|

|

市場調査レポート

商品コード

1689800

高級腕時計:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Luxury Watch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 高級腕時計:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

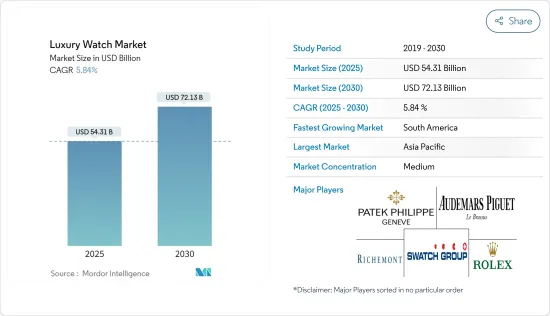

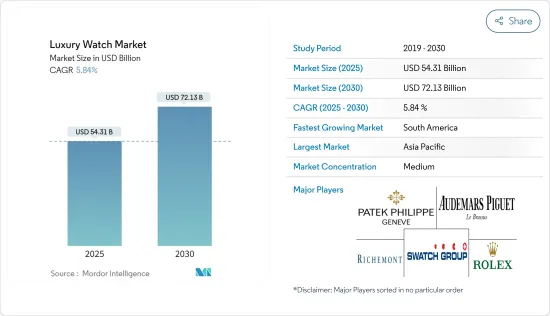

高級腕時計の市場規模は2025年に543億1,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは5.84%で、2030年には721億3,000万米ドルに達すると予測されます。

主なハイライト

- 世界の消費者は、高度に進歩した生産技術、材料、方法で作られた高品質の製品に傾倒しています。スチール、バイメタリック、貴金属などのプレミアム素材は、高級品やハイエンド品と関連付けられることが多く、時計に知覚価値を付加することができます。さらに、これらの素材は耐久性、耐傷性、耐食性などの利点があり、製品の魅力をさらに高めることができます。このように、ステータスシンボルとして認識される高品質で高級な時計に対する消費者の嗜好の高まりが、高級腕時計市場の主な促進要因となっています。

- 加えて、心拍数、血液・酸素濃度、睡眠、身体活動追跡などの健康状態をモニターする高度な機能を備えた高級スマートウォッチの革新も、市場成長を強化する大きな要因となっています。その結果、メーカーは世界市場に新しい高級スマートウォッチを投入しています。

- 例えば、2022年10月、高級スマートウォッチメーカーのガーミンは、高級スマートウォッチの最新コレクションであるMARQシリーズを発表しました。高級スマートウォッチの新しいガーミンMARQコレクションは、高価格帯の価格設定とチタン製の外装が特徴です。同社の声明によると、このモデルは、心拍数モニタリング、睡眠モニタリング、呼吸、ストレストラッキング、ボディバッテリーエネルギーモニタリングを含む、健康とウェルネス機能を備えて開発されています。

- また、市場プレーヤーによる様々な広告・マーケティング戦略の採用も、市場の成長を後押ししています。しかし、マーケットプレースにおける偽造高級品の流通は、高級腕時計メーカーにとって大きな脅威となっています。

高級腕時計市場の動向

高級品への消費支出の増加

- 高級腕時計が高い地位と富の象徴であるという認識が、高級腕時計市場の成長に重要な役割を果たしています。

- さらに、高所得者の増加が高級品の売上を押し上げています。一方、メーカーは消費者の需要に応えるため、常に革新的な新製品を発表しています。これには、消費者が期待する耐久性や快適性を維持しながら、時計の品質や機能性を向上させるために最新の技術や素材を取り入れることも含まれます。

- 例えば、2022年1月、ルイ・ヴィトンは「タンブールホライゾンライトアップ」シリーズを発表し、スマートウォッチのポートフォリオを拡大しました。この製品は、カスタム設計のオペレーティングシステム、通知用LEDライト、専用の心拍数モニターを搭載して開発されています。

アジア太平洋は高級腕時計の最大市場

- 世界的に見て、中国は富裕層人口の増加により、近年高級腕時計にとって最も重要な市場のひとつとなっています。同国の経済成長により、国民の可処分所得が大幅に増加し、高級腕時計を含む贅沢品への需要が高まっています。

