|

市場調査レポート

商品コード

1643163

クラウドファンディング:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Crowdfunding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| クラウドファンディング:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 124 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

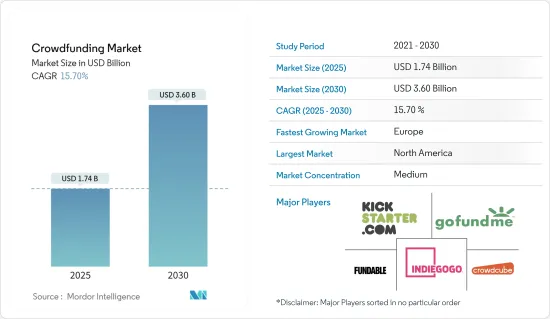

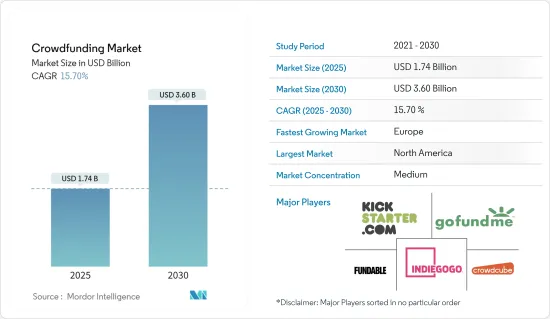

クラウドファンディングの市場規模は2025年に17億4,000万米ドルと推定され、予測期間中(2025-2030年)のCAGRは15.7%で、2030年には36億米ドルに達すると予測されます。

主なハイライト

- クラウドファンディングは、群衆と呼ばれる不特定多数の人々から少額の資金を募るものです。クラウドファンディングプラットフォームは、寄付者と受益者の仲介役となり得る。この仲介者は、潜在的な寄付者の行動に影響を与えるために、多くのマーケティング手法を利用することができます。したがって、資金調達のためのソーシャルメディアプラットフォームのようなクラウドファンディングプラットフォームで使用されている影響因子を探すことが不可欠です。

- 近年、クラウドファンディングは、従来の方法による資金調達に課題を抱える起業家や新興企業にとって、未開拓で広大な新たな機会として高く評価されています。スタートアップのエコシステムを支える資金調達のためのクラウドファンディング専用プラットフォームが存在します。例えば、今年8月、オランダの投資型クラウドファンディング会社Symbidは、ブカレストにあるソフトウェア企業向けの共同投資プラットフォームSeedBlinkに買収されました。西欧におけるベンチャー・パートナーの事業を拡大することで、あらゆる段階の欧州のデジタル・スタートアップへの株式投資のインフラを統合・発展させる準備を進めているSeedBlinkのリーチを拡大します。

- クラウドファンディングイニシアチブをキュレーションし、統計を追跡している共和国所有のポータルサイト、アローラ・プロジェクトによると、今年5月末までにエクイティクラウドファンディングプラットフォームで新興企業に投資された金額は2億1,500万米ドルを超え、前年同期の約2億米ドルから増加しました。昨年、クラウドファンディングプログラムは総額5億200万米ドルを調達しました。

- 今年後半には、世界中の起業家、発行者、投資家が一堂に会し、2020年に始まったオンデマンド・ビジネス教育プラットフォームStartupStarterが主催する第2回Equity Crowdfunding Week Conferenceが開催されます。エクイティ・クラウドファンディングウィークは、米国、カナダ、そしてそれ以外の国々でプライベート・ファイナンスを調達している最もクリエイティブな企業を紹介する3日間の没入型イベントです。ブラック・オン・ザ・ブロック(BOTB)の参加により、この完全没入型体験は、起業家とエクイティ・クラウドファンディングの世界で成功を収めたいと願うBOTB参加者へのアクセスと機会の提供に焦点を当てることになります。

- クラウドファンディングプラットフォームとしてキャンペーンを利用することは、市場シェアを拡大する上で極めて重要です。クラウドファンディングの拡大を後押ししている主な要因のひとつは、一般人口の慢性疾患の増加です。さらに、世界中の様々なプレーヤーが新興企業や成長企業への投資を開始しました。

