|

市場調査レポート

商品コード

1690066

自動車用スマート照明:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Automotive Smart Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用スマート照明:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 142 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

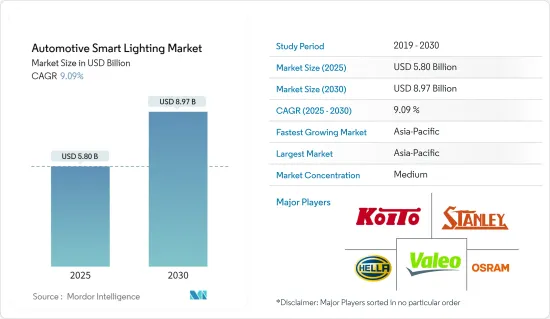

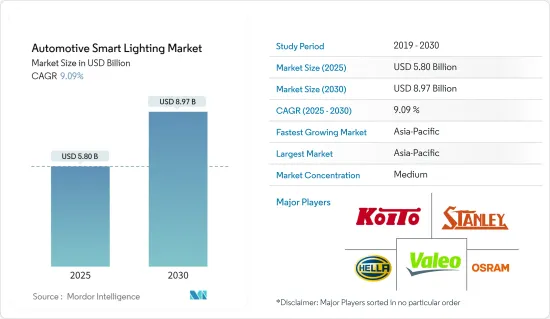

自動車用スマート照明の市場規模は2025年に58億米ドルと推定され、予測期間(2025-2030年)のCAGRは9.09%で、2030年には89億7,000万米ドルに達すると予測されます。

COVID-19のパンデミックは、主に製造活動の停止に起因する市場の研究に害を与えました。景気減速は、照明やその他の製品の輸入に課される関税と相まって、この市場の成長を妨げると予想されます。加えて、外部補助灯に関する各国固有の規制が市場の成長に影響を及ぼす可能性もあります。しかし、2021年には新車や商用車の販売が増加し、オートハイビームヘッドランプ、アクティブヘッドランプ、ジェスチャーコントロール式室内灯などのスマート照明機能を搭載した高級車の需要が増加しました。

LEDライトはハロゲンライトやHIDライトに比べて消費電力が少なく、寿命も長いため、長期的には多くの自動車メーカーがLEDライトを自動車に組み込むことに大きな関心を示しています。さらに、LEDライトは耐久性、強度、高品質を提供します。

自動車メーカーは、主要な照明アプリケーションであるヘッドライトを中心に、新しい照明技術とソリューションの開発に投資しています。OEM各社は、夜間の安全運転を提供するため、アダプティブ・ヘッドライトを搭載した自動車を発売しています。

自動車用スマート照明の研究開発は、電気自動車の普及や販売など、いくつかの大きな要因によって推進されています。それは、電気駆動の範囲を拡大し、既存および今後の自動車から高度な機能を採用することです。さらに、このシナリオは今後も続くと予想されます。

自動車用スマート照明市場で事業を展開している主要企業には、スタンレー・エレクトリック、ヴァレオグループ、オスラム・リヒトAGなどがあります。これらのプレーヤーは、製品ポートフォリオのアップグレードに注力しており、顧客に革新的なソリューションを提供するために新技術に投資しています。

自動車用スマート照明市場の動向

車外照明が自動車用スマート照明市場をリードします。

自動車メーカーと政府は、特に乗用車を中心とした安全運転技術の開発と普及に注力しています。こうした技術の大半は、今後不可欠なものになると予想されます。例えば、カナダ政府は、運転支援技術に関する認知度を高めつつ、すべての車両の安全試験を発表し、自動運転車やコネクテッドカーを配備しました。

国内の事故件数を減らすため、道路交通高速道路省はADAS(先進運転支援システム)を自動車に必須とするよう取り組んでいると発表しました。

アダプティブ・ヘッドライト、ドライバーの眠気注意システム、死角情報システム、車線逸脱警告システム、前方衝突警報などの運転支援システムが同省で検討されていました。したがって、新車にさまざまなADAS機能が搭載されるにつれて、スマート照明技術に対する需要が増加しています。大手企業は、この競争市場で優位に立つため、新たな研究開発施設に投資しています。

2021年7月、Magna International Inc.は、自動車安全技術の大手であるVeoneerInc.を買収する計画を発表しました。この買収により、マグナはADASポートフォリオと業界での地位を強化・拡大することを目指しました。

