|

|

市場調査レポート

商品コード

1190788

酸化エチレン市場- 成長、動向、予測(2023年-2028年)Ethylene Oxide Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 酸化エチレン市場- 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年01月18日

発行: Mordor Intelligence

ページ情報: 英文 160 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

酸化エチレン市場は、予測期間中にCAGR3%強の成長が見込まれます。

2020年、市場はCOVID-19の悪影響を受けました。世界の美容・パーソナルケア業界は、COVID-19の大流行により大きな影響を受けています。業界は手指消毒剤と洗浄剤の生産に従事するために再編されたもの、しかし、売上高の落ち込みは著しいです。2021年に業界の需要は回復し、今後数年間は緩やかな成長率で推移すると思われます。

主なハイライト

- 短期的には、飲食品業界におけるPETの使用量の増加、新興国での家庭用品やパーソナルケア製品の需要増加、不凍剤の需要拡大などが市場を牽引する主な要因となっています。

- しかし、高暴露による健康や環境への影響が市場成長の妨げになる可能性があります。

- 生産に石油由来のエチレンよりもバイオ由来のエチレンを使用することは、調査した市場にとって機会として作用する可能性があります。

- アジア太平洋地域は、予測期間中、最も高い市場シェアと最も速い成長を示すと予想されます。

主な市場動向

繊維産業からの需要増加

- 繊維産業は酸化エチレンの主要なエンドユーザーです。酸化エチレン誘導体は、さまざまな天然繊維や合成繊維の処理、耐久性のあるプレス、スパンデックス繊維の光安定化、ウールの防縮、静電気防止、防虫など、特定の化合物の前駆体として使用されているからです。

- インド、中国、米国は、世界の主要な繊維製造国です。需要の増加、投資の拡大、インフラ設備の改善により、この分野での需要は予測期間中に増加すると思われます。

- 2022年5月、インドではデリーのNIFTに革新的な生地やアパレルを生産するCenter of Excellence for Khadi(CoEK)が発足しました。新しいデザインを導入し、国際基準を採用することで、国内外の消費者のニーズを満たすことを目的としています。

- 中国は世界最大の繊維製品の生産国・輸出国の一つです。2022年10月、中国の繊維生産量は31億8000万メートルだっています。

- 米国はEUに1,803.93百万米ドル相当の繊維・アパレル製品を輸出し、ASEAN諸国への輸出は2022年1月から2022年10月までで509.86百万米ドル相当でした。

- したがって、上記のすべての要因は、予測期間中に市場成長に大きな影響を示すと予想されます。

アジア太平洋地域が市場を独占する

- 現在、酸化エチレンの世界市場を独占しているのはアジア太平洋地域です。アジア太平洋地域における酸化エチレンおよびその誘導体の主な消費量は中国が占めています。

- また、アジア太平洋地域は界面活性剤の最大の消費地であり、生産地でもあります。生産量は非常に高い水準に達しており、米国などの先進国への化粧品やパーソナルケア製品の輸出の主要拠点となっています。

- 中国の繊維産業は主要産業の一つであり、全世界で最大の衣料品輸出国となっています。2022年上半期の繊維・衣料品の輸出額は前年比10%増となっています。

- 中国はPET樹脂の主要生産国であり、ペトロチャイナグループと江蘇相方翔は200万トン以上の生産能力を持ち、量的に世界最大のメーカーの一つです。このように、エンドユーザー産業からのPET需要の高まりが、酸化エチレンの需要を促進しています。

- また、この地域は世界最大の自動車製造拠点であり、世界の約60%のシェアを記録しています。OICAによると、2021年の自動車生産台数は2,608万台となり、前年比3%増となりました。

- アマゾンインディアは、インド・マニプール州の織物職人の発展を促進するため、2022年6月にマニプール手織機・手工芸品開発公社とMoUを締結しました。

- したがって、上記の要因によって、アジア太平洋は予測期間中に最も高い市場シェアを示す可能性があります。

競合情勢

酸化エチレン市場は、部分的に統合された性質を持っています。市場の主要なプレーヤーには、Shell plc、China Petrochemical Corporation、Dow、SABIC、BASF SEが含まれます(順不同)。