- 昨年12月、ロンドンを拠点とするEdtech企業、マインド・ストーンは、エキサイティングなクラウドファンディングキャンペーンで170万米ドルを獲得し、資金調達目標を上回り、Seedrsプラットフォームで最も大規模なEdtech資金調達キャンペーンのひとつとなった。さらに昨年5月には、エレクトロサイクル開発の技術的パイオニアであるザイザー・モーターズが、同社の電動バイクの開発と製造を支援するため、ウェファンダー公式キャンペーンを開始しました。

- 企業は初めて、全欧州加盟国の潜在的投資家とつながることができるようになった。投資家を魅了するために、譲渡可能な証券、ローン、有限責任会社の株式に似た金融商品を採用し、クラウドソーシングを通じて毎年最大500万米ドルを調達することができます。

- 世界の金融・経済問題は多くの国々を苦しめ、政府が地域住民の緊急ニーズに対応することを極めて困難にしています。流動性の欠如は、政府、企業、家族、金融機関を含むすべての主体に影響を与えるため、この危機的なシナリオにおいて従来の資金源を動員することは困難です。

- その結果、起業家としての経験は、目標を達成するための資金調達が困難であることに気づいた。従来の資金調達ルートで資金を得る上でのこうした課題のため、クラウドファンディングが事業資金調達の重要な要因となっています。COVID-19の状況はクラウドファンディングの成長を劇的に加速させ、その変化はパンデミック後のシナリオでも続いています。

クラウドファンディング市場の動向

リワード型クラウドファンディングが市場の成長を加速させる

- リワード型クラウドファンディングは、企業(多くの場合、新興企業)がオンラインプラットフォームを通じてプレシードやシードマネーを募集し、出資者に資金提供の対価としてギフトや「特典」を提供する場合に発生します。プレセールスは、人々、イニシアチブ、または企業が、金銭以外のインセンティブと引き換えに銀行家から資金を調達する取引です。これによって、組織は既存のネットワークと交流し、利用できるものを募ることができます。このタイプのクラウドソーシングは通常、初期段階のビジネスや専門的なプロジェクトに適しています。

- パンデミックは、世界の大流行によって影響を受けた人々を支援することをターゲットとした寄付やリワードベースのクラウドファンディング事件の増加をもたらしました。欧州大陸全域で、さまざまな人々(市民、営利団体、財団、慈善団体、信託を含む)によって作成されたCOVID-19リワードベースのクラウドファンディングキャンペーンの数が大幅に増加しました。

- Indiegogo社によると、ハードウェアとテクノロジーのクラウドファンディングは日本でも人気が出ると予想されています。昨年、Indieogoは大小のキャンペンターと協力し、起業家ブランドが新たなオーディエンスにリーチし、新商品の小ロットテストを行うのを支援しました。

- フォーブス・ジャパンによると、日本の起業家は昨年、ほぼ70億米ドルを調達し、数年後には年間100億米ドルに増加すると予想されています。

- 企業への投資や融資を伴わないリワード型クラウドファンディングには、固有のリスクが伴います。クラウドファンディングは、支援者が活動やアピールを支援してくれたことに対する感謝の印として贈るものから、すぐに発展しました。多くの場合、ギフトは寄付と一緒に購入される商品であり、それによってギフトの対価が返される販売チャネルへと変化しています。

欧州が大きなシェアを占める見込み

- 欧州におけるクラウドファンディングのシェアと成長率は、クラウドファンディングモデルのルールを策定する政府が増えるにつれて高まると思われます。また、欧州連合(EU)諸国は、同地域のクラウドファンディングサイトが他のEU地域でも運営できるような法律を制定するとも言われています。

- ドイツのさまざまなクラウドファンディングプラットフォームは、初心者や経験豊富な投資家に個人投資の機会を提供しています。ドイツのクラウドソーシングサイトは、最も規制が厳しく、ベストプラクティスを遵守しています。ドイツのクラウドファンディングサイトは、中小企業や不動産への投資の選択肢を提供し、利用者に富を蓄積させています。

- thecrowdspace.comによると、ドイツにはP2P融資、株式、負債、寄付、報酬、ミニ債券に特化したプラットフォームが112あります。個人投資家や認定投資家は、物流、不動産、グリーンエネルギー、新興企業、個人ローン、アート、中小企業(SMEs)、健康・科学、社会貢献、教育、農業、スポーツ、海運など、いくつかの企業セクターで投資することができます。さらに、ドイツにはエクイティクラウドソーシングのサイトが25あります。これらのサイトは、不動産、グリーンエネルギー、新興企業、アート、中小企業、健康・科学、社会貢献、教育、農業に重点を置き、個人投資家や認定投資家向けにさまざまな投資の可能性を提供しています。最低投資額は、セクターや特定のプラットフォームの目的によってプラットフォームによって異なります。

