|

市場調査レポート

商品コード

1643118

MEMSベースIMU-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)MEMS-Based IMU - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| MEMSベースIMU-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

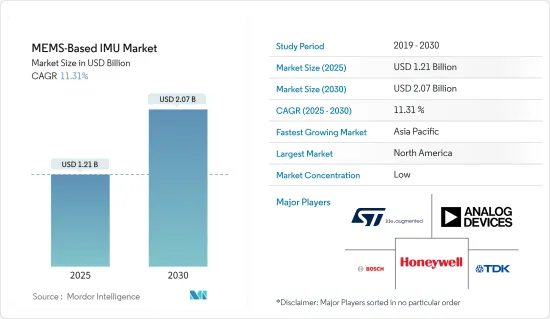

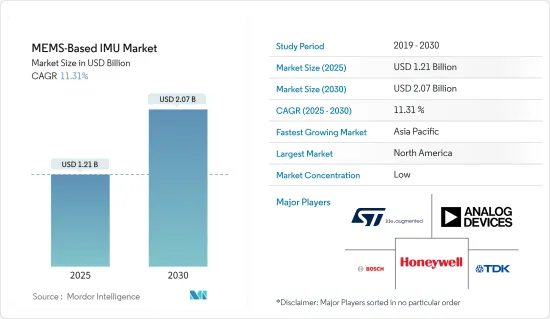

MEMSベースIMU市場規模は、2025年に12億1,000万米ドルと推定され、予測期間中(2025~2030年)のCAGRは11.31%で、2030年には20億7,000万米ドルに達すると予測されます。

市場成長の主要要因は、用途数の増加、技術の進歩、世界の新興国での需要の増加です。MEMS技術は、慣性計測システムの性能指標に妥協することなくデバイスのサイズと消費電力を縮小することで、慣性計測システムの用途基盤を拡大する上で重要な役割を果たし、市場の成長を牽引しています。

主要ハイライト

- このユニットで使用されるMEMS慣性センサは、非常に堅牢で信頼性が高く、高速で温度安定性の高い特性を備えているため、研究対象の市場は拡大しています。位置や加速度のわずかな変化も検出できます。さらに、IoT機器の開発が進んでいることも市場の成長を後押ししています。

- MEMS IMUの内部部品は、熱、湿気、腐食性化学品などの過酷な環境から保護する必要があります。しかし、製造や環境の変化に対する感度が高いため、マイクロマシニング・ジャイロスコープなどのIMUセンサの包装は困難な作業となり、包装コストが上昇するため、市場の成長を妨げています。COVID-19の世界の流行により、市場は大きな逆風に直面しています。COVID-19の世界の蔓延による操業停止は、デバイスの製造に影響を与え、エンドユーザー産業全体の消費者需要の足を引っ張り、価格に影響を与えました。しかし、復活に伴い、市場の需要は動向ラインまで上昇する可能性が高いです。

- 世界の防衛機関が精密兵器への依存度を高めるにつれ、シグナルチェーンの性能、品質、設計はさらにミッションクリティカルになっています。MEMSジャイロセンサは、シグナルチェーンの設計に不可欠な3つの側面で産業を強化します。

- 例えば、2021年12月、Honeywellは、米国国防高等研究計画局(DARPA)からの資金提供を受け、次世代のMEMSベースの慣性センサ技術の開発を発表し、商用と防衛ナビゲーション用途の両方で使用される予定です。Honeywellのラボでは最近、この新しいセンサの精度が、HoneywellのHG1930慣性測定ユニット(IMU)よりも1桁以上高いことを明らかにしました。

- さらに、COVID-19の流行が始まったことで、いくつかの製造業が操業停止となり、MEMSベースのIMU市場は大きな打撃を受けました。しかし、自動車メーカーはCOVID-19の大流行により、世界的に工場閉鎖の圧力が高まっています。連邦政府、州政府、地方政府は、可能な限り自宅待機を推奨し始めました。これにより、さまざまな産業でサプライチェーンの混乱が生じた。例えば、FordとGeneral Motorsはコロナウイルスの流行の中、北米にあるそれぞれの製造工場での生産を一時停止しました。Honda North AmericaとBMWも、世界のコロナウイルス流行に関連した自動車需要の減少が予想されるため、米国と欧州全域で工場を閉鎖しました。

