|

市場調査レポート

商品コード

1690073

自動車用音響材料:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Automotive Acoustic Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用音響材料:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

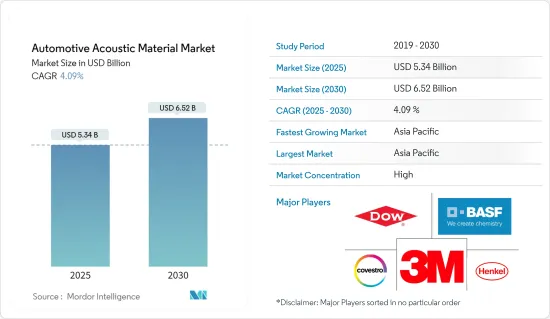

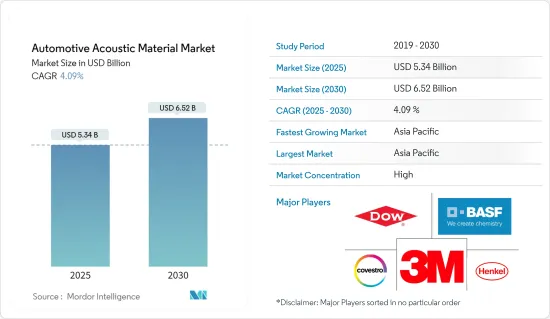

自動車用音響材料の市場規模は2025年に53億4,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは4.09%で、2030年には65億2,000万米ドルに達すると予測されます。

COVID-19の大流行による早期の供給と生産の中断に続いて、自動車業界は需要ショックを受けており、回復期間は未知数です。一部のOEMは、固定費を最小限に抑える余裕がないため、流動性収入が乏しいです。時価総額の不足と統合がかなりの期間続き、新たな投資を獲得しなければ、一部のプレーヤーは廃業する危険性があるため、パワーが低下しています。

自動車の内装は、カスタマイズや自律走行といった動向の結果、変化しつつあります。業界各社は、数々の革新的な機能を盛り込んだ自動車内装のデザイン開発に懸命に取り組んでいます。

カーアコースティックスは、現在の自動車の品質要素として徐々に人気を集めており、自動車メーカーも大きな関心を示しています。クルマの販売において、乗員の快適性は最優先事項のひとつに挙げられています。コンポーネントは、最適な快適性を提供しながら、可能な限り小さなスペースを占有しなければならないです。そのため、この分野では絶え間ない進歩が続いています。

エンジンカバーやダッシュインシュレーターなど、走行時に振動を受ける部品に多く使用されるため、自動車用音響材料のアフターマーケットは拡大が見込まれています。スポーツカーや高級車の需要が増え続けていることや、改造されたアンティークカーの人気が高まっていることが、自動車用音響材料の大きな市場を開く可能性があります。

景気の減速に加え、音響材料などの輸入にかかる税金やCOVID-19の流行が市場拡大の妨げになると予測されます。一方、音響材料の価格変動や環境問題による電気自動車需要の増加が業界を牽引すると予想されます。

自動車用音響材料市場の動向

プレミアムカーへの需要の高まり

高級車への需要が高まる中、高級感と快適性はメーカーにとって重要な焦点となっています。主な目標は、自動車の音を許容範囲内に抑えることです。このような騒音規制は、自動車音響システムにより大きな注意を払う必要があります。その結果、自動車用音響材料の市場は今後数年間で成長すると予想されます。

自動車用音響材料はインテリアの外観を整え、車室内の騒音、振動、ハーシュネス(NVH)を最小限に抑えるため、プレミアムカーの拡大が自動車用音響材料の需要を世界的に押し上げる可能性が高いです。

取り付けが簡単で、車内の空洞を完全に埋めることができる自動車用吸音材の登場は、自動車用吸音材市場の需要を高めると予測されています。政府による公共交通機関への投資は、自動車用音響材料の需要を押し上げると予想されます。

騒音吸収レベルを向上させるためのメーカーによる恒常的な研究開発費の増加が、自動車用音響材料市場を牽引しています。低周波音を吸収する能力を持つ複合材料が人気を集めています。さらに、自動車の内外装の外観のために優れた色仕上げを提供することへのメーカーの注目は、予測期間を通じて市場の成長に寄与すると予想されます。