- 欧州のクラウドファンディング市場は最近、飛躍的な発展を遂げています。テクノロジーの進化と欧州におけるプロテック事業の増加により、不動産、銀行、その他の業界において新たなクラウドファンディングの機会が生まれています。

- 例えば、今年4月、Heuraの第2回Equity for Good Rebelsクラウドファンディングキャンペーンは、わずか12時間で約422万米ドルを調達し、欧州で最も急成長している植物由来企業としての評判を確固たるものにしました。Crowdcubeのキャンペーンでは、欧州全土から4,500人の投資家が、タンパク質の移行を加速させることを使命とするGood Rebelコミュニティに参加しました。

- ドイツはクラウドファンディングにとって重要な市場であることは、ドイツの投資家に積極的に働きかけたり、ドイツで事業を拡大しようとしているいくつかの海外のプラットフォームが証明しています。しかし最近まで、ドイツの民間クラウドファンディング企業に対する規制環境は、もっと改善されていたはずです。そのため、クラウドファンディングサービス・プロバイダーに関するEU規則(ECSPR)が制定された当初は、ドイツが他のEU諸国と同じように簡単に実施するには支援が必要だと思われました。その結果、2021年6月、ドイツ議会はクラウドファンディングサービス・プロバイダーに関するEU規制を実施する法案を国内法として可決しました。

- ドイツのクラウドファンディング規制のローカルレベルにはいくつかの欠点があるとはいえ、一般的に堅調なドイツのFinTech業界、特にクラウドファンディングは、新しい規則によって悪影響を受けることはなく、ドイツのクラウドファンディングプラットフォームは調査期間中に着実な上昇を示すだろうと予想されています。

クラウドファンディング業界の概要

世界のクラウドファンディング市場は、少数の企業が市場を独占し、他の多くの企業が互いに競争しているため、適度に統合されています。また、これらの企業は、業界固有のエンドユーザー・アプリケーション向けに幅広い技術を顧客に提供するために大規模な投資を行っています。市場の最近の動向としては、以下のようなものがある:

2022年10月、韓国のボードゲーム・メーカーであるBad Comet社は、キックスターター・キャンペーンとして最新ボードゲームの発売を発表しました。

2022年4月、クラウドキューブはフランス向けのウェブサイトを開設しました。Crowdcubeは、英国および欧州全域で証券をクラウドソーシングするためのプラットフォームです。最近の規制変更により、以前から欧州で活動してきたCrowdcubeは、欧州加盟国全体で500万ユーロ(527万米ドル)を上限とする発行体の資金調達を支援しやすくなります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- 無料プロモーション・ソースとしてのソーシャルメディアの利用

- 投資家の前向きな戦略行動と投資家間の社会的交流の増加

- 市場抑制要因

- 時間のかかるプロセスと厳しい規制遵守

第6章 市場セグメンテーション

- 製品タイプ別

- リワード型クラウドファンディング

- エクイティクラウドファンディング

- 寄付およびその他の製品タイプ

- エンドユーザー用途別

- 文化部門

- テクノロジー

- 製品

- ヘルスケア

- その他のエンドユーザー用途

- 地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第7章 競合情勢

- 企業プロファイル

- Kickstarter PBC

- Indiegogo Inc.

- GoFundMe Inc.

- Fundable LLC

- Crowdcube Limited

- GoGetFunding

- Crowdfunder Inc.

- Alibaba Group Holding Limited

- Wefunder Inc.

- Fundly

- Jingdong Inc.

- Suning.com Co. Ltd

- Owners Circle

- Realcrowd Inc.

第8章 投資分析

第9章 市場の将来

The Crowdfunding Market size is estimated at USD 1.74 billion in 2025, and is expected to reach USD 3.60 billion by 2030, at a CAGR of 15.7% during the forecast period (2025-2030).

Key Highlights

- Crowdfunding entails soliciting many small amounts of money from an undefined group known as the crowd. Crowdfunding platforms could be intermediaries between donors and beneficiaries. This intermediary could exploit a plethora of marketing techniques to influence the behavior of the potential donor. Therefore it is essential to look for the influencing factors that are being used on crowdfunding platforms such as social media platforms for raising funds.

