|

市場調査レポート

商品コード

1850945

軍用ロボット:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Military Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 軍用ロボット:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月04日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

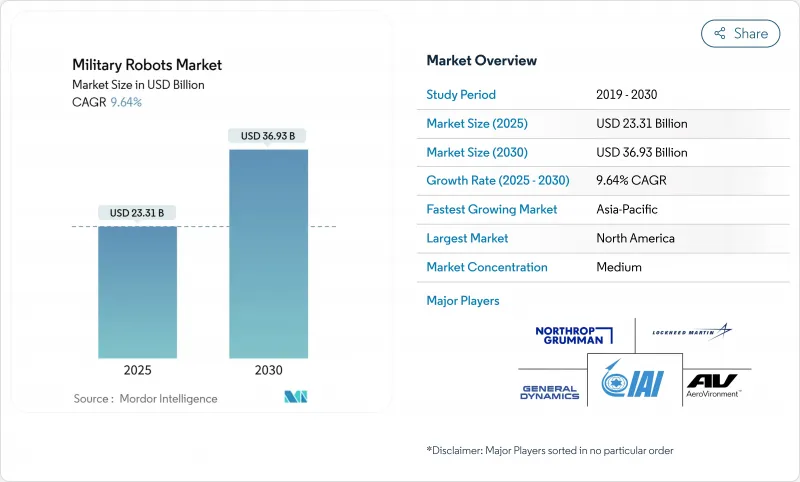

軍用ロボット市場規模は2025年に233億1,000万米ドル、2030年には369億3,000万米ドルに達し、CAGR 9.64%で拡大すると予測されています。

成長の原動力は、ウクライナ紛争の教訓、NATOとAUKUSのドクトリンの変化、急速なエッジAIイノベーションを反映した、空・陸・海にわたる自律・半自律システムの急速な採用です。従来の乗員付きプラットフォームから群がるドローンや非乗員地上車両(UGV)への予算再配分が需要を拡大しています。同時に、安全な通信と頑丈なプロセッサの進歩により、妨害された環境でも信頼性の高い運用が可能になっています。米国防総省のレプリケーター・プログラムは、敵対勢力を洗練された単位ではなく量で圧倒する消耗品システムの大量生産を加速させています。中国の民軍融合政策は、アジア太平洋全域での調達を強化する地域的な反応を引き起こしています。同時に、致死的自律性に関する欧州の輸出規制の強化や、砂漠での作戦におけるバッテリー密度の持続的な制限は、対抗手段としては機能するもの、軍用ロボット市場の全体的な上昇軌道を脱線させるまでには至っていないです。

世界の軍用ロボット市場の動向と洞察

加速するNATOとAUKUSの戦場デジタル化計画

同盟国の防衛予算の持続的な増加は、ネットワーク対応の無人プラットフォーム向けに計上されており、米国陸軍の各師団は2026年までに無人機を実戦配備する予定であり、AUKUSパートナーはプラグアンドファイトの相互運用性を可能にするためにコマンドアーキテクチャの調和を図っています。大規模なプライム企業は、複数のロボットがデータリンクを共有できるようにオープンコントローラーを標準化し、統合サイクルを短縮し、妨害電波に対して強化されたソフトウェア定義無線を提供するベンダーを支持しています。欧州の年間国防支出は現在6.1%増加しており、レガシーな搭乗員付き資産から、デジタル化されたフォーメーションに適合する機敏でミッションに特化したロボットへと調達の軸足を移す動きが強まっています。これらの力学を総合すると、10年末までの軍用ロボット市場を支える新たな受注動向が見えてくる。

