|

市場調査レポート

商品コード

1687845

DIYホームインプルーブメント:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)DIY Home Improvement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| DIYホームインプルーブメント:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

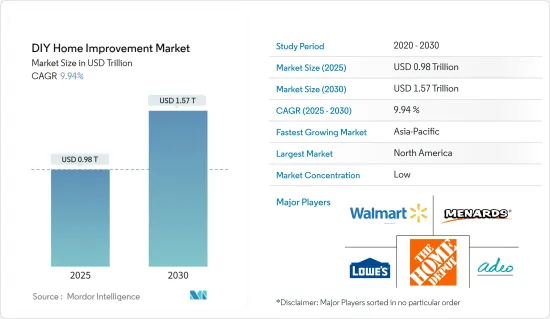

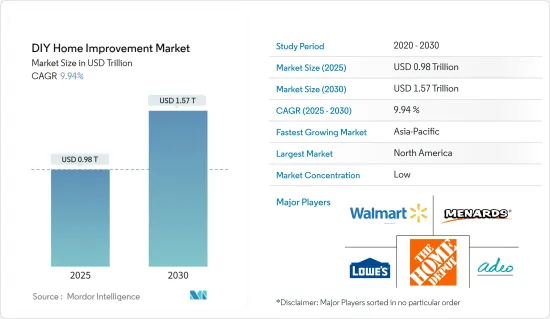

DIYホームインプルーブメント市場規模は2025年に9,800億米ドルと推定され、予測期間中(2025-2030年)のCAGRは9.94%で、2030年には1兆5,700億米ドルに達すると予測されます。

DIY(日曜大工)住宅設備市場は近年大きく成長しています。予測期間中も大幅な拡大が見込まれています。DIYホームセンター業界は、DIYアイテムに対する顧客の嗜好の高まりと、最先端技術の採用が顕著に増加していることから、今後数年間で急成長すると予測されます。新興国における女性の就業者数の増加とインテリアデザインの意思決定への関与が、こうしたプロジェクトに必要な資材の販売を促進しています。その結果、DIYによる住宅改修製品の採用が増加しています。DIY製品の使用は、高価な労働力に仕事を委託するのに比べ、長期的なコストを下げます。したがって、DIY住宅改修製品に対する需要は、調査された市場を牽引する重要な要因です。

DIYホームインプルーブメント市場の動向

DIYショップは業界にとって望ましい流通経路

DIYのリソースのほとんどはオンラインであるため、店舗での陳列はDIY消費者がDIY管理を学ぶ方法に大きく影響します。こうした戦略は、大型小売店の売上を伸ばしてきたが、小規模で地元密着型のホームセンターにも同様に有効です。たいていの場合、顧客サービスや店舗と消費者の関係については、小規模企業の方が大型店よりも優れています。DIYユーザーの約82%は、最終的な購入がオンラインであっても、店舗で商品を検討する可能性が高いです。ミレニアル世代のDIY愛好家は、特に塗料のような製品については、店頭で製品を探し、高品質の製品を購入する傾向が強いです。

北米におけるDIY市場の成長

予測期間を通じて、北米は都市化の進展と消費者の可処分所得の増加により、世界市場で最大の収益シェアを占めると予想されます。同地域の市場成長を促進すると予測されるその他の要因には、家庭装飾の取り組みへの参加増加や、家庭の視覚的魅力を高めることへの関心の高まりなどがあります。米国では、組み立て式(RTA)家具の人気と採用が高まっており、市場を牽引しています。米国では革新的なデザインのRTA家具の人気が高まっています。カスタマイズの人気も高まっています。そのため、大手ベンダーはオーダーメイドのインテリアのためにカスタムデザインのRTA家具を製造しており、これがDIY消費者の獲得につながり、収益を伸ばしています。また、ホームインプルーブメント企業が新たなホームインプルーブメント技術を生み出すために投資を拡大していることも、市場収益の伸びを促進する要因となっています。

DIYホームインプルーブメント業界の概要

DIYホームインプルーブメント市場は断片化されており、多くのプレーヤーが存在します。本レポートでは、DIYホームセンター業界に関与する主要外資系企業を取り上げました。現在、少数の重要な競合企業が市場シェアで業界を支配しています。しかし、需要を牽引するのは消費者の所得です。大企業は、大量仕入れ、幅広い品揃え、効率的なマーケティングとマーチャンダイジングの手法で競争します。中小企業は、特定の市場のニッチに集中し、幅広い品揃えと一流の顧客サポートを提供することで競争します。ホーム・デポ、ウォルマート、メナード、ロウズ、ADEOは、この市場の大手企業の一部です。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学と洞察

- 市場概要

- 市場促進要因

- カスタマイズとパーソナライゼーションの増加

- 住宅改修・リフォーム動向の高まり

- 市場抑制要因

- 専門知識の不足が市場を抑制

- 材料のコストが大きな制約となる可能性

- 市場機会

- DIY小売店の増加により、個人がDIY作品を展示・販売する機会が提供される

- バリューチェーン/サプライチェーン分析

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- 業界の技術的進歩に関する洞察

- COVID-19の市場への影響

第5章 市場セグメンテーション

- 製品タイプ別

- 製材と造園管理

- 装飾品と屋内庭園

- キッチン

- 塗装・壁紙

- 工具・金物

- 建築資材

- 照明器具

- 配管・設備

- 床材、修理、交換

- 電気工事

- 流通チャネル

- DIYホームセンター

- 専門店

- オンライン

- 家具およびその他の実店舗

- 地域

- 北米

- 米国

- カナダ

- その他北米

- 欧州

- 英国

- ドイツ

- その他欧州

- アジア太平洋

- インド

- 日本

- その他アジア太平洋地域

- 南米

- ブラジル

- ペルー

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他中東とアフリカ

- 北米

第6章 競合情勢

- 市場集中の概要

- 企業プロファイル

- Groupe ADEO

- Home Depot

- Lowe's Companies Inc.

