|

市場調査レポート

商品コード

1851162

過酢酸:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Peracetic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 過酢酸:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月19日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

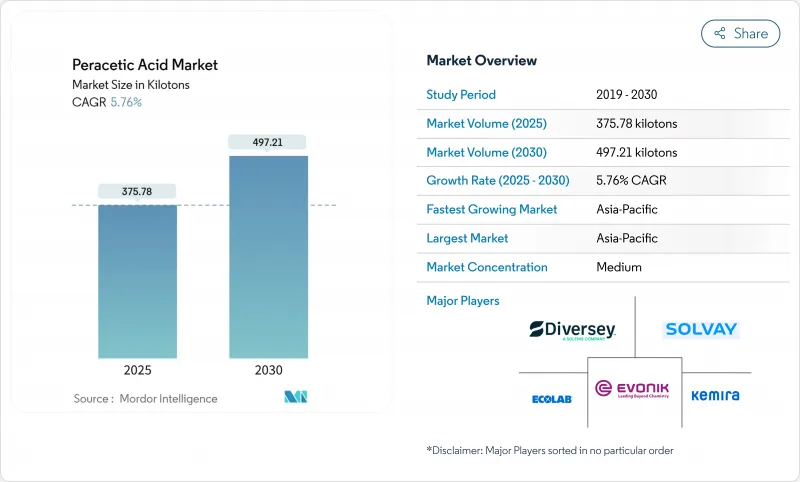

過酢酸市場規模は2025年に375.78キロトンと推計され、2030年には497.21キロトンに達すると予測され、予測期間(2025-2030年)のCAGRは5.76%です。

この見通しには、塩素系殺生物剤の使用を控える規制シフト、低温殺菌システムの導入、水再利用インフラへの継続的投資が寄与しています。有機的な取り扱いや残留物のない衛生管理のために認可された広域スペクトル抗菌剤を必要とする食品加工業者からの需要の高まりが、販売量の増加をさらに後押ししています。生産者はまた、水性混合物を安定させ、出荷コストを下げ、作業員の暴露リスクを削減するプロセス革新を活用しています。アジア太平洋と北米における買収は、高成長する最終用途に迅速に対応できる地域生産拠点への戦略的軸足を強調しています。

世界の過酢酸市場の動向と洞察

水処理業界からの需要の高まり

過酢酸は酢酸、水、酸素に分解されるため、規制対象の消毒副生成物を避けることができるため、自治体や産業界の事業者は過酢酸に切り替えています。2024年のPFAS飲料水規則により、残留化学物質に対する監視が強化されていますが、過酢酸は幅広いpH範囲で優れたウイルスと原虫の不活性化を達成することがパイロット試験で確認されています。酸化剤は既存の漂白剤供給ラインから注入できるため、改修コストは低く抑えられ、資本支出を削減できます。また、膜に蓄積するバイオフィルムが減少し、洗浄サイクルが短縮され、資産寿命が延びたという報告もあります。これらの性能とコンプライアンス上の利点が相まって、特に中国と米国で排水目標が段階的に厳しくなる2027年まで、大規模自治体システムの平均投与量が増加します。

飲食品衛生を促進する食品安全規制

米国農務省(USDA)の有機規則では、機器と表面の衛生に過酢酸が許可され、EPAによる500ppmの残留物免除により、従来の塩素洗浄で一般的であった微生物学的保留時間の遅延が解消されます。乾燥または泡沫安定化過酢酸製剤を採用する加工業者は、水使用量を削減し、より迅速なライン切り替えを実現することで、食肉や青果施設の処理能力を向上させています。研究によれば、殺生物剤は100ppm以下の用量でサルモネラ菌やリステリア菌に致死的であり、クリーンラベルの位置づけを支持しています。2024年10月の食肉加工に関するOSHAガイダンスでは、過酢酸が有効な細菌制御オプションとして取り上げられ、リスクの高い工場での転換が促進されました。かつては賞味期限の短さに敬遠していた小規模加工業者も、今では6ヶ月安定性の希釈済みバッグ・イン・ボックス・システムを購入するようになり、農村部での新たな需要開拓が進んでいます。