- In recent years, crowdfunding has been acclaimed as an untapped and vast new opportunity for entrepreneurs and startups that face challenges in obtaining funding from traditional methods. There is a dedicated crowdfunding platform for raising funds to support the startup ecosystem. For instance, in August this year, Dutch investment crowdfunding company, Symbid, was bought by SeedBlink, a co-investment platform for software firms situated in Bucharest. By expanding the venture partners' operations in Western Europe, the acquisition will expand SeedBlink's reach as it prepares to consolidate and develop the infrastructure for equity investment in European digital startups at all stages.

- According to the Arora Project, a Republic-owned portal that curates crowdfunding initiatives and tracks statistics, more than USD 215 million was invested in startups on equity crowdfunding platforms in the current year until the end of May, up from about USD 200 million in the same period last year. Last year, crowdfunding programs raised a total of USD 502 million.

- Later this year, entrepreneurs, issuers, and investors from around the world will gather in person for the second annual Equity Crowdfunding Week Conference, organized by StartupStarter, an on-demand business education platform that began in 2020. Equity Crowdfunding Week is a three-day immersive event that showcases the most creative firms raising private financing in the United States, Canada, and beyond. With the inclusion of black on the block (BOTB), this fully immersive experience will now focus on offering access and opportunities to the BOTB audience wanting to make a mark in the world of entrepreneurs and equity crowdfunding.

- Using campaigns as crowdfunding platforms is crucial in expanding the market share. The increased prevalence of chronic illnesses among the general population is one of the primary causes encouraging the expansion of crowdfunding. Furthermore, various players across the globe started investing in startups and growth companies.

- In December last year, Mind Stone, a London-based edtech firm, received USD 1.7 million in an exciting crowdfunding campaign, exceeding its funding goal and becoming one of the most extensive edtech financing campaigns on the Seedrs platform. Further, in May last year, Zaiser Motors, a technological pioneer in developing the Electrocycle, launched an official Wefunder campaign to support developing and manufacturing of its electric motorbike.

- Companies can now connect with potential investors across all Europe member states for the first time. To entice investors, they can employ transferrable securities, loans, or financial products that resemble shares of limited liability corporations to generate up to USD 5 million each year through crowdsourcing.

- The global financial and economic problems have hurt many nations, making it extremely difficult for governments to address the urgent needs of local populations. Traditional sources of finance are challenging to mobilize in this crisis scenario as lack of liquidity impacts all agents, including the government, businesses, families, and financial institutions.

- As a result, the entrepreneurial experience found itself challenging to raise money to fulfill its goal. Due to these challenges in obtaining finance through conventional fundraising channels, crowdfunding has become a significant factor in business financing. The COVID-19 situation dramatically accelerated the growth of crowdfunding, and the change is continuing in the post-pandemic scenario.

Crowdfunding Market Trends

Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market

- Reward-based crowdfunding occurs when a firm (often a start-up) seeks pre-seed and seed money via an online platform and provides investors with a gift or "perk" in exchange for their financial contribution. Pre-sales are transactions in which people, initiatives, or businesses raise funds from bankers in exchange for a non-monetary incentive. It allows organizations to interact and build on an existing network and solicit that can be used. This type of crowdsourcing is typically appropriate for early-stage businesses or specialized projects.

- The pandemic resulted in increased contributions and reward-based crowdfunding incidents targeted at assisting those impacted by the worldwide pandemic. The number of COVID-19 reward-based crowdfunding campaigns created by various persons (including citizens, commercial organizations, foundations, charities, and trusts) throughout the European continent increased significantly.

- According to Indiegogo, Inc., hardware and technology crowdfunding is expected to gain popularity in Japan. Last year, Indieogo collaborated with small and large campaigners to assist entrepreneurial brands in reaching new audiences and testing small batches of new goods.

- According to Forbes Japan, Japanese entrepreneurs raised almost USD 7,000 million last year, expected to rise to USD 10,000 million annually in a few years.

- Reward-based crowdfunding, which does not include making an investment in or a loan to a company, carries inherent risks. It soon advanced from giving supporters a token of thanks for their support of a cause or an appeal. In many instances, it has transformed into a sales channel where the gift is the product bought with the contribution, thereby giving the gift's price in return.

