|

市場調査レポート

商品コード

1439815

自律型BVLOSドローン:市場シェア分析、産業動向と統計、成長予測(2024~2029年)Autonomous BVLOS Drones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自律型BVLOSドローン:市場シェア分析、産業動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 104 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

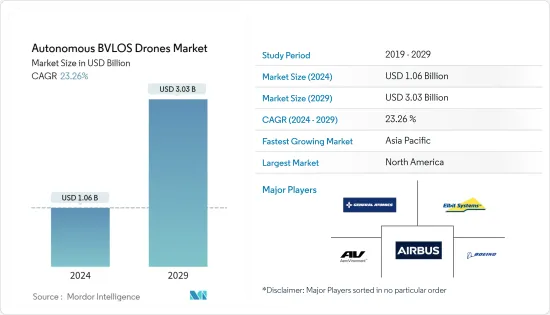

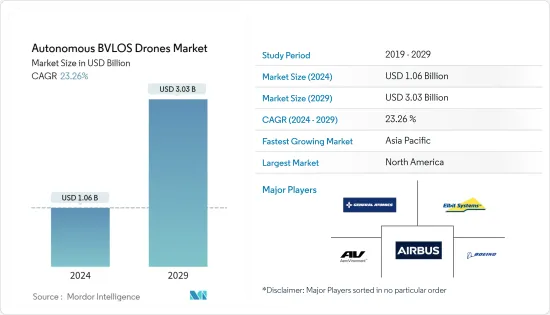

自律型BVLOSドローンの市場規模は、2024年に10億6,000万米ドルと推定され、2029年までには30億3,000万米ドルに達すると予測され、予測期間中(2024~2029年)にCAGR23.26%で成長する見込みです。

主なハイライト

- 自律型BVLOSドローン市場は、COVID-19パンデミックによりかつてない課題を目の当たりにしました。パンデミックの進行は、各国の国境閉鎖や封鎖の実施につながりました。これはサプライチェーンに影響を与え、メーカーは自律型BVLOSドローンシステムの生産に必要な原材料を受け取ることができず、最終的にBVLOSドローンシステムの生産減少につながりました。

- さらに、様々な企業が従業員を解雇したため、生産に必要なマンパワーがパンデミック中に影響を受けました。一方、COVID後は、自律型BVLOSドローンシステムを活用して様々な作戦を遂行する世界中の様々な防衛軍や民間企業による需要が増加したため、市場は力強い回復を見せ、これにより自律型BVLOSドローン市場は予測期間中に前向きな見通しと市場成長を示すことになります。

- ドローンと無人航空機は、過去数十年にわたってダイナミックな技術進歩を経験してきました。動作範囲、能力、サイズの技術的進歩は、防衛および商業セクターの様々な成長機会への道を大きく開いています。さらに、ドローンオペレーターが商業や軍事などの様々なエンドユーザーの需要に応えるためにBVLOSオペレーションを強固に拡大するにつれて、予測期間中に契約オペレーションからの収益が急増することが想定されます。

自律型BVLOSドローン市場動向

軍事セグメントが予測期間中に最も高いCAGRで成長すると予測される

- 軍事セグメントは予測期間中に大きな成長を示すと予測されています。このような成長の主な要因には、各国の防衛予算の増加や、見通し外軍事作戦を遂行するための各国の防衛要員による自律型BVLOSドローンの需要拡大があります。

- 軍事分野では、空中戦やISR用途など様々な目的で自律型UAVを配備しています。現在、既存の無人機に加え、政府や企業は人工知能のような先進技術の統合に取り組んでいます。また、世界中の軍が単価の高い大型UAVを主に使用しているため、軍事分野からの収益も高くなっています。自律型BVLOSドローンの既存モデルに加え、各社は新モデルの開発への投資を通じて製品ポートフォリオを拡大しています。例えば、2021年1月、日本政府は、2035年までに運用を開始する予定の国産戦闘ドローンの開発計画を発表しました。このドローンは3段階で開発され、自律的に運用される予定です。日本の取得・技術・ロジスティクス振興機構はUAVの人工知能(AI)の開発に取り組んでおり、政府はUAVの開発に約27億円(2,620万米ドル)を投資する計画です。

- 軍事における自律型BVLOSドローンの使用は、正確で精度の高い攻撃を行う能力を高めると思われます。これらのドローンは、敵の陣地や車両の位置を特定して標的にするためにも使用でき、民間人の死傷や巻き添え被害のリスクを低減する、より効果的で的を絞った攻撃を可能にします。

