|

市場調査レポート

商品コード

1405713

小骨・関節用整形外科デバイス:市場シェア分析、産業動向・統計、成長予測、2024年~2029年Small Bone and Joint Orthopedic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 小骨・関節用整形外科デバイス:市場シェア分析、産業動向・統計、成長予測、2024年~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

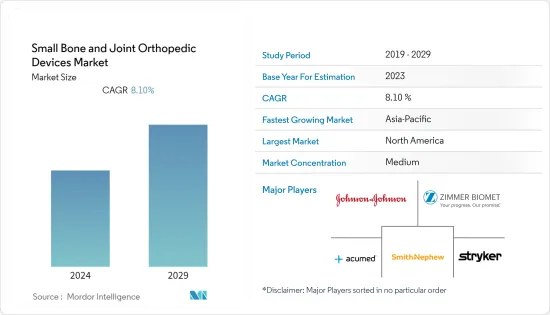

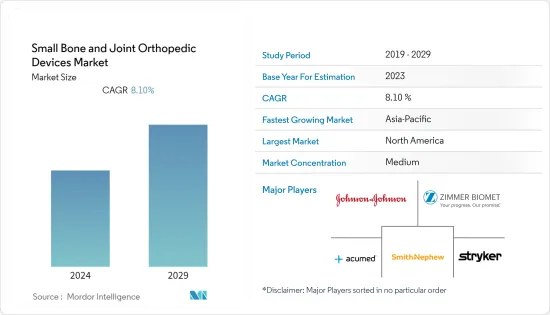

小骨・関節用整形外科デバイス市場は、予測期間中にCAGRで8.1%の成長を記録する見込みです。

COVID-19パンデミックは、予定されていた治療処置の中止や延期、新規診断や治療処置の数の減少につながっており、小骨・関節用整形外科デバイス市場に影響を与えています。例えば、2021年4月にSpringer Journal誌に掲載された調査結果によると、公立・私立の医療機関の90%近くが、パンデミックの間、選択的で緊急性のない整形外科手術を中止したが、私立病院の68%は緊急の外科治療を提供しました。その上、欧州では70%以上の医療機関で、外科チームが縮小されました。さらに、インドでCOVIDが流行した際には、整形外科医の64%が選択的手術を中止しました。これはパンデミック期間中、市場に深刻な影響を与えました。しかし、COVID-19症例の減少と小骨および整形外科手術の再開により、市場は順調に回復しています。

関節疾患の有病率を高める高齢化人口の増加、最小限の外科手術に対する需要の高まり、関節再建手術の増加などが、小骨・関節用整形外科デバイス市場の主な促進要因となっています。World Population Prospects 2022報告書によると、2022年の世界の65歳以上の人口は約7億7,100万人で、2030年には9億9,400万人、2050年には16億人に達すると予測されています。このように、老年人口は骨・関節疾患に罹患しやすいため、老年人口の増加が市場の成長を促進する可能性が高いです。

さらに、主要企業による新しい機器の発売、M&A、パートナーシップ、提携などの事業拡大活動が市場を押し上げると予想されます。例えば、2021年9月、Anika Therapeutics, Inc.は、サンフランシスコで開催されたAmerican Society for Surgery of the Hand(ASSH)2021 Annual Meetingにおいて、WristMotion Total Wrist Arthroplasty(TWA)システムを発表しました。WristMotion TWAシステムは、痛みの緩和と関節炎を起こした手関節の機能回復を目的としています。

このように、前述のすべての要因が市場の成長に寄与しています。しかし、厳しい規制基準が予測期間中の市場の抑制要因になりそうです。

小骨・関節用整形外科デバイス市場の動向

手・手首用デバイスセグメントが、予測期間中に大きなシェアを占める見込み

手・手首用デバイスには、親指、手首、肘、肩、およびその他の近傍部位の骨や関節の問題を治療するために使用される手首固定スプリントや橈骨遠位端スプリントが含まれます。この分野は、手の筋骨格系障害の有病率の高さとスポーツ関連の手の怪我の増加により、調査された市場で大きなシェアを占めると予想されています。例えば、2022年6月にPM & Knowledgeに掲載された記事によると、手首の怪我は労働関連の怪我全体の5.5%を占め、その割合は2.54/10,000人のフルタイム労働者で、平均16.75日の休業につながりました。同様に、2022年10月にPain Reportsに掲載された記事によると、米国では毎年260万人の手と手首の怪我が発生しています。このように、手や手首の怪我の大きな負担は、手や手首のデバイスの需要を増加させ、それによって予測期間中のセグメントの成長を押し上げると予想されます。