Europe is Expected to Hold Significant Share

- The European crowdfunding share of the market and growth is likely to increase as more governments in the area organize rules for the crowdfunding model. The European Union nations are also allegedly going to establish laws to allow crowdfunding sites in the region to operate across other EU regions.

- Different crowdfunding platforms in Germany give novice and experienced investors access to private investment opportunities. German crowdsourcing sites are among the most well-regulated and adhere to best practices. German crowdfunding websites provide choices for investment in SME and real estate and let users accumulate wealth.

- In Germany, there are 112 platforms dedicated to P2P lending, equity, debt, donations, rewards, and mini-bonds, according to thecrowdspace.com. Retail and accredited investors can invest through them in several company sectors, including logistics, real estate, green energy, startups, personal loans, art, small and medium-sized enterprises (SMEs), health & science, social causes, education, farming, sport, and maritime. Additionally, Germany has 25 sites for equity crowdsourcing. They provide various investment possibilities for retail and accredited investors, emphasizing real estate, green energy, startups, art, SME, health & science, social causes, education, or farming. The minimum investment amount varies from platform to platform depending on the sector or specific platform objectives.

- The European crowdfunding market has recently made tremendous strides. Technology advancements and increasing proptech businesses in Europe have created new crowdfunding opportunities in real estate, banking, and other industries.

- For instance, In April this year, Heura's second Equity for Good Rebels crowdfunding campaign raised almost USD 4.22 million in just 12 hours, cementing its reputation as Europe's fastest-growing plant-based firm. The Crowdcube campaign saw 4,500 investors from all over Europe join the Good Rebel community, which is on a mission to speed the protein transition.

- Germany is a key market for crowdfunding, as evidenced by the several foreign platforms aggressively courting German investors or trying to extend their operations there. However, until recently, Germany's regulatory climate for private crowdfunding enterprises could have been better. One of the main barriers to cross-border service provision was the absence of unified law, so when the EU regulation on Crowdfunding Service Providers (ECSPR) was created, it initially seemed that Germany would need help to implement it as easily as other EU nations. As a result, on June 2021, the German Parliament passed a bill into national legislation that implements the EU regulation on Crowdfunding Service Providers.

- Even though the local level of the German crowdfunding regulation has some shortcomings, it is anticipated that the robust German FinTech industry, in general, and crowdfunding, in particular, will not be negatively impacted by the new rule, and the German crowdfunding platforms will witness a steady rise in the study period.

Crowdfunding Industry Overview

The global crowdfunding market is moderately consolidated due to the presence of a few companies dominating the market with the presence of many other companies competing between themselves. Also, these companies are investing extensively in offering customers a wide range of technologies for industry-specific end-user applications. Some of the recent developments in the market are:

In October 2022, Bad Comet, a South Korean board game manufacturer, announced the launch of their newest board game as a Kickstarter campaign.

In April 2022, Crowdcube launched a France-facing website. Crowdcube is a platform for crowdsourcing securities in the UK and throughout Europe. Recent regulatory changes will make it easier for Crowdcube, which has been active in Europe for some time, to support issuers in raising up to Euro 5 million (USD 5.27 million) throughout European member states.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment on the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Use of Social Media as a Free of Cost Promotion Source

- 5.1.2 Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors

- 5.2 Market Restraints

- 5.2.1 Time Consuming Process and Stringent Regulatory Compliance

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Reward-based Crowdfunding

- 6.1.2 Equity Crowdfunding

- 6.1.3 Donation and Other Product Types

- 6.2 By End-User Application

- 6.2.1 Cultural Sector

- 6.2.2 Technology

- 6.2.3 Product

- 6.2.4 Healthcare

- 6.2.5 Other End-User Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-pacific

- 6.3.4 Middle East & Africa

- 6.3.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kickstarter PBC

- 7.1.2 Indiegogo Inc.

- 7.1.3 GoFundMe Inc.

- 7.1.4 Fundable LLC

- 7.1.5 Crowdcube Limited

- 7.1.6 GoGetFunding

- 7.1.7 Crowdfunder Inc.

- 7.1.8 Alibaba Group Holding Limited

- 7.1.9 Wefunder Inc.

- 7.1.10 Fundly

- 7.1.11 Jingdong Inc.

- 7.1.12 Suning.com Co. Ltd

- 7.1.13 Owners Circle

- 7.1.14 Realcrowd Inc.