その他の特典

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

目次

第1章 イントロダクション

- 調査の前提条件

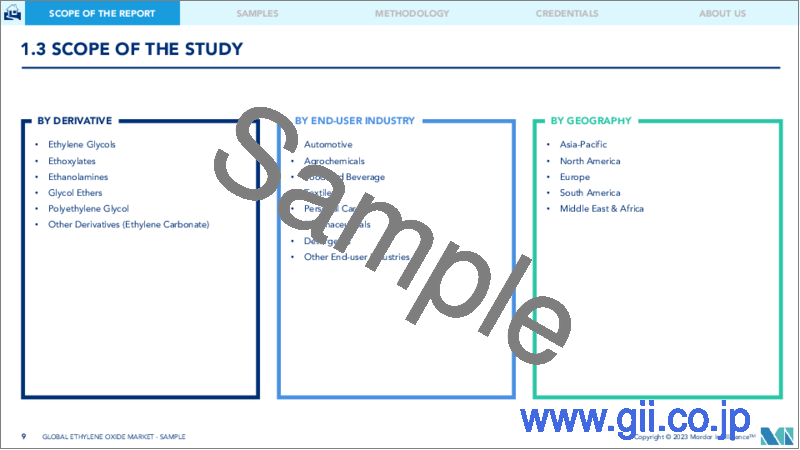

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 飲食品産業におけるPETの使用量増加

- 新興国における家庭用品・パーソナルケア用品の需要増加

- 抑制要因

- 高濃度曝露による健康・環境への影響

- 産業バリューチェーン分析

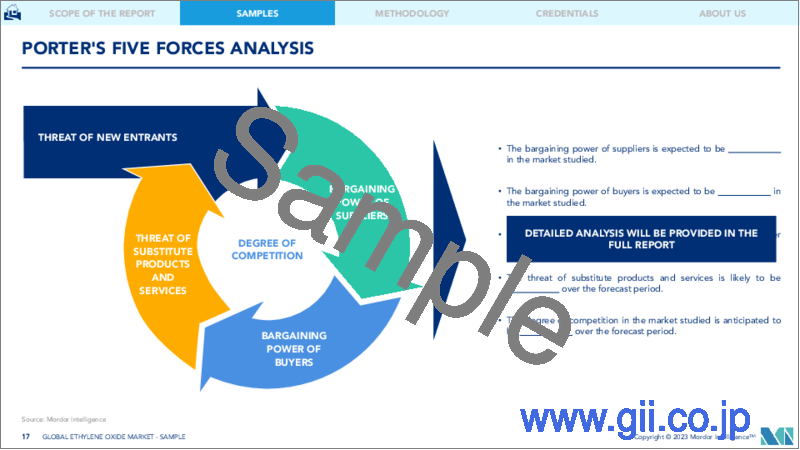

- ポーターファイブフォース

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の度合い

第5章 市場セグメンテーション(市場規模(数量ベース)

- 誘導体

- エチレングリコール

- モノエチレングリコール(MEG)

- ジエチレングリコール(DEG)

- トリエチレングリコール(TEG)

- エトキシレート

- エタノールアミン

- グリコールエーテル類

- ポリエチレングリコール

- その他の誘導体

- エチレングリコール

- エンドユーザー産業

- 自動車

- 農薬

- 飲料食品

- 繊維

- パーソナルケア

- 医薬

- 洗浄剤

- その他のエンドユーザー産業

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

- 中東・アフリカ地域

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- M&A、ジョイントベンチャー、コラボレーション、契約

- 市場ランキング分析

- リーディングプレイヤーが採用する戦略

- 企業プロファイル

- BASF SE

- China Petrochemical Corporation

- Clariant

- Dow

- India Glycols Limited.

- INEOS

- LOTTE Chemical Corporation.

- LyondellBasell Industries Holdings B.V.

- NIPPON SHOKUBAI CO., LTD.

- Reliance Industries Limited.

- Shell plc

- SABIC

- Sasol

第7章 市場機会と将来動向

- 石油由来エチレンに対するバイオ由来エチレンの生産用途

The ethylene oxide market is expected to grow with a CAGR of over 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. The global beauty and personal care industry has been significantly affected by the COVID-19 pandemic. Though the industry has restructured itself to engage in the production of hand sanitizers and cleaning agents, however, the drop in sales has been significant. The demand from the industry has recovered in 2021 and is likely to grow at a moderate rate in the coming years.

Key Highlights

- Over the short term, the major factors driving the market are the growing usage of PET in the food and beverage industry, increasing demand for household and personal care products in developing countries, and growing demand for antifreeze agents.

