|

市場調査レポート

商品コード

1406096

航空ベースRWS:市場シェア分析、産業動向・統計、成長予測、2024年~2029年Air-based Remote Weapon Stations - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空ベースRWS:市場シェア分析、産業動向・統計、成長予測、2024年~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 80 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

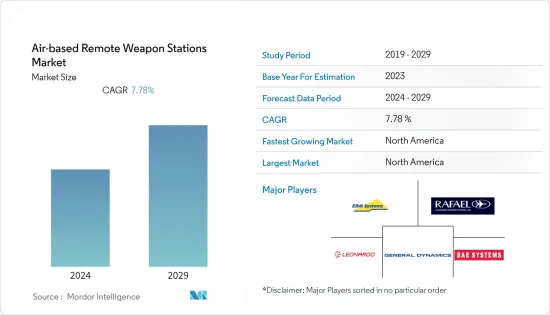

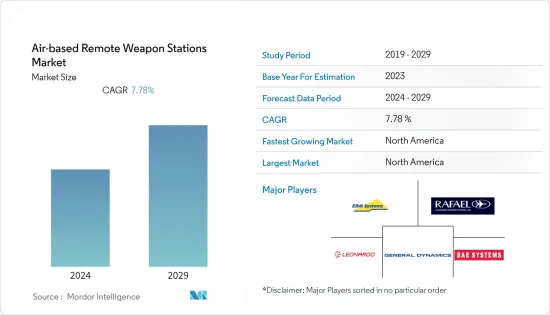

航空ベースRWS市場は、現在のところ34億5,000万米ドルと評価されています。

予測期間中のCAGRは7.78%で、5年後には50億2,000万米ドルに達すると予測されています。

新しい技術とプラットフォームは、米国、ロシア、中国といった国々の戦争戦略を一変させました。これらの諸国は、敵の拠点に深刻な影響を与え、武力衝突の場合に戦術的優位を獲得するのに役立つ、洗練された強力な兵器の開発に力を注いでいます。RWSは、その視覚的優位性と特定の場所への先制攻撃を行う能力により、現在の戦争シナリオで広範囲に使用されています。新しいセンサー技術(視覚システム)や発射システム(指向性エネルギー兵器のような)と統合された先進的な遠隔兵器ステーションの開発に向けた軍や遠隔兵器システムメーカーの投資が増加していることから、今後数年間は市場の成長を後押しすると予想されます。

しかし、ペイロード容量、空力プロファイル、射程距離を損なうことなく、先進機能を製品ポートフォリオに組み込むためにシステムインテグレーターが直面する設計課題が、市場の足かせとなる可能性があります。設計者はまた、完全に運用可能なRWSを開発するために、他のシステムメーカーの高度なオプトロニックセンサーやサブシステムと相互互換性のある高度な統合機能の利用可能性を確保しなければならず、全体的なシステム設計に複雑な見通しを与えています。

航空ベースRWS市場動向

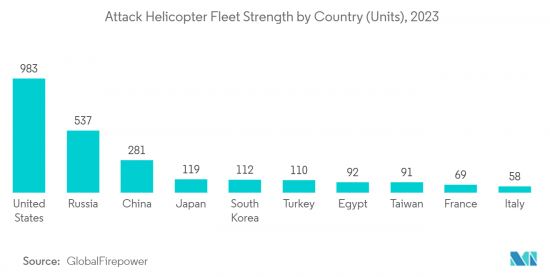

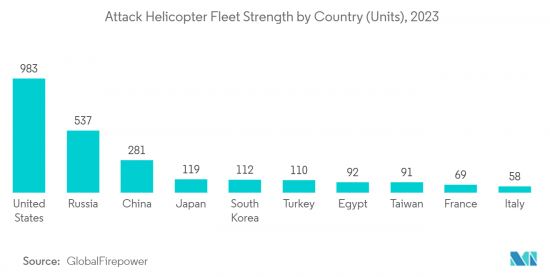

ヘリコプターセグメントが予測期間中に市場を独占する

航空ベースRWSは主にヘリコプターに搭載されます。攻撃ヘリに搭載されるRWSの代表例としては、オートキャノンや機関砲があり、これらは単砲身で回転式です。多くの国が攻撃ヘリ専用機を持っており、さまざまな武装を備えているが、実用ヘリや輸送ヘリにもRWSが装着されています。これらのカスタマイズは、専用の攻撃ヘリコプターを調達する資金がない国々で広く採用されています。サフランの空中兵器システム、ベルUH-1、ヒューイII、212、412機用に設計・生産されたジェネラル・ダイナミクス社のUH-1プランク・モジュラー・ヘリコプター兵器システム、エアバス社のHForceヘリコプター兵器一式、FNハースタル社の空中ピントル・マウント兵器システム。レイセオン・レーザー兵器システムは、現在使用されている遠隔操作兵器システムモデルの一部です。

