|

|

市場調査レポート

商品コード

1406085

ドローンセンサー:市場シェア分析、産業動向・統計、2024年~2029年の成長予測Drone Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ドローンセンサー:市場シェア分析、産業動向・統計、2024年~2029年の成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 96 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

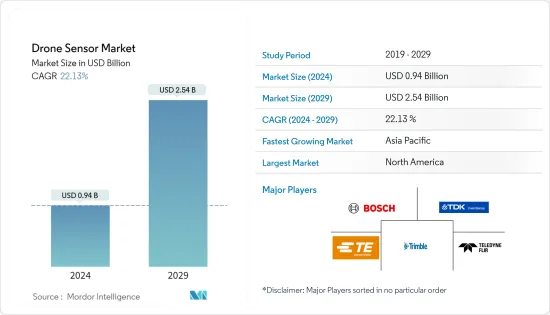

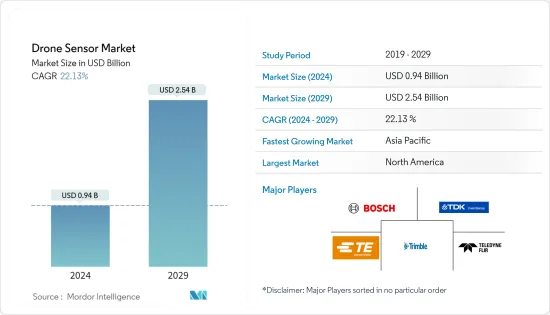

ドローンセンサー市場規模は2024年に9億4,000万米ドルと推定・予測され、2029年には25億4,000万米ドルに達し、市場推計・予測期間(2024年~2029年)にCAGR 22.13%で成長すると予測されています。

リモートセンシング、写真・ビデオ撮影、石油・ガス、鉱物探査、災害救助、レクリエーション用途など、さまざまな商業目的でのドローンの用途拡大が、ドローンセンサー市場の成長を促進しています。ドローン技術の進歩により、メーカー各社はサイズ、重量、形状の異なる幅広いモデルを製造できるようになり、他のセンサーペイロードを搭載できるようになったため、幅広い用途で有利になっています。

新しいセンサー技術を革新・開発し、IoTと自動化をサポートするために既存のインフラをアップグレードするために、ドローンとその付属品に多額の投資が行われていることが、世界の市場に影響を与えている主な動向です。しかし、政府による厳しい規制やドローンの改ざんが市場の成長を阻害しています。

ドローンセンサー市場動向

データ取得は予測期間中に最も高いCAGRで成長する見込み

データ取得分野は、予測期間中に最も高いCAGRで成長すると予測されます。様々な分野でドローンのニーズが進化しているため、ドローンメーカーは、ドローンが変化に適応できるような新技術をドローンに装備することを要求しています。最近では、LiDARが3Dマッピングと地理空間データ収集のための高解像度でより正確な選択肢になりつつあります。LiDARは紫外線と近赤外線を使用するため、効果的なマッピングが可能であり、その嗜好性の高まりに貢献しています。さらに、赤外線サーマルセンサーは、エンジニアや建築家による情報ベースのモデリングに使用されるクラウドポイントをキャプチャします。

パイプラインの漏れを検知する赤外線サーマルカメラを搭載したドローンが人気を集めており、多くの国で数百万マイルの地下天然ガスパイプラインが存在することが、同市場の成長機会となっています。同様に、太陽光発電所の検査では、企業は3Dビジュアライゼーションを作成し、効率を最大化するために太陽光発電パネルの配置を最適化するために様々なセンサーを搭載したドローンを採用しています。このように、ドローンセンサーの需要は、主に様々な産業におけるドローンの使用量の増加により増加しています。