ウクライナ戦争における攻撃可能な陸上ドローン群に対する需要

2025年3月のドネツクにおける完全ロボットによる攻撃は、低コストのUGVとFPVの組み合わせで重装甲を無力化できることを証明し、NATOの前線部隊に大量の消耗品プラットフォームを中心とした機動旅団の再設計を促しました。何千台ものシンプルなロボットを迅速に提供できる新興企業に資本が流れ、枠組み契約では計画的な損失率を想定したコスト上限が指定されることが多くなっています。その結果、軍用ロボット市場では、最終組立とテストを自動化できるスケールの大きなプレーヤーが報われ、単位利幅が縮小しても数量が増加しています。

ジュネーブ条約への懸念が致死性オートノミーの輸出を遅らせる

国連決議78/241とICRCの拘束力のあるルールの要求は、欧州の輸出許可を遅らせ、文書化コストを増加させ、AI対応致死ペイロードの開発サイクルを長くするコンプライアンス層を追加します。これは、「ヒューマン・オン・ザ・ループ」セーフガードの技術革新に拍車をかける一方で、短期的な注文の一部を制約の少ない地域にシフトさせ、認定された需要を断片化し、軍用ロボット市場の成長の勢いを弱める。

セグメント分析

2024年の軍用ロボット市場売上の46.58%は航空機搭載型ロボットです。しかし、陸上プラットフォームは13.49%のCAGRで拡大し、戦場で実証されたUGVが突破、負傷者避難、センサー中継ミッションに不可欠であることが証明されました。Ghost Xのような大型クアッドローターは、旅団ISRに不可欠なリーチと高さを依然として提供しているが、大きな損失を吸収できる攻撃可能な地上群に対する需要は急激に高まっています。ウクライナの25万米ドルのドローン搭載USVは、海軍オペレーターを軍用ロボット市場に引き込むクロスドメイン・イノベーションを強調しています。

陸上ロボットの成長は、より安価なドライブトレイン、より軽量な複合装甲、GPSなしで障害物との交渉を可能にするAIスタックによってさらに促進されます。航空プラットフォームは、関連性を維持するために、マルチペイロードベイや電子攻撃ポッドを追加することで対応しています。わずかなスライスではあるが、海洋ロボットは、オイルターミナル防衛に重点を置くGCC海軍から的を絞った支出を受けています。領域を超えた相互作用はサプライヤーのビジネスチャンスを広げ、軍用ロボット市場に新規参入をもたらします。

人間が操作するロボットが2024年の軍用ロボット市場シェアの56.50%を占める。しかし、完全自律型モードは、数ミリ秒以内に脅威を分類するオンボードニューラルネットワークアクセラレータのおかげで、12.84%のCAGRで進歩しています。CJADC2のようなプログラムは、指揮官が単一のコンソールから待ち時間なしで艦隊を再タスクできるように、時間に敏感なネットワーキングを統合しており、革命的な変化というより進化を表しています。

セミオートノミーは、認知的負荷を分割するため、依然として主力です。オペレーターがミッションの目標を定義し、オートノミーがルート計画や障害物回避を管理します。オーバーランドAIのウルトラビークルは、1人の兵士が複数の姉妹ユニットと一緒に操縦することができ、任務サイクルの監視がいかに労働力の要求を緩和するかを示しています。教義上の信頼が高まるにつれて、軍用ロボット市場では、事前に定義されたルールセットに縛られた、自律的に開始される交戦オプションが見られるようになるでしょう。

地域分析

北米は依然として最大の支出国であり、レプリケーターへの10億米ドルの資金投入と、2026年までに米国陸軍の全部隊へのドローン配備が義務化されることがその要因となっています。カナダのNORADのアップグレードは、極地条件に強い自律型北極監視タワーを実戦配備することで、これらの取り組みを補完しています。プライム企業と新興企業にまたがる成熟したサプライヤー基盤が技術のリーダーシップを維持し、この地域における軍用ロボット市場の継続的な優位性を確保しています。

