|

市場調査レポート

商品コード

1524184

ドローン分析:市場シェア分析、産業動向と統計、成長予測(2024年~2029年)Drone Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ドローン分析:市場シェア分析、産業動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年07月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

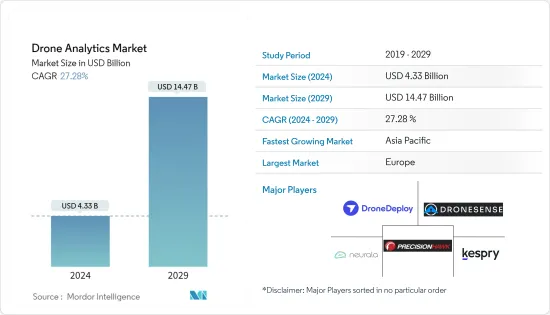

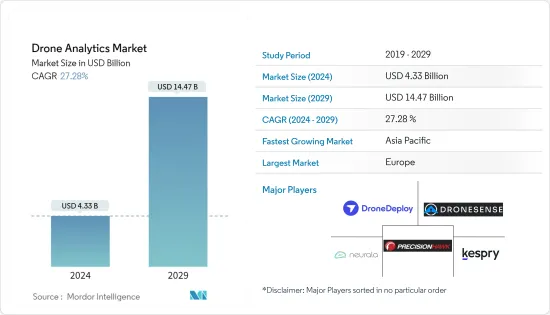

ドローン分析市場規模は2024年に43億3,000万米ドルと推定され、2029年には144億7,000万米ドルに達すると予測され、予測期間中(2024~2029年)のCAGRは27.28%で成長する見込みです。

ドローンは、短期間で数多くの産業の生産性を再定義し、向上させています。ドローン分析市場の需要は、セキュリティ監視、安全試験、資産監視・モニタリング、暴風雨追跡、物流、遠隔地スキャンによる環境調査など、様々な用途へのドローンの配備によって促進されています。様々な用途へのドローンの配備の増加に伴い、企業はドローン分析ソリューションに多額の投資を行っています。いくつかのエンドユーザーは、ドローン分析を使用して、ドローンセンサーから取得したデータを処理・分析しています。さらに、いくつかの政府は、商業セグメントでのドローンのBVLOS運用を許可し、いくつかの商業運用についてドローン分析企業に許可を与えています。

その一方で、ドローン産業は、ドローンの採用を制限する空域制限やプライバシーに関する懸念など、様々な航空当局が課す様々な規制や制限の対象となっています。機密情報を保護し、各国のデータ保護規制を確実に遵守することが、ドローン分析市場の成長を妨げる可能性があります。

しかし、次世代のドローンは、人工知能などの技術を搭載することが想定されています。この技術は、捕捉されたデータの負荷をリアルタイムで分析するのに役立ち、複雑な物理的構造を見渡し、捕捉されたデータに欠陥がないか分析するための新しい世界を開くからです。例えば、自動UAVは風力タービンのブレードをスキャンし、搭載されたAIモデルを介して欠陥を検出し、メンテナンスの必要性と時間スケールに関する推奨事項を提供することができます。ドローン分析へのAIの採用は、現在のドローンの能力に大きなプラス効果をもたらすと想定されています。それは、いくつかの産業におけるドローンの潜在的な用途を著しく増大させると考えられます。

ドローン分析市場動向

建設セグメントが市場で最も高いシェアを占める

ドローンは、従来の陸地監視方法に急速に取って代わりつつあります。ドローンは、人為的ミスを排除しながら、必要なデータを取得するための労力と時間を大幅に削減します。建設セグメントにおけるドローン分析の需要は、ドローンの導入が年々増加していることが背景にあります。

例えば、2019年と比較すると、2023年には、様々なセグメントでのドローンの導入量は756万台まで上昇し、その成長率は36%となっています。建設セグメントでは、建設現場のリスクの高い場所の目視点検にドローンの活用が進んでいます。ドローンからリアルタイムでデータを収集することで、現場でのコミュニケーションや管理の効率化も強化されます。ドローンはまた、エンジニアや測量士が高層構造物を実施し、空撮によってプロジェクトの進捗状況を可視化することで、潜在的な問題概要を提供し、建設現場での作業を合理化するための重要な意思決定を促進するのに役立っています。高度なデータ分析とドローンが撮影した画像の助けを借りて、建設事業に携わる企業はインフラを強化し、日常業務を最適化しています。ドローンが生成するデータは、建設管理者が正確な3D BIMモデルを開発し、標高や真の距離を測定する高解像度のオルソモザイクマップを作成するのに役立ちます。