MEMS慣性計測ユニット(IMU)市場動向

自動車セグメントが大きな市場シェアを占める

- 最新世代のADAS(先進運転支援システム)や自律走行車には、車両の動きを正確に予測してリアルタイムで正確な位置を特定する正確な慣性計測ユニットが必要であり、MEMSベースの慣性計測ユニット市場の成長を牽引しています。また、自律走行への進化に伴い、安全ベースの用途に対する需要が倍増し、市場にビジネス機会が生まれると予想されます。

- 乗用車や商用車の高い需要による生産工場の増加や、急速に拡大する経済圏の存在が、市場の成長を後押しするとみられます。

- 例えば、2022年7月、BMW Groupは、ドライバーを必要とせずに自動車が生産周辺を操縦する新プロジェクトを立ち上げました。工場の自動運転プロジェクトは、韓国のSeoul RoboticsとスイスのEmbotechという2つの新興企業と共同で実現されます。工場や配送センターにおける新車ロジスティクスの効率を高めています。

- さらに、パンデミックの第一波が終息する中、Analog Devices, Inc.は、同社の高精度慣性計測ユニット(IMU)が、CHC Navigationの次世代リアルタイムキネマティック(RTK)ローバー・レシーバーに採用されたと発表しました。この次世代RTKローバー・レシーバーは、衛星測位と慣性測位の組み合わせにより、あらゆる位置で高精度かつ高効率の測位・計測を実現できます。

- さらに、STMicroelectronicsは2022年5月、MEMベースの慣性計測ユニット(IMU)ASM330LHHXを発表し、スマートドライビングを実現するとともに、機械学習(ML)コアにより、より先進的自動化を目指す自動車産業をサポートします。

北米が最大の市場シェアを占める

- 自動車産業は、安定制御、安全対策、衝突検知システムなどの用途の進歩を受けて、ハイエンドIMUの新興市場となっています。プレミアム自動車メーカーが今後数年でL5自律走行に近づく可能性があるため、この市場は加速度、LiDAR、動き検出システムに関連するIMU搭載MEMSセンサに大きな機会を提供する可能性があります。

- 第2次パンデミックの波の中で、ソリッドステートLiDARセンサの開発企業であるInnoviz Technologies Ltdは、BMWのLiDAR搭載車を支援するために約1億7,000万米ドルを調達しました。

- 国際エネルギー機関(IEA)によると、2021年、米国は電気自動車市場で力強い復活を遂げ、販売台数は2倍以上の50万台以上となりました。米国の自動車市場全体も改善したが、電気自動車の市場シェアは4.5%に増加しました。米国ではTeslaが引き続き電気自動車市場を独占しています。全体として、同国の自動車部門は成長を続けており、同地域における自動車産業を中心とした市場調査に貢献しています。

- 2021年4月、Avita Health Systemは、心不全患者の治療にCardioMEMSベースのIMUシステムを移植する米国初のクリティカルアクセス病院となりました。この装置により、医師は心臓圧を遠隔モニタリングし、リアルタイムで治療を行うことができます。同社が提供する最初の装置はオハイオ州のガリオン病院に移植されました。

- さらに、2021年4月、Inertial Labsは、Inertial Labsのポートフォリオに新しい戦術グレードのMEMS IMUであるIMU-NAV-100を発表しました。この新しいセンサは、最先端の3軸MEMS加速度計とジャイロスコープを利用し、直線加速度、角速度、ピッチ/ロールを高精度で測定する完全統合型の慣性ソリューションです。

MEMSベースIMU産業概要

MEMSベースIMU(慣性計測ユニット)市場は細分化されています。全体として、既存企業間の競争間の敵対関係は高いです。今後、大企業の買収や提携が技術革新に力を入れます。同市場の主要企業には、Honeywell International Inc.、Analog Devices Inc.、Bosch Sensortec GmbH、STMicroelectronics International N.V.などがあります。

- 2022年1月-TDK株式会社は、6軸MEMSモーションセンサInvenSense ICM-45xxx SmartMotion超高性能(UHP)ファミリの発売を発表しました。オンチップセルフキャリブレーション、産業最小の消費電力、世界初のBalancedGyro(BG)技術を導入。

- 2021年4月-Honeywellは、クラス最高の精度と高衝撃環境にも耐えられる耐久性を備えたMEMSベースの小型慣性計測ユニットの新シリーズを発売。水筒のキャップとほぼ同じサイズの新しいHG1125とHG1126慣性測定ユニット(IMU)は低コストで、商用と軍事用用途の両方に対応します。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19が産業に与える影響の評価

第5章 市場力学

- 市場促進要因

- 新興用途の増加(IoTデバイス、ロボットカーなど)

- 低コストMEMSベースIMUの採用増加

- 市場抑制要因

- 変化する消費者需要への対応

第6章 市場セグメンテーション

- エンドユーザー産業

- 消費者

- 自動車

- 医療

- 航空宇宙・防衛

- 産業用

- その他

- 地域

- 北米

- 欧州

- アジア太平洋

- その他

第7章 競合情勢

- 企業プロファイル

- Honeywell International Inc.