多くのメーカーが研究開発に投資し、特性を強化した材料を開発しています。例えば

- 2021年11月、Autoneumはフェルトベースの新技術Flexi-Loftを発表しました。Flexi-Loftは再生綿と機能性繊維の独自のブレンドにより、製品の重量を軽減し、複雑な形状にも正確に適応できます。オートネウムはすでに、プライム・ライト技術に基づく様々なカーペット、インナーダッシュ、その他の音響部品の断熱材として、フレキシロフトを世界中で使用しています。

アジア太平洋地域が主要市場シェアを獲得

アジア太平洋地域が音響材料の最大市場として浮上しています。2021年の世界自動車生産台数はアジア太平洋地域が最大を占めました。同地域は、自動車用音響材料の数量および金額で最大の市場になると推定されます。同地域の膨大な自動車生産台数は、音響材料市場に多大な成長機会を提供しています。

中国は世界最大の自動車市場です。しかし、ここ数年、販売台数が減少しています。中国汽車工業協会(CAAM)の発表によると、世界最大の自動車市場における12月の販売台数は前年同月比3.8%増となり、2021年の総販売台数は2,628万台となりました。

ここ数年、中国ではさまざまな企業が生産施設を拡張し、新たな施設を開設しています。例えば:

- 2021年10月、ダイムラーは北京に新しい「ダイムラーR&Dテックセンター中国」を正式に開設しました。総投資額は11億人民元で、R&Dテックセンターの総床面積は55,000m2です。試験棟には、eDriveラボ、充電ラボ、揮発性有機化合物(VOC)ラボ、シャシーラボ、騒音・振動・ハーシュネス(NVH)ラボ、エンジンラボ、環境ラボの7つの試験施設があります。新しい試験棟は、同時に300台以上の試験車両を収容できます。

欧州は乗用車市場、特にプレミアムカー市場において第2位の市場です。プレミアムカーの販売は予測期間中に直線的な伸びを示すと予測されており、それによって欧州の音響材料需要が増加しています。

自動車用音響材料産業の概要

市場競争は激化しており、各社は新たな戦略的パートナーシップを結び、研究開発プロジェクトに多額の投資を行い、ライバルに差をつけるために新製品を市場に投入しています。例えば

- 2021年3月、帝人株式会社は、同社のポリエステル三次元成形吸音材がトヨタ自動車の燃料電池車(FCV)"MIRAI "に採用されたと発表しました。FCスタック内で水素と空気を化学反応させ、発生した水をFCスタックやドレンパイプから車外に排出する際の騒音を低減する素材として使用されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 材料

- ポリウレタン

- テキスタイル

- ガラス繊維

- その他の材料

- 車両タイプ

- 乗用車

- 商用車

- 用途

- ボンネットライナー

- ドアトリム

- その他の用途

- 地域

- 北米

- 米国

- カナダ

- その他北米

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州

- アジア太平洋

- インド

- 中国

- 日本

- 韓国

- その他アジア太平洋地域

- 世界のその他の地域

- ブラジル

- アラブ首長国連邦

- その他の国

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Dow Chemicals

- 3M Acoustics

- BASF SE

- Covestro

- Henkel Adhesive Technologies

- Lyondellbasell

- Sumitomo Riko

- Sika

- Toray Industries

- Huntsman

- Freudenberg Group

第7章 市場機会と今後の動向

The Automotive Acoustic Material Market size is estimated at USD 5.34 billion in 2025, and is expected to reach USD 6.52 billion by 2030, at a CAGR of 4.09% during the forecast period (2025-2030).

Following early supply and production interruptions as a result of the COVID-19 pandemic, the auto industry is undergoing a demand shock, with an unknown recovery period. Some OEMs have poor liquidity revenues due to a lack of room to minimize fixed expenses. Decreases in power due to a significant period of time of lacking in market capitalization and consolidation and without acquiring fresh investment, some players may risk going out of business.

Vehicle interiors are changing as a result of trends like customization and autonomous driving, in which the driver is increasingly becoming a passenger. Industry players are hard at work developing designs for car interiors that include a number of innovative features.

Car acoustics is slowly gaining popularity as a quality factor in current automobiles, and automakers are expressing a lot of interest in it. Passenger comfort has risen to the top of the priority list when it comes to selling a car. Components must occupy as little space as possible while providing optimal comfort. As a result, continuous progress is being made in this area.

Since they are used in numerous components such as the engine cover, dash insulator, and other components that are regularly vibrated when the car is driving, the aftermarket for automotive acoustic materials is expected to expand. The ever-increasing demand for sports and luxury vehicles and the growing popularity of modified antique cars may open up a large market for automotive acoustic materials.