- ロレックス、オメガ、パテック・フィリップ、カルティエ、チャンネル、ロンジン、ティソ、ラドー、ブランパン、ピアジェなどが、現在この国で競争している著名な高級腕時計メーカーです。例えば、スイス時計産業連盟によると、最新の数字では、中国などの本土市場へのスイス時計の輸出は2022年に2億1,200万スイスフラン(23億9,000万米ドル)に達し、市場シェアの8.8%を占め、米国がこれに続きます。

- さらに、ファッション動向の高まりやユニークなタイムピースへのニーズにより、カスタマイズや限定生産の高級腕時計への需要が高まっています。需要や市場の成長を察知したメーカーは、消費者の注目を集めるために限定版の高級腕時計を発売しています。例えば、スイスの高級腕時計ブランド、フランク・ミュラーは2022年10月、インド市場をターゲットにした限定モデルを発表しました。スティール&ゴールドとローズゴールドの2つのバリエーションがあり、それぞれにユニークなシリアルナンバー入りの時計には、時計ケースにインドの地図が刻まれています。

- さらに、オンライン・チャネルを通じて高級腕時計が入手できるようになったことで、市場競争は激化しています。この地域は観光に開放的であるため、予測期間中、観光客がこうした高額商品を購入する可能性が高いです。このような要因から、企業はこの地域での高級腕時計の販売増加をさらにサポートするためにオンライン小売を増やしています。

高級腕時計産業の概要

高級腕時計市場は競争が激しく、世界プレーヤーと国内プレーヤーの両方が存在します。市場の主要企業には、Rolex SA、Swatch Group Ltd、Compagnie Financiere Richemont SA、Patek Philippe SA、Audemars Piguetなどがあります。これらのプレーヤーは、製品ポートフォリオを拡大し、特に一体型アナログウォッチとスマートウォッチのカテゴリーで、さまざまな製品セグメントの要件に対応する機会を活用することに重点を置いています。これらのプレーヤーはまた、顧客の最大の注目を集めるために、製品のオンラインマーケティングとブランディングのためにソーシャルメディアプラットフォームとオンライン流通チャネルをターゲットにしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 時計需要を牽引する製品革新

- プレミアムファッションの需要増加

- 市場抑制要因

- 偽造品の存在

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- クオーツ/機械式時計

- デジタル時計

- エンドユーザー

- 女性

- 男性

- ユニセックス

- 流通チャネル

- オフライン小売店

- オンラインストア

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- スペイン

- 英国

- ドイツ

- ロシア

- フランス

- イタリア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- その他中東とアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- LVMH

- Chanel

- Hermes International SA

- Kering Group

- Rolex SA

- Compagnie Financiere Richemont SA

- Patek Philippe SA

- The Swatch Group Ltd

- Audemars Piguet

- Seiko Group Corporation

- Apple Inc.

第7章 市場機会と今後の動向

The Luxury Watch Market size is estimated at USD 54.31 billion in 2025, and is expected to reach USD 72.13 billion by 2030, at a CAGR of 5.84% during the forecast period (2025-2030).

Key Highlights

- Consumers worldwide are inclined toward quality products made with highly advanced production technologies, materials, and methods. Premium materials such as steel, bi-metallics, and precious metals are often associated with luxury and high-end products and can add perceived value to a watch. Moreover, these materials offer benefits such as durability, scratch resistance, and corrosion resistance, which can further enhance the attractiveness of the product. Thus, the growing consumer preference for high-quality, premium watches, perceived as status symbols, is the major driving factor for the luxury watches market.

- In addition, the innovation of luxury smartwatches with advanced features to monitor health conditions such as heart rate, blood and oxygen levels, sleep, and physical activity tracking is another significant factor strengthening the market growth. As a result, manufacturers are introducing new luxury smartwatches in the global market.