加えて、技術革新、新デバイスの導入、企業の合併・買収、市場参入企業によるその他の事業拡大イニシアティブが、手・手首用デバイスセグメントの成長をさらに促進すると予想されます。例えば、2021年5月、Orthopedic Implants社は、米国FDA認可と手首骨折プレーティング技術「DRPxシステム」の市販開始を発表しました。これは、整形外科医の技術的嗜好を満たす改良された人間工学的設計を特徴とする橈骨遠位端プレーティングシステムであると同時に、コスト削減を大幅に向上させ、外来手術センター(ASC)や病院の財政的実行可能性の向上に貢献します。

このように、前述の要因はすべて、予測期間中にセグメントの成長を押し上げると予想されます。

予測期間中、北米が市場で大きなシェアを占める見込み

北米は、整形外科手術件数の増加や同地域の高齢化人口の増加により、世界の小骨・関節用整形外科デバイス市場で大きなシェアを占めると予想されます。また、低侵襲手術に対する需要の高まりも市場の成長を後押ししています。

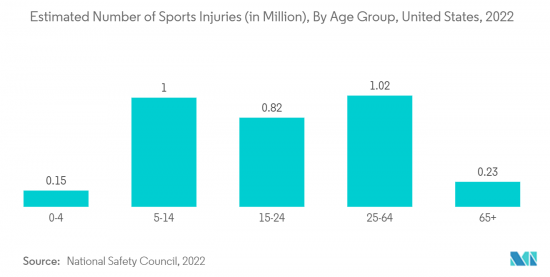

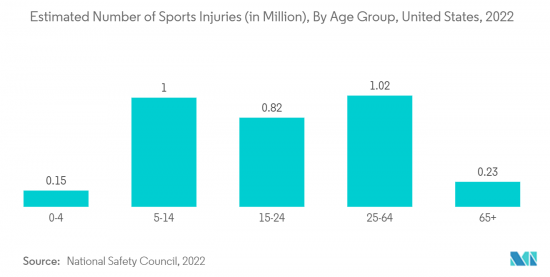

米国におけるスポーツ傷害の増加は、市場の成長を促進すると予想されています。例えば、国家安全評議会統計2022によると、スポーツやレクリエーションでの負傷率は2021年に前年比20%上昇しました。2021年には、320万人がスポーツやレクリエーション用具が関係する傷害のために救急部で治療を受けました。負傷に最も多く関連した活動は、運動、サイクリング、バスケットボールでした。運動器具による傷害については、2020年の377,939件から2021年には409,224件とわずかに増加しています。このように、スポーツ傷害の増加は予測期間中の市場成長に寄与すると考えられます。

小骨・関節用整形外科デバイス産業の概要

小骨・関節用整形外科デバイス市場は統合されており、少数の大手企業で構成されています。さらに、技術の進歩や製品の革新に伴い、中堅から中小の企業が、より低価格で新しい機器を導入することで、市場での存在感を高めています。現在市場を独占している大手企業には、Stryker Corporation、Zimmer Biomet、Johnson &Johnson(DePuy Synthes)、Acumed LLC、Smith &Nephew Plcなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 高齢化人口の増加と変性関節疾患の有病率の増加

- 低侵襲手術に対する需要の高まりと関節再建手術件数の増加

- 市場抑制要因

- 厳しい規制規範

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 製品タイプ別

- 手・手首用

- 足・足首用

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Stryker

- Zimmer Biomet

- Johnson & Johnson(DePuy Synthes)

- Acumed LLC

- Smith & Nephew

- Conventus Orthopaedics, Inc.(Flower Orthopedics)

- Arthrex Inc

- Ceraver

- Nutek Orthopedics

- DJO, LLC

- Orthofix US LLC

- Ortho Solutions UK Ltd

第7章 市場機会と今後の動向

The small bone and joint orthopedic devices market is expected to register a CAGR of 8.1% during the forecast period.

The COVID-19 pandemic has impacted the small bone and joint orthopedic devices market as it has led to the cancellation or postponement of scheduled treatment procedures and a decrease in the number of new diagnoses and treatment procedures. For instance, according to a research study published in the Springer Journal in April 2021, nearly 90% of public and private institutions discontinued elective, non-urgent orthopedic surgeries, while 68% of private hospitals provided urgent surgical care during the pandemic. Besides, in more than 70% of the institutions in Europe, the surgical team was reduced. Additionally, during the COVID outbreak in India, 64% of orthopedic physicians ceased elective procedures. This severely impacted the market during the pandemic. However, the market has recovered well owing to declining COVID-19 cases and the resumption of small bone and orthopedic surgeries.

The rising aging population which increases the prevalence of joint diseases, growing demand for minimal surgical procedures, and an increasing number of joint reconstruction surgeries are the key driving factors in the small bone and joint orthopedic devices market. According to the World Population Prospects 2022 report, around 771 million people worldwide were aged 65 years or older in 2022 which is projected to reach 994 million by 2030 and 1.6 billion by 2050. Thus, a growing geriatric population is likely to propel the growth of the market as this population is more prone to suffer from bone and joint diseases.