The slowing economy, combined with taxes on importing acoustic materials and other items, and the COVID-19 pandemic are projected to hinder the market's expansion. On the other hand, price fluctuations in acoustic materials and the increased demand for electric vehicles due to environmental concerns are expected to drive the industry.

Automotive Acoustic Material Market Trends

Growing Demand for Premium Cars

Luxury and comfort have been a significant focus area for manufacturers, as the demand for premium cars has grown. The primary goal is to keep the vehicle's sound within acceptable limits. These noise restrictions need greater attention in the automobile acoustic system. As a result, the market for automotive acoustic materials is expected to grow in the future years.

As automotive acoustic materials provide the interior appearance and minimize noise, vibration, and harshness (NVH) in the cabin, the expansion of the premium cars is likely to fuel the demand for automotive acoustic materials globally.

The advent of automotive acoustic materials that are easy to install and extend to completely fill interior cavities in vehicles is projected to enhance the demand in the automotive acoustic material market. The government's investment in public transportation is expected to boost the demand for vehicle acoustic materials.

The growth in constant R&D spending by manufacturers to enhance noise-absorbing levels is driving the automotive acoustic materials market. Composite materials with the ability to absorb low-frequency sounds are gaining popularity. Furthermore, manufacturers' attention to providing exceptional color finishes for the interior and exterior appearance of cars is expected to contribute to market growth throughout the forecast period.

Many manufacturers are investing in R&D to develop materials with enhanced properties. For instance:

- In November 2021, Autoneum announced a new felt-based technology Flexi-Loft, which due to a unique blend of recycled cotton and functional fibers, reduces product weight and allows for accurate adaptation even to complex shapes. Autoneum is already using Flexi-Loft worldwide as an insulator for various carpets, inner dashes, and other acoustic components based on its Prime-Light technology.

Asia-Pacific Captures the Major Market Share

The Asia-Pacific region has emerged as the largest market for acoustic materials. Asia-Pacific accounted for the largest global vehicle production in 2021. The region is estimated to be the largest market for automotive acoustic materials, by volume and value. The huge vehicle production in the region offers a tremendous growth opportunity for the acoustic materials market.

China is the largest automobile market in the world. However, for the past few years, the country has been witnessing a decline in sales. Overall sales in the world's largest auto market increased by 3.8% year-on-year in December, bringing the total sales for 2021 to 26.28 million, according to figures from the China Association of Automobile Manufacturers (CAAM).

In the past few years, the country has seen various companies expanding their production facilities and opening new facilities. For instance:

- In October 2021, Daimler opened its new 'Daimler R&D Tech Center China' officially in Beijing. With a total investment of CNY 1.1 billion, the R&D tech center has a gross floor area of 55,000 m2. The test building is home to seven testing facilities, including an eDrive lab, a charging lab, a volatile organic compounds (VOC) lab, a chassis lab, a noise, vibration and harshness (NVH) lab, an engine lab, and an environmental lab. The new test building can accommodate more than 300 test vehicles at the same time.

Europe is the second-largest market for passenger cars, particularly for premium cars. The sale of premium cars is projected to show linear growth during the forecast period, thereby increasing the demand for acoustic materials in Europe.

Automotive Acoustic Material Industry Overview

The competition in the market is increasing as the companies are making new strategic partnerships, investing majorly in R&D projects, and launching new products in the market to be ahead of their rivals. For instance:

- In March 2021, Teijin Limited announced that its polyester three-dimensional molded sound-absorbing material had been adopted for Toyota Motor Corporation's fuel cell vehicle (FCV) "Mirai." It will be used as a material to reduce noise when hydrogen and air chemically react in the FC stack, and the generated water is discharged from the FC stack or drain pipe outside the vehicle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Polyurethane

- 5.1.2 Textile

- 5.1.3 Fiberglass

- 5.1.4 Other Materials

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Application

- 5.3.1 Bonnet Liner

- 5.3.2 Door Trim

- 5.3.3 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Dow Chemicals

- 6.2.2 3M Acoustics

- 6.2.3 BASF SE

- 6.2.4 Covestro

- 6.2.5 Henkel Adhesive Technologies

- 6.2.6 Lyondellbasell

- 6.2.7 Sumitomo Riko

- 6.2.8 Sika

- 6.2.9 Toray Industries

- 6.2.10 Huntsman

- 6.2.11 Freudenberg Group