|

市場調査レポート

商品コード

1273333

フライアッシュ市場 - 成長、動向、予測(2023年-2028年)Fly Ash Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

価格

| フライアッシュ市場 - 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年04月14日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

ご注意事項 :

本レポートは最新情報反映のため適宜更新し、内容構成変更を行う場合があります。ご検討の際はお問い合わせください。

- 全表示

- 概要

- 目次

概要

フライアッシュ市場は、予測期間中に4%以上のCAGRで推移すると予測されています。

主なハイライト

- 2020年にCOVID-19が発生し、ほぼすべての主要なエンドユーザー産業が生産を一時的に停止したため、市場はフライアッシュの需要減少にマイナスの影響を受けました。しかし、2021年には建設業界が全地域で安定した成長を遂げたため、フライアッシュの需要が増加し、市場の成長に貢献しました。

- 建設業界からの需要の増加や、フライアッシュの使用を促進する政府政策の増加が、市場を牽引しています。反面、フライアッシュの有害な特性や寒冷地での非適応性が市場成長の妨げとなっています。

- フライアッシュ市場は、建設業界の急成長により成長しています。フライアッシュは石灰や水と混ぜると、ポルトランドセメントのような化合物を形成します。廃棄物処理とプレキャストコンクリート製品の需要増は、メーカーにとって好機であり、市場の成長を後押ししています。

