|

市場調査レポート

商品コード

1851138

アーバンエアモビリティ:市場シェア分析、産業動向、統計、成長予測(2025年~2040年)Urban Air Mobility - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2040) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アーバンエアモビリティ:市場シェア分析、産業動向、統計、成長予測(2025年~2040年) |

|

出版日: 2025年06月17日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

概要

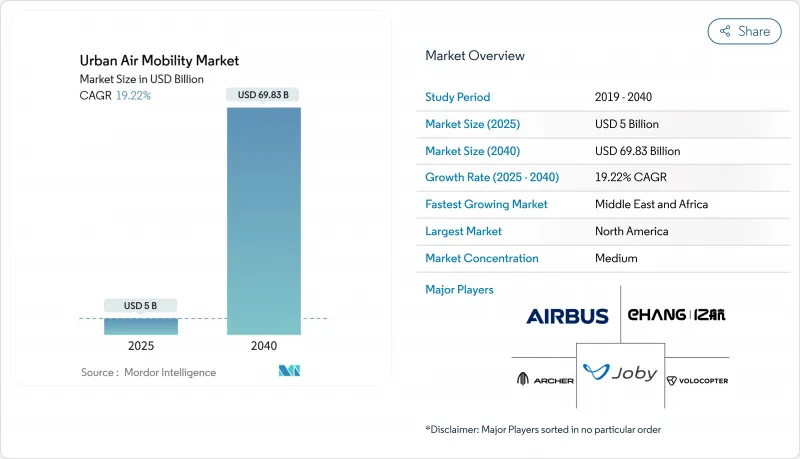

アーバンエアモビリティ(UAM)の市場規模は2025年に50億米ドルと推定・予測され、2040年にはCAGR19.22%で698億3,000万米ドルに達すると予測されます。

バッテリー・エネルギー密度の飛躍的向上により、eVTOLの航続距離は150kmを超え、収益性の高い都市間回廊が開かれ、プレミアム・サービスのビジネス・ケースが強化されました。米連邦航空局(Federal Aviation Administration)のパワーリフト規則(POWER-LIFT RULES)に助けられた認証の迅速化により、規制リスクが低下し、大規模な資本導入が促進されます。航空宇宙のパイオニアと自動車メーカーとの戦略的提携は製造コストを圧縮し、官民提携モデルは従来の航空インフラでは見られなかったペースでバーティポート・ネットワークに資金を供給しています。これらの力が相まって、UAM市場は急速な世界的拡大へと向かっています。

世界のアーバンエアモビリティ市場動向と洞察

バッテリー・エネルギー密度の急速な向上によりeVTOLの航続距離が150kmを超える

固体電池のエネルギー密度は450~550Wh/kgと、従来のリチウムイオン電池に比べて最大90%向上しています。飛行テストでは、1回の充電で48分のミッションが可能で、収益性の高い都市間シャトルの閾値を満たしています。航続距離が長いため、運行会社は複数の都市間の需要を集約することができ、1日の航空機の利用率を高め、シートマイルあたりのコストを直接下げることができます。このような性能向上は、規制当局が求める主要な安全指標も満たし、認証取得の旅をスムーズにします。その結果、都市間路線は、今後10年間にわたり、UAM市場の収益の大部分を占めるようになると予測されます。

自動車グレードのサプライチェーンがeVTOLの単価を引き下げる

eVTOLメーカーと自動車OEMとの提携により、量産ノウハウが航空宇宙プログラムに組み込まれつつあります。トヨタのJoby Aviation社への投資と部品調達の共有により、機体コストは2028年までに35%削減されます。標準化された部品、無駄のない組立ライン、自動車並みの品質管理プロセスは、立ち上げサイクルを短縮し、価格設定を安定させる。獲得コストの低下は運賃の引き下げにつながり、利用しやすい顧客基盤が拡大し、UAM市場全体の需要が強化されます。

Tier-1都市での遅いバーティポート許可

主要都市では、承認プロセスには10以上の機関が関与するのが普通で、2年以上のタイムラインを要し、保有コストを膨れ上がらせています。ロサンゼルスの場合、ダウンタウンの一カ所で、建設が開始されるまでにゾーニング、環境、緊急対応部門間の調整が必要でした。遅延はオペレーターを郊外のノードに向かわせ、初期段階のルート密度を制限し、UAM市場の完全な価値提案を先送りします。

セグメント分析

パイロット機は2024年の売上高の55.10%を占め、これは業界の初期段階において規制当局が慣れ親しんだコックピット・コンセプトを好んだことを反映しています。Joby AviationのS4は、2025年に3つのFAA認証段階を通過し、乗員付きプラットフォームが短期的に優位を占めることを明確にしました。このセグメントはUAM市場で最大のスライスを獲得し、より大規模なインフラネットワークが形成される間、金融機関に自信を与えています。オペレーターはまた、既存のパイロット養成パイプラインを活用して、顧客の支払い意欲が高い乗務員コストを相殺するような、プレミアム空港ーシャトル通路でサービスを拡大することもできます。

