|

市場調査レポート

商品コード

1435205

ゴム添加剤:市場シェア分析、産業動向、成長予測(2024~2029年)Rubber Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ゴム添加剤:市場シェア分析、産業動向、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

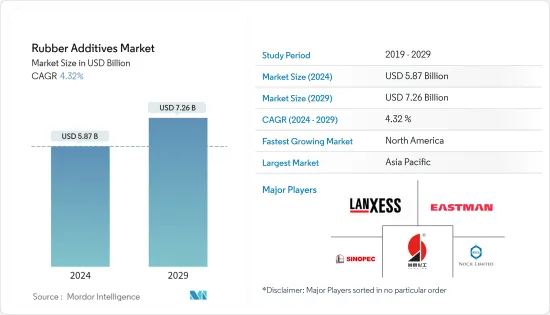

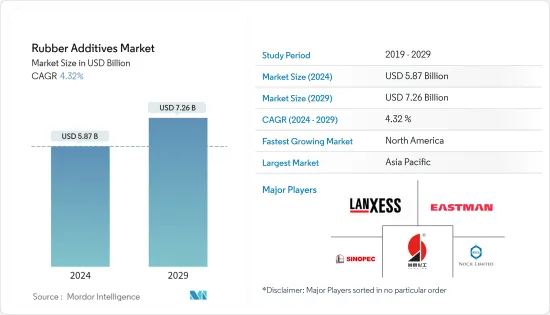

ゴム添加剤の市場規模は、2024年に58億7,000万米ドルと推定され、2029年までに72億6,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に4.32%のCAGRで成長します。

新型コロナウイルス感染症(COVID-19)のパンデミックは、自動車の製造とサプライチェーンが停止したため、ゴム添加剤市場に影響を及ぼしました。世界中でロックダウンがイントロダクションことで輸送に遅れが生じ、輸出入活動に支障が生じた。しかし、規制が段階的に解除されて以来、このセクターは順調に回復しています。電気自動車の販売増加と電子機器の需要の拡大が、過去2年間の市場回復を牽引してきました。

主なハイライト

- ゴムおよびタイヤ業界の成長と、建設業界の非タイヤ部門からの需要の増加が、調査対象市場の需要を促進する重要な要因です。

- その一方で、その廃棄に関連する環境への懸念が市場の成長を妨げると予想されます。

- 最終製品の耐久性を高める高性能ゴムを製造するための新しい添加剤の開発は、将来的にはチャンスとなる可能性があります。

- アジア太平洋地域はゴム添加剤市場を独占しており、インド、中国、日本が消費を牽引しています。

ゴム添加剤市場動向

市場を独占するタイヤセグメント

- 調査期間中、タイヤ業界がゴム添加剤市場で最大のシェアを占めました。天然ゴムは、ブタジエンゴムやスチレンブタジエンゴムなどの合成ゴムと組み合わせてタイヤの製造に主に使用されます。

- 高品質タイヤ製造技術の進歩により、タイヤ市場は成長を続けています。デバイスの自動化とビッグデータの導入の増加により、市場の成長が促進されています。さらに、費用対効果が高く高品質のタイヤを生産するために、一部のメーカーは自動化されたワンステップのタイヤ製造プロセスを使用しています。

- 米国タイヤ製造者協会(USTMA)によると、2021年の米国タイヤ総出荷量は3億3,520万本に対し、2022年は3億4,210万本となっています。

- 中国は世界最大のタイヤ生産国および消費国です。中国のあらゆる分野に大中小のタイヤメーカーが300社以上あります。中国のタイヤ産業は、金額と生産量の点で世界最大です。中国ゴム工業協会のタイヤ産業によると、会員上位38社は2021年に合計5億2,922万本のタイヤを生産し、前年比11.28%増加しました。

- さらに、フランスのタイヤ製造大手ミシュランによると、トラック・バス用タイヤ市場は、2022年以降、欧州と北米で受注の飽和を背景に、新車装着状態で引き続き好調に推移しました。北米では、2024年に新しい排出ガス基準が施行されることを見据えた車両タイヤの購入が需要を支えました。

- 上記のすべての事実と要因を考慮すると、タイヤ用途におけるゴム添加剤の使用と需要は、予測期間中に増加すると予想されます。

アジア太平洋地域が市場を独占

- 予測期間を通じてアジア太平洋が優勢になると予想されます。中国、インド、韓国などの国々では、自動車用途でのゴム添加剤の使用が加速し、電気・電子用途での用途が増加しているため、この地域でのゴム添加剤の消費量は増加しています。

- ゴム添加剤は、ゴムおよびその関連製品の加工に広く使用されています。自動車分野のタイヤ製造におけるゴムの需要の高まりにより、ゴム添加剤の市場が牽引されています。国内の自動車産業の回復と他のゴムベース産業の再開により、近い将来調査対象の市場が牽引されると予想されます。