Further, business expansion activities such as new device launches, mergers and acquisitions, partnerships, and collaborations by key companies are expected to boost the market. For instance, in September 2021, Anika Therapeutics, Inc. introduced the WristMotion Total Wrist Arthroplasty (TWA) system at the American Society for Surgery of the Hand (ASSH) 2021 Annual Meeting in San Francisco. The WristMotion TWA system is aimed at alleviating pain and restoring the function of the arthritic wrist joint.

Thus, all the aforementioned factors are contributing to the market growth. However, stringent regulatory norms are likely to restrain the market over the forecast period.

Small Bone and Joint Orthopedic Devices Market Trends

Hand and Wrist Devices Segment is Expected to Hold Significant Share in Studied Market Over the Forecast Period

Hand and wrist devices include wrist fusion splints and distal radius splints which are used to treat bone and joint problems of the thumb, wrist, elbow, shoulder, and other nearby areas. The segment is expected to account for a significant share of the studied market due to the high prevalence of musculoskeletal disorders of the hand and rising sports-related hand injuries. For instance, according to the article published in PM & Knowledge in June 2022, wrist injuries account for 5.5% of all work-related injuries, with a rate of 2.54/10,000 full-time workers which led to an average of 16.75 days of work off. Similarly, according to the article published in Pain Reports in October 2022, in the United States, 2.6 million hand and wrist injuries occur each year. Thus, the huge burden of hand and wrist injuries is expected to increase the demand for hand and wrist devices, thereby boosting segment growth over the forecast period.

In addition, technological innovations, the introduction of new devices, company mergers and acquisitions, and other business expansion initiatives by market players are expected to further fuel the growth of the hand and wrist device segment. For instance, in May 2021, Orthopedic Implants announced US FDA clearance and the commercial launch of its wrist fracture plating technology, the DRPx System. It is the distal radius plating system that features an improved ergonomic design that meets the technical preferences of orthopedic surgeons while significantly increasing cost savings, helping to improve the financial viability of ambulatory surgery centers (ASCs) and hospitals.

Thus, all the aforementioned factors are expected to boost segment growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market over the Forecast Period

North America is expected to hold a major share in the global small bone and joint orthopedic devices market due to the increasing number of orthopedic procedures and the rise in the aging population in this region. In addition, the growing demand for minimally invasive surgeries is also fuelling the growth of the market.

The increase in sports injuries in the United States is expected to propel the growth of the market. For instance, according to the National Safety Council Statistics 2022, sports and recreational injury rates rose 20% in 2021 compared to the previous year. In 2021, 3.2 million people were treated in emergency departments for injuries involving sports and recreational equipment. The activities most frequently associated with injuries were exercise, cycling, and basketball. Regarding exercise equipment injuries, the number of injuries increased slightly from 377,939 injuries in 2020 to 409,224 injuries in 2021. Thus, an increase in sports injuries is likely to contribute to the market growth over the forecast period.

Additionally, product launches by the players are expected to boost the market growth in the region over the forecast period. For instance, in April 2022, Medline Unite Foot and Ankle introduced its Calcaneal Fracture plating system and IM fibula implant in the United States. The Calcaneal Fracture plating system from Medline Unite offers a variety of implant options, including standard, offset, and extension dinus tarsi, as well as perimeter plates. It also has fully threaded 5.5 mm and 7.0 mm headed cannulated screws and a sinus tarsi extension plate inserter for easy plate insertion and positioning through a sinus tarsi incision for posterior tuberosity percutaneous screw placement.

Thus, all the aforementioned factors are expected to boost segment growth over the forecast period.

Small Bone and Joint Orthopedic Devices Industry Overview

The small bone and joint orthopedic devices market is consolidated and consists of a few major players. Moreover, with technological advancements and product innovations, mid-size to small companies are increasing their market presence by introducing new devices at fewer prices. A few of the major players which are currently dominating the market are Stryker Corporation, Zimmer Biomet, Johnson & Johnson (DePuy Synthes), Acumed LLC, and Smith & Nephew Plc, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Aging Population and Increasing Prevalence of Degenerative Joint Diseases

- 4.2.2 Growing Demand for Minimally Invasive Surgeries and Increasing Number of Joint Reconstruction Surgeries

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Norms

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Hand and Wrist Devices

- 5.1.2 Foot and Ankle Devices

- 5.1.3 Others

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 GCC

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Stryker

- 6.1.2 Zimmer Biomet

- 6.1.3 Johnson & Johnson (DePuy Synthes)

- 6.1.4 Acumed LLC

- 6.1.5 Smith & Nephew

- 6.1.6 Conventus Orthopaedics, Inc. (Flower Orthopedics)

- 6.1.7 Arthrex Inc

- 6.1.8 Ceraver

- 6.1.9 Nutek Orthopedics

- 6.1.10 DJO, LLC

- 6.1.11 Orthofix US LLC

- 6.1.12 Ortho Solutions UK Ltd