労働災害と取り扱いの課題

OSHAは、過酢酸を危険性の高い化学物質としてリストアップしており、在庫が1,000ポンドを超えるとプロセス安全規則が適用されます。蒸気閾値が1.24mg/m3であるため、施設は専用の換気装置と連続モニターを設置しなければならないです。小規模の加工業者では、こうした管理規則を導入するための資金が不足していることがあり、導入が遅れています。予算が許せば、作業員には適合試験済みの呼吸マスクと化学物質飛散防止用PPEが必要で、訓練費用がかさみます。軟質金属に対する腐食性は、ポリマーやステンレスの配管を要求し、改造費用を増加させる。自動注入システムは直接の取り扱いを減らすが、保険会社は、複数年の事故率が良好であることが証明されるまで、依然として高い保険料を課します。

セグメント分析

2024年の過酢酸市場の68.17%を液体ソリューションが占め、255キロ・トン以上に相当します。信頼性、供給慣れ、配合の複雑性の低さがこのリードを支えています。液体製品の過酢酸市場規模は、自治体、酪農場、飲料メーカーが確立された飼料システムに固執しているため、着実に上昇すると予測されます。しかし、水性ブレンドはCAGR 5.98%で最も急速に拡大しています。サプライヤーは現在、過酸化水素と安定剤で緩衝化された過酢酸を調合し、保存期間を12ヶ月まで延長して廃棄コストを削減しています。ブレンドは低濃度で出荷されるため、輸送コードがより厳格でなくなり、地方での利用範囲が広がります。装置メーカーは、これらのブレンドと、作業員の被ばくを低減するインライン希釈モジュールを組み合わせ、クラフトビール醸造所や分散型水再利用装置での採用を後押ししています。粉末や顆粒は、人里離れた鉱山や軍の厨房など、長期保管やゼロ・スピル輸送が不可欠なニッチな衛生ニーズに対応します。

技術の進歩は形態の多様化を支えています。泡で安定化したスプレーは垂直面に付着するため、孵卵場や食肉処理場での接触時間が長くなります。ドライブレンドの小袋は現場で溶解し、農産物の洗浄に的を絞った強度を生み出し、重量と貨物を削減します。サプライヤーは、ドライ製品の流通にかかる二酸化炭素排出量を20%削減できると主張しています。予測期間中、エネルギーコストの上昇とネット・ゼロの目標は、再構成ステップにもかかわらず、ユーザーを濃縮ドライフォームに向かわせるはずです。全体として、形態の多様性はサプライヤーの回復力を強化し、カスタマイズを促進するが、規制の動きや保険料が高強度貯蔵に決定的なペナルティを課すまでは、液体がバルクの優位性を維持する可能性が高いです。

過酢酸市場では、2024年の中型(5~15%)レンジのシェアが54.17%(約200キロ・トン)と報告されています。このレンジは、防爆保管を要求する閾値を下回る一方で6-logの微生物殺滅を実現し、ユーザーに最高のコスト対コンプライアンス比を提供します。需要は、飲料フィラー、チーズホイール、オペレーターがシフトごとに消毒を行う養鶏工場のスプレーチラーから生じています。2030年までのCAGRは6.02%です。これは、東南アジアの新規参入企業が輸入機器の仕様に合う中強度のパッケージを選択するためです。5%未満の低強度レンジは、レストラン・チェーンや医療用表面拭きなど、すぐに使えるニッチ・パックに使用されます。15%以上の高強度レンジは、軟性内視鏡の再処理や医薬品のクリーンルーム用のバルク滅菌剤に供給されるが、取り扱い上の割高感から広範な普及には限界があります。

