|

市場調査レポート

商品コード

1689689

バイオエネルギー- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Bioenergy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| バイオエネルギー- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 200 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

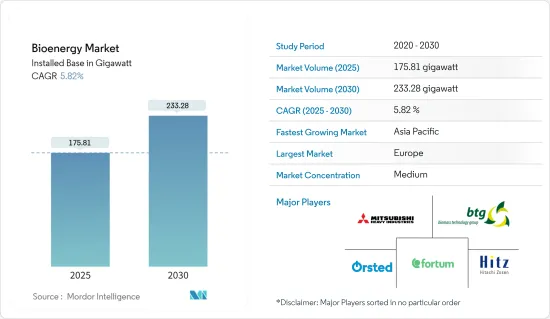

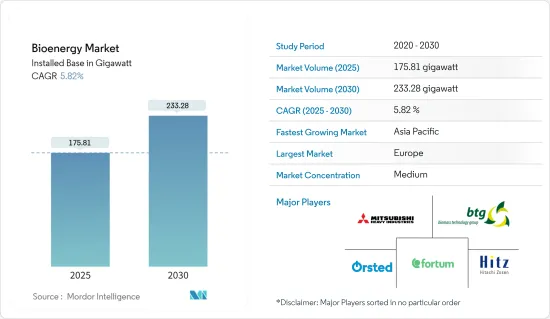

バイオエネルギー市場の設置ベース規模は、2025年の175.81ギガワットから2030年には233.28ギガワットに拡大し、予測期間(2025~2030年)のCAGRは5.82%と予測されます。

主要ハイライト

- 中期的には、バイオエネルギーへの投資の増加、バイオエネルギー施設からの発電コストの低下といった要因が、予測期間中の市場を牽引すると予想されます。

- 一方、プラント設立のための初期投資が高いことが、市場成長の妨げになる可能性があります。設置費用と運転費用を賄うためには、プラントの生産量が十分かつ安定していなければならないです。

- 廃棄物の生物学的処理におけるドイツの最近の技術革新であるデンドロ・リキッドエネルギー(DLE)のような新しい廃棄物エネルギー技術は、「廃棄物ゼロ」技術に近く、バイオエネルギーセグメントで高い可能性を示しています。

- 欧州が世界市場の大半を占めると予想され、需要の大半はノルウェー、ドイツ、英国などの国々からもたらされます。

バイオエネルギー市場動向

バイオマスが市場を独占する見込み

- バイオエネルギーは、木材や糞尿のような化学エネルギーを蓄積した有機物として特徴付けられる生物由来のエネルギーです。

- 国際エネルギー協会によると、現代のバイオエネルギーは世界最大の再生可能エネルギー源であり、再生可能エネルギーの55%、世界のエネルギー供給の6%以上を占めています。現代バイオエネルギーの導入は、2010~2021年の間に年平均約7%増加し、増加傾向にあります。

- 国際再生可能エネルギー協会(International Renewable Association)によると、2022年の世界のバイオエネルギー設備容量は約1億4,890万kWで、2021年から5%増加しました。

- バイオマスの供給源は、木質燃料、林業残渣、木炭、ペレット、農作物や残渣、都市廃棄物や産業廃棄物、バイオガス、バイオ燃料など様々です。大まかには、林業、農業、廃棄物の3部門に分類されます。

- 2023年6月、インド政府はサステイナブルエネルギーの実践を促進するためのイニシアチブをとり、電力省はバイオマス混焼施策の改定を発表しました。この改正により、発電所はバイオマスペレットを基準価格で購入できるようになり、輸入依存度が下がり、再生可能エネルギーとしてのバイオマスの導入が促進されます。

- 2023年6月、エネルギー情報局(EIA)が収集したデータによると、2023年3月に米国の高密度バイオマス燃料の総設備容量は1,336万トンに達し、その全設備容量が現在稼働中または一時的に稼働していないと記載されています。その内訳は、東部で196万トン、南部で1,051万トン、西部で88万4,200トンです。

- したがって、世界的に再生可能エネルギー発電の需要が増加していることから、バイオマス発電は予測期間中に大きな成長率を示すと予想されます。

欧州が市場を独占する見込み

- バイオエネルギーは、2030年の再生可能エネルギー目標達成に向け、今後10年間も重要な役割を果たすと予想されています。そのため、欧州連合(EU)加盟国は、国家再生可能エネルギー行動計画(NREAP)にバイオエネルギーの選択肢を組み込んでいます。