予測期間中は北米が市場を独占する見込み

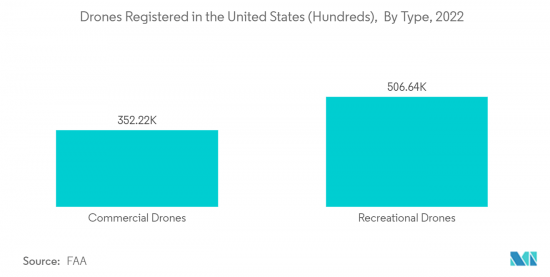

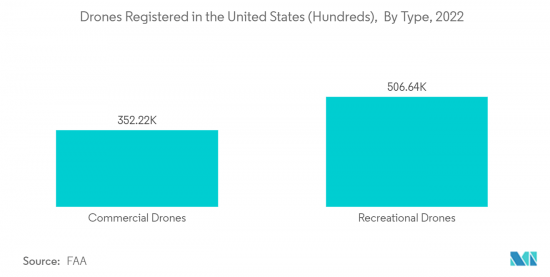

地域に関しては、北米が予測期間中に市場を独占すると予測されています。同市場の優位性は、様々な用途へのドローン採用の増加、大手OEMの存在、次世代ドローン技術の研究開発への投資の増加に起因します。例えば、2023年2月、Teledyne FLIR Defenseは米国国防総省から、同社の80D SkyRaider無人航空機システムの追加機能強化に関する1,300万米ドルの契約を獲得しました。テレダイン・フリアーは、この契約の一環として、R80Dスカイレイダー用の化学・放射線センサーの試作品を設計・製造し、米国陸軍が保有する既存の検出器を統合します。また2023年6月には、RTX Corporationが米国陸軍からMQ-1C Gray Eagle無人航空機システムの共通センサーペイロードを更新するために1億1,800万米ドルの契約を獲得しました。このような開拓により、ドローンの利用が促進され、予測期間中のドローンセンサー市場の見通しが向上すると期待されます。

ドローンセンサー業界の概要

ドローンセンサー市場は適度に断片化されており、複数の企業が市場で大きなシェアを占めています。ドローンセンサー市場で著名な企業には、Bosch Sensortec GmbH、TE Connectivity Ltd.、InvenSense, Inc.、Trimble Inc.、Teledyne FLIR LLCなどがあります。各社は、ドローンのさまざまな用途で使用される可能性のある新しく先進的なセンサーと関連技術を革新するために、研究開発に多額の投資を行っています。この点で、OEMは高度なセンサーの研究開発に投資しています。テレダイン・テクノロジーズ・インコーポレイテッドは2021年にフリアーシステムズを買収しました。このような買収により、市場は今後数年で競争力を増すと思われます。また、市場プレーヤーは、UAVの技術的熟練度を活用し、急速に進化する市場への浸透を強化するために、多大な資源と努力を傾ける意向です。製品の提供と連動した地理的市場の多様化は、長期的に収益性と生存を確保するための重要な基準になると予想されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

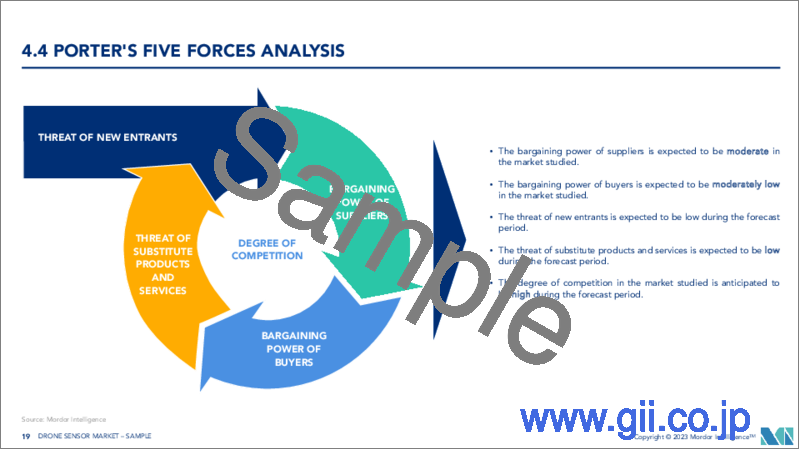

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手・消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- 慣性センサー

- 画像センサー

- 速度・距離・位置センサー

- その他のタイプ

- 用途

- ナビゲーション

- データ収集

- 衝突検知

- 気圧計測

- その他の用途

- 地域

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- インド

- 中国

- 日本

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- その他のラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- エジプト

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Bosch Sensortec GmbH

- TE Connectivity Ltd.

- Invensense, Inc.

- Trimble Inc.

- Teledyne FLIR LLC

- Velodyne LiDAR

- Sony Semiconductor Solutions Group

- Sparton Corporation

- KVH Industries, Inc.

- LORD Sensing Systems(Parker Hannifin Corp.)