アジア太平洋は、中国の民軍融合補助金が国内でのスケールアウトを加速させ、インド、韓国、日本からの反応に拍車をかけているため、最も急成長しているセグメントです。北京が人型ロボットと大量兵器を推し進めることで、地域の調達は安価で多数のシステムにシフトし、ソウルのハンファ・エアロスペースは非武装地帯のパトロールに最適化した武装UGVを展開します。南シナ海の海洋紛争は、USVと海底監視クローラーへの並行投資の引き金となります。

欧州の防衛予算は2035年まで毎年6.1%増となり、ウクライナ戦争の教訓からドローンや地上群による防衛が有効視されます。フランスのDROIDEフレームワークとドイツの新しい連邦軍ロボット計画は、NATOの東側を強化する緊急性を反映しています。致死的な自律性をめぐる輸出許可の精査は、出荷速度を和らげながらも、研究開発資金を「人間が関与する」セーフガードに振り向け、軍用ロボット市場への欧州の貢献を差別化しています。

中東では、石油基地警備のための海軍USVへの投資が注目されています。イスラエルでは、RobDozerとロボット型M113の実戦配備により、過酷な砂漠地帯での信頼性が証明されました。同時に、アラブ首長国連邦のEDGEグループは、ビジョン2030の国産化目標に沿った国産ボートと地上ロボットの能力を構築しています。サウジアラビアの自律型哨戒機に関する合弁事業は、軍用ロボット市場のニッチだが有利なスライスをさらに拡大します。

ブラジルの2025年の国防予算は237億米ドルで、広大な国境とアマゾンを取り締まるためのネットワーク化された大砲と監視ドローンに資金が割り当てられています。経済的な制約があるため数量は限られるが、反麻薬監視や災害救援といった地域特有のニーズが、ジャングルの状況に合わせた頑丈でコスト効率の高いロボットのチャンスを広げています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- NATOとAUKUSの戦場デジタル化プログラムの加速

- ウクライナ戦争による消耗型地上ドローン群の需要

- 米国国防総省「レプリケーター」使い捨て自律システム向け10億米ドルの取り組み

- エッジAIのブレークスルーにより、コンプライアンスに準拠した自律的なターゲット認識が可能に

- 石油インフラの保護が海軍のUSV導入を促進

- 中国の軍民融合補助金

- 市場抑制要因

- ジュネーブ条約は致死的自律性輸出許可の遅延を懸念している

- COTS通信リンクのEW妨害脆弱性

- バッテリーのエネルギー密度の限界が砂漠での運用を制約

- 米国の放射線耐性AIチップに対する輸出規制

- バリューチェーン分析

- 規制または技術の見通し

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- プラットフォーム別

- 陸上

- 航空

- 海洋

- 運用モード別

- 人間が操作

- 半自律

- 完全自律

- 用途別

- 情報監視偵察(ISR)

- 戦闘支援/攻撃

- 物流とEOD

- 捜索救助

- 消火活動とCBRN対応

- ペイロード別

- EO/IRセンサースイート

- レーダーおよびライダーモジュール

- 電子戦ポッド

- 致死性兵器ステーション

- 非致死性システム(テーザー銃、ネット)

- 重量別

- ナノ/マイクロ(10kg未満)

- 小型(10~200kg)

- 中型(200~2,000 kg)

- 重重量(2,000 kg以上)

- モビリティ

- 装軌プラットフォーム

- 車輪プラットフォーム

- 脚付き/バイオニックプラットフォーム

- ハイブリッド(履帯式)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- その他南米

- 欧州

- 英国

- フランス

- ドイツ

- イタリア

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- General Dynamics Corporation

- AeroVironment, Inc.

- Teledyne Technologies Incorporated

- QinetiQ Group plc

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Thales Group

- BAE Systems plc

- Saab AB

- Textron Inc.

- Boston Dynamics, Inc.

- Rheinmetall AG

- Milrem AS

- Anduril Industries, Inc.

- Ghost Robotics Corporation

- HYUNDAI MOTOR GROUP

- Hanwha Corporation

- EDGE Group PJSC

- Shield AI