Inc.と提携し、レアアース鉱物フリーの電気モーターを開発しました。このプロジェクトは、レアアース金属の代わりに、より豊富な金属で作られた永久磁石を使用する電気機械を作るものです。

永久磁石モーター産業の概要

永久磁石モーター市場は競争が激しいです。市場の既存企業は、技術革新と研究開発への投資によって優位に立ち、より大きな市場シェアを獲得することができます。競争企業間の敵対関係は、市場浸透率の上昇と市場プレイヤーの強力な競争戦略の展開により、さらに激化すると予想されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響

- 技術スナップショット

第5章 市場力学

- 市場促進要因

- 永久磁石によるモーター効率の向上

- 電気自動車需要の増加

- 産業分野における永久磁石モーター(PMM)の需要増加

- 市場の課題

- レアアース金属の入手可能性の減少

第6章 市場セグメンテーション

- モータータイプ

- 直流(DC)モーター

- 交流(AC)モーター

- 磁性材料タイプ

- フェライト

- ネオジム

- サマリウムコバルト

- その他の磁性材料タイプ

- エンドユーザー業種

- 自動車

- 一般産業

- エネルギー

- 上下水道管理

- 鉱業・石油・ガス

- 航空宇宙・防衛

- その他のエンドユーザー業種

- 地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Siemens AG

- Rockwell Automation

- ABB Limited

- Franklin Electric Company Inc.

- Allied Motion Technologies Inc.

- Toshiba Corporation

- Ametek Inc.

- Johnson Electric Holdings Ltd

- GIC Manufacturing, LLC(Autotrol Corporation)

- Robert Bosch GmbH

- Danaher Corporation

- Bonfiglioli Group

- Aerotech Corporation

- Crouzet Automatismes

- Buhler Motors GmbH

- Nidec Corporation

第8章 投資分析

第9章 市場の将来

The Permanent Magnet Motor Market size is estimated at USD 48.34 billion in 2024, and is expected to reach USD 77.71 billion by 2029, growing at a CAGR of 9.96% during the forecast period (2024-2029).

The market growth is driven by growing demand for electric vehicles and increased adoption in the industrial sector. Advancement in motor efficiency further fuels the adoption of permanent magnetic motors in end-user verticals.

Key Highlights

- Permanent magnet motors (PMM) are witnessing a significant increase in demand due to their high efficiency and throughput. These motors cover a wide range of applications, from stepping motors for wristwatches and industrial drives for machine tools to large PM synchronous motors for ship propulsion.

- Electric vehicles are expected to boost the growth of the market studied over the forecast period. The number of new electric cars registered globally hit an unprecedented market share in 2021, with the developed markets supporting this trend. With leading automakers increasingly incorporating permanent magnet motors into EVs, global demand is expected to rise, driving the market's growth over the forecast period.

- The high energy product, along with the high residual flux density of neodymium, make it a compulsive choice of material for industrial applications. Neodymium offers both high- and low-grade variants, enabling it to deliver superior performance and torque as compared to a conventional motor, thereby increasing its adoption. However, high prices and scarcity are likely to pose challenges to the growth of this material.

- The increasing demand for HVAC equipment is also expected to influence the market studied. It is majorly driven by the increase in the number of new households, rising average construction spending, rapid urbanization, and growth in disposable income across several major economies. The increasing standards on minimum energy efficiency for appliances and equipment are also driving the growth of PMMs in HVAC equipment.

- The increasing price of raw materials due to geopolitical concerns and scarcity of minerals sources results in increasing price of motors, which is expected to restrict market growth. Also, the limited availability of rare-earth metals further create challanges for the motor manufacturers and increase the production cost.

- The COVID-19 outbreak forced several industries to halt almost every industrial operation globally. Since the raw materials were and still are bought in from China, the sourcing was affected by the United States' tariffs. Further, amidst the pandemic spread of COVID-19, the market for PMMs, which has a significant application in industries (such as the manufacturing sector) and sees substantial adoption on the industrial front, was highly impacted.

Permanent Magnet Motor Market Trends

Direct Current Motor Holds Significant Share

- Permanent DC motors have been popular in the industry since the industry started shifting from induction motors. DC motors offer a few advantages, such as ease of operation, compact size, and the ability to perform without further control.

- PMDC motors are highly efficient and can provide considerable power and torque in a tiny form factor. Additionally, they can be easily interfaced with batteries because they have been widely used in various applications. Their small size and ability to work with batteries make them useful in many new industries and applications, such as drones, regenerative braking, power tools, etc.

- PMDC motors have various applications in automobile components, which include windows and blowers used in AC and heaters, in personal computer disks and drives, as well as small power ratings equipment like toys and small robots.

