|

市場調査レポート

商品コード

1689724

自動車用熱管理:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Automotive Thermal Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用熱管理:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 90 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

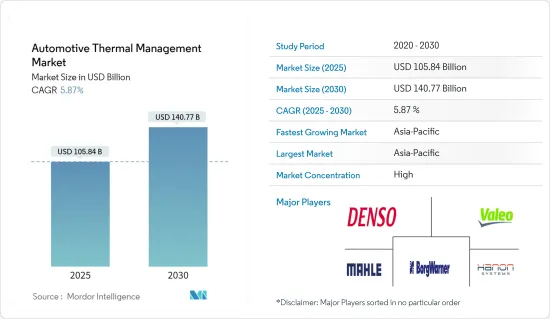

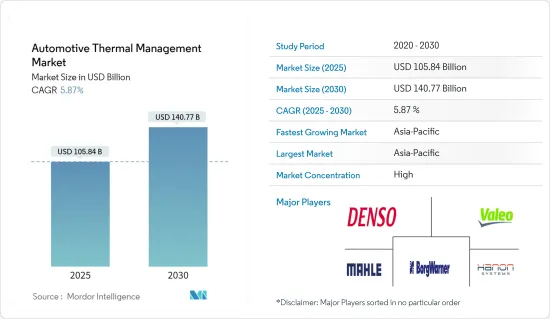

自動車用熱管理市場規模は2025年に1,058億4,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは5.87%で、2030年には1,407億7,000万米ドルに達すると予測されます。

COVID-19パンデミック時の製造停止、ロックダウン、貿易制限は、自動車用熱管理産業に悪影響を与えました。さらに、自動車生産の落ち込みと労働力不足も市場に大きな影響を与えました。例えば、2019年の世界の自動車生産台数は15.69%減少しました。2021年には、世界の自動車生産台数はパンデミックに見舞われた2020年に比べて大幅に増加したもの、主に半導体不足に起因する2019年の数字を大きく下回りました。

自動車産業では、乗り心地の向上と車室内の快適性のための断熱に対するニーズの高まりが非常に重視されており、熱管理システムの需要が大幅に高まっています。自動車内の電気・電子部品の数が増え続けていることも、放熱のためにより優れた熱管理システムの必要性を高めています。

長期的には、自動車産業が電動モビリティに移行するにつれて、ICエンジン用の熱管理システムは完全に時代遅れになると予想されます。しかし、ヘビーデューティーバッテリーや大電流モーターなど、ヘビーデューティーな電気部品が増加しているため、こうした面では高い需要が維持され続けると予想されます。自動化とパワートレインの電動化が進むにつれて、自動車産業では乗用車と商用車の両方で電気・電子部品の需要が指数関数的に増加しています。

主要な相手先商標製品メーカーは、電動車両に最良の走行距離を提供するため、熱管理システムの開発に注力しています。例えば

主要ハイライト

- 2021年12月、Volvoは電気部品と電子制御ユニットを使ってトラックのバッテリーを予熱する新しい熱管理システムの検査を行りました。このサーマルシステムは、過酷な気象条件下でも確実に温度を維持するため、需要が大幅に増加します。

自動車部品サプライヤーは、自動車の電動化の進展に伴い、熱エネルギー管理市場における国際競合を強化するための取り組みを加速させています。例えば

主要ハイライト

- 2022年2月、Borgwarner Inc.は、BMWグループのiXとi4完全電動アーキテクチャーに使用される高電圧クーラントヒーター(HVCH)を供給する契約を締結しました。このソリューションは、バッテリーの熱管理システムと車内暖房を制御し、バッテリーの走行距離と信頼性を大幅に向上させています。

アジア太平洋は、自動車用熱管理システムの大手OEMが存在すること、中国、インド、日本、韓国などの自動車市場が大きいこと、自動車製造業が発達していることから、最大の市場になると予測されています。

北米と欧州は、自動車保有率が高く、電気自動車や自律走行車の販売が伸びており、自動車製造業が発達していることから、次に大きな市場になると予測されています。

このように、前述の要因が重なることで、自動車用熱管理システムの成長が促進されると予想されます。

自動車用熱管理市場の動向

バッテリー熱管理で大幅成長

全電動パワートレインまたはハイブリッドパワートレインで走行する自動車には、バッテリー熱管理システムが必要です。バッテリーは、充電の貯蔵と利用効率を最大化するため、特定の温度下で運用されます。したがって、バッテリー電気自動車やプラグインハイブリッド車の増加が、調査期間中の自動車用熱管理市場を牽引する可能性が高いです。例えば

- 2021年には、多くの欧州諸国がEV販売台数の2桁成長を示し、欧州は2020年の43%に対し、2021年には世界のEV販売台数の約34%を獲得しました。プラグイン車全体の販売台数は、2020年の137万台に対し、2021年には約227万台に達しました。