自動車メーカーは、競争の激しい自動車ビジネスで差別化を図る方法をますます模索しています。それは、新しい外部および内部照明システムのスタイル特性を開発することによって達成されます。さまざまな用途や車種に対してより高い柔軟性と拡張性を提供する新技術により、自動車設計者は独自のスタイル、外観、使用感を確立することができます。

アジア太平洋地域が自動車用スマート照明市場をリードする見通し

アジア太平洋は2021年に世界の主要な自動車生産国・市場のひとつとなり、中国は2021年に約2,628万台を販売しました。中国、インド、日本は、この地域市場の主要経済国であり、世界市場でより速い成長が見込まれています。

近年、中国では高級自動車に対する需要が増加しています。消費習慣の増加と好景気が旺盛な需要に起因していると考えられます。2021年、SERESのAITOブランドは、まったく新しい高級スマートSUVであるWenjie M5を正式に発表しました。同車には3つのバージョンがあり、現在予約注文を受け付けており、価格は250,000元から320,000元となっています。10.4インチ曲面フルLCDダッシュボード、15.6インチ2K HDRインテリジェント・センターコンソール・スクリーン、総面積約2平方メートルのパノラマ・サンルーフ、インテリジェント・インタラクティブ照明、L2+自律走行機能などの特徴を備えています。

運転支援システムや近接センサーと互換性のある自動車照明システムを開発するための研究開発や技術革新に対するメーカーの多額の投資が市場収益を押し上げると予想されます。さらに、交通事故の増加により、車両と乗客の安全に対する懸念が高まり、自動車照明ソリューションの需要を押し上げています。政府や運輸当局による交通安全向上のための厳しい規制が市場の収益を押し上げています。

最近、自動車照明システムに関する2つのGB規格が更新されました。旧規格であるGB 5920-2008はGB 5920-2019(「自動車およびそのトレーラーのフロントおよびリアポジションランプ、エンドアウトラインマーカーランプ、ストップランプの測光特性」)に置き換えられる見通しであり、GB 23255-2009はGB 23255-2019(「動力駆動車の昼間走行ランプの測光特性」)に置き換えられる可能性があります。

豊田合成は2021年12月、自動車の室内を照らすフルカラーLED電球を開発しました。64色のバリエーションからユーザーの気分に合わせて自由に色を調整でき、個人の好みに合わせてさまざまに対応できます。

2021年8月、ZKWは、ダイナミックライティング機能のためのマイクロミラーモジュールを開発し、シリコンオーストリアラボ、Evatec、EVグループ、TDKエレクトロニクスがチームを組んでマイクロミラー技術を搭載し、ヘッドランプ、リアランプ、サイドプロジェクション、光学距離測定用LIDARシステムに使用できます。

2021年8月、起亜はEV6電動クロスオーバーがADAS(先進運転支援システム)を含むクラス最高レベルの安全性と利便性を備えていると発表しました。また、各LEDが独立して点灯する技術であるフロント・ライティング・システム(IFS)を搭載しました。

上記の要因や開発状況を考慮すると、コストの影響が消費者の購買行動に影響を与えることは明らかです。中級カテゴリーは、電気自動車や自律走行車への技術搭載が進むにつれて、コスト要因にさらに影響を与えると思われます。

自動車用スマート照明産業の概要

自動車用スマート照明市場は、小糸製作所、Stanley Electric、Valeo Group、Osram Licht AG、Magneti Marelli SpAといった数社によって適度に統合され、主に支配されています。同市場は、先端技術、センサーの利用拡大、研究開発プロジェクトへの投資拡大、電気自動車や自律走行車の市場拡大といった要因によって大きく牽引されています。主要な自動車用スマート照明メーカーは、将来に向けて新技術を開発し、市場拡大のために小規模プレーヤーを買収しています。例えば

2022年5月、グルーポZKWは、ヘッドライト、フォグランプ、補助ランプを生産するグアナファト州シラオ工場で、1億200万米ドルを投じた第3期拡張工事の最初の石を据えました。年間150万個のヘッドライトを生産する能力を持つ予定の15,700平方メートルの拡張工事では、ZKWはBMW、フォード、GMのEVおよびSUV用のヘッドライトとセンターバーランプを製造します。