- バイオマスは不可欠な再生可能エネルギー源であり、2030年までにEUのエネルギーミックスに占める再生可能エネルギーの割合を45%にするという、2030年までの欧州の再生可能エネルギー目標達成のための重要な要素です。

- バイオエネルギーは、2022年の欧州の再生可能エネルギー設備容量の5.8%を占めます。ドイツは、2023年には総設備容量の6.7%をバイオエネルギーが占めると予想されています。

- 2023年6月、スペインのエネルギー省は、2030年のバイオガスとグリーン水素の生産目標を倍増する計画を発表しました。改訂された計画では、2030年の電解槽の目標を従来の4GWから11GWに、バイオガスの生産量を20テラワット時(TWh)に設定しています。

- ドイツはバイオエネルギーの重要な担い手のひとつであり、バイオエネルギーの生産能力を絶えず拡大しています。2023年2月、バイオガスプラントの設計・建設・運営を専門とするドイツのBioEnergyは、BlueHills Capital Projects(Pty)Limitedから、マラウイ中央部のンコタコタ地区に56MWelのバイオガスプラントを建設する契約を獲得しました。このバイオガスプラントには、周辺の農園から採れるネピアグラスが供給されます。

- さらに、イタリアのような国々が、この地域のバイオエネルギーセグメントの成長を支援する可能性が高いです。2023年6月、Enterraはイタリアのバイオマス発電所向けに、UniCreditから3,800万米ドルのプロジェクト融資を受けました。アプリア州南部のフォッジャに位置する13MWのプラントは、バイオマスから電気エネルギーと熱エネルギーを生産します。

- したがって、今後予定されているプロジェクトと、今後数年間でカーボンニュートラル環境を達成するという目標により、この地域は予測期間中優位を占めると予想されます。

バイオエネルギー産業概要

バイオエネルギー市場は半セグメント化しています。同市場の主要企業(順不同)には、Mitsubishi Heavy Industries Ltd、Hitachi Zosen Corp.、BTG Biomass Technology Group、Babcock & Wilcox Volund AS、Biomass Engineering Ltd.、Orsted ASなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場概要

- イントロダクション

- 2028年までのバイオエネルギー設備容量の歴史的推移と予測

- 最近の動向と開発

- 政府の規制と施策

- 市場力学

- 促進要因

- 再生可能エネルギーへのシフト

- バイオエネルギーによる発電コストの低減

- 抑制要因

- 高い初期投資

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- 固体バイオマス

- バイオガス

- 再生可能廃棄物

- その他

- 技術

- ガス化

- 高速熱分解

- 発酵

- その他

- 市場分析:地域別(2028年までの市場規模・需要予測(地域別))

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- カタール

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 企業プロファイル

- Mitsubishi Heavy Industries Ltd

- MVV Energie AG

- A2A SpA

- Hitachi Zosen Corp.

- BTG Biomass Technology Group

- Babcock & Wilcox Volund AS

- Biomass Engineering Ltd

- Orsted AS

- Enerkem

- Fortum Oyj

第7章 市場機会と今後の動向

- 先端技術

目次

Product Code: 67322

The Bioenergy Market size in terms of installed base is expected to grow from 175.81 gigawatt in 2025 to 233.28 gigawatt by 2030, at a CAGR of 5.82% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing investments in bioenergy, and declining electricity generation costs from bioenergy facilities are expected to drive the market during the forecast period.

- On the other hand, the high initial investment for establishing plants may resist market growth. The plant output must be sufficient and consistent to cover the installation and operating costs.

- Nevertheless, Emerging waste-to-energy technologies, such as Dendro Liquid Energy (DLE), a recent German innovation in the biological treatment of waste, present high potential in the bioenergy field, being close to 'zero-waste' technology.

- Europe is expected to dominate the world's market, with most of the demand coming from countries such as Norway, Germany, and the United Kingdom.

Bioenergy Market Trends

Biomass is Expected to Dominate the Market

- Bioenergy is energy derived from biological materials characterized as organic materials with stored chemical energy like wood and manure.

- According to Internation Energy Association, Modern bioenergy is the largest renewable energy source globally, accounting for 55% of renewable energy and over 6% of the global energy supply. The adoption of modern bioenergy has increased on average by about 7% per year between 2010 and 2021 and is on an upward trend.