配合業者は、アルミニウム製コンベアや投与ポンプとの接触を可能にする、防錆添加剤入りの中級グレード配合を設計しています。この互換性により、顧客はコストのかかるステンレスのアップグレードから解放されます。並行して、クラウドに接続されたメーターは監査証跡のために濃度データを記録し、FDAやEUの衛生記録の義務付けを緩和します。このような機能強化は、切り替えコストを引き上げ、サプライヤーの囲い込みを助長します。原料の変動は利幅を圧迫しかねないが、生産者は二重の酢酸調達と先物契約でヘッジしています。競合価格の可視性により、中グレードのスプレッドは持続可能な範囲内に保たれ、今後数年間は安定した地位を維持することができます。

地域分析

アジア太平洋地域は、中国、インド、タイが牽引し、2024年の世界売上高の38.24%を占めました。可処分所得の増加が包装食品の需要に拍車をかける一方、中国のGB 31604.1食品接触材料規格などの厳しい規則が加工業者を塩素代替品へと向かわせています。日本唯一のメーカーは、高純度電子機器や医薬品の顧客にアピールする非塩素系技術を活用しています。スマート水道網への政府投資も、過酢酸を三次消毒段階へと引き込んでいます。この地域の予想CAGRは6.75%であるが、これはインドとインドネシアにおける病院建設が後押ししています。

北米は依然として成熟した市場であるが、規模は大きいです。2024年のPFAS規則とEPAの蒸気滅菌排出に関する提案は、公益企業や病院が準拠のために過酢酸を検討するよう促しています。食肉や鶏肉の輸出は、米国農務省認可の除菌剤に依存しており、大規模な加工業者では、化学薬品と自動スプレーキャビネットを組み合わせることが多いです。米国中西部のイノベーション・クラスターには、乾燥グレードや緩衝グレードを供給する複数の製剤専門企業があります。カリフォルニア州のピュアウォーター・サンディエゴ・プロジェクトのような自治体による再利用計画が、ベースライン需要を押し上げています。地域全体の成長は、改修活動と製品の多様化により世界平均に近いです。

欧州は、持続可能性の義務化に支えられた安定した拡大を示しています。スカンジナビアのパルプ工場は、エコラベルのステータスを確保するために過酢酸漂白を導入し、ドイツとベルギーのビール工場は、ライン洗浄に低発泡性混合物を採用しています。EUの雇用安全指令は、オペレーターの被曝量を制限し、クローズドフィードシステムを奨励しています。新興の東欧諸国は、結束基金の支援を受けて自治体の治療施設を改善し、二次消毒に過酢酸を導入しています。現在のところ、処理量の増加は緩やかであるが、炭素と塩素の排出制限が厳しくなっているため、2030年まで追加的な導入が可能です。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 水処理産業からの需要拡大

- 飲食品の衛生を高める食品安全規制

- 医療機器の低温滅菌の成長

- 塩素から環境に優しいパルプ漂白剤へのシフト

- さまざまな産業で殺菌剤としての用途が拡大

- 市場抑制要因

- 職業上の危険と取り扱いの課題

- 高コスト対塩素ベースの代替品

- 前駆体無水酢酸の価格変動

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 製品形態別

- リキッド・ソリューション

- 粉末/顆粒

- 水性ブレンド

- 濃縮グレード別

- 5%未満PAA(低)

- 5-15 % PAA(中)

- 15%以上PAA(高)

- 用途別

- 消毒剤

- 酸化剤

- 滅菌剤

- その他の用途(漂白剤、除菌剤など)

- エンドユーザー業界別

- 飲食品加工

- 水処理

- パルプ・紙

- ヘルスケア(医薬品を含む)

- ケミカル

- その他のエンドユーザー産業(農業・養殖業など)

- 地域別(数量)

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/ランキング分析

- 企業プロファイル

- ACURO ORGANICS LIMITED

- Aditya Birla Chemicals

- Airedale Group

- Biosan

- Brainerd Chemical

- Christeyns

- Diversey, Inc

- Ecolab

- Enviro Tech Chemical Services, Inc.

- Evonik Industries AG

- Hydrite Chemical

- Jubilant Pharmova Limited

- Kemira

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Solvay

- STOCKMEIER Group