多くのヘリコプターが、新しく先進的な兵器システムでアップグレードされています。例えば、シコルスキー社はブラック・ホーク・ヘリコプター用の新しい兵器システム後付けキットを開発し、認証を取得しました。開発と認証の段階でテストされた兵器には、固定前方GAU-19やM134砲などが含まれます。2022年10月、米国海軍は13年間使用したMQ-8Bを退役させ、より大型のMQ-8Cに更新しました。さらに、指向性エネルギー兵器のような新しい技術もヘリコプターでテストされています。

北米が予測期間中に市場の著しい成長を示す

緊張と国境紛争が激化する中、北米諸国は最新の戦闘機、ヘリコプター、無人航空機の調達のために年間防衛予算を増やしています。北米では、既存のシステムの戦闘即応性を確保するため、安全保障上の脅威に効果的に対応し、緊急かつ重要で危険な戦略的任務を遂行するために、地域軍の能力を効果的にアップグレードするいくつかの兵器近代化プログラムが現在進行中です。

米国は、北米におけるこのような兵器システムの主要ユーザーであり、現在、既存兵器のアップグレードに注力しています。さらに、米国はこのような装備の重要な世界的輸出国であり、消費国でもあります。イスラエル、ロシア、中国といった潜在的な敵対国が、米軍やその同盟国、パートナーの航空資産を脅かす可能性のある、ますます多様で広範かつ近代的な地域攻撃型ミサイル・システムを配備しているため、米国に拠点を置く防衛請負業者は、RWSポートフォリオの能力を積極的に拡大し、近代化しています。米国国防総省(DoD)は、F-35統合打撃戦闘機(JSF)に25mmガトリング砲を搭載することを目指しています。

ジェネラル・ダイナミクス社によると、4バレルの25mmガトリング砲は1分間に最大3,300発を発射でき、予測期間中に数機のF-35 JSFの納入が予定されているため、航空機による空対空攻撃や地上の部隊への近接航空支援任務を可能にします。

航空ベースRWS産業概要

航空ベースRWS市場は統合されており、少数のプレーヤーが市場で大きなシェアを占めています。市場の著名なプレーヤーには、Elbit Systems Ltd、Rafael Advanced Defense Systems Ltd、Leonardo S.p.A、General Dynamics Corporation、BAE Systems plcなどがあります。

遠隔兵器システム(RWS)メーカーは、製品ポートフォリオを増やすためにRWSの開発に多額の投資を行っています。先進的なセンサーシステムとオプトロニック機器を統合することで、各社は新興市場での地理的プレゼンスを拡大できると予想されます。また、この市場の地域プレーヤーは、国産能力を開発するために技術移転契約を結んで国際的なプレーヤーと協力しています。さらに、エンドユーザーである防衛軍の設計仕様や性能仕様に適合した高度なシステムを開発するために、メーカー間の戦略的コラボレーションが増加しています。このことは、予測期間中、業界の利害関係者に利益をもたらすと予想されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手・消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- コンポーネント

- 兵器

- 視覚システム

- プラットフォーム

- 航空機

- ヘリコプター

- 無人航空機

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- ロシア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- その他の地域

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- BAE Systems plc

- Duke Robotics Inc.

- Elbit Systems Ltd

- FN Herstal

- General Dynamics Corporation

- Leonardo S.p.A.

- Rafael Advanced Defense Systems Ltd.

- Singapore Technologies Engineering Ltd.

- Saab AB

第7章 市場機会と今後の動向

The Air-based remote weapon stations (RWS) market is valued at USD 3.45 billion in the current year. It is expected to reach USD 5.02 billion in five years, registering a CAGR of 7.78% during the forecast period.

New technologies and platforms have transformed the warfare strategies of nations such as the United States, Russia, and China. These countries have diverted their efforts toward developing sophisticated and powerful weapons that can severely impact enemy strongholds and help attain a tactical advantage in case of an armed standoff. RWS is used extensively in current warfare scenarios due to its visual superiority and capability to perform pre-emptive strikes on specific locations. The increasing investments of armed forces and remote weapon systems manufacturers into developing advanced remote weapon stations integrated with new sensor technologies (visual systems) and firing systems (like directed energy weapons) are anticipated to bolster the market's growth in the coming years.