- For instance, in October 2022, luxury smartwatch maker Garmin released its latest collection of luxury smartwatches, the MARQ series. The new Garmin MARQ collection of luxury smartwatches comes with pricing on the high end of the spectrum and a titanium exterior. As per the company's statement, the model is developed with health and wellness features, including heart rate monitoring, sleep monitoring, respiration, stress tracking, and body battery energy monitoring.

- The adoption of various advertising and marketing strategies by market players has also augmented the market growth. However, the extensive distribution of counterfeited luxury goods in the marketplace has become a significant threat to luxury watch manufacturers.

Luxury Watch Market Trends

Increasing Consumer Spending on Luxury Goods

- The perception of luxury watches as a symbol of high status and wealth has played a significant role in the growth of the luxury watch market.

- Additionally, the increasing number of people earning high incomes is driving the sales of luxury goods. On the other hand, manufacturers are constantly innovating and introducing new products to cater to consumer demands. This includes incorporating the latest technologies and materials to improve the quality and functionality of watches while maintaining the durability and comfort consumers expect.

- For instance, in January 2022, Louis Vuitton expanded its smartwatch portfolio with the launch of the Tambour Horizon Light Up series. The product is developed with a custom-designed operating system, LED light for notification, and a dedicated heart-rate monitor.

Asia-Pacific is the Largest Market for Luxury Watches

- Globally, China has become one of the most important markets for luxury watches in recent years due to its growing population of high-net-worth individuals. The country's economic growth has led to a significant increase in disposable income among its citizens, which has led to a rise in demand for luxury goods, including high-end watches.

- Rolex, Omega, Patek Philippe, Cartier, Channel, Longines, Tissot, Rado, Blancpain, and Piaget are prominent luxury watch manufacturers presently competing in the country. For instance, according to the Federation of the Swiss Watch Industry, the most recent figures show exports of Swiss watches to Mainland markets, such as China, totaled CHF 212 million (USD 2.39 billion) in 2022, holding 8.8% of the market share, followed by the United States.

- Moreover, the demand for customized and limited-edition luxury watches has increased with the rising fashion trend and the need for a unique timepiece. Sensing the demand and the growing market, manufacturers are launching limited edition luxury watches to gain consumer attention. For instance, in October 2022, the Swiss luxury watch brand Franck Muller launched limited-edition watches targeting the Indian market. Available in two variants - steel and gold and rose gold - each uniquely numbered watch has a map of India etched on the watch case.

- Moreover, the availability of premium watches through online channels has made the market more competitive. As the region is more open to tourism, tourists are more likely to purchase these high-value products over the forecast period. Owing to this factor, companies are increasing their online retail to support further the increasing sales of luxury watches in the region.

Luxury Watch Industry Overview

The luxury watch market is competitive, with the presence of both global and domestic players. The major players in the market include Rolex SA, The Swatch Group Ltd, Compagnie Financiere Richemont SA, Patek Philippe SA, and Audemars Piguet. These players focus on leveraging the opportunities to expand their product portfolios and cater to the requirements of various product segments, especially within the integrated analog and smartwatches category. These players are also targeting social media platforms and online distribution channels for the online marketing and branding of their products to capture the maximum attention of customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Product Innovations to Drive Demand for Watches

- 4.1.2 Rising Demand for Premium Fashion Items

- 4.2 Market Restraints

- 4.2.1 Presence of Counterfeit Products

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Quartz/Mechanical Watch

- 5.1.2 Digital Watch

- 5.2 End -User

- 5.2.1 Women

- 5.2.2 Men

- 5.2.3 Unisex

- 5.3 Distribution Channel

- 5.3.1 Offline Retail Stores

- 5.3.2 Online Retail Stores

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 Russia

- 5.4.2.5 France

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 LVMH

- 6.3.2 Chanel

- 6.3.3 Hermes International SA

- 6.3.4 Kering Group

- 6.3.5 Rolex SA

- 6.3.6 Compagnie Financiere Richemont SA

- 6.3.7 Patek Philippe SA

- 6.3.8 The Swatch Group Ltd

- 6.3.9 Audemars Piguet

- 6.3.10 Seiko Group Corporation

- 6.3.11 Apple Inc.