- さらに、自律型BVLOSドローンは、情報収集や敵の活動や動きの監視にも使用され、それによってより効果的な戦略や戦術の開発が可能になります。さらに、自律型BVLOSドローンは、軍隊の展開方法も変えています。自律型BVLOSUAVは、部隊に戦場のより良い理解と敵の動きに関する正確なリアルタイムデータを提供することができ、より効率的で安全な展開を可能にします。

- このように、複雑な軍事活動を遂行するために世界中の様々な防衛軍で自律型BVLOSドローンへのニーズが高まっていることと、様々な市場プレイヤーによる先進的な軍用自律型BVLOSドローンへの投資と開拓が増加していることが相まって、予測期間中の軍用セグメントにおける自律型BVLOSドローンの見通しと市場成長は明るいものとなると思われます。

アジア太平洋は予測期間中に目覚ましい成長を示すだろう

- アジア太平洋は予測期間中に最も高い成長を示すと予測されています。この成長の主な要因は、様々なbeyond line-of-sight活動を実施するための商用および軍事分野での自律型BVLOSドローンの使用の増加と、国内の主要な市場プレーヤーによる高度なBVLOS自律型ドローンの研究開発の面での投資の増加です。これは、今後数年間の市場成長の増加につながります。

- 中国は現在、自律型ドローンの増加を目の当たりにしています。中国の大手企業による技術的に高度な自律型ドローンの開発への投資が拡大しています。現在、様々な中国企業が高度な能力を持つ自律型BVLOSドローンシステム開発のための研究面での投資を増やしています。インドも自律型ドローンの開発という点で大きな成長を目の当たりにしています。ここ数年来、インド国防軍は、主に監視、偵察、目標捕捉、兵站、精密打撃を目的として、無人航空機(UAV)やドローンの調達を強化しています。さらに、医療分野での自律型BVLOSドローンの使用に関する動きも活発化しています。Marut Dronesのような企業は、到達困難な地域に医療物資を届けることができる高度な自律型BVLOSドローンの研究開発を強化しています。さらに、最近では、自律型BVLOSドローンもインドで大きな人気を集めており、技術的な利点が増えたことで、そのようなドローンは今やMake in Indiaの一部となりつつあり、インドでのビジネス展開も後押ししています。自律型BVLOSドローンに関する新たな開発により、そのようなドローンが重いペイロードを積んで長距離飛行することが可能になりました。

- さらに、自律型BVLOSドローンの能力を高めるために、現在インドではいくつかの開発が進んでいます。例えば、2021年8月、ANRA Technologiesは、インドで100時間のBeyond Visual Line of Sightドローン配送飛行を実施し、民間航空総局(DGCA)が開始したプロジェクトを支援したと発表しました。さらに、このプロジェクトの目標にはデータ収集も含まれており、政府の利害関係者がBVLOS運航のための次期ドローン規則を準備する際、インドの規制プロセスに役立ちます。

- アジア太平洋の他の様々な国々も、自律型BVLOSドローンシステムの面で大きな発展を目の当たりにしています。その他アジア太平洋では、貯水池の監視や高度なUAV運用など、様々な活動を行うための高度な自律型BVLOSドローンシステムが開発されています。例えば、2021年7月、シンガポールの国家水資源庁(PUB)は、市内にある6つの貯水池の水質監視に自律型見通し外(BVLOS)ドローンの使用を開始すると発表しました。ドローンにはリモートセンシング技術とリアルタイムのビデオデータ用カメラが搭載され、藻類の濃度レベルに基づいて水生植物の繁茂や水質不良を検知するのに役立ちます。さらに、ドローンは携帯端末を通じてPUB職員にライブ警報を送信し、即座に対応できるようにします。アラートには、非指定区域での違法漁業や船舶の過密状態などが含まれます。このように、使用事例の急増も、予測期間中に自動BVLOSドローンの需要を促進します。

自律型BVLOSドローン産業概要

自律型BVLOSドローン市場は細分化されており、様々なプレーヤーが大きなシェアを占めています。著名な市場プレイヤーには、Airbus SE、AeroVironment, Inc.、Elbit Systems Ltd.、General Atomics、The Boeing Companyなどがあります。

市場の主なプレーヤーは、視線外能力をさらに向上させるために、高度な機能を備えた先進的な自律型BVLOS市場の開拓に注力しています。軍事・商業両部門向けの高度自律型BVLOSドローンシステムの製造に向けた研究開発への支出の増加は、間もなくより良い機会を生み出すことにつながると思われます。さらに、様々なメーカーが現在、高度なライダーセンサーや地形マッピングなどの技術を統合しており、これが予測期間中の自律型BVLOSドローン市場の成長をサポートすると予想されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 市場タイプ

- 小型UAV

- 中型UAV

- 大型UAV

- 用途

- 軍事

- 民間・商業

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他アジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- カタール

- その他中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Airbus SE

- AeroVironment, Inc.