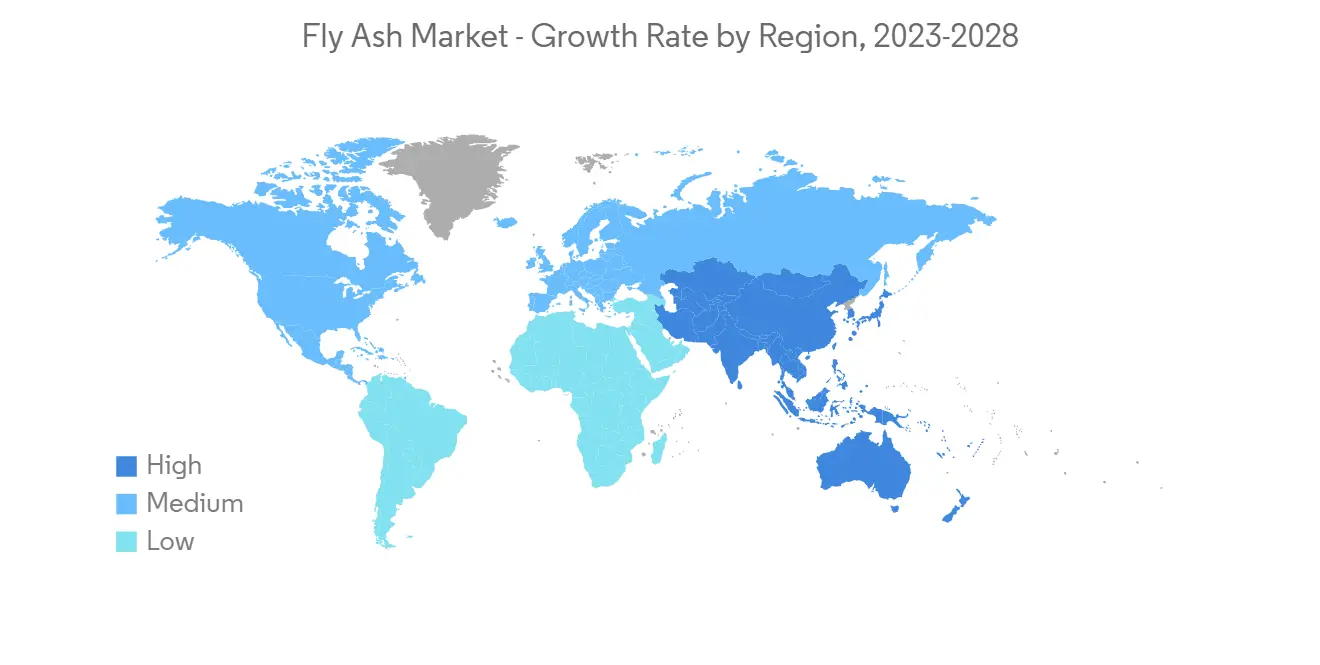

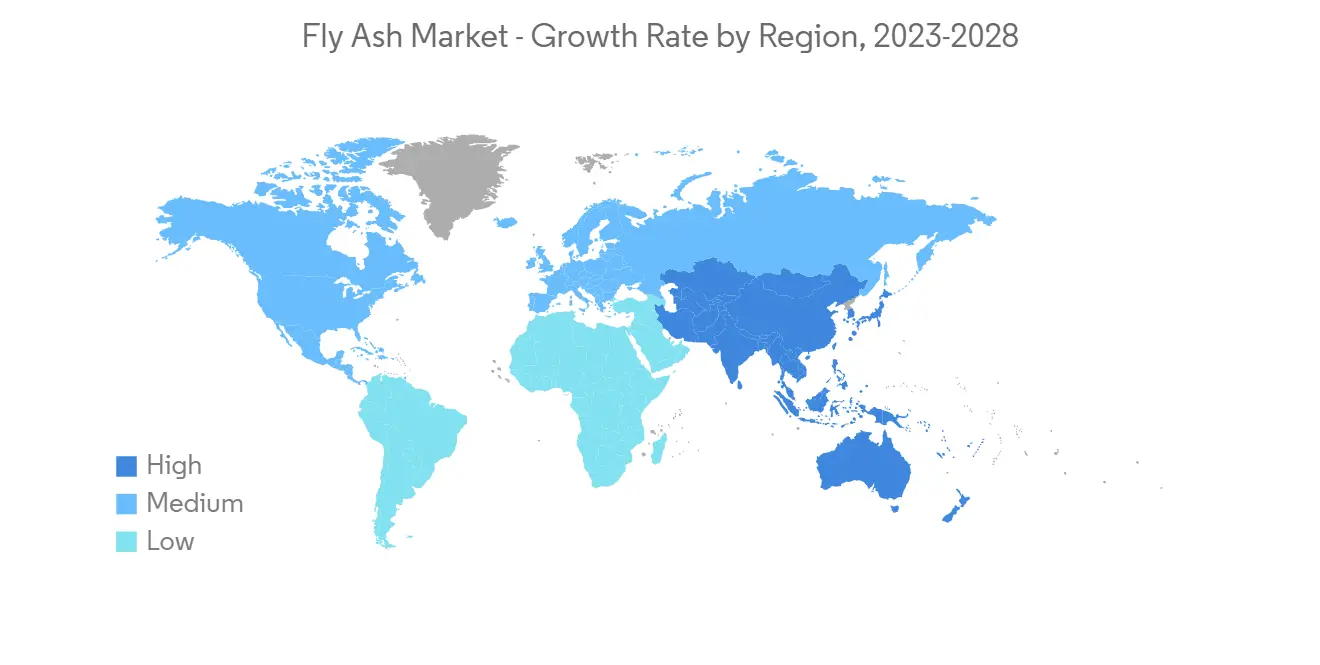

- アジア太平洋地域が市場を独占すると予想され、最大の消費量はインドや中国などの国々で記録されています。

フライアッシュの市場動向

建設業界からの需要の増加

- 人口の増加、工業化の進展、生活水準の向上が、建設業界におけるフライアッシュの需要を押し上げています。フライアッシュは、堤防やローラーコンパクトコンクリートダムの建設に使用されています。フライアッシュは、不透水性と強度を高めるため、流動性充填材や構造用充填材の充填材として使用されています。また、アスファルト道路敷設の際、空隙を埋める充填材としても使用されています。

- 世界的に建設業は増加しており、フライアッシュの需要を生み出しています。フライアッシュは二酸化炭素の排出が少なく、環境に優しいため、各国の政府がフライアッシュの使用を推進しているため、アジア太平洋地域が世界で最も速いCAGRで成長し、北米がそれに続いています。欧州は、世界第3位のフライアッシュ市場です。