例えば、2024年1月、DJIは同社初の3Dモデル編集ソフトウェアであるDJI Terraを発売しました。DJI Terraは、航空測量、モデリング、編集のためのオールインワンソリューションです。このソフトウェアは、ドローンで撮影された大規模なデータセットを処理し、高品質の3D地図やモデルを簡単に生成することができ、建設などの業界の専門家に最適です。このような開発は、予測期間中、このセグメントの成長を促進すると予想されます。

予測期間中、アジア太平洋が最も高い成長を示す

同地域のいくつかの国で最近ドローン規制が変更されたことが、同市場の成長を後押しすると予想されます。中国は過去6年間でドローン製造の世界のハブとなっています。世界の民間ドローン市場の70%以上は中国が支えています。例えば、2023年6月、中国の無人航空機産業協会は、2022年に全国のドローンの登録台数が9万5,000台に達したと発表しました。ドローン産業の年間生産高は2022年に1,170億元(183億9,000万米ドル)に達し、前年より34%以上増加しました。また、報告書によると、2022年末までに中国のドローン関連企業は1万5,000社以上に急増し、2021年より25%増加しました。ドローンの用途セグメントの拡大は、同時に中国におけるこれらのUAVの需要を促進しています。

さらに、建設、農業、インフラ、エネルギー、通信、鉱業、保険業界における監視、試験、測量、モニタリング用途のドローン需要の増加が、中国におけるドローン分析市場の成長を促進しています。例えば、2022年、中国民用航空局は、航空物流を発展させ、中国の物流インフラを構築するために配送ドローンの配備を促進するための第14次5カ年計画を発表しました。さらに、インドのような国は、様々な産業セグメントでのドローンの導入を促進するために、ドローン購入に対する様々な補助金制度やその他の有利な国内政策を提供しています。例えば、2023年8月、インド政府はAtmanirbhar Bharat政策の一環として、生産連動奨励金(PLI)スキームを承認し、ドローンとドローン部品の開発のために3年間で12億インドルピー(1,450万米ドル)の資金を割り当てた。こうした発展は、予測期間中、同地域のドローン分析市場に好影響を与えると予想されます。

ドローン分析産業概要

ドローン分析市場は非常にセグメント化されています。そのため、地域レベルや地方レベルで事業を展開する新規参入企業も、コスト差別化や優れた技術力別の製品を活用することで市場シェアを高めています。このため、DroneDeploy, Inc.、Kespry Inc.(Firmatek, LLC)、Neurala, Inc.、DroneSense, Inc.、PrecisionHawk Inc.などの著名な市場参入企業は、市場の優位性を維持するために、既存のサービスポートフォリオをアップグレードする新技術の開発に熱心に投資しています。競争の激化は市場の技術革新を促進し、それによってドローン分析業界がユーザーのコンプライアンス問題に対処し、サービスの制限に対処し、医療モビリティなどの新興セグメントのセグメントで既存の課題を克服するのに役立つと予想されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブ概要

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手・消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 用途

- 建設

- 農業

- エネルギー

- 法執行

- その他

- 地域

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- その他の欧州

- アジア太平洋

- インド

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- AeroVironment, Inc.

- Kespry Inc.(Firmatek, LLC)

- DroneDeploy, Inc.

- Delta Drone(Tonner Drones)

- PrecisionHawk, Inc.

- Pix4D SA

- Environmental Systems Research Institute, Inc.

- Sentera Inc.

- AgEagle Aerial Systems Inc.,

- Optelos

- DroneSense, Inc.,

- Delair SAS

- Skycatch, Inc.

- Heavy Construction Systems Specialists, LLC.

- Neurala, Inc.

第7章 市場機会と今後の動向

The Drone Analytics Market size is estimated at USD 4.33 billion in 2024, and is expected to reach USD 14.47 billion by 2029, growing at a CAGR of 27.28% during the forecast period (2024-2029).

Drones have redefined and enhanced the productivity of numerous industries within a short period. The demand for the drone analytics market is driven by the deployment of drones for various applications such as security monitoring, safety inspections, asset monitoring and surveillance, storm tracking, logistics, and broadly studying the environment by scanning remote areas. With the growth in the deployment of drones in various applications, companies are investing substantially in drone analytics solutions. Several end-users use drone analytics to process and analyze the data acquired from the drone sensors. In addition, several governments are allowing the BVLOS operations of drones in the commercial sector and granting permissions for drone analytics companies for several commercial operations.

On the other hand, the drone industry is subject to various regulations and restrictions imposed by various aviation authorities, including air space restrictions and privacy concerns that limit the adoption of drones. Protecting sensitive information and ensuring compliance with data protection regulations in various countries may hamper the growth of the drone analytics market.

However, the next generation of drones is envisioned to be powered by technologies such as artificial intelligence, as the technology helps in analyzing the captured loads of data on a real-time basis, opening a new world for looking over complex physical structures and analyzing the captured data for defects. For instance, automated UAVs can scan blades on wind turbines and, via onboard AI models, can detect defects and provide recommendations on the necessity and timescale of maintenance. The introduction of AI in drone analytics is envisioned to have a profound positive effect on the current capabilities of a drone. It would severely augment the potential applications of drones in several industries.