- Menard

- Walmart

- Ace Hardware

- Travis Perkins

- Kingfisher PLC

- Hornbach Holding

- Bauhaus

- Obi(Tengelmann)

- Hagebau

- Maxeda

- Crate and Barrel*

第7章 市場動向

第8章 免責事項

The DIY Home Improvement Market size is estimated at USD 0.98 trillion in 2025, and is expected to reach USD 1.57 trillion by 2030, at a CAGR of 9.94% during the forecast period (2025-2030).

The do-it-yourself (DIY) home improvement market has grown significantly in recent years. It is expected to expand significantly throughout the forecast period. The DIY home improvement industry is anticipated to grow rapidly in the next few years due to the growing customer preference for DIY items and the notable uptick in the adoption of cutting-edge technologies. The increasing number of employed women in emerging nations and their involvement in interior design decision-making drive the sales of the materials needed for these projects. Subsequently, there is an increasing adoption of DIY home improvement products. The use of DIY products lowers long-term costs compared to work outsourced to expensive labor. Therefore, the demand for DIY home improvement products is a significant factor driving the market studied.

DIY Home Improvement Market Trends

DIY Shops are Preferable Distribution Channels for the Industry

As most DIY resources are online, in-store displays significantly influence how DIY consumers learn to manage DIYs. These strategies have increased sales for big-box retailers and are just as useful for small and local home improvement businesses. Most often, small companies excel over big box stores regarding customer service and store-consumer relationships. About 82% of DIYers are likely to explore products in the store, even if the final purchase is made online. Millennial DIYers are more likely to seek the product and purchase quality products in-store, especially for products like paint.

Rise in DIY Market in North America

Throughout the forecast period, North America is expected to hold the largest revenue share of the global market, owing to growing urbanization and rising consumer disposable income. Other factors projected to fuel market revenue growth in the region include rising participation in home decor initiatives and an increased interest in enhancing the visual appeal of homes. The increased popularity and adoption of ready-to-assemble (RTA) furniture in the United States are driving the market. The popularity of innovatively designed RTA furniture is growing in the United States. Customization is becoming more popular. Thus, leading vendors are producing custom-designed RTA furniture for bespoke interiors, which has helped them attract more DIY consumers, increasing revenue. Growing investments by home improvement enterprises in creating new home improvement techniques is another factor projected to fuel market revenue growth.

DIY Home Improvement Industry Overview

The DIY home improvement market is fragmented, with many players. Major foreign companies involved in the do-it-yourself home improvement industry have been included in the report. Currently, a few significant competitors control the industry in terms of market share. But consumer income is what drives demand. Big businesses compete by buying in bulk, offering a wide range of goods, and using efficient marketing and merchandising techniques. Small businesses concentrate on a certain market niche and compete by offering a wide range of goods and first-rate customer support. Home Depot, Walmart Inc., Menard Inc., Lowe's, and ADEO are a few of the major companies in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Customization and Personalization

- 4.2.2 Increasing Home Improvement and Renovation Trends

- 4.3 Market Restraints

- 4.3.1 Lack of Expertise Restraining the Market

- 4.3.2 The Cost of the Materials can be a Significant Restraint

- 4.4 Market Opportunities

- 4.4.1 Growing Number of DIY Retail Stores Provides an Opportunity for Individuals to Showcase and Sell their DIY Creations

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Lumber and Landscape Management

- 5.1.2 Decor and Indoor Garden

- 5.1.3 Kitchen

- 5.1.4 Painting and Wallpaper

- 5.1.5 Tools and Hardware

- 5.1.6 Building Materials

- 5.1.7 Lighting

- 5.1.8 Plumbing and Equipment

- 5.1.9 Flooring, Repair, and Replacement

- 5.1.10 Electrical Work

- 5.2 Distribution Channel

- 5.2.1 DIY Home Improvement Stores

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.2.4 Furniture and Other Physical Stores

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 Japan

- 5.3.3.3 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Peru

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Groupe ADEO

- 6.2.2 Home Depot

- 6.2.3 Lowe's Companies Inc.

- 6.2.4 Menard

- 6.2.5 Walmart

- 6.2.6 Ace Hardware

- 6.2.7 Travis Perkins

- 6.2.8 Kingfisher PLC

- 6.2.9 Hornbach Holding

- 6.2.10 Bauhaus

- 6.2.11 Obi (Tengelmann)

- 6.2.12 Hagebau

- 6.2.13 Maxeda

- 6.2.14 Crate and Barrel*