- Analog Devices Inc.

- TDK Corporation

- Bosch Sensortec GmbH

- STMicroelectronics N.V.

- Xsens Technologies B.V.

- NXP Semiconductors N.V.

- Sensonor AS

- Northrop Grumman LITEF GmbH

- Silicon Sensing Systems Limited

- Murata Manufacturing Co. Ltd

- MEMSIC Inc.

第8章 投資分析

第9章 市場の将来

The MEMS-Based IMU Market size is estimated at USD 1.21 billion in 2025, and is expected to reach USD 2.07 billion by 2030, at a CAGR of 11.31% during the forecast period (2025-2030).

The market's growth is primarily fueled by the increase in the number of applications, technological advancements, and the increasing demand in emerging countries globally. The MEMS technology played a significant role in expanding the application base for inertial measurement systems by scaling down these devices' size and power consumption without compromising on their performance metrics, thereby driving the market's growth.

Key Highlights

- The market studied is growing, as MEMS inertial sensors used in the unit offer highly robust, reliable, fast, and temperature-stable characteristics. They can detect even the most minor changes in position and acceleration. Furthermore, the growing development of IoT devices is driving the market's growth.

- The internal components of MEMS IMU need to be protected from harsh environments, such as heat, moisture, and corrosive chemicals. However, the high sensitivity to fabrication and environmental variations makes the packaging of IMU sensors, such as micromachined gyroscopes, a challenging task and increases the packaging cost, thereby hampering the market's growth. The market is facing heavy headwinds due to the outbreak of COVID-19 worldwide. Lockdowns enforced by the spread of COVID-19 worldwide affected the manufacturing of devices, dragged consumer demand across end-user industries, and influenced the prices. However, with the resurgence, the market demand will likely rise to the trend line.

- As global defense agencies become more dependent on precision weapons, the signal chain's performance, quality, and design are even more mission-critical. MEMS gyroscope strengthens the industry with three essential aspects of signal chain design.

- For instance, in December 2021, Honeywell announced the development of the next generation of MEMS-based inertial sensor technology with financing from the US Defense Advanced Research Projects Agency (DARPA), which will be used in both commercial and defense navigation applications. Honeywell lab studies recently revealed that the new sensors are more than an order of magnitude more precise than Honeywell's HG1930 inertial measurement unit (IMU), a tactical-grade device with more than 150,000 units in operation.

- Furthermore, the beginning of the COVID-19 pandemic has severely hit the market for MEMS-based IMU owing to the shutdown of several manufacturing industries. However, automakers globally have faced increased pressure to shut down their factories due to the COVID-19 pandemic. After the federal, state, and local governments started recommending people stay in their homes as much as possible. This has caused supply chain disruptions across various industries. For instance, Ford and General Motors suspended production at their respective manufacturing facilities in North America amid the coronavirus outbreak. Honda North America and BMW also closed their plants throughout the U.S. and Europe owing to an expected decline in car demand related to the global coronavirus outbreak.

MEMS Inertial Measurement Unit (IMU) Market Trends

Automotive Sector is to Hold Significant Market Share

- The latest generation of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles require an exact inertial measurement unit to accurately predict the motion of a vehicle to determine its precise position in real-time, thereby driving the growth of the MEMS-based inertial measurement unit market. Also, with the evolution towards autonomous driving, the demand for the market is expected to increase multiple-fold for safety-based applications and create opportunities in the market.

- The increase in the number of production plants for passenger and commercial vehicles due to the high demand for these vehicles and the presence of rapidly expanding economies are likely to boost the market's growth.

- For instance, in July 2022, The BMW Group launched a new project that will see cars manoeuvre around production without requiring a driver. The Automated Driving In-Plant project is being realized in collaboration with two startups - Seoul Robotics from South Korea and Embotech from Switzerland. It will enhance the efficiency of new-vehicle logistics in plants and distribution centers.