- Elbit Systems Ltd.

- General Atomics

- The Boeing Company

- Northrop Grumman Corporation

- Israel Aerospace Industries Ltd.

- Saab AB

- Textron Inc.

- Plymouth Rock Technologies Inc.

- DELAIR SAS

- Zipline International Inc.

- Drone Delivery Canada Corp.

- EHang Holdings Limited

- Wingcopter GmbH

第7章 市場機会と今後の動向

- 人工知能、ビッグデータ、その他の技術の導入によるUAVの自律能力の向上

The Autonomous BVLOS Drones Market size is estimated at USD 1.06 billion in 2024, and is expected to reach USD 3.03 billion by 2029, growing at a CAGR of 23.26% during the forecast period (2024-2029).

Key Highlights

- The autonomous BVLOS drone market witnessed unprecedented challenges due to the COVID-19 pandemic. The advancement of the pandemic led to the closing of borders by various countries as well as the implementation of lockdowns. This affected the supply chain and prevented manufacturers from receiving raw materials which were required for the production of autonomous BVLOS drone systems, which ultimately led to a decline in the production of BVLOS drone systems.

- Moreover, with various companies laying off employees, the necessary manpower required for production was affected during the pandemic. On the other hand, the market showed a strong recovery post-COVID owing to increasing demand by various defense forces as well as commercial companies around the world who make use of autonomous BVLOS drone systems to carry out various operations, and this will lead to the autonomous BVLOS drones market witnessing a positive outlook and market growth during the forecast period.

- Drones and unmanned aerial vehicles have experienced dynamic technological advancements over the last few decades. The technological advancement in operating range, capabilities, and size largely paves the way for various growth opportunities for the defense and commercial sectors. Moreover, as the drone operators robustly expand their BVLOS operations to cater to the demand of various end-users, such as commercial and military, a surge in revenues from contractual operations is envisioned to occur for the market players during the forecast period.

Autonomous BVLOS Drones Market Trends

Military Segment is Anticipated to Grow with the Highest CAGR During the Forecast Period

- The military segment is expected to show significant growth during the forecast period. The main factors which are attributable to such a growth include an increase in the defense budget of various countries and the growing demand for autonomous BVLOS drones by the defense personnel of various countries to carry out beyond line-of-sight military operations.

- The military sector deploys autonomous UAVs for various purposes like aerial warfare and ISR applications. Currently, in addition to the existing drones, governments and companies are working on integrating advanced technologies like artificial intelligence. The revenues have also been higher from the military segment, as military forces around the globe mostly use large UAVs with higher unit prices. In addition to the existing models of autonomous BVLOS drones, the companies are expanding their product portfolio through investments in the development of new drone models. For instance, in January 2021, the Japanese government announced its plan to develop an indigenous combat drone, which is planned to enter service by 2035. The drone is planned to be developed in three stages and operate autonomously. Japan's Acquisition, Technology, and Logistics Agency is working on the development of UAV's artificial intelligence (AI), and government plans to invest about JPY 2.7 billion (USD 26.2 million) in the development of the UAV.

- The usage of autonomous BVLOS drones in the military will increase their capabilities for carrying out precise and accurate strikes. These drones can also be used to locate and target enemy camps and vehicles, allowing for a more effective and targeted attack which reduces the risk of civilian casualties and collateral damage.

- Moreover, autonomous BVLOS drones are also being used to gather intelligence and monitor enemy activity and movements, thereby allowing for the development of more effective strategies and tactics. In addition, autonomous BVLOS drones have also changed the way militaries deploy troops. Autonomous BVLOS UAVs can provide troops with a better understanding of the battlefield, as well as accurate real-time data on enemy movements, allowing for more efficient and safe deployments.

- Thus, the growing need for autonomous BVLOS drones by various defense forces around the world to carry out complex military activities, coupled with increasing investments and development of advanced autonomous BVLOS drones for the military by various market players, will lead to a positive outlook and market growth for autonomous BVLOS drones in the military segment during the forecast period.