- 高速道路やハイウェイのメガプロジェクトの勃興により、フライアッシュの需要が増加しています。各国の政府は建設業界に資金を提供しています。例えば、2022年2月、フランス政府は中国と提携し、世界的に7つの主要インフラプロジェクトを建設しました。両国は「第4ラウンド中国・フランス第三者市場協力パイロットプロジェクトリスト」に署名しました。この合意の下、両国は様々なインフラプロジェクトに投資することで合意しています。

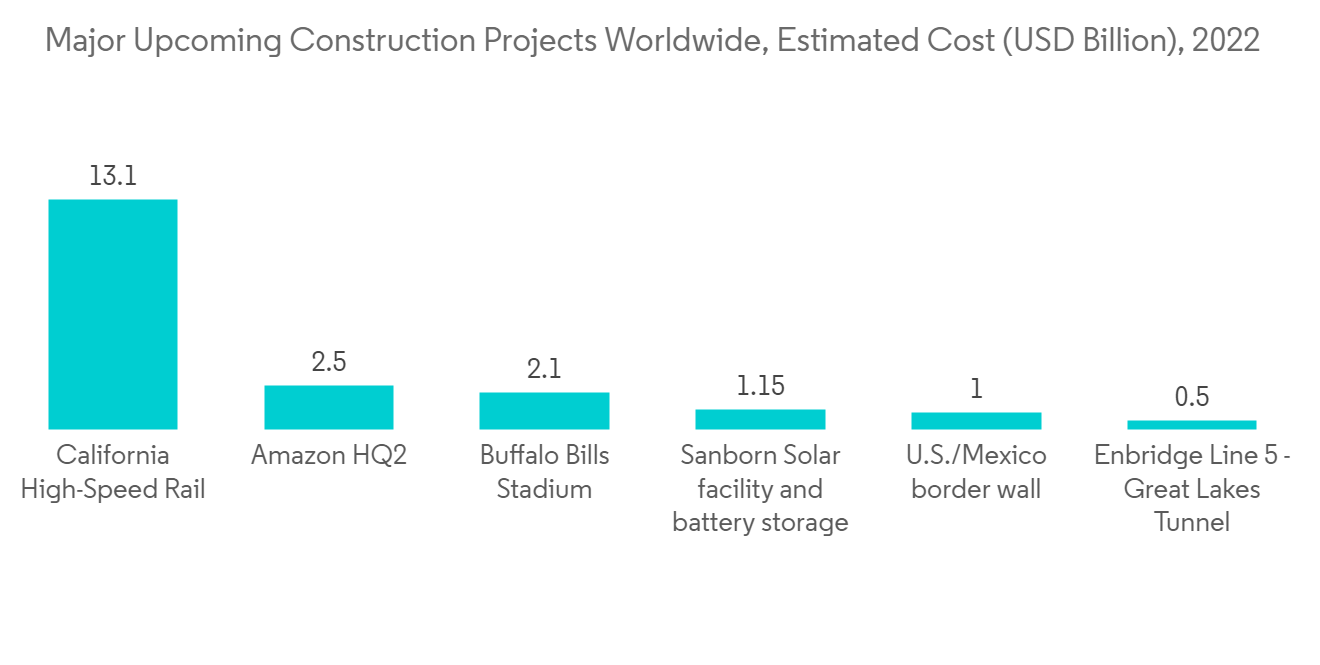

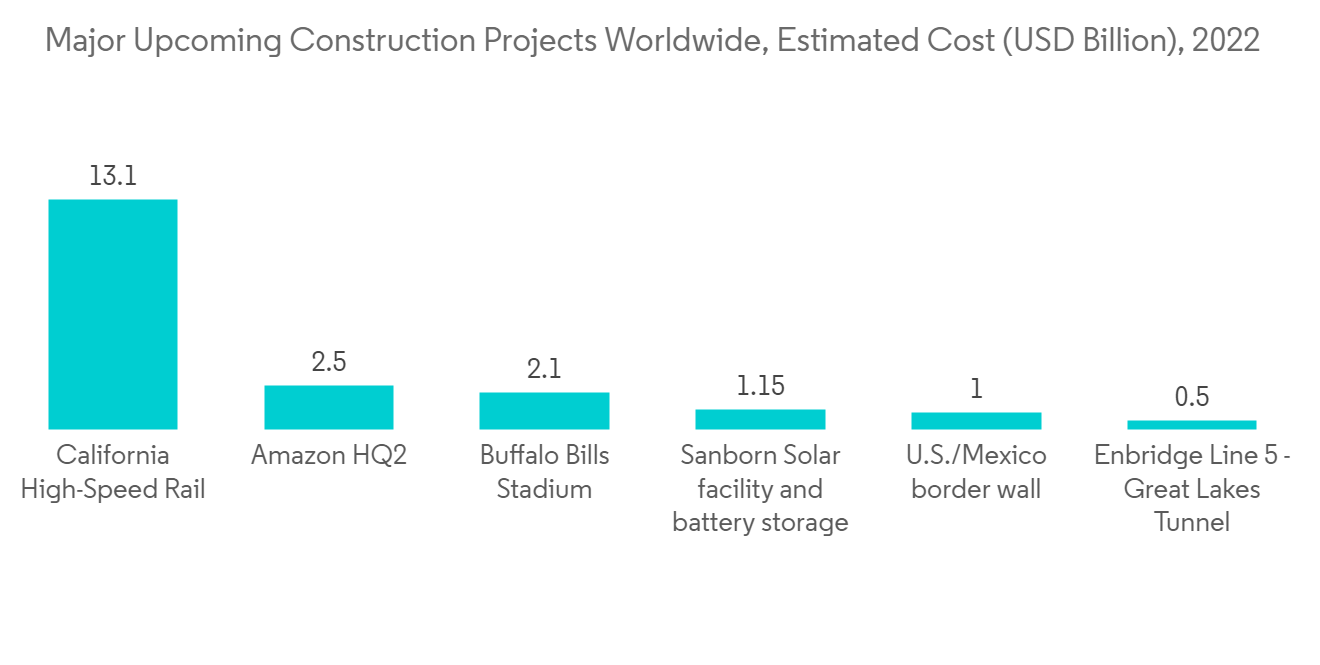

- 米国建築家協会(AIA)によると、2022年の建物に対する建設支出は9%以上増加しました。2023年にはさらに6%増加すると推定されています。Statistaの推計によると、建設業界の規模は2022年に8兆2,000億米ドルに達し、2029年には17兆米ドルに達すると予想されています。

- さらに、中国は建設分野で大規模な成長を遂げています。国家統計局(NBS)によると、2021年、中国の建設生産高は約4兆5,000億米ドルと評価されました。米国では、建設業界は良好な経済状況、雇用機会の増加、建設業界を後押しする政府のコミットメントに支えられています。米国では、コンクリートの50%以上がフライアッシュを使用して製造されています。

- このような要因から、建設業界におけるフライアッシュの需要は、予測期間中に急成長すると予測されています。

アジア太平洋地域が市場を独占する

- アジア太平洋地域は、中国、インド、日本などの国々からの需要の増加により、予測期間中、最大かつ最も急成長する地域と予測されています。

- フライアッシュの需要は、様々な政府がフライアッシュの消費について生態学的な理由を強調しているため、増加しています。フライアッシュの使用により、フライアッシュを使用していない混合物と比較して、同様の混合物の水セメント比を低くすることができます。マレーシア、インドネシア、中国、インドなどの政府は、フライアッシュを使ったインフラ整備への投資を増やしています。フライアッシュは浸透性が低く、二酸化炭素の排出量も少ないため、排出量削減に貢献しています。

- 中国は、2025年までの今後5年間で、主要な建設プロジェクトに1兆4,300億米ドルを投資しています。国家発展改革委員会(NDRC)によると、上海の計画には今後3年間で387億米ドルの投資が含まれており、広州は80億9,000万米ドルを投資する16の新しいインフラプロジェクトに調印しました。