この販売台数の急増は、さまざまな組織や政府が排出ガスレベルを管理し、ゼロ・エミッション車を普及させるために規制基準を強化した結果です。

企業は、今後登場するバッテリー式電気自動車のために、より効率的なバッテリーソリューションの製造に投資しています。例えば

- 2022年9月、Mahleはドイツのハノーバーで開催されたIAA Transportationで商用電気自動車用の新しい熱管理システムを発表しました。

このように、上記の要因は、予測期間中に自動車用サーマルシステムの市場を大幅に拡大すると予測されます。

アジア太平洋が引き続き主要市場シェアを獲得

アジア太平洋の自動車セクタの成長(インドと中国が欧米自動車大手の自動車部品製造拠点として台頭)は、同地域の熱管理システム市場を牽引すると予想されます。

電気自動車の普及を促進する政府規制の高まりや、中国の自動車産業からの需要増に対応するために同地域のOEMやサプライヤーが採用する強固な事業拡大は、予測期間中の市場成長に明るい展望をもたらすと予想されます。例えば

- 2022年8月、Schaeffler Groupは中国で500万個の熱管理モジュールの生産を祝りました。

インドの自動車産業は世界第4位で、商用車生産では世界第7位です。同国における自動車部品事業も、過去5年間で大幅に増加しています。

- 2022年3月、アーメダバードを拠点とし、未来志向のサステイナブルソリューションの提供に注力する技術革新スタートアップ企業Matterによって、新しい高速ミッドトルク電気モーターの開発が明らかにされました。同社によると、マタードライブ1.0モーターは、統合インテリジェント熱管理システムなど、さまざまな重要なブレークスルーを含む新しいインテリジェント・ドライブトレインだといわれています。

さらに、中国、インド、日本、韓国などの国々で電気自動車やハイブリッド車の販売が増加しており、アジア太平洋の自動車用サーマルシステム市場はさらに拡大すると考えられます。

このように、アジア太平洋は予測期間中、世界最大の自動車用サーマルシステム市場であり続けると予測されています。

自動車用熱管理産業概要

自動車用熱管理市場は適度に統合されており、大手企業が市場を独占しています。これらの参入企業には、Denso Corporation、Valeo、Mahle GmbH、Hanon System、BorgWarner Inc.などが含まれます。これらの参入企業は、事業活動を拡大し、市場での地位を固めるために、新製品の発売、合弁事業、生産能力の拡大に取り組んでいます。

- 2022年11月、Denso Corp.は、オーストラリアのシドニーで開催されたBus & Coach Expoで、バスとコーチ用の新しいLD9電気ゼロエミッション熱管理ユニットを発表しました。

- 2022年3月、Hanon Systemsは、電動化車両用の暖房・換気・空調(HVAC)モジュールを製造する新工場を中国の湖西に開設しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場の促進要因

- 市場抑制要因

- 産業の魅力-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 用途

- エンジン冷却

- キャビン熱管理

- トランスミッション熱管理

- 廃熱回収/排気ガス再循環(EGR)熱管理

- バッテリー熱管理

- モーターとパワーエレクトロニクスの熱管理

- 車種

- 乗用車

- 商用車

- 地域

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- その他

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Robert Bosch GmbH

- Dana Incorporated

- MAHLE GmbH

- Gentherm Incorporated

- Hanon Systems

- Denso Corporation

- BorgWarner Inc.

- Valeo Group

- Modine Manufacturing Company

- Schaeffler Technologies AG & Co. KG

- Kendrion NV

- ZF Friedrichshafen

- Aptiv Inc.

第7章 市場機会と今後の動向

The Automotive Thermal Management Market size is estimated at USD 105.84 billion in 2025, and is expected to reach USD 140.77 billion by 2030, at a CAGR of 5.87% during the forecast period (2025-2030).

Manufacturing shutdowns, lockdowns, and trade restrictions during the COVID-19 pandemic negatively affected the automotive thermal management industry. Furthermore, the fall in automotive production and lack of labor significantly impacted the market. For instance, worldwide automobile production fell by 15.69% in 2019. Although in 2021, global automotive production increased significantly compared to the pandemic hit 2020, it was well below the figures of 2019, primarily attributed to the semiconductor shortage.

The rising need for better ride quality and heat insulation for cabin comfort is greatly emphasized in the automotive industry, leading to a much higher demand for thermal management systems. The ever-increasing number of electrical and electronic components inside vehicles also drives the need for better thermal management systems due to heat dissipation.

Over the long term, as the automotive industry moves to electric mobility, thermal management systems for IC engines are expected to go completely obsolete. However, the increasing number of heavy-duty electrical components, such as heavy-duty batteries and high-current motors, is expected to continue keeping the high demand in these aspects. With increasing automation and powertrain electrification, the demand for electrical and electronic components exponentially increased, in both passenger cars and commercial vehicles, in the automotive industry.

Major original equipment manufacturers are focusing on the development of thermal management systems to offer the best possible travel range for their electric fleet. For instance,

Key Highlights

- In December 2021, Volvo tested its new thermal management system that pre-heats a truck's batteries using electrical components and electronic control units. The thermal system ensures the temperature is maintained under extreme weather conditions, thus increasing their demand to a large extent.