- 中国は天然ゴムの世界最大の消費国であり、世界の消費量の37%を占めているが、国内で必要な量のほんの一部しか生産するのに適した土地が不足しています。その結果、中国政府は中国企業にゴム生産への投資を奨励し始めました。したがって、ゴム添加剤は天然ゴムと合成ゴムの両方の加工に使用されるため、この国ではゴム添加剤の可能性があります。

- 2005年以来、中国は世界最大のタイヤ生産国および消費国となっています。タイヤの生産と消費は非常に健全な成長を遂げてきましたが、ここ数年、特に過去2年間、タイヤ市場は国内および国内で事業を展開する外国企業にとって非常に厳しいものとなっています。ただし、自動車の生産とさまざまなエンドユーザー業界でのゴム添加剤の使用が拡大し続けるため、消費量は予測期間中に増加すると予測されています。

- 国際自動車建設機構(OICA)によると、世界経済の不確実性にもかかわらず、同国の自動車生産は2021年に7%、2022年に3%の増加を記録しました。

- さらに、同協会によると、インド、オーストラリア、韓国の自動車生産は、2022年にそれぞれ24%、13%、9%の年間増加を記録したといいます。

- 国家統計局によると、中国の電子情報製造部門は2022年に安定した成長を記録し、生産と投資の面で力強い拡大を示しました。工業情報化省によると、この分野の大企業の付加価値はこの期間に前年比7.6%増加し、全産業よりも4%高かったです。これにより、電線の使用が増加しています。

- インドのエレクトロニクス産業は、世界で最も急速に成長している産業の1つです。最近、電子情報技術省はインドのエレクトロニクス製造に関するビジョン文書第2巻を発表し、エレクトロニクス製造産業は2025~26年までに3,000億米ドルに達すると予想されていると述べています。

- 上記のすべての要因は、予測された期間にわたってアジア太平洋のゴム添加剤市場の成長を促進する可能性があります。

ゴム添加剤業界の概要

世界のゴム添加剤市場は本質的に部分的に統合されており、上位5社で市場全体の40%以上を占めています。大手企業も研究開発活動に注力しており、製品開発のための革新的な技術を開発し、市場シェアを拡大するために合併・買収に取り組み、市場での有効性と専門性を高めるためにサプライチェーンを最適化しています。調査対象となった市場の主要企業には、中国サンシンケミカルホールディングスリミテッド、ラインケミー(ランクセス)、イーストマンケミカルカンパニー、中国石油化工集団(シノペック)、NOCIL LIMITEDなどが含まれます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- タイヤゴム産業の成長

- 建設業界における非タイヤセグメントの需要拡大

- その他の促進要因

- 抑制要因

- ゴム薬品に関する環境制約

- その他の阻害要因

- 業界バリューチェーン分析

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競合の度合い

第5章 市場セグメンテーション(金額ベース市場規模)

- タイプ

- 活性剤

- 加硫抑制剤

- 可塑剤

- その他のタイプ

- 用途

- タイヤ

- コンベヤーベルト

- 電気ケーブル

- その他の用途

- フィラー

- カーボンブラック

- 炭酸カルシウム

- シリカ

- その他のフィラー

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他中東とアフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア(%)**/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- BASF SE

- Behn Meyer

- China Petrochemical Corporation(SINOPEC)

- China Sunsine Chemical Holdings Limited

- Eastman Chemical Company

- Emery Oleochemicals

- Kemai Chemical Co. Ltd

- MLPC International(Arkema Group)

- NOCIL LIMITED

- PUKHRAJ ZINCOLET

- Rhein Chemie(Lanxess)

- Sumitomo Chemical Co. Ltd

- Thomas Swan & Co. Ltd

第7章 市場機会と今後の動向

- 電気自動車からの需要拡大

- バイオベースのゴム添加剤の開発

The Rubber Additives Market size is estimated at USD 5.87 billion in 2024, and is expected to reach USD 7.26 billion by 2029, growing at a CAGR of 4.32% during the forecast period (2024-2029).

The COVID-19 pandemic affected the rubber additives market as automotive manufacturing and supply chains were halted. The introduction of lockdowns across the world caused transportation delays and hindered import-export activities. However, the sector is recovering well since restrictions were gradually lifted. An increase in electric vehicle sales and growing demand for electronic appliances have led the market recovery over the last two years.

Key Highlights

- The growing rubber and tire industry along with increasing demand from the non-tire segment of the construction industry are the key attributes driving the demand for the market studied.

- On the flipside, environmental concerns related to its disposal are expected to hinder the growth of the market.

- The development of new additives to produce high-performance rubbers that increase the durability of the end product is likely to act as an opportunity in the future.

- Asia-Pacific region dominated the market for rubber additives with India, China, Japan driving the consumption.

Rubber Additives Market Trends

Tire Segment to Dominate the Market

- The tire industry accounts for the largest share of the rubber additives market during the study period. Natural rubber in combination with synthetic rubbers like butadiene rubber or styrene butadiene rubber is majorly used in tire manufacturing.