- However, the health and environmental effects of high exposure can hinder market growth.

- Using bio-derived ethylene over petro-based ethylene for production can act as an opportunity for the market studied.

- The Asia-Pacific region is expected to witness the highest market share and fastest growth during the forecast period.

Key Market Trends

Increasing Demand from the Textile Industry

- The textile industry is a major end-user industry for ethylene oxide as the derivatives are used for the treatment of a wide variety of natural and synthetic fibers, as precursors for certain compounds providing durable press, light stabilization of spandex fibers, shrink-proofing wool, static prevention, and mothproofing, among others.

- India, China, and United States represent major textile manufacturing countries in the world. With rising demand, growing investments, and improved infrastructure facilities, the demand from the sector is likely to increase in the forecast period.

- In May 2022, the Center of Excellence for Khadi (CoEK) at NIFT in Delhi was inaugurated in India to produce innovative fabrics and apparel. The aim is to meet the needs of both domestic and foreign consumers by introducing new designs and adopting international standards.

- China is one of the largest producers and exporters of textiles in the world. In October 2022, textile production in China was 3.18 billion meters.

- United States exported USD 1,803.93 Million worth of textiles and apparel to the European Union while the exports to the ASEAN countries were worth USD 509.86 million from January 2022 to October 2022.

- Thus, all the above-mentioned factors are expected to show a significant impact on the market growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global ethylene oxide market currently. China accounts for the major consumption of ethylene oxide and its derivatives in the Asia-Pacific region.

- Asia-Pacific has also become the largest consumer and producer of surfactants. The production has reached very high levels, becoming a major hub for the exporting of cosmetics and personal care products to developed nations, such as United States.

- China's textile industry is one of the major industries, and the country is the largest clothing exporter across the world. In the first half of 2022, the export value of textiles and apparel increased by 10% compared to the previous year.

- China is a major producer of PET resins with the PetroChina Group and Jiangsu Sangfangxiang among the largest global manufacturers in terms of volume, with capacities of more than 2 million tons. Thus, the rising demand for PET from end-user industries is driving the demand for ethylene oxide.

- Also, the region is the largest automotive manufacturing hub, registering almost 60% share of the world. According to OICA, in the year 2021, the total production of vehicles stood at 26.08 million units registering an increase of 3% compared to the previous year.

- To encourage the development of weavers and artisans in Manipur, India, Amazon India signed an MoU with Manipur Handloom and Handicrafts Development Corporation Limited in June 2022.

- Hence, owing to the above-mentioned factors, Asia-Pacific is likely to witness the highest market share during the forecast period.

Competitive Landscape

The ethylene oxide market is partially consolidated in nature. Some of the key players in the market include Shell plc, China Petrochemical Corporation, Dow, SABIC, and BASF SE (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of PET in the Food and Beverage Industry

- 4.1.2 Increasing Demand for Household and Personal Care Products in the Developing Countries

- 4.2 Restraints

- 4.2.1 Health and Environmental Effects over High Exposure

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Derivative

- 5.1.1 Ethylene Glycols

- 5.1.1.1 Monoethylene Glycol (MEG)

- 5.1.1.2 Diethylene Glycol (DEG)

- 5.1.1.3 Triethylene Glycol (TEG)

- 5.1.2 Ethoxylates

- 5.1.3 Ethanolamines

- 5.1.4 Glycol Ethers

- 5.1.5 Polyethylene Glycol

- 5.1.6 Other Derivatives

- 5.1.1 Ethylene Glycols

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Agrochemicals

- 5.2.3 Food and Beverage

- 5.2.4 Textile

- 5.2.5 Personal Care

- 5.2.6 Pharmaceuticals

- 5.2.7 Detergents

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 China Petrochemical Corporation

- 6.4.3 Clariant

- 6.4.4 Dow

- 6.4.5 India Glycols Limited.

- 6.4.6 INEOS

- 6.4.7 LOTTE Chemical Corporation.

- 6.4.8 LyondellBasell Industries Holdings B.V.

- 6.4.9 NIPPON SHOKUBAI CO., LTD.

- 6.4.10 Reliance Industries Limited.

- 6.4.11 Shell plc

- 6.4.12 SABIC

- 6.4.13 Sasol

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage of Bio-derived Ethylene over Petro-based Ethylene for Production