Asia-Pacific Will Showcase Remarkable Growth During the Forecast Period

- Asia-Pacific is projected to show the highest growth during the forecast period. The main factor behind this growth is the increasing usage of autonomous BVLOS drones in the commercial and military sectors for carrying out various beyond line-of-sight activities and the increasing investments in terms of research and development of advanced BVLOS autonomous drones by major market players in the country. This will lead to an increase in market growth in the coming years.

- China, currently, is witnessing an increase in terms of autonomous drones. There have been growing investments by major companies in China in developing technologically advanced autonomous drones. Currently, various Chinese firms have increased their investments in terms of research for the development of autonomous BVLOS drone systems with advanced capabilities. India is also witnessing significant growth in terms of the development of autonomous drones. Since the last few years, the Indian defense forces have stepped up the procurement of unmanned aerial vehicles (UAVs) or drones, primarily for the purposes of surveillance, reconnaissance, target acquisition, logistics, and precision strikes. Moreover, there have been growing developments regarding the usage of autonomous BVLOS drones in the medical sector. Companies such as Marut Drones are increasing their research and development for advanced autonomous BVLOS drones, which are able to deliver medical supplies to hard-to-reach areas. Moreover, in recent times, autonomous BVLOS drones are also gaining significant traction in India, and with increased technological benefits, such drones are now becoming a part of Make in India and also encourage business development in India. New developments in terms of autonomous BVLOS drones have made it possible for such drones to fly long distances carrying heavy payloads.

- Furthermore, there are several developments that are going on in India currently in order to increase the capabilities of autonomous BVLOS drones. For instance, in August 2021, ANRA Technologies announced that they had conducted 100 hours of Beyond Visual Line of Sight drone delivery flights in India and have supported a project which was initiated by the Directorate General of Civil Aviation (DGCA). Moreover, the goal of the project included data collection, which will help the Indian regulatory process as government stakeholders prepare the next set of drone rules for BVLOS operations.

- Various other countries in the Asia-Pacific region are also witnessing immense development in terms of autonomous BVLOS drone systems. Advanced Autonomous BVLOS drone systems are now being developed in the rest of Asia-Pacific countries to carry out various activities such as reservoir monitoring and advanced UAV operations, among others. For instance, in July 2021, Singapore's National Water Agency (PUB) announced that they would start using autonomous Beyond Visual Line of Sight (BVLOS) drones to monitor water quality at six reservoirs across the city-state. The drones will be fitted with remote sensing technology and cameras for real-time video data, which will help detect aquatic plant overgrowth and poor water quality based on levels of algae concentration. In addition, the drones will also send live alerts to PUB officers via their mobile devices, enabling them to respond immediately. Alerts include illegal fishing in non-designated areas and vessel overcrowding. Thus, the surge in use cases will also drive the demand for automated BVLOS drones during the forecast period.

Autonomous BVLOS Drones Industry Overview

The autonomous BVLOS drone market is fragmented in nature, with various players holding significant shares in the market. Some prominent market players are Airbus SE, AeroVironment, Inc., Elbit Systems Ltd., General Atomics, and The Boeing Company, amongst others.

The key players in the market are focusing on the development of the advanced autonomous BVLOS market with advanced capabilities in order to further improve its beyond-line-of-sight capabilities. Growing expenditure on research and development towards manufacturing advanced autonomous BVLOS drone systems for both the military and commercial sectors will lead to creating better opportunities soon. Moreover, various manufacturers are now integrating technologies, like advanced Lidar sensors as well as terrain mapping, and this is expected to support the growth of the autonomous BVLOS drone market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Small UAVs

- 5.1.2 Medium UAVs

- 5.1.3 Large UAVs

- 5.2 Application

- 5.2.1 Military

- 5.2.2 Civil and Commercial

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Qatar

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Airbus SE

- 6.2.2 AeroVironment, Inc.

- 6.2.3 Elbit Systems Ltd.

- 6.2.4 General Atomics

- 6.2.5 The Boeing Company

- 6.2.6 Northrop Grumman Corporation

- 6.2.7 Israel Aerospace Industries Ltd.

- 6.2.8 Saab AB

- 6.2.9 Textron Inc.

- 6.2.10 Plymouth Rock Technologies Inc.

- 6.2.11 DELAIR SAS

- 6.2.12 Zipline International Inc.

- 6.2.13 Drone Delivery Canada Corp.

- 6.2.14 EHang Holdings Limited

- 6.2.15 Wingcopter GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase the autonomous capabilities of the UAVs with the introduction of artificial intelligence, big data, and other technologies.