Auto parts suppliers are accelerating efforts to strengthen their global competitiveness in the thermal energy management market with the advancement of vehicle electrification. For instance,

Key Highlights

- In February 2022, Borgwarner Inc. secured an agreement to supply High-Voltage Coolant Heater (HVCH) to be used in BMW Group's iX and i4 fully electric architecture. The solution controls the battery's thermal management system and cabin heating and significantly increases the driving range and reliability of the battery.

Asia-Pacific is anticipated to be the largest market due to the presence of large OEMs for automotive thermal management systems, large markets for automobiles like China, India, Japan, and South Korea, and a well-developed automobile manufacturing industry.

North America and Europe are projected to be the next biggest markets due to high vehicle ownership rates, growing electric and autonomous vehicle sales, and extensive automobile manufacturing industries.

Thus, the confluence of the aforementioned factors is anticipated to drive the growth of automotive thermal management systems.

Automotive Thermal Management Market Trends

Battery Thermal Management to Witness Significant Growth

Vehicles that run on an all-electric powertrain or hybrid powertrain require a battery thermal management system. The battery is operated under a specific temperature for maximum charge storage and utilization efficiency. Hence, the increase in battery electric vehicles or plug-in hybrid vehicles is likely to drive the automotive thermal management market during the study period. For instance,

- In 2021, many European countries witnessed double-digit growth in EV sales, whereas the European region captured around 34% of global EV sales in 2021 compared to 43% in 2020. The overall plug-in vehicle sales reached about 2.27 million units in 2021 compared to 1.37 million in 2020.

This spike in sales is the result of an increase in regulatory norms by various organizations and governments to control emission levels and propagate zero-emissions vehicles.

Companies are investing in making more efficient battery solutions for the upcoming battery electric vehicles. For instance,

- In September 2022, Mahle launched its new thermal management systems for commercial electric vehicles at IAA Transportation in Hannover, Germany.

Thus, the above factors are estimated to significantly expand the market for automotive thermal systems during the forecast period.

Asia-Pacific Continues to Capture Major Market Share

The growing automobile sector in Asia-Pacific (with India and China emerging as automotive part manufacturing hubs for the western automobile giants) is expected to drive the market for thermal management systems in this region.

The growing government regulations improving electric vehicle adoption and robust expansion adopted by OEMs and suppliers in the region to accommodate the rising demand from the automotive industry in China are expected to create a positive outlook for market growth during the forecast period. For instance,

- In August 2022, Schaeffler Group celebrated the production of five million thermal management modules in China.

The Indian automotive industry is the fourth-largest in the world, and in terms of commercial vehicle production, the country ranks seventh globally. The auto component business in the country has also increased significantly over the past five years. For instance,

- In March 2022, the development of a new high-speed mid-torque electric motor was revealed by Matter, an Ahmedabad-based technological innovation start-up focusing on delivering futuristic sustainable solutions. The company says that Matter Drive 1.0 Motor is a new intelligent drive train that includes a variety of significant breakthroughs, such as the Integrated Intelligent Thermal Management System.

In addition, rising sales of electric and hybrid vehicles in counties like China, India, Japan, and South Korea will further augment the market for automotive thermal systems in the Asia-Pacific region.

Thus, the Asia-Pacific region is predicted to remain the largest market for automotive thermal systems in the world during the forecast period.

Automotive Thermal Management Industry Overview

The automotive thermal management market is moderately consolidated, with the major players dominating the market. Some of these players include Denso Corporation, Valeo, Mahle GmbH, Hanon System, and BorgWarner Inc. These payers engage in new product launches, joint ventures, and capacity expansions to expand their business activities and cement their market position. For instance,

- In November 2022, Denso Corp. launched a new LD9 electric zero emissions thermal management unit for buses and coaches at Bus & Coach Expo in Sydney, Australia.

- In March 2022, Hanon Systems inaugurated a new plant located in Huchai, China, to manufacture heating, ventilation, and air conditioning (HVAC) modules for electrified vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Engine Cooling

- 5.1.2 Cabin Thermal Management

- 5.1.3 Transmission Thermal Management

- 5.1.4 Waste Heat Recovery/ Exhaust Gas Recirculation (EGR) Thermal Management

- 5.1.5 Battery Thermal Management

- 5.1.6 Motor and Power Electronics Thermal Management

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Dana Incorporated

- 6.2.3 MAHLE GmbH

- 6.2.4 Gentherm Incorporated

- 6.2.5 Hanon Systems

- 6.2.6 Denso Corporation

- 6.2.7 BorgWarner Inc.

- 6.2.8 Valeo Group

- 6.2.9 Modine Manufacturing Company

- 6.2.10 Schaeffler Technologies AG & Co. KG

- 6.2.11 Kendrion NV

- 6.2.12 ZF Friedrichshafen

- 6.2.13 Aptiv Inc.