- 2022年、インドは、Housing to Allやスマートシティ計画など、インフラ整備や手頃な価格の住宅に関する政府の取り組みにより、建設業界に約6,400億米ドルを貢献しました。同国における建設活動の活発化はシリコンの需要を促進し、ひいてはクロロメタン市場を予測期間中に牽引する可能性があります。

- 農業分野では、土壌安定化のためにフライアッシュが使用されており、フライアッシュ市場の約14%を占めています。鉱業は、代替の積み込み材料を探しており、フライアッシュは水の消費量を約50%削減するため、その代替品として実証されています。アジア太平洋は世界の鉱業プロジェクトの約38%を占めており、このためフライアッシュの需要が高まっています。

- また、フライアッシュは水処理にも使用され、総溶解固形物(TDS)、総浮遊物質(TSS)、水のph値を下げて水を浄化するため、同地域のフライアッシュの需要を促進しています。

- 同地域の主要企業には、Boral LimitedやAshtech(India)Pvt Ltd.などがあります。

- 前述の要因や政府の支援が、フライアッシュ市場の需要増加に寄与しています。

フライアッシュの産業概要

フライアッシュ市場は断片化されており、大手企業が市場のわずかなシェアを占めています。市場に参入している企業には、Boral、Cemex SAB de CV、Charah Solutions Inc.、Separation Technologies LLC、Cement Australiaなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 本調査の対象範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 建設業界からの需要の増加

- フライアッシュの利用を促進する政府の政策

- 抑制要因

- フライアッシュの有害な特性

- 寒冷地での非適応性

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の度合い

第5章 市場セグメンテーション(金額ベース市場規模)

- タイプ

- クラスF

- クラスC

- 用途

- 建設

- レンガ・ブロック

- 道路工事

- ポルトランドセメント、コンクリート

- 農業

- 鉱業

- 水処理

- その他の用途

- 建設

- 地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米地域

- 中東・アフリカ地域

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- M&A、ジョイントベンチャー、コラボレーション、契約書

- 市場シェア分析**/ランキング分析

- 主要企業が採用した戦略

- 企業プロファイル

- Ashtech Industries

- Boral Resources

- Charah Solutions,Inc

- Cemex SAB de CV

- Cement Australia

- LafargeHolcim

- Salt River Materials Group

- Seperation Technologies LLC

- Suyog Suppliers

- Waste Management

第7章 市場機会および今後の動向

- 廃棄物処理とプレキャストコンクリート製品による需要の高まり

目次

Product Code: 68701

The fly ash market is estimated to register a CAGR of over 4% during the forecast period.

Key Highlights

- The market was negatively impacted by COVID-19 in 2020, as almost all the major end-user industries halted their production temporarily, leading to a decrease in demand for fly ash. However, the construction industry experienced steady growth in 2021 across all regions, which increased the demand for fly ash and helped the market to grow.

- Increasing demand from the construction industry and increasing government policies to promote the usage of fly ash are driving the market. On the flip side, the harmful properties of fly ash and its non-suitability in cold weather conditions are hindering market growth.

- The fly ash market has been growing due to the construction industry's rapid growth. When mixed with lime and water, fly ash forms a compound like Portland cement. Rising demand from waste management and precast concrete products is an opportunity for the manufacturers and helps the market's growth.

- The Asia-Pacific region is expected to dominate the market, with the largest consumption being registered in countries like India and China.

Fly Ash Market Trends

Increasing Demand from the Construction Industry

- Growing population, increasing industrialization, and living standards have driven the demand for fly ash in the construction industry. Fly ash is used for the construction of embankments and roller-compacted concrete dams. Fly ash is used as a filler in flowable and structural fills as it gives impermeability and more strength. It is also used as a filler material in asphalt road laying to fill voids.

- Globally the construction industry is increasing, generating demand for fly ash. Asia-Pacific region is growing at the fastest CAGR across the globe, followed by North America due to the promotion of fly ash by governments of various countries as it releases less carbon dioxide and is eco-friendly. Europe has the world's third-largest fly ash market.