- According to the International Renewable Association, in 2022, the global installed capacity for bioenergy accounted for about 148.9 GW, with a 5% increase from 2021.

- Biomass supply comes from various feedstock - wood fuel, forestry residues, charcoal, pellets, agriculture crops and residues, municipal and industrial waste, biogas, biofuels, etc. Broadly, the supply can be classified into three main sectors - forestry, agriculture, and waste.

- In June 2023, the Indian government took the initiative to promote sustainable energy practices, and the Ministry of Power announced the revision of the biomass co-firing policy. This revision will enable power plants to purchase biomass pellets at benchmark prices, reducing import dependencies and enhancing the adoption of biomass as a renewable energy source.

- In June 2023, data gathered by the Energy Information Administration (EIA) showed that the total United States densified biomass fuel capacity reached 13.36 million tons in March 2023, with all of that capacity listed as currently operating or temporarily not in operation. Capacity included 1.96 million tons in the East, 10.51 million in the South, and 884,200 tons in the West.

- Therefore, with the increasing demand for renewable energy sources worldwide, biomass-based electricity generation is expected to witness a significant growth rate during the forecast period.

Europe is Expected to Dominate the Market

- Bioenergy is expected to remain crucial over the next decade to reach renewable energy targets in 2030. Hence, the European Union (EU) member states incorporated the bioenergy option in their National Renewable Energy Action Plans (NREAPs).

- Biomass is an essential renewable energy source and is a key factor in reaching the European renewable energy target by 2030, where the target for the share of renewables in the EU energy mix to 45% by 2030

- Bioenergy contributed to 5.8% of the total renewable energy installed capacity in Europe in 2022. Germany is expected to have 6.7% of its total installed capacity from bioenergy in 2023.

- In June 2023, the Energy Ministry of Spain announced plans to double its 2030 biogas and green hydrogen production targets. The revised plan sets a 2030 target of 11 gigawatts (GW) of electrolyzers, up from a previous target of 4 GW and biogas production to 20 terawatt hours (TWh).

- Germany is one of the crucial players in bioenergy, and the country is constantly expanding its bioenergy capacity. In February 2023, BioEnergy Germany company, which specializes in the design, construction, and operation of biogas plants, secured a contract for the construction of a 56 MWel biogas plant in Nkhotakota District in the Central Region of Malawi by BlueHills Capital Projects (Pty) Limited. The biogas plant will be fed with Napier grass from the surrounding plantations.

- Further, countries like Italy are likely to support the region's growth in the bioenergy sector. In June 2023, Enterra secured USD 38 million in project financing from UniCredit for a biomass plant in Italy. Located in Foggia in the southern region of Apulia, the 13 MW plant produces electric and thermal energy from biomass.

- Hence, with the upcoming projects and the targets to achieve a carbon-neutral environment during the upcoming years, the region is expected to have dominancy during the forecast period.

Bioenergy Industry Overview

The bioenergy market is semi fragmented. Some of the major players in the market (in no particular order) include Mitsubishi Heavy Industries Ltd, Hitachi Zosen Corp., BTG Biomass Technology Group, Babcock & Wilcox Volund AS, Biomass Engineering Ltd., and Orsted AS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Bioenergy Installed Capacity Historic and Forecast, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Shift towards Renewable Energy

- 4.5.1.2 Less Electricity Generation Cost from Bioenergy

- 4.5.2 Restraints

- 4.5.2.1 High Initial Investments

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solid Biomass

- 5.1.2 Biogas

- 5.1.3 Renewable Waste

- 5.1.4 Other Types

- 5.2 Technology

- 5.2.1 Gasification

- 5.2.2 Fast Pyrolysis

- 5.2.3 Fermentation

- 5.2.4 Other Technologies

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Heavy Industries Ltd

- 6.3.2 MVV Energie AG

- 6.3.3 A2A SpA

- 6.3.4 Hitachi Zosen Corp.

- 6.3.5 BTG Biomass Technology Group

- 6.3.6 Babcock & Wilcox Volund AS

- 6.3.7 Biomass Engineering Ltd

- 6.3.8 Orsted AS

- 6.3.9 Enerkem

- 6.3.10 Fortum Oyj

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advanced Technologies