- The tire market continues to grow due to technological advances in manufacturing high-quality tires. Increasing device automation and big data adoption is boosting the market growth. Additionally, for cost-effective and high-quality tire production, some manufacturers are using an automated, one-step tire manufacturing process.

- According to the United States Tire Manufacturers Association (USTMA), total U.S. tire shipments of 342.1 million units in 2022, compared to 335.2 million units in 2021.

- China is the world's largest tire producer and consumer. There are more than 300 large, medium, and small tire manufacturers in all segments of China. China's tire industry is the largest in the world in terms of value and volume. According to China Rubber Industry Association's Tire Industry, the top 38 member companies produced a total of 529.22 million tires in 2021, an increase of 11.28% from previous year.

- Furthermore, according to the French tire manufacturing giant Michelin, in original equipment, the truck and bus tire market continued to perform well in Europe and North America against a backdrop of saturated order books since 2022. In North America, demand was supported by purchases of vehicles in anticipation of a new emissions standard coming into force in 2024.

- Considering all the above facts and factors, the usage and demand of rubber additives for tire applications are expected to grow in the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate through the forecast period. With the accelerating usage of rubber additives in automotive and increasing application in electrical and electronucs applications in countries such as China, India, and South Korea, the consumption of rubber additives is growing in the region.

- Rubber additives are widely used in the processing of rubber and its allied products. The growing demand for rubber in tire manufacturing in the automotive sector has been driving the market for rubber additives. The recovering automotive industry and resuming of other rubber-based industries in the country are expected to drive the market studied in the near future.

- China is the world's largest consumer of natural rubber, accounting for 37% of global consumption, but lacks suitable land to produce only a fraction of what it needs domestically. As a result, the Chinese government began encouraging Chinese companies to invest in rubber production. Thus, there is a potential for rubber additives in the country as they are used both to process natural and synthetic rubber.

- Since 2005, China has been the world's largest tire producer and consumer. Although tire production and consumption have enjoyed a very healthy growth, the last few years, especially the last two years, the market has been very tough for domestic and foreign companies operating in the country. However, as the automotive production and usage of rubber additives in different end-user industies constinues to expand, the consumption is projected to increase during the forecast period.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), despite the global economic unceratinities prevailing, the country's motor vehicle production registered an increase of 7% in 2021 and 3% in 2022.

- In addition, according to the association, motor vehicle production in India, Australia, and South Korea registered annual increases of 24%, 13%, and 9%, respectively, in 2022.

- According to the National Statistics Bureau, China's electronic information manufacturing sector recorded steady growth in 2022, signaling strong expansion in terms of production and investment. According to the Ministry of Industry and Information Technology, the added value of large companies in this sector increased by 7.6% year-on-year in this period, making the industry 4% higher than all industries. This is boosting the usage of electric cables.

- The Indian electronics industry is one of the fastest growing industries in the world. Recently, the Ministry of Electronics and Information Technology released Volume 2 of its vision document on electronics manufacturing in India, stating that the electronics manufacturing industry is anticipated to reach USD 300 billion by 2025-26.

- All factors above are likely to fuel the growth of rubber additives market in Asia-Pacific over the forecasted time frame.

Rubber Additives Industry Overview

The global rubber additives market is partially consolidated in nature, with top 5 players together accounting for more than 40% of the total market. Major players are also focusing on R&D activities, developing innovative techniques for the development of the product, engaging in mergers and acquisitions in order to increase their market share and optimizing supply chain to increase its efficacy and specialization in the market. The key players in the market studied include China Sunsine Chemical Holdings Limited, Rhein Chemie (LANXESS), Eastman Chemical Company, China Petrochemical Corporation (Sinopec), and NOCIL LIMITED, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth in the Tire and Rubber Industry

- 4.1.2 Growing Demand from the Non-Tire Segment in the Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Constraints Pertaining to Rubber Chemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Activators

- 5.1.2 Vulcanization Inhibitors

- 5.1.3 Plasticizers

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Tires

- 5.2.2 Conveyor Belts

- 5.2.3 Electric Cables

- 5.2.4 Other Applications

- 5.3 Fillers

- 5.3.1 Carbon Black

- 5.3.2 Calcium Carbonate

- 5.3.3 Silica

- 5.3.4 Other Fillers

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Behn Meyer

- 6.4.3 China Petrochemical Corporation (SINOPEC)

- 6.4.4 China Sunsine Chemical Holdings Limited

- 6.4.5 Eastman Chemical Company

- 6.4.6 Emery Oleochemicals

- 6.4.7 Kemai Chemical Co. Ltd

- 6.4.8 MLPC International (Arkema Group)

- 6.4.9 NOCIL LIMITED

- 6.4.10 PUKHRAJ ZINCOLET

- 6.4.11 Rhein Chemie (Lanxess)

- 6.4.12 Sumitomo Chemical Co. Ltd

- 6.4.13 Thomas Swan & Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand From Electric Vehicles

- 7.2 Development of Bio-based Rubber Additives