|

市場調査レポート

商品コード

1851143

航空機用電気システム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Aircraft Electrical Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空機用電気システム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月24日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

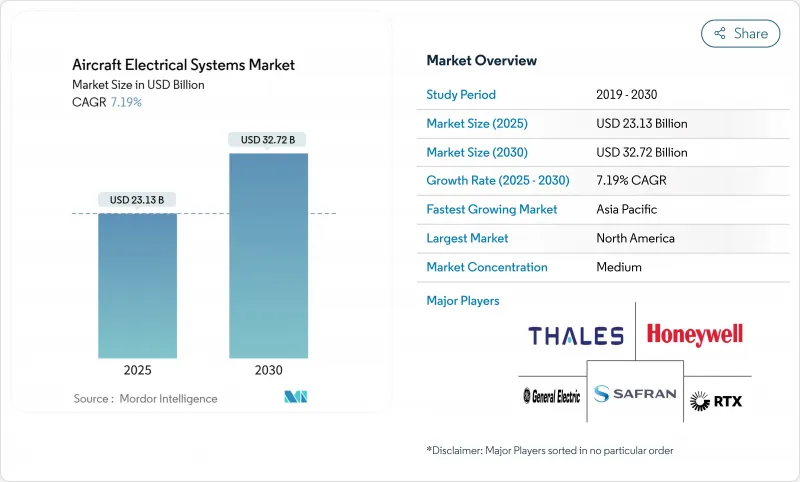

航空機用電気システムの市場規模は2025年に231億3,000万米ドル、2030年には327億2,000万米ドルに拡大すると予測され、CAGRは7.19%です。

電動化装備品航空機(MEA)アーキテクチャの採用、単通路の生産台数の増加、客室電化のための改造需要の加速は、総体として対処可能な収益プールを拡大します。高電圧直流(HVDC)配電、炭化ケイ素(SiC)パワーエレクトロニクス、モジュール式バッテリーパックは、エネルギー密度と熱効率に競争の軸足を移しています。エアバス社、ボーイング社、企業プロファイルの持続的な受注残と、いくつかのeVTOLプラットフォームの初期生産が、サプライチェーンの制約によって納期プロファイルが変化しても、ベースライン需要を支えています。サイバーセキュリティと電磁波防護への並行投資により、民間および防衛プログラムにまたがって拡張可能な統合電気アーキテクチャの必要性が高まっています。

世界の航空機用電気システム市場の動向と洞察

機械的な複雑さを軽減し効率を向上させるため、MEA(More-Electric Aircraft)アーキテクチャの採用が増加。

MEAの導入により、ブリードエアラインと油圧ポンプが取り除かれ、軽量化とメンテナンスの合理化を実現する電力密度の高い電気的代替品に置き換えられます。B787の+-270V DCフレームワークは、油圧式に比べて信頼性が向上し、ライフサイクルコストが低減することを実証しています。航空会社は、燃料消費量の低減とライン交換可能なユニット故障の減少により、MEAの統合による運用コストの38%削減を見込んでいます。F-35のパワーマネージメントモジュールは、民間の動向と同じであり、デュアルユースの適用が可能であることが確認されています。システムの収束に伴い、OEMは配電ユニットに層状のサイバー保護を組み込み、手動介入なしで故障の切り分けを確実にします。

航空機の生産量増加と受注残の持続が高度電気システムの需要を促進

COMACは、1,000以上の確約パイプラインを活用し、2025年にC919の生産量を50機まで引き上げる意向です。エアバスは、A320neoの立ち上げを2027年にシフトしたにもかかわらず、2025年に720機以上の納入を目標としており、電気インテグレーターにとっては複数年にわたる見通しが確保されています。単通路ジェット機が増設の大部分を占めるため、フレームごとに発電、変換、客室システムの需要が増加します。サプライヤーは、原材料の価格変動に備えるため、プリント回路アセンブリとハーネスを地域間で二重調達しています。

システム電圧レベルの上昇に伴う熱と配線の複雑さへの対処が課題

電圧の上昇により導体表面温度は180℃まで上昇し、EUのICOPEイニシアチブの下、アニール処理された熱分解黒鉛ヒートパイプの採用が促されています。EMIシールドの要求により、ハーネスバンドルが大型化し、設置の手間が増え、寄生質量が増加するため、ペイロードが2%減少する可能性があります。液冷バスバーは、多くの熱ボトルネックを解決するもの、ポンプ、冷却水、リーク検出ロジックを追加することになります。スペースが限られたeVTOLキャビンは、構造チームと電気チームとの間で学際的な最適化を余儀なくされるため、パッケージングに関する深刻な問題に直面します。

セグメント分析

エネルギー貯蔵の収益は2030年までCAGR 9.21%で増加すると予測され、eVTOLの航続距離目標を支えるモジュール式リチウムイオンパックと新興のソリッドステートオプションがこれを後押しします。エネルギー貯蔵の航空機用電気システム市場規模は、ハイブリッド電気推進における中心性を反映して、予測期間終了までに64億米ドルを超えると予想されます。配電は依然として基幹産業であり、2024年の売上高の36.78%を占め、スマートコンタクタアレイとソフトウェア定義スイッチングユニットが異常動作時の負荷優先順位を確保します。

HVDCの採用はコンポーネントのロードマップを再形成し、コンバータ設計をAC115Vから200kHzのスイッチング周波数で動作するシリコンカーバイド・スイッチを利用したマルチレベルDC-DCトポロジーへとシフトさせています。サフラン・シャフトなどのバッテリー・サプライヤーは、2025年に60℃のバースト放電をサポートする1,200Vパックを発表し、航空電子工学グレードの高電圧規格の成熟を示唆しました。長距離用プラットフォームでは、燃料電池の航続距離延長装置とバッテリー・バッファーを組み合わせた複合サイクル・アーキテクチャが求められ、統合パワー・マネジメント・スイートのライフサイクル収益が拡大します。