- Moreover, during the end of the first wave of the pandemic, Analog Devices, Inc. announced its high-precision inertial measurement unit (IMU) was selected by CHC Navigation to enable its next-generation, real-time kinematic (RTK) rover receiver, which can achieve high-precision and high-efficiency positioning and measurement at any position through the combination of satellite and inertial positioning.

- Further, in May 2022, STMicroelectronics announced MEMs-based inertial measurement unit (IMU) ASM330LHHX to enable smart driving and support the automotive industry's quest for higher levels of automation with its machine-learning (ML) core.

North America Accounts for the Largest Market Share

- The automotive sector is the emerging market for high-end IMUs, following advancements in applications, such as stability control, safety measures, and crash detection systems. As the premium automakers may approach L5 autonomous driving in the next few years, the market may provide a massive opportunity for IMU-powered MEMS sensors related to acceleration, LiDAR, and motion detection systems.

- During the second pandemic wave, Innoviz Technologies Ltd, a developer of solid-state LiDAR sensors, raised around USD 170 million to back BMW's LiDAR-equipped cars, which will be rolled out by the beginning of 2022.

- According to the International Energy Agency (IEA), in 2021, the United States made a strong comeback in the electric car market, with sales more than doubling to more than half a million units. The entire car market in the United States improved as well, but electric vehicles increased their market share to 4.5%. Tesla continues to dominate the electric car market in the United States. Overall, the automotive sector in the country has been growing, contributing to the market studied, especially in the automotive industry, in the region.

- In April 2021, Avita Health System became the first critical access hospital in the United States to implant the CardioMEMS- based IMU system for treating heart failure patients. The device enables doctors to monitor cardiac pressure remotely and provide real-time treatments. The first device offered by the company was implanted at Galion Hospital in Ohio.

- Further, in April 2021, Inertial Labs launched the IMU-NAV-100, a new tactical-grade MEMS IMU in Inertial Labs' portfolio. The new sensor is a fully integrated inertial solution that measures linear accelerations, angular rates, and pitch/roll with high accuracy, utilizing state-of-the-art three-axis MEMS accelerometers and gyroscopes.

MEMS Inertial Measurement Unit (IMU) Industry Overview

The MEMS-based Inertial Measurement Unit Market is fragmented. Overall, the competitive rivalry among existing competitors is high. Moving forward, acquisitions and partnerships of large companies are focused on innovation. Some of the key players in the market are Honeywell International Inc., Analog Devices Inc., Bosch Sensortec GmbH, and STMicroelectronics International N.V.

- January 2022 - TDK Corporation announced the availability of the InvenSense ICM-45xxx SmartMotion ultra-high-performance (UHP) family of 6-axis MEMS motion sensors. This introduces the on-chip self-calibration, the industry's lowest power consumption, and the world's first BalancedGyro (BG) technology.

- April 2021 - Honeywell launched a new series of MEMS-based miniature inertial measurement units that are ruggedized to offer best-in-class accuracy and durability to survive high-shock environments. Roughly the size of a water bottle cap, the new HG1125 and HG1126 inertial measurement units (IMUs) are low-cost and serve both commercial and military applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of the impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Emerging Applications (IoT Devices, Robotic Cars, etc.)

- 5.1.2 Increasing Adoption of Low-cost MEMS-based IMUs

- 5.2 Market Restraints

- 5.2.1 Keeping Pace with the Changing Consumer Demand

6 MARKET SEGMENTATION

- 6.1 End-user Industry

- 6.1.1 Consumer

- 6.1.2 Automotive

- 6.1.3 Medical

- 6.1.4 Aerospace & Defense

- 6.1.5 Industrial

- 6.1.6 Others End-user Industries

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Analog Devices Inc.

- 7.1.3 TDK Corporation

- 7.1.4 Bosch Sensortec GmbH

- 7.1.5 STMicroelectronics N.V.

- 7.1.6 Xsens Technologies B.V.

- 7.1.7 NXP Semiconductors N.V.

- 7.1.8 Sensonor AS

- 7.1.9 Northrop Grumman LITEF GmbH

- 7.1.10 Silicon Sensing Systems Limited

- 7.1.11 Murata Manufacturing Co. Ltd

- 7.1.12 MEMSIC Inc.