Drone Analytics Market Trends

Construction Segment Holds Highest Shares in the Market

Drones have been rapidly replacing traditional land surveillance methods. They offer a significant reduction in labor and time to capture the necessary data while eliminating the scope of human error. The demand for drone analytics in the construction sector is driven by the rising adoption of drones annually.

For instance, compared to 2019, in 2023, the adoption of drones in various sectors rose to 7.56 million in volume, with a growth of 36% compared to 2019. In the field of construction, drones are being increasingly utilized to perform visual inspections of high-risk areas of a construction site. The efficiency of on-site communication and management is also bolstered by collecting real-time data from drones. Drones also help engineers and surveyors conduct high-rise structures and visualize project progress through aerial shots to provide an overview of potential issues and facilitate key decision-making to streamline operations at a construction site. With the help of advanced data analytics and the images captured by drones, companies involved in the construction business have strengthened their infrastructure and optimized daily business operations. The data generated by drones help construction managers develop accurate 3D BIM models, along with high-resolution ortho mosaic maps to measure elevation and true distances.

For instance, in January 2024, DJI launched DJI Terra, the company's first 3D model editing software. DJI Terra is an all-in-one solution for aerial surveying, modeling, and editing. The software can process large data sets captured by drones and generate high-quality 3D maps and models with ease, making it ideal for professionals in industries like construction. Such developments are expected to drive the growth of the segment during the forecast period.

Asia-Pacific to Exhibit the Highest Growth During the Forecast Period

The recent changes in drone regulations in several countries across the region are expected to support the growth of the market. China has become the global hub for drone manufacturing in the past six years. More than 70% of the global civilian drone market is supported by China. For instance, in June 2023, the Unmanned Aerial Vehicle Industry Association in China announced that the registered drones across the country reached 95,000 in 2022. The drone industry's annual output reached 117 billion yuan (USD 18.39 billion) in 2022, up more than 34 per cent than the previous year. The report also stated that the drone-related enterprises in China surged to more than 15,000 by the end of 2022 which was 25% higher than in 2021. The growing application areas of drones are simultaneously propelling the demand for these UAVs in China.

Furthermore, an increase in demand of drones for monitoring, inspection, surveying, and surveillance applications in the construction, agriculture, infrastructure, energy, telecommunications, mining, and insurance industries is propelling the growth of the drone analytics market in China. For instance, in 2022, China's Civil Aviation Administration released its 14th five-year plan to develop aviation logistics and to promote the deployment of delivery drones to build up China's logistics infrastructure. Additionally, countries like India are providing various subsidy schemes and other favourable domestic policies for drone purchases to promote the adoption of drones in various industrial sectors. For instance, in August 2023, as a part of the Atmanirbhar Bharat policy, the Indian Government approved the Production-Linked Incentive (PLI) scheme and allocated a fund of INR 120 crore (USD 14.5 million) for three years for the development of drones and drone components. Such developments are expected to favourably impact the market for drone analytics in the region during the forecast period.

Drone Analytics Industry Overview

The drone analytics market is highly fragmented. Hence, new market players that operate at regional and local levels are also able to enhance their market share by leveraging their products based on cost differentiation and superior technical capabilities. Thus, to retain market dominance, prominent market players, such as DroneDeploy, Inc., Kespry Inc. (Firmatek, LLC), Neurala, Inc., DroneSense, Inc., and PrecisionHawk Inc., are keenly investing in the development of new technology to upgrade their existing service portfolio. Rising competition is anticipated to drive innovation in the market, thereby helping the drone analytics industry to address user compliance issues, address service limitations, and overcome existing challenges in the field of emerging sectors, such as healthcare mobility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Construction

- 5.1.2 Agriculture

- 5.1.3 Energy

- 5.1.4 Law Enforcement

- 5.1.5 Other Industries

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 AeroVironment, Inc.

- 6.2.2 Kespry Inc. (Firmatek, LLC)

- 6.2.3 DroneDeploy, Inc.

- 6.2.4 Delta Drone (Tonner Drones)

- 6.2.5 PrecisionHawk, Inc.

- 6.2.6 Pix4D SA

- 6.2.7 Environmental Systems Research Institute, Inc.

- 6.2.8 Sentera Inc.

- 6.2.9 AgEagle Aerial Systems Inc.,

- 6.2.10 Optelos

- 6.2.11 DroneSense, Inc.,

- 6.2.12 Delair SAS

- 6.2.13 Skycatch, Inc.

- 6.2.14 Heavy Construction Systems Specialists, LLC.

- 6.2.15 Neurala, Inc.