バッテリーパックとBMSは、エネルギー密度、セルの寿命、安全性のバランスをとる役割を反映し、CAGR 9.56%で拡大。スマートBMSアルゴリズムは現在、フライトデッキのアビオニクスと直接インターフェースし、残りの耐用年数を放送し、パックの交換間隔を予測することで、予定外のメンテナンスを減らします。ジェネレーターとスターター・ジェネレーターは、2024年の航空機用電気システム市場シェアの21.19%を占め、機内厨房の電化とエンベロープ保護負荷をサポートするため、600~800kWクラスの高出力定格への移行が続いています。

DC1,000V、500A定格のコネクターは、タッチセーフ形状やアーク抑制バネを特徴とし、認定段階に入りつつあります。ワイヤーハーネスのサプライヤーは、導電性を維持しながら質量を30%削減するために、ナノ粒子コーティングを施したアルミコアの代替品を開発します。組込み配電ソフトウェアは、50msごとに負荷分散階層を再計算する機械学習ルーチンを採用し、アークフォルトに対する耐性を向上させています。

地域分析

北米は、米国の国防予算と発電機、アクチュエータ、熱管理ハードウェアにまたがる豊富なサプライヤー基盤に牽引され、2024年の売上高の40.92%を占めました。この地域の見通しは、FAAのサイバーセキュリティ指令によって強化され、認証されたデータバスが義務付けられ、既存の航空機のアビオニクスと電力変換のアップグレードに拍車をかけています。ハネウェルの19億米ドルのCAES買収のような統合取引は電磁波保護ポートフォリオを強化し、北米を最大の買い手と技術インキュベーターにしています。

アジア太平洋は2030年までCAGR 7.85%で最速の成長を記録。COMACのC919の生産台数が増加し、インドでは20年間で最大1,000機のジェット機が必要と予測され、発電機、コンバーター、ハーネスへの需要が高まる。日本と韓国の地元Tier-1が、ボーイングとエアバス向けのビルド・トゥ・プリントのワークパッケージを拡大し、地域のコンテンツをグローバルプログラムに組み込みます。シンガポールとマレーシアの政府支援によるMRO回廊は、客室電化とミッション・システムの強化に焦点を当てた改修プログラムを誘致しています。

欧州は、クリーンアビエーションへの資金援助、厳格な排出政策、広範な研究ネットワークにより、引き続き重要な位置を占めています。サフランは高電圧バッテリーと電気推進器の分野で欧州をリードしており、コリンズ・エアロスペースのトゥールーズ研究所はメガワット級インバータの検証を先導しています。CS-25/Amdt26に基づくEASAの雷保護ハーモナイゼーションは、広帯域試験を実施し、OEMにシールド強化ソリューションの認証を促しています。また、同大陸では、ヒートパイプ冷却に取り組む複数の実証機をホストし、長距離ハイブリッド車向けの次世代熱アーキテクチャを検証しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 機械的な複雑さを軽減し効率を向上させるため、電動化装備品航空機(MEA)アーキテクチャの採用が増加します。

- 航空機の生産台数の増加と持続的な受注残が先端電気システムの需要を牽引

- 次世代電力アーキテクチャをサポートする高電圧直流(HVDC)配電システムの導入

- 無人航空機プラットフォームに合わせた軽量かつコンパクトな電気システムへのニーズの高まり

- シリコン・カーバイド・パワー・エレクトロニクスは、より高い温度限界を可能にする

- 座席内電源や調理室の近代化など、客室電化に焦点を当てたレトロフィット主導のアップグレード

- 市場抑制要因

- システム電圧レベルの上昇に伴う熱と配線の複雑さを管理する上での課題

- 高度な航空宇宙用バッテリー技術に関連する高い認証コスト

- 航空宇宙グレードの性能と信頼性基準を満たす認定半導体の入手可能性が限られています。

- サイバーセキュリティの懸念によるソフトウェア駆動型配電装置の規制承認の遅れ

- バリューチェーン分析

- 規制状況と技術的展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- システム別

- 発電事業

- 配電

- 電力変換

- エネルギー貯蔵

- コンポーネント別

- 発電機とスタータージェネレーター

- 配電ユニット

- コンバーター

- バッテリーパックとBMS

- 配線とケーブル

- コネクターおよび接触器

- 配電ソフトウェア

- プラットフォーム別

- 商用航空

- ナローボディ

- ワイドボディ

- リージョナルジェット

- 貨物機

- 軍事航空

- 戦闘機

- 輸送機

- UAV

- 練習機

- 一般航空

- ビジネスジェット

- ヘリコプター

- eVTOL/AAM

- 商用航空

- 用途別

- 発電管理

- 飛行制御と操作

- キャビンシステム

- コンフィギュレーション管理

- 空気加圧とコンディショニング

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- RTX Corporation

- Honeywell International Inc.

- General Electric Company

- Safran SA

- Thales Group

- Amphenol Aerospace

- Astronics Corporation

- Crane Aerospace and Electronics(Crane Company)

- AMETEK Inc.

- Nabtesco Corporation

- Hartzell Engine Tech LLC

- PBS AEROSPACE Inc.

- Acme Aerospace Inc. & Avionic Instruments, LLC

- BAE Systems plc

- Moog, Inc.

- Parker-Hannifin Corporation

- Rolls-Royce plc

- Vicor Corporation