第7章 市場機会と今後の動向

The Drone Sensor Market size is estimated at USD 0.94 billion in 2024, and is expected to reach USD 2.54 billion by 2029, growing at a CAGR of 22.13% during the forecast period (2024-2029).

The growing applications of drones for various commercial purposes, like remote sensing, photo and videography, oil, gas, mineral exploration, disaster relief, recreational uses, and other meanings, are driving the growth of the drone sensor market. The advancements in drone technologies have allowed manufacturers to produce a wide range of models in different sizes, weights, and shapes, which can carry other sensor payloads, making them favorable across a broad application base.

Substantial investments in the drone and its accessories to innovate and develop new sensor technologies and upgrade the existing infrastructure to support IoT and automation have been the primary trends impacting the market globally. However, stringent regulations by governments and tampering with drones will be hindering the growth of the market.

Drone Sensor Market Trends

Data Acquisition is Expected to Grow at Highest CAGR during the Forecasted Period

The data acquisition segment is expected to grow at the highest CAGR during the forecasted period. The evolving need for drones in various fields demands drone manufacturers equip the drones with new technologies that help them adapt to the changes. Of late, LiDAR is becoming a high-resolution and more accurate option for 3D mapping and geospatial data collection. As LiDAR uses ultraviolet and near-infrared light, effective mapping can be done, helping the growth of its preference. In addition, infrared thermal sensors capture cloud points used in information-based modeling by engineers and architects.

The presence of millions of miles of underground natural gas pipelines across many countries is presenting growth opportunities for the market, as drones equipped with thermal imaging sensors for pipeline leak detection are gaining popularity. Similarly, for solar farm inspection, companies employ drones with various sensors to create 3D visualizations and optimize the placement of photovoltaic panels to maximize efficiency. Thus, the demand for drone sensors is increasing, primarily due to the growth in the usage of drones in various industries.

North America is Expected to Dominate the Market During the Forecasted Period

Regarding geography, North America is projected to dominate the market during the forecast period. The dominance of the market can be attributed to the increasing adoption of drones for various applications, the presence of major OEMs, and increasing investments in research and development of following-generation drone technologies. For instance, In February 2023, Teledyne FLIR Defense was awarded a USD 13 million contract with the US Department of Defense to make additional enhancements to its 80D SkyRaider unmanned aerial system. Teledyne FLIR will design and build prototype chemical and radiological sensor payloads for the R80D Skyraider and integrate existing detectors in the U.S. Army's inventory as a part of the contract. Also, in June 2023, RTX Corporation secured a USD 118 million contract from the US Army to update the common sensor payload for MQ-1C Gray Eagle unmanned aircraft systems. Such developments are expected to enhance drone usage and the market prospects for drone sensors during the forecast period.

Drone Sensor Industry Overview

The drone sensor market is moderately fragmented, with several players accounting for significant shares in the market. Some of the prominent companies in the drone sensor market are Bosch Sensortec GmbH, TE Connectivity Ltd., InvenSense, Inc., Trimble Inc., and Teledyne FLIR LLC. Companies are investing heavily in research and development to innovate new and advanced sensors and related technologies that may be used in different applications of drones. In this regard, OEMs are investing in the research and development of advanced sensors. Teledyne Technologies Incorporated has acquired FLIR Systems, Inc in 2021. Such acquisitions will make the market more competitive in the years to come. Also, the market players intend to devote significant resources and efforts to capitalizing on the technological proficiency of UAVs and enhancing their penetration into the rapidly evolving market. It is anticipated that diversification of geographical markets, in tandem with the product offerings, would be a key criterion for ensuring profitability and survival in the long run.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Inertial Sensor

- 5.1.2 Image Sensor

- 5.1.3 Speed, Distance, and Position Sensor

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Navigation

- 5.2.2 Data Acquisition

- 5.2.3 Collision Detection

- 5.2.4 Air Pressure Measurement

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Egypt

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Bosch Sensortec GmbH

- 6.2.2 TE Connectivity Ltd.

- 6.2.3 Invensense, Inc.

- 6.2.4 Trimble Inc.

- 6.2.5 Teledyne FLIR LLC

- 6.2.6 Velodyne LiDAR

- 6.2.7 Sony Semiconductor Solutions Group

- 6.2.8 Sparton Corporation

- 6.2.9 KVH Industries, Inc.

- 6.2.10 LORD Sensing Systems (Parker Hannifin Corp.)