2021年4月、フォードは、ドライバーから発見される前にビームを次のコーナーに導き、危険や他の道路利用者をより迅速かつ効果的に照らす予測型スマート・ヘッドライト・システムを開発したと発表しました。プロトタイプの先進照明システムは、GPS位置データ、先進技術、高精度の道路形状情報を使用して、前方の道路の曲がり角を正確に識別します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 自動車タイプ別

- 乗用車

- 商用車

- 用途タイプ別

- 室内照明

- 車外照明

- 技術タイプ別

- ハロゲン

- キセノン

- LED

- その他の技術

- 地域別

- 北米

- 米国

- カナダ

- その他北米

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州

- アジア太平洋

- インド

- 中国

- 日本

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- その他中東とアフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Koito Manufacturing Co. Ltd

- Stanley Electric Co. Ltd

- Valeo Group

- OsRam Licht AG

- Magneti Marelli SpA

- HELLA KGaA Hueck & Co.

- Hyundai Mobis

- Mitsuba Corporation

- Lumax Industries

- Koninklijke Philips NV

第7章 市場機会と今後の動向

The Automotive Smart Lighting Market size is estimated at USD 5.80 billion in 2025, and is expected to reach USD 8.97 billion by 2030, at a CAGR of 9.09% during the forecast period (2025-2030).

The COVID-19 pandemic harmed the market studied, primarily attributed to halted manufacturing activities. The economic slowdown, coupled with the tariffs imposed on importing lights and other products, is expected to hamper the growth of this market. In addition, country-specific regulations for external auxiliary lights may affect the market's growth. However, with new car and commercial vehicle sales increasing in 2021, the demand for luxury cars with smart lighting features such as auto high-beam headlamps, active headlamps, and gesture-controlled interior lights increased demand for luxury cars with smart lighting features such as auto demand for smart lighting increased.

Over the long term, many vehicle manufacturers show great interest in integrating LED lights into their vehicles, as these lights use less power and have a longer lifespan than halogen and HID lights. Furthermore, LED lights offer durability, strength, and high quality.

The automotive manufacturers are investing in developing new lighting technologies and solutions focusing on the major lighting application, headlights. OEMs are launching vehicles with adaptive headlights to provide a safe driving experience at night.

A few major factors drive the research and development in automotive smart lighting, such as the adoption and sales of electric vehicles. It is to extend the range of electric drives and adopt advanced features from existing and upcoming vehicles. Moreover, this scenario is expected to continue in the future.

Some major players operating in the automotive smart lighting market are Stanley Electric Co. Ltd, ValeoGroup, Osram Licht AG, and others. These players are focusing on upgrading their product portfolio and are investing in new technologies to offer innovative solutions to their customers.

Automotive Smart Lighting Market Trends

Exterior lightening will lead the automotive smart lighting market.

Automobile manufacturers and governments focus on developing and promoting safe driving technologies, especially passenger vehicles. Most of those technologies are expected to become essential. For instance, the Canadian government announced the safe testing of every vehicle and deployed automated and connected vehicles while creating awareness regarding driver-assistance technologies.

To lower the number of accidents in the nation, the Ministry of Road Transport and Highways announced that it was working on making ADAS (advanced driver assistance systems) essential for automobiles.

Driver assistance systems, such as adaptive headlights, driver drowsiness attention systems, blind-spot information systems, lane-departure warning systems, forward collision warnings, and others, were under discussion by the ministry. Hence, the demand for smart lighting technology is increasing as new vehicles are loaded with various ADAS features. The major players are investing in new R&D facilities to stay ahead in this competitive market.

In July 2021, Magna International Inc. announced its plans to acquire safety tech major VeoneerInc., a leading player in automotive safety technology. With this acquisition, Magna aimed to strengthen and broaden its ADAS portfolio and industry position.

Automakers are increasingly looking for ways to differentiate themselves in the competitive automotive business. It is accomplished by developing new external and interior lighting system style characteristics. New technologies offering greater flexibility and scalability across several applications and vehicle types allow automotive designers to establish their distinct styles, appearance, and feel.

Asia-Pacific is Anticipated to Lead the Automotive Smart Lighting Market

The Asia-Pacific was among the leading global automobile producers and markets in 2021, and China sold around 26.28 million vehicles in 2021. China, India, and Japan are the major economies in the regional market that are anticipated to grow faster in the global market.