- The emerging mega projects of expressways and highways have increased the demand for fly ash. Governments of various countries are funding the construction industry. For instance, in February 2022, France government partnered with China to build seven key infrastructure projects globally. Both countries signed the Fourth Round China-France Third-Party Market Cooperation Pilot Project List. Under the agreement, the two countries have agreed to invest in various infrastructure projects.

- According to the American Institute of Architects (AIA), construction spending on buildings increased by over 9% in 2022. It is estimated to increase further by 6% in 2023. According to the estimation by Statista, the construction industry size amounted to USD 8.2 trillion in 2022 and is expected to reach USD 17 trillion by 2029.

- Furthermore, China is experiencing massive growth in its construction sector. According to the National Bureau of Statistics (NBS), in 2021, the construction output in China was valued at approximately USD 4.5 trillion. In the United States, the construction industry is backed by good economic conditions, increasing job opportunities, and the government's commitment to boosting the construction industry. More than 50% of the concrete in the United States is manufactured using fly ash.

- Owing to the aforementioned factors, the demand for fly ash from the construction industry is projected to grow at a rapid rate during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is forecasted to be the largest and the fastest-growing region over the forecast period owing to the increasing demand from countries such as China, India, and Japan.

- The demand for fly ash is increasing because various governments have emphasized ecological reasons for the consumption of fly ash. The usage of fly ash allows for a low water-cement ratio for similar mixtures when compared to non-fly ash mixes. The government of countries like Malaysia, Indonesia, China, and India is investing more in infrastructure developments from fly ash as it is less permeable and emits less carbon dioxide, contributing towards fewer emissions.

- China is investing USD 1.43 trillion in major construction projects in the next five years till 2025. According to National Development and Reform Commission (NDRC), the Shanghai plan includes an investment of USD 38.7 billion in the next three years, whereas Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In 2022, India contributed about USD 640 billion to the construction industry due to government initiatives in infrastructure development and affordable housing, such as housing to all, smart city plans, and others. The growing construction activities in the country are driving the demand for silicones, which, in turn, may drive the chloromethane market over the forecast period.

- The agriculture sector uses fly ash for soil stabilization, accounting for about 14% of the fly ash market. The mining industry is looking for alternative stowing materials, and fly ash has been demonstrated as the alternative, as fly ash reduces water consumption by about 50%. Asia Pacific holds about 38% of the global mining project, thus increasing the demand for fly ash.

- It is also used in water treatment to reduce total dissolved solids(TDS), total suspended solids(TSS), and the ph level of water to purify water in the region, thus propelling the demand for fly ash.

- Major companies in the region include Boral Limited and Ashtech (India) Pvt Ltd.

- The aforementioned factors and government support have helped contribute to the increasing demand for the fly ash market.

Fly Ash Industry Overview

The fly ash market is fragmented, with the major players accounting for marginal shares of the market. Some of the companies in the market include Boral, Cemex SAB de CV, Charah Solutions Inc., Separation Technologies LLC, and Cement Australia, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Industry

- 4.1.2 Government Policies to Promote the Usage of Fly Ash

- 4.2 Restraints

- 4.2.1 Harmful Properties of Fly Ash

- 4.2.2 Non-suitability in Cold Weather Conditions

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Class F

- 5.1.2 Class C

- 5.2 Application

- 5.2.1 Construction

- 5.2.1.1 Bricks and Blocks

- 5.2.1.2 Road Construction

- 5.2.1.3 Portland Cement and Concrete

- 5.2.2 Agriculture

- 5.2.3 Mining

- 5.2.4 Water Treatment

- 5.2.5 Other Applications

- 5.2.1 Construction

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ashtech Industries

- 6.4.2 Boral Resources

- 6.4.3 Charah Solutions,Inc

- 6.4.4 Cemex SAB de CV

- 6.4.5 Cement Australia

- 6.4.6 LafargeHolcim

- 6.4.7 Salt River Materials Group

- 6.4.8 Seperation Technologies LLC

- 6.4.9 Suyog Suppliers

- 6.4.10 Waste Management

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand from Waste Management and Precast Concrete Products

お電話でのお問い合わせ

044-952-0102

( 土日・祝日を除く )