自律航法機は、現在では小さなカテゴリーだが、2040年までのCAGRは21.51%と、あらゆる乗り物タイプの中で最速で成長すると予測されています。ウィスク・エアロ社とNASAとの協力は、無搭乗の商業サービスの前提条件である検知・回避の検証を加速させる。パイロットを排除することで、直接的な運航経費を約26%削減することができ、より広い地域をカバーし、運賃を下げることができます。AI対応のUTMプラットフォームが成熟するにつれて、自律性はUAM市場全体の運用モデルを変化させ、ソフトウェアの信頼性とフリートオーケストレーションに競争の焦点を移すと予想されます。

100km未満の都市内セグメントは、2024年のUAM市場規模の59.81%を占め、都心と空港を結ぶ混雑緩和ルートが牽引します。スカイポート・インフラストラクチャーは同年、都心に複数の空港を開設し、消費者の早期認知を促しました。事業者は、エネルギーを大量に消費する垂直フェーズでもバッテリーの残量に余裕があり、予測可能なスケジュールと迅速な資産回転が可能なため、このような短距離ホップを好んでいます。

100kmを超える都市間ミッションは最も勢いがあり、CAGR 22.82%で上昇すると予測されます。固体電池とハイブリッド電気推進は、近接する巨大都市を結び、道路のボトルネックを回避するための航続距離と積載量のニーズを満たすようになりました。中東の地域政府は、こうした回廊を観光や分散型経済圏の実現につながると見ており、配備の加速化を後押ししています。都市間輸送の採用は、対応可能な顧客層を広げ、ネットワーク効果を拡大し、UAM市場の長期的拡大を後押しします。

地域分析

北米は、FAAの明確な認証パスウェイと豊富なベンチャー資金プールに支えられ、2024年の売上高の46.89%を占め、引き続き最大地域です。固定ベースオペレーター・チェーンのアトランティックとシグネチャーは、2025年初頭に主要空港でバーティポート・クラスターの建設を開始し、高収量のコリドー全域で運航の厚みを増しました。米国空軍のアジリティ・プライム・プログラムは、軍事試験データを民間認証の証拠に変えることで、技術の準備態勢をさらに加速させる。こうした市場開拓は北米のUAM市場を支え、他地域の雛形となります。

中東・アフリカ地域は最も急な成長曲線を示しており、2025年から2040年までのCAGRは28.21%と予測されています。アブダビは、アーチャー・アビエーション社との間で、UAEを世界的なショーケースとして位置づけ、初の商用エアタクシー・サービスを開始することで最終合意しました。ソブリンファンドがバーティポート・インフラに多額の資金を投入し、多様な地域が砂漠や山岳地帯での魅力的な都市間利用事例を生み出しています。早期参入者としての優位性と規制当局の強力なバックアップにより、UAM市場における地域リーダーとしての地位が確立されることが期待されます。

欧州は、先進的な規制と持続可能性の義務化により、強力な地位を維持しています。EASAは2024年に包括的なUAMフレームワークを採択し、事業者に明確な運用ルールを与えました。2025年に発表された市民意識調査では、eVTOLの騒音と安全基準について住民に説明した場合、83%が好意的であることが示されている(easa.europa.eu)。パリやロンドンのような都市は、主要な国際イベントの前にサービスを開始し、グリーンモビリティの目標を活用してインフラ資金を集めることを目指しています。このような協調的なアプローチにより、欧州は進歩するUAM市場にしっかりと組み込まれています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- バッテリー・エネルギー密度の急速な向上により、eVTOLの航続距離は150kmを超える

- 自動車グレードのサプライチェーンがeVTOLの単価を引き下げる

- バーティポートPPP資金調達モデルがインフラ整備を加速させる

- 規制の「サンドボックス」回廊が認証取得時期を早める

- メガハブの拡張によるプレミアム空港シャトル需要

- AI対応UTMプラットフォームが高密度空域運用のリスクを軽減する

- 市場抑制要因

- Tier-1都市におけるバーティポート認可の遅れ

- 騒音と視覚公害に対する社会的受容の逆風

- 電池原料価格の変動

- 完全自律化前のパイロット不足がボトルネックに

- バリューチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 車両タイプ別

- パイロット

- 自律

- 範囲別

- イントラシティ(100km未満)

- インターシティ(100km以上)

- 推進タイプ別

- フル電動

- ハイブリッド

- ガソリン

- 用途別

- 旅客エアタクシー

- 都市内シャトル

- 緊急医療サービス

- 貨物およびロジスティクス

- エンドユーザー別

- ライドシェア事業者

- 法人およびVIP顧客

- eコマース・ロジスティクス企業

- ヘルスケア・プロバイダー

- 軍および政府機関

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 南米

- ブラジル

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Airbus SE

- Joby Aero, Inc.

- Eve Holding, Inc.

- Volocopter Technologies GmbH

- Vertical Aerospace

- Archer Aviation, Inc.

- BETA Technologies, Inc.

- Wisk Aero LLC

- Guangzhou EHang Intelligent Technology Co., Ltd.

- Supernal, LLC

- Textron, Inc.

- Jaunt Air Mobility LLC

- Pivotal Aero, LLC.

- Ascendance Flight Technologies S.A.S

- AutoFlight Co. Ltd.

- SkyDrive Inc.