In recent years, China has seen an increase in demand for luxury automobiles. The increased spending habits and booming economy can be attributable to the strong demand. In 2021, the AITO brand of SERES officially released the Wenjie M5, an all-new luxury smart SUV. The vehicle is offered in three versions and is now available for pre-order, with prices ranging from CNY 250,000 to CNY 320,000. The vehicle has features such as a 10.4-inch curved full LCD dashboard, a 15.6-inch 2K HDR intelligent center console screen, a panorama sunroof covering a total area of about 2 square meters, intelligent interactive lighting, and L2+ autonomous driving functions.

Manufacturers' significant investments in research and development and innovation to develop automobile lighting systems compatible with driver assistance systems and proximity sensors are expected to boost market revenue. In addition, the growing number of road accidents has raised concerns regarding vehicle and passenger safety, driving up demand for automobile lighting solutions. Government and transportation authorities' strict restrictions to increase road safety and boost the market's revenue.

Recently, two GB standards regarding automotive lighting systems have been updated. The old standard GB 5920-2008 is expected to be replaced by GB 5920-2019 ("Photometric characteristics of front and rear position lamps, end-outline marker lamps and stop lamps for motor vehicles and their trailers"), and GB 23255-2009 may be superseded by GB 23255-2019 ("Photometric characteristics of daytime running lamps for power-driven vehicles").

In December 2021, Toyoda Gosei Co. Ltd created full-color LED bulbs illuminating automobile interiors. The color may be freely adjusted from 64 variations to meet the user's mood and respond in various ways to individual preferences.

In August 2021, ZKW developed a micromirror module for dynamic lighting function, with Silicon Austrian Labs, Evatec, EV Group, and TDK Electronics joining teams to onboard micromirror technology, which can be used in headlamps, rear lamps, side projection, and LIDAR systems for optical distance measurement.

In August 2021, Kia announced that the EV6 electric crossover was equipped with class-leading levels of safety and convenience, including an advanced suite of driver assistance systems (ADAS). It got Front-lighting System (IFS), a technology that enables each LED to light independently.

Considering the factors mentioned above and developments, it is evident that the impact of cost can influence the purchasing behavior of consumers. The mid-level category will further influence the cost factor with the rising embedment of technology in electric and autonomous vehicles.

Automotive Smart Lighting Industry Overview

The automotive smart lighting market is moderately consolidated and majorly dominated by a few players, such as Koito Manufacturing Co. Ltd, Stanley Electric Co. Ltd, Valeo Group, Osram Licht AG, and Magneti Marelli SpA. The market is highly driven by factors like advanced technology, more use of sensors, growing investment in R&D projects, and a growing market of electric and autonomous vehicles. Major automotive smart lighting manufacturers are developing new technology for the future and acquiring small players to expand their market reach. For instance,

In May 2022, Grupo ZKW laid the first stone of the third phase of a USD 102 million expansion at its Silao, Guanajuato plant that produces headlights, fog lamps, and auxiliary lamps. In the 15,700-square-meter expansion, which is expected to have the capacity to produce 1.5 million headlights per year, ZKW will manufacture headlights and center bar lamps for BMW, Ford, and GM EVs and SUVs.

In April 2021, Ford announced it had developed a predictive smart headlight system that directs beams into upcoming corners even before drivers see them, illuminating hazards and other road users more quickly and effectively. The prototype advanced lighting system uses GPS location data, advanced technologies, and highly accurate street geometry information to accurately identify turns in the road ahead.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Application Type

- 5.2.1 Interior Lighting

- 5.2.2 Exterior Lighting

- 5.3 By Technology Type

- 5.3.1 Halogen

- 5.3.2 Xenon

- 5.3.3 LED

- 5.3.4 Other Technologies

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Koito Manufacturing Co. Ltd

- 6.2.2 Stanley Electric Co. Ltd

- 6.2.3 Valeo Group

- 6.2.4 OsRam Licht AG

- 6.2.5 Magneti Marelli SpA

- 6.2.6 HELLA KGaA Hueck & Co.

- 6.2.7 Hyundai Mobis

- 6.2.8 Mitsuba Corporation

- 6.2.9 Lumax Industries

- 6.2.10 Koninklijke Philips NV