- In recent years, the world has witnessed the advent of electric vehicles. Electric cars are often considered the future of the automotive market. Increasing adoption of PMDC motors in electric cars and increasing investments by leading players, like Tesla Motors, are expected to boost the market. The number of battery electric vehicles sold worldwide was approximately 7.3 million units in 2022, increase from around 4.6 billion in 2021, as per the IEA.

- Moreover, the market is witnessing a lot of developments as countries look for faster deployment of electric vehicles with an aim to move towards a sustainable future. For instance, in July 2022, IIT Kharagpur developed an indigenous, efficient, and affordable smart controller for e-rickshaws as a part of the Ministry of Electronics and Information Technology's (MeitY) program for indigenous development of electric vehicle subsystems. The smart controller uses a brushless DC motor (BLDC) powered by a direct current voltage supply.

North America Holds Significant Market Share

- The North American region is expected to hold a significant share globally due to the increasing investments by market players and other organizations, coupled with government initiatives toward building an energy-efficient and sustainable environment. The strong wind energy sector is set to grow in the region and boost the growth of the permanent magnet market during the forecast period.

- With the focus on energy-efficient solutions rising, industries across the region are deploying PMM across various factory operation segments, thereby augmenting the market for PMM. Canada is focusing heavily on energy consumption with programs like CIPEC (Canada Industry Program for Energy Conservation).

- Geomega Resources Inc., a rare earth cleantech developer for mining and recycling, also worked with USA Rare Earth, a funding and development partner of the Round Top-Heavy Rare Earth and Critical Minerals Project West Texas, to recycle rare earth-containing production waste. This waste comes from USA Rare Earths production of sintered neodymium iron boron permanent magnets (sintered neo magnets) in the United States. Such initiatives are expected to boost the adoption of PMMs in the region, especially in this sector, which is a major industry in the region.

- Furthermore, researchers at the University of Pittsburgh partnered with Powdermet Inc., an advanced materials research and development company in Ohio, to develop a rare-earth mineral-free electric motor. The project will create an electric machine that uses permanent magnets made of more abundant metals instead of rare-earth metals.

Permanent Magnet Motor Industry Overview

The Permanent Magnet Motor Market is highly competitive. Market incumbents can gain an advantage and garner a larger market share with innovations and investments in R&D. The intensity of competitive rivalry is expected to increase further, owing to increasing market penetration and the deployment of powerful competitive strategies by market players.

- July 2023 - Delta Line announced a new range of brushed permanent magnet DC motors in three sizes 52DI, 42DI, and 63DI. These new motors feature nominal torque up to 0.22Nm in 52mm, 0.06Nm in 42mm, and 0.27Nm in 63mm.

- July 2022, Collins Aerospace announced the development of the first working prototype of its 500-kilowatt electric motor for Airlander 10 aircraft in partnership with Hybrid Air Vehicles and the University of Nottingham. Collins wants the 2,000 rpm permanent magnet electric motor to have a power density of 9 kW/kg and an efficiency of 98%. He does this by using a new motor topology and a composite construction.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Motor Efficiency due to Permanent Magnets

- 5.1.2 Rising Demand for Electric Vehicles

- 5.1.3 Rising Demand for Permanent Magnet Motor (PMM) in the Industrial Sector

- 5.2 Market Challenges

- 5.2.1 Diminishing Availability of Rare-earth Metals

6 MARKET SEGMENTATION

- 6.1 Motor Type

- 6.1.1 Direct Current (DC) Motor

- 6.1.2 Alternating Current (AC) Motor

- 6.2 Magnetic Material Type

- 6.2.1 Ferrite

- 6.2.2 Neodymium

- 6.2.3 Samarium Cobalt

- 6.2.4 Other Magnetic Material Types

- 6.3 End-user Vertical

- 6.3.1 Automotive

- 6.3.2 General Industrial

- 6.3.3 Energy

- 6.3.4 Water and Wastewater Management

- 6.3.5 Mining, Oil, and Gas

- 6.3.6 Aerospace and Defense

- 6.3.7 Other End-user Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Rockwell Automation

- 7.1.3 ABB Limited

- 7.1.4 Franklin Electric Company Inc.

- 7.1.5 Allied Motion Technologies Inc.

- 7.1.6 Toshiba Corporation

- 7.1.7 Ametek Inc.

- 7.1.8 Johnson Electric Holdings Ltd

- 7.1.9 GIC Manufacturing, LLC (Autotrol Corporation)

- 7.1.10 Robert Bosch GmbH

- 7.1.11 Danaher Corporation

- 7.1.12 Bonfiglioli Group

- 7.1.13 Aerotech Corporation

- 7.1.14 Crouzet Automatismes

- 7.1.15 Buhler Motors GmbH

- 7.1.16 Nidec Corporation