However, the market may be deterred by the design challenges system integrators face to incorporate advanced features in their product portfolio without compromising the payload capacity, aerodynamic profile, and range of a delivery platform. Designers must also ensure the availability of sophisticated integrated features cross-compatibility with the advanced optronic sensors and subsystems from other system manufacturers to develop a fully operational RWS, rendering a complex outlook to the overall system design.

Air-based Remote Weapon Stations Market Trends

Helicopters Segment is Projected to Dominate the Market During the Forecast Period

Airborne remote weapon systems (RWS) are primarily mounted on helicopters. Typical examples of RWS used on attack helicopters include autocannons and machine guns, which are single-barrel and rotating. While many countries have dedicated attack helicopters that possess a wide range of armaments, there are also RWS attached to utility and transport helicopters. These customizations are being widely adopted by countries that lack the funds to procure dedicated attack helicopters. Safran's airborne weapon systems, General Dynamics UH-1 Plank modular helicopter weapon system designed and produced for the Bell UH-1, Huey II, 212, and 412 aircraft, the Airbus HForce helicopter weapons suite, FN Herstal's airborne pintle mounted weapon systems. Raytheon Laser weapon systems are some of the remotely operated weapon system models currently being used.

Many helicopters are being upgraded with new and advanced weapon systems. For instance, Sikorsky developed and certified a new weapons system retrofit kit for the Black Hawk helicopters. The weapons tested during the development and certification phase included fixed-forward GAU-19 and M134 guns, among others. In October 2022, the US Navy recently retired its fleet of MQ-8Bs after 13 years of service and replaced them with the larger MQ-8C. In addition, emerging technologies, like directed energy weapons, are also being tested on helicopters. Such developments will propel the growth of the market in the forecast years.

North America Will Showcase Significant Growth in the Market During the Forecast Period

Amidst escalating tensions and border disputes, countries in North America are increasing their annual defense budget for procurement of the latest combat aircraft, helicopters, and uncrewed aerial vehicles. North America, to ensure combat readiness of existing systems, several weapon modernization programs are currently underway to effectively upgrade the capabilities of the regional armed forces for effectively responding to security threats and accomplishing urgent, critical, and dangerous strategic missions.

The United States is the leading user of such weapon systems in North America and is currently focusing on upgrading its existing armada. Moreover, the country is a critical global exporter and consumer of such equipment. With potential adversaries, such as Israel, Russia, and China, fielding an increasingly diverse, expansive, and modern range of regional offensive missile systems that can threaten the aerial assets of the US forces, its allies, and partners, the US-based defense contractors are actively expanding and modernizing the capabilities of their RWS portfolio. The US Department of Defense (DoD) aims to integrate the 25mm Gatling gun onboard the F-35 Joint Strike Fighter (JSF).

According to General Dynamics Corporation, the four-barrel 25mm Gatling gun can fire up to 3,300 rounds per minute to enable the aircraft to perform air-to-air attacks and close-air-support missions to troops on the ground since there are several F-35 JSFs scheduled for delivery during the forecast period. Such developments will drive the market growth in the coming years.

Air-based Remote Weapon Stations Industry Overview

The air-based remote weapon stations market is consolidated, with a few players holding significant shares in the market. Some prominent players in the market are Elbit Systems Ltd, Rafael Advanced Defense Systems Ltd, Leonardo S.p.A, General Dynamics Corporation, and BAE Systems plc.

Remote weapon systems (RWS) manufacturers invest heavily in developing RWS to increase their product portfolio. Integrating advanced sensor systems and optronic equipment is anticipated to help the companies expand their geographical presence in emerging markets. Also, the regional players in the market are collaborating with international players with technology transfer agreements for developing indigenous capabilities. Furthermore, strategic collaborations between manufacturers are on the rise to develop sophisticated systems that conform to end-user defense forces' design and performance specifications. This is expected to benefit industry stakeholders during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Weaponry

- 5.1.2 Vision Systems

- 5.2 Platform

- 5.2.1 Aircraft

- 5.2.2 Helicopters

- 5.2.3 Unmanned Aerial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems plc

- 6.2.2 Duke Robotics Inc.

- 6.2.3 Elbit Systems Ltd

- 6.2.4 FN Herstal

- 6.2.5 General Dynamics Corporation

- 6.2.6 Leonardo S.p.A.

- 6.2.7 Rafael Advanced Defense Systems Ltd.

- 6.2.8 Singapore Technologies Engineering Ltd.

- 6.2.9 Saab AB